|

市场调查报告书

商品编码

1907312

对二甲苯(PX):市占率分析、产业趋势与统计、成长预测(2026-2031)Paraxylene (PX) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

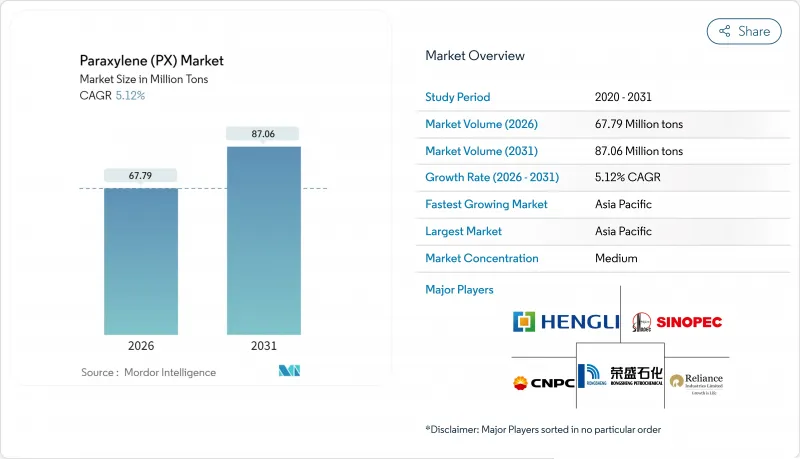

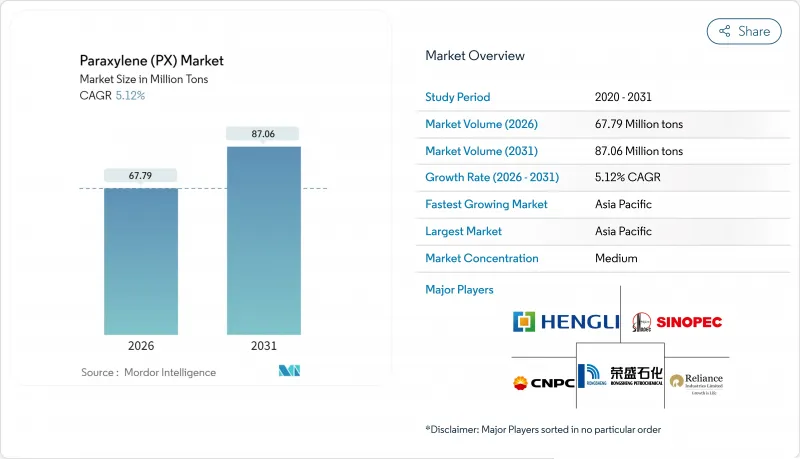

对二甲苯(PX)市场预计将从 2025 年的 6,448 万吨增长到 2026 年的 6,779 万吨,预计到 2031 年将达到 8,706 万吨,2026 年至 2031 年的复合年增长率为 5.12%。

对二甲苯的稳定供应对全球聚酯产业至关重要,因为纯对苯二甲酸(PTA)可直接转化为聚对苯二甲酸乙二醇酯(PET),用于包装和纤维生产。中国的综合石化企业透过原油直接转化为芳烃,享有成本优势,此模式使得中国在2024年至2025年间新增对二甲苯产能超过1000万吨。原料经济性仍然至关重要,石脑油价格年减16.5%至每吨554.79美元,儘管供应过剩对现货价格构成压力,但仍有助于利润率在2025年初回升。饮料和个人护理包装、产业用纺织品以及全部区域可支配收入的成长支撑了需求的韧性。同时,生物基路线和化学回收利用对现有生产商而言既是风险也是机会。因此,竞争优势取决于规模、整合、能源效率以及应对影响品牌筹资策略的永续性的能力。

全球对二甲苯(PX)市场趋势及展望

PET包装材料需求激增

品牌商在包装饮料、家用液体和个人保健产品,正越来越多地用PET取代较重的材料,从而推动了对二甲苯(PTA)的需求。 PTA约占瓶子树脂重量的70%。信实工业(Reliance Industries)报告称,2024财年全球PET回收量将成长13%,这主要得益于轻巧且完全可回收的瓶型,它们满足了零售商对运输效率和展示效果的需求。线上杂货和直销通路进一步推动了这一需求,因为PET在长途通路中不易破损的特性得到了充分体现。政府法规越来越多地采用强制性的最低再生材料含量要求,而非彻底禁止,这使得原生对二甲苯能够满足不断增长的包装需求,同时促进了回收基础设施的发展。因此,拥有芳烃和PTA一体化装置的炼油厂可以确保可预测的基本负载需求,即使在运输燃料週期性低迷时期也能维持收入稳定。

亚洲聚酯纤维的扩张

亚太地区仍然是世界纺织品生产基地,儘管对二甲苯价格波动,但聚酯纤维相对于棉花的成本优势支撑着纺织品需求。中国计划在2024年运作400多万吨聚酯短纤维产能,印度也已核准一项基于绩效的化学纤维激励计划,以促进国内服饰出口。汽车安全气囊、输送机和地工织物技术纺织品的需求取决于对二甲苯胺(PTA)的持续供应,因为这些产品需要稳定且高利润的供应。位于贾姆讷格尔和大连的综合产业群聚将对二甲苯、PTA和纤维纺丝集中在一处,降低了运输成本,增强了区域竞争力。快时尚品牌正在加快订货週期,工厂优先选择能够确保PTA准时交付的供应商。这种能力在中国东部沿海省份的大型综合产业丛集中最为容易取得。

加强对一次性塑胶製品的监管

欧盟的《一次性塑胶指令》将禁止某些外带食品,并征收生产者延伸责任费,这将增加使用原生PET的加工商的合规成本。加州的一项类似提案将强制要求到2028年,饮料瓶中必须含有25%的再生材料,这将迫使品牌所有者转向铝和纸基解决方案,以应对小众产品。从营运层面来看,速食包装对对二甲苯的需求可能会停滞不前,而无菌果汁和乳製品等阻隔性PET应用仍将受到性能要求的保护。这将导致成熟市场成长放缓,树脂流向那些设定了切实可行的回收目标而非简单使用限制的地区。

细分市场分析

到2025年,纯对苯二甲酸将占全球产量的94.35%,巩固其作为对二甲苯主要用途的地位。江苏、浙江和古吉拉突邦正在进行的对苯二甲酸(PTA)扩产预计将超过该领域芳烃的供应,到2031年将达到5.32%的复合年增长率。炼厂到化工环节一体化程度的提高,增强了运转率的柔软性,最大限度地减少了对二甲苯和PTA装置之间的物流转运,并确保了原料供应的稳定性。因此,该单体大型企划的PTA年产能超过300万吨,实现了规模经济,从而降低了现货市场对二甲苯溢价的价格波动。利用数位双胞胎模型优化热整合网络,可降低10-12%的能源成本并减少排放。这项优势至关重要,因为欧洲出口客户必须遵守范围1的碳排放限制。

随着授权生产商逐步淘汰酯交换生产线,对苯二甲酸二甲酯 (DMT) 的利基市场正在萎缩,其可变成本比直接采用对二甲苯 (PTA) 路线高出 15-20%。特种溶剂、塑化剂和除草剂中间体占对二甲苯消耗量的剩余 1-2%,呈现个位数的温和成长,但不足以推动总需求。然而,它们在控制重整芳烃池中的异构体比例方面仍然发挥着重要作用,从而能够制定最大化整个炼厂价值而非单一分子价值的生产计画。虽然替代生物芳烃展现出一定的潜力,但其商业化产量仍微乎其微,这意味着在预测期内,传统的对二甲苯 (PTA) 路线仍将继续主导对二甲苯市场。

对二甲苯 (PX) 市场报告按应用(纯对苯二甲酸、对苯二甲酸二甲酯及其他应用)、终端用户行业(塑胶、纺织品及其他终端用户行业)和地区(亚太地区、北美地区、欧洲地区、南美地区以及中东和非洲地区)进行细分。市场预测以公吨为单位。

区域分析

预计到2025年,亚太地区将以82.10%的市占率主导对二甲苯市场,并在2031年之前维持5.48%的复合年增长率。这主要得益于中国、印度和东南亚地区下游聚酯产业生态系的不断强化。中国的石化集中化策略将在2024年至2025年间促成五个新联合装置的投产,每个装置都将运作对二甲苯、对苯二甲酸单酯(PTA)和聚合物生产单元。光是大宇山一家就将年产1180万吨芳烃。印度正利用其位于贾姆讷格尔的年产140万吨对二甲苯装置以及不断扩大的产业用纺织品出口激励措施,提高区域自给率,并吸引外资进入其服装製造群。日本和韩国仍在供应高品质对二甲苯,但随着国内需求趋于平稳,两国正被迫进行产能优化。

北美市场规模虽小,却在全球市场占有重要的战略地位。由于混合二甲苯原料与汽油混合后辛烷值较高,因此在燃料需求高峰期,北美地区单独生产对二甲苯的利润率低于亚洲。然而,先进的连续燃烧重整(CCR)维修和丰富的页岩冷凝油供应确保了原料来源的多样性。到2031年,北美对二甲苯市场规模预计将扩大至447万吨。这项成长将主要得益于那些位置消费品品牌、致力于缩短物流链的特种PET和生物基对二甲苯(bio-PX)先导工厂。化学回收材料的政策支持将进一步促进原料来源多元化,但在预测期内,其对原生对二甲苯的绝对替代效应将十分有限。

能源和监管成本的上涨给欧洲带来了挑战,导致从中东和亚洲的进口量增加。天然气价格持续高企推高了蒸气裂解装置的公用成本,降低了本地对甲苯(PX)的竞争力。然而,一次性塑胶法规正推动需求转向完全可回收的聚对苯二甲酸乙二醇酯(PET),从而维持了采用闭合迴路的对甲苯(PTA)工厂的基本负载需求。中东正透过将过剩的石脑油和重整油转化为芳烃,并专注于与亚洲主要聚酯公司签订出口合同,来收紧全球供应平衡。南美洲的需求主要由巴西饮料产业驱动,造成了结构性的对甲苯(PX)亏损,这种逆差透过与美国墨西哥湾沿岸和阿拉伯湾地区的出口商签订长期供应协议来弥补。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- PET包装材料需求激增

- 亚洲聚酯纤维的扩张

- 轻巧、可回收的饮料瓶推动了PX的需求。

- 高产率CCR和PRT芳烃装置的商业化。

- 生物基对二甲苯商业规模先导工厂(非化石燃料)

- 市场限制

- 加强对一次性塑胶製品的监管

- 原油价格波动主导原物料价格波动

- 用新型化学回收取代原生PX

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过使用

- 纯对苯二甲酸(PTA)

- 对苯二甲酸二甲酯(DMT)

- 其他用途

- 按最终用户行业划分

- 塑胶

- 纺织品

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 印尼

- 马来西亚

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- China Petrochemical Corporation

- CNPC

- Eneos Corporation

- Exxon Mobil Corporation

- FCFC

- GS Caltex Corporation

- Hengli Petrochemical Co., Ltd.

- Idemitsu Kosan Co.,Ltd.

- Ineos

- LOTTE CHEMICAL CORPORATION

- PTT Global Chemical Public Company Limited

- Reliance Industries Limited

- Rongsheng Petrochemical Co., Ltd.

- S-oil Corporation

- TotalEnergies

第七章 市场机会与未来展望

The Paraxylene Market is expected to grow from 64.48 Million tons in 2025 to 67.79 Million tons in 2026 and is forecast to reach 87.06 Million tons by 2031 at 5.12% CAGR over 2026-2031.

A secure supply of para-xylene underpins the global polyester chain because purified terephthalic acid (PTA) converts directly into polyethylene terephthalate (PET) for packaging and fiber. Integrated oil-to-chemicals complexes in China hold cost advantages by processing crude directly into aromatics, an approach that added more than 10 million tons of new para-xylene capacity during 2024-2025. Feedstock economics remain pivotal; a 16.5% year-over-year decrease in naphtha pricing to USD 554.79 per ton restored margins in early 2025 even as oversupply pressured spot values. Demand resilience comes from beverage and personal-care packaging, technical textiles and rising disposable incomes across Asia-Pacific, while bio-based routes and chemical recycling offer both risk and opportunity for incumbent producers. Competitive positioning, therefore, rests on scale, integration, energy efficiency, and the ability to navigate sustainability mandates that influence brand procurement strategies.

Global Paraxylene (PX) Market Trends and Insights

Surging Demand for PET Packaging

Brand owners that package beverages, home-care liquids and personal-care products continue to substitute heavier materials with PET, propelling para-xylene demand because PTA constitutes nearly 70% of bottle resin weight. Reliance Industries reported a 13% in global PET off-take during fiscal 2024, driven by lightweight and fully recyclable bottle formats that satisfy retailer requirements for transport efficiency and shelf appeal. Online grocery and direct-to-consumer channels magnify these volumes because PET resists breakage throughout longer distribution chains. Government regulations increasingly specify minimum recycled content rather than outright bans, allowing virgin para-xylene to keep pace with packaging growth while stimulating collection infrastructure. Consequently, refineries with integrated aromatics and PTA assets secure predictable baseload demand, smoothing earnings even when transportation fuels see cyclical downturns.

Polyester-Fiber Expansion in Asia

Asia-Pacific remains the textile workbench of the world, and polyester's cost advantage over cotton sustains fiber demand despite para-xylene price volatility. China commissioned more than 4 million tons of new polyester staple capacity in 2024, while India approved performance-linked incentive schemes covering man-made fibers to stimulate domestic garment exports. Technical textile off-take in automotive airbags, conveyor belts, and geotextiles adds steadier, higher-margin volumes that rely on consistent PTA supply. Integrated complexes in Jamnagar and Dalian reduce transport costs by colocating para-xylene, PTA, and fiber spinning, thereby boosting regional competitiveness. Fast-fashion brands accelerate order cycles, meaning mills favor suppliers that guarantee just-in-time PTA deliveries, a capability most feasible inside large integrated clusters across Eastern China's coastal provinces.

Single-Use-Plastic Legislation Tightening

The European Union's Single-Use Plastics Directive bans selected takeaway items and imposes extended-producer-responsibility fees that raise compliance costs for converters using virgin PET. Similar proposals in California mandate 25% recycled content in beverage bottles by 2028, prompting brand owners to diversify into aluminum or paper-based solutions for niche SKUs. Operationally, para-xylene demand could stall in quick-service packaging, though high-barrier PET applications such as aseptic juice or dairy remain protected by performance requirements. The net effect reduces growth in mature markets while redirecting resin flows toward regions with pragmatic recyclability targets rather than outright volume caps.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight, Recyclable Beverage Bottles Push PX

- High-Yield CCR and PRT Aromatics Units Commercializing

- Crude-Oil-Led Feedstock Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Purified terephthalic acid retained 94.35% of global volume in 2025, cementing its status as the core outlet for the para-xylene market. The scale of PTA expansions underway in Jiangsu, Zhejiang, and Gujarat means the segment will outpace overall aromatics supply, generating a 5.32% CAGR to 2031. Ongoing refinery-to-chemicals integration raises operating-rate flexibility, minimizing logistics transfers between para-xylene and PTA units and locking in feedstock security. As a result, PTA capacity at single-site mega-projects now exceeds 3 million tons per year, enabling economies that blunt price swings in spot PX premiums. Digital-twin models optimize heat-integration networks within these complexes, shaving 10-12 % from energy costs and shrinking emissions-an advantage when compliance with Scope 1 carbon limits affects European export customers.

The dimethyl terephthalate niche shrinks as licensees retire transesterification lines, citing 15-20 % higher variable costs than direct PTA routes. Specialty solvents, plasticizers, and herbicide intermediates account for the residual 1-2 % of para-xylene consumption and exhibit mid-single-digit growth, insufficient to sway aggregate demand. Nevertheless, they remain important for balancing isomer ratios inside reformer aromatics pools, ensuring that production planning maximizes overall refinery value rather than a single molecule. While substitute bio-aromatics appear promising, commercial tonnage remains minimal, indicating that conventional PTA will continue to shape the para-xylene market during the outlook period.

The Paraxylene (PX) Market Report is Segmented by Application (Purified Terephthalic Acid, Dimethyl Terephthalate, and Other Applications), End-User Industry (Plastics, Textile, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominated the para-xylene market with an 82.10% share in 2025 and is forecast to maintain a 5.48% CAGR to 2031 as China, India, and Southeast Asia reinforce downstream polyester ecosystems. China's centralized oil-to-chemicals strategy placed five new complexes online in 2024-2025, each with integrated para-xylene, PTA, and polymer units; Dayushan alone yields 11.8 million tons of aromatics annually. India leverages Jamnagar's 1.4 million-ton PX train and the nation's expanding technical-textile export incentives, enhancing regional self-sufficiency and attracting foreign investment in apparel manufacturing clusters. Japan and South Korea continue to supply premium specification PX grades, although capacity rationalizations loom as domestic demand plateaus.

North America retains a smaller but strategically important slice of global volume. Mixed-xylene streams fetch a strong octane value in gasoline blending, pushing stand-alone PX margins below those in Asia during high-fuel-demand seasons. Nevertheless, advanced CCR revamps and abundant shale condensate maintain feedstock diversity. The para-xylene market size in North America could edge toward 4.47 million tons by 2031, with incremental growth tied to specialty PET and bio-PX pilots located close to consumer brands that value shorter logistics chains. Policy support for chemically recycled content further diversifies sourcing, though absolute displacement of virgin PX remains modest through the forecast horizon.

Europe confronts steeper energy and regulatory costs, driving imports from the Middle East and Asia. Persistent natural-gas premiums elevate steam-cracker utility expenses, eroding local PX competitiveness. Nonetheless, single-use-plastic rules tilt demand toward fully recyclable PET, preserving baseload offtake for PTA plants that adopt closed-loop recycling schemes. The Middle East tightens global supply equations by channeling surplus naphtha and reformate into aromatics, focusing on export contracts with Asia's polyester majors. South America's demand centers on Brazil's beverages sector, leading to structural PX trade deficits addressed through long-term supply contracts with U.S. Gulf Coast and Arabian Gulf exporters.

- China Petrochemical Corporation

- CNPC

- Eneos Corporation

- Exxon Mobil Corporation

- FCFC

- GS Caltex Corporation

- Hengli Petrochemical Co., Ltd.

- Idemitsu Kosan Co.,Ltd.

- Ineos

- LOTTE CHEMICAL CORPORATION

- PTT Global Chemical Public Company Limited

- Reliance Industries Limited

- Rongsheng Petrochemical Co., Ltd.

- S-oil Corporation

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for PET Packaging

- 4.2.2 Polyester-fiber Expansion in Asia

- 4.2.3 Lightweight, Recyclable Beverage Bottles Push PX

- 4.2.4 High-yield CCR and PRT Aromatics Units Commercialising

- 4.2.5 Bio-based PX Commercial Scale Pilots (non-fossil)

- 4.3 Market Restraints

- 4.3.1 Single-use-plastic Legislation Tightening

- 4.3.2 Crude-oil Led Feedstock Price Volatility

- 4.3.3 Emerging Chemical Recycling Displacing Virgin PX

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Purified Terephthalic Acid (PTA)

- 5.1.2 Dimethyl Terephthalate (DMT)

- 5.1.3 Other Applications

- 5.2 By End-user Industry

- 5.2.1 Plastics

- 5.2.2 Textile

- 5.2.3 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Indonesia

- 5.3.1.7 Malaysia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 China Petrochemical Corporation

- 6.4.2 CNPC

- 6.4.3 Eneos Corporation

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 FCFC

- 6.4.6 GS Caltex Corporation

- 6.4.7 Hengli Petrochemical Co., Ltd.

- 6.4.8 Idemitsu Kosan Co.,Ltd.

- 6.4.9 Ineos

- 6.4.10 LOTTE CHEMICAL CORPORATION

- 6.4.11 PTT Global Chemical Public Company Limited

- 6.4.12 Reliance Industries Limited

- 6.4.13 Rongsheng Petrochemical Co., Ltd.

- 6.4.14 S-oil Corporation

- 6.4.15 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment