|

市场调查报告书

商品编码

1907272

气雾罐:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

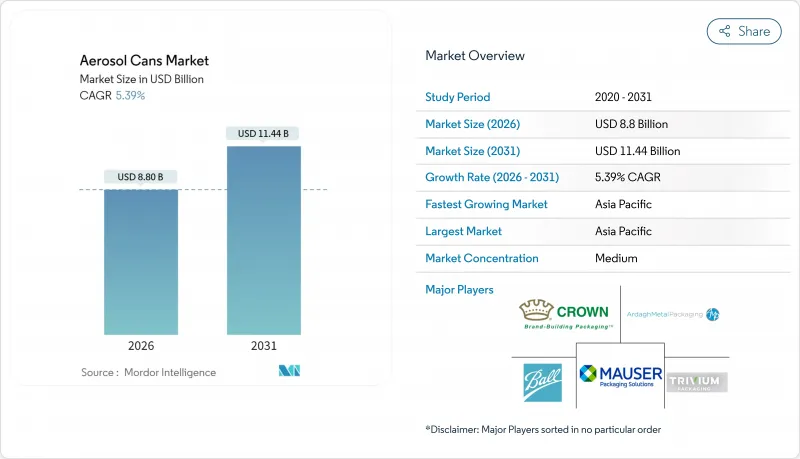

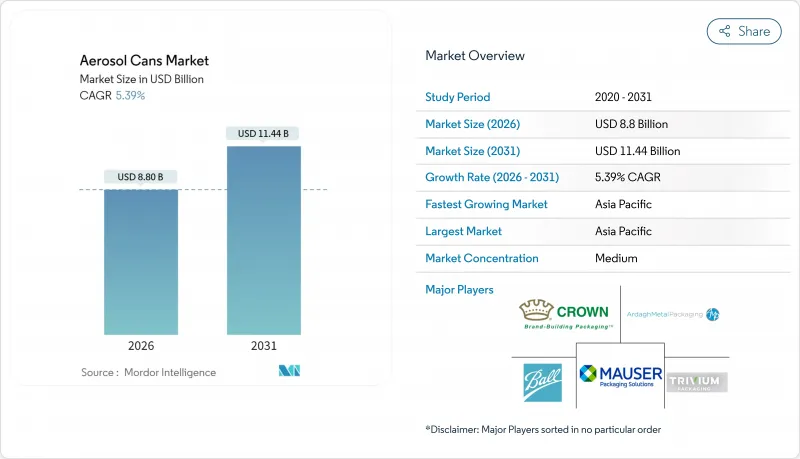

预计到 2026 年,气雾罐市场规模将达到 88 亿美元,高于 2025 年的 83.5 亿美元。预计到 2031 年,该市场规模将达到 114.4 亿美元,2026 年至 2031 年的复合年增长率为 5.39%。

包装产业的持续成长得益于其向可再生材料的转型、监管政策与循环经济目标的契合,以及铝製包装在满足更严格的挥发性有机化合物 (VOC) 排放限制方面的卓越表现。电子商务的蓬勃发展进一步推动了这一趋势,品牌商们正寻求能够承受复杂物流网路考验的防漏、可直接上架的包装形式。低全球暖化潜势 (GWP) 推进剂和单一材料罐体设计的创新,正在增强市场领导的竞争优势。然而,原材料成本的波动以及可重复填充概念的快速普及,正在限制短期内的利润率。

全球气雾罐市场趋势与洞察

可回收性和与循环经济的兼容性

铝的无限可回收性使其成为品牌所有者在生产者延伸责任制(EPR)计划下记录产品生命週期末期性能的关键材料。波尔公司的ReAl合金在保持强度的同时,将罐体的碳足迹减少了50%,从而增强了现有全球回收基础设施的闭合迴路效益——目前,全球75%的铝製品仍在循环利用。这一良好记录为波尔公司与面临气候变迁报告要求和塑胶减量目标的大型消费品公司签订长期供应协议提供了有力支持。

个人护理和化妆品行业的需求快速增长

高端个人保健产品线正越来越多地采用拉丝金属外观和特殊阀门,以提升用户体验并实现更高的定价。 Ball and Meadow 计划于 2025 年推出的可填充式「Meadow Kapsul」喷雾罐,展现了高端护肤和护髮品牌如何透过采用时尚的铝製气雾罐,以永续性和设计脱颖而出。电子商务正在加速这一趋势,因为金属容器在最后一公里配送过程中更耐磕碰和洩漏,并且兼容 360 度全景摄影,便于进行数位促销。

严格的挥发性有机化合物和废弃物处理法规

美国环保署(EPA)的修正案将于2025年7月生效,该修正案强制规定了产品加权反应性限值,并要求替换高反应性溶剂。欧洲的氟化气体法规也即将生效,这进一步增加了合规难度,迫使中小型製造商将研发外包或退出受影响的生产线。处置法规要求按照既定通讯协定对废旧罐体进行排气和压缩,这增加了处理成本,并催生了对专业回收解决方案的需求,例如Republic Services的专用设施。

细分市场分析

到2025年,铝将占据84.72%的市场份额,这表明其基础设施完善,且符合大多数回收法规的要求。这一主导地位有助于实现经济高效的闭合迴路供应,并与欧盟已实施的生产者延伸责任制相契合。气雾槽市场正受惠于ReAl合金的进步,在不影响抗凹陷性的前提下,厚度和重量减少了15%,降低了碳排放指标,同时维持了单位经济效益。

塑胶气雾剂正以每年 8.18% 的速度成长,满足了品牌对完全透明、抗衝击性和与酸性配方相容性的需求。 Plastipak 的无金属「SprayPET 革命」证明,随着树脂製造商采用先进的隔离层,聚合物可以满足压力阈值,并与主流 PET 回收基础设施保持相容。在个人保健产品和食品喷雾应用领域,塑胶正日益普及,因为这些应用领域关注金属味和冷衝击问题。儘管发展势头强劲,但由于单一材料法规和金属价格波动,铝仍然是气雾剂罐市场策略的核心组成部分。

到 2025 年,采用单次衝击挤压製程的一体式单体生产线将占总产量的 64.58%,该生产线可最大限度地减少焊接并简化品管。均匀壁厚结构因其抗跌落测试性能和高内压性能而闻名,这对于髮胶喷雾和汽车煞车清洁剂等易燃推进剂产品至关重要。

同时,两片式易拉罐正以7.05%的复合年增长率快速增长,这主要得益于伺服控製成型技术提升了侧缝强度,以及采用混合金属厚度材料减少了材料用量。品牌商看重两片式易拉罐能够生产出高挑纤细的罐身,以及能够无变形地包裹圆柱形罐体的高清光刻技术。为了满足季节性产品上市带来的快速设计变更需求,製造商正在投资研发模组化模具,以便在一体式和两片式生产之间切换,从而适应不断变化的市场偏好。

区域分析

2025年,亚太地区将占全球消费量的39.62%,年复合成长率达7.86%,主要得益于中国作为主要消费和生产中心的双重地位。都市化和可支配收入的成长推动了个人护理气雾剂产品的普及,而地方政府推行的回收政策与铝的闭合迴路优势相辅相成。日本品牌商正积极推广单一材料设计,而印度美容产业的快速发展也促使当地填充剂生产商扩大生产规模。

欧洲在技术和法规方面继续保持领先地位。对氯氟烃(CFC)和挥发性有机化合物(VOC)排放的限制正在加速向绿色推进剂的转型,使拥有合规产品系列的现有企业获得优势。德国和英国在轻量化罐体研发方面主导,而东欧工厂正在扩大低成本灌装产能,以满足跨区域的快速消费品(FMCG)合约需求。市场成长倾向于高级产品和永续产品,传统品类的饱和限制了其扩张。

北美市场持续保持着创新主导的稳定需求。美国环保署(EPA)的反应性法规要求对配方进行重新设计,而充足的研发资金则使当地生产商能够维持产品系列的柔软性。美国在非处方医疗产品和DIY涂料气雾剂领域处于主导,墨西哥作为近岸製造地的地位日益增强。加拿大消费者对低气味家用喷雾的兴趣日益浓厚,推动了水性推进剂的普及。这些趋势共同推动成熟且盈利的区域市场保持着持续的温和个位数成长。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 可回收性和循环经济相容性

- 个人护理和化妆品需求激增

- 向低挥发性有机化合物/绿色推进剂过渡

- 电子商务中「货架上的即时销售」的差异化

- 推动单一材料包装法规

- 营养保健品/非处方气雾剂的兴起

- 市场限制

- 严格的挥发性有机化合物和废弃物处理法规

- 铝和钢价格波动

- 可重复填充产品和浓缩液的兴起

- 消费者对气雾剂产品的环保意识

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 生命週期与碳足迹分析

第五章 市场规模与成长预测

- 依材料类型

- 铝

- 钢

- 镀锡

- 塑胶

- 其他材料类型

- 按罐的类型

- 一体化(单体式)

- 两件套

- 三件套

- 按推进剂类型

- 压缩气体

- 液化气

- 碳氢化合物

- DME

- 其他液化气体

- 阀门式袋

- 按容量(毫升)

- 不足100

- 101-300

- 301-500

- 超过500

- 按最终用户行业划分

- 个人护理和化妆品

- 家居用品

- 汽车和工业

- 医疗/製药

- 食品/饮料

- 油漆和清漆

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Ball Corporation

- Crown Holdings Inc.

- Ardagh Metal Packaging SA

- Trivium Packaging

- Mauser Packaging Solutions

- Toyo Seikan Co. Ltd

- CCL Container

- Colep Packaging Portugal SA

- CPMC Holdings Limited

- Nampak Ltd

- Graham Packaging Company

- SGD Pharma

- Silgan Holdings

- DS Containers

- Montebello Packaging

- Tubex GmbH

- Grupo Zapata(Exal)

- Hindustan Tin Works

- Thai Beverage Can

- Bharat Containers

第七章 市场机会与未来展望

Aerosol cans market size in 2026 is estimated at USD 8.8 billion, growing from 2025 value of USD 8.35 billion with 2031 projections showing USD 11.44 billion, growing at 5.39% CAGR over 2026-2031.

Sustained growth is shaped by the packaging sector's pivot toward recyclable materials, regulatory alignment with circular-economy targets, and the proven ability of aluminum containers to meet stricter volatile-organic-compound (VOC) limits. E-commerce expansion adds momentum as brands seek leak-proof, shelf-ready pack formats that withstand complex fulfillment networks. Innovation in low-GWP propellants and mono-material can designs is strengthening the competitive differentiation of market leaders. At the same time, raw-material cost volatility and fast-rising refillable concepts temper near-term margins.

Global Aerosol Cans Market Trends and Insights

Recyclability and circular-economy alignment

Aluminum's infinite recyclability has turned it into a decisive material for brand owners that must document end-of-life performance under extended producer responsibility schemes. Ball Corporation's ReAl alloy cuts the can body's carbon footprint by 50% while maintaining strength, reinforcing the closed-loop advantages of an existing global recycling infrastructure where 75% of aluminum ever produced remains in active circulation. Such credentials underpin long-term supply contracts with consumer-goods majors that face climate-reporting requirements and plastic-reduction targets.

Surging demand from personal-care and cosmetics

Premium personal-care lines increasingly specify brushed-metal aesthetics and specialized valves that elevate user experience and enable higher pricing. Ball and Meadow's 2025 launch of refillable MEADOW KAPSUL cartridges illustrates how luxury skin- and hair-care brands turn to elegant aluminum aerosols to differentiate on sustainability and design. E-commerce accelerates this trend because metallic containers resist dents and leakage during last-mile delivery while offering 360-degree imaging for digital merchandising.

Stringent VOC and disposal regulations

EPA amendments effective July 2025 enforce product-weighted reactivity ceilings that oblige formulators to swap high-reactivity solvents or face penalties. Parallel F-gas restrictions in Europe intensify compliance complexity, pushing smaller firms to outsource R&D or exit affected lines.Disposal rules now require spent cans to be vented and baled under documented protocols that elevate processing costs, yet also spur specialized recycling solutions such as Republic Services' dedicated facilities.

Other drivers and restraints analyzed in the detailed report include:

- Transition to low-VOC/green propellants

- E-commerce "shelf-ready" differentiation

- Volatility in aluminum and steel prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aluminum captured 84.72% of the 2025 volume, underscoring its entrenched infrastructure and acceptance under most recycling codes. This leadership supports cost-efficient closed-loop supply and aligns with extended-producer-responsibility statutes already active in the EU. The aerosol cans market benefits from ReAl alloy advances that trim gauge weight by 15% without compromising dent resistance, keeping unit economics competitive while lowering carbon metrics.

Plastic aerosols, growing 8.18% annually, address brand requirements for full transparency, shatter resistance, and compatibility with acidic formulas. Plastipak's metal-free SprayPET Revolution validates that polymers can meet pressure thresholds and remain compatible with mainstream PET recycling infrastructures as resin suppliers roll out advanced barrier layers, plastics secure footholds in personal-care and food spray applications where metal taste or cold shock are concerns. Even with this momentum, mono-material legislation and metal price volatility keep aluminum at the core of the aerosol cans market strategy.

One-piece monobloc lines own 64.58% of 2025 unit output thanks to single-stroke impact-extrusion that minimizes weld seams and simplifies quality control. The configuration's uniform wall thickness supports a reputation for drop-test resilience and elevated internal pressures, essential for flammable propellants in hair-spray or automotive brake-cleaner SKUs.

Two-piece cans, posting a 7.05% CAGR, gain traction as servo-controlled body-maker technology enhances side-seam strength and allows hybrid metal gauges that lower material use. Brand owners appreciate the ability to produce tall, slim profiles and high-definition lithography that wraps around the cylindrical body without distortion. With demand for fast design turnarounds in seasonal product drops, manufacturers invest in modular tooling that switches between monobloc and two-piece runs, hedging against market preference shifts.

The Aerosol Cans Market Report is Segmented by Material Type (Aluminium, Steel, Tinplate, and More ), Can Type (One-Piece (Monobloc), Two-Piece, Three-Piece), Propellant Type (Compressed Gas, Bag-On-Valve, and More), Capacity (ml) (Less Than 100, 101-300, and More), End-User Industry (Personal Care and Cosmetics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific composed 39.62% of 2025 consumption and is rising at an 7.86% CAGR, anchored by China's dual role as leading consumer and production hub. Urbanization and disposable-income growth support wider adoption of personal-care aerosols, while regional authorities impose recycling mandates that dovetail with aluminum's closed-loop advantages. Japanese brand owners advance mono-material designs, and India's accelerating beauty segment amplifies volumes for local fillers.

Europe remains a technology and regulation frontrunner. F-gas and VOC ceilings prompt swift migration to green propellants, rewarding incumbents with compliant product portfolios.Germany and the United Kingdom lead in lightweight-can R&D, while Eastern European plants extend low-cost filling capacity to pan-regional FMCG contracts. Market growth leans toward premium and sustainable offerings as volume saturation limits expansion in traditional categories.

North America demonstrates steady, innovation-driven demand. EPA reactivity rules compel formula redesigns, yet robust R&D funding helps local converters maintain portfolio agility. The United States leads in OTC healthcare and DIY paint aerosols, while Mexico strengthens as a near-shore manufacturing base. Canadian consumers show elevated interest in low-odor household sprays, bolstering adoption of water-based propellants. Together these trends sustain mid-single-digit growth across a maturing yet profitable regional landscape.

- Ball Corporation

- Crown Holdings Inc.

- Ardagh Metal Packaging SA

- Trivium Packaging

- Mauser Packaging Solutions

- Toyo Seikan Co. Ltd

- CCL Container

- Colep Packaging Portugal SA

- CPMC Holdings Limited

- Nampak Ltd

- Graham Packaging Company

- SGD Pharma

- Silgan Holdings

- DS Containers

- Montebello Packaging

- Tubex GmbH

- Grupo Zapata (Exal)

- Hindustan Tin Works

- Thai Beverage Can

- Bharat Containers

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Recyclability and circular?economy alignment

- 4.2.2 Surging demand from personal-care and cosmetics

- 4.2.3 Transition to low-VOC/green propellants

- 4.2.4 e-commerce "shelf-ready" differentiation

- 4.2.5 Regulatory push for mono-material packaging

- 4.2.6 Emergence of nutraceutical/OTC aerosol formats

- 4.3 Market Restraints

- 4.3.1 Stringent VOC and disposal regulations

- 4.3.2 Volatility in aluminium and steel prices

- 4.3.3 Rise of refillable and concentrated formats

- 4.3.4 Consumer eco-perception of aerosols

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Lifecycle and Carbon-Footprint Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Aluminium

- 5.1.2 Steel

- 5.1.3 Tinplate

- 5.1.4 Plastic

- 5.1.5 Other Material Type

- 5.2 By Can Type

- 5.2.1 One-piece (Monobloc)

- 5.2.2 Two-piece

- 5.2.3 Three-piece

- 5.3 By Propellant Type

- 5.3.1 Compressed Gas

- 5.3.2 Liquefied Gas

- 5.3.2.1 Hydrocarbon

- 5.3.2.2 DME

- 5.3.2.3 Other Liquefied Gas

- 5.3.3 Bag-on-Valve

- 5.4 By Capacity (ml)

- 5.4.1 Less than 100

- 5.4.2 101-300

- 5.4.3 301-500

- 5.4.4 More than 500

- 5.5 By End-User Industry

- 5.5.1 Personal Care and Cosmetics

- 5.5.2 Household Care

- 5.5.3 Automotive and Industrial

- 5.5.4 Healthcare and Pharmaceutical

- 5.5.5 Food and Beverage

- 5.5.6 Paints and Varnishes

- 5.5.7 Other End-User Industry

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ball Corporation

- 6.4.2 Crown Holdings Inc.

- 6.4.3 Ardagh Metal Packaging SA

- 6.4.4 Trivium Packaging

- 6.4.5 Mauser Packaging Solutions

- 6.4.6 Toyo Seikan Co. Ltd

- 6.4.7 CCL Container

- 6.4.8 Colep Packaging Portugal SA

- 6.4.9 CPMC Holdings Limited

- 6.4.10 Nampak Ltd

- 6.4.11 Graham Packaging Company

- 6.4.12 SGD Pharma

- 6.4.13 Silgan Holdings

- 6.4.14 DS Containers

- 6.4.15 Montebello Packaging

- 6.4.16 Tubex GmbH

- 6.4.17 Grupo Zapata (Exal)

- 6.4.18 Hindustan Tin Works

- 6.4.19 Thai Beverage Can

- 6.4.20 Bharat Containers

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment