|

市场调查报告书

商品编码

1910432

包装薄膜:市占率分析、产业趋势与统计、成长预测(2026-2031)Packaging Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

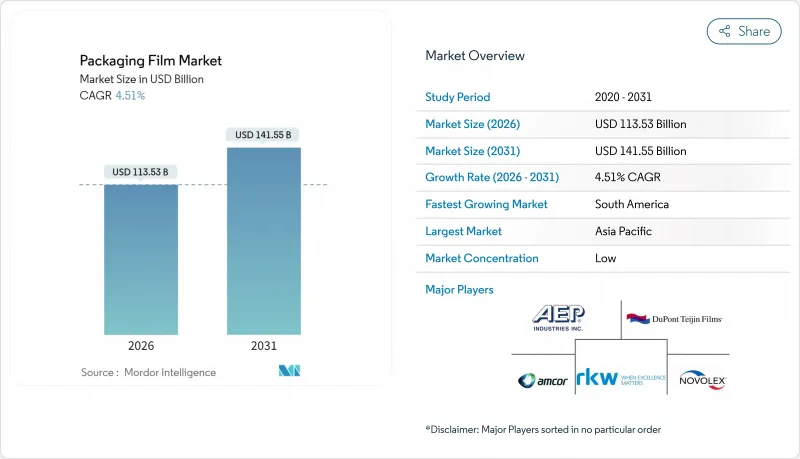

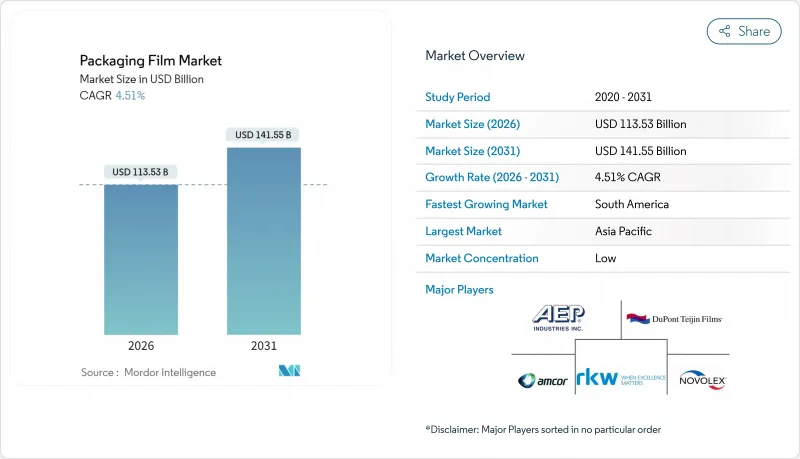

2025年包装薄膜市值为1,086.3亿美元,预计从2026年的1135.3亿美元成长到2031年的1,415.5亿美元,在预测期(2026-2031年)内复合年增长率为4.51%。

对轻量化电商运输材料的需求不断增长、欧洲日益严格的回收法规以及亚太地区新兴经济体低温运输的快速扩张,共同支撑着该行业的稳步增长势头。多层阻隔技术创新、抗菌母粒和化学再生原料等方面的合作协议,为高端细分市场提供了支持,而策略併购则进一步凸显了全球领先加工商之间的规模优势。

全球包装薄膜市场趋势与洞察

电子商务的快速成长推动了对轻型运输薄膜的需求。

随着小包裹数量的成长,品牌商正致力于开发更轻薄的运输包装,在保持抗摔性能的同时,将体积重量降低高达30%。 PAC Worldwide的Eco PAC封套系统实现了运输信封的自动化,降低了履约中心的人事费用,在成本效益和回收目标之间实现了平衡。双层密封的宅配袋为逆向物流专案提供了支持,而逆向物流对于维繫客户忠诚度至关重要。快速製作的图形利用数位印刷技术,能够实现主题促销活动,从而增强品牌互动,并避免高昂的製版成本。这些因素共同作用,使包装薄膜市场成为全球零售业数位化的主要受益者之一。

欧盟推广单一材料再生薄膜

《包装及包装废弃物法规》要求到2030年,塑胶食品包装的再生材料含量必须达到30%,并且完全可回收,这加速了向聚烯单层复合材料的过渡。 Mopac公司经认证的80%再生聚乙烯(rPE)结构已展现出商业性可行性,加工商正在实施脱墨和清洁系统以促进合规。生产者延伸责任制(EPR)成本推高了材料成本,促使企业采用闭合迴路回收设计。随着法规期限的临近,包装薄膜市场正在采用兼顾性能和可回收性的标准设计规则。

北美和欧洲的塑胶禁令和课税

一次性产品课税和 PFAS 禁令迫使企业快速修订产品规格,这给中型工厂的研发预算带来了压力,并延长了客户的认证週期。由于各品牌需要应对旧式层压板在不同地区的淘汰期限,因此政策执行的不均衡也使库存计划变得更加复杂。

细分市场分析

聚乙烯凭藉其优异的成本绩效和多功能加工性能,预计到2025年将维持42.10%的包装薄膜市占率。高密度聚乙烯将用于半硬质包装,而低密度聚乙烯(LDPE)和线性低密度聚乙烯(LLDPE)将主导吹膜应用。受政策趋势和品牌承诺加强的推动,生质塑胶预计到2031年将维持7.75%的强劲复合年增长率。假设原料规模化生产成功,生质塑胶包装薄膜市场预计10年将达到数十亿美元。双向拉伸聚丙烯具有极具竞争力的透明度和刚性,适用于高端糖果甜点包装。聚对苯二甲酸乙二醇酯(PET)层为蒸馏应用提供尺寸稳定性,并通常与氧化铝涂层结合使用,以实现高气体阻隔性能。化学回收技术的进步使得闭合迴路聚乙烯(PE)的性能能够与原生原料相媲美,其中硅酸钛触媒技术目前处于中试阶段。嵌段共聚物聚乳酸(PLA)的创新降低了脆性,为生鲜食品包装袋提供了80%生物基的替代方案。

聚乙烯加工商正投资茂金属催化剂以提高密封渗透性能,这对于高速成型-填充-封口生产线至关重要。包装薄膜市场力求在成本效益和永续性之间取得平衡,传统製造商在维持产量的同时,特种生物聚合物也在努力满足不断变化的监管要求和消费者偏好。

多层结构透过各层的功能性优化机械、光学和阻隔性能,预计到2025年将占销售额的56.20%。随着医药物流和蒸馏食品对长期储存的需求日益增长,含有EVOH或AlOx层的阻隔层压板正以6.14%的复合年增长率快速扩张。同时,单层薄膜在需要简化回收流程的化学成分的领域仍然发挥着重要作用,尤其是在北美地区的店内回收领域。

共挤出机增加了在线连续拉伸单元,用于生产沿着机器方向取向的聚乙烯(PE)复合材料,在满足可回收性要求的同时,保持了抗穿刺性能。奈米黏土分散体在相同厚度下可氧气透过率降低60%,为製造更薄的壁厚铺平了道路。层厚扫描仪提高了轮廓精度,并最大限度地减少了启动废弃物,提高了产量比率,直接转化为包装薄膜市场参与企业盈利。

区域分析

预计到2025年,亚太地区将维持37.00%的包装薄膜市场份额,这得益于其丰富的树脂供应、具有竞争力的劳动力和庞大的消费群。中国新的过度包装法规GB/T 31268-2024推动了对符合小包裹重量限制的超轻包装袋的需求。泰国和印尼正在协调食品接触法规,规范检测通讯协定,并推动本地挤出技术的进步。印度企业,例如JPFL Films,已新增6万吨年双向拉伸聚丙烯(BOPP)薄膜产能,以抓住国内和出口机会。日本和韩国正在推动阻隔涂层的研究与开发,而澳洲则致力于提高消费后回收材料的使用率。

欧洲正面临一场变革性的投资週期,以满足聚丙烯废料(PPWR)的可再生和再生材料含量标准。康斯坦蒂亚柔性包装公司(Constantia Flexibles)收购Aluflexpack后,整合了铝箔加工技术,并巩固了其在东南亚的地位。各品牌正在引进QR码的消费后处理说明,以提高回收产品的纯度。英国和德国已试验设立化学回收投放点,推动了再生聚乙烯(rPE)的整合。

北美拥有成熟的电子商务网路和日趋明朗的政策。 PFAS(全氟烷基物质)的禁用日期促使加工商转向使用金属化双向拉伸聚丙烯(BOPP)和氧化铝聚对苯二甲酸乙二醇酯(AlOx PET)。加拿大凭藉其原料成本优势,继续保持领先出口国的地位。墨西哥的工厂既供应国内零食市场,也供应美国南部价值链。

到2031年,南美洲将以7.60%的复合年增长率实现最快增速,主要得益于高阻隔薄膜需求的农产品出口。 OPP FILM COLOMBIA和GDM Plasticos的投资将扩大双向拉伸聚丙烯(BOPP)和共混聚丙烯(CPP)的生产基地。区域性资助机构将支持生态设计研究所,使其成为包装薄膜市场的新成长点。

预计中东和非洲地区将出现强劲的两位数销售成长,主要得益于都市区零售业的扩张。沙乌地阿拉伯和阿拉伯联合大公国推出了可再生塑胶强制性规定,以指导采购选择;而南非成熟的加工商则以成本优化的产品服务于更广泛的非洲大陆市场。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务的快速成长推动了对轻型运输薄膜的需求。

- 欧盟推广单一材料可回收薄膜

- 新兴亚太地区低温运输包装食品的成长

- 数位印刷技术可实现小批量个人化包装。

- 肉类膜用抗菌添加剂母粒

- 食品级再生聚乙烯(rPE)化工再生原料供应合约

- 市场限制

- 北美和欧洲的塑胶禁令/课税

- 原生树脂价格波动

- 生物基薄膜的阻隔性能极限

- 超薄膜导致转换器停机

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 依材料类型

- 聚乙烯

- 高密度聚苯乙烯(HDPE)

- 低密度聚乙烯(LDPE)

- 线型低密度聚乙烯(LLDPE)

- 聚丙烯

- 聚酯纤维(双向拉伸聚酯薄膜)

- 生质塑胶

- 其他材料类型

- 聚乙烯

- 透过薄膜结构

- 单层

- 多层结构(2-3层)

- 多层阻隔结构(3层或以上)

- 透过使用

- 食品/饮料

- 药品和医疗保健

- 个人护理和化妆品

- 消费耐久财和电子产品

- 工业和机构

- 农业和园艺

- 其他应用

- 特定用途的格式

- 袋子和小袋

- 包装膜和封盖膜

- 标籤和封套

- 泡壳和袋装包装

- 收缩膜和拉伸膜

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 新加坡

- 马来西亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor plc

- Sealed Air Corporation

- Mondi plc

- Jindal Poly Films Ltd

- Cosmo Films Ltd

- Uflex Ltd

- Huhtamaki Oyj

- ProAmpac Holdings

- Novolex Holdings

- AEP Industries

- RKW SE

- Toray Plastics

- Coveris Holdings

- Sigma Plastics Group

- SRF Limited

- Klockner Pentaplast

- Taghleef Industries

- Polyplex Corporation

- Transcontinental Inc.

- Dupont Teijin Films

第七章 市场机会与未来展望

The packaging film market was valued at USD 108.63 billion in 2025 and estimated to grow from USD 113.53 billion in 2026 to reach USD 141.55 billion by 2031, at a CAGR of 4.51% during the forecast period (2026-2031).

Heightened demand for lightweight e-commerce shipping materials, stricter European recyclability rules, and rapid cold-chain expansion in emerging Asia-Pacific economies sustain steady momentum. Multilayer barrier innovations, antimicrobial masterbatches, and chemical-recycling feedstock agreements underpin premium growth niches, while strategic mergers accentuate scale advantages among the top global converters.

Global Packaging Film Market Trends and Insights

E-commerce Boom Driving Demand for Lightweight Shipping Films

Parcel-volume growth pushes brands to down-gauge shipping packs, trimming dimensional weight by up to 30% while preserving drop resistance. PAC Worldwide's Eco PAC jacket system automates mailer conversion and reduces labor at fulfillment centers, aligning cost efficiency with recyclability goals. Dual-seal courier bags support reverse-logistics programs that are integral to customer loyalty. Short-run graphics tap digital presses for thematic promotions that strengthen brand engagement and circumvent high plate charges. These factors collectively reinforce the packaging film market as a core beneficiary of global retail digitization.

EU Push for Mono-Material Recyclable Films

The Packaging and Packaging Waste Regulation obligates 30% recycled content in plastic food packs by 2030 and requires full recyclability, accelerating the shift toward polyolefin-only laminates. Mopack's certified structures with 80% rPE validate commercial readiness, while converters install de-inking and wash systems to secure compliance. Extended Producer Responsibility fees become a material cost lever that favors designs enabling closed-loop recovery. As compliance deadlines approach, the packaging film market adopts standardized design rules that harmonize performance with recyclability.

Plastic Bans/Taxes in North America and Europe

Single-use levies and PFAS prohibitions force rapid specification overhaul, stretching R&D budgets at mid-sized plants and lengthening customer qualification cycles. Fragmented policy rollouts complicate inventory planning as brands juggle differing regional cutoffs for legacy laminates.

Other drivers and restraints analyzed in the detailed report include:

- Cold-Chain Packaged Food Growth in Emerging Asia-Pacific

- Digital Printing Enabling Short-Run Personalised Packs

- Volatile Virgin-Resin Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene preserves 42.10% share of the packaging film market in 2025, riding its favorable price-performance profile and broad processability. High-density grades serve semi-rigid uses while LDPE and LLDPE underpin the bulk of blown-film applications. Bioplastics post a robust 7.75% CAGR through 2031 as policy signals and brand pledges intensify. The packaging film market size for bioplastic variants is projected to reach multi-billion USD territory by decade-end, provided feedstock scaling continues apace. Polypropylene's biaxially oriented formats compete on clarity and stiffness for premium confectionery. PET layers ensure dimensional stability in retort applications, often coupled with aluminum-oxide coatings for a high gas barrier. Chemical-recycling advances promise closed-loop PE that matches virgin properties, with titanosilicate catalysis now at pilot scale. Block-copolymerized PLA breakthroughs cut brittleness, offering an 80% bio-based alternative for fresh-produce pouches.

Polyethylene converters invest in metallocene catalysts that upgrade seal-through-contamination performance, an essential trait for high-speed form-fill-seal lines. The packaging film market thus balances cost efficiency against sustainability pulls, with incumbents safeguarding volume while specialty biopolymers address regulatory requirements and consumer preference shifts.

Multilayer constructions controlled 56.20% revenue in 2025 by optimizing mechanical, optical and barrier attributes through layer-specific functionality. Barrier stacks incorporating EVOH or AlOx layers are on course for 6.14% CAGR as pharma logistics and ready-meal sectors require longer shelf life. Monolayer films retain relevance where recovery streams demand simpler chemistries, notably for store drop-off recycling in North America.

Co-extruders add inline orientation units to produce machine-direction oriented PE laminates that satisfy recyclability while keeping puncture resistance. Nanoclay dispersions cut oxygen transmission by 60% at equivalent calipers, paving the way for further down-gauging. Layer-thickness scanners improve profile accuracy and minimize start-up scrap, delivering yield gains that feed directly into bottom-line improvement for participants within the packaging film market.

The Packaging Film Market Report is Segmented by Material Type (Polyethylene, Polypropylene, Polyester, and More), Film Structure (Monolayer, and More), Application (Food and Beverage, Pharmaceutical and Medical, Personal Care and Cosmetics, and More), End-Use Format (Bags and Pouches, Wraps and Lidding Films, Labels and Sleeves, and More ), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific sustained 37.00% share of the packaging film market in 2025, underpinned by abundant resin supply, competitive labor, and a vast consumer base. China's GB/T 31268-2024 rule on excessive packaging triggers demand for ultra-light pouches that meet parcel weight caps. Thailand and Indonesia implement harmonized food-contact controls that standardize test protocols and elevate local extrusion sophistication. Indian players such as JPFL Films add 60,000 tpa BOPP capacity to capture domestic and export opportunities. Japan and South Korea champion barrier-coating R&D, while Australia emphasizes post-consumer recycling content.

Europe faces transformative investment cycles to satisfy PPWR recyclability and recycled-content thresholds. Constantia Flexibles' acquisition of Aluflexpack consolidates foil competencies and bolsters Southeast-European footholds. Brands introduce QR-coded disposal instructions to guide consumers and to enhance collection purity. The UK and Germany pilot chemical-recycling drop-offs, driving rPE integration.

North America leverages mature e-commerce networks and rolling policy clarity. PFAS withdrawal deadlines steer converters toward metallized BOPP and AlOx PET, while Canada capitalizes on feedstock cost advantages to remain a major exporter. Mexican facilities supply both domestic snack markets and southern U.S. value chains.

South America records the fastest 7.60% CAGR through 2031, propelled by agricultural exports that require high-barrier films. Investments by OPP FILM COLOMBIA and GDM Plasticos expand BOPP and CPP footprints, while regional funding bodies support eco-design labs. The momentum positions the region as the new growth frontier in the packaging film market.

Middle East and Africa post solid double-digit volume gains fostered by urban retail expansion. Saudi Arabia and the UAE introduce mandates for recyclable plastics that guide procurement choices, and South Africa's established converters serve the broader continent with cost-optimized offerings.

- Amcor plc

- Sealed Air Corporation

- Mondi plc

- Jindal Poly Films Ltd

- Cosmo Films Ltd

- Uflex Ltd

- Huhtamaki Oyj

- ProAmpac Holdings

- Novolex Holdings

- AEP Industries

- RKW SE

- Toray Plastics

- Coveris Holdings

- Sigma Plastics Group

- SRF Limited

- Klockner Pentaplast

- Taghleef Industries

- Polyplex Corporation

- Transcontinental Inc.

- Dupont Teijin Films

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom driving demand for lightweight shipping films

- 4.2.2 EU push for mono-material recyclable films

- 4.2.3 Cold-chain packaged food growth in emerging Asia-Pacific

- 4.2.4 Digital printing enabling short-run personalised packs

- 4.2.5 Antimicrobial additive masterbatches for meat films

- 4.2.6 Chemical-recycling feedstock agreements for food-grade rPE

- 4.3 Market Restraints

- 4.3.1 Plastic bans / taxes in NA and Europe

- 4.3.2 Volatile virgin-resin prices

- 4.3.3 Barrier limits of bio-based films

- 4.3.4 Converter downtime from ultra-thin gauges

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Polyethylene

- 5.1.1.1 High-Density Polyethylene (HDPE)

- 5.1.1.2 Low-Density Polyethylene (LDPE)

- 5.1.1.3 Linear Low-Density Polyethylene (LLDPE)

- 5.1.2 Polypropylene

- 5.1.3 Polyester (BOPET)

- 5.1.4 Bioplastics

- 5.1.5 Other Material Types

- 5.1.1 Polyethylene

- 5.2 By Film Structure

- 5.2.1 Monolayer

- 5.2.2 Multilayer (2-3 layers)

- 5.2.3 Barrier multilayer (More than 3 layers)

- 5.3 By Application

- 5.3.1 Food and Beverage

- 5.3.2 Pharmaceutical and Medical

- 5.3.3 Personal Care and Cosmetics

- 5.3.4 Consumer Durables and Electronics

- 5.3.5 Industrial and Institutional

- 5.3.6 Agriculture and Horticulture

- 5.3.7 Other Application

- 5.4 By End-Use Format

- 5.4.1 Bags and Pouches

- 5.4.2 Wraps and Lidding Films

- 5.4.3 Labels and Sleeves

- 5.4.4 Blister and Sachets

- 5.4.5 Shrink and Stretch Wrap

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Netherlands

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Malaysia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Sealed Air Corporation

- 6.4.3 Mondi plc

- 6.4.4 Jindal Poly Films Ltd

- 6.4.5 Cosmo Films Ltd

- 6.4.6 Uflex Ltd

- 6.4.7 Huhtamaki Oyj

- 6.4.8 ProAmpac Holdings

- 6.4.9 Novolex Holdings

- 6.4.10 AEP Industries

- 6.4.11 RKW SE

- 6.4.12 Toray Plastics

- 6.4.13 Coveris Holdings

- 6.4.14 Sigma Plastics Group

- 6.4.15 SRF Limited

- 6.4.16 Klockner Pentaplast

- 6.4.17 Taghleef Industries

- 6.4.18 Polyplex Corporation

- 6.4.19 Transcontinental Inc.

- 6.4.20 Dupont Teijin Films

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment