|

市场调查报告书

商品编码

1907330

即时定位系统:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Real Time Location System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

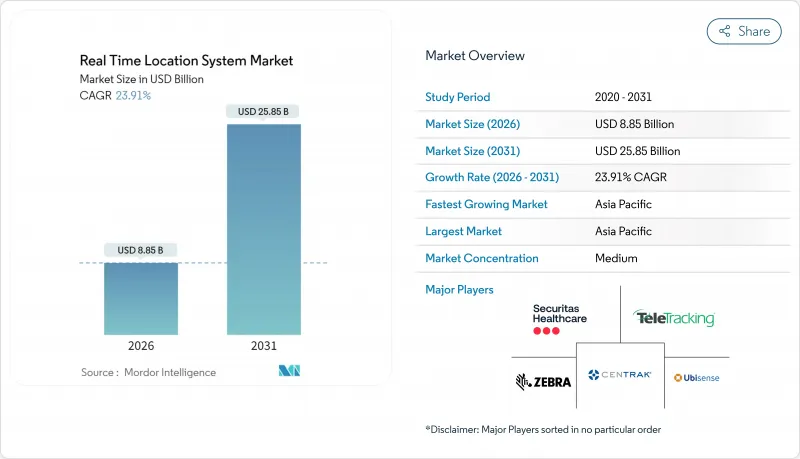

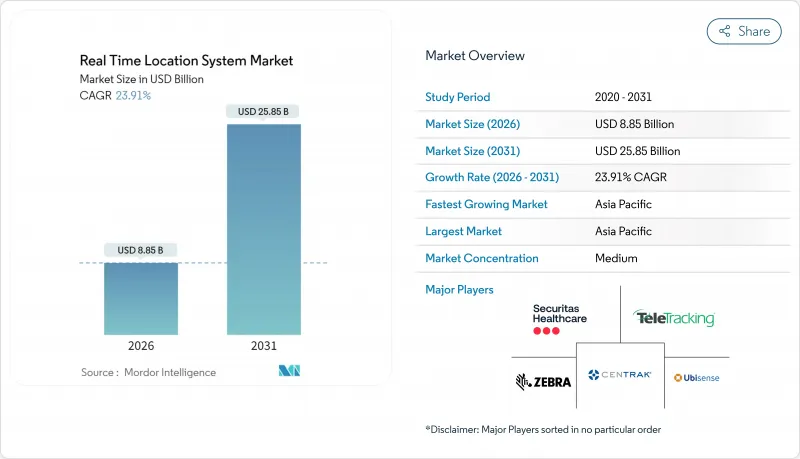

即时定位系统市场预计将从 2025 年的 71.4 亿美元成长到 2026 年的 88.5 亿美元,到 2031 年将达到 258.5 亿美元,2026 年至 2031 年的复合年增长率为 23.91%。

医疗保健行业的强制性要求、超宽频 (UWB) 技术精度的不断提高以及数位双胞胎技术的日益普及,正在推动即时定位系统市场的需求成长,同时,託管服务和云端交付模式正在改变供应商的收入来源。随着终端使用者从被动的资产管理转向预测性的工作流程编排,竞争优势取决于准确性、互通性和网路安全保障。 UWB、低功耗蓝牙 (BLE) 和混合平台的部署选项不断扩展,加上围绕患者安全和职场合规性的监管力度,正在降低采用门槛。随着企业寻求更快实现价值和可扩展的分析能力,资本支出正趋向于软体和咨询领域。

全球即时定位系统市场趋势与洞察

降低成本和优化流程的必要性

医院报告称,光是设备追踪一项每年就能节省近 20 万美元,消除了以往占临床轮班时间 30% 的资产搜寻时间。製造工厂将即时定位系统 (RTLS) 迭加到数位双胞胎仪錶板上,以识别瓶颈并实现预测性维护,从而减少 10% 的停机时间。人工智慧演算法分析即时位置数据,以可视化隐藏的流程浪费,在人手不足的环境下带来可衡量的投资报酬率。这些优势在人事费用上升和供应链波动显着压缩利润率的行业尤为突出,使 RTLS 成为提高效率的策略工具。

医疗领域的快速发展以及对病患安全措施的需求

美国医院协会 (AHA) 预测,到 2032 年,用于病患流程管理、人员精简和感染控制的医疗保健即时定位系统 (RTLS) 的收入将增加四倍。与 RTLS 定位精度相连的紧急按钮可将紧急回应时间缩短 30%。与徽章关联的手部卫生监测可将医疗相关感染减少 40% 以上。法规结构正在加速完善,将 RTLS 定位为关键基础设施,加快预算核准并规范部署方案。基于价值的医疗保健支付模式进一步增强了营运透明度,并将整个 RTLS 产业的财务绩效连结起来。

最终用户的传统基础设施

现有工厂通常使用频宽受限的专有通讯协定,这会阻碍即时定位系统 (RTLS) 的资料流,并迫使企业进行成本高昂的网路升级和分阶段部署。整合复杂性会增加服务支出、延长引进週期,并疏远对预算敏感的产业。云端原生 RTLS 和迭加网路目前为维修提供了一条途径,但只有在进行广泛的 IT 现代化改造后,才能充分发挥其优势。

细分市场分析

到2025年,医疗保健产业将占即时定位系统市场规模的41.62%,巩固其作为支撑生态系统创新关键产业的地位。病患流程仪錶板将位置遥测资料与电子健康记录连接起来,以缩短急诊室的等待时间并改善报销指标。预计在预测期内,交通运输和物流行业将以24.72%的复合年增长率实现最快的收入成长,这主要得益于对最后一公里可视性和低温运输合规性的需求。随着亚太地区工业4.0维修获得政策支持,製造业也将紧跟其后。

受感染控制和人员安全相关法规日益严格的推动,医疗保健产业将占据即时定位系统市场的主要份额,从而持续推动对临床级精准解决方案的需求。同时,物流业者倾向于选择坚固耐用的标籤和低功耗蓝牙信标,以便在货柜和拖车上进行大规模部署。零售商正在利用货架级追踪技术来防止缺货损失,而国防机构则正在试点使用抗欺骗超宽频(UWB)技术的自主集群导航。

截至2025年,硬体在即时定位系统市场占有率中占比40.08%,这主要得益于持续的锚点更新周期和标籤小型化计划。然而,託管服务收入正以28.13%的复合年增长率增长,反映出买家更倾向于将硬体、软体和分析功能捆绑在一起的、基本契约。边缘运算锚点韧体减少了校准工作量,促使整合商转向订阅模式。

目前,硬体创新主要集中在系统晶片超宽频无线电技术并拥有多年电池寿命的BLE 5.3标籤上,而云端协作套件则将原始XYZ数据转化为热图和预测性警报,从而实现跨职能的投资回报率并维持服务续订率。随着中端市场买家的涌入,承包的「即时定位系统即服务」产品正在降低资本支出并缩短谈判週期。

区域分析

到2025年,北美将占据即时定位系统(RTLS)市场43.76%的份额,这主要得益于医疗保健行业的数位化以及符合美国职业安全与健康管理局(OSHA)规定的工人安全法规的实施。美国医疗机构正在采用RTLS来优化基于价值的报销机制,加拿大医院正在将HL7整合位置资料标准化,而墨西哥物流业者则正在投资拖车远端资讯处理技术以提高区域物流密度。

预计到2031年,亚太地区将以22.88%的复合年增长率成长,这主要得益于中国智慧工厂扶持计画(补贴超宽频锚点安装)以及日本汽车製造商将即时追踪技术融入精实生产线。印度正透过公私合营加速医院现代化进程,而韩国则在半导体工厂中整合即时定位系统(RTLS)和私有5G网络,以控制自主堆高机。

在欧洲,由于符合GDPR规范的设计和工业IoT框架,UWB-BLE混合网路的应用正在稳定成长。德国汽车製造商正在素车工厂部署混合UWB-BLE网络,英国国民医疗服务体系(NHS)信託机构正在扩大病患流量管理的试点计画。中东和非洲在石油和天然气行业的安全分区方面已初见成效,南美矿山正在使用RFID技术追踪井下工人,这些都展现了多元化的发展路径。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 降低成本和优化流程的必要性

- 医疗领域的迅速传播和强制性患者安全措施

- UWB 精确和多模态追踪平台的进步

- 与工业4.0数位双胞胎概念的集成

- 人工智慧驱动的位置分析助力超自动化

- 加强对职场安全和接触者追踪合规性的监管

- 市场限制

- 终端用户的传统基础设施

- 隐私和网路安全问题

- 高昂的初始硬体和校准成本

- 高密度物联网环境中的射频干扰风险

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按最终用户行业划分

- 卫生保健

- 製造业

- 零售

- 运输/物流

- 政府和国防部

- 石油和天然气

- 航太航太

- 矿业

- 农业和畜牧业

- 教育

- 饭店和娱乐

- 按组件

- 硬体

- 软体

- 服务

- 整合与咨询

- 透过技术

- RFID(主动式和被动式)

- Wi-Fi

- Bluetooth Low Energy(BLE)

- 超宽频(UWB)

- 红外线 (IR)

- ZigBee

- GPS/GNSS

- 超音波

- 透过使用

- 资产追踪

- 在製品管理

- 员工安全保障

- 患者/居民监测

- 库存和供应链可视性

- 环境与状态监测

- 手部卫生遵从性

- 接触者追踪

- 防盗和防损措施

- 近场行销

- 车辆和车队管理

- 自主平台导航

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Zebra Technologies Corporation

- Ubisense Limited

- Securitas Healthcare LLC(Securitas AB)

- TeleTracking Technologies Inc.

- Savi Technology Inc.

- CenTrak Inc.(Halma plc)

- AiRISTA Flow Inc.

- Midmark Corporation

- IDENTEC SOLUTIONS AG

- Sonitor Technologies AS

- Kontakt.io Inc.

- Alien Technology LLC

- Impinj Inc.

- Stanley Healthcare(Stanley Black & Decker)

- Ekahau Inc.

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company(Aruba Networks)

- Honeywell International Inc.

- Siemens Healthineers AG

- Trimble Inc.

- Quuppa Oy

- BlueIOT Technology Co. Ltd.

第七章 市场机会与未来展望

The Real Time Location System Market is expected to grow from USD 7.14 billion in 2025 to USD 8.85 billion in 2026 and is forecast to reach USD 25.85 billion by 2031 at 23.91% CAGR over 2026-2031.

Healthcare mandates, ultra-wideband (UWB) accuracy gains, and digital-twin rollouts underpin demand expansion in the real time loaction system market, while managed services and cloud delivery models reshape vendor revenue streams. Competitive advantage hinges on precision, interoperability, and cybersecurity assurance as end users migrate from reactive asset handling to predictive workflow orchestration. UWB, Bluetooth Low Energy (BLE), and hybrid platforms widen deployment choices, and regulatory momentum around patient safety and workplace compliance lowers adoption barriers. Capital spending tilts toward software and consulting as enterprises seek quick time-to-value and scalable analytics.

Global Real Time Location System Market Trends and Insights

Need for Cost Reduction and Process Optimisation

Hospitals cite annual savings nearing USD 200,000 from equipment tracking alone, cutting asset search time that once absorbed 30% of clinical shifts . Manufacturing plants overlay RTLS on digital-twin dashboards to flag bottlenecks and enable predictive maintenance that trims downtime by 10%. AI algorithms mine live location data to reveal hidden process waste, delivering measurable ROI in labor-constrained settings. These gains resonate most where payroll inflation and supply-chain volatility squeeze margins, positioning RTLS as a strategic lever for efficiency.

Rapid Adoption in Healthcare and Patient-Safety Mandates

The American Hospital Association expects healthcare RTLS revenue to quadruple by 2032 as systems tackle patient flow, staff duress, and infection control. Panic buttons tied to RTLS precision cut emergency response times by 30%. Hand-hygiene monitoring integrated with badges curbs healthcare-associated infections by more than 40%. Regulatory frameworks increasingly label RTLS as essential infrastructure, accelerating budget approvals and standardizing deployment blueprints. Value-based care payment models further reinforce the link between operational visibility and financial performance within the broader RTLS industry.

Legacy Infrastructure Across End Users

Brown-field factories often run on proprietary protocols with bandwidth limits that choke RTLS data streams, forcing costly network upgrades and phased rollouts. Integration complexity inflates services spend and prolongs deployment cycles, deterring budget-sensitive sectors. Cloud-native RTLS and overlay networks now offer retrofit pathways, but full benefits materialize only after broader IT modernization.

Other drivers and restraints analyzed in the detailed report include:

- Advances in UWB Accuracy and Multi-Modal Tracking Platforms

- Integration with Industry 4.0 Digital-Twin Initiatives

- Privacy and Cyber-Security Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Healthcare generated 41.62% of the real-time location system market size in 2025, reinforcing its role as the anchor vertical that finances ecosystem innovation. Patient flow dashboards tie location telemetry to electronic health records, shortening emergency department wait times and elevating reimbursement metrics. Over the forecast horizon, transportation and logistics will post the steepest revenue climb at a 24.72% CAGR, propelled by last-mile visibility and cold-chain compliance needs. Manufacturing follows as Industry 4.0 retrofits gain policy support in Asia-Pacific.

Healthcare's heavy share of the real-time location system market underscores its regulatory push around infection control and staff safety, creating durable demand for clinical-grade accuracy solutions. Conversely, logistics operators favor ruggedized tags and battery-sipping BLE beacons to scale across containers and trailers. Retailers apply shelf-level tracking to fight out-of-stock losses, while defense agencies pilot autonomous swarm navigation that leans on UWB's resilience to spoofing.

Hardware captured 40.08% of the real-time location system market share in 2025, led by ongoing anchor refresh cycles and tag miniaturization projects. Yet managed services revenue is expanding at 28.13% CAGR, reflecting buyers' preference for outcome-based contracts that bundle hardware, software, and analytics. Edge-ready anchor firmware reduces calibration labor, steering integrators toward subscription models.

Hardware innovation now centers on system-on-chip UWB radios and BLE 5.3 tags with multi-year battery life. Meanwhile, cloud orchestration suites translate raw X-Y-Z data into heatmaps and predictive alerts, unlocking cross-departmental ROI and sustaining services renewal rates. As mid-market buyers enter, turnkey "RTLS-as-a-service" offerings lower capex and shorten negotiation cycles.

The Real-Time Location System (RTLS) Market Report is Segmented by End-User Vertical (Healthcare, Transportation and Logistics, and More), Component (Hardware, Software, Services, and More), Technology (RFID, Wi-Fi, and More), Application (Asset Tracking, Work-In-Process Tracking, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 43.76% of the real-time location system market share in 2025 on the back of extensive healthcare digitization and OSHA-aligned worker safety rules. U.S. providers adopt RTLS to optimize value-based reimbursement, while Canadian hospitals standardize on HL7-integrated location feeds. Logistics carriers across Mexico invest in trailer telematics, widening regional density.

Asia-Pacific is forecast for a 22.88% CAGR through 2031 in the real-time location system (RTLS) market as Chinese smart-factory incentives subsidize UWB anchor installs and Japanese automakers embed real-time tracking in lean production lines. India accelerates hospital modernization via public-private partnerships, while South Korea combines RTLS with private 5G to steer autonomous forklifts in semiconductor fabs.

Europe records steady uptake driven by GDPR-compliant design and industrial IoT frameworks. German automakers deploy hybrid UWB-BLE grids in body-in-white shops, and British NHS trusts expand patient-flow pilots. Middle East and Africa see early wins in oil-and-gas safety zoning, whereas South American miners deploy RFID for underground personnel tracking, signaling diversified growth corridors.

- Zebra Technologies Corporation

- Ubisense Limited

- Securitas Healthcare LLC (Securitas AB)

- TeleTracking Technologies Inc.

- Savi Technology Inc.

- CenTrak Inc. (Halma plc)

- AiRISTA Flow Inc.

- Midmark Corporation

- IDENTEC SOLUTIONS AG

- Sonitor Technologies AS

- Kontakt.io Inc.

- Alien Technology LLC

- Impinj Inc.

- Stanley Healthcare (Stanley Black & Decker)

- Ekahau Inc.

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company (Aruba Networks)

- Honeywell International Inc.

- Siemens Healthineers AG

- Trimble Inc.

- Quuppa Oy

- BlueIOT Technology Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need for cost reduction and process optimisation

- 4.2.2 Rapid adoption in healthcare and patient-safety mandates

- 4.2.3 Advances in UWB accuracy and multi-modal tracking platforms

- 4.2.4 Integration with Industry 4.0 digital-twin initiatives

- 4.2.5 AI-enabled location analytics for hyper-automation

- 4.2.6 Regulatory push for workplace-safety/contact-tracing compliance

- 4.3 Market Restraints

- 4.3.1 Legacy infrastructure across end users

- 4.3.2 Privacy and cyber-security concerns

- 4.3.3 High upfront hardware and calibration costs

- 4.3.4 RF interference risk in dense IoT environments

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End-user Vertical

- 5.1.1 Healthcare

- 5.1.1.1 Major Applications

- 5.1.1.2 Segmentation by Technology

- 5.1.2 Manufacturing

- 5.1.2.1 Major Applications

- 5.1.2.2 Segmentation by Technology

- 5.1.3 Retail

- 5.1.4 Transportation and Logistics

- 5.1.5 Government and Defense

- 5.1.6 Oil and Gas

- 5.1.7 Aerospace and Aviation

- 5.1.8 Mining

- 5.1.9 Agriculture and Livestock

- 5.1.10 Education

- 5.1.11 Hospitality and Entertainment

- 5.1.1 Healthcare

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.2.4 Integration and Consulting

- 5.3 By Technology

- 5.3.1 RFID (Active and Passive)

- 5.3.2 Wi-Fi

- 5.3.3 Bluetooth Low Energy (BLE)

- 5.3.4 Ultra-Wideband (UWB)

- 5.3.5 Infrared (IR)

- 5.3.6 ZigBee

- 5.3.7 GPS / GNSS

- 5.3.8 Ultrasound

- 5.4 By Application

- 5.4.1 Asset Tracking

- 5.4.2 Work-in-Process Tracking

- 5.4.3 Personnel Safety and Security

- 5.4.4 Patient / Resident Monitoring

- 5.4.5 Inventory and Supply-Chain Visibility

- 5.4.6 Environmental and Condition Monitoring

- 5.4.7 Hand-Hygiene Compliance

- 5.4.8 Contact Tracing

- 5.4.9 Theft and Loss Prevention

- 5.4.10 Proximity-Based Marketing

- 5.4.11 Vehicle and Fleet Management

- 5.4.12 Autonomous-Platform Navigation

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Israel

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Turkey

- 5.5.5.1.5 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Zebra Technologies Corporation

- 6.4.2 Ubisense Limited

- 6.4.3 Securitas Healthcare LLC (Securitas AB)

- 6.4.4 TeleTracking Technologies Inc.

- 6.4.5 Savi Technology Inc.

- 6.4.6 CenTrak Inc. (Halma plc)

- 6.4.7 AiRISTA Flow Inc.

- 6.4.8 Midmark Corporation

- 6.4.9 IDENTEC SOLUTIONS AG

- 6.4.10 Sonitor Technologies AS

- 6.4.11 Kontakt.io Inc.

- 6.4.12 Alien Technology LLC

- 6.4.13 Impinj Inc.

- 6.4.14 Stanley Healthcare (Stanley Black & Decker)

- 6.4.15 Ekahau Inc.

- 6.4.16 Cisco Systems Inc.

- 6.4.17 Hewlett Packard Enterprise Company (Aruba Networks)

- 6.4.18 Honeywell International Inc.

- 6.4.19 Siemens Healthineers AG

- 6.4.20 Trimble Inc.

- 6.4.21 Quuppa Oy

- 6.4.22 BlueIOT Technology Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment