|

市场调查报告书

商品编码

1907258

异氰酸酯:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Isocyanates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

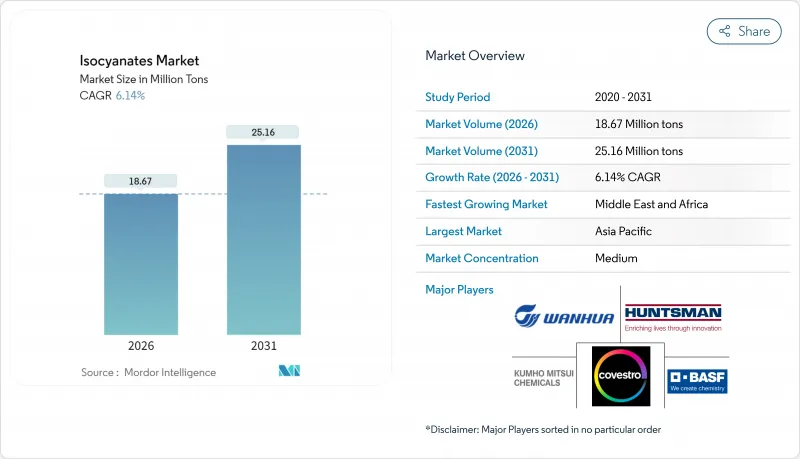

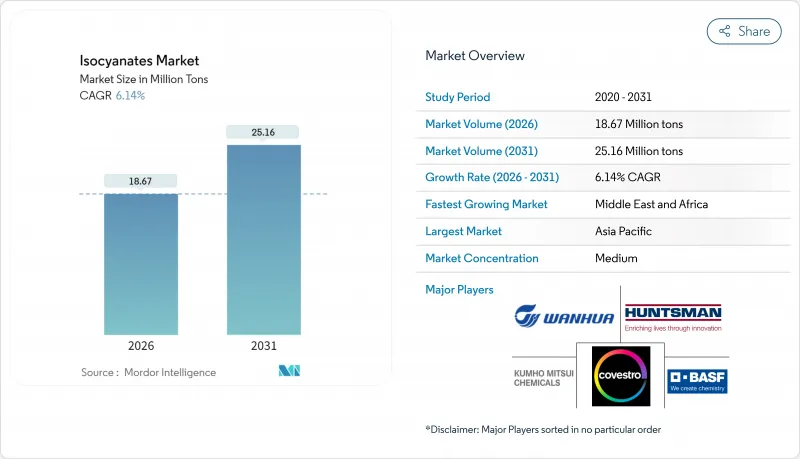

预计到 2026 年,异氰酸酯市场规模将达到 1,867 万吨,高于 2025 年的 1,759 万吨。预计到 2031 年将达到 2,516 万吨,2026 年至 2031 年的复合年增长率为 6.14%。

这一成长轨迹反映了高性能聚氨酯系统的日益普及、供应端的整合以及有利于垂直整合生产商的日益严格的环境法规。随着保温标准的提高,对硬质泡棉的需求依然强劲,同时轻型汽车也推动了建筑应用以外特种泡沫的需求。一体化的原料策略、贸易政策的转变以及向高脂肪族化学品的转型,进一步塑造了异氰酸酯市场的竞争格局。

全球异氰酸酯市场趋势与洞察

建筑隔热材料领域对硬质聚氨酯泡棉的需求激增

2024 年国际建筑规范修订版要求对含有可燃隔热材料的外墙组装进行 NFPA 285 防火测试,这使得成熟的异氰酸酯基系统成为设计师的低风险选择。聚异氰酸酯板材的导热係数极低,仅为 0.018 W/m*K,与空间受限的维修中使用的矿棉相比,可实现更薄的墙体组装。各州能源规范越来越多地引用 ASHRAE 90.1 标准,要求建筑商在现有建筑围护结构中达到使用硬质聚氨酯所能实现的高隔热性能(R 值)。随着现有建筑进行维修以达到净零排放目标,这推动了异氰酸酯市场的发展。此外,全球绿色建筑认证专案更倾向于选择具有成熟生命週期资料的材料,这使得 MDI 基泡棉材料具有额外的相容性优势。

亚太地区的快速工业化与都市化

东南亚国家正将製造地拓展至中国以外,从而创造了MDI和TDI的新区域需求。在越南、泰国和印尼设有生产基地的製造商既能满足不断增长的本地消费需求,又能降低地缘政治因素带来的供应链风险。东曹在越南的年产13万吨MDI工厂便是这种多元化策略的典范。东协大规模城市住宅和交通计划推动了对隔热材料、密封剂和复合板的需求,而这些产品都依赖异氰酸酯化学。收入水准的提高以及耐用品(尤其是床垫和家用电器)消费的成长,也推动了对柔软性泡棉材料的稳定需求。儘管其他地区的出口成长放缓,但这些结构性变化使得异氰酸酯市场得以保持多年的成长势头。

苯和硝基苯原料价格波动

由于苯是MDI和TDI的主要芳烃前驱物,原油价格与石脑油价格的挂钩上涨会直接影响异氰酸酯的生产成本。亚洲现货苯价格波动剧烈,迫使生产商启用月度价格调整条款,并降低了买家对价格的预期。无法追溯取得芳烃原料的非一体化转化企业利润率压缩最为迅速,促使企业进行垂直整合并签署长期承购协议。库存策略已演变为对冲至少三个月的需求以降低波动性,但这会占用营运资金并增加持有成本。因此,当原料价格不确定时,合成商会延后订单,抑制近期消费成长。

细分市场分析

到2025年,MDI将占据异氰酸酯市场58.75%的份额,这主要得益于其在硬质发泡体和复合材料配方中的多功能性,满足了高需求建筑和工业应用的需求。同时,脂肪族异氰酸酯的复合年增长率(CAGR)为6.72%,超过了整体异氰酸酯市场的成长速度。具有紫外线稳定性的HDI和IPDI正在渗透到汽车透明涂层和风力发电机叶片树脂系统中,这些产品因其长期耐久性而价格较高。 TDI在床上用品和家具行业的需求仍然强劲,但随着该领域日趋成熟,以及来自黏弹性MDI体系的竞争压力加剧,其成长速度正在放缓。特种嵌段和预聚物变体透过针对较低的产量、电子封装、船舶涂料和航太复合材料等领域,提供了更高的利润空间。

随着汽车和可再生能源行业的原始设备製造商 (OEM) 对耐久性的要求不断提高,而芳香族化学品难以达到这些标准,脂肪族异氰酸酯的市场规模预计将稳步扩大。为因应北美和欧洲可能出现的本地采购限制,生产商正在投资建造更多的 HDI 单体生产线,以缩短下游聚异氰酸酯生产的供应链。同时,MDI 供应商也在提高产量,以消除瓶颈并维持成本优势,这凸显了一种双轨投资策略,即在商品规模和高附加价值特种产品之间取得平衡。

本异氰酸酯市场报告按类型(MDI、TDI、脂肪族、其他)、应用(硬质泡沫、软质泡沫、油漆和涂料、黏合剂和密封剂等)、终端用户行业(建筑和施工、汽车、医疗、家具、其他终端用户等)以及地区(亚太地区、北美、欧洲等)进行分析。市场预测以吨为单位。

区域分析

到2025年,亚太地区将占据异氰酸酯市场46.85%的份额。这一主导地位主要得益于中国以苯为主导的MDI生产体係以及东南亚新兴的製造地,这些基地能够为区域加工商提供更快的交货速度。在中国,随着排放法规的排放严格,中小型工厂的整合使得生产集中在规模更大的企业手中,这些企业既能利用规模经济,又能实现环保目标。越南和印尼的下游丛集也在扩大硬质发泡体和鞋类产品的生产,从而强化了自我维持的需求循环,使其不易受出口波动的影响。

北美凭藉其以页岩气为主的原料供应以及接近性汽车和建筑行业的地理优势,占据关键地位,而这两个行业正是聚氨酯消费的主要支撑。BASF在路易斯安那州盖斯马的持续扩建计画将使该地区的MDI名义产能于2026年达到约60万吨/年,从而确保不断增长的电动车产能所需的充足供应。贸易政策的不确定性,例如美国国际贸易委员会(USITC)将于2025年对中国MDI展开反倾销调查,促使企业采用双重采购模式,并支持国内工厂的运转率。儘管欧洲技术先进,但遵守REACH法规的成本正迫使中小加工商从海外采购原材料,儘管对保温维修的需求持续存在,但这在一定程度上减缓了该地区的成长前景。

预计中东和非洲将成为该地区成长最快的市场,到2031年复合年增长率将达到6.25%,主要得益于各国政府对大型基础建设计划和石化自给自足计划的资金投入。国营企业正利用低成本的丙烷脱氢和苯萃取技术,为MDI和TDI整合装置提供原料。智慧城市和医疗综合体的建设,尤其是在波湾合作理事会(GCC)国家,正在推动对高性能隔热材料和密封剂的需求,进一步扩大该地区异氰酸酯市场规模的成长。在阿曼和沙乌地阿拉伯拥有资产的生产商还可以逆向整合到基础芳烃领域,从而在全球苯价格波动的情况下提高利润率。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 建筑隔热材料用硬质聚氨酯泡棉的需求激增

- 亚太地区的快速工业化与都市化

- 轻量化汽车趋势推动聚氨酯复合材料的应用

- 低温运输和电子商务包装的成长

- 利用异氰酸酯复合材料製造风力发电机叶片

- 市场限制

- 苯和硝基苯原料价格波动;

- 欧盟REACH法规训练与分类障碍

- 中国环境法规导致停产,造成供应受限

- 价值链分析

- 监管环境

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 价格趋势

第五章 市场规模与成长预测

- 按类型

- MDI

- TDI

- 脂肪族(例如 HDI、IPDI)

- 其他类型

- 透过使用

- 硬发泡塑胶

- 柔性泡沫

- 油漆和涂料

- 黏合剂和密封剂

- 弹性体

- 活页夹

- 其他用途

- 按最终用户行业划分

- 建筑/施工

- 车

- 卫生保健

- 家具

- 其他终端使用者(航太、电子、船舶)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 土耳其

- 埃及

- 奈及利亚

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率/排名分析

- 公司简介

- Anderson Development Company

- Asahi Kasei Chemicals

- BASF SE

- BorsodChem

- Chemtura Corp.

- China National Bluestar(Group)Co. Ltd.

- Covestro AG

- Dow Inc.

- Evonik Industries

- Huntsman Corporation LLC

- Kemipex

- Korea Fine Chemical Co. Ltd.

- Kumho

- MITSUI CHEMICALS AMERICA INC.

- Perstorp

- Tosoh Corporation

- Vencorex

- Wanhua Chemical Group Co. Ltd.

第七章 市场机会与未来展望

Isocyanates market size in 2026 is estimated at 18.67 million tons, growing from 2025 value of 17.59 million tons with 2031 projections showing 25.16 million tons, growing at 6.14% CAGR over 2026-2031.

This trajectory reflects escalating adoption of high-performance polyurethane systems, supply-side consolidation, and tightening environmental regulations that reward vertically integrated producers. Rigid foam maintains momentum as efficiency standards raise thermal-insulation baselines, while automotive lightweighting broadens specialized demand beyond strictly construction uses. Integrated feedstock strategies, trade-policy shifts, and a pivot toward premium aliphatic chemistries further shape competitive positioning within the isocyanates market.

Global Isocyanates Market Trends and Insights

Surging Demand for Rigid PU Foam in Building Insulation

Revisions to the 2024 International Building Code mandate NFPA 285 fire testing for exterior wall assemblies that contain combustible insulation, making proven isocyanate-based systems the low-risk route for specifiers. Polyisocyanurate boards offer thermal conductivity as low as 0.018 W/m*K, allowing for thinner wall assemblies compared to mineral wool in retrofit settings where space is limited. State energy codes now cite ASHRAE 90.1 more frequently, pushing builders to higher R-values that rigid polyurethane can achieve within existing envelopes. The isocyanates market, therefore, benefits from retro-demand as older structures upgrade to meet net-zero targets. Global green-building certifications also favor materials with established life-cycle data, giving MDI-based foams a further compliance edge.

Rapid Industrialization and Urbanization in APAC

Southeast Asian economies are scaling manufacturing bases beyond China, creating new intra-regional demand pools for MDI and TDI. Producers with units in Vietnam, Thailand, and Indonesia can meet the rising local consumption while mitigating geopolitical-driven supply-chain risks. Tosoh's 130,000-tpy MDI plant in Vietnam exemplifies this diversification strategy. Large-scale urban housing and transportation projects across ASEAN are driving demand for insulation, sealants, and composite panels, all of which rely on isocyanate chemistries. As income levels rise, consumption of durable goods-especially mattresses and appliances-drives steady demand for flexible foam. These structural shifts keep the isocyanates market on a multi-year growth path, irrespective of export softness elsewhere.

Volatile Benzene and Nitro-Benzene Feedstock Pricing

Benzene is the primary aromatic precursor for both MDI and TDI, so any spike in crude-linked naphtha values cascades directly into isocyanate manufacturing costs. Spot benzene in Asia swung, forcing producers to issue monthly price-adjustment clauses that eroded buyer visibility. Margins compress fastest for non-integrated converters that lack backward links to aromatics, encouraging vertical integration or long-term offtake contracts. Inventory strategies are evolving toward hedged positions that cover at least three months of demand to cushion volatility; however, this ties up working capital and raises carrying costs. The net result is a dampening effect on short-term consumption growth as formulators delay orders when the feedstock price direction is unclear.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight Vehicle Trend Driving PU Composites Adoption

- Cold-Chain and E-Commerce Packaging Growth

- EU REACH Training and Classification Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

MDI held a 58.75% market share of the isocyanates market in 2025, backed by its versatility in rigid foam and composite formulations that serve high-volume construction and industrial applications. At the same time, aliphatic isocyanates are tracking a 6.72% CAGR that outpaces the overall isocyanates market, with UV-stable HDI and IPDI penetrating automotive clearcoat and wind-blade resin systems where long-term durability commands premium prices. TDI demand remains resilient in bedding and furniture, but growth is slower as the segment reaches maturity and competitive pressure from viscoelastic MDI systems intensifies. Specialty blocked and pre-polymer variants, while low volume, offer elevated margins by targeting electronics encapsulation, marine coatings, and aerospace composites.

The isocyanates market size for aliphatic grades is set to climb steadily as OEM specifications in both automotive and renewable-energy sectors pivot to durability metrics that aromatic chemistries struggle to meet. Producers are investing in additional HDI monomer loops to shorten supply chains for downstream polyisocyanate production, anticipating regional content rules in North America and Europe. Meanwhile, MDI suppliers are adding capacity to address bottlenecks to retain cost leadership, highlighting a dual-track investment landscape that balances commodity scale with specialty value capture.

The Isocyanates Market Report is Segmented by Type (MDI, TDI, Aliphatic, and Other Types), Application (Rigid Foam, Flexible Foam, Paints and Coatings, Adhesives and Sealants, and More), End-User Industry (Building and Construction, Automotive, Healthcare, Furniture, and Other End-Users), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific accounted for 46.85% of the isocyanates market share in 2025, a lead secured by China's benzene-advantaged MDI complexes and Southeast Asia's emerging manufacturing corridors that shorten delivery times to regional converters. The consolidation of smaller Chinese plants under stricter emissions regulations is driving volume toward large operators that can leverage economies of scale while meeting environmental targets. Vietnamese and Indonesian downstream clusters are also scaling rigid-foam and footwear production, reinforcing a self-sustaining demand loop that cushions the region from export swings.

North America holds a significant position, benefiting from shale-advantaged feedstock and proximity to the automotive and construction sectors, which anchor polyurethane consumption. BASF's ongoing expansion at Geismar, Louisiana, will lift regional MDI nameplate capacity to roughly 600,000 t/y in 2026, ensuring supply sufficiency as electric-vehicle output scales. Trade-policy uncertainty, exemplified by the 2025 USITC antidumping probe into Chinese MDI, encourages dual sourcing and supports domestic plant utilization. Europe, while technologically advanced, contends with REACH training costs that nudge smaller converters toward offshore sourcing, modestly softening local growth prospects despite continued retro-insulation activity.

The Middle-East and Africa are projected to experience the fastest regional expansion at a 6.25% CAGR to 2031, as governments fund mega-infrastructure projects and petrochemical self-sufficiency programs. State-backed players leverage low-cost propane dehydrogenation and benzene extraction to feed integrated MDI and TDI units. The construction of smart cities and healthcare complexes-particularly in the Gulf Cooperation Council-drives demand for high-performance insulation and sealants, further amplifying the regional isocyanates market size trajectory. Producers with assets in Oman and Saudi Arabia can also back-integrate into basic aromatics, enhancing margin capture under volatile global benzene pricing.

- Anderson Development Company

- Asahi Kasei Chemicals

- BASF SE

- BorsodChem

- Chemtura Corp.

- China National Bluestar (Group) Co. Ltd.

- Covestro AG

- Dow Inc.

- Evonik Industries

- Huntsman Corporation LLC

- Kemipex

- Korea Fine Chemical Co. Ltd.

- Kumho

- MITSUI CHEMICALS AMERICA INC.

- Perstorp

- Tosoh Corporation

- Vencorex

- Wanhua Chemical Group Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for rigid PU foam in building insulation

- 4.2.2 Rapid industrialization and urbanization in APAC

- 4.2.3 Lightweight vehicle trend driving PU composites adoption

- 4.2.4 Cold-chain and e-commerce packaging growth

- 4.2.5 Wind-turbine blade production using isocyanate composites

- 4.3 Market Restraints

- 4.3.1 Volatile benzene and nitro-benzene feedstock pricing

- 4.3.2 EU REACH training and classification hurdles

- 4.3.3 Supply tightness from China environmental shutdowns

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Price Trend

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 MDI

- 5.1.2 TDI

- 5.1.3 Aliphatic (e.g., HDI, IPDI)

- 5.1.4 Other Types

- 5.2 By Application

- 5.2.1 Rigid Foam

- 5.2.2 Flexible Foam

- 5.2.3 Paints and Coatings

- 5.2.4 Adhesives and Sealants

- 5.2.5 Elastomers

- 5.2.6 Binders

- 5.2.7 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Automotive

- 5.3.3 Healthcare

- 5.3.4 Furniture

- 5.3.5 Other End-users (Aerospace, Electronics, Marine)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Nordic Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Turkey

- 5.4.5.5 Egypt

- 5.4.5.6 Nigeria

- 5.4.5.7 South Africa

- 5.4.5.8 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Anderson Development Company

- 6.4.2 Asahi Kasei Chemicals

- 6.4.3 BASF SE

- 6.4.4 BorsodChem

- 6.4.5 Chemtura Corp.

- 6.4.6 China National Bluestar (Group) Co. Ltd.

- 6.4.7 Covestro AG

- 6.4.8 Dow Inc.

- 6.4.9 Evonik Industries

- 6.4.10 Huntsman Corporation LLC

- 6.4.11 Kemipex

- 6.4.12 Korea Fine Chemical Co. Ltd.

- 6.4.13 Kumho

- 6.4.14 MITSUI CHEMICALS AMERICA INC.

- 6.4.15 Perstorp

- 6.4.16 Tosoh Corporation

- 6.4.17 Vencorex

- 6.4.18 Wanhua Chemical Group Co. Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment