|

市场调查报告书

商品编码

1906283

锗:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Germanium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

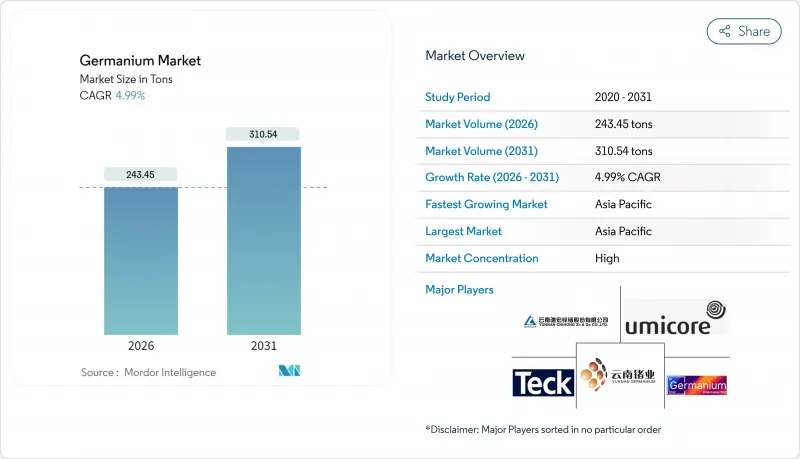

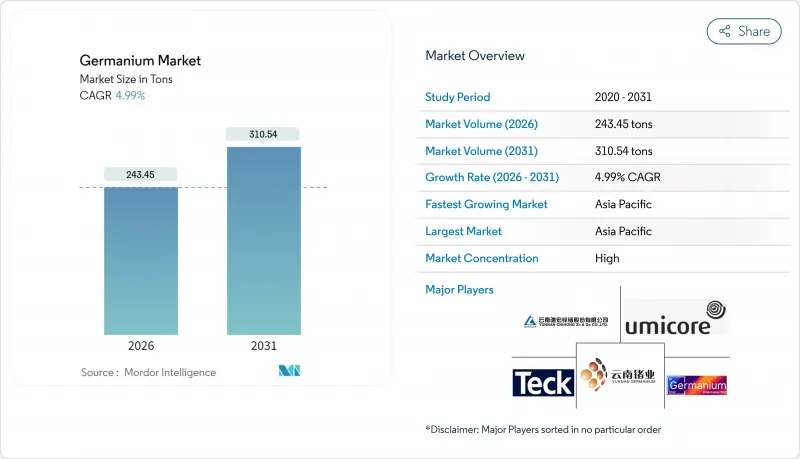

预计到 2026 年,锗市场规模将达到 243.45 吨,高于 2025 年的 231.88 吨。预测到 2031 年,锗市场规模将达到 310.54 吨,2026 年至 2031 年的复合年增长率为 4.99%。

价格趋势印证了这一成长轨迹:中国收紧出口限制导致现货价格在2025年3月飙升至每公斤4,150美元,较2023年1月上涨75%。需求主要集中在高效能应用领域,锗的优异光学和电学性能弥补了其高成本。光纤基础设施部署、航太太阳能电池阵列和量子研究都在推动锗的消费量,国防机构也正在资助国内新建晶圆产能以降低供应风险。锗作为锌提炼产品,其独特的性质限制了生产对价格飙升的反应速度,加剧了持续的供应紧张。这些因素共同推动了全球锗市场在需求主导,但又高度依赖地缘政治因素的扩张。

全球锗市场趋势与洞察

对光纤通讯的需求不断增长

通讯业者在扩展5G回程传输网路和试运行6G原型时,依赖掺锗二氧化硅来维持洲际距离上的讯号强度。这种材料的高屈光对比度在超低损耗光纤中无与伦比,因此在长途线路中很难找到替代品。所以,即使每公里掺锗量下降,网路密集化仍将推动总使用量的成长。中国在2023年后的战略性锗储备和更严格的许可监管加剧了西方通讯业者的安全担忧,并促使他们同时努力获得非中国炼製路线的认证。日本和美国对大型预製棒工厂的投资表明,随着数据流量的增长,锗市场仍有持续上涨的空间。

自动驾驶汽车和工业成像领域对红外线光学元件的需求激增

锗在 8-12 微米波长范围内的透明特性,为热成像技术开闢了新的应用领域,从驾驶辅助摄影机到工厂检测镜头,均可应用。欧盟法规强制要求从 2024 年起新车必须配备驾驶员监控功能,加速了该技术的普及。硫系玻璃虽然价格更低,但在透射效率和环境稳定性方面不如锗,因此,原始设备製造商 (OEM) 仍然选择锗光学元件来建造高端安全系统。同时,工业维护领域对能够耐受腐蚀性环境的红外线窗口的需求也在不断增长。

供应集中度以及中国的出口许可和禁令

截至2024年,中国将开采或提炼全球超过65%的原生锗,其于2024年12月禁止直接向美国出口锗的倡议,凸显了这种供应集中带来的影响。根据美国地质调查局(USGS)估计,全面禁止对美出口锗将使美国GDP减少34亿美元,其中40%的损失集中在半导体製造业。这凸显了关键供应链的脆弱性。儘管总部位于比利时的优美科(Umicore)和总部位于刚果民主共和国的STL公司正在将其工厂扩建至年产能30吨,但产量仍然小规模,不足以弥补长期供应中断带来的影响。

细分市场分析

二氧化锗占锗市场总量的30.08%,稳固确立了其作为光纤预型体和催化剂生产关键中间体的地位。其需求与通讯电缆铺设的趋势密切相关,因此该细分市场正处于稳定而渐进的成长轨道上。中国和比利时工厂溶剂萃取製程的改进提高了回收率,从而略微增加了从烟气中获取原料的需求。

预计到2031年,四氯化锗的年复合成长率将达到5.54%,主要得益于量子级晶体生长商对超干燥、超纯前驱体的需求,这些前驱体可用于化学气相沉积反应器。此外,雷射光学镀膜应用也存在一定的市场需求,此应用需要透过氯化物基化学製程实现高精度的化学计量比控制。通常采用区域纯化法製备的11N纯度锗锭可满足红外线透镜毛坯和高频晶体管基板的需求。然而,由于需求量不足(每年少于10吨),该细分市场的发展受到限制,而价格溢价则保护了综合生产商免受大宗商品价格波动的影响。其他锗化学品,例如四氟化锗和碘化锗,目前仍处于实验室阶段,等待更广泛的商业性化应用。

锗市场报告按类型(二氧化锗、四氯化锗、锗锭及其他)、应用(光纤系统、红外线光学元件、聚合催化剂、电子产品、太阳能电池及其他)和地区(亚太地区、北美地区、欧洲地区及世界其他地区)进行细分。市场预测以吨为单位。

区域分析

到2025年,亚太地区将占据全球锗市场58.80%的份额,主要得益于中国垂直整合的製造商将锌冶炼厂浸出残渣转化为6N或更高纯度的锗。随着通讯业者完成5G部署和半导体晶圆厂扩大高频宽记忆体生产,预计到2031年,亚太地区的消费量将以5.53%的复合年增长率成长。中国政府的「战略材料2035」计画为13N晶体拉丝生产线的升级改造提供补贴,进一步巩固了该地区的产能优势。

北美市场地位显着提升,这主要得益于国防和航太相关合约对超纯晶片稳定供应的重视。 5N Plus 和 Teck Resources 等公司正在供应国内材料,但供应量不足以完全消除供应链风险。华盛顿州 2024 年国防生产法案的拨款正在推动新建提炼的可行性研究,这预示着该地区锗市场将在政策主导扩张。

欧洲主要依赖比利时、德国和波兰工厂的小规模生产,其余部分则依赖进口,主要来自中国。欧盟于2024年6月通过的《关键材料法案》设定了2030年将进口依赖度降低至65%或以下的目标,并为回收示范计画提供资金。优美科在刚果民主共和国的合资企业已取得初步进展,于2024年10月交付了首批5吨产品。世界其他地区,例如纳米比亚和哈萨克斯坦,也存在其他有发展前景的地区,但要达到环境和纯度标准,需要大量资金投入。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对光纤通讯的需求不断增长

- 自动驾驶汽车和工业成像领域对红外线(IR)光学元件的需求激增

- 在高效能多结太阳能电池中采用锗基板

- 超高纯锗在量子计算量子位元和低温检测器的应用

- 国防部资助扩大国内半导体级锗芯片产能

- 市场限制

- 供应集中度以及中国的出口许可和禁令措施

- 锌矿开采的产品特性导致价格波动。

- 与硅基替代品相比,纯化和晶体生长成本较高

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 二氧化锗

- 四氯化锗

- 锗锭

- 其他类型(四氟化锗、溴化锗、碘化锗)

- 透过使用

- 光纤系统

- 红外线光学

- 聚合催化剂

- 电子设备

- 太阳能电池

- 其他应用(磷光体、冶金、伽马射线检测器)

- 按地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 比利时

- 俄罗斯

- 其他欧洲地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率**(%)/排名分析

- 公司简介

- 5N Plus Inc.

- China Germanium Co., Ltd.

- Indium Corporation

- JSC Germanium

- Nyrstar

- Societe Pour Le Traitment du Terril de Lubumbashi(STL)

- Teck Resources Limited

- Umicore

- Yunnan Chihong Zinc & Germanium Co.

- YUNNAN GERMANIUM

第七章 市场机会与未来展望

Germanium market size in 2026 is estimated at 243.45 tons, growing from 2025 value of 231.88 tons with 2031 projections showing 310.54 tons, growing at 4.99% CAGR over 2026-2031.

Price momentum underscores this growth path: spot quotations climbed to USD 4,150 per kg in March 2025, a 75% jump from January 2023, after China widened its export curbs. Demand concentrates in high-performance uses where germanium's optical and electrical properties outweigh elevated costs. Fiber-optic infrastructure roll-outs, aerospace solar arrays, and quantum research all consume rising volumes, while defense agencies fund new domestic wafer capacity to contain supply risk. Ongoing tightness is accentuated by germanium's status as a by-product of zinc smelting, which limits the speed with which production can respond to price spikes. Together these forces anchor a demand-driven but geopolitically sensitive expansion for the global germanium market.

Global Germanium Market Trends and Insights

Rising demand for fiber-optic telecommunications

Telecom operators expanding 5G backhaul and trialing 6G prototypes rely on germanium-doped silica to preserve signal strength over transcontinental distances. The material's high refractive-index contrast is unmatched for ultra-low-loss fibers, keeping substitution infeasible for long-haul lines. Network densification, therefore, lifts tonnage even as dopant loadings per kilometer fall. China's strategic stock build and tighter licensing since 2023 amplified security concerns among Western carriers, prompting parallel efforts to qualify non-Chinese refining routes. Investments in larger preform facilities in Japan and the United States indicate sustained upside for the germanium market amid data-traffic growth.

Surging need for infrared optics in autonomous vehicles & industrial imaging

Germanium's 8-12 μm transparency opens thermal-imaging use cases from driver-assist cameras to factory inspection lenses. EU regulations that require driver-monitoring features in new models from 2024 accelerate adoption. While chalcogenide glasses offer a cheaper alternative, they lag germanium in transmission efficiency and environmental stability, keeping OEMs anchored to germanium optics for premium safety systems. Parallel demand comes from industrial maintenance, where infrared windows withstand corrosive conditions.

Concentrated supply & Chinese export licensing/bans

China mined or refined more than 65% of primary germanium in 2024, and its December 2024 ban on direct shipments to the United States showcased the leverage that concentration confers. The USGS projects that a full embargo would cut U.S. GDP by USD 3.4 billion, 40% of which would fall on semiconductor fabrication, underlining exposure along critical supply chains. Belgium's Umicore and DRC-based STL are scaling a 30 tpy plant but volumes remain too small to offset a prolonged suspension.

Other drivers and restraints analyzed in the detailed report include:

- Deployment of ultra-high-purity germanium in quantum computing qubits & cryogenic detectors

- Defense funding to on-shore semiconductor-grade germanium wafer capacity

- Price volatility linked to zinc-mine by-product nature

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The germanium market size attributed to germanium dioxide accounted for 30.08% of total volume, cementing its role as the workhorse intermediate for optical-fiber preforms and catalyst production. Demand tracks telecom cable deployment patterns, giving this segment a stable yet moderate growth path. Improving solvent-extraction circuits in Chinese and Belgian plants are lifting recovery yields, marginally expanding accessible feedstock from flue dusts.

Germanium tetrachloride is projected to grow at 5.54% CAGR through 2031 as quantum-grade crystal growers source ultra-dry, ultrapure precursor for chemical-vapor-deposition reactors. Niche volumes also serve laser-optic coatings where chloride-route chemistry delivers high stoichiometric control. Ingots, typically zone-refined to 11N purity, fulfill infrared lens blanks and high-frequency transistor substrates. Their sub-10 ton annual requirements keep this tier tight, with pricing premiums shielding integrated producers from commodity swings. Other germanium chemicals such as tetrafluoride and iodide remain laboratory-scale, awaiting broader commercial validation.

The Germanium Market Report is Segmented by Type (Germanium Dioxide, Germanium Tetrachloride, Germanium Ingots, Other Types), Application (Fiber Optics System, Infrared Optics, Polymerisation Catalysts, Electronics, Solar Cells, Other Applications), and Geography (Asia-Pacific, North America, Europe, Rest of the World). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominated the germanium market with a 58.80% share in 2025, supported by vertically integrated Chinese producers that convert zinc-smelter leach residues into 6N metal and higher. Regional consumption will climb at a 5.53% CAGR through 2031 as telecom carriers complete 5G roll-outs and semiconductor fabs ramp high-bandwidth memory production. Government incentives under China's "Strategic Materials 2035" program subsidize upgrades to 13N crystal pulling lines, reinforcing local capacity advantages.

North America has significantly strengthened its position in the market due to defense and space contracts, which prioritize guaranteed access to ultra-pure wafers. 5N Plus and Teck Resources furnish domestic feed, but volumes remain insufficient to fully de-risk the supply chain. Washington's Defense Production Act allocations in 2024 spurred feasibility studies for additional refining furnaces, signaling a policy-driven uptick in the region's germanium market.

Europe relies on Belgian, German, and Polish plants for modest production, importing the remainder mainly from China. The EU Critical Raw Materials Act, adopted in June 2024, sets a 65% import-dependency ceiling by 2030 and earmarks funding for recycling pilots. Early progress is visible in Umicore's DRC joint venture, which shipped its first 5-ton batch in October 2024. Rest-of-World locations such as Namibia and Kazakhstan host resource prospects but require significant capital to meet environmental and purity benchmarks.

- 5N Plus Inc.

- China Germanium Co., Ltd.

- Indium Corporation

- JSC Germanium

- Nyrstar

- Societe Pour Le Traitment du Terril de Lubumbashi (STL)

- Teck Resources Limited

- Umicore

- Yunnan Chihong Zinc & Germanium Co.

- YUNNAN GERMANIUM

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for fiber-optic telecommunications

- 4.2.2 Surging need for infrared (IR) optics in autonomous vehicles and industrial imaging

- 4.2.3 Adoption of germanium substrates in high-efficiency multi-junction solar cells

- 4.2.4 Deployment of ultra-high-purity Ge in quantum computing qubits and cryogenic detectors

- 4.2.5 Defense funding to on-shore semiconductor-grade germanium wafer capacity

- 4.3 Market Restraints

- 4.3.1 Concentrated supply and Chinese export licensing/bans

- 4.3.2 Price volatility linked to zinc-mine by-product nature

- 4.3.3 High purification and crystal-growth costs vs. silicon alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Germanium Dioxide

- 5.1.2 Germanium Tetrachloride

- 5.1.3 Germanium Ingots

- 5.1.4 Other Types (Germanium Tetrafluoride, Germanium Bromide, Germanium Iodide)

- 5.2 By Application

- 5.2.1 Fiber Optics System

- 5.2.2 Infrared Optics

- 5.2.3 Polymerisation Catalysts

- 5.2.4 Electronics

- 5.2.5 Solar Cells

- 5.2.6 Other Applications (Phosphors, Metallurgy, and Gamma Ray Detectors)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 South Korea

- 5.3.1.4 India

- 5.3.1.5 Rest of Asia-pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Belgium

- 5.3.3.4 Russia

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 5N Plus Inc.

- 6.4.2 China Germanium Co., Ltd.

- 6.4.3 Indium Corporation

- 6.4.4 JSC Germanium

- 6.4.5 Nyrstar

- 6.4.6 Societe Pour Le Traitment du Terril de Lubumbashi (STL)

- 6.4.7 Teck Resources Limited

- 6.4.8 Umicore

- 6.4.9 Yunnan Chihong Zinc & Germanium Co.

- 6.4.10 YUNNAN GERMANIUM

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment