|

市场调查报告书

商品编码

1906990

纤维水泥:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Fiber Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

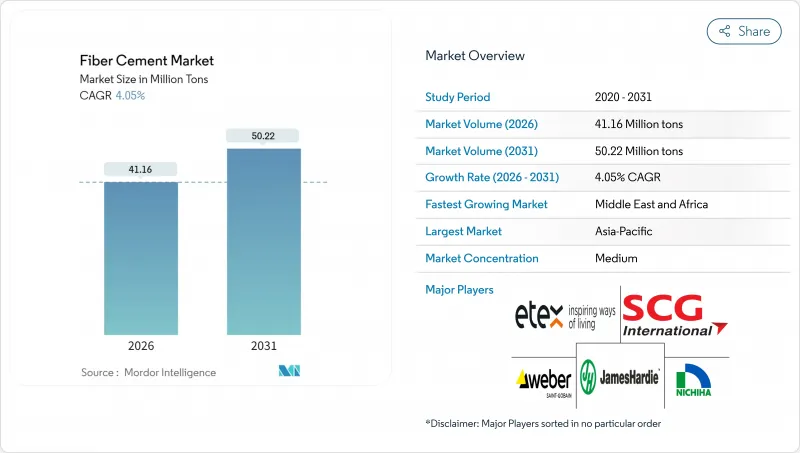

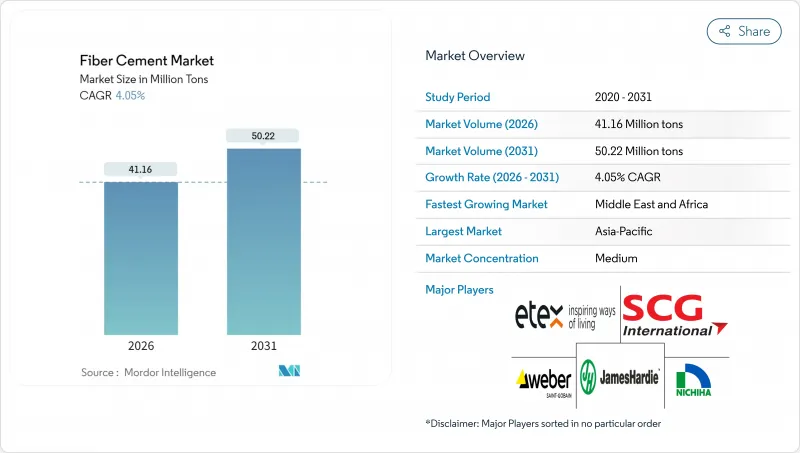

预计到 2026 年,纤维水泥市场规模将达到 4,116 万吨,高于 2025 年的 3,956 万吨,预计到 2031 年将达到 5,022 万吨。

预计2026年至2031年年复合成长率(CAGR)为4.05%。

强劲的需求源自于纤维水泥的诸多优异特性,例如不可燃性(有助于满足更严格的防火安全标准)、卓越的耐候性(可降低生命週期内的更换成本)以及设计柔软性(可满足从住宅翻新到大型商业开发等各种应用需求)。供应链合作伙伴也认可纤维水泥能够弥合木质墙板和合成材料替代品之间的性能差距,即使在整体建筑週期放缓的情况下,也能保持强劲的销售成长。业主看重其长达40年的使用寿命,而保险公司则为不可燃外墙提供保费折扣,这进一步推动了易发野火地区的纤维水泥应用。在竞争方面,大型製造商正加速与建筑商签订直接合同,以加强对分销管道的控制,而中型企业则专注于合成纤维创新和碳负排放配方技术,以维持利润率。

全球纤维水泥市场趋势与洞察

亚太地区的快速都市化和住宅建设復苏

政府住宅政策和大型基础设施项目正推动中国、印度和东南亚国协对纤维水泥市场产生稳定需求。预计2024年,中国的都市化将达到66.2%,每年新增城镇居民1,400万人。预计到2050年,印度的城镇居民将达到4.16亿。预计2024年印尼的建筑许可数量将成长8.3%,而泰国的东部经济走廊计画预计将在2025年推动该产业成长4.2%。东协统一消防安全标准将纤维水泥列为不可燃外墙材料,进一步巩固了其在该地区的应用。人口结构变化、保障性住宅政策和更严格的建筑规范共同为纤维水泥市场未来多年的需求成长奠定了基础。

严格的防火和隔音建筑标准

加州2024年第24号法规修正案强制要求森林-城市交界区(WUI)的450万栋建筑使用A级覆材覆层。同样,澳洲国家建筑规范修正案也将对280万套住宅施加类似的要求。 2024年国际建筑规范(IBC)强化了多用户住宅计划的声学性能标准,鼓励采用能降低噪音传播的高密度外墙覆层材料。北卡罗来纳州的防火测试数据显示,纤维水泥的燃点比木质墙板低73%,且无需额外加固即可降低18分贝的噪音。这些法规正使纤维水泥从一种高端选择转变为越来越多地区的强制性要求。

与乙烯基替代品相比,初始安装成本比较

纤维水泥外墙的安装成本为每平方英尺 8 至 12 美元,比乙烯基外墙贵 60% 至 100%。许多地区人手不足,加上需要使用专业的除尘工具,导致工时增加 25% 至 35%,进一步拉大了价格差距。关税政策可能使进口材料成本再增加 6% 至 14%,这将进一步扩大首次住宅的价格差距,而首次购屋者在 2024 年占购屋总数的 32%。成本压力在多用户住宅计划中最为显着,因为开发商通常在产生维护成本之前就出售房产,这抑制了他们对使用寿命长的外墙进行投资。

细分市场分析

到2025年,墙板将保持34.75%的市场份额,这反映了其在独栋住宅和维修计划中的长期应用,在这些项目中,木纹纤维水泥符合美学标准。老旧住宅存量的更换需求使销售量免受新建设週期性波动的影响,而安装人员的高度熟悉也增强了通路的稳定性。然而,由于中高层建筑严格的消防法规以及预製建筑系统的快速普及,预计到2031年,覆层的复合年增长率将超过墙板,达到4.52%。资料中心建设和大型计划中对不可燃建筑幕墙的频繁采用,促使建筑师越来越多地指定使用能够承受极端温度变化的厚纤维水泥覆层层板。屋顶、装饰线条和装饰组件的需求持续稳定成长,为製造商提供了利用现有涂装设施进行交叉销售的机会。这种不断变化的应用组合为整个纤维水泥市场提供了均衡的成长要素。

覆层的扩展正在缩小其与墙板之间的历史差距,并促使供应商拓展色彩范围和表面纹理,以契合现代复合材料的美学概念。最新版《国际建筑规范》(IBC)中的监管细则进一步强化了这一趋势,确立了优先考虑不可燃外墙组件的性能要求。随着开发商全面评估总成本和法规遵循性,纤维水泥在商业建筑幕墙中日益普及,这为纤维水泥市场开闢了重要的成长途径。

本纤维水泥市场报告按应用领域(墙板、覆层、模具及装饰、屋顶及其他应用)、终端用户行业(住宅、商业、工业及公共、基础设施)和地区(亚太、北美、欧洲、南美、中东和非洲)进行细分。市场预测以吨为单位。

区域分析

亚太地区预计到2025年将占全球纤维水泥市场总量的42.45%,主要得益于全部区域快速的都市化、扶持住宅政策以及严格的消防安全标准。中国每年新增1400万城镇居民,而印度大都市的扩张也带动了强劲的建筑许可需求。印尼的建筑许可数量预计在2024年增长8.3%,而泰国东部经济走廊超过1.7兆泰铢(约472亿美元)的投资预计将推动2025年建筑业增长4.2%。接近性纤维素原料产地和发达的水泥基础设施带来了成本优势,吸引了纤维水泥市场各领域的产能投资。

北美市场成熟且稳定,受建筑规范驱动的重建需求支撑着市场规模。美国西部地区大规模野火风险的增加,加速了房屋外墙维修向不可燃建筑材料的转变,而保险公司的激励措施也激发了房主的购买意愿。在加拿大,强劲的维修市场抵消了多户住宅开工量的放缓。同时,在墨西哥,新兴中产阶级推动了对中层住宅住宅耐用外墙覆层需求的成长。预製板材的持续创新以及与建筑商的直接合作,继续支撑着北美市场的需求,使该地区继续保持其在纤维水泥行业全球战略中的核心地位。

预计到2031年,中东和非洲地区将实现4.38%的年复合成长率,成为该地区成长最快的区域。沙乌地阿拉伯的「2030愿景」大型企划(包括NEOM和The Line)将创造超过5000亿美元的建筑价值,所有这些项目都必须符合严格的外墙性能标准。阿联酋和卡达的基础建设也持续推进,高层建筑的消防法规鼓励使用不可燃覆层。沿岸地区极端的气候条件推动了对耐候材料的需求,提高了纤维水泥的吸引力。虽然当地产能有限可能会限制短期供应,但先前宣布的合资企业和工厂扩建计划旨在解决这一前景广阔的纤维水泥市场领域的瓶颈问题。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场驱动因素

- 亚太地区的快速都市化和住宅建设復苏

- 严格的防火和隔音建筑标准

- 与木质和乙烯基墙板相比,生命週期成本优势

- 在中高层建筑采用板式预製建筑幕墙

- 利用纤维素奈米纤维的碳负排放水泥配方技术

- 市场限制

- 与乙烯基替代品相比,初始安装成本较高

- 可供选择的替代方案,例如工程木墙板

- 全球纸浆价格波动导致纤维采购面临风险

- 价值链分析

- 监管环境

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 终端用户产业趋势

第五章 市场规模与成长预测

- 透过使用

- 墙板

- 覆层

- 塑形和修剪

- 屋顶材料

- 其他用途

- 按最终用户行业划分

- 住宅

- 商业的

- 工业和公共设施

- 基础设施

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Allura

- American Fiber Cement.

- CSR Limited

- ElEMENTIA MATERIALS, SAB DE CV

- Eterno Ivica Srl

- Etex Group

- Everest

- HIL Limited

- James Hardie Building Products Inc.

- KMEW Co., Ltd.

- Mahaphant Fibre-Cement(South Asia)Pvt. Ltd

- Maxitile Inc.

- NICHIHA

- Ramco Industries Limited

- Renaatus Group

- Saint-Gobain(Weber & Eternit)

- SCG International Corporation

- SHERA Public Company Limited

- Swisspearl Group AG

第七章 市场机会与未来展望

第八章:执行长面临的关键策略挑战

Fiber Cement Market size in 2026 is estimated at 41.16 Million tons, growing from 2025 value of 39.56 Million tons with 2031 projections showing 50.22 Million tons, growing at 4.05% CAGR over 2026-2031.

Robust demand stems from the material's non-combustible nature that eases compliance with stricter fire codes, its superior weather resistance that lowers life-cycle replacement outlays, and design flexibility that satisfies both single-family renovators and large-scale commercial developers. Supply chain partners also recognize fiber cement's ability to bridge the performance gap between wood siding and synthetic substitutes, a factor that underpins resilient volume growth even when broader construction cycles moderate. Building owners favor the product's four-decade service life, while insurers reward non-combustible facades with lower premiums, reinforcing adoption intent in wildfire-prone regions. On the competitive front, leading manufacturers accelerate direct builder agreements that tighten channel control, whereas mid-tier players focus on synthetic fiber innovation and carbon-negative formulations to defend margins.

Global Fiber Cement Market Trends and Insights

Rapid Urbanization and Residential Construction Rebound in Asia-Pacific

Government housing mandates and mega-infrastructure programs stimulate steady fiber cement market demand across China, India, and ASEAN nations. China posted a 66.2% urbanization rate in 2024, adding 14 million urban residents each year, while India is expected to integrate 416 million city dwellers by 2050. Construction permit issuances in Indonesia rose 8.3% during 2024 and Thailand forecasts 4.2% sector growth in 2025 under the Eastern Economic Corridor framework. Harmonized ASEAN fire-safety standards that classify fiber cement as a non-combustible facade option further solidify regional usage. The confluence of demographic shifts, pro-housing policies, and stricter codes secures a multi-year demand runway for the fiber cement market.

Stringent Fire and Acoustic-Performance Building Codes

California's 2024 update to Title 24 now requires Class A exteriors in Wildland-Urban Interface zones covering 4.5 million structures, while Australia's National Construction Code revision applies comparable mandates to 2.8 million dwellings. The 2024 International Building Code tightens acoustic performance benchmarks for multifamily projects, driving adoption of dense facades that limit sound transfer. North Carolina fire-test data show fiber cement exhibits 73% lower ignition probability than wood siding and achieves an 18-decibel noise reduction without extra layers. These regulations elevate fiber cement from premium option to compliance necessity across an expanding set of jurisdictions.

High Initial Installation Cost Versus Vinyl Alternatives

Fiber cement requires USD 8-12 per square foot installed, a 60-100% price premium over vinyl. Labor scarcity in many regions inflates the gap because installers need specialized dust-management tools that add 25-35% to man-hours. Tariff scenarios could raise imported input costs another 6-14%, widening the delta for first-time homebuyers who already represent 32% of 2024 purchases. Cost headwinds are most acute in multifamily projects where developers monetize properties before maintenance bills accrue, reducing willingness to pay for longer-life facades.

Other drivers and restraints analyzed in the detailed report include:

- Lifecycle Cost Advantage Over Wood and Vinyl Siding

- Adoption of Panelized Prefab Facades in Mid-Rise Buildings

- Availability of Substitutes Such as Engineered Wood Siding

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Siding retained 34.75% of 2025 volume, reflecting long-standing use in detached housing and renovation projects where fiber cement's wood-like grain patterns satisfy aesthetic norms. Replacement demand from an aging housing stock cushions volume against cyclical new-build fluctuations, and wide installer familiarity fortifies channel stability. Cladding, however, is set to outpace siding with a 4.52% CAGR through 2031, propelled by stringent fire codes for mid-rise and high-rise structures and the rapid embrace of panelized construction systems. Data center builds and infrastructure megaprojects frequently select non-combustible facades, prompting architects to specify thicker fiber cement cladding panels that withstand extreme temperature swings. Roofing, moulding, and trimming components continue to deliver steady supplemental demand, offering manufacturers cross-selling opportunities that leverage existing color-coating assets. Collectively, this evolving application mix underpins balanced growth drivers across the fiber cement market.

The expansion of cladding narrows the historical gap with siding and encourages suppliers to broaden color palettes and surface textures compatible with contemporary mixed-material aesthetics. Regulatory clarity within the latest International Building Code strengthens this trajectory by codifying performance requirements that favor non-combustible exterior wall assemblies. As developers evaluate total cost and regulatory compliance holistically, fiber cement's rising profile in commercial facades becomes a pivotal growth avenue within the fiber cement market.

The Fiber Cement Market Report is Segmented by Application (Siding, Cladding, Moulding and Trimming, Roofing and Other Applications), End-User Sector (Residential, Commercial, Industrial and Institutional, and Infrastructure), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific commanded 42.45% of 2025 volume thanks to rapid urbanization, supportive housing policies, and region-wide adoption of stricter fire-safety codes. China continues to add 14 million urban residents annually, and India's metro expansions underpin robust permit pipelines. Indonesia's building permits rose 8.3% in 2024, while Thailand projects 4.2% construction growth for 2025 under Eastern Economic Corridor investments exceeding THB 1.7 trillion (USD 47.2 billion). Proximity to cellulose feedstock and developed cement infrastructure yields cost advantages that attract capacity investments throughout the fiber cement market.

North America represents a mature but stable arena where code-driven replacement activity sustains volume. Extensive wildfire exposure in the western United States accelerates siding upgrades to non-combustible alternatives, and insurance incentives bolster homeowner interest. In Canada, a resilient renovation segment offsets moderation in multifamily starts, while Mexico's emerging middle class drives incremental demand for durable facades in mid-rise housing. Continued innovation in prefabricated panels and direct builder contracting further supports North American volume, keeping the region central to global strategy within the fiber cement industry.

Middle East and Africa is set to achieve the fastest regional CAGR of 4.38% through 2031. Saudi Arabia's Vision 2030 megaprojects, including NEOM and The Line, add more than USD 500 billion of construction value, all subject to stringent facade performance criteria. The UAE and Qatar continue infrastructure build-outs, and fire-safety regulations in high-rise clusters favor non-combustible cladding. Climatic extremes in the Gulf place a premium on weather-resistant materials, amplifying fiber cement's appeal. Limited local production capacity may constrain near-term supply, yet joint ventures and plant expansions already announced are aimed at mitigating bottlenecks in this promising slice of the fiber cement market.

- Allura

- American Fiber Cement.

- CSR Limited

- ElEMENTIA MATERIALS, SAB DE CV

- Eterno Ivica S.r.l.

- Etex Group

- Everest

- HIL Limited

- James Hardie Building Products Inc.

- KMEW Co., Ltd.

- Mahaphant Fibre-Cement (South Asia) Pvt. Ltd

- Maxitile Inc.

- NICHIHA

- Ramco Industries Limited

- Renaatus Group

- Saint-Gobain (Weber & Eternit)

- SCG International Corporation

- SHERA Public Company Limited

- Swisspearl Group AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Rapid Urbanisation and Residential Construction Rebound in Asia-Pacific

- 4.1.2 Stringent Fire and Acoustic-Performance Building Codes

- 4.1.3 Lifecycle Cost Advantage Over Wood and Vinyl Siding

- 4.1.4 Adoption of Panelised Prefab Facades in Mid-Rise Buildings

- 4.1.5 Carbon-Negative Cement Formulations Using Cellulose Nanofibers

- 4.2 Market Restraints

- 4.2.1 High Initial Installation Cost Versus Vinyl Alternatives

- 4.2.2 Availability of Substitutes Such as Engineered Wood Siding

- 4.2.3 Fibre-Sourcing Risk Amid Global Pulp-Price Volatility

- 4.3 Value Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 End Use Sector Trends

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Siding

- 5.1.2 Cladding

- 5.1.3 Moulding and Trimming

- 5.1.4 Roofing

- 5.1.5 Other Applications

- 5.2 By End-User Sector

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial and Institutional

- 5.2.4 Infrastructure

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Allura

- 6.4.2 American Fiber Cement.

- 6.4.3 CSR Limited

- 6.4.4 ElEMENTIA MATERIALS, SAB DE CV

- 6.4.5 Eterno Ivica S.r.l.

- 6.4.6 Etex Group

- 6.4.7 Everest

- 6.4.8 HIL Limited

- 6.4.9 James Hardie Building Products Inc.

- 6.4.10 KMEW Co., Ltd.

- 6.4.11 Mahaphant Fibre-Cement (South Asia) Pvt. Ltd

- 6.4.12 Maxitile Inc.

- 6.4.13 NICHIHA

- 6.4.14 Ramco Industries Limited

- 6.4.15 Renaatus Group

- 6.4.16 Saint-Gobain (Weber & Eternit)

- 6.4.17 SCG International Corporation

- 6.4.18 SHERA Public Company Limited

- 6.4.19 Swisspearl Group AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment