|

市场调查报告书

商品编码

1906245

负载测试器:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Load Bank - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

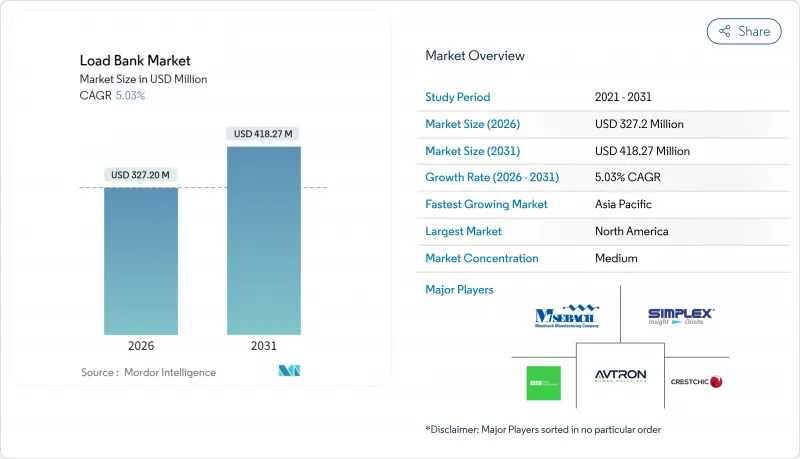

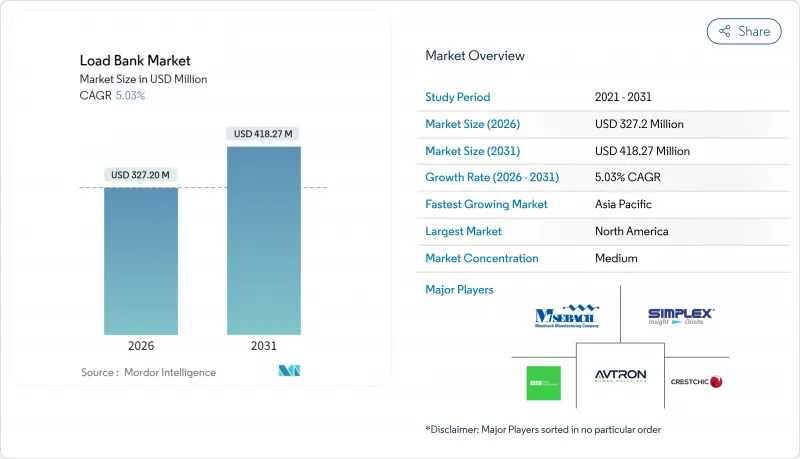

预计到 2026 年,负载测试器市场规模将达到 3.272 亿美元,高于 2025 年的 3.1153 亿美元。

预计到 2031 年将达到 4.1827 亿美元,2026 年至 2031 年的复合年增长率为 5.03%。

这一成长动能主要由超大规模资料中心的扩张、需要进行稳定性检验的可再生能源密集型电网以及关键任务设施日益严格的效能要求所驱动。资料中心营运商正在提高功率密度标准,这需要进行多阶段检验,并扩大了负载测试器服务供应商的租赁机会。可再生能源的併网增加了对电阻性和电抗性系统以及能够模拟风能、太阳能和储能计划动态负载曲线的电子系统的需求。製造商正在透过可回收高达96%测试能量的再生设计来应对这一需求,这一特性正日益成为新建公用事业和微电网采购的必要条件。同时,原物料价格上涨和计划交付週期缩短正促使许多买家转向轻资产租赁模式,进而影响整个负载测试器市场的竞争策略。

全球负载测试器市场趋势与洞察

资料中心容量快速扩张

2024年,资料中心建设支出将达到每年315亿美元,全球新增资料中心面积将接近5,000万平方英尺。超大规模营运商现在要求从工厂启动到整合系统检验全程进行持续验收测试,这显着提高了租赁负载测试器的使用率。为了维持服务等级协议,临时负载箱会在维护窗口期间定期重新部署,从而产生持续收入。人工智慧工作负载的功率密度不断提高,迫使资料中心试运行需要进行兆瓦级负载测试的高容量备用发电机。託管空间的提前预租正在加快试运行进度,缩短测试时间,并推高市场上可快速部署的负载测试器产品的溢价。

由于可再生能源的快速成长,电网稳定变得尤为重要。

整合风能和太阳能的电力公司必须证明其符合 IEEE 1547-2018 併网通讯协定,该协议强调有功功率管理和频率响应。在巴西的 Morro dos Ventos 风电场通讯协定中,使用了一个 3.3 MVA 的负载测试器来检验145 MW 风力涡轮机的输出功率,然后再併网。对于太阳能发电计划,在不断变化的太阳辐射条件下进行弃风测试是强制性的,这推动了对能够模拟突发负载变化的可编程电子单元的需求。能源储存系统增加了场景的复杂性,电池放电和发电机备用电源之间的无缝切换透过混合负载测试来检验。亚洲和南美洲的电力公司正在寻求能够支援多个变电站的携带式大容量设备,这促进了相容负载测试器市场的扩张。

计划週期短更有利于租赁而非购买。

试运行团队越来越多地在几週内完成负载测试器的采购,这削弱了设备采购的合理性。储存、维护和折旧免税额成本使得租赁在生命週期经济效益方面更具优势,尤其是在多个计划并行运作时。大型租赁公司利用与原始设备製造商 (OEM) 的批量折扣,挤压了单一製造商的利润空间。设施管理团队倾向于将测试纳入能源基础设施合约的打包服务协议,从而减少了对设备的直接需求。这种向服务型模式的结构性转变预计将增加负载测试器市场的整体收入,但会抑制独立销售量。

细分市场分析

混合式负载单元将电阻性和无功功率元件整合于同一机壳内,预计到2025年将占据负载测试器市场44.60%的份额,使承包商能够使用单一租赁单元完成各种试运行任务。儘管电子负载系统目前的装置量较小,但预计到2031年将以7.78%的复合年增长率成长。其可再生能源架构可将高达96%的吸收能量回馈电网,从而降低测试週期内的运作成本并减少现场的余热需求。纯电阻式产品定位为入门级产品,适用于无需功率因数校正的简单发电机下拉测试。同时,无功式产品可为马达控制和UPS检验提供精确的感性或容性负载。

在超大规模资料中心,电子类产品应用最为迅速,因为降低冷却负荷和缩短停机时间至关重要。营运商正越来越多地采用机架级再生式冷冻单元,并将其与楼宇管理软体对接。同时,混合式设计在租赁设备中仍然很受欢迎,它在单一撬装单元上模拟主动和被动组件,从而提高可用性并降低物流成本。纯被动产品仍是电力公司检验运转率因数校正设备的小众市场。泰克科技于2024年4月收购了EA Elektro-Automatik,将其3.8MW再生式冷冻平台扩展至96%以上的往返效率,凸显了产业向高效、数位化控制解决方案的融合趋势。

功率超过2000kW的设备将以6.62%的复合年增长率成长,这反映了需要超过100MW电力的超大规模资料中心的快速成长。这些资料中心需要兆瓦级的发电机组和对应的负载测试器,以便透过一次下拉测试即可对整个系统进行全面测试。同时,功率低于500kW的设备在2025年仍将占总收入的39.30%,这主要得益于医院和商业建筑对UPS和紧急发电机进行例行检查的需求。随着中型资料中心的兴起,501-2000kW负载测试器的市场规模也在稳定扩大,但增速低于功率两端的设备。

规模经济有利于大容量撬装设备的生产,但运输物流和现场搬运的限制仍是限制因素。小型平台由于成本低、易于移动而保持市场需求,尤其是在服务分散基本客群的租赁车队中。最小和最大细分市场之间的两极化凸显了不同产业采购标准的差异,并强化了产品系列多元化作为竞争优势的必要性。

负载测试器市场报告按类型(混合负载测试器、电子负载测试器等)、负载容量(500KW 以下、2000KW 以上等)、外形规格(可携式、机架式/模组化等)、应用(资料中心/云端、可再生能源整合/微电网等)、最终用户(公共产业、租赁/服务供应商等)和地区(北美、欧洲、亚太地区)进行细分、欧洲、亚太地区等地区。

区域分析

到2025年,北美地区将占施耐德电气总收入的35.10%,这得益于Schneider Electric计画在2027年前投资7亿美元扩大其製造能力。此举将加强资料中心和公共产业的国内供应链。诸如NFPA 110等法规结构要求对关键基础设施的发电机进行满载测试,从而保障了基准需求。铜价上涨加剧了成本压力,并推动了在地采购,从而缩短了前置作业时间。成熟的租赁生态系统支援快速部署,并使该地区的服务能力脱颖而出。

亚太地区预计将以7.45%的复合年增长率成为成长最快的地区,这主要得益于资料中心装置容量年均22%的成长,预计东京、雪梨、孟买和首尔等主要大都会地区的装置容量将达到2996兆瓦。各国为促进人工智慧和云端运算应用而製定的策略正在推动对备用电源的投资,而多样化的气候条件则要求设备能够承受高湿度和极端温度变化。中国新的资料中心能源效率法规,以及新加坡计划的重启,正在推动先进可再生能源设备的采购。

欧洲在严格的环境政策基础上稳步取得进展。欧盟指令2000/14/EC限制了室外装置的噪音排放,促使原始设备製造商(OEM)采用改良的挡板和低速风扇设计。欧盟再生能源计画(REPowerEU)的可再生能源容量目标正在加速分散式能源併网测试,并扩大其应用范围。市场参与企业正在利用模组化货柜解决方案,以满足都市区噪音法规和面积,并与更广泛的绿色基础设施倡议保持一致。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 资料中心容量快速成长

- 由于可再生能源的快速成长,对电网稳定性的需求日益增长

- 关键设施的容错需求

- 租赁/临时电力设施扩建

- 偏远地区混合交流-直流微电网的兴起

- 燃料节约促使人们倾向选择再生负载测试器

- 市场限制

- 由于计划週期短,租房比买房更受欢迎。

- 原物料价格波动(铜、不锈钢)

- 原始设备製造商之间缺乏互通性标准

- 都市区噪音和热排放法规遵守情况问题

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 电阻负载测试器

- 无功负载测试器

- 混合负载测试器

- 电子负载测试器

- 按负载容量(千瓦额定值)

- 小于500千瓦

- 501~1,000 kW

- 1,001~2,000 kW

- 2000度或以上

- 按外形规格

- 可携式的

- 拖车式/移动式

- 固定式

- 机架式/模组化

- 透过使用

- 发电和试运行

- 资料中心和云

- 製造业和工业

- 海洋/造船

- 石油天然气和石化

- 可再生能源併网和微电网

- 国防和航太地面支援

- 医疗及其他必要设施

- 最终用户

- 公共产业

- 商业和工业业主

- 租赁和服务供应商

- 国防和政府机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧国家

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- ASCO Power Technologies(Schneider Electric)

- Crestchic Loadbanks

- Avtron Power Solutions(Vertiv)

- Simplex(Cummins)

- Mosebach Manufacturing

- Load Banks Direct

- Eagle Eye Power Solutions

- Kaixiang Power

- Sephco Industries

- Powerohm Resistors(AMETEK)

- Hillstone Products

- Tatsumi Ryoki

- Shenzhen KSTAR

- ComRent International

- Hitec Power Protection

- Nordhavn Power Solutions

- Pite Tech

- Johnson Controls(Load Bank Division)

- Trystar Load Banks

- Pacific Power Source

- Powerhaul International

第七章 市场机会与未来展望

Load Bank Market size in 2026 is estimated at USD 327.2 million, growing from 2025 value of USD 311.53 million with 2031 projections showing USD 418.27 million, growing at 5.03% CAGR over 2026-2031.

Momentum originates from hyperscale data-center build-outs, renewable-rich grids requiring stability validation, and stricter performance mandates for mission-critical facilities. Data-center operators are raising power-density benchmarks, prompting multi-stage validation that expands rental opportunities for load-bank service providers. Renewable integration adds demand for resistive-reactive and electronic systems that can simulate dynamic load profiles for wind, solar, and storage projects. Manufacturers respond with regenerative designs that recover up to 96% of test energy, a feature increasingly requested in new utility and microgrid procurements. At the same time, raw-material inflation and short project timelines pivot many buyers toward asset-light rental models, influencing competitive strategy across the load bank market.

Global Load Bank Market Trends and Insights

Rapid Data-Center Capacity Additions

Annual data-center construction spending stood at USD 31.5 billion in 2024, and the global pipeline is nearing 50 million ft2 of new space. Hyperscale operators now demand sequential acceptance tests that start at the factory and end with integrated system validation, significantly lifting the utilization of rental load banks. Temporary fleets are routinely redeployed during maintenance windows to sustain service-level agreements, generating recurring revenue. AI workloads lift power density, forcing facilities to commission higher-capacity standby generators that require multi-megawatt load tests. Early pre-leasing of colocation space accelerates the commissioning schedule, compressing test timelines and elevating the premium on fast-deploy load bank market offerings.

Grid-Stability Needs Amid Renewable Surge

Utilities integrating wind and solar must show compliance with IEEE 1547-2018 interconnection protocols, which emphasize active power management and frequency response.Wind-farm projects such as Brazil's Morro Dos Ventos used a 3.3 MVA load bank to validate 145 MW of turbine output before grid tie-in. Photovoltaic installations now include curtailment testing under varying irradiance profiles, driving demand for programmable electronic units that can replicate rapid load ramps. Energy-storage systems complicate scenarios; seamless transition between battery discharge and generator backup is verified through hybrid load tests. Utilities in Asia and South America seek portable high-capacity rigs to service multiple substations, bolstering the addressable load bank market.

Short Project Cycles Favor Rentals Over Purchases

Commissioning teams increasingly source load banks for only a few weeks, undermining the case for capital purchases. Storage, maintenance, and depreciation costs tilt life-cycle economics toward renting, especially when multiple projects run concurrently. Large rental houses leverage volume-purchase discounts with OEMs, tightening margin pressure on standalone manufacturers. Facilities management groups prefer bundled service contracts that fold testing into wider energy-infrastructure deals, reducing direct equipment demand. This structural swing toward services constrains unit volumes as overall load bank market revenues grow.

Other drivers and restraints analyzed in the detailed report include:

- Resiliency Mandates for Mission-Critical Facilities

- Expansion of Rental/Temporary Power Fleet

- Volatility in Raw-Material Prices (Copper, Stainless Steel)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid units held 44.60% of the load bank market share in 2025 by combining resistive and reactive elements inside one enclosure, allowing contractors to complete a wider range of commissioning tasks with a single rental. Though smaller in installed base, electronic systems are forecast for an 7.78% CAGR through 2031 as their regenerative architecture returns up to 96% of absorbed energy to the grid, trimming test-cycle operating costs and lowering on-site heat rejection needs. Pure resistive products remain the entry-level option for straightforward generator pull-down checks where power-factor correction is unnecessary, while reactive models provide precise inductive or capacitive loading for motor-control and UPS validation.

The electronic category is gaining ground fastest inside hyperscale data halls that must limit cooling loads and shorten outage windows; operators increasingly embed rack-level regenerative units that synchronize with building-management software. Meanwhile, hybrid designs stay popular with rental fleets because a single skid can simulate real and reactive components, improving utilization and cutting logistics. Pure reactive offerings persist as a niche for utilities that verify power-factor compensation banks. Tektronix's April 2024 acquisition of EA Elektro-Automatik expanded its regenerative platform to 3.8 MW with >=96% round-trip efficiency, underscoring industry convergence on high-efficiency, digitally controlled solutions.

Units above 2,000 kW will expand at a 6.62% CAGR, mirroring the surge of hyperscale campuses exceeding 100 MW utility feeds. These facilities require multi-megawatt generator strings and commensurate load banks capable of full-system testing in a single pull-down. Conversely, sub-500 kW devices maintained 39.30% of 2025 revenue, underpinned by routine UPS and standby-generator checks in hospitals and commercial buildings. The load bank market size for 501-2,000 kW equipment advances steadily as mid-tier data-centers proliferate, though growth moderates relative to extremes at both ends.

Economies of scale favor manufacturing higher-capacity skids, but transport logistics and site-handling constraints remain limiting factors. Smaller platforms preserve demand due to low cost and ease of mobility, particularly in rental fleets that service distributed customer bases. Polarization between the smallest and largest segments underscores divergent procurement criteria across industries, reinforcing product-portfolio diversification as a competitive necessity.

The Load Bank Market Report is Segmented by Type (Hybrid Load Banks, Electronic Load Banks, and More), Load Capacity (Up To 500 KW, Above 2, 000 KW, and More), Form Factor (Portable, Rack-Mounted/Modular, and More), Application (Data Centres and Cloud, Renewable-Energy Integration and Microgrids, and More), End-User (Utilities, Rental and Service Providers, and More), and Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America controlled 35.10% of 2025 revenue, underpinned by Schneider Electric's USD 700 million manufacturing expansion pledge through 2027, which enhances domestic supply chains serving data centers and utilities. Regulatory frameworks such as NFPA 110 prescribe full-load generator tests for critical infrastructure, sustaining baseline demand. Tariffs on copper raise cost pressure and prompt localization moves that shorten lead times. Mature rental ecosystems support rapid deployment, differentiating the region's service capability.

Asia-Pacific is projected to have the quickest 7.45% CAGR thanks to a 22% annual increase in data-center inventory reaching 2,996 MW across metro hubs like Tokyo, Sydney, Mumbai, and Seoul. National strategies encouraging AI and cloud adoption elevate backup-power investments, while diverse climates necessitate equipment able to endure high humidity and wide temperature swings. China's new data-center energy-efficiency rules and Singapore's restart of the project collectively stimulate the procurement of advanced regenerative units.

Europe exhibits steady progression anchored in stringent environmental policy. Directive 2000/14/EC caps noise emissions for outdoor equipment, pushing OEMs to integrate improved baffling and low-RPM fan designs. Renewable-capacity targets under REPowerEU accelerate grid-support trials for distributed energy resources, widening the application scope. Market participants leverage modular container solutions compatible with urban noise and footprint constraints, aligning with broader green-infrastructure ambitions.

- ASCO Power Technologies (Schneider Electric)

- Crestchic Loadbanks

- Avtron Power Solutions (Vertiv)

- Simplex (Cummins)

- Mosebach Manufacturing

- Load Banks Direct

- Eagle Eye Power Solutions

- Kaixiang Power

- Sephco Industries

- Powerohm Resistors (AMETEK)

- Hillstone Products

- Tatsumi Ryoki

- Shenzhen KSTAR

- ComRent International

- Hitec Power Protection

- Nordhavn Power Solutions

- Pite Tech

- Johnson Controls (Load Bank Division)

- Trystar Load Banks

- Pacific Power Source

- Powerhaul International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid data-centre capacity additions

- 4.2.2 Grid-stability needs amid renewable surge

- 4.2.3 Resiliency mandates for mission-critical facilities

- 4.2.4 Expansion of rental/temporary power fleet

- 4.2.5 Rise of hybrid AC-DC microgrids in remote sites

- 4.2.6 Growing preference for regenerative load banks to curb fuel burn

- 4.3 Market Restraints

- 4.3.1 Short project cycles favour rentals over purchases

- 4.3.2 Volatility in raw-material prices (copper, stainless steel)

- 4.3.3 Limited interoperability standards across OEMs

- 4.3.4 Noise & heat-dissipation compliance hurdles in urban sites

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Resistive Load Banks

- 5.1.2 Reactive Load Banks

- 5.1.3 Hybrid Load Banks

- 5.1.4 Electronic Load Banks

- 5.2 By Load Capacity (kW Rating)

- 5.2.1 Up to 500 kW

- 5.2.2 501 to 1,000 kW

- 5.2.3 1,001 to 2,000 kW

- 5.2.4 Above 2,000 kW

- 5.3 By Form Factor

- 5.3.1 Portable

- 5.3.2 Trailer-Mounted/Mobile

- 5.3.3 Stationary

- 5.3.4 Rack-Mounted/Modular

- 5.4 By Application

- 5.4.1 Power Generation and Commissioning

- 5.4.2 Data Centres and Cloud

- 5.4.3 Manufacturing and Industrial

- 5.4.4 Marine and Shipbuilding

- 5.4.5 Oil and Gas and Petrochemical

- 5.4.6 Renewable-Energy Integration and Microgrids

- 5.4.7 Defence and Aerospace Ground Support

- 5.4.8 Healthcare and Other Mission-Critical Facilities

- 5.5 By End-user

- 5.5.1 Utilities

- 5.5.2 Commercial and Industrial Owners

- 5.5.3 Rental and Service Providers

- 5.5.4 Defence and Government

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 NORDIC Countries

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 ASEAN Countries

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 ASCO Power Technologies (Schneider Electric)

- 6.4.2 Crestchic Loadbanks

- 6.4.3 Avtron Power Solutions (Vertiv)

- 6.4.4 Simplex (Cummins)

- 6.4.5 Mosebach Manufacturing

- 6.4.6 Load Banks Direct

- 6.4.7 Eagle Eye Power Solutions

- 6.4.8 Kaixiang Power

- 6.4.9 Sephco Industries

- 6.4.10 Powerohm Resistors (AMETEK)

- 6.4.11 Hillstone Products

- 6.4.12 Tatsumi Ryoki

- 6.4.13 Shenzhen KSTAR

- 6.4.14 ComRent International

- 6.4.15 Hitec Power Protection

- 6.4.16 Nordhavn Power Solutions

- 6.4.17 Pite Tech

- 6.4.18 Johnson Controls (Load Bank Division)

- 6.4.19 Trystar Load Banks

- 6.4.20 Pacific Power Source

- 6.4.21 Powerhaul International

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment