|

市场调查报告书

商品编码

1906942

液体包装纸盒:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Liquid Packaging Cartons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

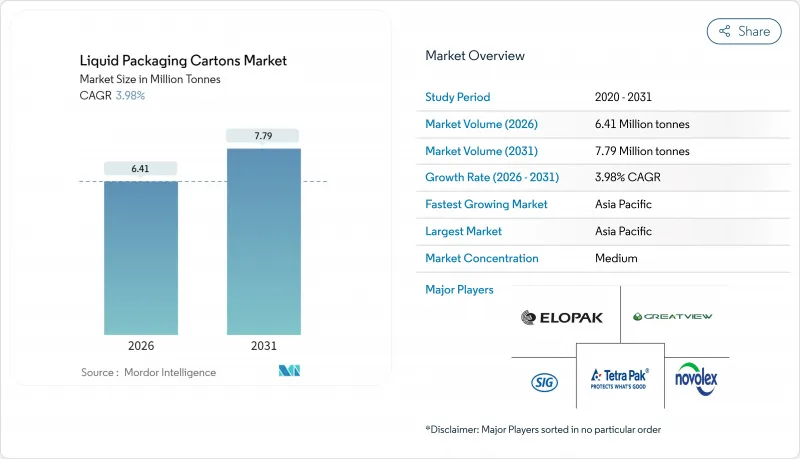

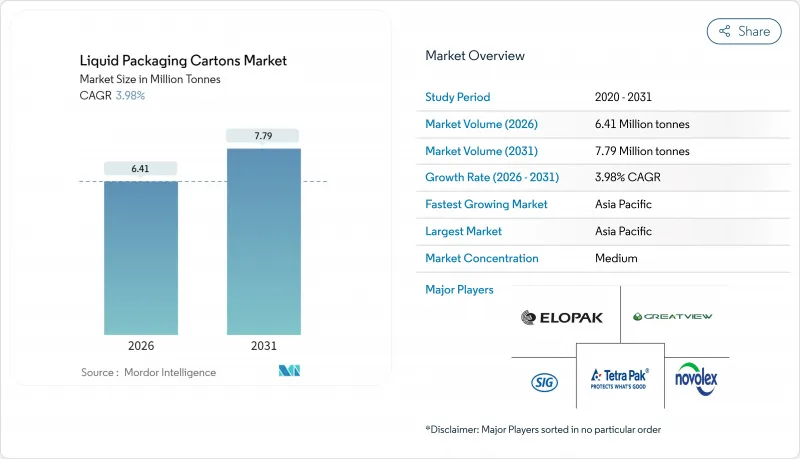

2025 年液体包装纸盒市场价值为 616 万吨,预计从 2026 年的 641 万吨增长到 2031 年的 779 万吨,在预测期(2026-2031 年)内以 3.98% 的复合年增长率增长。

有利于纤维基材料的监管政策、延长保质期阻隔技术的创新以及食品零售业的快速数位化,正在推动成熟经济体和新兴经济体液体包装纸盒市场的扩张。亚太地区预计将实现最强劲的成长,因为公共营养计划和不断变化的食品接触法规推动了对保质期长包装的需求。同时,乳製品和植物性饮料的优质化趋势正在推动增值纸盒形式的应用。与永续性相关的资金筹措管道也引导资金流向纤维材料创新。随着现有企业透过大力投资脱碳和回收能力来捍卫市场份额,而区域专家则利用本地成本优势和灵活的打入市场策略,竞争日益激烈。

全球液体包装纸盒市场趋势与洞察

新兴亚洲地区对超高温灭菌乳製品的需求

印尼的免费营养计画预计,该国乳製品消费量将从2024年的420万吨增加到2025年的530万吨,从而对无需冷藏且能适应热带物流的无菌纸盒产生可持续的需求。中国的GB 4806食品接触标准提高了合规溢价,并赋予获得认证的纸盒供应商在液体包装纸盒市场中的定价权。这些因素共同巩固了亚太地区在价值和销售成长方面的主导地位,鼓励跨国公司促进本地生产,并与国内加工商签订长期供应协议。中产阶级收入的成长进一步加速了家庭对常温保存乳製品的接受度。这些因素共同推动亚太地区对全球液体包装纸盒市场的贡献显着超过历史平均值。

电子商务驱动的食品市场成长推动了室温储存

预计到2025年,线上食品杂货市场将占全球零售市场的61%,这将推动常温产品的需求,因为常温产品可以简化低温运输流程并降低配送成本。液体包装纸盒市场被视为提升电商效率的直接促进者,其中常温饮料受益最大。零售商正优先考虑可堆迭、轻巧且可回收的纤维基包装,进一步加速了这项转型。这些优势在都市区尤其显着,因为「最后一公里」的排放和交通拥堵会影响包装的选择。

更轻的宝特瓶缩小了碳排放差距

随着PET材质重量的减轻,纸盒在其整个生命週期中的碳排放优势正在逐渐消失,在某些饮料应用场景下,从生产到废弃的碳排放量差距缩小至每1000公升不足20公斤二氧化碳当量。随着PET回收率的提高,其成本绩效也随之提升,促使对价格敏感的果汁和水品牌继续使用PET塑胶瓶。因此,纸盒供应商,尤其是在PET生态系统已较成熟的北美和欧盟市场,必须加快阻隔性能创新和回收率提升,以防止消费者转向其他替代材料。

细分市场分析

截至2025年,牛奶在液体包装纸盒市场的份额将维持在48.30%(约300万吨)。然而,由于饮食习惯的改变、乳糖不耐受问题的日益突出以及消费者对道德消费行为的日益关注,非乳製品替代饮料预计将以5.42%的复合年增长率增长,到2031年其市场份额将扩大至21.80%。燕麦、杏仁和豆奶饮料的液体包装纸盒市场规模受益于无菌加工技术,这些技术无需添加剂即可保留营养成分。剪切响应均质化和酵素辅助黏度控制等技术改进需要使用性能优异的阻隔材料来抑制氧化造成的风味劣化。因此,加工商正与灌装商合作,开发兼顾保质期和成本的客製化产品规格。

营养强化和风味添加的优质配方提升了产品价值,使品牌所有者能够承担高成本。在消费习惯根深蒂固的地区,乳製品仍然十分重要,尤其是在政府主导的学生营养计画实施地区。然而,即使在乳製品领域,消费者对低脂和维生素强化产品的需求也在不断增长,因此更青睐支持高解析度印刷和包装故事叙述的纸盒。在预测期内,乳製品和植物性产品的共存预计将扩大液体包装纸盒市场,而不是蚕食现有市场。

液体包装纸盒市场报告按液体类型(乳製品、非乳製品、果汁、机能饮料和机能饮料等)、包装类型(无菌纸盒、山形盖顶纸盒)、开启方式(螺旋盖、吸管孔、拉环)和地区(北美、欧洲、亚太、南美、中东和非洲)进行细分。市场预测以公吨为单位。

区域分析

亚太地区预计到2025年将占全球出货量的45.38%(约280万吨),并预计到2031年将超过395万吨,年复合成长率达5.92%。这一增长主要得益于印尼覆盖8,200万受益者的学校供餐倡议,以及中国因监管标准加强而优先选择符合标准的纸盒供应商。东南亚地区日益加速的都市化进程也推动了人们对即饮饮料的需求,进而带动了对拉环包装和小包装无菌包装的需求。

北美市场已趋于成熟,但在高附加价值领域占据主导地位。随着植物奶日益普及,预计市场将持续成长;同时,更严格的生产者责任延伸(EPR)法规也推动了国内回收生产线的投资。欧洲市场需求稳定,这得益于糖税改革带来的产品改进以及优先使用纤维材料而非PET的ESG融资。然而,由于市场迅速转向更轻的PET容器,液体纸盒在折扣自有品牌果汁市场正逐渐失去市场份额。

在拉丁美洲,乳製品强化计画和不断壮大的中产阶级的购买力正在推动市场成长,但货币波动和供应链脆弱性限制了近期的成长。中东和非洲地区正经历缓慢但稳定的成长,常温包装有助于在冷藏成本仍然较高的地区获得乳製品。地域多角化有助于全球液体纸盒市场减轻区域衝击的影响,为跨洲均衡扩张奠定基础。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 新兴亚洲对超高温灭菌乳製品的需求

- 电子商务生鲜销售的成长推动了常温保质期的延长

- 与环境、社会及公司治理(ESG)相关的融资有利于纺织包装产业。

- 糖税推动产品改进,促进果汁盒装产品的普及。

- 纤维素基阻隔技术的创新减少了聚合物层

- 乳製品和植物来源产品领域高附加价值品牌的崛起,正在推动高价值纸盒包装的需求。

- 市场限制

- 透过减轻宝特瓶的重量来缩小碳排放差距

- 缺乏无菌回收基础设施

- 纸浆短缺导致液态纸板价格波动

- 随着全球监管日益严格,遵守标籤和食品接触法规的成本也不断上升。

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 新进入者的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按液体类型

- 乳製品

- 植物奶

- 汁

- 机能饮料和机能饮料

- 其他液体类型

- 按包装类型

- 无菌纸盒

- 盖布尔顶纸箱

- 按建立格式

- 螺帽

- 吸管孔

- 拉环

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 俄罗斯

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 印尼

- 泰国

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Tetra Pak International SA

- SIG Group AG

- Pactiv Evergreen Inc.(Novolex)

- Elopak AS

- Greatview Aseptic Packaging Co. Ltd

- Nippon Paper Industries Co. Ltd

- UFlex Limited(ASEPTO)

- IPI Srl(Coesia)

- Lami Packaging(Kunshan)Co. Ltd

- Visy Industries

- Klabin SA

- Obeikan Industrial Investment Group

- Nampak Ltd

- Italpack Srl

- Parksons Packaging Ltd

- Shandong Bihai Packaging Materials Co. Ltd

- Southern Packaging Group Ltd

第七章 市场机会与未来展望

The liquid packaging cartons market was valued at 6.16 million tonnes in 2025 and estimated to grow from 6.41 million tonnes in 2026 to reach 7.79 million tonnes by 2031, at a CAGR of 3.98% during the forecast period (2026-2031).

Regulatory momentum favoring fiber-based materials, barrier-technology breakthroughs that prolong shelf life, and the rapid digitization of grocery retail are enlarging the liquid packaging cartons market footprint across both mature and emerging economies. Asia-Pacific delivers the strongest uplift as public nutrition programs and evolving food-contact rules deepen demand for ambient-stable packs. Simultaneously, premiumization trends in dairy and plant-based beverages advance the adoption of value-added carton formats, while sustainability-linked financing channels funnel capital toward fiber innovations. Competitive intensity is mounting as incumbents invest heavily in decarbonization and recycling capacity to defend share against regional specialists that exploit local cost advantages and agile market entry strategies.

Global Liquid Packaging Cartons Market Trends and Insights

UHT Dairy Demand in Emerging Asia

Indonesia's Free Nutritious Meals Program pushes the nation's dairy intake from 4.2 million tonnes in 2024 to 5.3 million tonnes in 2025, generating sustained uptake of aseptic cartons that tolerate tropical logistics without refrigeration. China's GB 4806 food-contact rules elevate compliance premiums, granting certified carton suppliers pricing power within the liquid packaging cartons market. These forces reinforce the region's leadership in value and volume growth, encouraging multinationals to localize production and forge long-term supply contracts with domestic processors. Rising middle-class incomes further spur household penetration of shelf-stable dairy. Collectively, these factors lift Asia-Pacific's contribution to the global liquid packaging cartons market well above historic averages.

E-commerce Grocery Growth Pushing Ambient Formats

Online grocery is forecast to control 61% of global retail by 2025, channeling demand toward ambient products that remove cold-chain complexity and lessen fulfillment costs. Ambient-stable beverages benefit most, positioning the liquid packaging cartons market as a direct enabler of e-commerce efficiency. Retailers prioritize fiber-based packs that are stackable, lightweight, and recyclable, further reinforcing the shift. These advantages resonate strongly in urban zones where last-mile emissions and congestion drive packaging choices.

PET Bottle Lightweighting Narrowing Carbon Gap

Lightweight PET advances erode cartons' life-cycle carbon lead, with cradle-to-grave differentials contracting under 20 kg CO2e per 1,000 litres in some beverage use cases.As PET incorporates higher recycled content, cost-performance ratios improve, tempting price-sensitive juice and water brands to retain polymer bottles. Carton suppliers must therefore accelerate barrier innovation and recycling rates to prevent substitution, especially in North American and EU markets where PET ecosystems are already well capitalized.

Other drivers and restraints analyzed in the detailed report include:

- Cellulose-Based Barrier Breakthroughs Cutting Polymer Layers

- Brand Premiumization in Dairy and Plant-Based Segments Boosting Value-Added Carton Formats

- Volatile Liquid Board Prices Tied to Pulp Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dairy milk retained 48.30% share of the liquid packaging cartons market in 2025, translating to nearly 3 million tonnes. Non-dairy alternatives, however, outpaced with a 5.42% CAGR that will lift their contribution to 21.80% by 2031, propelled by dietary shifts, lactose-free preferences, and ethical purchasing drivers. The liquid packaging cartons market size for oat, almond, and soy beverages benefits from aseptic processing that preserves nutrients without additives. Technical adaptations, such as shear-sensitive homogenization and enzyme-assisted viscosity control, demand robust barrier materials to curb oxidative flavor degradation. Consequently, converters collaborate with fillers on customized specifications that balance shelf life and cost.

Premium formulations with fortification or added flavors increase product value, allowing brand owners to absorb higher carton costs. Dairy milk remains vital in regions with established consumption patterns, especially where government initiatives bolster student nutrition. Yet even within dairy, value migrates toward low-fat, vitamin-enriched products that favor cartons capable of high-graphic print for on-pack storytelling. Over the forecast horizon, the co-existence of dairy and plant-based categories broadens the addressable liquid packaging cartons market rather than cannibalizing volume.

The Liquid Packaging Cartons Market Report is Segmented by Liquid Type (Dairy-Based Milk, Non-Dairy Milk, Juices, Energy and Functional Drinks, and More), Packaging Type (Aseptic Cartons, and Gable Top Cartons), Opening Format (Screw Cap, Straw Hole, and Pull Tab), and Geography (North America, Europe, Asia Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Volume (Tonnes).

Geography Analysis

Asia-Pacific accounted for 45.38% of 2025 shipments, roughly 2.8 million tonnes, and its 5.92% CAGR positions the region to exceed 3.95 million tonnes by 2031. Expansion is driven by Indonesia's school meal initiative serving 82 million beneficiaries and China's elevated regulatory standards that reward compliant carton suppliers.Southeast Asian urbanization accelerates on-the-go beverage demand, boosting pull tab and small-format aseptic packs.

North America trails with a mature but high-value presence. Incremental growth aligns with plant-based milk adoption, while tightening EPR regulations spur investment in domestic recycling lines. European demand remains steady, underpinned by sugar-tax reformulation and ESG financing that favor fiber over PET. However, aggressive PET lightweighting erodes the liquid packaging cartons market share in discounted private-label juices.

Latin America benefits from dairy fortification programs and expanding middle-class purchasing power, yet currency volatility and supply-chain fragility curb immediate upside. The Middle East and Africa register modest but steady gains as ambient-stable packaging supports dairy access in climates where refrigeration costs remain prohibitive. Collectively, geography diversification cushions the global liquid packaging cartons market against regional shocks and positions the industry for balanced, multi-continent expansion.

- Tetra Pak International SA

- SIG Group AG

- Pactiv Evergreen Inc. (Novolex)

- Elopak AS

- Greatview Aseptic Packaging Co. Ltd

- Nippon Paper Industries Co. Ltd

- UFlex Limited (ASEPTO)

- IPI Srl (Coesia)

- Lami Packaging (Kunshan) Co. Ltd

- Visy Industries

- Klabin SA

- Obeikan Industrial Investment Group

- Nampak Ltd

- Italpack Srl

- Parksons Packaging Ltd

- Shandong Bihai Packaging Materials Co. Ltd

- Southern Packaging Group Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 UHT dairy demand in emerging Asia

- 4.2.2 E-commerce grocery growth pushing ambient formats

- 4.2.3 ESG-linked financing favouring fibre-based packs

- 4.2.4 Sugar-tax led reformulations increasing juice carton adoption

- 4.2.5 Cellulose-based barrier breakthroughs cutting polymer layers

- 4.2.6 Brand premiumisation in dairy and plant-based segments boosting value-added carton formats

- 4.3 Market Restraints

- 4.3.1 PET bottle lightweighting narrowing carbon gap

- 4.3.2 Aseptic recycling infrastructure deficits

- 4.3.3 Volatile liquid board prices tied to pulp shortages

- 4.3.4 Labelling and food-contact compliance costs rising with stricter global regulations

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of Substitutes

- 4.7.4 Threat of New Entrants

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VOLUME)

- 5.1 By Liquid Type

- 5.1.1 Dairy-based Milk

- 5.1.2 Non-dairy Milk

- 5.1.3 Juices

- 5.1.4 Energy and Functional Drinks

- 5.1.5 Other Liquid Types

- 5.2 By Packaging Type

- 5.2.1 Aseptic Cartons

- 5.2.2 Gable Top Cartons

- 5.3 By Opening Format

- 5.3.1 Screw Cap

- 5.3.2 Straw Hole

- 5.3.3 Pull Tab

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Spain

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 Australia and New Zealand

- 5.4.4.5 Indonesia

- 5.4.4.6 Thailand

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 United Arab Emirates

- 5.4.5.1.2 Saudi Arabia

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Tetra Pak International SA

- 6.4.2 SIG Group AG

- 6.4.3 Pactiv Evergreen Inc. (Novolex)

- 6.4.4 Elopak AS

- 6.4.5 Greatview Aseptic Packaging Co. Ltd

- 6.4.6 Nippon Paper Industries Co. Ltd

- 6.4.7 UFlex Limited (ASEPTO)

- 6.4.8 IPI Srl (Coesia)

- 6.4.9 Lami Packaging (Kunshan) Co. Ltd

- 6.4.10 Visy Industries

- 6.4.11 Klabin SA

- 6.4.12 Obeikan Industrial Investment Group

- 6.4.13 Nampak Ltd

- 6.4.14 Italpack Srl

- 6.4.15 Parksons Packaging Ltd

- 6.4.16 Shandong Bihai Packaging Materials Co. Ltd

- 6.4.17 Southern Packaging Group Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment