|

市场调查报告书

商品编码

1906244

聚乙烯丁醛(PVB)中间层:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Polyvinyl Butyral (PVB) Interlayers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

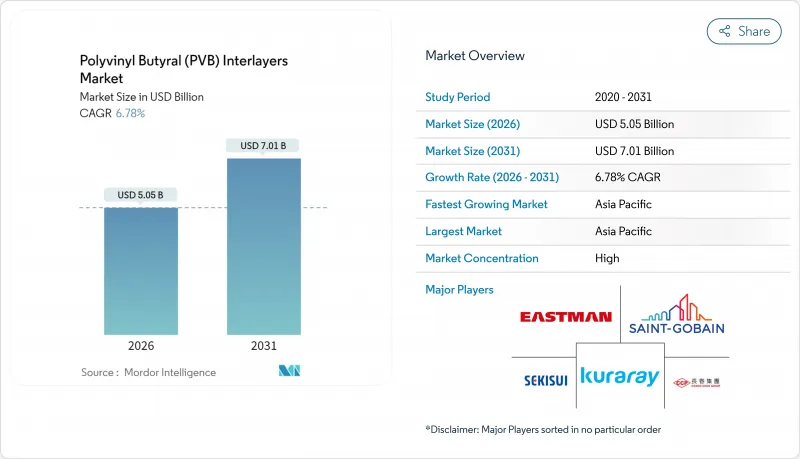

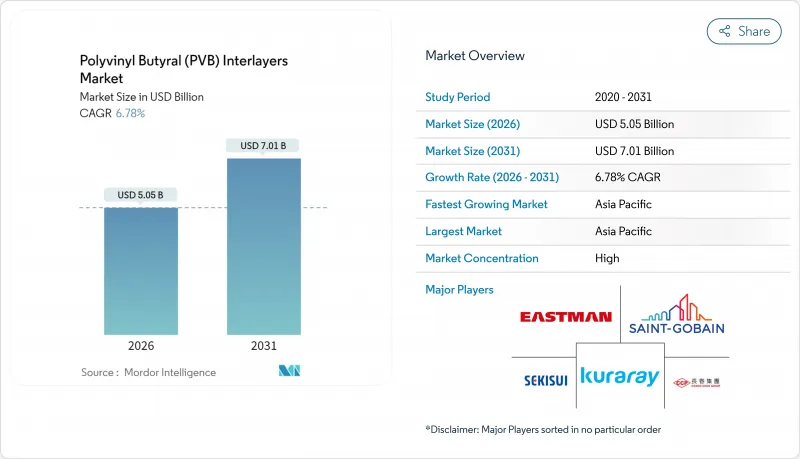

聚乙烯丁醛(PVB) 中间层市场预计将从 2025 年的 47.3 亿美元成长到 2026 年的 50.5 亿美元,预计到 2031 年将达到 70.1 亿美元,2026 年至 2031 年的复合年增长率为 6.78%。

日益严格的安全法规、永续性以及对轻量化车辆和绿色建筑的需求,是推动这一市场扩张的根本动力。电动车专案正在扩大玻璃的应用范围,从挡风玻璃扩展到所有窗户;而获得LEED认证的建筑则指定使用高性能夹层建筑幕墙,以减少太阳热量的穿透并阻挡紫外线。製造商正在推出集隔音、太阳能控制和防撞功能于一体的多功能薄膜,这进一步拓展了聚乙烯丁醛(PVB)夹层市场的潜在机会。然而,原材料成本的波动和新兴的回收管道正在挤压利润空间,并推动主要供应商进行垂直整合。

全球聚乙烯丁醛(PVB)中间层薄膜市场趋势及洞察

汽车和建筑领域对夹层安全玻璃的应用日益广泛

电动车专案消除了引擎杂讯掩蔽效应,推动了汽车製造商对整合式隔音聚乙烯丁醛)层的侧窗和后窗玻璃的需求。积水化学最新推出的S-LEC系列产品可阻挡近红外光,降低车内温度并延长车辆续航里程。同时,建筑师们正在为高层建筑的外墙指定使用大型夹层玻璃面板,其中的夹层可以吸收衝击能量并防止碎片粘附,从而确保居住者的安全。跨领域的技术转移缩短了研发週期,使得一个终端应用领域的创新能够快速应用于其他领域,从而增强了聚乙烯丁醛(PVB)夹层市场。

车辆乘员安全和玻璃强度方面的监管要求

美国公路交通安全管理局 (NHTSA) 的联邦机动车辆安全标准 217a 将于 2027 年生效,该标准要求客车使用先进的玻璃,这将显着扩大聚乙烯丁醛(PVB) 夹层的需求。欧洲经济委员会 (ECE) 的修正案也强调行人安全和翻滚强度,迫使汽车製造商转向使用更厚、多层层压玻璃,并采用高模量夹层。更严格的法规将增加每辆车的材料用量,这将使能够配製在宽温度范围内保持透明度的抗衝击薄膜的供应商获得优势。

聚乙烯丁醛醛树脂及其添加剂的价格波动

积水化学株式会社于2024年10月将其S-LEC薄膜的标价上调6%至15%,随后伊士曼公司也于2025年4月起将塑化剂价格上调0.04美元/磅。中国于2025年1月将PVC进口关税提高至5.5%,这将为树脂加工商带来每吨22.95至23.85美元的额外成本负担。由于OEM合约中价格通常按每个型号週期固定,下游加工商面临利润空间压缩,聚乙烯丁醛(PVB)中间层市场整体正在经历行业整合和深化垂直一体化,以确保原材料供应并规避价格波动风险。

细分市场分析

到2025年,标准薄膜将占总销售额的61.62%,证实了其在安全玻璃领域的广泛应用。同时,随着电动车动力系统风噪和胎噪的增加,隔音薄膜的年复合成长率(CAGR)也达到了7.48%。 Sufflex Q隔音薄膜无需改变生产流程即可降低车内声压高达7分贝。将隔音、遮光和结构性能整合于单一层压板中的多功能混合产品,正吸引希望减少零件数量的汽车製造商的注意。用于隔音解决方案的聚乙烯丁醛(PVB)中间层的市场规模预计将从2026年的5亿美元增长到2031年的7.1亿美元,这预示着价值结构的转变。紫外线阻隔和抗飓风等级的产品虽然仍处于小众市场,但利润丰厚,尤其是在美国沿海和加勒比海地区的建筑市场,这些地区极易受到极端天气的影响,因此对这些产品的需求尤为强劲。

在竞争中,产品系列的广度正成为比单价更重要的决定性因素。製造商透过调整塑化剂比例,即可将标准级芯材与声学级芯材互换,从而优化工厂使用率,并与全球原始设备製造商 (OEM) 达成双重采购协议。这种能力正在加速传统薄膜的替代,同时增强供应商的锁定效应,并提升其在聚乙烯丁醛(PVB) 中间层市场的定价权。

2025年,片材和捲材产品占出货量的84.10%,主要得益于成熟的物流和层压设施。然而,随着建筑幕墙承包商寻求减少废弃物和提高生产线速度,根据计划特定尺寸量身定制的薄膜产品正以7.55%的复合年增长率快速增长。数位切割刀和雷射系统能够实现与BIM模型相符的客製化布局,从而减少现场修整工作。受都市区大型企划兴起的推动,预计到2025年,客製化规格聚乙烯丁醛(PVB)夹层的市场份额将达到15.90%,并在2031年超过20%。本地层压设施对于运输宽度超过3.2米的大型面板至关重要,这有助于实现地域多角化,并促进薄膜製造商和建筑幕墙玻璃安装商之间的合作。

价值创造正从树脂吨位转向服务。能够提供结构模拟、准时交货套件和现场技术支援的供应商,正在将大宗商品参与企业难以匹敌的无形差异化优势货币化。即使树脂价格走软,这些能力也能推高聚乙烯丁醛(PVB) 中间层市场的平均售价,并确保利润率。

聚乙烯丁醛(PVB) 中间层薄膜市场报告按类型(标准 PVB、隔音 PVB 等)、形式(片材/捲材、定制切割/预层压薄膜)、应用(汽车挡风玻璃、汽车侧窗和后窗玻璃等)、最终用户行业(汽车和运输、建筑等)和地区(亚太地区、北美等)细分。

区域分析

到2025年,亚太地区将占全球营收的44.35%,年复合成长率达7.84%,主要得益于中国每年2,500万辆的汽车产量和创纪录的城市建设速度。 2025年1月,PVC进口关税上调至5.5%,这将使树脂成本增加23美元/吨,促使玻璃加工商转向国内PVB薄膜供应商。在印度,不断增长的汽车销售和智慧城市规划(儘管基数较低)也成为额外的成长要素。日本和韩国的领先製造商正在推出隔音和隔热创新技术,这些技术正在影响整个区域供应链。同时,东南亚国协正利用其低廉的人事费用和位于亚洲物流中心的地理位置,吸引新的层压板生产能力。

北美是一个稳定的替换市场,这得益于美国美国公路交通安全管理局 (NHTSA) 严格的法规,这些法规推动了规范标准的製定。计划于 2027 年生效的公车玻璃法规预计将增加市场需求量和复杂性。节能建筑维修,尤其是在美国阳光地带,倾向于使用遮阳聚乙烯醇缩丁醛 (PVB) 玻璃来抵消尖峰时段冷却负荷。加拿大的联邦碳定价机制将进一步推动维修选择高隔热玻璃,从而扩大聚乙烯丁醛(PVB) 夹层玻璃的潜在市场。

欧洲仍以技术为中心,其生产者延伸责任制(EPR)体系的实施,使得人们对回收的期望日益提高。 Tarkett公司2024年推出的层压板再生料回收技术创新,将碳排放强度降低至全新PVB材料的1/25。诸如此类的进步,正将再生材料的使用从监管负担转变为市场优势。儘管需求成长缓慢,但随着产品组合的扩展,纳入多功能、低碳中间层,其价值成长速度持续超过销售成长速度。

南美洲和中东及非洲地区合计占全球销售额不到10%,但却在小规模的基数上实现了两位数的成长。巴西汽车需求的復苏以及沿岸地区的大型建设计划对具有优异耐热性和耐磨性的玻璃提出了更高的要求。随着区域法规的日益严格,那些针对热带气候优化配方的供应商正在抢占先机,为聚乙烯丁醛(PVB)中间层市场的未来规模化发展奠定了基础。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 汽车和建筑业对夹层安全玻璃的需求不断增长

- 关于乘员安全和玻璃强度的法规要求

- 对节能玻璃和紫外线防护的需求不断增长

- 扩大绿建筑和LEED认证建筑

- 挡风玻璃和建筑玻璃面板的更换率不断提高

- 市场限制

- 聚乙烯丁醛(PVB)树脂及添加剂的价格波动

- 废旧产品回收的限制

- 运输大卷材料面临的物流挑战

- 价值链分析

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 标准聚乙烯丁醛(PVB)中间层

- 声学聚乙烯丁醛(PVB)中间层

- 太阳能控制聚乙烯丁醛(PVB)中间层

- 彩色和色调聚乙烯丁醛(PVB)夹层

- 抗紫外线/高性能聚乙烯丁醛(PVB)中间层

- 按形式

- 片材/卷材

- 客製化切割/预覆膜薄膜

- 透过使用

- 汽车挡风玻璃

- 汽车侧窗和后窗

- 建筑玻璃(窗户、建筑幕墙、屋顶)

- 室内装潢玻璃和隔间

- 特殊应用(防弹/防爆)

- 按最终用户行业划分

- 汽车和运输设备

- 建筑/施工

- 国防与安全

- 家用电子电器和智慧显示器

- 其他终端用户产业(铁路、航太、海运)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Chang Chun Group

- Eastman Chemical Company

- Everlam

- Genau Manufacturing Company LLP(GMC LLP)

- Guangzhou Aojisi New Material Co., Ltd.

- Huakai Plastic(Chongqing)Co., Ltd.

- Jiangsu Daruihengte Science & Technology Co., Ltd.

- Jinjing(Group)Co., Ltd.

- KB PVB

- Kuraray Co., Ltd.

- Saint-Gobain

- SEKISUI CHEMICAL CO., LTD.

- ZHEJIANG DECENT NEW MATERIAL CO., LTD

第七章 市场机会与未来展望

The Polyvinyl Butyral Interlayers market is expected to grow from USD 4.73 billion in 2025 to USD 5.05 billion in 2026 and is forecast to reach USD 7.01 billion by 2031 at 6.78% CAGR over 2026-2031.

Rising safety regulations, sustainability mandates and the push for lighter vehicles and greener buildings anchor this expansion. Electric-vehicle programs are widening the glazing envelope from the windshield to every window, while LEED-driven construction specifies high-performance laminated facades that curb solar heat gains and block ultraviolet radiation. Manufacturers are unveiling multi-functional films that combine acoustic damping, solar control and bird-collision deterrence, thereby enlarging the addressable opportunity for the polyvinyl butyral interlayers market. At the same time, raw-material cost swings and still-nascent recycling routes squeeze margins and spur vertical integration among leading suppliers.

Global Polyvinyl Butyral (PVB) Interlayers Market Trends and Insights

Growing Adoption of Laminated Safety Glass in Automotive and Construction

Electric-vehicle programs remove the masking effect of engine noise, intensifying OEM demand for side and rear glass that integrates acoustic polyvinyl butyral layers. SEKISUI's latest S-LEC series blocks near-infra-red radiation to trim cabin heat and extend driving range. Architects simultaneously specify oversized laminated panels in high-rise facades, where the interlayer absorbs impact energy and keeps shards bonded for occupant safety. Trans-sector technology transfer shortens development cycles and reinforces the polyvinyl butyral interlayers market as innovations in one end-use quickly migrate to the other.

Regulatory Mandates for Vehicle-Occupant Safety and Glass Strength

The U.S. NHTSA Federal Motor Vehicle Safety Standard 217a comes into effect in 2027 and compels advanced glazing on long-distance buses, materially enlarging the downstream pool for the polyvinyl butyral interlayers market. Similar ECE revisions in Europe focus on pedestrian safety and rollover integrity, driving OEMs toward thicker multi-layer laminates with higher-modulus interlayers. Regulations heighten per-vehicle material loading and reward suppliers capable of formulating impact-resistant films that remain clear under wider temperature ranges.

Price Fluctuations in Polyvinyl Butyral Resins and Additives

SEKISUI raised S-LEC film list prices by 6-15% in October 2024, followed by Eastman adding USD 0.04/lb on plasticizers from April 2025. China's January 2025 tariff lift on PVC imports to 5.5% imposes an incremental USD 22.95-23.85/t cost burden on resin processors. Because OEM contracts often lock prices for model cycles, downstream fabricators face margin compression, prompting consolidation and deeper vertical integration to secure feedstock and hedge volatility across the polyvinyl butyral interlayers market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Energy-Efficient Glazing and UV Protection

- Expansion of Green Buildings and LEED-Certified Construction

- Limitations in Recycling of End-of-Life PVB Interlayers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Standard films delivered 61.62% of 2025 revenue, underscoring their ubiquity in safety glass. Meanwhile acoustic formats are growing at 7.48% CAGR as electric-vehicle drivetrains expose wind and tire noise. Saflex Q reduces cabin sound pressure by up to 7 dB without process retooling. Multi-functional hybrids that embed acoustic, solar and structural properties in one stack entice automakers to curb part counts. The polyvinyl butyral interlayers market size for acoustic solutions is projected to climb from USD 0.5 billion in 2026 to USD 0.71 billion in 2031, illustrating a shift in value mix. UV-screening and hurricane-rated grades stay niche yet profit-rich, particularly in coastal U.S. and Caribbean construction markets vulnerable to extreme weather.

In competitive terms, portfolio breadth is overtaking unit cost as the decisive lever. Producers offering interchangeable cores that switch from standard to acoustic by adjusting plasticizer ratios optimize plant utilization and win dual-sourcing awards with global OEMs. This capability accelerates cannibalization of legacy films but anchors supplier lock-in, which supports pricing leverage within the polyvinyl butyral interlayers market.

Sheet and roll goods supplied 84.10% of 2025 shipments due to mature logistics and lamination tooling. Yet tailored-cut films, dispensed in project-specific dimensions, are gaining 7.55% CAGR as facade contractors demand waste minimization and faster line speeds. Digital knife and laser systems enable custom layouts that mirror BIM models, reducing on-site trim. The polyvinyl butyral interlayers market share for tailor-made formats reached 15.90% in 2025 and could top 20% by 2031 as urban megaprojects proliferate. Transporting jumbo panels wider than 3.2 m calls for local lamination hubs, encouraging regionalisation of production footprints and alliances between film makers and facade glaziers.

Value creation shifts from resin tonnage to service. Suppliers bundling structural simulation, on-time kit delivery and on-site technical support monetize intangible differentiators difficult for commodity entrants to match. Those capabilities elevate average selling prices even when resin indices soften, insulating margins across the polyvinyl butyral interlayers market.

The Polyvinyl Butyral (PVB) Interlayers Market Report is Segmented by Type (Standard PVB, Acoustic PVB, and More), Form (Sheet/Roll Form, Custom-Cut/Pre-laminated Film), Application (Automotive Windshields, Side and Rear Automotive Glazing, and More), End-User Industry (Automotive and Transportation, Building and Construction, and More), and Geography (Asia-Pacific, North America, and More).

Geography Analysis

Asia-Pacific produced 44.35% of global revenue in 2025 and is growing at 7.84% CAGR, powered by China's 25-million-unit vehicle output and record-breaking urban construction pace. The January 2025 hike in PVC import tariffs to 5.5% adds USD 23/t to resin costs, nudging glass processors toward domestic PVB film suppliers. India's vehicle-sales expansion and smart-city programs feed additional momentum, albeit from a lower base. Japanese and South Korean champions inject acoustic and solar-control innovation that diffuses through regional supply chains. Meanwhile ASEAN countries attract new lamination capacity, leveraging lower labor costs yet remaining inside Asia's logistical orbit.

North America represents a steady replacement market where stringent NHTSA rules elevate specification levels. The forthcoming 2027 bus-glazing mandate is set to lift demand volumes and complexity. Building retrofits for energy savings, especially in the U.S. Sun Belt, favor solar-control PVB that offsets peak cooling loads. Canada's federal carbon-pricing scheme further tilts renovation choices toward high-insulation glass, widening the addressable slice of the polyvinyl butyral interlayers market.

Europe remains technology-centric, with Extended Producer Responsibility schemes escalating recycling expectations. Tarkett's 2024 breakthrough in reclaiming lamination offcuts shrinks carbon intensity by 25 times relative to virgin PVB. Such advances reposition recycled content from compliance burden to marketing gain. Demand growth is modest, yet product-mix enrichment toward multi-functional and low-carbon interlayers keeps value rising ahead of volume.

South America, the Middle East and Africa together account for under 10% of global turnover but deliver double-digit growth off small bases. Brazil's auto-recovery and Gulf construction mega-projects require heat-resistant, sand-abrasion-tolerant glazing. Suppliers that tailor formulations to tropical climates lock in early influence as regional regulations tighten, setting the stage for future scale in the polyvinyl butyral interlayers market.

- Chang Chun Group

- Eastman Chemical Company

- Everlam

- Genau Manufacturing Company LLP (GMC LLP)

- Guangzhou Aojisi New Material Co., Ltd.

- Huakai Plastic (Chongqing) Co., Ltd.

- Jiangsu Daruihengte Science & Technology Co., Ltd.

- Jinjing (Group) Co., Ltd.

- KB PVB

- Kuraray Co., Ltd.

- Saint-Gobain

- SEKISUI CHEMICAL CO., LTD.

- ZHEJIANG DECENT NEW MATERIAL CO., LTD

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption of laminated safety glass in automotive and construction

- 4.2.2 Regulatory mandates for vehicle-occupant safety and glass strength

- 4.2.3 Rising demand for energy-efficient glazing and UV protection

- 4.2.4 Expansion of green buildings and LEED-certified construction

- 4.2.5 Increasing replacement rate of windshields and architectural glass panels

- 4.3 Market Restraints

- 4.3.1 Price fluctuations in Polyvinyl Butyral (PVB) resins and additives

- 4.3.2 Limitations in recycling of end-of-life Polyvinyl Butyral (PVB) interlayers

- 4.3.3 Logistical challenges in transporting large-format rolls

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Standard Polyvinyl Butyral (PVB) Interlayers

- 5.1.2 Acoustic Polyvinyl Butyral (PVB) Interlayers

- 5.1.3 Solar-Control Polyvinyl Butyral (PVB) Interlayers

- 5.1.4 Colored and Tinted Polyvinyl Butyral (PVB) Interlayers

- 5.1.5 UV-Resistant / High-Performance Polyvinyl Butyral (PVB) Interlayers

- 5.2 By Form

- 5.2.1 Sheet / Roll Form

- 5.2.2 Custom-Cut / Pre-laminated Film

- 5.3 By Application

- 5.3.1 Automotive Windshields

- 5.3.2 Side and Rear Automotive Glazing

- 5.3.3 Architectural Glazing (Windows, Facades, Roofs)

- 5.3.4 Interior Decorative Glass and Partitions

- 5.3.5 Specialty (Bullet-, Blast-Resistant)

- 5.4 By End-user Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Building and Construction

- 5.4.3 Defense and Security

- 5.4.4 Consumer Electronics and Smart Displays

- 5.4.5 Other End-user Industries (Rail, Aerospace, Marine)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Nordic Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles {(includes ... Recent Developments)}

- 6.4.1 Chang Chun Group

- 6.4.2 Eastman Chemical Company

- 6.4.3 Everlam

- 6.4.4 Genau Manufacturing Company LLP (GMC LLP)

- 6.4.5 Guangzhou Aojisi New Material Co., Ltd.

- 6.4.6 Huakai Plastic (Chongqing) Co., Ltd.

- 6.4.7 Jiangsu Daruihengte Science & Technology Co., Ltd.

- 6.4.8 Jinjing (Group) Co., Ltd.

- 6.4.9 KB PVB

- 6.4.10 Kuraray Co., Ltd.

- 6.4.11 Saint-Gobain

- 6.4.12 SEKISUI CHEMICAL CO., LTD.

- 6.4.13 ZHEJIANG DECENT NEW MATERIAL CO., LTD

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growth in smart-glass and switchable Polyvinyl Butyral (PVB) technologies

- 7.3 Advancement in bio-based and recyclable interlayers