|

市场调查报告书

商品编码

1907279

水凝胶:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Hydrogel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

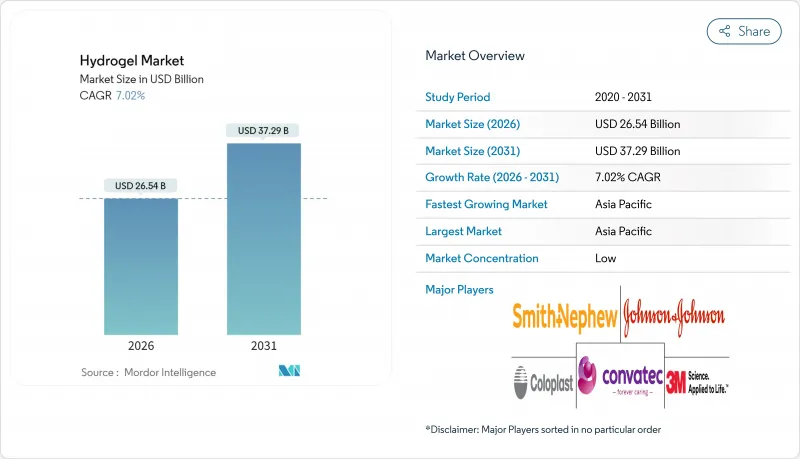

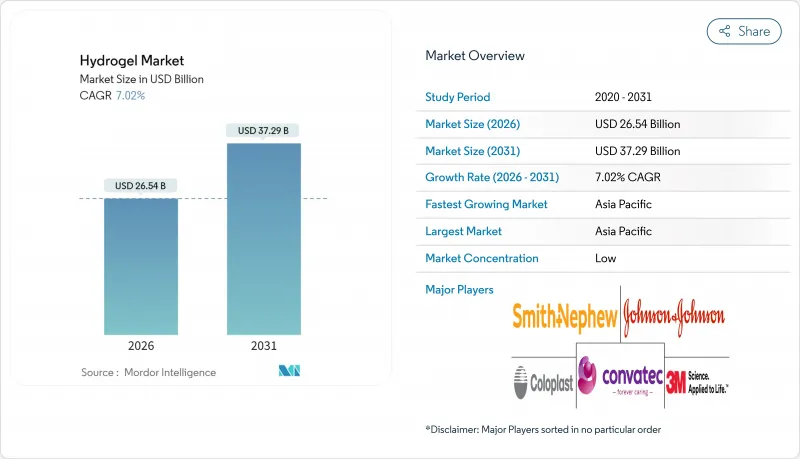

预计到 2026 年,水凝胶市场规模将达到 265.4 亿美元,高于 2025 年的 248 亿美元。预计到 2031 年,该市场规模将达到 372.9 亿美元,2026 年至 2031 年的复合年增长率为 7.02%。

这一增长反映了材料的快速创新、在医疗、农业和个人护理领域日益广泛的应用,以及生物基化学与日益严格的永续永续性要求的契合。长戴型硅水凝胶隐形眼镜、4D列印植入和用于土壤改良的超吸收性聚合物因其可衡量的临床效益和更高的资源利用效率,成为推动需求成长的主要动力。亚太地区持续保持强劲的销售成长,而北美和欧洲则凭藉其监管方面的专业知识和快速的创新週期,继续保持较高的价格。原料价格的波动以及不可生物降解的超吸收性聚合物的掩埋限制,在抑制利润的同时,也加速了向可再生单体和可降解网路的转型。整体而言,水凝胶市场正处于均衡成长阶段,成本主导的商品产品支撑着现金流,而高价值的医疗设备和智慧农业则推高了平均售价。

全球水凝胶市场趋势与洞察

扩大先进创伤护理敷料的应用

临床证据表明,与纱布和泡沫敷料相比,水凝胶敷料能够促进上皮化并减少换药频率,因此被医院网路广泛纳入通讯协定。 2025年1月核准FDA批准的胶原蛋白基DermiSphere hDRT,证明了模拟细胞外基质的支架作为再生医学平台而非被动敷料的有效性。采用一次性支付模式的医疗系统已证明,儘管单位成本较高,但总医疗成本有所降低。 ISO 13485合规性和CE认证有助于简化跨国扩张流程,并保护创新者免受低品质仿冒品的侵害。随着支付方将重点放在疗效上,能够证明癒合速度更快、感染率更低的供应商将维持定价权。

拓展在一次性卫生用品中的应用

现代婴儿尿布和女性用卫生棉中都含有吸水性极强的水凝胶颗粒,其吸水量可达自身重量的500至1000倍,从而创造出防漏且轻薄的产品。中国和日本的大型製造商利用成熟的聚丙烯酸酯生产工艺,而新兴参与企业则致力于研发植物来源丙烯酸工艺,以符合欧洲和亚洲的微塑胶法规。消费者对舒适度的需求推动了颗粒尺寸和凝胶强度等方面的技术发展,因此需要持续的研发投入。印度、印尼和奈及利亚的都市化推动了水凝胶产品销售的两位数成长,确保卫生用品市场仍然是水凝胶市场规模最大的单一需求来源。

丙烯酸和硅酮原料价格波动;

原油价格波动导致丙烯酸价格每年波动幅度高达40%,挤压了那些未后向整合至丙烯EIA(乙烯异丁烯乙炔缩醛)生产线的生产商的利润空间。硅酮单体市场反映了中国聚硅氧烷产能的扩张,进一步加剧了成本的不确定性。避险、多元化采购和指数挂钩的客户合约可以部分降低风险,但小批量特种化合物生产商在采购方面处于劣势。生物基生产路线可望带来价格稳定性,但需要高资本投入和较长的规模化生产週期。

细分市场分析

截至2025年,半结晶质级水凝胶占了45.35%的市场。其有序的结晶域赋予了水凝胶所需的抗拉强度,这对于承重伤口敷料和土壤改良剂至关重要。可预测的溶胀动力学支持药物控释基质的应用,而低蠕变变形速率则降低了产品在长期磨损应用中失效的风险。製造商利用其位于东亚的成熟供应链来确保规模优势和价格竞争力。然而,研究实验室仍在不断优化结晶质相与非晶相的比例,以平衡机械完整性和扩散速率,从而开发用于肌肉骨骼再生的下一代支架材料。

受注射疗法和需要快速溶剂交换和细胞浸润的3D生物列印组织的需求驱动,非晶态水凝胶预计将以7.96%的复合年增长率成长。其无规捲曲网络赋予其剪切稀化特性,使其能够以微创方式给药,并适应复杂的解剖部位。生物製药公司正在整合在体温下凝胶的热响应性共聚物,以提高其在体内的保留率,而无需手术固定。虽然快速降解限制了其在承重领域的应用,但透过可控交联和奈米纤维素复合增强,其应用范围正在不断扩大,包括重组手术、眼科和药物储存库等领域。

区域分析

预计到2025年,亚太地区将占全球水凝胶市场收入的41.00%,到2031年将以7.98%的复合年增长率成长,超过全球平均。中国凭藉其一体化的丙烯酸生产能力以及针对干旱地区高吸水性土壤改良剂的补贴政策,在该领域占据主导地位。在日本,HOYA株式会社等公司凭藉其高精度聚合技术和全球分销网络,引领硅水凝胶隐形眼镜领域的创新。韩国凭藉其快速的监管响应和电子製造方面的专业知识,使国内企业在柔性生物电子水凝胶组件的供应方面占据了优势。

北美已在医疗保健和农业领域建立了高附加价值产业,受益于清晰的FDA法规、创业投资资金和先进的製造基础设施。美国糖尿病发生率的上升促使人们采用水凝胶敷料伤口护理,而美国西部各州正在引入高吸收性土壤改良剂以应对严重的水资源短缺问题。加拿大公共医疗保健系统正在寻求经济高效的先进敷料,这为采购经过验证的高价值产品创造了机会。墨西哥作为近岸製造地,既能发挥成本优势满足美国市场需求,又能促进当地消费。

欧洲对永续性的重视推动了可生物降解水凝胶的早期应用,并加强了对掩埋处理方式的监管。德国弗劳恩霍夫研究所正在加速研发4D列印植入原型,政府也正在津贴生物基聚合物计划的研究。英国在脱欧后正在重组相关法规,同时保持与欧盟CE标准的一致性,并为医疗技术领域的成长型企业提供奖励。北欧国家优先发展循环经济材料,并推动纤维素基水凝胶的研发。法国和义大利正利用其高端化妆品分销网络,推广优质水凝胶面膜和护肤精华液。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 扩大先进创伤护理敷料的应用

- 拓展在一次性卫生用品中的应用

- 促进节水农业材料相关法规的製定

- 硅水凝胶隐形眼镜的需求不断增长

- 利用4D列印技术的智慧水凝胶植入

- 市场限制

- 丙烯酸和硅酮原料价格波动;

- 对不可生物降解的树液製定了严格的掩埋规定

- 与泡沫敷料和藻酸盐敷料的竞争

- 价值链分析

- 波特五力模型

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按结构

- 半结晶质

- 非晶质

- 结晶质

- 材料

- 聚丙烯酸酯

- 聚丙烯酰胺

- 硅酮

- 其他成分

- 按最终用户行业划分

- 个人护理和卫生用品

- 药品和医疗保健

- 食物

- 农业

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- 3M

- Alcon

- Ashland

- Axelgaard Manufacturing Co., Ltd.

- Cardinal Health

- Coloplast Ltd

- Convatec

- CooperVision

- DSM

- Essity Health & Medical

- Hannox International Corp.

- HOYA Corporation

- Johnson and Johnson

- Molnlycke Health Care AB

- PAUL HARTMANN AG

- Sekisui Kasei

- Smith+Nephew

第七章 市场机会与未来展望

Hydrogel market size in 2026 is estimated at USD 26.54 billion, growing from 2025 value of USD 24.80 billion with 2031 projections showing USD 37.29 billion, growing at 7.02% CAGR over 2026-2031.

The expansion reflects rapid material innovation, a widening application spectrum across health care, agriculture and personal care, and the alignment of bio-based chemistries with tightening sustainability requirements. Extended-wear silicone-hydrogel contact lenses, 4D-printed implants and soil-conditioning superabsorbent polymers anchor much of the incremental demand by offering measurable clinical or resource-efficiency gains. Asia-Pacific maintains outsized volume growth, yet North America and Europe retain premium price realization through regulatory expertise and fast innovation cycles. Feedstock price volatility and landfill rules on non-biodegradable superabsorbent polymers temper margins but simultaneously accelerate the shift to renewable monomers and degradable networks. Overall, the hydrogel market enjoys balanced momentum as cost-driven commodity volumes underpin cash flow while high-value medical devices and smart agriculture lift average selling prices.

Global Hydrogel Market Trends and Insights

Rising Adoption in Advanced Wound-Care Dressings

Clinical evidence shows that hydrogel dressings accelerate epithelialization and reduce dressing-change frequency versus gauze or foam, prompting broader protocol inclusion by hospital networks. FDA clearance of collagen-based DermiSphere hDRT in January 2025 validated extracellular-matrix-mimicking scaffolds as regenerative platforms rather than passive coverings. Health systems that employ bundled-payment models recognize lower total cost of care despite premium unit pricing. ISO 13485 alignment and CE marking streamline multinational launches and protect innovators against low-spec imitators. As payors focus on outcomes, suppliers that document faster healing and lower infection rates retain pricing power.

Expanding Use in Disposable Hygiene Products

Modern baby diapers and feminine hygiene pads integrate hydrogel particles capable of absorbing 500-1000 times their weight, enabling thinner products without leakage. Large-scale producers in China and Japan capitalize on well-established polyacrylate networks, while new entrants target plant-based acrylic acid routes to meet microplastics regulations in Europe and Asia. Consumer demand for comfort drives engineering around particle size and gel strength, forcing continuous R&D investment. Urbanization in India, Indonesia and Nigeria sustains double-digit unit volumes, ensuring that hygiene remains the single largest outlet for hydrogel market volume.

Volatile Acrylic-Acid and Silicone Feedstock Prices

Crude-oil fluctuations drive acrylic-acid swings of up to 40% annually, eroding margins for producers not backward-integrated into propylene EIA. Silicone monomer markets mirror polysiloxane capacity additions in China, injecting further cost uncertainty. Hedging, multi-sourcing and index-linked customer contracts partially alleviate risk, but specialty formulators with low volumes face purchasing disadvantages. Bio-based routes promise pricing stability but require high capital intensity and scale-up timelines.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Water-Saving Agricultural Inputs

- Growing Demand for Silicone-Hydrogel Contact Lenses

- Strict Landfill Rules on Non-Biodegradable SAPs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Semi-crystalline grades represented 45.35% of hydrogel market share in 2025 because their ordered domains deliver tensile strength essential for load-bearing wound dressings and soil conditioners. Predictable swelling kinetics support controlled drug-release matrices, and the lower creep deformation rate reduces product failure risk in extended-wear applications. Manufacturers capitalize on established supply chains anchored in East Asia, ensuring scale advantages and competitive pricing. Research laboratories nevertheless refine crystalline-amorphous ratios to balance mechanical integrity with diffusion rates, enabling next-generation scaffolds for musculoskeletal regeneration.

Amorphous hydrogels are forecast to post an 7.96% CAGR, propelled by injectable therapeutics and 3D-bioprinted tissues requiring rapid solvent exchange and cellular infiltration. Their random coil networks facilitate shear-thinning behavior, allowing minimally invasive delivery that conforms to complex anatomical sites. Biopharma firms integrate thermo-responsive copolymers that gel at body temperature, improving site retention without surgical fixation. Although susceptibility to rapid degradation can limit load-bearing applications, cross-link modulation and composite reinforcement with nanocellulose broaden use cases across reconstruction, ophthalmology and drug depots.

The Hydrogel Market Report is Segmented by Structure (Semi-Crystalline, Amorphous, and Crystalline), Material (Polyacrylate, Polyacrylamide, and Other Materials), End-User Industry (Personal Care and Hygiene, Pharmaceuticals and Healthcare, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 41.00% of global hydrogel market revenue in 2025 and is projected to expand at an 7.98% CAGR through 2031, outpacing the global average. China's dominance rests on integrated acrylic-acid capacity and a policy agenda that subsidizes superabsorbent soil conditioners in drought-prone provinces. Japan leads innovation in silicone-hydrogel contact lenses through firms such as HOYA Corporation, which leverage high-precision polymerization and global distribution networks. South Korea combines regulatory agility with electronics manufacturing know-how, positioning local players to supply hydrogel components for flexible bioelectronics.

North America secures high value density across medical and agricultural applications, benefiting from FDA clarity, venture funding and advanced manufacturing infrastructure. Hospitals in the United States increasingly adopt hydrogel dressings for chronic wounds tied to diabetes prevalence, while western states deploy superabsorbent soil amendments to offset severe water scarcity. Canada's public health system seeks cost-effective advanced dressings, creating procurement opportunities for value-demonstrated products. Mexico serves as a near-shore manufacturing hub, aligning cost advantages with United States demand while spurring regional consumption.

Europe foregrounds sustainability, driving early adoption of biodegradable hydrogels and rigorous scrutiny of landfill disposal practices. Germany's Fraunhofer institutes accelerate 4D-printed implant prototyping, and the government channels research grants toward bio-based polymer projects. The United Kingdom, navigating post-Brexit regulatory realignment, aims to preserve alignment with CE standards while tailoring incentives for med-tech scale-ups. Nordic countries prioritize circular-economy materials, fostering cellulose-based hydrogel R&D. France and Italy exploit luxury cosmetics channels to market premium hydrogel sheet masks and skin-conditioning serums.

- 3M

- Alcon

- Ashland

- Axelgaard Manufacturing Co., Ltd.

- Cardinal Health

- Coloplast Ltd

- Convatec

- CooperVision

- DSM

- Essity Health & Medical

- Hannox International Corp.

- HOYA Corporation

- Johnson and Johnson

- Molnlycke Health Care AB

- PAUL HARTMANN AG

- Sekisui Kasei

- Smith+Nephew

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption in Advanced Wound-Care Dressings

- 4.2.2 Expanding Use in Disposable Hygiene Products

- 4.2.3 Regulatory Push for Water-Saving Agricultural Inputs

- 4.2.4 Growing Demand For Silicone-Hydrogel Contact Lenses

- 4.2.5 4D-Printed Smart Hydrogel Implants

- 4.3 Market Restraints

- 4.3.1 Volatile Acrylic-Acid and Silicone Feedstock Prices

- 4.3.2 Strict Landfill Rules on Non-Biodegradable Saps

- 4.3.3 Competition From Foam and Alginate Dressings

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Structure

- 5.1.1 Semi-crystalline

- 5.1.2 Amorphous

- 5.1.3 Crystalline

- 5.2 By Material

- 5.2.1 Polyacrylate

- 5.2.2 Polyacrylamide

- 5.2.3 Silicone

- 5.2.4 Other Materials

- 5.3 By End-user Industry

- 5.3.1 Personal Care and Hygiene

- 5.3.2 Pharmaceuticals and Healthcare

- 5.3.3 Food

- 5.3.4 Agriculture

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Alcon

- 6.4.3 Ashland

- 6.4.4 Axelgaard Manufacturing Co., Ltd.

- 6.4.5 Cardinal Health

- 6.4.6 Coloplast Ltd

- 6.4.7 Convatec

- 6.4.8 CooperVision

- 6.4.9 DSM

- 6.4.10 Essity Health & Medical

- 6.4.11 Hannox International Corp.

- 6.4.12 HOYA Corporation

- 6.4.13 Johnson and Johnson

- 6.4.14 Molnlycke Health Care AB

- 6.4.15 PAUL HARTMANN AG

- 6.4.16 Sekisui Kasei

- 6.4.17 Smith+Nephew

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment