|

市场调查报告书

商品编码

1907229

二苯基甲烷二异氰酸酯(MDI):市场份额分析、产业趋势与统计、成长预测(2026-2031)Methylene Diphenyl Di-isocyanate (MDI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

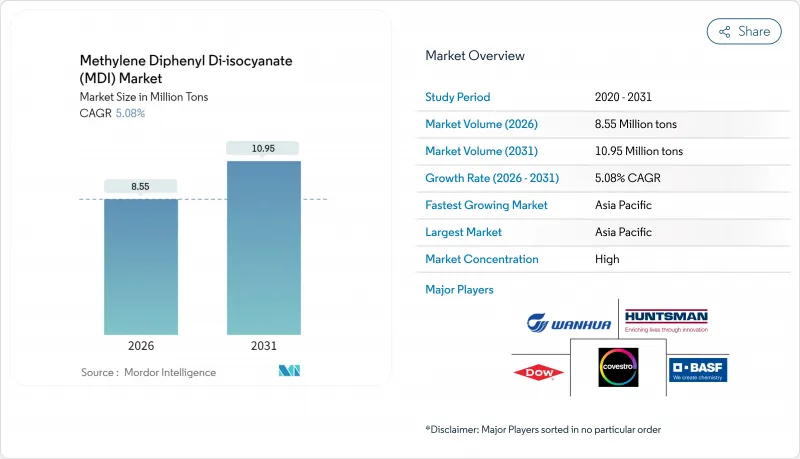

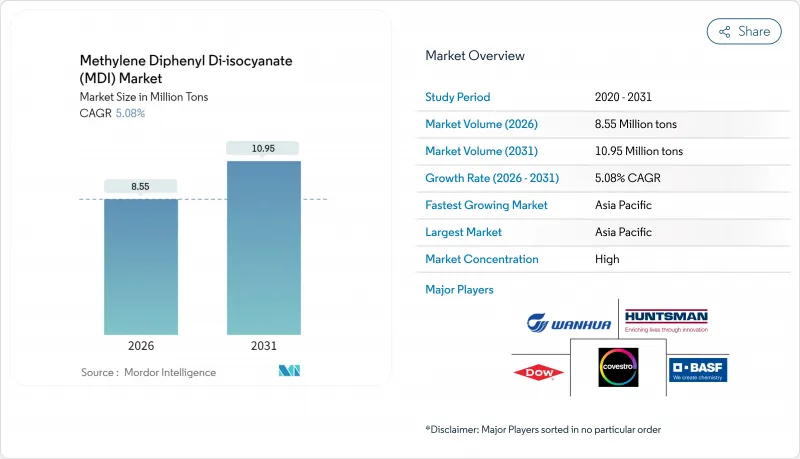

预计二苯基甲烷二异氰酸酯(MDI) 市场将从 2025 年的 814 万吨增长到 2026 年的 855 万吨,到 2031 年将达到 1095 万吨,2026 年至 2031 年的复合年增长率为 5.08%。

亚太地区具有成本竞争力的供应扩张,以及北美和欧洲净零建筑法规和电器能源效率标准的实施,都为此成长轨迹提供了支撑。产业领导企业正在扩大生物回收和物料平衡等级产品的生产,以维持客户忠诚度,而无光气试验生产线的投产则预示着製程的长期转型。儘管原物料价格波动(预计2025年苯胺价格将年减36.81%)将导致利润率波动,但一体化生产商拥有更强的缓衝能力。更严格的工人接触法规以及新工厂的高资本密集度将维持企业的竞争优势,并加速以技术领先的现有企业为中心的产业整合。

全球二苯基甲烷二异氰酸酯(MDI)市场趋势及展望

净零能耗建筑推动了聚氨酯隔热材料需求的激增。

欧盟《建筑能源性能指令》要求成员国到2030年投资3.5兆欧元(3.8兆美元)提高能源效率。新建建筑必须达到近零能耗目标,现有建筑必须进行大规模维修,并建议使用导热係数低于0.022 W/m*K的硬质聚氨酯板。加州2025年建筑规范中的类似规定正在推动北美地区对MDI的需求。随着先进控制系统对隔热性能要求的提高,建筑自动化规范将进一步推动MDI的消费。这种监管和性能方面的协同作用已使硬质泡沫稳固地成为MDI市场中成长最快的细分市场。

扩大食品和药品低温运输设施

疫情后的疫苗物流凸显了温度波动带来的成本,推动了医药供应链转型为超低温储存的。印度的补贴低温运输计画将新建采用聚氨酯系统的仓库,其保温性能可低至-80°C。受城市生活方式转变的推动,食品低温运输也将促进东协和拉丁美洲冷藏运输和零售包装的升级。高性能规格的提升提高了优质MDI等级产品的利润率,并在原材料价格上涨的情况下增强了销售量韧性。

收紧二异氰酸酯的工人暴露限值

欧盟已将职场的NCO暴露量限制在6µg/m³以内,并强制要求所有操作人员接受认证培训,美国职业安全与健康管理局(OSHA)也采取了类似措施。合规要求需要在通风、监测和医疗监护方面进行投资,这增加了喷涂泡沫安装商和小家电生产线的固定成本。这种负担正在加速市场集中于资金雄厚的加工商手中,并使需求转向价格较高但需要配方专业知识的低单体或预聚物解决方案。

细分市场分析

到2025年,硬质泡沫将占MDI市场规模的36.78%,预计到2031年将以5.63%的复合年增长率成长。这一类别受益于聚异氰酸酯板材,其导热係数低至0.022 W/m*K,是同类产品中的佼佼者,使住宅和商业建筑能够达到净零能耗标准。软质泡棉在床垫和汽车座椅领域保持着需求,但其市场成熟度限制了成长潜力。涂料和弹性体支撑着基准产量,这得益于工业维护和物料搬运应用领域的持续需求。新兴应用,例如电动车电池封装,要求在热循环下保持尺寸稳定性,这体现了MDI化学的多功能性。硬质泡沫在屋顶维修和幕墙系统中的日益普及几乎可以确保其在MDI市场中继续占据主导地位。

随着全球建筑规范日益严格,保险公司和金融机构强制要求最低隔热性能值(R值),而这只有使用薄壁结构中的硬质聚氨酯或聚异氰脲酸酯(PIR)产品才能实现。 Leticel 的「Eurowall Impact」板材含有 25% 的回收生物成分,在不牺牲隔热性能的前提下,生产过程中二氧化碳排放减少了 43%。黏合剂和密封剂在汽车和基础设施维修领域构成了一个小众但盈利的细分市场,其中 MDI 具有快速固化和结构黏合的优势。特殊弹性体在矿用筛网和工业车轮中发挥关键作用,并创造了稳定的售后市场收入。总而言之,这些细分市场使硬质泡沫成为 MDI 市场长期成长的关键驱动力。

二苯基甲烷二异氰酸酯(MDI) 市场报告按应用(硬质泡沫、软质泡沫、涂料、弹性体、黏合剂和密封剂、其他)、终端用户行业(建筑、家具和室内装饰、电子和家用电器、汽车、鞋类、其他)和地区(亚太地区、北美、欧洲、南美、中东和非洲)进行分析。

区域分析

预计到2025年,亚太地区将占MDI市场46.35%的份额,并在2031年之前以5.90%的复合年增长率保持区域领先成长。中国绿色建筑标准和基础设施建设的蓬勃发展将带动对硬质发泡体的巨大需求,而印度疫苗物流的推进则推动了冷藏储存能力的扩张。锦湖三井化学株式会社计划增产20万吨(透过改造其丽水工厂,将产能提升至61万吨)等扩建计划也为当地供应提供了支撑。

由于维修奖励和有利于高性能住宅的第45L条税额扣抵,北美市场仍然十分重要。特别是,科思创向凯雷建筑材料公司供应的生物再生MDI,与化石基MDI相比,可减少99%的上游工程碳排放。当地家电製造商也指定使用高密度泡棉材料,以符合2025年能源法规的要求,从而支撑了稳定的基础设施需求。

欧洲的政策主导正在创造超过内部成长的合成需求。欧盟建筑能源性能指令 (EPBD) 制定的 3.5 兆欧元维修计画正在加速硬质泡棉材料的应用,而 6 微克的暴露限值也促使配方师转向低单体配方。生产商的关注点与循环经济一致,例如BASF剥离了其上海合资企业,并优化了其 190 万吨的全球 MDI 生产网络,从而释放资源用于物料平衡生产。同时,中东和非洲地区正藉助物流园区和气候控制农业实现追赶式成长,但许多产品仍依赖从欧洲和亚洲进口。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 净零能耗建筑对聚氨酯隔热材料的需求激增

- 扩大食品和药品低温运输能力

- 暖通空调能源效率法规促进电器发泡的使用

- 电动车电池组温度控管泡沫的兴起

- 透过循环经济促进实现物料平衡/ISCC-Plus MDI

- 市场限制

- 收紧二异氰酸酯的工人暴露限值

- 原油价格波动会影响苯胺原料。

- 光气化装置资本密集度高

- 价值链分析

- 监理政策分析

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 生产流程分析

- 技术授权和专利分析

- 价格趋势情景

第五章 市场规模与成长预测

- 透过使用

- 硬泡沫

- 柔性泡沫

- 涂层

- 弹性体

- 黏合剂和密封剂

- 其他的

- 按最终用户行业划分

- 建造

- 家具和室内装饰

- 家用电器

- 车

- 鞋类

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- BASF

- Covestro AG

- Dow

- Hexion Inc.

- Huntsman International LLC

- Karoon Petrochemical Company

- Kumho Mitsui Chemicals Inc

- KURMY CORPORATIONS

- Sadara

- Shanghai Lianheng Isocyanate Co. Ltd

- Sumitomo Chemical Co. Ltd

- Tosoh Corporation

- Vardhman Chemicals

- Wanhua

第七章 市场机会与未来展望

The Methylene Diphenyl Di-isocyanate market is expected to grow from 8.14 Million tons in 2025 to 8.55 Million tons in 2026 and is forecast to reach 10.95 Million tons by 2031 at 5.08% CAGR over 2026-2031.

Cost-competitive supply expansions in Asia-Pacific, paired with net-zero building mandates and appliance efficiency standards across North America and Europe, underpin this growth trajectory. Industry leaders are scaling bio-circular and mass-balanced grades to retain customer loyalty, while phosgene-free pilot lines point to longer-term process disruption. Feedstock price swings-aniline fell 36.81% year-on-year in 2025-add margin volatility, yet integrated producers remain better cushioned. Intensifying worker-exposure regulations and the capital intensity of new plants keep the competitive moat high and accelerate consolidation around technology-rich incumbents.

Global Methylene Diphenyl Di-isocyanate (MDI) Market Trends and Insights

Surge in PU-Insulation Demand from Net-Zero Buildings

The Energy Performance of Buildings Directive obliges EU member states to invest EUR 3.5 trillion (USD 3.8 trillion) in energy upgrades by 2030. New builds must meet near-zero energy targets, while older stock faces mandatory deep retrofits that favor rigid polyurethane panels with thermal conductivity down to 0.022 W/m*K. Comparable rules in California's 2025 codes replicate this pull in North America. Building automation specifications further boost MDI consumption because advanced controls demand tighter thermal envelopes. The synergy between regulation and performance cements rigid foams as the highest-growth slice of the MDI market.

Cold-Chain Capacity Build-Out for Food and Pharma

Post-pandemic vaccine logistics illustrated the cost of temperature excursions, pivoting pharma supply chains toward ultralow-temperature storage. India's subsidized cold-chain programs add greenfield warehouses that rely on polyurethane systems capable of -80 °C thermal integrity. Parallel food cold-chains, driven by urban lifestyle changes, upscale refrigerated transport and retail cases across ASEAN and Latin America. Higher performance specs elevate margin profiles for premium MDI grades, strengthening volume resilience even amid raw-material inflation.

Stricter Worker-Exposure Limits for Diisocyanates

The EU capped workplace exposure at 6 µg NCO/m3 and mandated certified training for all handlers. OSHA is following suit. Compliance forces investments in ventilation, monitoring and medical surveillance, raising fixed costs for spray-foam contractors and small appliance lines. The burden accelerates market consolidation toward capital-rich processors and biases demand toward low-monomer or prepolymer solutions that command price premiums but require formulation know-how.

Other drivers and restraints analyzed in the detailed report include:

- HVAC Efficiency Regulations Boosting Appliance Foams

- Rise of Battery-Thermal-Management Foams in EV Packs

- High Capital Intensity of Phosgenation Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rigid foams contributed 36.78% of the MDI market size in 2025 and are expected to climb at a 5.63% CAGR to 2031. The category benefits from polyisocyanurate panels delivering best-in-class 0.022 W/m*K thermal conductivity, enabling compliance with net-zero standards in residential and commercial construction. Flexible foams maintain relevance in bedding and automotive seats, though maturity limits upside. Coatings and elastomers secure recurring demand from industrial maintenance and materials-handling applications, reinforcing baseline volumes. Emerging uses include EV battery encapsulants that need dimensional stability under thermal cycling, highlighting the versatility of MDI chemistry. Rigid foams' rising uptake in re-roofing and curtain-wall systems all but assures their continued dominance within the MDI market.

With building codes tightening globally, insurers and financiers are prescribing minimum R-values that only rigid polyurethane or PIR products can feasibly meet at slim wall sections. Recticel's Eurowall Impact board, featuring 25% bio-circular content, cut embodied CO2 by 43% without compromising thermal performance. Adhesives and sealants form a niche yet profitable sub-segment in automotive and infrastructure repair, where MDI imparts fast cure and structural bonding. Specialty elastomers carry weight in mining screens and industrial wheels, generating steady aftermarket revenue. Collectively, these sub-segments make rigid foams the linchpin of long-term growth for the MDI market.

The Methylene Diphenyl Di-Isocyanate (MDI) Market Report is Segmented by Application (Rigid Foams, Flexible Foams, Coatings, Elastomers, Adhesives and Sealants, and Others), End-User Industry (Construction, Furniture and Interiors, Electronics and Appliances, Automotive, Footwear, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific controlled 46.35% of the MDI market in 2025 and is projected to expand at a region-leading 5.90% CAGR to 2031. China's green-building codes and infrastructure boom absorb vast rigid-foam volumes, while India's vaccine logistics push inflate cold-storage capacity. Expansion projects, such as Kumho Mitsui's 200 kt debottlenecking that lifted its Yeosu complex to 610 kt, underpin local supply.

North America remains significant through retrofit incentives and the Section 45L tax credit that rewards high-performance residential buildings. Notably, Covestro supplies bio-circular MDI to Carlisle Construction Materials, cutting upstream carbon 99% relative to fossil-based grades. Local appliance makers also specify higher-density foams to satisfy 2025 energy rules, anchoring stable base demand.

Europe's policy leadership creates a synthetic pull exceeding organic growth. The EPBD's EUR 3.5 trillion retrofit agenda accelerates rigid-foam adoption, while the 6 µg exposure cap motivates formulators to shift toward low-monomer variants. Producer focus aligns with circularity: BASF separated its Shanghai joint venture to optimize its 1.9 million-ton global MDI grid, freeing assets for mass-balanced production. Meanwhile, Middle East and Africa register catch-up growth driven by logistics parks and climate-controlled agriculture, though most product still ships in from Europe and Asia.

- BASF

- Covestro AG

- Dow

- Hexion Inc.

- Huntsman International LLC

- Karoon Petrochemical Company

- Kumho Mitsui Chemicals Inc

- KURMY CORPORATIONS

- Sadara

- Shanghai Lianheng Isocyanate Co. Ltd

- Sumitomo Chemical Co. Ltd

- Tosoh Corporation

- Vardhman Chemicals

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in PU-insulation demand from net-zero buildings

- 4.2.2 Cold-chain capacity build-out for food and pharma

- 4.2.3 HVAC efficiency regulations boosting appliance foams

- 4.2.4 Rise of battery-thermal-management foams in EV packs

- 4.2.5 Circular-economy push for mass-balanced/ISCC-Plus MDI

- 4.3 Market Restraints

- 4.3.1 Stricter worker-exposure limits for diisocyanates

- 4.3.2 Crude-oil price volatility hitting aniline feedstock

- 4.3.3 High capital intensity of phosgenation plants

- 4.4 Value Chain Analysis

- 4.5 Regulatory Policy Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Degree of Competition

- 4.7 Production Process Analysis

- 4.8 Technology Licensing and Patent Analysis

- 4.9 Price Trend Scenario

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Rigid Foams

- 5.1.2 Flexible Foams

- 5.1.3 Coatings

- 5.1.4 Elastomers

- 5.1.5 Adhesives and Sealants

- 5.1.6 Others

- 5.2 By End-user Industry

- 5.2.1 Construction

- 5.2.2 Furniture and Interiors

- 5.2.3 Electronics and Appliances

- 5.2.4 Automotive

- 5.2.5 Footwear

- 5.2.6 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 Hexion Inc.

- 6.4.5 Huntsman International LLC

- 6.4.6 Karoon Petrochemical Company

- 6.4.7 Kumho Mitsui Chemicals Inc

- 6.4.8 KURMY CORPORATIONS

- 6.4.9 Sadara

- 6.4.10 Shanghai Lianheng Isocyanate Co. Ltd

- 6.4.11 Sumitomo Chemical Co. Ltd

- 6.4.12 Tosoh Corporation

- 6.4.13 Vardhman Chemicals

- 6.4.14 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Phosgene-free MDI Production Process