|

市场调查报告书

商品编码

1907288

印刷油墨:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Printing Inks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

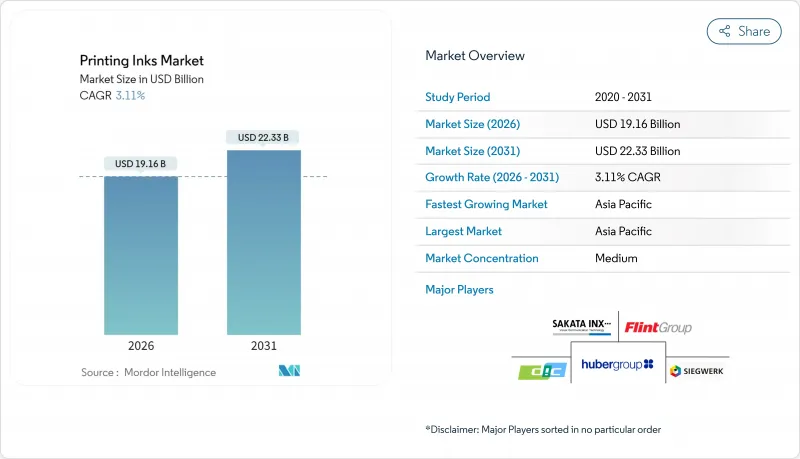

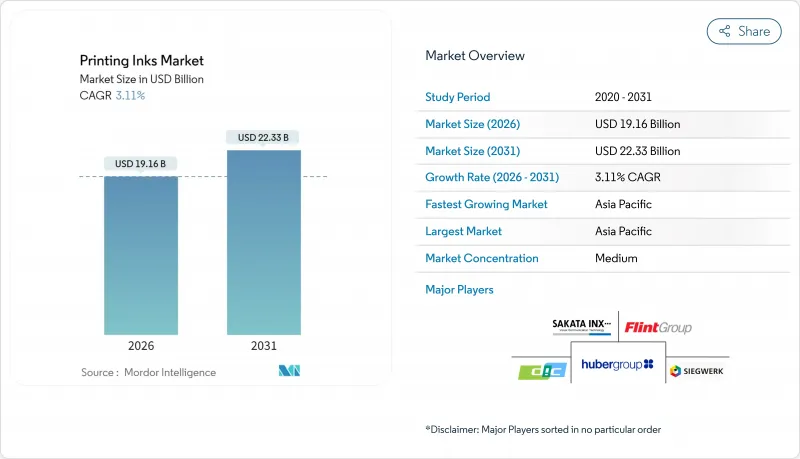

2025 年印刷油墨市场价值为 185.8 亿美元,预计从 2026 年的 191.6 亿美元增长到 2031 年的 223.3 亿美元,在预测期(2026-2031 年)内复合年增长率为 3.11%。

包装、数位化和永续性正在融合,共同塑造需求模式、资本投资和区域格局。包装目前已占印刷油墨市场55.94%的份额,并将持续维持成长最快的应用领域,到2030年复合年增长率将达到4.37%。油性油墨仍占据市场主导地位,但随着加工商追求即时固化和更低能耗,UV-LED油墨预计将以7.59%的复合年增长率成为成长最快的领域。因此,印刷油墨市场正在努力平衡传统优势与新兴的绿色数位化能力。

全球印刷油墨市场趋势与洞察

数位印刷产业的成长

数位印刷正在重塑印刷油墨市场,从利基概念发展成为主流生产平台。设备成本的持续下降和印字头性能的提升,正促使加工商将中小批量生产转向喷墨印刷,从而缩短交货週期并降低库存风险。油墨製造商积极回应,提供低黏度、高光学密度的颜料配方,即使在高喷射速度下也能保持色彩稳定性。受按需服装和装饰订製需求的推动,数位织物印刷量正增长至每年近150亿公尺。包装加工商正在利用可变数据来实现季节性促销和区域语言支持,将前置作业时间从数週缩短至数天。

包装和标籤需求不断增长

随着都市化加快、家庭规模缩小以及电子商务物流的兴起,全球对包装产品的需求稳步增长,这主要得益于消费者习惯的改变。瓦楞纸箱、纸板套和软包装袋都需要耐用且食品安全的油墨,以承受运输过程中的机械应力和潮湿环境。品牌靠着高清影像和触感表面处理在琳琅满目的货架上脱颖而出,从而提升了特殊涂料和金属颜料的价值。包装食品和个人保健产品在亚太和非洲部分新兴经济体中实现了两位数的成长,推动了对水性柔版印刷和凹版印刷油墨的需求成长。标籤应用越来越多地整合资料密集型讯息,例如QR码和防伪功能,这要求油墨具有精确的套准精度和优异的色彩稳定性。因此,即使在宏观经济放缓时期,包装产业的需求仍持续成长,巩固了其作为印刷油墨市场关键成长引擎的地位。

传统商业印刷业的衰退

随着广告商将预算重新分配到数位管道,报纸和杂誌的发行量每季都在萎缩。 2024年1月,美国印刷和书写纸的出货量较去年同期下降了9%。这导致胶印油墨消费量减少,造成油墨调配产能过剩,并加剧了价格竞争。印刷商正在淘汰老旧印刷机,降低了售后市场对替代油墨的需求,也减少了维修服务收入。一些供应商正在透过改造调配设备来生产水性柔印系统,但鑑于商业印刷需求疲软,投资回收期很长。这种长期放缓将使预测的复合年增长率降低0.4个百分点,但来自新兴数位印刷和包装领域的需求成长将部分抵消这一影响。

细分市场分析

由于油性油墨具有成本效益高、相容性广等优点,预计到2025年,其收入将占总收入的40.70%,但由于VOC(挥发性有机化合物)法规日益严格,其成长速度预计将会放缓。 UV-LED产品的复合年增长率将达到7.47%,反映出加工商对即时固化和节能的偏好。水性包装在瓦楞纸箱和纸杯等产品中越来越普遍,尤其是在欧盟,由于食品接触法规和回收要求更加严格,其需求量不断增长。溶剂型系统将继续用于需要极强附着力的特殊工业贴花,但生产正逐步转向挥发性较低的替代品。

製造物流驱动消费者的购买行为。 UV-LED印表机的灯管寿命通常超过20,000小时,避免了长时间的维修停机。能量固化化学品由于减少了废弃物并降低了能源成本,因此具有整体拥有成本优势。同时,由于原材料价格波动以及企业永续性报告标准中揭露要求的提高,人们对生物基油替代品的兴趣日益浓厚。虽然生物溶剂供应链尚不成熟,但早期采用者已从植物来源成分中获得了市场优势。这些趋势共同表明,印刷油墨市场正逐步但稳定地转型为低VOC、快速固化平台。

印刷油墨市场报告按类型(溶剂型、水性、油性、UV、UV-LED、其他)、工艺(胶印、柔印、凹印、数位印刷、其他)、应用(包装、商业印刷/出版、纺织品、其他应用)和地区(亚太地区、北美、欧洲、南美、中东/非洲)进行分析。

区域分析

到2025年,亚太地区将占全球收入的40.10%,年复合成长率达3.96%,这反映了中国、印度和东南亚地区强大的製造业生态系统。随着中产阶级的壮大,国内消费不断成长,推动了对包装零食、个人护理用品和药品的需求。当地加工商正在投资高速柔版印刷生产线,并对其维修,加装紫外线LED灯,以节省能源并满足出口客户的审核。中国和印度政府正在支持电子产品和太阳能组件的供应链,间接刺激了对用于感测器和汇流排的导电油墨的需求。颜料和树脂中间体等区域原料采购环境有利于价格竞争,并促进了印刷油墨的全球贸易流量。

欧洲拥有世界上最严格的环境法规,加速了水性油墨和能量固化油墨的转型。德国在环保油墨领域的主导以及法国对矿物油的禁用,正促使区域供应商重新配製油墨并实施溶剂回收系统。在义大利和法国的奢侈品牌聚集区,对高端表面处理的追求推动了对金属光泽、珠光和触感清漆系统的需求。东欧的加工商正在安装模组化柔印生产线,以服务跨洲零售集团,并且越来越多地指定使用与西欧买家相同的低迁移油墨。

北美正经历技术成熟与VOC(挥发性有机化合物)法规日益严格的双重挑战。美国环保署(EPA)的《有毒物质控制法案》(TSCA)评估迫使配方师检验原料的毒理学特性,并引入更安全的替代品。大型加工商正在部署预测性维护平台,INX International公司在其生产线上应用人工智慧分析技术后,产能运转率提高了13%。墨西哥作为美国和加拿大包装食品和个人保健产品的近岸外包中心,其市场份额不断扩大,推动了该地区对油墨的需求。品牌商正在推广可回收油墨,这些油墨不会阻碍纸张再製浆或聚烯回收,从而促进了整个包装价值链的合作。该地区充分展现了自动化、永续性和日益严格的法规如何相互交织,共同塑造印刷油墨市场的未来。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 数位印刷产业的成长

- 包装和标籤需求不断增长

- 过渡到水性环保油墨

- 紫外线/能量固化技术的兴起

- 功能性导电油墨在电子设备的应用

- 市场限制

- 传统商业印刷业的衰退

- 严格的挥发性有机化合物 (VOC) 和废弃物处理法规

- 硝化纤维素原料短缺

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 溶剂型

- 水溶液

- 油腻的

- UV

- UV-LED

- 其他类型

- 透过流程

- 平版印刷

- 柔版印刷

- 凹版印刷

- 数位印刷

- 其他流程

- 透过使用

- 包装

- 硬包装

- 纸容器

- 瓦楞纸箱

- 硬质塑胶容器

- 金属罐

- 其他硬质包装

- 软包装

- 标籤

- 其他包装

- 硬包装

- 商业与出版

- 纤维

- 其他用途

- 包装

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 西班牙

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- ALTANA

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- DIC Corporation

- DuPont

- Epple Druckfarben AG

- Flint Group

- FUJIFILM Corporation

- hubergroup

- Nazdar

- Sakata INX Corporation

- Sanchez SA de CV

- SICPA HOLDING SA

- Siegwerk Druckfarben AG & Co. KGaA

- T&K TOKA Corporation

- Tokyo Printing Ink Mfg. Co., Ltd.

- Toyo Ink Co. Ltd(artience Co. Ltd)

- Wikoff Color Corporation

- Yip's Chemical Holdings Limited

- Zeller+Gmelin

第七章 市场机会与未来展望

The Printing Inks Market was valued at USD 18.58 billion in 2025 and estimated to grow from USD 19.16 billion in 2026 to reach USD 22.33 billion by 2031, at a CAGR of 3.11% during the forecast period (2026-2031).

Packaging, digitalization, and sustainability together shape demand patterns, capital investment, and regional shifts. Packaging already commands 55.94% of the printing inks market and remains the fastest-expanding application at 4.37% CAGR through 2030. Oil-based formulations keep a major share, but UV-LED inks post the highest 7.59% CAGR as converters pursue instant curing and lower energy use. The printing inks market, therefore, balances legacy strengths with emerging eco-friendly and digital capabilities.

Global Printing Inks Market Trends and Insights

Growth in Digital Printing Industry

Digital printing has moved from a niche concept to a mainstream production platform that reshapes the printing inks market. Continuous drops in equipment cost and head improvements allow converters to migrate short and medium runs toward inkjet, improving job turnaround and reducing inventory risk. Ink manufacturers respond with low-viscosity, high-optical-density pigment packages that maintain color consistency at high jetting speeds. Digital fabric printing already approaches 15 billion meters annually, stimulated by on-demand apparel and decor customization. Packaging converters exploit variable data to address seasonal promotions and localized languages, compressing lead times from weeks to days.

Expansion of Packaging and Labels Demand

Global demand for packaged goods expands steadily as rising urbanization, smaller household sizes, and e-commerce fulfillment change consumption habits. Corrugated boxes, paperboard sleeves, and flexible pouches all require durable, food-safe inks that withstand mechanical stress and logistics humidity. Brands rely on high-fidelity graphics and tactile finishes to stand out on crowded shelves, which boosts the value of specialty coatings and metallic pigments. Emerging economies in Asia-Pacific and parts of Africa see double-digit growth in packaged food and personal care, underpinning volume gains for water-based flexo and gravure inks. Label applications become more data-rich, integrating QR codes and anti-counterfeiting features that demand precise registration and robust color stability. The net result is sustained volume expansion even during macro-economic slowdowns, reinforcing packaging's role as the primary growth engine for the printing inks market.

Decline in Conventional Commercial Printing

Newspaper and magazine circulations shrink every quarter as advertisers reallocate budgets to digital channels. In January 2024, shipments of U.S. printing-writing paper fell 9% year on year. Offset ink consumption therefore declines, leaving surplus blending capacity and intensifying price competition. Print houses retire older presses, which trims aftermarket demand for replacement inks and dampens revenue for maintenance services. Some suppliers respond by refitting mixing facilities to produce water-based flexo systems, but pay-back periods stretch when demand for commercial print remains soft. The secular downturn subtracts 0.4 percentage points from the forecast CAGR, partially offset by new digital and packaging volumes.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Water-Based Eco-Friendly Inks

- Emergence of UV/Energy-Curable Technologies

- Stringent VOC and Waste-Disposal Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oil-based inks secured 40.70% of 2025 revenue due to cost efficiency and broad compatibility, yet their growth remains subdued under tightening VOC rules. UV-LED products post a 7.47% CAGR, reflecting converter preference for instant curing and energy savings. Water-based packages gain traction in corrugated cartons and paper cups, especially inside the European Union where food-contact and recyclability requirements grow stricter. Solvent systems persist in specialized industrial decals that need extreme adhesion, though volume gradually migrates toward less volatile alternatives.

Conversion logistics shape purchasing behavior. UV-LED presses avoid extended maintenance shut-downs because lamp life often exceeds 20,000 hours. Reduced scrap and lower energy bills tilt the total cost of ownership advantage toward energy-curable chemistries. In parallel, bio-based oil replacements gain interest as feedstock volatility and disclosure requirements under corporate sustainability reporting standards increase. Early adopters secure marketing premiums for plant-derived content, although supply chains for bio-solvents remain nascent. The combined trend signals a gradual, though definitive, reweighting of the printing inks market toward low-VOC, quick-cure platforms.

The Printing Inks Report is Segmented by Type (Solvent-Based, Water-Based, Oil-Based, UV, UV-LED, and Other Types), Process (Lithographic Printing, Flexographic Printing, Gravure Printing, Digital Printing, Other Processes), Application (Packaging, Commercial and Publication, Textiles, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific holds 40.10% of global 2025 revenue and grows at 3.96% CAGR, reflecting robust manufacturing ecosystems in China, India, and Southeast Asia. Domestic consumption rises alongside expanding middle classes, boosting demand for packaged snacks, personal care, and pharmaceuticals. Local converters invest in high-speed flexo lines and adopt UV-LED retrofits to conserve energy and meet export customer audits. Governments in China and India support electronics and solar module supply chains, indirectly stimulating conductive ink opportunities for sensors and busbars. Regional raw material access, notably pigments and resin intermediates, supports competitive pricing that feeds into global trade flows of printing inks.

Europe enforces some of the most stringent environmental rules, accelerating migration to water-based and energy-curable platforms. Germany's leadership in eco-ink adoption and France's mineral-oil ban drive regional suppliers to overhaul formulations and invest in closed-loop solvent recovery. Luxury brand clusters in Italy and France pursue premium finishing, elevating the demand for metallic, pearlescent, and tactile varnish systems. Eastern European converters adopt modular flexo lines to serve cross-continent retail groups, often specifying the same low-migration inks required by Western buyers.

North America combines technological maturity with tight VOC oversight. The EPA's TSCA evaluations push formulators to validate raw-material toxicology and invest in safer alternatives. Major converters implement predictive maintenance platforms; INX International reported a 13% bump in asset availability after deploying AI analytics on production lines. Mexico gains share as a near-shoring hub for packaged food and personal care goods destined for the United States and Canada, lifting regional ink volumes. Brand owners push for recycling-ready inks that do not impair paper repulping or polyolefin reclamation, fostering collaboration across the packaging value chain. The region exemplifies how automation, sustainability, and regulatory stringency intersect to shape the future trajectory of the printing inks market.

- ALTANA

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- DIC Corporation

- DuPont

- Epple Druckfarben AG

- Flint Group

- FUJIFILM Corporation

- hubergroup

- Nazdar

- Sakata INX Corporation

- Sanchez SA de CV

- SICPA HOLDING SA

- Siegwerk Druckfarben AG & Co. KGaA

- T&K TOKA Corporation

- Tokyo Printing Ink Mfg. Co., Ltd.

- Toyo Ink Co. Ltd (artience Co. Ltd)

- Wikoff Color Corporation

- Yip's Chemical Holdings Limited

- Zeller+Gmelin

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Digital Printing Industry

- 4.2.2 Expansion of Packaging and Labels Demand

- 4.2.3 Shift Toward Water-Based, Eco-Friendly Inks

- 4.2.4 Emergence of UV/Energy-Curable Technologies

- 4.2.5 Adoption of Functional Conductive Inks for Electronics

- 4.3 Market Restraints

- 4.3.1 Decline in Conventional Commercial Printing

- 4.3.2 Stringent VOC and Waste-Disposal Regulations

- 4.3.3 Nitrocellulose Raw-Material Shortages

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Solvent-Based

- 5.1.2 Water-Based

- 5.1.3 Oil-Based

- 5.1.4 UV

- 5.1.5 UV-LED

- 5.1.6 Other Types

- 5.2 By Process

- 5.2.1 Lithographic Printing

- 5.2.2 Flexographic Printing

- 5.2.3 Gravure Printing

- 5.2.4 Digital Printing

- 5.2.5 Other Processes

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.1.1 Rigid Packaging

- 5.3.1.1.1 Paperboard Containers

- 5.3.1.1.2 Corrugated Boxes

- 5.3.1.1.3 Rigid Plastic Containers

- 5.3.1.1.4 Metal Cans

- 5.3.1.1.5 Other Rigid Packaging

- 5.3.1.2 Flexible Packaging

- 5.3.1.3 Labels

- 5.3.1.4 Other Packaging

- 5.3.1.1 Rigid Packaging

- 5.3.2 Commercial and Publication

- 5.3.3 Textiles

- 5.3.4 Other Applications

- 5.3.1 Packaging

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 ASEAN Countries

- 5.4.1.7 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Spain

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ALTANA

- 6.4.2 Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- 6.4.3 DIC Corporation

- 6.4.4 DuPont

- 6.4.5 Epple Druckfarben AG

- 6.4.6 Flint Group

- 6.4.7 FUJIFILM Corporation

- 6.4.8 hubergroup

- 6.4.9 Nazdar

- 6.4.10 Sakata INX Corporation

- 6.4.11 Sanchez SA de CV

- 6.4.12 SICPA HOLDING SA

- 6.4.13 Siegwerk Druckfarben AG & Co. KGaA

- 6.4.14 T&K TOKA Corporation

- 6.4.15 Tokyo Printing Ink Mfg. Co., Ltd.

- 6.4.16 Toyo Ink Co. Ltd (artience Co. Ltd)

- 6.4.17 Wikoff Color Corporation

- 6.4.18 Yip's Chemical Holdings Limited

- 6.4.19 Zeller+Gmelin

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment