|

市场调查报告书

商品编码

1906867

聚酰胺:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Polyamides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

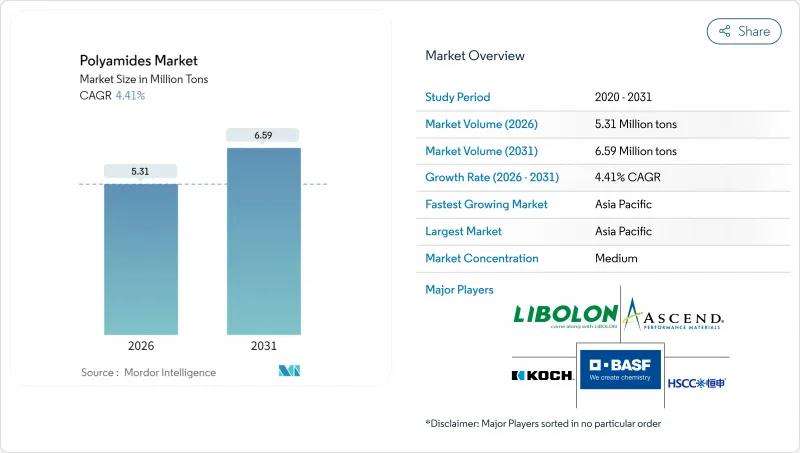

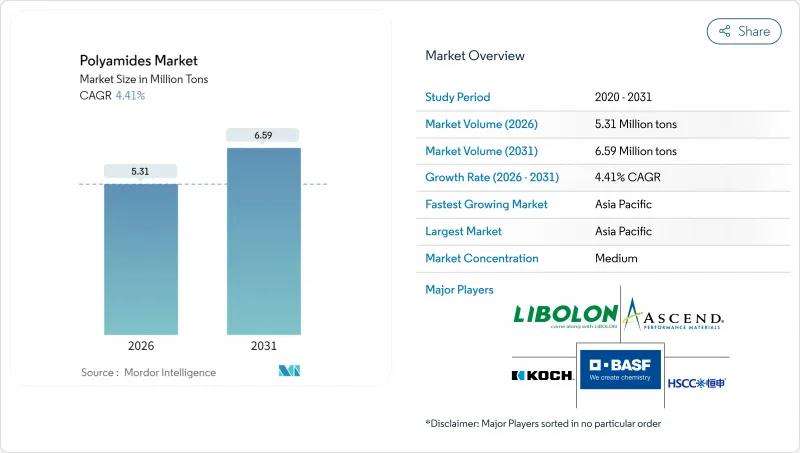

2025 年聚酰胺市场价值为 509 万吨,预计从 2026 年的 531 万吨增长到 2031 年的 659 万吨,在预测期(2026-2031 年)内复合年增长率为 4.41%。

这一成长趋势得益于汽车轻量化法规、电动车 (EV) 产量的快速成长以及 5G 电子产品中高温聚合物的加速应用。聚酰胺,尤其是 PA6 和 PA66,正不断取代金属,应用于引擎室零件、线束和电池组件,从而在减轻重量的同时,还能承受约 180°C 的持续高温。包装应用领域也呈现成长势头,食品保鲜领域对阻隔薄膜的需求日益增长,而生物基聚酰胺则满足了品牌所有者的永续性目标。供应安全仍然是战略重点。 2024 年原物料价格的波动挤压了利润空间,己二腈供不应求限制了 PA 66 的生产,这使得拥有整合供应链的製造商获得了市场份额。

全球聚酰胺市场趋势与洞察

轻量化汽车应用领域需求强劲

为了满足日益严格的燃油经济性和排放气体法规,汽车製造商正越来越多地采用PA6和PA66。电气化进一步加速了这一趋势,因为每减轻一公斤重量都能在不牺牲车内空间的前提下增加车辆续航里程。欧洲汽车製造商报告称,将动力传动系统部件从金属部件转向玻璃纤维增强聚酰胺,重量减轻了15-20%。对于引擎室零件而言,聚酰胺在高达180°C的温度下仍保持稳定,其性能优势是传统聚丙烯无法比拟的。随着全球乘用车产量的復苏和电动车普及速度的加快,整车製造商的筹资策略正在确保树脂的长期供应,巩固了聚酰胺市场最具影响力的成长支柱。

由于电气化,对线束和温度控管的需求迅速增长。

电动车架构需要紧凑的线束和能够承受高电压和高热流的坚固电池外壳。 PA12 和耐热 PA66 具有优异的耐电解性和低温柔柔软性,可实现更薄的壁厚和更小的弯曲半径。特斯拉在其 Model Y 的线束网路中采用了特种聚酰胺,在保持介电性能的同时减轻了线束重量。电动车的快速普及加速了这一需求,亚洲、欧洲和北美的新电池和线束工厂纷纷运作。计划从早期阶段就开始指定使用高性能聚酰胺材料。

己内酰胺和己二酸原料价格波动

2024年,与原油价格挂钩的己内酰胺价格大幅上涨,挤压了未避险的聚合物工厂的转换利润率。依赖亚洲进口的欧洲和北美生产商面临不断扩大的到岸成本价差,压缩了BASF聚酰胺部门的盈利。限制一氧化氧化亚氮的己二酸法规排放收紧了供应,加剧了成本波动,并抑制了长期合约的签订,尤其是对于中小加工商而言。

细分市场分析

2025年,PA 6占据了聚酰胺市场58.12%的份额。其均衡的性能和宽广的加工窗口使其适用于大规模生产的汽车零件和工业齿轮。区域性混炼厂商重视其与玻璃纤维和阻燃剂的相容性,并维持成熟的供应链。然而,随着成熟应用接近饱和,其成长速度正在放缓。 PA66预计到2031年将以4.74%的复合年增长率(CAGR)保持最高水平,这主要得益于对热变形温度超过200°C的发动机舱部件、电池冷却板和5G连接器的需求。儘管己二酸丁腈橡胶的供应受到限制,但原始设备製造商(OEM)对设计的执着将保障需求并维持其价格溢价。

酰胺纤维和PPA(聚亚苯丙烯)等特殊丛集占据了小众但盈利的市场需求。酰胺纤维在航太蜂窝、防弹材料和高抗拉强度绳索等领域的应用利润率很高,但产量仍有限。 PPA产品已渗透到涡轮增压器空气冷却器端盖和电动动力传动系统模组中,并享有两位数的价格溢价。为了因应特种纤维市场的扩张,BASF等传统PA6供应商推出了「Ultramid Advanced」系列产品,该系列产品具有更高的玻璃化转变温度和耐化学性。这模糊了产品类别之间的界限,迫使买家评估特定应用的性能,而不是通用树脂系列。聚酰胺市场占有率的成长取决于成本、供应安全和技术利润之间的平衡。 OEM材料选择委员会越来越关注整体拥有成本(TCO),权衡轻量化和小型化带来的好处与原物料价格波动带来的风险。因此,PA6 在对成本敏感的组件领域保持主导地位,而 PA66 和 PPA 在对工作温度和化学应力要求较高的先进应用中正在取得进展。

本聚酰胺市场报告按树脂子类型(PA6、PA66、芳香聚酰胺、PPA)、终端用户产业(汽车、电气电子、航太、工业机械、建筑施工、包装及其他终端用户产业)和地区(亚太、北美、欧洲、南美、中东和非洲)进行细分。市场预测以数量(吨)和价值(美元)为单位。

区域分析

预计到2025年,亚太地区将占聚酰胺市场50.88%的份额,并在2031年之前以4.89%的复合年增长率成长。中国不断扩大的电动车(EV)产量预计将增加对线束树脂的需求,而印度蓬勃发展的电子产业预计将推动对高温树脂的需求。日本为混合动力传动系统供应精密混炼和芳香族聚酰胺,而韩国则将聚酰胺聚合物(PPA)应用于销往全球的5G模组。儘管原料自给率正在提高,但己内酰胺供应的集中性使得该地区容易受到原油价格波动的影响。马来西亚和泰国等国正在推行下游投资奖励措施,旨在实现生产基地多元化,吸引第二批寻求在中国以外地区建立生产基地的加工商。

美国汽车製造商正积极采用轻质聚合物,而航太巨头则指定使用3D列印粉末製造乘客舱和引擎室零件。儘管Ascend垂直整合的PA66供应链在一定程度上保障了国内买家免受己二腈短缺的影响,但特种等级的PA66仍面临产能限制。墨西哥日益增长的汽车组装趋势利用了当地复合材料生产商提供的高性价比PA6,而加拿大的航太供应链正在试验高性能芳香聚酰胺。欧洲正着力发展循环经济。儘管成本增加,德国高端OEM厂商仍在推进生物基和再生聚酰胺的采用,并将永续性纳入供应商评估标准。法国航空航太业正在加快增材製造等级的认证,而义大利机械工业丛集对耐磨零件的需求保持稳定。欧洲化学品管理局(ECHA)正在扩大其REACH法规的积层製造审查范围,并对拥有完善监管文件的生产商给予奖励。脱欧后,英国製造商正瞄准高利润的特殊化合物,以弥补生产损失。南美洲和中东及非洲虽然合计份额较小,但由于汽车产业的本土化和基础设施的扩张,呈现上升趋势。巴西的软包装加工商正在探索用于出口型农产品运输的聚酰胺多层薄膜,而波湾合作理事会(GCC)国家则利用低成本原料吸引树脂投资。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 轻量化汽车应用领域需求强劲

- 电动车对线束和温度控管的需求快速成长

- 5G电子产品对耐高温聚合物的需求成长

- 消费品牌向生物基聚酰胺的转变

- 新兴航太增材製造级

- 市场限制

- 己内酰胺和己二酸原料价格波动

- PA 66基聚合物持续供需失衡

- 软包装领域对PET和PP替代品的需求日益增长

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 新进入者的威胁

- 监管环境

- 进出口分析

- 价格趋势

- 回收利用概述

- 终端用户产业趋势

- 航太(航太零件生产收入)

- 汽车(汽车产量)

- 建筑与施工(新建建筑占地面积)

- 电气电子设备(电气电子设备生产收入)

- 包装(塑胶包装量)

第五章 市场规模及成长预测(以金额为准及数量)

- 依树脂亚型

- 聚酰胺(PA)6

- 聚酰胺(PA)66

- 芳香聚酰胺

- 聚邻苯二甲酰胺(PPA)

- 按最终用户行业划分

- 车

- 电气和电子设备

- 航太

- 工业和机械

- 建筑/施工

- 包装

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 马来西亚

- 亚太其他地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 欧洲

- 德国

- 法国

- 义大利

- 英国

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- AdvanSix

- Arclin

- Arkema SA

- Ascend Performance Materials

- BASF SE

- Celanese Corporation

- Domo Chemicals

- Envalior

- Evonik Industries

- Hangzhou Juheshun New Materials Co., Ltd.

- Highsun Holding Group

- Invista

- Koch Industries, Inc.

- Kuraray Co., Ltd.

- LIBOLON

- Solvay SA

- Ube Corporation

第七章 市场机会与未来展望

第八章:执行长面临的关键策略挑战

The Polyamides Market was valued at 5.09 million tons in 2025 and estimated to grow from 5.31 million tons in 2026 to reach 6.59 million tons by 2031, at a CAGR of 4.41% during the forecast period (2026-2031).

This growth trajectory is underpinned by automotive lightweighting mandates, the rapid scaling of electric vehicle (EV) production, and the accelerating adoption of high-temperature polymers in 5G electronics. Polyamide grades, notably PA 6 and PA 66, continue to displace metals in under-hood parts, wire harnesses, and battery components because they provide weight savings while withstanding sustained temperatures near 180 °C. Packaging applications are also gaining momentum as barrier-film requirements rise in food preservation, while bio-based polyamides answer brand-owner sustainability targets. Supply security remains a strategic priority: feedstock price swings in 2024 squeezed margins, and adiponitrile bottlenecks constrained PA 66 output, prompting producers with integrated chains to capture share.

Global Polyamides Market Trends and Insights

Robust Demand from Lightweight Automotive Applications

Automakers are increasingly selecting PA 6 and PA 66 to comply with stringent fuel-efficiency and emission regulations. Electrification intensifies this trend because every kilogram of mass eliminated extends driving range without sacrificing cabin space. European OEMs report 15-20% weight cuts in powertrain parts after shifting from metals to glass-fiber-reinforced polyamides. Under-hood components benefit from polyamides' stability up to 180 °C, providing performance margins that conventional polypropylene cannot achieve. As global passenger-vehicle output rebounds and EV penetration accelerates, OEM sourcing strategies lock in long-term resin volumes, anchoring the most influential growth pillar for the polyamides market.

Surge in E-Mobility Wire Harness and Thermal Management Needs

EV architecture demands compact wiring looms and robust battery housings that can handle higher voltages and heat flux. PA 12 and heat-stabilized PA 66 exhibit superior electrolyte resistance and low-temperature flexibility, enabling slim wall thickness and tighter bend radii. Tesla introduced specialized polyamides into the Model Y wiring networks, reducing harness mass while maintaining dielectric properties. Rapid EV scaling makes this driver immediate, with Asia, Europe, and North America commissioning greenfield battery and harness plants that specify high-performance polyamide grades from project inception.

Volatility in Caprolactam and Adipic Acid Feedstock Prices

Crude-linked caprolactam quotations spiked in 2024, eroding conversion margins at polymer plants that lack hedged sourcing. European and North American producers, who are dependent on Asian imports, faced wider landed-cost spreads, compressing profitability at BASF's polyamides division. Adipic-acid regulations restricting nitrous oxide emissions further squeezed the supply, amplifying cost volatility and deterring long-term contracts, especially for smaller processors.

Other drivers and restraints analyzed in the detailed report include:

- Growth in 5G Electronics Requiring High-Temperature Polymers

- Shift Toward Bio-Based Polyamides in Consumer Brands

- Persistent Supply-Demand Imbalance in PA 66 Base Polymer

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PA 6 accounted for 58.12% of the polyamides market size in 2025, as its balanced property set and wide processing window favor large-volume automotive components and industrial gears. Regional compounders appreciate its compatibility with glass fibers and flame retardants, sustaining entrenched supply chains. Yet growth moderates as mature applications saturate. PA 66 recorded the leading 4.74% CAGR through 2031, propelled by under-hood parts, battery cooling plates, and 5G connectors where heat deflection temperatures exceed 200 °C. Despite adiponitrile bottlenecks, OEM design lock-in protects demand, and price premiums remain defensible.

The specialty cluster-aramids and PPA-addresses niche but lucrative needs. Aramid fiber usage in aerospace honeycomb, ballistic protection, and high-tension cords yields strong margins; however, volumes remain modest. PPA grades penetrate turbocharger air-cooler end tanks and electric powertrain modules, commanding double-digit price premiums. Traditional PA 6 suppliers, such as BASF, introduced Ultramid Advanced lines that elevate glass-transition temperatures and chemical resistance to counter specialty incursions. This blurs category boundaries, nudging buyers to evaluate performance on an application-specific basis rather than generic resin families. Polyamides market share gains hinge on balancing cost, availability, and technical headroom. OEM material-selection committees are increasingly running total-cost-of-ownership scenarios, weighing feedstock volatility against the advantages of lightweighting or miniaturization. As such, PA 6 retains leadership in cost-critical parts, whereas PA 66 and PPA capture frontier applications where operating temperatures or chemical exposure escalate.

The Polyamides Market Report is Segmented by Sub-Resin Type (PA 6, PA 66, Aramid, and PPA), End-User Industry (Automotive, Electrical and Electronics, Aerospace, Industrial and Machinery, Building and Construction, Packaging, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD)

Geography Analysis

The Asia-Pacific region held a 50.88% share of the polyamides market in 2025 and is projected to grow at a 4.89% CAGR through 2031. China's growing EV output will magnify demand for wire harness resins, while India's electronics push is expected to add volumes in high-temperature grades. Japan supplies precision compounding and aromatic polyamides for hybrid powertrains, and South Korea deploys PPA in 5G modules sold worldwide. Although feedstock self-sufficiency is improving, the caprolactam supply concentration makes the region vulnerable to crude oil price fluctuations. Nations such as Malaysia and Thailand target downstream investment incentives to diversify production footprints, attracting second-wave processors seeking China-plus-one strategies.

United States automakers incorporate lightweighting polymers aggressively, and aerospace primes specify 3D-printing powders for cabin and engine-bay parts. Ascend's vertically integrated PA 66 chain shields domestic buyers from some adiponitrile shortages, but capacity constraints still ripple across specialist grades. Mexico's vehicle assembly uptrend taps cost-efficient PA 6 from regional compounders, while Canada's aerospace supply base experiments with high-performance aramids. Europe underscores circularity. Germany's premium OEMs are locking in bio-content or recycled polyamides despite higher costs, thereby embedding sustainability into their supplier scorecards. France's aviation segment drives certification of additive-manufacturing grades, and Italy's machinery cluster maintains reliable demand for engineered wear parts. The European Chemicals Agency continues to expand scrutiny of additives under REACH, rewarding producers with robust regulatory dossiers. Brexit-era U.K. manufacturing targets high-margin specialty compounds to offset volume leakage. South America, the Middle East, and Africa collectively account for smaller shares, yet deliver upside through automotive localization and infrastructure expansion. Brazil's flexible-packaging converters are exploring polyamide multilayers for export-oriented agrifood shipments, whereas Gulf Cooperation Council countries are leveraging low-cost feedstock to attract resin investments.

- AdvanSix

- Arclin

- Arkema S.A.

- Ascend Performance Materials

- BASF SE

- Celanese Corporation

- Domo Chemicals

- Envalior

- Evonik Industries

- Hangzhou Juheshun New Materials Co., Ltd.

- Highsun Holding Group

- Invista

- Koch Industries, Inc.

- Kuraray Co., Ltd.

- LIBOLON

- Solvay S.A.

- Ube Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust Demand from Lightweight Automotive Applications

- 4.2.2 Surge in E-Mobility Wire Harness and Thermal Management Needs

- 4.2.3 Growth in 5G Electronics Requiring High-Temperature Polymers

- 4.2.4 Shift Toward Bio-Based Polyamides in Consumer Brands

- 4.2.5 Emerging Aerospace Additive-Manufacturing Grades

- 4.3 Market Restraints

- 4.3.1 Volatility in Caprolactam and Adipic Acid Feedstock Prices

- 4.3.2 Persistent Supply-Demand Imbalance in PA 66 Base Polymer

- 4.3.3 Rising PET And PP Substitution in Flexible Packaging

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of Substitutes

- 4.5.4 Competitive Rivalry

- 4.5.5 Threat of New Entrants

- 4.6 Regulatory Landscape

- 4.7 Import and Export Analysis

- 4.8 Price Trends

- 4.9 Recycling Overview

- 4.10 End-use Sector Trends

- 4.10.1 Aerospace (Aerospace Component Production Revenue)

- 4.10.2 Automotive (Automobile Production)

- 4.10.3 Building and Construction (New Construction Floor Area)

- 4.10.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.10.5 Packaging (Plastic Packaging Volume)

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Sub-Resin Type

- 5.1.1 Polyamide (PA) 6

- 5.1.2 Polyamide (PA) 66

- 5.1.3 Aramid

- 5.1.4 Polyphthalamide (PPA)

- 5.2 By End-User Industry

- 5.2.1 Automotive

- 5.2.2 Electrical and Electronics

- 5.2.3 Aerospace

- 5.2.4 Industrial and Machinery

- 5.2.5 Building and Construction

- 5.2.6 Packaging

- 5.2.7 Other End-User Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Malaysia

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 Canada

- 5.3.2.2 Mexico

- 5.3.2.3 United States

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 United Kingdom

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AdvanSix

- 6.4.2 Arclin

- 6.4.3 Arkema S.A.

- 6.4.4 Ascend Performance Materials

- 6.4.5 BASF SE

- 6.4.6 Celanese Corporation

- 6.4.7 Domo Chemicals

- 6.4.8 Envalior

- 6.4.9 Evonik Industries

- 6.4.10 Hangzhou Juheshun New Materials Co., Ltd.

- 6.4.11 Highsun Holding Group

- 6.4.12 Invista

- 6.4.13 Koch Industries, Inc.

- 6.4.14 Kuraray Co., Ltd.

- 6.4.15 LIBOLON

- 6.4.16 Solvay S.A.

- 6.4.17 Ube Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment