|

市场调查报告书

商品编码

1906270

印尼工业包装:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Indonesia Industrial Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

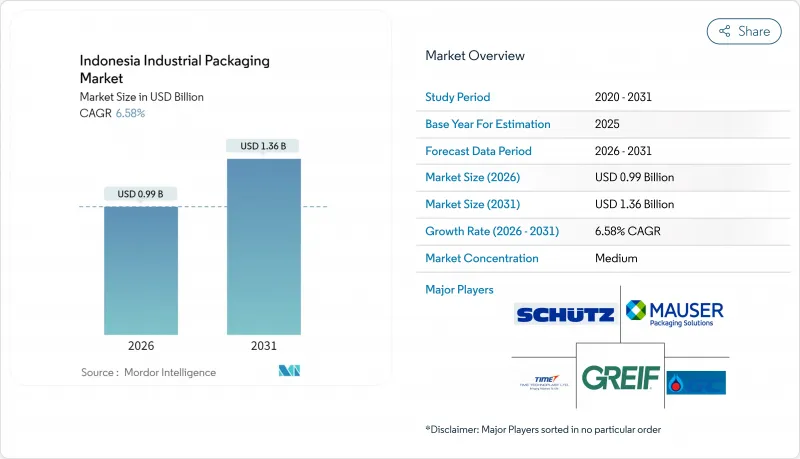

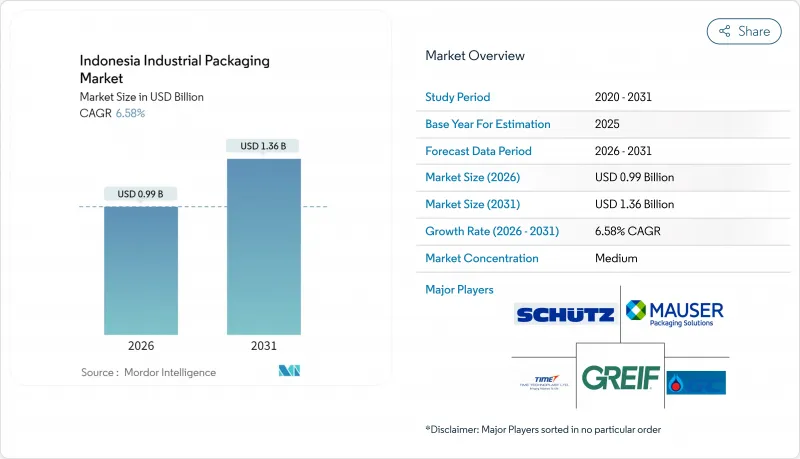

2025年,印尼工业包装市场价值9.3亿美元,预计2031年将达到13.6亿美元,高于2026年的9.9亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 6.58%。

这一前景反映了印尼作为东南亚最大经济体的地位。在印尼,不断增长的石化产能、政府主导的营养计划以及电子商务的快速发展,持续推动终端用户对散装和运输包装解决方案的需求。诸如年产能420万吨的Chandra Asri综合石化厂以及财政部2024年422.7兆印尼币(约258亿美元)的基础设施累计等投资,将加强国内供应链,并推动化工、食品和建筑业的包装消费。同时,小包装废弃物管理条例、新的食品接触标准以及不断发展的生产者延伸责任制(EPR)规则,正在促使人们重新思考包装材料的选择,并加速采用纸基和纤维基替代品进行直接食品接触应用。

印尼工业包装市场趋势与洞察

加速对食品和饮料加工产业的投资

从2025年起,印尼的免费营养计画将需要每天包装1.9亿份餐食,这将对份量控制的食品包装产生稳定的需求。百事公司位于芝卡朗的工厂投资2亿美元,是印尼2025年最大的食品饮料单笔投资项目,该工厂配备了基于阻隔桶、杀菌袋和耐热纸盒的高速无菌生产线。印尼本土企业Indofood和Mayora计划在2024年扩大产能,其中Mayora投资2.526兆印尼币(约1.54亿美元)新建一座工厂,该工厂需要调节气体包装和多层纸质包装解决方案。不断壮大的中产阶级和2.7亿人口支撑着休閒食品、即饮食品和方便食品生产的持续成长。这些因素共同推动了印尼工业包装市场的稳定成长,加工商正在拓展包装选择,以满足便携性、保质期和永续性的要求。

扩大化工和石化生产

埃克森美孚投资150亿美元的综合石化计画和乐天化学的乙烯裂解装置扩建计画是外资流入印尼化工价值链的最大规模计画。钱德拉·阿斯里公司新建的年产420万吨的树脂工厂稳定了国内树脂供应,从而促进了大容量桶、IBC货柜和耐腐蚀复合材料容器的普及。下游产业(如製药、农业化学品和特殊中间体)的成长带动了对符合联合国标准的包装和防篡改瓶盖的二次需求。限制原料出口的国内下游政策促使更多化学品在本地加工,从而扩大了印尼工业包装市场对高附加价值容器系统的潜力。从长远来看,芝勒贡和格雷西克化工产业丛集的发展将支撑散装树脂和溶剂出货量持续保持两位数成长。

更严格的塑胶废弃物法规和不断上涨的合规成本

印尼环境部已强制要求在2030年前在全国逐步淘汰多层包装袋,迫使加工商重新设计包装,并采用单层复合材料以实现大规模回收。生产者延伸责任制(EPR)法规要求品牌所有者和包装製造商承担收集和回收成本,这将使单位生产成本增加15-20%。印尼食品药物管理局(BPOM)于2024年11月向世贸组织通报的食品接触法规,要求在商业化之前进行广泛的过渡测试和工厂审核。印尼碳排放交易平台下的新塑胶信用市场计画于2025年1月启动,将进一步加重合规负担,同时为高回收率企业提供商机。这些相互交织的政策正在挤压印尼工业包装市场的利润空间,并延长认证週期,尤其对资金有限的中小型加工商而言更是如此。

细分市场分析

由于丰富的国内树脂资源和完善的挤出及吹塑成型基础设施,预计到2025年,塑胶製品将占印尼工业包装市场份额的47.12%。儘管一次性用品的监管日益严格,但印尼塑胶解决方案的工业包装市场规模预计到2030年仍将保持可观,因为西爪哇和万丹的石化产业扩张确保了原材料的稳定供应。高密度聚苯乙烯桶、聚丙烯编织袋和多层薄膜是化学、农业和电子商务领域散装运输的基础包装材料。

纸基和纤维基材料以7.62%的复合年增长率领跑,主要得益于印尼食品药物管理局(BPOM)新标准SNI 8218:2024的实施。该标准建议在食品接触包装中使用纸板而非聚苯乙烯。随着品牌商采取有利于回收利用的策略,用于高速电商生产线的瓦楞纸板、模塑纤维嵌件和復合牛皮纸袋的需求量不断增长。金属、复合材料和生物基聚合物则满足了腐蚀性化学品封装、热灌装和可堆肥餐饮用品等特定需求。可口可乐装瓶商PT Amandina Bumi Nusantara每月3000吨的再生PET(rPET)生产线标誌着饮料二次包装领域正朝着使用再生材料的方向发展。持续的材料替代和树脂循环利用的提高将塑造印尼工业包装行业的未来需求格局。

至2025年,桶装产品将占印尼工业包装市场规模的34.92%,成为化学品、润滑油和建筑添加剂的标准包装形式。其受欢迎程度主要得益于标准化的托盘、堆高机相容性以及印尼物流业者对联合国认证的高度认可。

中型散货箱(IBC)正以7.97%的复合年增长率快速成长。智慧工厂正在采用配备整合式液位感测器和RFID标籤的1000公升IBC容器,以实现高效的库存管理。贸泽包装与Lictec于2024年达成的合作,标誌着市场正转向符合循环经济目标的双层壁、再生材料製成的IBC瓶。托盘和板条箱在电子商务小包裹处理和施工机械物流领域的需求不断增长,而保温包装则在偏远岛屿的疫苗和生技药品领域得到广泛应用。用于危险品、电池电解和温敏食品配料的专用包装,进一步丰富了印尼工业包装市场的多元化产品。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速对食品和饮料加工产业的投资

- 扩大化工和石化生产

- 电子商务导致小包裹数量快速增长

- 基础建设与建筑热潮带动托盘式物流需求成长

- 由于国内树脂产能提高,原料成本下降。

- 引进人工智慧智慧工厂需要一个相容感测器的软体包

- 市场限制

- 更严格的塑胶废弃物法规和不断上涨的合规成本

- 聚合物和钢铁原料价格波动

- 回收和收集基础设施不完善

- 对关键原料和成品包装征收贸易救济税

- 产业价值链分析

- 监管环境

- 技术展望

- 宏观经济因素如何影响市场

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 材料

- 塑胶

- 金属

- 纸张和纤维基

- 其他成分

- 依产品类型

- 果冻罐

- 中型散货箱(IBC)

- 鼓和桶

- 木箱和托盘

- 保温运输货柜

- 其他包装形式

- 按最终用户行业划分

- 化学品和製药

- 食品/饮料

- 车

- 石油、天然气和石化

- 建筑/施工

- 其他终端用户产业

- 按包装容量

- 50公升或以下

- 51~500 L

- 501~1,000 L

- 1,001~2,000 L

- 超过2000公升

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Greif Inc.

- Mauser Packaging Solutions Holding Company

- SCHUTZ GmbH & Co. KGaA

- Time Technoplast Ltd.

- PTT Global Chemical Public Company Limited

- PT Kadujaya Perkasa

- PT Rheem Indonesia

- PT Repal Internasional Indonesia

- PT Prajamita Internusa

- PT Novo Complast Indonesia

- PT Yanasurya Bhaktipersada

- PT Dinito Jaya Sakti

- PT Indragraha Nusaplasindo

- PT Java Taiko

- Amcor plc

- Brambles Limited(CHEP Indonesia)

- Cabka NV

- Grecon Holding BV

- PT Plastpack Indonesia

- PT Mitra Indo Plast

第七章 市场机会与未来展望

The Indonesia industrial packaging market was valued at USD 0.93 billion in 2025 and estimated to grow from USD 0.99 billion in 2026 to reach USD 1.36 billion by 2031, at a CAGR of 6.58% during the forecast period (2026-2031).

This outlook reflects the country's position as Southeast Asia's largest economy, where rising petrochemical capacity, government-led nutrition programs, and an e-commerce boom continue to expand end-user demand for bulk and transit packaging solutions. Investments such as Chandra Asri's 4.2 MTPA integrated petrochemical complex and the Ministry of Finance's IDR 422.7 trillion (USD 25.8 billion) infrastructure budget in 2024 strengthen domestic supply chains and stimulate packaging consumption across chemicals, food, and construction verticals. At the same time, regulations targeting sachet waste, new food-contact standards, and evolving Extended Producer Responsibility (EPR) rules are reshaping material choices and accelerating paper- and fiber-based alternatives for direct-food applications.

Indonesia Industrial Packaging Market Trends and Insights

Accelerating Food and Beverage Processing Investments

Indonesia's Free Nutritious Meals program requires packaging for 190 million meals every day beginning in 2025, creating consistent demand for portion-controlled food-grade containers. PepsiCo's USD 200 million Cikarang plant, the country's largest single F&B investment in 2025, is outfitted with high-speed, aseptic lines that rely on barrier drums, retort pouches, and temperature-stable cartons. Domestic majors Indofood and Mayora expanded capacity in 2024, with Mayora investing IDR 2.526 trillion (USD 154 million) in new facilities that require modified-atmosphere and multilayer paper-based solutions. Growing middle-class consumption and a 270 million-strong population underpin continuing output growth across snacks, ready-to-drink beverages, and convenience meals. Together these factors reinforce a steady uptick in the Indonesia industrial packaging market as processors diversify pack formats to meet portability, shelf-life, and sustainability mandates.

Expansion of Chemicals and Petrochemicals Output

ExxonMobil's USD 15 billion integrated petrochemical complex and Lotte Chemical's ethylene cracker expansion represent the largest inflows of foreign capital into Indonesia's chemical value chain. Domestic resin supply from Chandra Asri's new 4.2 MTPA plant stabilizes input prices and drives higher adoption of large-volume drums, IBCs, and corrosion-resistant composite containers. Downstream growth in pharmaceuticals, agrochemicals, and specialty intermediates multiplies secondary demand for UN-approved packs and tamper-evident closures. National downstreaming policies that restrict raw material exports ensure more chemicals are processed locally, extending the addressable Indonesia industrial packaging market size for higher-value containment systems. Over the long term, chemical-cluster build-outs in Cilegon and Gresik support ongoing double-digit volume growth in bulk resin and solvent shipments.

Escalating Plastic-Waste Regulation and Compliance Costs

The Ministry of Environment has mandated a national phase-out of multilayer sachets by 2030, compelling converters to redesign packs and invest in mono-material laminates that are recyclable at scale. EPR rules require brand owners and pack producers to finance collection and recycling, adding 15-20% to unit production costs. BPOM's November 2024 food-contact regulation, notified to the WTO, imposes broad-spectrum migration testing and factory audits prior to commercialization. A new plastic-credit market introduced under Indonesia's January 2025 carbon trading platform further increases compliance burdens but opens revenue opportunities for high-recovery operators. These overlapping policies tighten margins and lengthen certification cycles within the Indonesia industrial packaging market, particularly for SME converters with limited capital.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce-Fuelled Surge in Logistics Parcel Volumes

- Infrastructure and Construction Boom Increasing Palletised Flows

- Volatile Polymer and Steel Feed-Stock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The plastic segment captured 47.12% of the Indonesia industrial packaging market share in 2025, supported by abundant domestic resin and well-established extrusion and blow-molding infrastructure. The Indonesia industrial packaging market size for plastic solutions is expected to remain sizeable through 2030 despite tightening single-use rules, as petrochemical expansion in West Java and Banten ensures stable feedstock. High-density polyethylene drums, polypropylene woven sacks, and multilayer films underpin bulk transport across chemicals, agrocommodities, and e-commerce sectors.

Paper and fiber-based materials post the highest 7.62% CAGR, propelled by BPOM's new SNI 8218:2024 food-contact standard that favors paperboard over polystyrene for direct-food packs. Corrugated grades for high-speed e-commerce lines, molded-fiber inserts, and laminated kraft sacks gain traction as brand owners adopt easy-recycling strategies. Metal, composite, and bio-based polymers fill niche requirements in corrosive chemical containment, high-temperature filling, and compostable foodservice items. Coke bottler PT Amandina Bumi Nusantara's 3,000 tons/month rPET line highlights the shift toward recycled content in beverage secondary packaging. Continuous material substitution and improved resin circularity will shape future demand patterns in the Indonesia industrial packaging industry.

Drums and barrels retained 34.92% of the Indonesia industrial packaging market size in 2025, serving as the default format for chemicals, lubricants, and construction additives. Their ubiquity stems from standardized pallets, forklift compatibility, and UN certification familiarity among Indonesian logistics providers.

Intermediate bulk containers are growing at an 7.97% CAGR, as smart factories adopt 1,000 L units with integrated level sensors and RFID tags that streamline inventory tracking. Mauser Packaging's 2024 partnership with RIKUTEC demonstrates a shift to double-walled, recycled-content IBC bottles that meet circularity targets. Pallets and crates benefit from e-commerce parcel handling and construction equipment logistics, while insulated containers expand in vaccine and biologics distribution across remote islands. Specialized packs for hazardous materials, battery electrolytes, and temperature-sensitive food ingredients round out the diversified product landscape in the Indonesia industrial packaging market.

The Indonesia Industrial Packaging Market Report is Segmented by Material (Plastics, Metal, and More), Product Type (Jerry Cans, Ibcs, and More), End-User Industry (Chemicals and Pharmaceuticals, Food and Beverage, Automotive, Oil Gas and Petrochemicals, and More), Packaging Capacity (<=50L, 51-500L, 501-1000L, 1001-2000L, >2000L). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Greif Inc.

- Mauser Packaging Solutions Holding Company

- SCHUTZ GmbH & Co. KGaA

- Time Technoplast Ltd.

- PTT Global Chemical Public Company Limited

- PT Kadujaya Perkasa

- PT Rheem Indonesia

- PT Repal Internasional Indonesia

- PT Prajamita Internusa

- PT Novo Complast Indonesia

- PT Yanasurya Bhaktipersada

- PT Dinito Jaya Sakti

- PT Indragraha Nusaplasindo

- PT Java Taiko

- Amcor plc

- Brambles Limited (CHEP Indonesia)

- Cabka N.V.

- Grecon Holding B.V.

- PT Plastpack Indonesia

- PT Mitra Indo Plast

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating food and beverage processing investments

- 4.2.2 Expansion of chemicals and petrochemicals output

- 4.2.3 E-commerce-fuelled surge in logistics parcel volumes

- 4.2.4 Infrastructure and construction boom increasing palletised flows

- 4.2.5 Added domestic resin capacity lowering input costs

- 4.2.6 AI-enabled smart-factory adoption demanding sensor-ready packaging

- 4.3 Market Restraints

- 4.3.1 Escalating plastic-waste regulation and compliance costs

- 4.3.2 Volatile polymer and steel feed-stock prices

- 4.3.3 Under-developed recycling/collection infrastructure

- 4.3.4 Trade-remedy tariffs on key inputs and finished packs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 The Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.2 Metal

- 5.1.3 Paper and Fiber-based

- 5.1.4 Other Materials

- 5.2 By Product Type

- 5.2.1 Jerry Cans

- 5.2.2 Intermediate Bulk Containers (IBCs)

- 5.2.3 Drums and Barrels

- 5.2.4 Crates and Pallets

- 5.2.5 Insulated Shipping Containers

- 5.2.6 Other Packaging Types

- 5.3 By End-user Industry

- 5.3.1 Chemicals and Pharmaceuticals

- 5.3.2 Food and Beverage

- 5.3.3 Automotive

- 5.3.4 Oil, Gas and Petrochemicals

- 5.3.5 Building and Construction

- 5.3.6 Other End-user Industries

- 5.4 By Packaging Capacity

- 5.4.1 <= 50 L

- 5.4.2 51 - 500 L

- 5.4.3 501 - 1,000 L

- 5.4.4 1,001 - 2,000 L

- 5.4.5 > 2,000 L

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Greif Inc.

- 6.4.2 Mauser Packaging Solutions Holding Company

- 6.4.3 SCHUTZ GmbH & Co. KGaA

- 6.4.4 Time Technoplast Ltd.

- 6.4.5 PTT Global Chemical Public Company Limited

- 6.4.6 PT Kadujaya Perkasa

- 6.4.7 PT Rheem Indonesia

- 6.4.8 PT Repal Internasional Indonesia

- 6.4.9 PT Prajamita Internusa

- 6.4.10 PT Novo Complast Indonesia

- 6.4.11 PT Yanasurya Bhaktipersada

- 6.4.12 PT Dinito Jaya Sakti

- 6.4.13 PT Indragraha Nusaplasindo

- 6.4.14 PT Java Taiko

- 6.4.15 Amcor plc

- 6.4.16 Brambles Limited (CHEP Indonesia)

- 6.4.17 Cabka N.V.

- 6.4.18 Grecon Holding B.V.

- 6.4.19 PT Plastpack Indonesia

- 6.4.20 PT Mitra Indo Plast

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment