|

市场调查报告书

商品编码

1906968

环氧涂料:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Epoxy Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

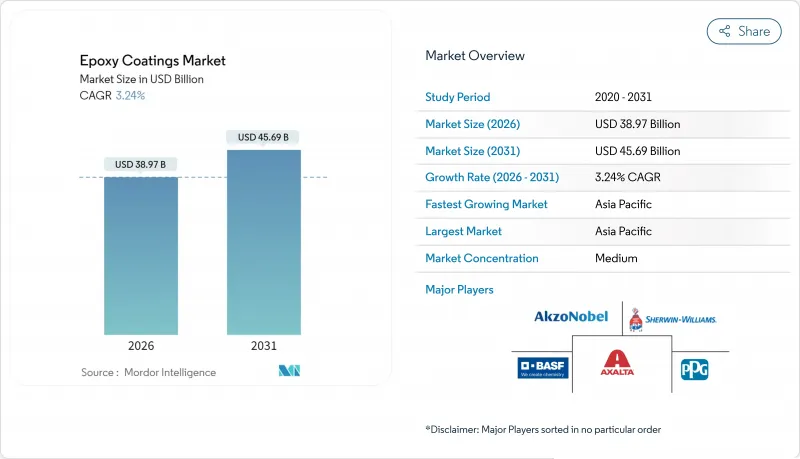

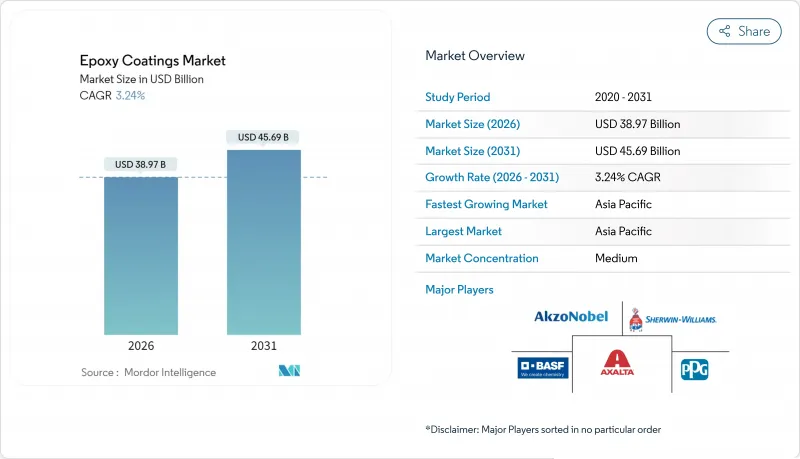

2025年环氧涂料市场价值为377.5亿美元,预计到2031年将达到456.9亿美元,而2026年为389.7亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.24%。

这种温和的成长速度反映出该行业日益成熟,需要在日益严格的排放法规和不断扩大的终端用户需求之间寻求平衡。製造商正在增加对永续化学技术的投资,特别是能够减少挥发性有机化合物(VOC)的水基技术。建筑、汽车和工业领域的客户正在转向使用这些低VOC产品,以满足日益严格的空气品质法规并提高职场安全。随着供应商将业务重心转向特殊应用和区域成长中心,优化产品组合(例如剥离大宗商品产品线并收购高性能资产)已成为一项关键的竞争策略。

全球环氧涂料市场趋势与洞察

提高水性环氧树脂在工业防护涂料中的渗透性。

为了满足美国环保署 (EPA) 制定的每加仑 4.8 磅的严格挥发性有机化合物 (VOC)排放限值,工业设施正在加速向水性系统转型。树脂化学的进步使得水性环氧树脂的延伸率和耐化学性能够媲美以往只有溶剂型产品才能达到的水平。 2024 年的一项研究表明,使用环氧天然橡胶乳胶的涂料在不牺牲耐久性的前提下,延伸率提高了 370%。高固态配方在施工过程中几乎不排放VOC,这有助于工厂达到空气品质许可标准,并提高工人的安全保障。随着监管合规期限的临近,工厂维护计画中向水性产品的转变正逐渐成为结构性的市场变革,而不再只是短期趋势。

食品饮料工厂的工业地板材料升级改造

食品加工企业正用环氧树脂地板材料取代生产区域的普通地板,这种地板能够耐受强效消毒剂,并符合美国农业部 (USDA) 的检验标准。酚醛树脂基环氧树脂具有卓越的耐酸性,尤其适用于处理低 pH 值饮料的场所;而 100% 固含量配方无需溶剂挥发运作,从而减少停机时间。生命週期成本分析表明,环氧树脂地板能够降低维护成本并减少停机次数,这促使企业愿意承担较高的初始成本。随着全球食品安全审核日益频繁且严格,这一趋势正在加速发展。

全球对溶剂型系统的VOC/HAP排放限制更加严格。

纽约州将工业维护涂料的挥发性有机化合物(VOC)含量限制在250克/公升,而加州则根据具体应用情况将限制放宽至100克/公升。中国的GB 30981-2020标准也为有害成分设定了类似的上限。违反这些规定可能导致罚款和市场准入壁垒,迫使配方商投资重新设计产品或退出该地区市场。在许多情况下,水性涂料和粉末涂料的替代品尚未能达到传统产品的性能水平,导致一些专业细分市场出现短期供应缺口。

细分市场分析

2025年,水性化学品将占总收入的41.80%,维持最高的复合年增长率(CAGR),达到4.32%。随着原料供应商开发出室温固化胺添加物和自交联树脂,其成本竞争力已提升。溶剂型涂料持续应用于船舶、石油天然气和重型机械产业,在这些产业中,耐腐蚀性比VOC(挥发性有机化合物)法规更为重要。粉末涂料的市场份额正在增长,但仍处于少数地位,其在汽车轮毂、家用电器和金属家具领域的应用日益增多。石墨烯增强型粉末涂料已被证明能够使盐雾试验中的防腐蚀週期延长一倍。

一家水性涂料製造商正着力提升从生产到处置的永续性指标:生命週期评估中零热点、减少工厂通风量、降低保险成本。采用可回收容器生产双组分涂料,并儘可能减少塑胶用量,进一步降低了范围 3排放,与客户的净零排放计划相契合。一家粉末涂料供应商正致力于透过推广低温固化技术来实现脱碳,该技术不仅节省烘箱能源,还能在热敏基材上进行涂装。

环氧涂料报告按技术(水性、溶剂型、粉末涂料)、终端用户产业(建筑、汽车、交通运输、工业及其他)和地区(亚太、北美、欧洲、南美、中东和非洲)进行细分。市场预测以美元以金额为准。

区域分析

到2025年,亚太地区将占全球销售额的46.43%,反映了该地区庞大的製造业基础和持续的基础设施建设。中国将占该地区需求的一半以上,政府对溶剂的禁令加速了水性外墙涂料的转型。印度的智慧城市计画和印尼收费公路的扩建正在推动桥樑、机场和公共交通枢纽对环氧树脂的需求。该地区环氧涂料市场预计将以3.63%的复合年增长率成长。拥有本土业务的供应商享有优惠关税和快速交货期,尤其是在印尼,该国对油漆进口征收额外关税。

北美凭藉着专为航太和电动汽车工厂设计的快速固化和复合材料相容系统,保持其技术领先地位。包括工厂车间、石油管线维修和海上平台在内的维修需求,即使宏观经济趋于平稳,也将维持稳定的基准消耗量。欧洲的需求成长主要受老旧基础设施更新和日益严格的VOC法规的推动,加速了从溶剂型涂料转向水性涂料的转变。客户愿意为获得环保标籤认证、证明其生命週期排放量低的涂料支付溢价。南美和中东/非洲地区的成长缓慢但不均衡。巴西的外国投资正在復苏,其中一项11.5亿美元的收购案尤其引人注目,该收购案扩大了当地的分销网络。儘管外汇波动和政治风险会影响计划计划,但承包商仍在继续采用耐用衬里,以延长恶劣环境下的资产使用寿命。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 增强水性环氧树脂在工业防护涂料中的渗透性。

- 扩大亚太和非洲的建筑业

- 食品饮料厂工业地面地板材料改造

- 用于高产能的快速固化紫外线/LED固化环氧树脂技术

- 电动车电池外壳和马达外壳需要耐化学腐蚀涂层。

- 市场限制

- 加强全球溶剂型系统VOC/HAP排放法规

- 双酚A和环氧氯丙烷的价格波动会扰乱成本结构。

- 经认证的生物基环氧树脂前驱物供应有限

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过技术

- 水溶液

- 溶剂型

- 粉状

- 按最终用户行业划分

- 建筑/施工

- 车

- 运输

- 产业

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧国家

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- AkzoNobel NV

- Asian Paints

- Axalta Coating Systems LLC

- BASF

- Berger Paints India

- Diamond Vogel

- DuluxGroup Ltd

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- Koster Bauchemie AG

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries Limited

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- The Euclid Chemical Company

- The Sherwin-Williams Company

- Tikkurila

第七章 市场机会与未来展望

The Epoxy Coatings Market was valued at USD 37.75 billion in 2025 and estimated to grow from USD 38.97 billion in 2026 to reach USD 45.69 billion by 2031, at a CAGR of 3.24% during the forecast period (2026-2031).

The measured pace mirrors a mature sector that is balancing tougher emission rules with widening end-use demands. Manufacturers are channeling investment toward sustainable chemistries, particularly waterborne technologies that curb volatile organic compounds. Construction, automotive, and industrial customers are pivoting toward these low-VOC offerings to comply with tightening air-quality mandates and to improve workplace safety. Portfolio optimization, such as divestitures of commodity lines and acquisitions of high-performance assets, has become the dominant competitive tactic as suppliers reposition around specialty applications and regional growth hotspots.

Global Epoxy Coatings Market Trends and Insights

Waterborne Epoxy Penetration Rising in Industrial Protective Coatings

Industrial facilities are accelerating the shift toward waterborne systems to meet strict volatile organic compound caps, such as the U.S. Environmental Protection Agency limit of 4.8 pounds per gallon. Advances in resin chemistry now allow waterborne epoxies to match the elongation and chemical resistance once exclusive to solvent-based products. A 2024 study using epoxidized natural-rubber latex recorded a 370% gain in elongation without sacrificing durability. High-solids versions emit virtually no VOCs during application, helping plants satisfy air-quality permits and improve worker safety profiles. As compliance deadlines tighten, the conversion of factory maintenance programs to waterborne offerings is becoming a structural market shift rather than a short-term trend.

Industrial Flooring Upgrades in Food and Beverage Plants

Food processors are resurfacing production areas with epoxy floors that withstand aggressive sanitizers and meet USDA inspections. Novolac chemistries offer exceptional acid resistance for facilities that handle beverages with low pH, while 100% solids formulations shorten turnaround times because they cure without solvent evaporation. Operators are willing to pay higher upfront costs once lifecycle models reveal lower maintenance spending and fewer shutdowns. The trend gains momentum as global food-safety audits grow in frequency and rigor.

Stringent Global VOC/HAP Emission Limits on Solvent-Based Systems

New York limits industrial maintenance coatings to 250 g/L VOC, while California allows as little as 100 g/L depending on use. China's GB 30981-2020 standard sets parallel caps on harmful constituents. Non-compliance triggers fines and market access barriers, forcing formulators to invest in re-engineering or face regional exit. In many cases, waterborne or powder alternatives cannot yet duplicate the performance of legacy products, leaving short-term supply gaps in specialty niches.

Other drivers and restraints analyzed in the detailed report include:

- Rapid-Cure UV/LED-Curable Epoxy Technologies Enabling Higher Throughput

- EV Battery Casings and Motor Housings Need Chemically-Resistant Coats

- BPA and Epichlorohydrin Price Volatility Disrupting Cost Structures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Water-based chemistries contributed 41.80% of 2025 revenue and hold the top growth slot at 4.32% CAGR. Cost competitiveness has improved as raw-material suppliers develop amine adducts and self-crosslinking resins that cure under ambient conditions. Solvent-borne grades continue in marine, oil-and-gas, and heavy-equipment segments where extreme corrosion resistance overrides VOC concerns. Powder coatings account for a rising but still minority share; adoption is pacing automotive wheels, home appliances, and metal furniture. Graphene-reinforced powders have proven to double corrosion-protection cycle time in salt-spray testing.

Waterborne suppliers emphasize cradle-to-grave sustainability metrics: zero-hot-spot life-cycle assessments, reduced plant ventilation needs, and lower insurance premiums. Production of two-component packs in minimal-plastic, returnable containers further cuts scope-3 emissions, aligning with customer net-zero roadmaps. Powder-coating vendors target decarbonization by promoting low-temperature cure chemistries that save furnace energy and enable coating of heat-sensitive substrates.

The Epoxy Coatings Report is Segmented by Technology (Water-Based, Solvent-Based, and Powder-Based), End-User Industry (Building and Construction, Automotive, Transportation, Industrial, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 46.43% of global sales in 2025, reflecting its broad manufacturing base and relentless infrastructure build-out. China represents more than half of regional demand and is intensifying its transition to waterborne exterior wall coatings under municipal solvent bans. India's Smart Cities Mission and Indonesia's toll-road expansions funnel epoxy orders into bridges, airports, and mass-transit depots. The epoxy coatings market is forecast to grow by a 3.63% CAGR in the region. Local suppliers with in-country hubs enjoy tariff advantages and faster delivery times, especially in Indonesia, where paint imports face incremental duties.

North America remains a technology leader through rapid-cure and composite-compatible systems designed for aerospace and electric-vehicle plants. Retrofit demand, such as factory floors, oil-pipeline refurbishment, and offshore platforms, maintains a steady baseline consumption even in flat macro cycles. European demand is driven by the renovation of aged infrastructure and progressive VOC legislation that accelerates solvent-to-water conversions. Customers are willing to pay premiums for coatings certified under Ecolabel frameworks that validate low life-cycle emissions. South America, the Middle East, and Africa offer incremental but uneven growth. Brazil is experiencing renewed foreign investment, exemplified by a USD 1.15 billion acquisition that broadens local distribution reach. Currency swings and political risk temper project pipelines, yet contractors continue to specify durable linings to extend asset life under harsh environmental conditions.

- AkzoNobel N.V.

- Asian Paints

- Axalta Coating Systems LLC

- BASF

- Berger Paints India

- Diamond Vogel

- DuluxGroup Ltd

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- Koster Bauchemie AG

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries Limited

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- The Euclid Chemical Company

- The Sherwin-Williams Company

- Tikkurila

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Waterborne Epoxy Penetration Rising in Industrial Protective Coatings

- 4.2.2 Construction Sector Expansion in APAC and Africa

- 4.2.3 Industrial Flooring Upgrades in Food and Beverage Plants

- 4.2.4 Rapid-Cure UV/LED-Curable Epoxy Technologies Enabling Higher Throughput

- 4.2.5 EV Battery Casings and Motor Housings Need Chemically Resistant Coats

- 4.3 Market Restraints

- 4.3.1 Stringent Global VOC/HAP Emission Limits on Solvent-Based Systems

- 4.3.2 BPA and Epichlorohydrin Price Volatility Disrupting Cost Structures

- 4.3.3 Limited Supply of Certified Bio-Based Epoxy Precursors

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Powder-based

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Transportation

- 5.2.4 Industrial

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 NORDIC

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AkzoNobel N.V.

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 BASF

- 6.4.5 Berger Paints India

- 6.4.6 Diamond Vogel

- 6.4.7 DuluxGroup Ltd

- 6.4.8 Hempel A/S

- 6.4.9 Jotun

- 6.4.10 Kansai Paint Co., Ltd.

- 6.4.11 Koster Bauchemie AG

- 6.4.12 Nippon Paint Holdings Co., Ltd.

- 6.4.13 Pidilite Industries Limited

- 6.4.14 PPG Industries, Inc.

- 6.4.15 RPM International Inc.

- 6.4.16 Sika AG

- 6.4.17 The Euclid Chemical Company

- 6.4.18 The Sherwin-Williams Company

- 6.4.19 Tikkurila

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment