|

市场调查报告书

商品编码

1907325

乙丙橡胶(EPDM):市场占有率分析、产业趋势与统计、成长预测(2026-2031)Ethylene Propylene Diene Monomer (EPDM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

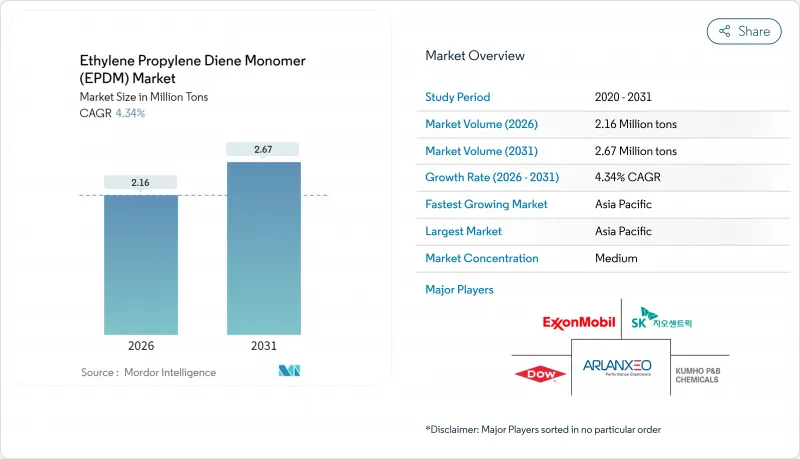

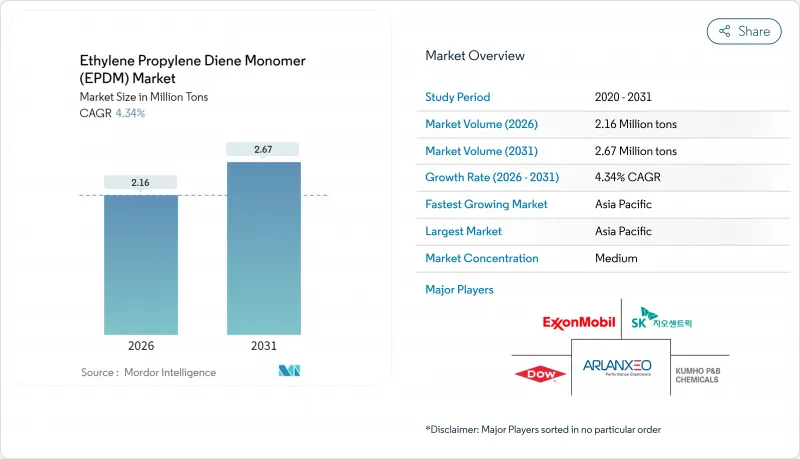

2025年乙丙橡胶(EPDM)市值207万吨,预计2031年将达到267万吨,高于2026年的216万吨。

预测期(2026-2031 年)的复合年增长率预计为 4.34%。

电动车电池密封件、净零排放屋顶膜以及氢燃料电池的早期应用等应用领域的需求增长势头强劲,这些应用领域都非常看重EPDM高达150°C的耐热性和优异的耐臭氧性能。竞争优势日益依赖生物基原料和先进催化剂,这些技术能够在不牺牲聚合物性能的前提下降低碳足迹。区域供应的稳定性,尤其是在亚太地区,支撑了我们主导的销售地位,并降低了成本波动的风险。儘管原料价格波动和热塑性硫化橡胶(TPV)渗透率的不断提高带来了成本和替代压力,但差异化的EPDM等级在对介电稳定性、耐化学性和使用寿命耐久性要求极高的高端应用领域仍然保持优势。

全球乙丙橡胶(EPDM)市场趋势与洞察

零能耗建筑对EPDM防水卷材的需求激增

EPDM防水卷材的使用寿命超过50年,与寿命较短的热塑性材料相比,为开发商提供了更具成本效益的使用成本。白色配方能够反射太阳辐射,有助于获得LEED和BREEAM认证体系中的能源效率积分。欧洲独立评估机构一致认为,EPDM的环境影响低于TPO和PVC等替代材料,使其成为气候适应建筑的首选。日益都市区热岛效应缓解法规推动了对反射性屋顶材料的需求,而该材料的化学惰性使其能够用于建造雨水收集系统和绿色屋顶。此外,EPDM与太阳能光电装置的兼容性进一步促进了其在维修和新建计划中的应用,这些专案旨在提高能源和水资源利用效率。

电动车产量加速成长,推动了对密封件和垫圈的需求。

电动车电池需要能够承受-55°C至+150°C温度循环、在振动下保持弹性、并能耐受冷却乙二醇基添加剂和阻燃剂的密封垫片。 EPDM的低压缩永久变形可保护电池组的完整性并抑制水分渗入,从而直接满足电池保固要求。介电性能在高压车辆架构中至关重要,而EPDM在目前正在大规模生产的800V系统中提供了稳定的绝缘性能。亚太地区仍然是需求成长的中心,其中中国是主要的电池製造中心,而韩国则是大型密封件製造商的所在地。儘管汽车製造商正在尝试使用热塑性弹性体(TPV)来减轻重量并提高可回收性,但在引擎室等温度和化学腐蚀环境超出TPV限制的条件下,EPDM仍然具有性能优势。

与原油价格相关的原物料价格波动

由于炼油厂停产以及烯烃供需紧张,丙烯和乙烯价格高企,对三元乙丙橡胶(EPDM)的利润率带来压力。炼油厂的合理化改造与新增聚丙烯产能导致2025年美国聚合物级丙烯现货价格上涨。亚洲乙烯价格在过去几个月中出现了两位数的波动,这使得轮胎和垫片製造商的合约谈判和库存计划变得更加复杂。虽然拥有自有裂解装置的一体化EPDM供应商可以部分抵消这种风险,但非一体化製造商往往被迫承受利润率下降,或者在对成本敏感的应用领域中,因替代材料的竞争而失去市场份额。

细分市场分析

到2025年,溶液聚合製程将占据EPDM市场59.10%的份额,因为汽车製造商和屋顶防水卷材製造商愿意为实现压缩永久变形性能所需的严格分子量控制支付溢价。此製程能够精确控制二烯的引入,使混炼商能够灵活地调整固化速度和模量,以满足电池垫片严苛的要求。近期触媒技术的创新,例如AlranZeo公司的Keltan ACE钛κ1-脒基络合物,可在不改变下游混炼配方的情况下降低能耗和单位生产成本。

浆料/悬浮製程预计将以4.78%的复合年增长率成长,满足软管和电缆绝缘用通用等级材料的需求,因为反应器升级为更有效率的混合系统可减少溶剂用量。气相工艺是一项小众技术,但人们对用于特种压缩密封件的超高分子量等级材料的兴趣日益浓厚。

乙丙橡胶(EPDM)市场报告按生产工艺(溶液聚合工艺、浆料/悬浮液聚合工艺、气相聚合工艺)、应用领域(汽车、建筑、製造及其他)和地区(亚太、北美、欧洲、南美、中东和非洲)进行细分。市场预测以吨为单位。

区域分析

预计到2025年,亚太地区将占据EPDM市场56.05%的份额,这主要得益于中国电池式电动车的生产以及韩国锦湖聚合物化学公司22万吨产能工厂的扩建。来自一体化裂解装置和蒸汽裂解装置的充足丙烯供应降低了原料风险和运输成本,推动该地区以4.58%的复合年增长率成长。全球密封件供应商的本地化策略使电动车製造商能够缩短前置作业时间,从而形成技术支援和集中需求的良性循环。

随着底特律汽车製造商加速推广电动车,以及商业屋顶承包商指定使用EPDM进行节能维修,北美市场正在扩张。儘管国内裂解装置面临间歇性的丙烯供应限制,但页岩气经济效益持续推动烯烃投资,并有望在中期内带来更稳定的下游价格。联邦政府对清洁能源建筑的税收优惠政策正在推动新仓库屋顶的安装,进一步促进了EPDM的消费。

在欧洲,由于严格的环境法规青睐具有成熟生命週期效益的材料,高价值应用占据主导地位。循环经济指令鼓励企业安装内部脱硫生产线,为区域混炼企业在再生EPDM混炼领域领先奠定了基础。中东和非洲地区虽然规模较小,但正呈现出由基础设施需求主导的復苏态势,而南美洲的需求成长则依赖巴西的石化投资週期和邻近地区的丙烯供应。在所有地区,高压电力系统和气候适应基础设施的转型都有利于EPDM的性能优势,从而在原材料价格波动的情况下维持全球消费。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 零能耗建筑对EPDM屋顶防水卷材的需求激增

- 电动车产量加速成长,推动了对密封件和垫圈的需求。

- 强制部署5G基础设施需要耐候电缆

- 氢燃料电池基础设施需要耐高温弹性体

- 透过促进循环经济实现EPDM再生和脱硫

- 市场限制

- 原料价格因与原油价格挂钩而波动

- 与热塑性聚烯弹性体的竞争

- 深入探讨石油衍生聚合物的碳排放强度

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 透过製造工艺

- 溶液聚合工艺

- 浆料/悬浮液工艺

- 气相聚合工艺

- 透过使用

- 车

- 建筑/施工

- 製造业

- 电气和电子设备

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 西班牙

- 土耳其

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 埃及

- 奈及利亚

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- ARLANXEO

- Carlisle Companies Inc.

- Dow

- ENEOS Materials Corporation

- Exxon Mobil Corporation

- Goodyear Rubber Company

- Kumho P&B Chemicals(Kumho Polychem)

- LANXESS

- Lion Elastomers

- Mitsui Chemicals Inc.

- SABIC

- SK geocentric Co., Ltd.

- Versalis SpA

- West American Rubber Company LLC

第七章 市场机会与未来展望

The Ethylene Propylene Diene Monomer Market was valued at 2.07 million tons in 2025 and estimated to grow from 2.16 million tons in 2026 to reach 2.67 million tons by 2031, at a CAGR of 4.34% during the forecast period (2026-2031).

Demand momentum is tied to electric-vehicle battery sealing, net-zero roofing membranes, and early hydrogen fuel cell adoption, all of which reward EPDM's thermal stability up to 150 °C and outstanding ozone resistance. Competitive positioning increasingly hinges on bio-based feedstocks and advanced catalysts that lower carbon footprints without compromising polymer properties. Regional supply security, particularly abundant propylene integration in Asia-Pacific, underpins volume leadership and buffers cost volatility risks. Feedstock price swings and rising thermoplastic vulcanizate (TPV) penetration pose cost and substitution pressures, yet differentiated EPDM grades continue to defend premium applications where dielectric stability, chemical resistance, and lifecycle durability are non-negotiable.

Global Ethylene Propylene Diene Monomer (EPDM) Market Trends and Insights

Surging Demand for EPDM Roofing Membranes in Net-Zero Buildings

EPDM membranes deliver service lives exceeding 50 years, giving developers a favorable cost-in-use equation against shorter-lived thermoplastics. White-colored formulations reflect solar radiation, helping projects achieve energy-efficiency credits under LEED and BREEAM schemes. Independent European reviews consistently rank EPDM's environmental impact lower than TPO or PVC alternatives, strengthening specification preference in climate-resilient construction. Growing urban heat-island mitigation codes increase demand for reflective roofs, while the material's chemical inertness supports rainwater harvesting and green-roof assemblies. Compatibility with photovoltaic mounting systems further raises adoption prospects in retrofits and new builds that seek combined energy and water performance benefits.

Accelerated EV Production Boosting Seals and Gaskets Demand

Electric-vehicle batteries require gaskets that withstand thermal cycling between -55 °C and +150 °C, remain elastic under vibration, and endure exposure to coolant glycols and fire-retardant additives. EPDM's low compression set protects pack integrity and limits moisture ingress, directly supporting battery warranty targets. Higher-voltage vehicle architectures make dielectric performance critical, and EPDM offers stable insulation in the 800-V systems now moving to mass production. Asia-Pacific remains the epicenter of demand growth due to China's dominant cell manufacturing base and Korea's high-capacity seal producers. Automakers are trialing TPVs to cut weight and aid recyclability, but EPDM still holds the performance edge in under-hood environments where temperatures and chemical exposure exceed TPV limits.

Volatile Crude-Oil-Linked Feedstock Prices

Propylene and ethylene price spikes driven by refinery shutdowns and tight olefin balances erode EPDM profit margins. U.S. polymer-grade propylene spot prices climbed in 2025 on the heels of refinery rationalizations and new polypropylene capacity additions. Asian ethylene values have displayed double-digit percentage swings within months, complicating contract negotiations and inventory planning for tire and gasket producers. Integrated EPDM suppliers with captive crackers partially offset the risk, but merchant producers often absorb margin compression or cede share to substitute materials in cost-sensitive applications.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory 5G Infrastructure Roll-outs Requiring Weather-Resistant Cables

- Hydrogen Fuel-Cell Infrastructure Needs High-Temperature Elastomers

- Competition from Thermoplastic Polyolefin Elastomers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solution polymerization delivered 59.10% of the EPDM market size in 2025 as automakers and roof-membrane fabricators paid premiums for tight molecular-weight control essential to compression-set performance. The process allows precise diene incorporation, giving compounders latitude to tailor cure speed and elasticity for demanding battery gasket profiles. Recent catalyst breakthroughs, such as ARLANXEO's Keltan ACE titanium κ1-amidinate complex, reduce energy consumption, trimming unit production costs without altering downstream compounding recipes.

Slurry/suspension routes, projected to climb at a 4.78% CAGR, are capturing commodity grades for hose and cable insulation as operators retrofit reactors with higher-efficiency agitation systems that cut solvent use. Gas-phase technology remains niche but draws interest for ultra-high molecular-weight grades used in specialty compression seals.

The Ethylene Propylene Diene Monomer (EPDM) Report is Segmented by Manufacturing Process (Solution Polymerization Process, Slurry/Suspension Process, and Gas-Phase Polymerization Process), Application (Automotive, Building and Construction, Manufacturing, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific represented 56.05% of the EPDM market size in 2025, buoyed by Chinese battery-electric vehicle production and Korean capacity expansions such as Kumho Polychem's 220,000-ton site. Regional growth at 4.58% CAGR is supported by ample propylene supply from integrated crackers and steam-cracking complexes, reducing feedstock risk and freight cost. Localization strategies by global seal suppliers shorten lead times for EV manufacturers, creating a virtuous cycle of technical support and demand concentration.

North America's market is growing as Detroit automakers accelerate EV roll-outs and commercial roofing contractors specify EPDM for retrofit energy-efficiency upgrades. Domestic crackers face intermittent propylene tightness, but shale-gas economics continue to encourage olefin investment that promises more stable downstream pricing over the medium term. Federal tax incentives for clean-energy buildings are catalyzing new warehouse roof installations, further underpinning EPDM consumption.

Europe commands a premium application share driven by stringent environmental regulations that favor materials with demonstrated lifecycle benefits. Circular-economy directives encourage in-house devulcanization lines, giving regional compounders a head start in recycled-content EPDM blends. The Middle East and Africa, though smaller, show infrastructure-driven demand recovery, while South America's uptake hinges on petrochemical investment cycles in Brazil and nearby propylene supply. Across all regions, the shift toward higher-voltage power systems and climate-resilient infrastructure favors EPDM's performance attributes, sustaining worldwide consumption even amid feedstock volatility.

- ARLANXEO

- Carlisle Companies Inc.

- Dow

- ENEOS Materials Corporation

- Exxon Mobil Corporation

- Goodyear Rubber Company

- Kumho P&B Chemicals (Kumho Polychem)

- LANXESS

- Lion Elastomers

- Mitsui Chemicals Inc.

- SABIC

- SK geocentric Co., Ltd.

- Versalis S.p.A

- West American Rubber Company LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for EPDM Roofing Membranes in Net-Zero Buildings

- 4.2.2 Accelerated EV Production Boosting Seals and Gaskets Demand

- 4.2.3 Mandatory 5G Infrastructure Rollouts Requiring Weather-Resistant Cables

- 4.2.4 Hydrogen Fuel-Cell Infrastructure Needs High-Temperature Elastomers

- 4.2.5 Circular-Economy Push for EPDM Reclaim and Devulcanization

- 4.3 Market Restraints

- 4.3.1 Volatile Crude-Oil-Linked Feedstock Prices

- 4.3.2 Competition from Thermoplastic Polyolefin Elastomers

- 4.3.3 Carbon-Intensity Scrutiny of Petro-Based Polymers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Manufacturing Process

- 5.1.1 Solution Polymerization Process

- 5.1.2 Slurry/Suspension Process

- 5.1.3 Gas-phase Polymerization Process

- 5.2 By Application

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.3 Manufacturing

- 5.2.4 Electrical and Electronics

- 5.2.5 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Spain

- 5.3.3.7 Turkey

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ARLANXEO

- 6.4.2 Carlisle Companies Inc.

- 6.4.3 Dow

- 6.4.4 ENEOS Materials Corporation

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Goodyear Rubber Company

- 6.4.7 Kumho P&B Chemicals (Kumho Polychem)

- 6.4.8 LANXESS

- 6.4.9 Lion Elastomers

- 6.4.10 Mitsui Chemicals Inc.

- 6.4.11 SABIC

- 6.4.12 SK geocentric Co., Ltd.

- 6.4.13 Versalis S.p.A

- 6.4.14 West American Rubber Company LLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment