|

市场调查报告书

商品编码

1906257

电动工具:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Power Tools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

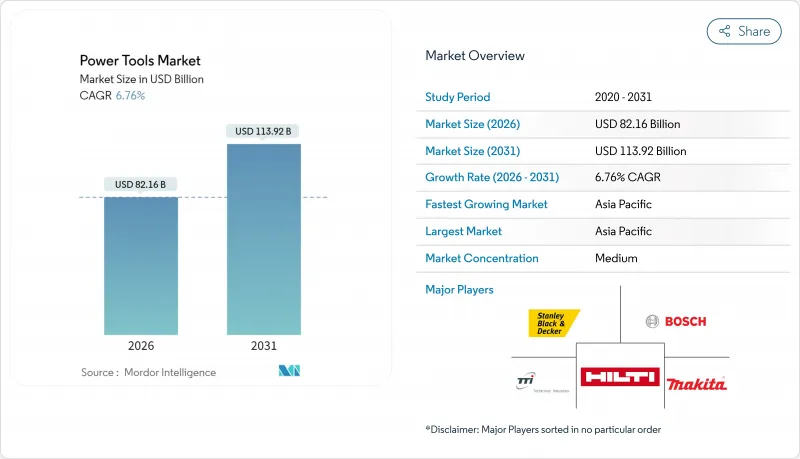

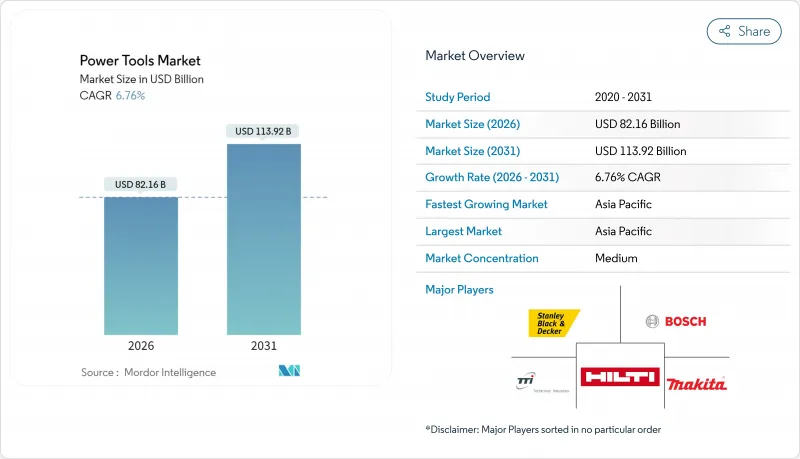

预计电动工具市场将从 2025 年的 769.6 亿美元成长到 2026 年的 821.6 亿美元,到 2031 年将达到 1,139.2 亿美元,2026 年至 2031 年的复合年增长率为 6.76%。

基础设施建设规划的扩展、快速的都市化以及向无线技术的转变,在供应链逐步恢復正常的同时,也支撑着市场需求。无线技术正在重新定义工作场所的生产力,而主要城市日益严格的排放法规正在加速从气动和汽油动力设备向电池动力平台的过渡。新兴经济体中DIY参与度的提高以及电子商务的普及正在扩大消费群,而亚洲和欧洲的智慧製造激励措施正在推动工厂对高精度、互联工具系统的投资。市场竞争强度仍然适中,主要企业透过差异化的电池生态系统来捍卫市场份额,而中国新进入者则利用在地化生产和积极的定价策略。

全球电动工具市场趋势与洞察

向高功率密度锂离子电池平台过渡

电池化学技术的进步使能量密度每年持续提升 5-7%,让承包商既能享受有线工具的运作时间,又能体验无线工具的便携性。得伟 (DEWALT) 的无工作台电池结构在减轻重量的同时,功率提升了 50%,使屋顶工和电工能够携带更轻的工具包,而无需牺牲扭矩。

北美和欧洲施工机械的电气化

鑑于排放法规和生命週期成本的降低,美国和加拿大66%的建筑经理预计将在两年内实现工地全面电动化。欧洲市政当局也正在追求类似的目标,沃尔沃等汽车製造商已承诺在2030年实现全电动车型阵容。行动快速充电器的广泛普及也缓解了里程焦虑。都市区计划越来越多地指定使用电池供电或有线电动工具,这给气压和液压工具市场带来了压力,而燃油动力工具在缺乏电网的偏远地区仍然是小众市场。已部署全电动车队的承包商报告称,二氧化碳排放量减少了高达60%,工期缩短了30%,证明了他们投资的有效性。

锂和钴价格的波动正在推高无线产品的零件成本。

美国加征关税已将中国产锂离子电池的整体关税税率提高至2025年的58%,这将对原始设备製造商(OEM)的利润率和零售价格造成压力。电池组件占高功率无线工具成本的30%至40%,现货价格上涨迫使製造商在澳洲和非洲等地寻求替代采购协议,以确保供应并稳定价格。

细分市场分析

在电动工具市场,到2025年,电动工具将占总销量的63.02%。随着锂离子电池组的性能逐渐接近有线产品,预计到2031年,无线电动工具细分市场将以7.24%的复合年增长率成长。气动工具将在已有压缩空气系统的领域中保持其市场地位,油压设备将服务于需要超高扭矩的细分市场,例如桥樑张紧。由于都市区噪音和排放气体法规的限制,引擎驱动的设备仅限于离网建筑工地和林业作业。由于多品牌电池联盟带来的成本降低和充电基础设施简化,无线电动工具市场规模预计将快速成长。然而,由于原料价格波动以及发展中地区快速充电技术的普及程度有限,价格敏感型用户仍将继续青睐有线产品。

改良的人体工学设计、无刷驱动和韧体更新如今已成为高阶无线产品的差异化优势。博世的 Professional 18V 系统和牧田的 LXT 可互换电池组充分展现了生态系统的一致性如何确保客户忠诚度。车队管理人员也支持这项转型,他们讚赏无线作业环境带来的停机时间减少和安全性提升。

到2025年,钻头和紧固工具将占电动工具市场收入的31.88%,这反映出它们在建筑工地和组装线上的广泛应用。衝击扳手和衝击起子将以7.78%的复合年增长率增长,这主要得益于汽车和航太行业日益严格的紧固规范,这些规范要求精确的扭矩控制和数据采集以实现可追溯性。切割和铣削工具仍将保持强劲势头,博世推出的硬质合金刀片的使用寿命是双金属刀片的20倍,深受大规模生产中木工的青睐。

手部振动症候群 (HAVS) 法规正在推动电锤的重新设计,博世的 GSH 18V-5 无线电锤结合了 8.5 焦耳的衝击能量和变速控制功能,有效降低了振动。热风枪和无线黏合工具等新兴品类正在推动室内装修和电子产品维修领域的需求,从而开拓了传统建设业以外的市场。儘管价格竞争日益激烈,但高端无刷产品的全面供应正帮助顶级品牌保持在电动工具市场的份额。

区域分析

预计到2025年,亚太地区将占全球电动工具收入的39.55%,年复合成长率达7.61%。这主要得益于中国升级改造计画带来的25%的资本支出成长,以及印度「印度製造」倡议吸引了许多国内外原始设备製造商(OEM)。在地化的电池组生产和不断增长的可支配收入正在推动无线产品的普及,而成熟且创新驱动的日本市场则透过高端无刷机型实现了产品差异化。

北美是电动工具市场技术先进但成长缓慢的地区。美国租赁协会 (ARA) 预测,到 2024 年,设备租赁收入将达到 773 亿美元,证实了市场需求的持续强劲。然而,对中国製造电池征收的关税推高了采购成本,并促使企业将生产转移到墨西哥。在墨西哥,电动工具进口正以两位数的速度成长,供应链也正在进行重组以规避关税。

欧洲电动工具市场在不同地区呈现不同的发展趋势。西方市场面临租赁管道饱和和严格的手振动症候群(HAVS)法规的挑战,而东欧则受益于欧盟的资金支持和新的製造能力。欧盟81亿欧元的智慧工厂投资倡议(IPCEI)正在推动智慧工厂投资,并创造对互联精密工具的需求。遵守环保法规的压力促使电动工具更受青睐,主要原始设备製造商(OEM)透过低振动认证和可回收包装来凸显自身优势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美和欧洲施工机械车队的电气化

- 亚洲电子商务的普及正在推动DIY文化的扩张。

- 汽车轻量化需要高精度,这推动了无刷工具的应用。

- 政府对智慧製造的奖励(例如「中国製造2025」、欧盟的IPCEI)

- 向锂离子电池平台过渡,实现高功率密度无线工具

- 建筑公司中模组化、订阅式按需工具程式的普及

- 市场限制

- 锂和钴价格的波动推高了无线工具零件的成本。

- 西欧成熟租赁通路的饱和

- 监管机构对臂部振动综合症 (HAVS) 的担忧限制了重型拆除工具的采用。

- 新兴市场仿冒品供应分散,侵蚀品牌溢价。

- 价值/供应链分析

- 监理与行业政策展望

- 技术展望

- 产业吸引力—五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 分销通路分析

第五章 市场规模与成长预测

- 按操作模式

- 电

- 无线

- 有线

- 气压

- 油压

- 引擎驱动

- 电

- 副产品

- 钻孔和紧固工具

- 锯子/切割工具

- 研磨和抛光工具

- 材料去除工具(砂光机等)

- 拆除工具(破碎机、风镐)

- 衝击扳手和衝击起子

- 射钉枪和订书机

- 其他(热风枪、热熔胶枪、搅拌器、专用工具)

- 最终用户

- 建筑和基础设施

- 车

- 航太/国防

- 能源与发电

- 造船、航运和铁路

- 製造业(电子、金属加工、木工等)

- 住宅/DIY

- 其他(公共产业、采矿等)

- 按销售管道

- 离线

- 直接面向行业/分销商

- 量贩店/家居建材商店

- 在线的

- 电子商务市场

- 公司内部数位商店

- 离线

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 秘鲁

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- 北欧国家(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东协(印尼、泰国、菲律宾、马来西亚、越南)

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 科威特

- 土耳其

- 埃及

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、合作、产品发布)

- 市占率分析

- 公司简介

- Stanley Black & Decker Inc.

- Robert Bosch GmbH

- Techtronic Industries Co. Ltd.

- Makita Corporation

- Hilti Corporation

- Atlas Copco AB

- Ingersoll Rand Inc.

- Snap-on Incorporated

- Apex Tool Group

- Emerson Electric Co.

- Husqvarna AB

- Honeywell International Inc.

- KYOCERA Corporation

- Festool GmbH

- Cummins Inc.(Tool segment)

- Hitachi Koki(HiKOKI)

- Illinois Tool Works(ITW)

- Ridgid(Emerson)

- Baier Power Tools

- Positec Tool Corporation

- Panasonic Life Solutions

- CEMBRE SpA

- CSUN Power Tools*

第七章 市场机会与未来展望

The Power Tools market is expected to grow from USD 76.96 billion in 2025 to USD 82.16 billion in 2026 and is forecast to reach USD 113.92 billion by 2031 at 6.76% CAGR over 2026-2031.

Expanding infrastructure programs, rapid urbanization, and the shift toward cordless technologies sustain demand even as supply chains normalize. Cordless electrification is redefining job-site productivity, while stricter emissions rules in major cities accelerate the replacement of pneumatic and gas-powered units with battery platforms. Rising DIY participation and e-commerce access in emerging economies widen the consumer base, and smart manufacturing incentives in Asia and Europe stimulate factory-floor investments in high-precision, connected tool systems. Competitive intensity remains moderate; leaders safeguard their share through differentiated battery ecosystems, whereas new Chinese entrants leverage localized production and aggressive pricing.

Global Power Tools Market Trends and Insights

Shift to Lithium-ion Battery Platforms Enabling Higher Power Density Cordless Tools

Cell chemistries continue to raise energy density by 5-7% annually, giving contractors similar runtime to corded equivalents with the benefit of untethered mobility. DEWALT's tabless cell architecture boosts power 50% while shedding weight, allowing roofers and electricians to carry lighter packs without sacrificing torque.

Electrification of Construction Equipment Fleet in North America & Europe

Sixty-six percent of construction managers in the United States and Canada now expect fully electric jobsites within two years, citing emissions caps and lower lifetime running costs. European municipalities pursue similar goals; OEMs such as Volvo pledge all-electric line-ups by 2030 while mobile fast-charging rollouts shrink range anxiety. Urban projects increasingly specify battery or corded-electric tools, pressuring pneumatic and hydraulic segments yet leaving a niche for engine-driven units on remote sites lacking grid access. Contractors adopting all-electric fleets report up to 60% CO2 savings and 30% shorter project timelines, reinforcing the payback narrative.

Volatility in Lithium & Cobalt Prices Inflating Cordless BOM Cost

US tariffs have lifted the composite duty on Chinese lithium-ion batteries to 58% in 2025, pressuring OEM margins and retail prices. Battery inputs account for 30-40% of high-power cordless tool cost; spikes in spot prices force manufacturers to negotiate alternate offtake deals in Australia and Africa to secure supply and smooth pricing.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Smart Manufacturing

- DIY Culture Expansion Fueled by E-commerce Penetration in Asia

- Saturation of Mature Rental Channels in Western Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electric formats captured 63.02% of 2025 revenue in the power tool market, with cordless sub-segments expanding at 7.24% CAGR through 2031 as lithium-ion packs approach corded performance parity. Pneumatic tools retain footholds where compressed-air systems already exist, and hydraulic devices address ultra-high-torque niches such as bridge tensioning. Engine-driven equipment is relegated to off-grid construction and forestry operations due to urban noise and emissions limits. The power tools market size for cordless solutions is projected to widen sharply as multi-brand battery alliances cut ownership costs and simplify charging infrastructure. However, raw-material pricing swings and limited fast-charging availability in developing regions keep corded units relevant for price-sensitive users.

Enhanced ergonomics, brushless drives, and firmware updates now differentiate premium cordless products. Bosch's Professional 18V System and Makita's LXT interchangeable packs highlight how ecosystem consistency locks in customer loyalty. Fleet managers appreciate the reduced downtime and safety gains derived from cable-free worksites, reinforcing the transition.

Drilling and fastening tools accounted for 31.88% of 2025 revenue in the power tool market, reflecting their ubiquity across construction and assembly lines. Impact drivers and wrenches register an 7.78% CAGR thanks to automotive and aerospace tightening specifications that require exact torque and data capture for traceability. Sawing and cutting remain resilient; carbide-tipped blades introduced by Bosch offer 20x life versus bi-metal alternatives, appealing to high-volume carpenters.

Regulations targeting HAVS prompt redesigns in demolition hammers; Bosch's cordless GSH 18V-5 balances 8.5 J impact energy with adaptive speed control to mitigate vibration exposure. Emerging categories such as heat guns and cordless glue tools gain traction in decor and electronics rework, expanding the addressable universe beyond traditional construction trades. Collectively, premium brushless offerings underpin power tools market share retention for tier-one brands despite price competition.

The Power Tools Market is Segmented by Mode of Operation (Electric, and Others), by Product (Drilling & Fastening Tools, and Others), by End-User (Construction & Infrastructure, and Others), by Sales Channel (Offline and Online), and by Region (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 39.55% of 2025 global revenue in the power tool market and is poised for a 7.61% CAGR, anchored by China's 25% capital-investment hike under its upgrading plan and India's Make in India incentives that draw both domestic and foreign OEMs. Localized battery pack production and rising disposable incomes spur cordless adoption, while Japan's mature yet innovation-centric market relies on premium brushless models to differentiate offerings.

North America constitutes a technologically advanced yet slower-growing region in the power tools market. The American Rental Association expects equipment rental revenue to climb to USD 77.3 billion in 2024, reinforcing a substantial recurring demand base. Nevertheless, tariffs on Chinese batteries inflate procurement costs, motivating near-shoring in Mexico, where tool imports surge double digits and supply chains reconfigure to sidestep duties.

Europe shows divergent trajectories in the power tools market: Western markets see rental channel saturation and strict HAVS regulation, whereas Eastern Europe benefits from EU funding and fresh manufacturing capacity. The EU's EUR 8.1 billion IPCEI initiative stimulates smart-factory investments, generating demand for connected precision tools. Environmental compliance pressure favors electric models, and leading OEMs differentiate through low-vibration certifications and recyclable packaging.

- Stanley Black & Decker Inc.

- Robert Bosch GmbH

- Techtronic Industries Co. Ltd.

- Makita Corporation

- Hilti Corporation

- Atlas Copco AB

- Ingersoll Rand Inc.

- Snap-on Incorporated

- Apex Tool Group

- Emerson Electric Co.

- Husqvarna AB

- Honeywell International Inc.

- KYOCERA Corporation

- Festool GmbH

- Cummins Inc. (Tool segment)

- Hitachi Koki (HiKOKI)

- Illinois Tool Works (ITW)

- Ridgid (Emerson)

- Baier Power Tools

- Positec Tool Corporation

- Panasonic Life Solutions

- CEMBRE S.p.A.

- CSUN Power Tools*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification of Construction Equipment Fleet in North America & Europe

- 4.2.2 DIY Culture Expansion Fueled by E-commerce Penetration in Asia

- 4.2.3 Automotive Light-weighting Demands Higher Precision, Driving Brushless Tools Adoption

- 4.2.4 Government Incentives for Smart Manufacturing (e.g., Made-in-China 2025, EU IPCEI)

- 4.2.5 Shift to Lithium-ion Battery Platforms Enabling Higher Power Density Cordless Tools

- 4.2.6 Surge in Modular, Subscription-based Tool-on-Demand Programs Among Contractors

- 4.3 Market Restraints

- 4.3.1 Volatility in Lithium & Cobalt Prices Inflating Cordless Tool BOM Cost

- 4.3.2 Saturation of Mature Rental Channels in Western Europe

- 4.3.3 Regulatory Noise Around Hand-Arm Vibration Syndrome (HAVS) Limiting Heavy Demolition Tool Uptake

- 4.3.4 Fragmented Counterfeit Supply in Emerging Markets Undercutting Brand Premiums

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Industry Policies Outlook

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Distribution Channel Analysis

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Mode of Operation

- 5.1.1 Electric

- 5.1.1.1 Cordless

- 5.1.1.2 Corded

- 5.1.2 Pneumatic

- 5.1.3 Hydraulic

- 5.1.4 Engine-Driven

- 5.1.1 Electric

- 5.2 By Product

- 5.2.1 Drilling & Fastening Tools

- 5.2.2 Sawing & Cutting Tools

- 5.2.3 Grinding & Polishing Tools

- 5.2.4 Material Removal Tools (sanders, etc.)

- 5.2.5 Demolition Tools (Breakers, Jackhammers)

- 5.2.6 Impact Drivers & Wrenches

- 5.2.7 Nailers & Staplers

- 5.2.8 Others (heat guns, glue guns, mixers, speciality tools)

- 5.3 By End-user

- 5.3.1 Construction & Infrastructure

- 5.3.2 Automotive

- 5.3.3 Aerospace & Defense

- 5.3.4 Energy & Power Generation

- 5.3.5 Shipbuilding, Marine & Railways

- 5.3.6 Manufacturing (Electronics, Metalworking, Wood Work, etc.)

- 5.3.7 Residential / DIY

- 5.3.8 Others (Utilities, Mining, etc.)

- 5.4 By Sales Channel

- 5.4.1 Offline

- 5.4.1.1 Direct Industrial/ Distributor

- 5.4.1.2 Mass Retail / Home Centers

- 5.4.2 Online

- 5.4.2.1 E-commerce Marketplaces

- 5.4.2.2 Brand-Owned Digital Stores

- 5.4.1 Offline

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Peru

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Kuwait

- 5.5.5.5 Turkey

- 5.5.5.6 Egypt

- 5.5.5.7 South Africa

- 5.5.5.8 Nigeria

- 5.5.5.9 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, Product Launches)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 Stanley Black & Decker Inc.

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Techtronic Industries Co. Ltd.

- 6.4.4 Makita Corporation

- 6.4.5 Hilti Corporation

- 6.4.6 Atlas Copco AB

- 6.4.7 Ingersoll Rand Inc.

- 6.4.8 Snap-on Incorporated

- 6.4.9 Apex Tool Group

- 6.4.10 Emerson Electric Co.

- 6.4.11 Husqvarna AB

- 6.4.12 Honeywell International Inc.

- 6.4.13 KYOCERA Corporation

- 6.4.14 Festool GmbH

- 6.4.15 Cummins Inc. (Tool segment)

- 6.4.16 Hitachi Koki (HiKOKI)

- 6.4.17 Illinois Tool Works (ITW)

- 6.4.18 Ridgid (Emerson)

- 6.4.19 Baier Power Tools

- 6.4.20 Positec Tool Corporation

- 6.4.21 Panasonic Life Solutions

- 6.4.22 CEMBRE S.p.A.

- 6.4.23 CSUN Power Tools*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment