|

市场调查报告书

商品编码

1906926

游戏化:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Gamification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

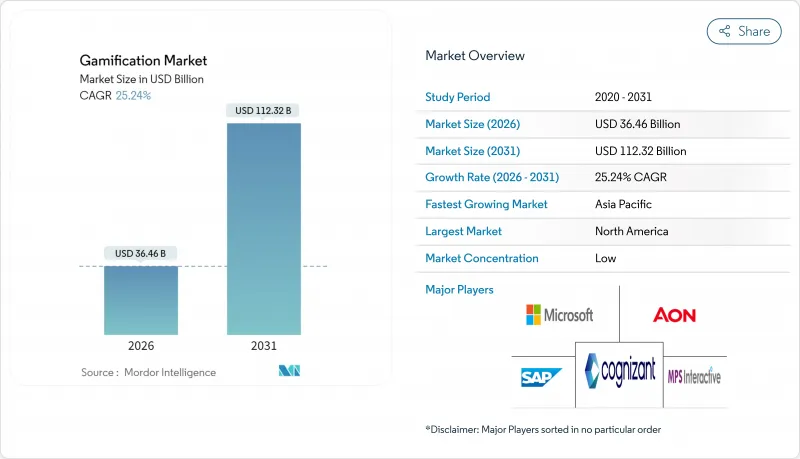

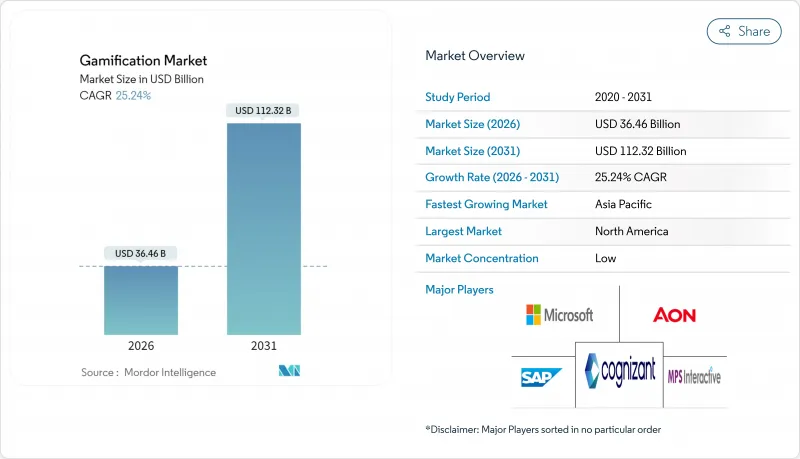

2025 年游戏化市场价值 291.1 亿美元,预计从 2026 年的 364.6 亿美元成长到 2031 年的 1123.2 亿美元,在预测期(2026-2031 年)内复合年增长率为 25.24%。

基于云端的部署已占据大部分支出,并透过为分散式团队提供即时分析,为当前的业务扩张提供了强有力的支援。虽然大型企业仍然占据大部分收入,但随着低程式码平台实施成本的下降,中小企业 (SME) 的成长速度正在加快。零售业的忠诚度计画是最大的应用领域,而员工计划,尤其是微学习计划,则获得了最快的普及。从区域来看,北美保持主导地位,但亚太地区以行动优先的商业文化正将重心转移到新兴数位经济体。竞争依然激烈,成熟的软体供应商和专业的Start-Ups在争夺受监管行业中尚未开发的市场机会。

全球游戏化市场趋势与洞察

云端优先的数位化工作场所采用率激增

企业加速云端迁移需要能够原生支援混合团队协作的互动工具。 Microsoft Power Apps 将游戏机制直接嵌入工作流程,将采用时间从数月缩短至数週。云端託管平台预计将以 27.58% 的复合年增长率成长,因为它们能够统一资料流并向任何装置提供即时排行榜。将游戏化与现有云端基础设施整合的组织报告称,在远端办公环境中,生产力提升高达 90%。订阅授权的成本优势进一步加速了云端原生应用程式的普及。随着 IT 部门精简本地资产,云端原生供应商获得了结构性优势,这一趋势在预测期内不太可能逆转。

低程式码游戏化平台的兴起

拖放式开发使互动体验的设计更加大众化。 SAP Build 让非专业开发者无需编写程式码即可将挑战、徽章和奖励嵌入核心业务流程,与客製化计划相比,开发成本降低了 70%。这种更高的可近性将目标市场扩展到了缺乏技术资源的中小型企业。平台供应商报告称,专门用于销售竞赛和新用户入职任务的模板数量激增,这表明这些模板在商业领域日益普及。低程式码技术堆迭还可以缩短价值验证週期,这对中小企业来说是一个重要的采购障碍,因为它们可以直接连接到 SaaS 生态系统。客製化开发的结构性下降与中小企业领域 28.67% 的复合年增长率相符。

设计不良的项目会产生负投资报酬率。

粗放式的推广和敷衍了事的认证会疏远员工并浪费预算。 Versus Systems 的采用率从 2023 年的 16 家骤降至 5 家。此案例研究凸显了人们对肤浅推广的抵触情绪,而这种推广不足导致用户兴趣无法持续。如今,企业在核准新计画之前,需要以业务成果指标(例如收入成长和错误率降低)为基础。这种严格的审查延长了销售週期,并迫使供应商提供更多咨询支援。早期采用者的错误会让后进企业心存疑虑,进而限制短期支出。忽视教学设计和行为科学的供应商将面临声誉风险,这种风险可能会波及整个游戏化市场。

细分市场分析

预计到2025年,云端解决方案将占游戏化市场收入的67.62%,并将在2031年之前以26.91%的复合年增长率进一步扩大其市场份额。即时遥测、无缝更新和弹性储存是云端解决方案备受青睐的原因,而成熟的安全认证甚至正在影响一些较保守的行业。虽然在资料主权至关重要的领域,本地部署方案仍然非常重要,但IT预算的缩减和网路保险费用的增加正使託管服务在成本效益方面更具优势。

透过持续交付管道实现的快速迭代周期,使云端供应商能够微调交付演算法并进行 A/B 测试,而无需客户端打补丁。当高阶分析即时提案个人化挑战时,企业报告生产力提高了 37%。混合部署是一种过渡方案,允许敏感资料保留在本地,而交互逻辑则驻留在云端。在预测期内,迁移到公共云端基础设施有望实现整合模式的标准化,降低整体拥有成本并整合供应商资源。

大型企业将占2025年收入的57.02%,反映出它们雄厚的预算和复杂的整合需求。同时,中小企业是游戏化市场成长最快的细分市场,年复合成长率高达27.65%。免费增值模式、范本库和收费付费架构降低了中小企业的进入门槛。

中小企业通常会部署这些工具来解决特定问题,例如激励销售团队或培训季节性员工,并可在几週内展现投资报酬率。新加坡等市场的政府数位化津贴透过补贴订阅费用进一步推动了这些工具的普及。随着云端平台以大众市场价格提供企业级身分管理功能,功能差距正在缩小。因此,中阶市场负责人越来越需要符合 SOC 2 标准和单一登入功能,迫使供应商在保持价格弹性的同时加快安全蓝图的开发。

区域分析

北美地区将占到2025年总收入的38.74%,这得益于SaaS的早期普及和完善的供应商生态系统。随着企业优先考虑与人力资源资讯系统(HRIS)和客户关係管理(CRM)套件的集成,快速的功能推出正在推动市场份额的成长。联邦政府无障碍诉讼的风险促使平台投资于符合WCAG标准的设计,从而提高了所有供应商的品质标准。

亚太地区以28.6%的复合年增长率领先,这主要得益于行动优先的工作模式和政府主导的数位技能培训计画。新加坡在公共服务领域所推行的游戏化措施已取得显着成效,并鼓励私部门效法。泰国正在尝试利用游戏化奖励来推广其央行数位货币(CBDC),这表明泰国在政策层面给予了支持。企业正受益于提供针对低延迟5G网路优化的轻量级应用程序,加速了印度和印尼等人口稠密市场的普及。

儘管欧洲的隐私法规十分严格,但市场需求依然稳定。 GDPR 的强制要求正在推动差分隐私分析领域的创新,以实现薪资资料的匿名化。拥有内部法律团队的供应商在为受 MiFID-II 约束的金融机构客製化同意流程方面具有优势。虽然南美和中东及非洲地区的市场规模相对落后,但智慧型手机普及率的不断提高使云端託管的行动原生解决方案成为首选。在这些新兴地区,语言和文化在地化仍然是影响转换率的关键因素。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 市场驱动因素

- 云端优先的数位化工作场所采用率激增

- 低程式码游戏化平台的兴起

- 零售业日益激烈的忠诚度之争以及积分徽章系统的引入

- 针对第一线员工的智慧型手机微学习培训

- 保护隐私的互动分析

- 中央银行的游戏化央行数位货币试点项目

- 市场限制

- 设计不良的项目会带来负投资收益。

- 平台间的资料所有权纠纷

- 特定产业合规性中的反赌博条款(HIPAA、MiFID-II)

- 因游戏机制不包容而引发的无障碍诉讼

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业生态系分析

- 主要用例和案例研究

- 宏观经济趋势评估

- 投资分析

第五章 市场规模与成长预测

- 透过部署

- 本地部署

- 云

- 按组织规模

- 大公司

- 中小企业

- 按行业

- 零售

- BFSI

- 政府

- 卫生保健

- 教育与研究

- 资讯科技和电信

- 其他的

- 透过使用

- 行销与销售

- 人员和培训

- 产品开发与创新

- 客户支援与客户经验

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 新加坡

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Microsoft Corporation

- SAP SE

- Cognizant Technology Solutions Corp.

- Axonify Inc.

- Aon plc(incl. Aon Assessment)

- Bunchball Inc.

- Salesforce Inc.(incl. Trailhead)

- Cisco Systems Inc.

- LevelEleven LLC

- Badgeville Inc.

- Genesys Cloud Services Inc.

- Callidus Software Inc.(SAP Litmos)

- Ambition Solutions Inc.

- MPS Interactive Systems Ltd.

- IACTIONABLE Inc.

- G-Cube Solutions

- Gamifier Inc.

- BI Worldwide

- Kahoot!ASA

- Classcraft Studios Inc.

第七章 市场机会与未来展望

The gamification market was valued at USD 29.11 billion in 2025 and estimated to grow from USD 36.46 billion in 2026 to reach USD 112.32 billion by 2031, at a CAGR of 25.24% during the forecast period (2026-2031).

Cloud-based deployments already capture the majority of spend and, by delivering real-time analytics across distributed teams, underpin much of the current expansion. Large enterprises still account for the bulk of revenue, yet small and medium enterprises (SMEs) are scaling faster as low-code platforms lower adoption costs. Retail loyalty schemes remain the single-largest application, but employee-centric programs-particularly micro-learning initiatives-are recording the strongest uptake. Regionally, North America holds the lead, although Asia-Pacific's mobile-first business culture is shifting the center of gravity toward emerging digital economies. Competitive intensity stays high because established software vendors and specialist start-ups target the same white-space opportunities in regulated verticals.

Global Gamification Market Trends and Insights

Surge in Cloud-First Digital-Workplace Roll-Outs

Enterprises accelerating cloud migration need engagement tools that function natively across hybrid teams. Microsoft Power Apps embeds game mechanics directly into workflows, cutting rollout times from months to weeks . Cloud-hosted platforms generate the 27.58% CAGR forecast because they consolidate data streams and push real-time leaderboards to any device. Organizations integrating gamification with existing cloud infrastructure report up to 90% productivity improvement in remote work settings. The cost advantages of subscription licensing further accelerate adoption. As IT departments rationalize on-premise assets, cloud-native vendors gain a structural advantage that is unlikely to reverse over the outlook period.

Proliferation of Low-Code Gamification Platforms

Drag-and-drop development is democratizing the design of engagement experiences. SAP Build allows citizen developers to insert challenges, badges, and rewards into core business processes without writing code, trimming development spend by 70% against bespoke projects. The accessibility expands the total addressable base beyond large enterprises to SMEs that lacked technical resources. Platform vendors report a surge in templates focused on sales contests and onboarding missions, indicating mainstream business adoption. Because low-code stacks connect directly to SaaS ecosystems, they also shorten proof-of-value cycles, a key procurement hurdle for smaller firms. The structural decline in custom development aligns with the segment's 28.67% SME CAGR.

Poorly-Designed Programs Deliver Negative ROI

Superficial point-and-badge deployments risk disengagement and budget waste. Versus Systems' client roster fell from 16 to 5 in 2023 after lackluster implementations failed to sustain user interest, exemplifying backlash against gimmicky rollouts. Enterprises now demand business-outcome metrics, such as sales lift or error-rate reduction, before green-lighting new projects. This scrutiny lengthens sales cycles and forces vendors to provide stronger consultative support. Implementation missteps in early-adopter sectors also create caution among laggards, dampening near-term spend. Vendors that neglect instructional design and behavioral science risk reputational damage that can reverberate across the wider gamification market.

Other drivers and restraints analyzed in the detailed report include:

- Retail Loyalty Wars Escalating Points and Badges Adoption

- Smartphone-Centric Micro-Learning for Frontline Workforces

- Antigaming Clauses in Sector-Specific Compliance (HIPAA, MiFID-II)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud solutions accounted for 67.62% of 2025 revenue, and their share of the gamification market size is projected to climb further, given a 26.91% CAGR to 2031. Real-time telemetry, seamless updates, and elastic storage underpin the preference, while maturing security certifications sway even conservative sectors. On-premise packages remain relevant where data sovereignty is paramount, yet shrinking IT budgets and rising cyber-insurance premiums tilt cost-benefit equations toward managed hosting.

Rapid iteration cycles, achieved through continuous delivery pipelines, let cloud vendors fine-tune achievement algorithms and A/B-test narratives without client-side patches. Enterprises report 37% productivity gains when advanced analytics recommend personalized challenges in real time. Hybrid rollouts serve as a transitional choice, allowing sensitive data to stay on site while engagement logic resides in the cloud. Over the forecast, migration to public-cloud stacks is expected to standardize integration patterns, reducing total cost of ownership and consolidating vendor footprints.

Large enterprises contributed 57.02% to 2025 revenue, reflecting deep budgets and complex integration needs. In contrast, SMEs represent the fastest-growing slice of the gamification market, expanding at 27.65% CAGR. Freemium pricing, template libraries, and pay-as-you-grow architectures lower entry barriers for smaller firms.

SMEs typically target narrow pain points-motivating a sales pod or onboarding seasonal staff-allowing them to demonstrate ROI within weeks. Government digitalization grants in markets such as Singapore further stimulate uptake by offsetting subscription fees. Feature parity is narrowing because cloud platforms offer enterprise-grade identity management at mass-market price tiers. As a result, mid-market buyers increasingly insist on SOC 2 compliance and single-sign-on, forcing vendors to harden security roadmaps while keeping price elasticity.

Gamification Market Report is Segmented by Deployment (On-Premise, and Cloud), Organization Size (Small and Medium Enterprises, and Large Enterprises), Industry Vertical (Retail, BFSI, Government, Healthcare, and More), Application (Marketing and Sales, HR and Training, Product Development and Innovation, Customer Support and Experience, and Others), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.74% of 2025 revenue, benefitting from early SaaS adoption and a deep vendor ecosystem. Corporations prioritize integrations with HRIS and CRM suites, leading to rapid feature rollouts that drive wallet share. Federal accessibility litigation risk motivates platforms to invest in WCAG-compliant design, raising quality thresholds for all suppliers.

Asia-Pacific records the highest regional CAGR at 28.6%, powered by mobile-first working patterns and government-sponsored digital-skills programs. Singapore's public-service gamification initiatives validate efficacy and encourage private-sector replication. Thailand's digital-wallet scheme experiments with gamified Central Bank Digital Currency incentives, signaling policy-level endorsement. Companies capitalize by shipping lightweight applications optimized for low-latency 5G networks, accelerating uptake in populous markets such as India and Indonesia.

Europe shows steady demand despite stringent privacy rules. GDPR obligations spur innovation in differential-privacy analytics that anonymize reward data. Vendors with in-house legal teams gain an edge when customizing consent flows for financial institutions subject to MiFID-II. South America and the Middle East and Africa trail in absolute dollars but benefit from growing smartphone penetration, making cloud-hosted, mobile-native solutions the default choice. Localization-both linguistic and cultural-remains a decisive factor in conversion rates across these emerging territories.

- Microsoft Corporation

- SAP SE

- Cognizant Technology Solutions Corp.

- Axonify Inc.

- Aon plc (incl. Aon Assessment)

- Bunchball Inc.

- Salesforce Inc. (incl. Trailhead)

- Cisco Systems Inc.

- LevelEleven LLC

- Badgeville Inc.

- Genesys Cloud Services Inc.

- Callidus Software Inc. (SAP Litmos)

- Ambition Solutions Inc.

- MPS Interactive Systems Ltd.

- IACTIONABLE Inc.

- G-Cube Solutions

- Gamifier Inc.

- BI Worldwide

- Kahoot! ASA

- Classcraft Studios Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in cloud-first digital-workplace roll-outs

- 4.2.2 Proliferation of low-code gamification platforms

- 4.2.3 Retail loyalty wars escalating points and badges adoption

- 4.2.4 Smartphone-centric micro-learning for frontline workforces

- 4.2.5 Privacy-preserving engagement analytics

- 4.2.6 Gamified CBDC pilots by central banks

- 4.3 Market Restraints

- 4.3.1 Poorly-designed programs deliver negative ROI

- 4.3.2 Inter-platform data-ownership disputes

- 4.3.3 Antigaming clauses in sector-specific compliance (HIPAA, MiFID-II)

- 4.3.4 Accessibility lawsuits on non-inclusive game mechanics

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium Enterprises (SMEs)

- 5.3 By Industry Vertical

- 5.3.1 Retail

- 5.3.2 BFSI

- 5.3.3 Government

- 5.3.4 Healthcare

- 5.3.5 Education and Research

- 5.3.6 IT and Telecom

- 5.3.7 Others

- 5.4 By Application

- 5.4.1 Marketing and Sales

- 5.4.2 HR and Training

- 5.4.3 Product Development and Innovation

- 5.4.4 Customer Support and Experience

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 SAP SE

- 6.4.3 Cognizant Technology Solutions Corp.

- 6.4.4 Axonify Inc.

- 6.4.5 Aon plc (incl. Aon Assessment)

- 6.4.6 Bunchball Inc.

- 6.4.7 Salesforce Inc. (incl. Trailhead)

- 6.4.8 Cisco Systems Inc.

- 6.4.9 LevelEleven LLC

- 6.4.10 Badgeville Inc.

- 6.4.11 Genesys Cloud Services Inc.

- 6.4.12 Callidus Software Inc. (SAP Litmos)

- 6.4.13 Ambition Solutions Inc.

- 6.4.14 MPS Interactive Systems Ltd.

- 6.4.15 IACTIONABLE Inc.

- 6.4.16 G-Cube Solutions

- 6.4.17 Gamifier Inc.

- 6.4.18 BI Worldwide

- 6.4.19 Kahoot! ASA

- 6.4.20 Classcraft Studios Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment