|

市场调查报告书

商品编码

1910427

雷达感测器:市场份额分析、产业趋势与统计、成长预测(2026-2031)Radar Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

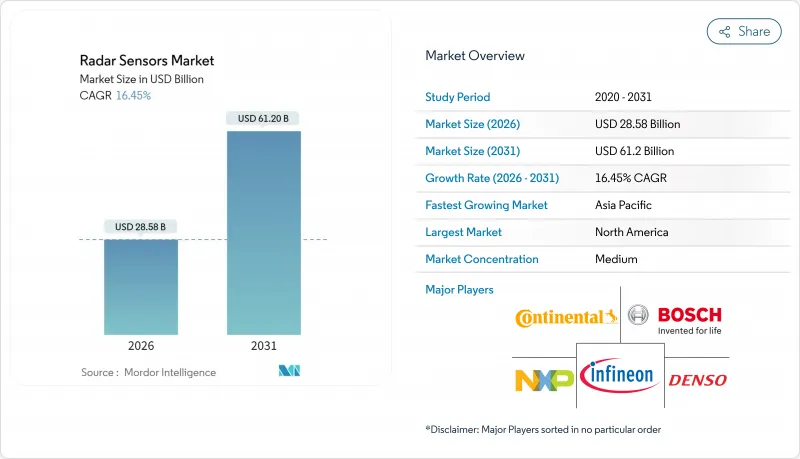

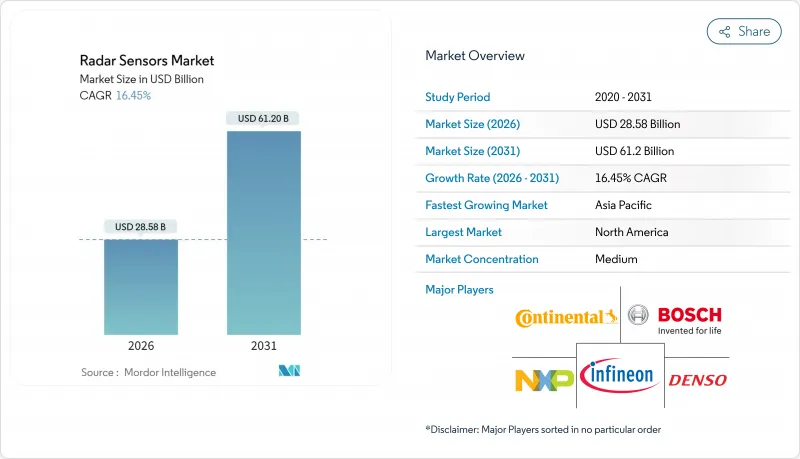

预计雷达感测器市场将从 2025 年的 245.4 亿美元成长到 2026 年的 285.8 亿美元,到 2031 年将达到 612 亿美元,2026 年至 2031 年的复合年增长率为 16.45%。

这项快速扩张反映了该技术正从国防应用领域转型为汽车安全、工业自动化、无人机测绘和智慧基础设施专案等大批量应用领域。欧盟通用安全法规(GDPR)等安全法规的出台,例如强制要求新车配备基于77-81 GHz雷达的自动紧急煞车系统,正在推动该技术的应用。供应方面的驱动因素包括价格合理的毫米波晶片组和氮化镓功率元件,这些元件在提高测距解析度的同时,还能降低尺寸、重量和功耗。亚太地区强劲的军事现代化、欧洲5G道路计划的扩展以及全球范围内气候适应型气象雷达网路的建设,都进一步推动了潜在需求。近期面临的挑战主要集中在10 GHz以下频宽的频谱拥塞、成像阵列校准成本以及由于中国占据98%的镓产量份额而导致的镓供应风险。

全球雷达感测器市场趋势与洞察

汽车安全系统中77-81 GHz雷达的应用日益广泛

监管机构和汽车製造商建议使用77-81 GHz频段,相比传统的24 GHz设备,具有更远的探测距离和更高的角度分辨率。大陆集团的ARS640雷达侦测距离超过300米,能够进行适用于L2+级自动驾驶的物体分类。中国工业和资讯化部于2022年暂停核准新的24 GHz雷达,迫使国内汽车製造商转向此频段。博世也扩大了在摩托车领域的业务,为KTM摩托车配备了探测距离达210公尺的雷达,实现了主动车距控制巡航系统和盲点警告功能。这些发展正在推动各类车辆稳定采用雷达感测器,并促进雷达感测器市场的成长。

无人机地形测绘对紧凑型成像雷达的需求激增

多旋翼无人机采用轻型合成孔径雷达,即使在光学载重失效的植被和云层区域,也能产生亚米级高程模型。研究表明,72.73%的矿场探勘任务优先选择多旋翼无人机而非直升机平台,在提高空间解析度的同时,还能降低60%的测量成本。美国地质调查局的移动雷达站可在野火发生后数分钟内采集降雨径流数据,进而助力紧急应变。这些成功案例正在推动高频宽晶片组和机载处理技术的研发投入,进而促进雷达感测器市场的扩张。

10 GHz 以下频宽频率分配的限制

雷达开发人员与通讯业者和卫星营运商争夺10GHz以下的有限频谱资源。美国营运120多部3GHz以下的雷达,限制了民用频率重复使用的潜力。为了符合国际法规,联邦通讯委员会(FCC)近期收紧了24GHz频段的带频宽限制,迫使厂商对设计进行修改。认证流程可能长达九个月,导致产品发布延迟,并在短期内限制雷达感测器市场的发展。

细分市场分析

到2025年,非成像设备将占总收入的70.35%,这表明它们在泊车辅助和基础自适应巡航控制领域已被广泛应用。然而,随着L2级及以上自动驾驶技术的日益普及,影像解决方案预计到2031年将以18.12%的复合年增长率成长。恩智浦半导体(NXP)和sinPro的48通道入门4D单元可提供1度方位角和每帧2000个点云,这标誌着高解析度感知技术的广泛应用。影像功能使自动煞车系统能够识别行人和道路标誌,从而将OEM厂商的应用范围扩展到豪华车以外的领域。预计到2031年,支援成像功能的雷达感测器市场规模将达到197.6亿美元,这将推动软体定义车辆预算的成长。同时,在识别精度要求不高的领域,例如送货机器人、堆高机碰撞警报和降雨量估算,成本优化的非成像类别仍将保持其主导地位。製造商们正在提供结合简单 FMCW晶粒和封装天线设计的产品,以降低组件成本并维持雷达感测器市场的成长。

目前,竞争性蓝图将嵌入式讯号处理与边缘AI加速相结合,以降低延迟。大陆集团的ARS640整合了神经网路滤波,透过即时识别弱势道路使用者来提升功能安全指标。在材料方面,硅锗前端对现有的砷化镓(GaAs)元件构成挑战,使得大规模生产的晶粒价格低于10美元。这项成本优势支持中端车辆成像性能的逐步提升,并为雷达感测器进入Scooter和微型出行领域铺平了道路。

77-81 GHz频宽在传输损耗和天线孔径面积之间实现了最佳平衡,预计将占2025年收入的42.55%。此频宽能够在250公尺范围内实现车辆探测,同时保持成本效益。欧洲、中国和北美地区的监管协调简化了认证流程,扩大了雷达感测器市场。意法半导体(STMicroelectronics)的77 GHz收发器在冰雪和泥泞环境中仍能保持性能,证明其适用于恶劣环境下的路侧设备。在94 GHz以上频段,超宽频通道可实现亚厘米级分辨率,用于路面裂缝监测和医疗微多普勒成像。随着晶圆级氮化镓(GaN)功率放大器技术的成熟,预计到2031年,94 GHz以上频段的出货量将成长两倍以上,复合年增长率(CAGR)将达到21.25%。

10 GHz 以下的频宽正面临饱和,迫使开发人员转向更高的频宽。中国已暂停核准新的 24 GHz 车载雷达,加速了全球频段的迁移。短程 60 GHz 设备在车内感知、人员侦测和手势控制方面表现出色。德克萨斯(TI) 的单晶片雷达无需摄影机即可将儿童存在侦测的准确率提高到 98%。包含 24 GHz 角落单元、77 GHz 前单元和 60 GHz 车内单元的复杂多频段配置,正在从多个层面拓展雷达感测器市场。

区域分析

北美地区在2024年仍将是最大的区域贡献者,这主要得益于先进驾驶辅助系统和大规模国防升级的普及。然而,镓供应风险威胁着美国6,020亿美元的经济产出,促使政策制定者推动氮化镓外延和废料回收的在地化(csis.org)。儘管美国因认证延迟而面临减缓商业部署的挑战,但加拿大正在扩大其汽车雷达测试设施,而墨西哥则受益于一级供应商生产线的近岸外包。

由于统一的安全法规和大规模的智慧道路投资,欧洲预计在未来将实现最高的复合年增长率。欧盟自动紧急煞车系统(AEB)强制要求所有车型统一安装感知器,各国道路管理机构也正在部署雷达进行壅塞分析。英国smartmicro公司已交付超过1,000个路侧单元,展现了其强大的市场整合能力(smartmicro.com)。供应链回流有助于缓解半导体短缺问题,而5G走廊正在同步整合雷达和V2X信标。

亚太地区正在推动国防和气象领域的支出成长。日本的AN/SPY-7飞弹部署和韩国的L-SAM II计划就是高预算专案推动国内氮化镓(GaN)代工厂发展的典型例子。中国将汽车雷达频率从24GHz转向77GHz的政策转变,正加速本土OEM厂商的转型。印度价值5000万美元的气象雷达订单表明,公共部门对精准气象监测的需求强劲。这些共同努力正在将雷达感测器市场从消费移动领域拓展到更广泛的应用领域。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 77-81GHz雷达在汽车安全系统的应用日益广泛

- 无人机地形测绘对紧凑型成像雷达的需求激增

- 亚太地区军方加大对主动相控阵雷达(AESA雷达)的投入

- 工业机器人对用于避障的毫米波感测器的需求日益增长

- 促进欧洲智慧高速公路和交通监控雷达的基础建设

- 气候变迁促使多普勒天气雷达在沿海地区得到更广泛的应用

- 市场限制

- 10 GHz 以下频段频率分配的限制

- 成像雷达阵列的高品质维护和维修成本

- 高功率毫米波晶片组的温度控管挑战

- 零售业3D行人追踪雷达的资料隐私问题

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 成像雷达

- 非成像雷达

- 按频段

- 10 GHz 以下(HF/UHF/ L波段)

- 24 GHz ISM频段

- 60-64 GHz

- 77-81 GHz

- 94 GHz 或更高

- 按范围

- 短程雷达感测器(小于30公尺)

- 中程雷达感测器(30-150公尺)

- 远程雷达感测器(超过150公尺)

- 透过技术

- 脉衝雷达

- 调频连续波(FMCW)雷达

- 相位阵列/AESA雷达

- 数位调变与MIMO雷达

- 最终用户

- 车

- 航太/国防

- 安防监控(固定和移动)

- 工业自动化与机器人

- 环境和气象监测

- 交通监控和智慧基础设施

- 医疗和护理机构

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、资金筹措、合作)

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- Continental AG

- Infineon Technologies AG

- NXP Semiconductors NV

- Denso Corporation

- Hella GmbH and Co. KGaA

- Veoneer Inc.

- STMicroelectronics NV

- Texas Instruments Incorporated

- Analog Devices Inc.

- Renesas Electronics Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Valeo SA

- Hitachi Astemo Ltd.

- Smart Microwave Sensors GmbH

- InnoSenT GmbH

- Baumer Group

- Banner Engineering Corp.

- Lockheed Martin Corporation

- Raytheon Technologies Corp.

- Northrop Grumman Corp.

- Thales Group

- Honeywell International Inc.

第七章 市场机会与未来展望

The radar sensor market is expected to grow from USD 24.54 billion in 2025 to USD 28.58 billion in 2026 and is forecast to reach USD 61.2 billion by 2031 at 16.45% CAGR over 2026-2031.

The rapid scaling reflects the technology's migration from exclusive defense use to high-volume automotive safety, industrial automation, drone mapping, and smart infrastructure programs. Adoption is propelled by safety regulations such as the European Union General Safety Regulation, which mandates automatic emergency braking using 77-81 GHz radar in new vehicles. Supply-side catalysts include affordable millimeter-wave chipsets and gallium-nitride power devices that enhance range resolution while lowering size, weight, and power requirements. Robust military modernization in Asia-Pacific, expanding 5G-enabled road projects in Europe, and climate-resilient weather radar networks worldwide deepen addressable demand. Near-term challenges center on below-10 GHz spectrum congestion, calibration expenses for imaging arrays, and gallium supply risks stemming from China's 98% production dominance.

Global Radar Sensors Market Trends and Insights

Increasing adoption of 77-81 GHz radars in automotive safety systems

Regulators and automakers endorse 77-81 GHz because it delivers longer detection ranges and sharper angular resolution than legacy 24 GHz devices. Continental's ARS640 exceeds 300 m range and enables object classification fit for Level 2+ autonomy. China's Ministry of Industry and Information Technology halted new 24 GHz radar approvals in 2022, compelling local OEMs to shift frequency bands. Bosch extended the band to motorcycles, equipping KTM bikes with 210 m range radar for adaptive cruise and blind-spot warning. These developments reinforce steady sensor penetration across vehicle classes, underpinning radar sensor market growth.

Surging demand for compact imaging radars in drone-based terrain mapping

Multirotor drones use lightweight synthetic-aperture radars to generate sub-meter elevation models even in vegetation or cloud cover where optical payloads fail. Research shows 72.73% of mining exploration missions now favor multirotor over helicopter platforms, cutting survey cost by 60% while improving spatial granularity. The U.S. Geological Survey's mobile radar observatory captures rainfall-runoff data minutes after wildfires, supporting emergency response. Such proof points fuel R&D investment in higher-bandwidth chipsets and on-board processing, broadening the radar sensor market.

Spectrum allocation constraints in sub-10 GHz bands

Radar developers compete with telecom and satellite operators for scarce sub-10 GHz slots. The U.S. Department of Defense runs more than 120 radars below 3 GHz, limiting civilian spectrum re-farm potential. The FCC recently tightened 24 GHz out-of-band limits to satisfy global rulings, forcing design changes. Certification queues can stretch nine months, delaying product launches and curbing near-term radar sensor market adoption.

Other drivers and restraints analyzed in the detailed report include:

- Rising military spend on AESA radars in Asia-Pacific

- Growing need for mm-wave sensors in industrial robot collision avoidance

- High calibration & maintenance cost of imaging radar arrays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-imaging devices represented 70.35% of 2025 revenue, illustrating entrenched use in parking assistance and basic adaptive cruise. Imaging solutions, however, are forecast to post an 18.12% CAGR through 2031 as Level 2+ autonomy proliferates. NXP and sinPro's 48-channel entry-level 4D unit reaches 1-degree azimuth and 2,000 point clouds per frame, signaling democratization of high-resolution perception. Imaging capability lets automated brakes distinguish pedestrians from roadside signs, pushing OEM fitment beyond luxury trims. The radar sensor market size for imaging-enabled modules is projected to reach USD 19.76 billion by 2031, capturing escalating software-defined vehicle budgets. Conversely, the cost-optimized non-imaging category retains dominance in delivery robots, forklift collision alerts, and rainfall estimation where identification finesse is less critical. Manufacturers bundle simple FMCW dies with antenna-in-package designs to lower bill-of-material cost and sustain the wider radar sensor market.

Competitive roadmaps now combine embedded signal processors with edge AI acceleration to shrink latency. Continental's ARS640 integrates neural network filtering to classify vulnerable road users in real time, raising functional safety metrics. On the materials side, silicon germanium front-ends challenge GaAs incumbents, promising sub-USD 10 die price at high volumes. This cost curve supports incremental imaging upgrades in mid-segment cars and paves the way for radar sensor market penetration in scooters and micro-mobility.

The 77-81 GHz tier held 42.55% 2025 revenue due to a sweet spot between path loss and antenna aperture, enabling 250 m automotive detection while remaining cost-effective. Regulatory harmonization in Europe, China, and North America cut certification complexity and boosted the radar sensor market. STMicroelectronics' 77 GHz transceiver sustains performance in snow or dirt, validating use in harsh roadside units. Above 94 GHz, ultra-wideband channels achieve sub-centimeter resolution prized in pavement crack monitoring and medical micro-Doppler imaging. With a 21.25% CAGR, >=94 GHz shipments are set to more than triple by 2031 as wafer-scale GaN power amplifiers mature.

Spectrum below 10 GHz faces saturation, pushing developers to migrate upward. China no longer approves new 24 GHz automotive radars, accelerating global pivot. Short-range 60 GHz gear excels in cabin sensing, occupancy detection, and gesture control; Texas Instruments' single-chip radar improves child presence alert accuracy to 98% without cameras. Blended multi-band architectures deploy 24 GHz corners, 77 GHz front units, and 60 GHz interiors, expanding the radar sensor market across multiple tiers.

The Radar Sensor Market is Segmented by Type (Imaging Radar, Non-Imaging Radar), Frequency Band (More Than 10 GHz, 24 GHz ISM Band, and More), Range (Short-Range Radar Sensor, Medium-Range Radar Sensor, and More), Technology (Pulsed Radar, Phased-Array / AESA Radar, and More), End-User and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest regional contributor in 2024, supported by advanced driver-assistance deployment and sizable defense upgrades. Gallium supply risk, however, threatens USD 602 billion of U.S. economic output, pushing policymakers to localize GaN epitaxy and recycle scrap csis.org. The United States also grapples with certification delays that slow civilian rollouts, while Canada scales automotive radar test facilities and Mexico benefits from near-shoring Tier-1 production lines.

Europe posts the highest forward CAGR due to unified safety laws and expansive smart-road investments. The EU's AEB mandate ensures uniform sensor installation across vehicle classes, while national road agencies deploy radar for congestion analytics. smartmicro UK surpassed 1,000 roadside units, illustrating integrator momentum smartmicro.com. Supply-chain reshoring counters semiconductor scarcity, and 5G corridors embed radar hand-in-hand with V2X beacons.

Asia-Pacific leads defense and weather spending. Japan's AN/SPY-7 roll-out and South Korea's L-SAM II project typify high-budget programs driving domestic GaN foundry growth. China's policy shift away from 24 GHz automotive radar accelerates migration to 77 GHz across local OEM plants. India's USD 50 million weather radar order demonstrates public-sector appetite for precision meteorology. Collectively, these initiatives expand the radar sensor market beyond consumer mobility.

- Robert Bosch GmbH

- Continental AG

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Denso Corporation

- Hella GmbH and Co. KGaA

- Veoneer Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Analog Devices Inc.

- Renesas Electronics Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Valeo SA

- Hitachi Astemo Ltd.

- Smart Microwave Sensors GmbH

- InnoSenT GmbH

- Baumer Group

- Banner Engineering Corp.

- Lockheed Martin Corporation

- Raytheon Technologies Corp.

- Northrop Grumman Corp.

- Thales Group

- Honeywell International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of 77-81 GHz Radars in Automotive Safety Systems

- 4.2.2 Surging Demand for Compact Imaging Radars in Drone-based Terrain Mapping

- 4.2.3 Rising Military Spend on Active Electronically Scanned Array (AESA) Radars in Asia-Pacific

- 4.2.4 Growing Need for mm-Wave Sensors in Industrial Robot Collision Avoidance

- 4.2.5 Infrastructure Push for Smart Highways and Traffic-Monitoring Radars in Europe

- 4.2.6 Climate-change-driven Uptake of Doppler Weather Radars in Coastal Regions

- 4.3 Market Restraints

- 4.3.1 Spectrum Allocation Constraints in Sub-10 GHz Bands

- 4.3.2 High Calibration and Maintenance Cost of Imaging Radar Arrays

- 4.3.3 Thermal Management Challenges in High-power mm-Wave Chipsets

- 4.3.4 Data-privacy Concerns Over 3-D People-tracking Radars in Retail

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Threat of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Imaging Radar

- 5.1.2 Non-Imaging Radar

- 5.2 By Frequency Band

- 5.2.1 Less than 10 GHz (HF/UHF/L-Band)

- 5.2.2 24 GHz ISM Band

- 5.2.3 60-64 GHz

- 5.2.4 77-81 GHz

- 5.2.5 94 GHz and Above

- 5.3 By Range

- 5.3.1 Short-range Radar Sensor (less than 30 m)

- 5.3.2 Medium-range Radar Sensor (30-150 m)

- 5.3.3 Long-range Radar Sensor ( greater than 150 m)

- 5.4 By Technology

- 5.4.1 Pulsed Radar

- 5.4.2 Frequency-Modulated Continuous-Wave (FMCW) Radar

- 5.4.3 Phased-Array / AESA Radar

- 5.4.4 Digital Modulation and MIMO Radar

- 5.5 By End-User

- 5.5.1 Automotive

- 5.5.2 Aerospace and Defense

- 5.5.3 Security and Surveillance (Fixed and Mobile)

- 5.5.4 Industrial Automation and Robotics

- 5.5.5 Environment and Weather Monitoring

- 5.5.6 Traffic Monitoring and Smart Infrastructure

- 5.5.7 Healthcare and Assisted-Living

- 5.5.8 Other End-Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 Infineon Technologies AG

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 Denso Corporation

- 6.4.6 Hella GmbH and Co. KGaA

- 6.4.7 Veoneer Inc.

- 6.4.8 STMicroelectronics N.V.

- 6.4.9 Texas Instruments Incorporated

- 6.4.10 Analog Devices Inc.

- 6.4.11 Renesas Electronics Corporation

- 6.4.12 Aptiv PLC

- 6.4.13 ZF Friedrichshafen AG

- 6.4.14 Valeo SA

- 6.4.15 Hitachi Astemo Ltd.

- 6.4.16 Smart Microwave Sensors GmbH

- 6.4.17 InnoSenT GmbH

- 6.4.18 Baumer Group

- 6.4.19 Banner Engineering Corp.

- 6.4.20 Lockheed Martin Corporation

- 6.4.21 Raytheon Technologies Corp.

- 6.4.22 Northrop Grumman Corp.

- 6.4.23 Thales Group

- 6.4.24 Honeywell International Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment