|

市场调查报告书

商品编码

1907270

北美聚氯乙烯(PVC):市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)North America Polyvinyl Chloride (PVC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

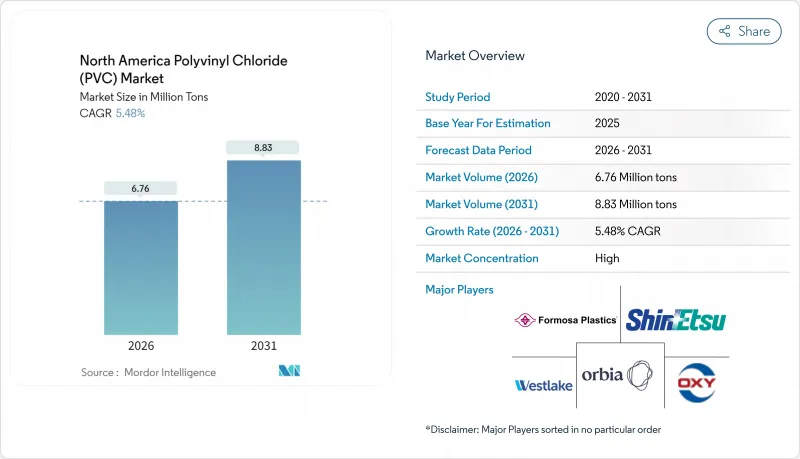

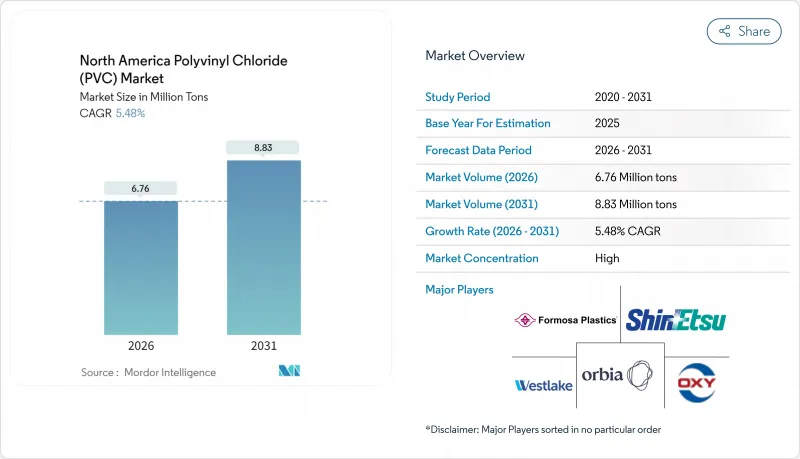

预计北美聚氯乙烯(PVC)市场将从2025年的641万吨成长到2026年的676万吨,到2031年将达到883万吨,2026年至2031年的复合年增长率为5.48%。

儘管供应链持续波动,但基础设施的持续现代化,特别是联邦政府资助的铅水管更换项目,支撑了这一增长。市政当局被要求在10年内完成铅管的全面更换,这为市场提供了稳定的市场需求,并降低了管道采购受整体经济波动的影响。美国是最大的PVC消费国,这得益于有利的乙烷价格,使生产商免受原材料价格飙升的影响。医疗产业作为成长最快的终端用户,其重要性日益凸显,这主要受人口结构变化和医疗设备无邻苯二甲酸酯化趋势的推动。日益激烈的竞争集中在垂直整合、特殊配方和永续性创新方面,这些都有助于在全球树脂供应过剩的市场中保护利润空间。

北美聚氯乙烯(PVC)市场趋势与洞察

建筑和施工行业的需求不断增长

建筑业的PVC消费量与公共工程支出的復苏密切相关,其中管道和管件应用几乎占所有用途的一半。联邦法规禁止延期,促使州和地方政府更换老化的管线网路。限制铅含量的建筑规范推动计划转向使用硬质PVC系统,而生产商则利用一体化的乙烯产业链来稳定成本。长期基础设施规划正在创造一个可预测的订单基础,该基础不受私人住宅週期的影响,从而推动国内工厂产能扩张,并维持对PVC树脂的需求。

医疗设备和输液袋数量迅速增加

医疗产业的需求正以6.34%的复合年增长率成长,医院指定使用不含邻苯二甲酸二辛酯(DEHP)的化合物来生产血袋、输液管和导管。材料配方商现在提供不含邻苯二甲酸酯的添加剂,这些添加剂通过了FDA的测试,且不会影响透明度、柔软性或耐灭菌性。不断提高的监管门槛和验证成本有利于成熟的供应商,使他们能够收取溢价,从而抵消北美聚氯乙烯市场大宗商品利润率面临的压力。人口老化和居家医疗的扩张为这一需求的增长提供了更大的空间。

氯乙烯单体和乙烯价格波动;

原料成本占生产成本的70%之多,原料价格波动会对利润率造成压力。近期发生的铁路事故凸显了物流风险,而主要裂解装置的计划性停产导致区域供应紧张,加剧了现货市场的波动。虽然一体化企业可以利用其有利的乙烷供应来缓解部分影响,但公司买家则面临更快速的价格上涨,这使得北美PVC市场的库存规划更加复杂。

细分市场分析

到2025年,硬质PVC将占总产量的59.65%,这充分体现了其在地下水基础设施领域的优势,因为在这些领域,管道的耐久性和成本稳定性至关重要。这一份额在北美PVC市场中占据最大比例,主要得益于联邦政府资助计划对管道的需求。此外,硬质PVC也用于窗框和墙板,在公共工程之外也创造了稳定的需求。

受医疗设备、软管和电线涂层等领域对特殊化合物的需求所推动,柔性材料品类正以5.82%的复合年增长率快速成长。製造商透过透明度、低温柔柔软性和不含邻苯二甲酸酯的化学配方来区分产品。氯化聚氯乙烯(PVC)在热水管道领域占有一席之地,而低烟等级的PVC则符合运输和高密度建筑的防火安全标准。产品组合正持续向利润率更高、对全球大宗商品週期依赖性更低的特种等级产品转变。

北美聚氯乙烯(PVC) 市场报告按产品类型(硬质 PVC、软质 PVC、低烟 PVC、氯化 PVC)、应用领域(管道及管件、薄膜及片材等)、终端用户行业(建筑、电气电子、医疗、汽车等)和地区(美国、加拿大、墨西哥)进行细分。市场预测以吨为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 建筑和施工行业的需求不断增长

- 医疗设备和输液袋使用量的快速成长

- 联邦政府为水利基础设施升级提供资金

- 无铅管道监管势头强劲

- 生物基塑化剂开发高端利基市场

- 市场限制

- 氯乙烯单体和乙烯价格波动;

- 加强环境和健康监测

- 加强对邻苯二甲酸酯类塑化剂的监管

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 进出口趋势

第五章 市场规模及成长预测(以金额为准及数量)

- 依产品类型

- 硬质PVC

- 透明硬质PVC

- 不透明硬质聚氯乙烯

- 软PVC

- 透明软质PVC

- 不透明柔性PVC

- 低烟聚氯乙烯

- 氯化聚氯乙烯

- 硬质PVC

- 透过使用

- 管道和配件

- 薄膜和片材

- 电线电缆

- 瓶子

- 型材、软管和管材

- 其他用途

- 按最终用户行业划分

- 建筑/施工

- 电气和电子设备

- 卫生保健

- 车

- 包装

- 鞋类

- 其他终端用户产业

- 按国家/地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- AMCO International

- Aurora Material Solutions

- Braskem

- Formosa Plastics Corporation

- GEON

- INEOS

- Kem One

- LG Chem

- Lubrizol

- Occidental Petroleum Corporation

- Orbia Polymer Solutions(Vestolit)

- SABIC

- Shin-Etsu Chemical Co., Ltd.

- SIMONA AMERICA

- Teknor Apex

- Westlake Corporation

第七章 市场机会与未来展望

The North America Polyvinyl Chloride market is expected to grow from 6.41 million tons in 2025 to 6.76 million tons in 2026 and is forecast to reach 8.83 million tons by 2031 at 5.48% CAGR over 2026-2031.

Continued infrastructure modernization, especially the federally funded replacement of lead service lines, underpins this expansion even as supply-chain volatility persists. Demand visibility is strong because municipalities must comply with the ten-year mandate for full lead pipe replacement, insulating pipe purchases from broader economic swings. The United States accounts for the largest regional PVC consumption, supported by advantaged ethane costs that cushion producers from feedstock price shocks. Healthcare is gaining importance as the fastest-growing end user, propelled by demographic trends and the shift to phthalate-free medical devices. Competitive intensity centers on vertical integration, specialty compounding, and sustainability innovations that protect margins in a globally oversupplied resin market.

North America Polyvinyl Chloride (PVC) Market Trends and Insights

Rising Demand from Building and Construction

PVC consumption in construction tracks the recovery of public works spending, with pipes and fittings representing almost half of all applications. States and provinces are replacing aging distribution networks because federal rules prohibit deferrals. Building codes that cap lead content steer projects toward rigid vinyl systems, while producers leverage integrated ethylene chains to stabilize costs. Long-term infrastructure programs create predictable order books, encouraging capacity upgrades at domestic plants and sustaining resin uptake regardless of private housing cycles.

Surging Use in Medical-Grade Devices and IV Bags

Healthcare demand expands at 6.34% CAGR as hospitals specify non-DEHP compounds for blood bags, tubing, and catheters. Material formulators now offer phthalate-free additives that pass FDA tests without trade-offs in clarity, flexibility, or sterilization resistance. Higher regulatory barriers and validation costs favor established suppliers, enabling premium pricing that offsets commodity margin pressure in the North America Polyvinyl Chloride market. An aging population and the growth of home-based care further extend this demand runway.

Volatile Vinyl Chloride Monomer and Ethylene Prices

Feedstock swings erode margins because raw materials represent up to 70% of production cost. Recent rail incidents underscore logistical risk, while planned shutdowns at major crackers tighten regional availability and amplify spot volatility. Integrated firms cushion some of the impact through advantaged ethane, but merchant buyers face sharper price spikes, complicating inventory planning across the North America Polyvinyl Chloride market.

Other drivers and restraints analyzed in the detailed report include:

- Federal Funding for Replacement Water Infrastructure

- Regulatory Tailwinds for Lead-Free Plumbing

- Intensifying Environmental and Health Scrutiny

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rigid PVC accounted for 59.65% of total volume in 2025, underscoring its strength in underground water infrastructure, where lifespan and cost stability prevail. That share translates to the largest slice of the North America Polyvinyl Chloride market size, anchored by pipes mandated in federally funded projects. Rigid formulations also serve window profiles and siding, adding steady demand outside public works.

The flexible category advances at a 5.82% CAGR as medical devices, hoses, and wire coatings adopt specialized compounds. Manufacturers differentiate through clarity, low-temperature flexibility, and phthalate-free chemistries. Chlorinated PVC retains a niche in hot-water lines, while low-smoke grades address fire-safety codes in transit and high-occupancy buildings. Product mix continues shifting toward specialty grades that command higher margins and reduce exposure to global commodity cycles.

The North America Polyvinyl Chloride (PVC) Market Report is Segmented by Product Type (Rigid PVC, Flexible PVC, Low-Smoke PVC, and Chlorinated PVC), Application (Pipes and Fittings, Films and Sheets, and More), End-User Industry (Building and Construction, Electrical and Electronics, Healthcare, Automotive, and More), and Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- AMCO International

- Aurora Material Solutions

- Braskem

- Formosa Plastics Corporation

- GEON

- INEOS

- Kem One

- LG Chem

- Lubrizol

- Occidental Petroleum Corporation

- Orbia Polymer Solutions (Vestolit)

- SABIC

- Shin-Etsu Chemical Co., Ltd.

- SIMONA AMERICA

- Teknor Apex

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from building and construction

- 4.2.2 Surging use in medical-grade devices and IV bags

- 4.2.3 Federal funding for replacement water infrastructure

- 4.2.4 Regulatory tailwinds for lead-free plumbing

- 4.2.5 Bio-based plasticizers unlocking premium niches

- 4.3 Market Restraints

- 4.3.1 Volatile vinyl chloride monomer and ethylene prices

- 4.3.2 Intensifying environmental and health scrutiny

- 4.3.3 Tightening limits on phthalate plasticizers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Import-Export Trends

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Product Type

- 5.1.1 Rigid PVC

- 5.1.1.1 Clear Rigid PVC

- 5.1.1.2 Non-clear Rigid PVC

- 5.1.2 Flexible PVC

- 5.1.2.1 Clear Flexible PVC

- 5.1.2.2 Non-clear Flexible PVC

- 5.1.3 Low-smoke PVC

- 5.1.4 Chlorinated PVC

- 5.1.1 Rigid PVC

- 5.2 By Application

- 5.2.1 Pipes and Fittings

- 5.2.2 Films and Sheets

- 5.2.3 Wires and Cables

- 5.2.4 Bottles

- 5.2.5 Profiles, Hoses and Tubing

- 5.2.6 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Electrical and Electronics

- 5.3.3 Healthcare

- 5.3.4 Automotive

- 5.3.5 Packaging

- 5.3.6 Footwear

- 5.3.7 Other End-user Industries

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AMCO International

- 6.4.2 Aurora Material Solutions

- 6.4.3 Braskem

- 6.4.4 Formosa Plastics Corporation

- 6.4.5 GEON

- 6.4.6 INEOS

- 6.4.7 Kem One

- 6.4.8 LG Chem

- 6.4.9 Lubrizol

- 6.4.10 Occidental Petroleum Corporation

- 6.4.11 Orbia Polymer Solutions (Vestolit)

- 6.4.12 SABIC

- 6.4.13 Shin-Etsu Chemical Co., Ltd.

- 6.4.14 SIMONA AMERICA

- 6.4.15 Teknor Apex

- 6.4.16 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment