|

市场调查报告书

商品编码

1907303

全球塑胶包装市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Global Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

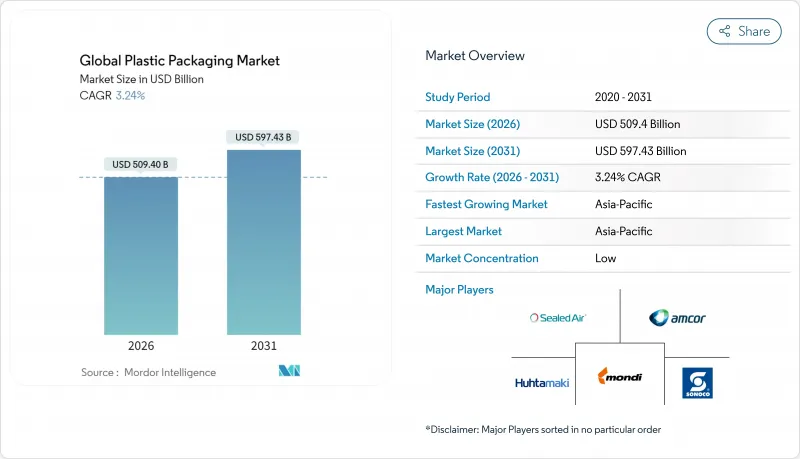

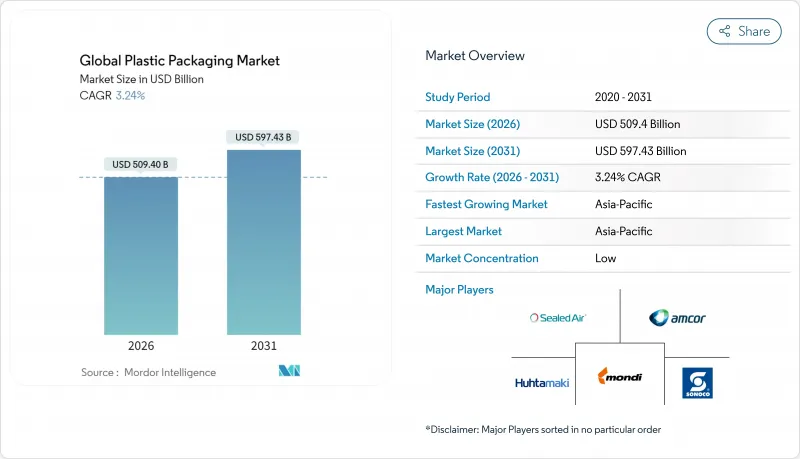

预计到2026年,塑胶包装市场规模将达到5,094亿美元,高于2025年的4,934.2亿美元。预计到2031年,该市场规模将达到5,974.3亿美元,2026年至2031年的复合年增长率为3.24%。

儘管监管力度加大,但蓬勃发展的电子商务、日益增长的方便食品消费以及与替代材料的成本竞争力等因素,仍在支撑着市场的持续需求。能够投资化学回收生产线、重新设计包装以符合瓶盖限制法规并实现高回收率的现有企业正在获得竞争优势,而规模较小的加工商则面临着不断上涨的合规成本。同时,物流成本的上升也强化了轻巧灵活包装的价值提案,这种包装形式能够降低运输成本,并加强电子商务、食品和医疗保健产业的供应商协议。规模正成为资金筹措先进研发和闭合迴路供应链协议的必要条件,加速了产业整合。

全球塑胶包装市场趋势与洞察

电子商务的蓬勃发展需要耐用的末端配送包装。

在最后一公里配送模式中,包裹需要经过多次搬运并按体积重量收费,品牌商更倾向于使用薄膜、软包装袋和邮寄袋,与硬质包装相比,这些包装可减少高达 75% 的空隙率。亚马逊的「无挫包装」通讯协定(目前涵盖超过 30 万个 SKU)已成为事实上的行业标准,引导中小型卖家采用符合规范的聚乙烯和聚丙烯包装解决方案。自动化分类线要求包装采用单一材料结构以透过光学检测;混合材料包装则有被拒收和返工高成本的风险。包装体积减少 15% 可转化为运输成本降低 12%,足以抵消高性能柔性薄膜材料成本 8-10% 的增加。阻隔涂层柔性包装还能为电子产品和温度敏感型药品提供更全面的保护,使其应用范围扩展到食品以外的领域。

方便食品和饮料消费量的快速成长

都市化、家庭规模缩小和工作时间延长正在推动消费者对单一品类、常温保存食品的需求。预计到2024年,都市区消费者对包装食品的购买量将年增8.2%,创历史新高。多层软包装结合了氧气和水分阻隔性以及微波炉适用性,与纸质包装相比,具有更长的保质期和更高的安全性。为了避免监管处罚,饮料生产商会增加固定瓶盖和防篡改功能,每单位成本增加0.02至0.04欧元。常温保存包装也使乳製品和果汁品牌能够打入缺乏冷藏配送网络的农村市场,进一步巩固了软包装在新兴市场的优势。

全球禁止及课税一次性塑胶製品

加州塑胶袋禁令、英国湿纸巾禁令以及南澳发泡聚苯乙烯限制,几乎在一夜之间摧毁了整个产品类型。包括进口限制和高额罚款在内的执法行动,促使企业紧急改善产品并进行资本投资。一项针对加纳拟议塑胶袋禁令的学术研究估计,该禁令每週将造成34万美元的税收损失,凸显了其广泛的经济连锁反应。跨国公司在不同司法管辖区面临「一次性」产品定义不一的问题,这使得全球SKU(库存单位)的统一化变得更加复杂。随着立法者将禁令范围扩大到显而易见的一次性产品之外,餐饮服务和二次包装产品也面临更大的销售风险。

细分市场分析

预计到2025年,软包装将占销售额的54.10%,并在2031年之前以每年4.41%的速度成长,在塑胶包装市场中显着超越硬质包装。燃油价格上涨和按体积重量计费的货运价格正在推动市场结构转向软包装转变,例如采用袋装、邮寄包装和缠绕包装,从而降低运输物流成本。随着加工商采用符合生产者延伸责任(EPR)框架且不影响保质期的单一材料方案,薄膜和缠绕包装的使用率正在不断提高。在结构和高端展示至关重要的领域,硬质瓶、罐和托盘仍然必不可少,但随着可重复密封的拉炼、吸嘴和自主型形式的出现,其市场份额正在逐渐下降,因为它们正在削弱传统的独特优势。提供软硬包装的综合供应商正在获得更高的市场份额,因为品牌所有者正在优化其供应商结构。

如果树脂价格飙升超过其转嫁能力,硬质包装细分市场将面临利润率压力。另一方面,软包装透过提供更低的单位重量来降低风险。玻璃和金属替代品将继续在饮料和罐头食品等小众市场占有一席之地。托盘製造商将继续在餐饮服务管道占有一席之地,因为该通路需要烤箱适用和微波炉适用等增值功能。总体而言,软包装将在销售和成长率方面占据主导地位,并在整个预测期内巩固其在推动塑胶包装市场发展中的核心作用。

到2025年,聚乙烯仍将占据塑胶包装市场41.85%的份额,而聚丙烯则以5.55%的强劲复合年增长率(CAGR)成为成长最快的树脂家族。聚丙烯具有高耐热性、优异的透明度和良好的密封性,使其成为满足可回收性要求并确保食品安全的单一材料解决方案。 PET由于其成熟的瓶到瓶回收循环,在饮料行业保持稳固的地位,但机械回收的局限性限制了在不增加高成本的化学回收产能的情况下提高再生材料含量。 PVC、聚苯乙烯和其他苯乙烯类树脂由于日益严格的环境法规和品牌所有者偏好的转变而逐渐减少,这为生物基树脂和特种共聚物的细分市场创造了机会。

化学回收的经济效益有利于那些具有稳定解聚路径的树脂。因此,PET和PP吸引了更多资本投资,而PS和PVC计划则难以克服投资障碍。树脂供应商正透过应用工程团队来提升自身竞争力,这些团队能够指导加工商完成材料转换,在不断发展的生产者延伸责任(EPR)框架和FDA食品接触法规的背景下,这项服务备受重视。

区域分析

预计到2025年,亚太地区将占全球塑胶包装市场收入的40.80%,年复合成长率达6.78%,成为塑胶包装市场成长的强劲驱动力。中国目前占最大份额,但日益严格的废弃物进口法规和碳中和目标正迫使中国本土製造商投资建设回收能力。印度、越南和印尼的销售成长均达到两位数,这得益于有组织的零售和电子商务的渗透率不断提高。汇率波动和地缘政治因素正促使跨国品牌所有者在东南亚国协实现采购多元化,并减少对单一国家的过度依赖。

北美地区正经历稳定的个位数中成长,这主要得益于医药需求、生鲜食品物流以及先进回收设施的发展。省级塑胶废弃物法规虽然增加了复杂性,但也为再生塑胶和单一材料技术的开发商创造了新的机会。加拿大即将实施的全国性生产者延伸责任制(EPR)有望加速向可回收包装的转型,并促进跨国合作。

欧洲是生产者延伸责任制(EPR)和固定排放限值规定的中心,其价值增长虽较为温和,但对全球设计标准的影响却举足轻重。高昂的劳动力和能源成本推动了塑胶的製程自动化和轻量化,而不断提高的再生材料含量基准值则刺激了对化学回收的投资。东欧的加工企业正吸引着许多品牌公司将生产基地迁回国内,这些公司希望在不承担西欧高成本的情况下,尽可能接近性生产区域,从而推动了资本流入波兰和匈牙利。

拉丁美洲和中东及非洲的市场份额落后,但部分地区正经历快速成长。巴西受益于需要阻隔包装的农产品出口,而海湾合作委员会(GCC)国家则利用其石化一体化优势出口价格具有竞争力的树脂。非洲市场正开始禁止一次性包装,这为能够提供价格实惠、克重低、阻隔性高的软包装解决方案的製造商创造了一个充满前景的市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务的蓬勃发展推动了对耐用型末端配送包装的需求。

- 简便食品和饮料的消费量迅速成长

- 与其他基材的成本竞争力比较

- 扩大化学品回收基础设施

- 过渡到单一材料薄膜以符合生产者延伸责任制 (EPR) 的要求

- 欧盟繫绳帽法规推动了对特种封口的需求

- 市场限制

- 全球禁止及课税一次性塑胶製品

- 石油原料价格波动

- 品牌拥有者转向使用柔性纸包装

- 由于可重复使用和补充装模式的普及,销量下降。

- 供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按包装类型

- 硬包装类型

- 瓶子和罐子

- 瓶盖和封口

- 托盘和容器

- 其他产品类型

- 柔性包装类型

- 麻袋和袋子

- 薄膜和包装

- 其他产品类型

- 硬包装类型

- 材料

- 聚乙烯(高密度聚苯乙烯、低密度聚乙烯、线性低密度聚乙烯)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 聚苯乙烯和EPS

- 聚氯乙烯(PVC)

- 其他(EVOH、生质塑胶等)

- 按最终用户行业划分

- 食物

- 饮料

- 医疗和药品

- 化妆品和个人护理

- 其他终端用户产业

- 透过分销管道

- 直销

- 间接销售

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor PLC

- Mondi PLC

- Sealed Air Corporation

- ALPLA Group

- International Paper

- Pact Group

- Plastipak Holdings Inc.

- Huhtamaki Oyj

- UFlex Limited

- Constantia Flexibles

- Tetra Pak International SA

- Novolex

- Anchor Packaging LLC

- Liquibox(Olympus Partners)

- Quadpack Industries SA

- Dart Container Corporation

- American Packaging Corporation

- Printpack Inc.

- Winpak Ltd.

- Sigma Plastics Group

- Sonoco Products Company

- Transcontinental Inc.

- Greif, Inc.

- Coveris Group

- Nampak Ltd.

第七章 市场机会与未来展望

plastic packaging market size in 2026 is estimated at USD 509.4 billion, growing from 2025 value of USD 493.42 billion with 2031 projections showing USD 597.43 billion, growing at 3.24% CAGR over 2026-2031.

Robust e-commerce activity, rising convenience-food consumption, and cost-competitive advantages over alternate substrates underpin sustained demand even as regulatory scrutiny intensifies. Incumbents able to fund chemical-recycling lines, redesign packs for tethered-cap rules, and meet high recycled-content thresholds secure competitive insulation while smaller converters confront escalating compliance costs. Concurrently, logistics inflation elevates the value proposition of lightweight flexible formats that trim freight bills, strengthening supplier contracts in e-commerce, food, and healthcare channels. Consolidation accelerates as scale becomes prerequisite for funding advanced R&D and closed-loop supply agreements.

Global Plastic Packaging Market Trends and Insights

E-commerce Boom Demanding Durable Last-Mile Packs

Last-mile delivery models expose packages to multiple handling events and dimensional weight billing, prompting brand owners to favor films, pouches, and mailers that shrink void space by up to 75% versus rigid alternatives. Amazon's frustration-free packaging protocol, now covering more than 300,000 SKUs, shapes de facto industry specifications and pushes SME sellers toward compliant polyethylene and polypropylene solutions. Automated sortation lines require mono-material constructions that withstand optical detection; mixed-material packs risk rejection and costly rework. A 15% reduction in package volume translates to 12% lower freight expenditure, more than offsetting the 8-10% material premium for high-performance flexible films. Barrier-coated flexibles also extend protection to electronics and temperature-sensitive pharmaceuticals, broadening addressable segments beyond food.

Surge in Convenience-Food and Beverage Consumption

Urbanization, smaller household sizes, and longer working hours spur demand for single-portion, shelf-stable meals. Processed-food uptake among urban consumers rose 8.2% year-on-year in 2024, the fastest climb on record.Multilayer flexibles combining oxygen and moisture barriers plus microwave compatibility outperform paper-based options on shelf-life and safety. Beverage innovators add tethered closures and tamper-evident features, absorbing EUR 0.02-0.04 extra per unit in manufacturing cost to avoid regulatory penalties. Extended shelf-life packs enable dairy and juice brands to reach rural areas lacking cold chains, further cementing flexible dominance in emerging markets.

Global Single-Use Plastic Bans and Taxes

California's bag prohibitions, the UK's wet-wipe ban, and South Australia's EPS restrictions remove entire product categories virtually overnight. Enforcement includes import restrictions and stiff fines, driving emergency reformulations and CapEx outlays. Academic work on Ghana's proposed bag bans estimates weekly tax-revenue losses of USD 0.34 million, underscoring broader economic spillovers. Multinationals grapple with divergent definitions of "single-use" across jurisdictions, complicating global SKU harmonization. As legislators widen scope beyond obvious disposable items, additional volume risks emerge for food-service and secondary-packaging formats.

Other drivers and restraints analyzed in the detailed report include:

- Cost-Competitive Performance Versus Alternate Substrates

- Expansion of Chemical-Recycling Infrastructure

- Volatile Petro-Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible formats commanded 54.10% of 2025 sales and are forecast to grow at 4.41% annually through 2031, expanding the plastic packaging market far faster than rigid alternatives. Fuel cost inflation and dimensional-weight freight tariffs reinforce a structural migration toward pouches, mailers, and wrap films that cut outbound logistics charges. Films and wraps gain further traction as converters deploy mono-material options that satisfy EPR frameworks without compromising shelf life. Rigid bottles, jars, and trays retain indispensability where structure or premium shelf presence is paramount, yet their share gradually declines as resealable zippers, spouts, and stand-up formats erode historical feature advantages. Integrated suppliers offering both formats secure higher wallet share as brand owners streamline vendor bases.

Rigid-package sub-segments confront margin pressure when resin spikes outpace pass-through ability, whereas flexible peers mitigate exposure through lighter gram-weight per unit. Glass and metal replacements remain niche, limited to beverages and canned foods. Tray makers preserve relevance in food-service channels where oven-safe or microwave-ready features command price premium. Overall, flexibles' dual leadership in volume and growth cements their central role in driving the plastic packaging market over the forecast horizon.

Although polyethylene held 41.85% plastic packaging market share in 2025, polypropylene's superior 5.55% CAGR positions it as the fastest-advancing resin family. PP's higher heat resistance, improved clarity, and better seal integrity facilitate mono-material solutions that meet recyclability mandates while safeguarding food safety. PET protects its beverage stronghold owing to established bottle-to-bottle recycling loops, yet mechanical-recycling limitations cap recycled content without costly chemical-recycling capacity additions. PVC, polystyrene, and other styrenics retreat under stricter environmental rules and brand-owner deselection, opening space for bio-based and specialty co-polymer niches.

Chemical-recycling economics further favor resins with stable depolymerization pathways; hence PET and PP attract greater capex, while PS and PVC projects struggle to clear investment hurdles. Resin suppliers differentiate through application engineering teams that guide converters during material transitions, a service highly prized amid evolving EPR frameworks and FDA food-contact rules.

The Plastic Packaging Market Report is Segmented by Packaging Type (Rigid Packaging Type, Flexible Packaging Type), Material (Polyethylene, PET, Polypropylene, Polystyrene and EPS, PVC, Others), End-User Industry (Food, Beverage, Healthcare and Pharmaceuticals, and More), Distribution Channel (Direct Sales, Indirect Sales), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 40.80% of global revenue in 2025 and is expanding at 6.78% CAGR, making it the undisputed engine of plastic packaging market growth. China accounts for the lion's share, though stricter waste-import rules and carbon-neutrality pledges compel local producers to invest in recycling capacity. India, Vietnam, and Indonesia record double-digit volume gains as organized retail and e-commerce penetration deepens. Currency volatility and geopolitics prompt multinational brand owners to diversify sourcing into ASEAN nations, reducing overreliance on any single country.

North America manifests steady mid-single-digit expansion underpinned by pharmaceutical demand, fresh-produce logistics, and the build-out of advanced-recycling hubs. State-level plastic-waste legislation adds complexity, yet it simultaneously opens opportunities for recycled and mono-material innovators. Canada's forthcoming nationwide EPR framework accelerates shift toward recyclable packs, encouraging cross-border partnerships.

Europe, the epicenter of EPR and tethered-cap mandates, experiences modest value growth but exerts outsized influence on global design standards. High labor and energy costs incentivize process automation and resin lightweighting, while regulators push recycled-content thresholds that drive chemical-recycling investments. Eastern European converters attract reshoring projects as brands seek regional proximity without Western Europe's cost base, spurring capital inflows into Poland and Hungary.

Latin America and the Middle East & Africa trail in share but register pockets of rapid expansion. Brazil benefits from agrifood exports that require barrier packaging, whereas GCC nations leverage petrochemical integration to export competitively priced resin. African markets begin to legislate single-use bans, creating fertile terrain for flexible producers that can deliver low-gram-weight, high-barrier solutions at affordable price points.

- Amcor PLC

- Mondi PLC

- Sealed Air Corporation

- ALPLA Group

- International Paper

- Pact Group

- Plastipak Holdings Inc.

- Huhtamaki Oyj

- UFlex Limited

- Constantia Flexibles

- Tetra Pak International SA

- Novolex

- Anchor Packaging LLC

- Liquibox (Olympus Partners)

- Quadpack Industries SA

- Dart Container Corporation

- American Packaging Corporation

- Printpack Inc.

- Winpak Ltd.

- Sigma Plastics Group

- Sonoco Products Company

- Transcontinental Inc.

- Greif, Inc.

- Coveris Group

- Nampak Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom demanding durable last-mile packs

- 4.2.2 Surge in convenience-food and beverage consumption

- 4.2.3 Cost-competitive performance versus alternate substrates

- 4.2.4 Expansion of chemical-recycling infrastructure

- 4.2.5 Shift to mono-material films for EPR compliance

- 4.2.6 EU tethered-cap rule driving specialty closures volume

- 4.3 Market Restraints

- 4.3.1 Global single-use plastic bans and taxes

- 4.3.2 Volatile petro-feedstock prices

- 4.3.3 Brand owners pivoting to paper-based flexibles

- 4.3.4 Refill/reuse models cannibalising volume growth

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Type

- 5.1.1 Rigid Packaging Type

- 5.1.1.1 Bottles and Jars

- 5.1.1.2 Caps and Closures

- 5.1.1.3 Trays and Containers

- 5.1.1.4 Other Product Types

- 5.1.2 Flexible Packaging Type

- 5.1.2.1 Pouches and Bags

- 5.1.2.2 Films and Wraps

- 5.1.2.3 Other Product Types

- 5.1.1 Rigid Packaging Type

- 5.2 By Material

- 5.2.1 Polyethylene (HDPE, LDPE, LLDPE)

- 5.2.2 Polyethylene Terephthalate (PET)

- 5.2.3 Polypropylene (PP)

- 5.2.4 Polystyrene and EPS

- 5.2.5 Polyvinyl Chloride (PVC)

- 5.2.6 Others (EVOH, Bioplastics, etc.)

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Healthcare and Pharmaceuticals

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Other End-user Industry

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Mondi PLC

- 6.4.3 Sealed Air Corporation

- 6.4.4 ALPLA Group

- 6.4.5 International Paper

- 6.4.6 Pact Group

- 6.4.7 Plastipak Holdings Inc.

- 6.4.8 Huhtamaki Oyj

- 6.4.9 UFlex Limited

- 6.4.10 Constantia Flexibles

- 6.4.11 Tetra Pak International SA

- 6.4.12 Novolex

- 6.4.13 Anchor Packaging LLC

- 6.4.14 Liquibox (Olympus Partners)

- 6.4.15 Quadpack Industries SA

- 6.4.16 Dart Container Corporation

- 6.4.17 American Packaging Corporation

- 6.4.18 Printpack Inc.

- 6.4.19 Winpak Ltd.

- 6.4.20 Sigma Plastics Group

- 6.4.21 Sonoco Products Company

- 6.4.22 Transcontinental Inc.

- 6.4.23 Greif, Inc.

- 6.4.24 Coveris Group

- 6.4.25 Nampak Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment