|

市场调查报告书

商品编码

1910435

硬体钱包:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Hardware Wallet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

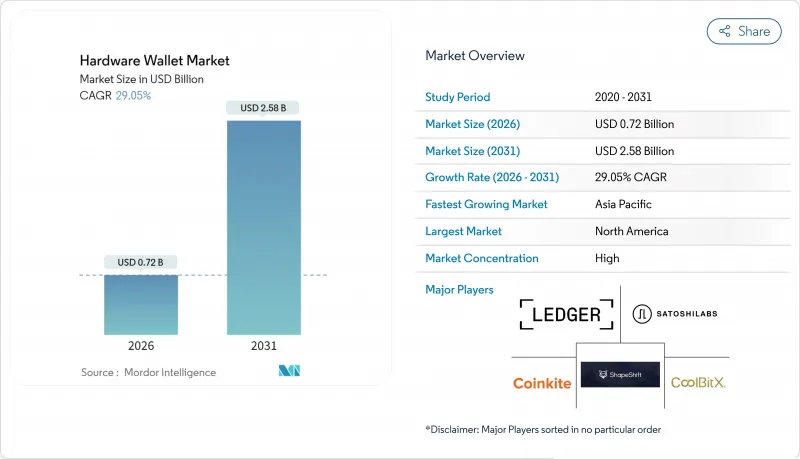

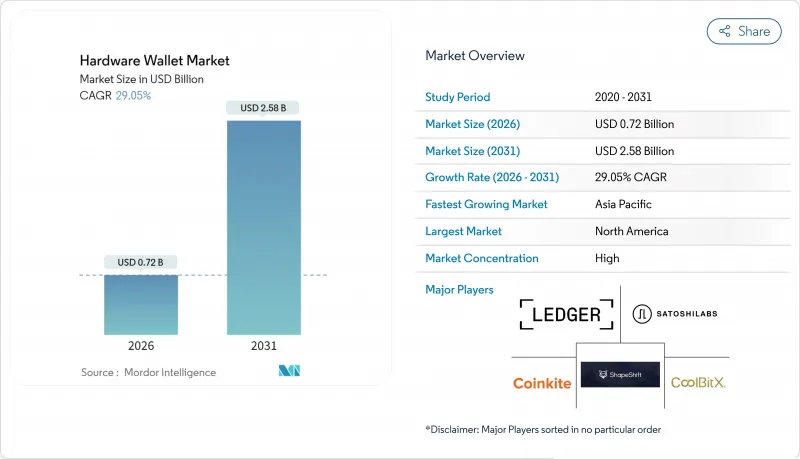

预计到 2025 年,硬体钱包市场价值将达到 5.6 亿美元,从 2026 年的 7.2 亿美元成长到 2031 年的 25.8 亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 29.05%。

资产管理公司迅速转向自託管、交易所安全漏洞频发以及MiCA和OCC等法规结构的明确化,共同为硬体钱包市场的持续成长奠定了基础。企业客户正透过以本地金钥管理设备取代託管帐户来推动更大的订单量,迫使传统上以消费者为中心的供应商提高认证等级并扩展专业服务。此外,关税衝击后安全元件生产的本地化以及多链DeFi活动的兴起也推动了硬体钱包市场的发展,后者需要具备跨多个Layer 1和Layer 2网路进行交易签署的设备。由于多年创业投资资金使新进业者能够尝试外形规格,竞争格局正在发生变化,但拥有雄厚资本的现有企业在认证成本和供应链管理方面仍然保持优势。

全球硬体钱包市场趋势与洞察

机构采用自我管理解决方案的速度加快

各机构正将数位资产视为金融资产而非投机性资产,决策者也摒弃了单一託管模式,转而采用符合董事会风险接受度的确定性控制措施。这种转变解释了为何硬体钱包市场围绕着FIPS认证的安全元件、基于REST的签章协定堆迭和SOC-2报告层展开。 Dfns正是这种转变的体现,该公司已成功资金筹措1,600万美元,用于扩展其为富达国际和Zodiac Custody提供支援的「钱包即服务」(WaaS)基础设施。企业级应用程式推高了平均售价,并延长了更新周期。供应商正转向订阅模式,将韧体更新、身份验证服务和硬体保固捆绑在一起。同时,系统整合商透过将钱包整合到HSM机架和零信任安全区中,延长了设备的使用寿命,从而扩大了硬体钱包市场的潜在规模。

网路安全漏洞揭露事件激增,推动了对离线金钥的需求。

加密货币窃盗案的显着增加重新唤起了人们对热钱包攻击面的关注。 Bybit 和 Femex 的事件促使人们紧急迁移资产,导致消费者设备过载,并揭露了备份检验和金钥分割工作流程的缺陷。厂商们随即展示了符合通用准则 EAL5+ 标准的晶片、环氧树脂填充机壳和防篡改全像图,强调离线恢復能力。行销宣传活动利用安全漏洞新闻带来的认知衝击,反覆将空气间隙储存定位为「金融资产与国家级骇客之间的最后一道防线」。由此带来的品牌价值进一步巩固了家族办公室和交易所交易产品赞助商对硬体钱包的接受度,并将硬体钱包市场扩展到技术爱好者之外。

不断变化的反洗钱/了解你的客户 (AML/KYC) 法规推高了合规成本。

监管机构现在要求硬体供应商在其设备中加入机制,以便对受制裁地址发出警报、实施地址筛检API,并记录其设备群中的可疑活动。实施这些韧体会增加韧体开销,需要定期更新列表,并将资料保护责任转移到供应商身上。没有法务团队的Start-Ups通常会将合规任务外包给云端评分服务,这会恶化单位经济效益并加剧营运资金压力。对加密模组严格的跨境出口限制进一步加剧了物流复杂性,导致运往高成长地区的货物延迟,并减缓了硬体钱包市场的发展。同时,成熟的製造商可以透过利用现有的FATF审核文件,以更低的合规成本维持全球营运。

细分市场分析

截至2025年,USB连接的硬体钱包将维持46.98%的市场份额,这得益于空气间隙架构和极小的攻击面。同时,NFC设备正以29.62%的复合年增长率成长,这主要得益于消费者将他们在Apple Pay和PayNow等非接触式支付方式中养成的习惯应用于加密货币消费。 Arculus和Sugi等厂商正引领着这一趋势,他们将安全元件整合到可放入普通钱包的时尚卡片中,从而在销售点实现「轻触签名」并扫描QR码的便捷支付流程。因此,随着东南亚超级应用不断扩大接受稳定币小额支付的商家数量,基于NFC的硬体钱包市场规模预计将大幅成长。

对于机构用户而言,实体线缆仍然是减少射频洩漏并在 SOC-2审核期间保持确定性路径的首选方案。然而,新一代空气间隙解决方案以无状态方式采用 NFC 技术,无需暴露私钥即可实现外部安全元件认证。一旦 ISO/TC 68 等标准组织发布 NFC 安全储存的最终指南,法律规范可能会增加。目前,供应商提供三种模式的 SKU——USB、NFC 和蓝牙——以涵盖所有操作环境,防止通路竞食,并提高硬体钱包市场的整体潜在份额。

早期用户行为偏好热钱包,在去中心化交易所的即插即用交换和挖矿奖励的推动下,到2025年,热钱包将占据硬体钱包市场62.78%的份额。然而,2024年资产损失的消息促使託管机构加快向冷储存的转型。随着董事会为每种託管模式分配量化风险评分,预计到2031年,冷储存的复合年增长率将达到29.85%。这一趋势正在推动硬体钱包市场中空气间隙保险库(包括安装在地下的HSM机架,配备旨在抵御物理入侵的安全元件刀片)的规模增长。

这种混合设计模糊了界限,允许在M/N法定人数核准下暂时暴露签名权限的「温」状态,然后在清盘完成后恢復到冷状态。这种可控的启动方式符合以USDC支付工资并将储备金离线储存的资金管理策略。在新兴资本市场监管中,MiCA将冷资料储存视为储备金检验的参考架构,进一步提升了对冷钱包的需求。透过这种转型实现盈利的供应商获得了更高的毛利率,并在硬体钱包市场保持了盈利能力,因为每个冷钱包SKU都配备了额外的法拉第笼套管、环氧树脂密封的PCB以及用于完整显示智能合约调用数据的高像素盈利屏幕。

区域分析

预计到2025年,北美将占据全球39.15%的市场份额,这主要得益于美国联邦存款保险公司(OCC)的政策澄清,促使美国银行整合硬体安全支付服务。强大的产权保护、深厚的保险实力以及充裕的创业投资投资,为Start-Ups快速迭代安全元件设计创造了有利环境,而机构投资者则透过严格的渗透测试检验这些产品。随着资产管理公司以符合SOC-2管理标准的本地冷钱包库取代综合託管帐户,硬体钱包市场也将从中受益。

预计到2031年,亚太地区将以29.66%的复合年增长率成长。新加坡金融管理局(MAS)将助记词管理不当认定为重大营运风险,以及日本金融厅(FSA)强制要求隔离存储,都推动了这一增长。国内组件製造商更短的前置作业时间和更低的成本,使得OneKey等品牌能够以更低的平均售价提供开放原始码产品,与西方竞争对手相媲美。消费者对超级应用的依赖推动了NFC和蓝牙技术的普及,促使行动领先功能在该地区率先应用,随后扩展到欧洲和北美,进一步增强了亚太地区对硬体钱包市场蓝图的影响力。

欧洲的MiCA框架正在将隐私优先的概念转化为系统性的硬体应用,推动硬体市场在2031年前实现持续但相对缓慢的成长。法国是Ledger安全元件组装线的位置,这反映了供应链回归传统模式以规避关税和地缘政治风险的趋势。同时,北欧退休基金正在游说监管机构,允许在冷钱包中进行有限的加密货币配置,并要求储备证明,从而进一步将安全硬体融入传统的金融工作流程。这些区域性措施正在提高创新密度,并推动整个硬体钱包市场提升整体安全标准。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 机构采用自我管理解决方案的速度加快

- 网路安全漏洞事件曝光度的提高推动了对离线金钥的需求。

- 促进隔离加密资产託管的监管(MiCA、OCC)

- 扩展 DeFi 和 NFT 生态系统需要多链支持

- 蓝牙/NFC外形规格的兴起推动了行动支付的发展

- 对中国製造的加密硬体征收新的进口关税可能会促进国内生产。

- 市场限制

- 反洗钱/了解你的客户 (AML/KYC) 法规的不断演变导致合规成本不断增加

- 持久性消费者使用者体验的复杂性

- 安全元件硬体供应链短缺

- 标准碎片化阻碍了互通性

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 硬体钱包对比

- 宏观经济因素评估

- 案例研究分析

第五章 市场规模与成长预测

- 连结性别

- USB

- NFC

- Bluetooth

- 其他的

- 按钱包类型

- 热钱包

- 冷钱包

- 最终用户

- 个人/零售

- 对于企业/公司

- 透过分销管道

- 在线的

- 离线

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 亚太其他地区

- 中国

- 日本

- 印度

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Ledger SAS

- SatoshiLabs sro

- ShapeShift AG

- Coinkite Inc.

- CoolBitX Technology Ltd.

- Shift Crypto AG

- Penta Security Systems Inc.

- SecuX Technology Inc.

- ARCHOS SA

- ELLIPAL Ltd.

- BitLox Limited

- SafePal Technology Ltd.

- Keystone(Cobo Technology Ltd.)

- OPOLO SARL

- zSofitto NV(Sugi)

- KeepKey LLC

- IoTrust Co., Ltd.(D'CENT)

- Prokey Technologies Co., Ltd.

- CryoBit LLC

- BC VAULT doo

- Tangem AG

- OneKey Technology Co., Ltd.

第七章 市场机会与未来展望

The hardware wallet market was valued at USD 0.56 billion in 2025 and estimated to grow from USD 0.72 billion in 2026 to reach USD 2.58 billion by 2031, at a CAGR of 29.05% during the forecast period (2026-2031).

A sharp pivot by asset managers toward self-custody, an upsurge in high-profile exchange breaches, and clarity from frameworks such as MiCA and the OCC have together created a durable demand runway for the hardware wallet market. Enterprise clients now drive larger order values as they replace custodial accounts with on-premises key-management appliances, forcing formerly consumer-centric vendors to upgrade certification levels and professional-service offerings. The hardware wallet market also benefits from manufacturers localizing secure-element production after tariff shocks, and from multi-chain DeFi activity that rewards devices able to sign transactions across numerous layer-1 and layer-2 networks. Competitive conditions remain fluid because multi-year venture funding lets new entrants experiment with form factors, yet certification costs and supply-chain control continue to favor incumbents with deeper capital pools.

Global Hardware Wallet Market Trends and Insights

Intensifying Institutional Adoption of Self-Custody Solutions

Organizations now treat digital assets as treasury items rather than speculative holdings, so decision-makers reject omnibus custody in favor of deterministic control that satisfies board-level risk appetites. This change explains why the hardware wallet market increasingly revolves around FIPS-certified secure elements, REST-based signing stacks, and SOC-2 reporting layers. Dfns illustrates the shift by raising USD 16 million to scale wallet-as-a-service infrastructure that supports Fidelity International and Zodia Custody. Enterprise adoption raises average selling prices, lengthens replacement cycles, and nudges vendors toward subscription models bundling firmware updates, attestation services, and hardware warranties. In parallel, systems integrators extend device life by embedding wallets in HSM racks or zero-trust enclaves, widening the addressable hardware wallet market.

Surge in Cyber-Breach Publicity Pushing Demand for Offline Keys

Crypto theft reached signficantly, reigniting awareness of hot-wallet attack surfaces. Incidents at Bybit and Phemex triggered emergency asset migrations that overloaded consumer-grade devices, exposing feature gaps in backup verification and key-sharding workflows. Vendors responded by showcasing Common Criteria EAL5+ chips, epoxy-filled enclosures, and tamper-evident holograms that underline offline resilience. Marketing campaigns play on the cognitive impact of breach headlines, repeatedly framing air-gapped storage as the last line of defense between treasury assets and state-linked exploit groups. The resulting brand equity further entrenches device use among family offices and exchange-traded-product sponsors, expanding the hardware wallet market beyond technology enthusiasts.

Evolving AML/KYC Mandates Raising Compliance Costs

Regulators now ask hardware suppliers to embed mechanisms that flag sanctioned addresses, impose address-screening APIs, and log suspicious activity across device fleets. Implementing these functions adds firmware overhead, demands regular list updates, and exposes vendors to data-protection liability. Start-ups lacking legal teams often outsource compliance to cloud scorers, inflating unit economics and stretching working capital. Stringent cross-border export classifications for cryptographic modules further complicate logistics, delaying shipment into high-growth corridors and slowing the hardware wallet market momentum. Meanwhile, established manufacturers lean on pre-existing FATF audit files to maintain global reach at a lower marginal compliance outlay.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Segregated Crypto Custody (MiCA, OCC)

- Expanding DeFi and NFT Ecosystems Requiring Multi-Chain Support

- Persistent Consumer UX Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

USB connectivity retained a 46.98% slice of the hardware wallet market in 2025, underpinned by its air-gapped lineage and minimal attack surface. NFC devices, however, are racing ahead at a 29.62% CAGR as consumers align crypto spending with contactless habits honed on Apple Pay and PayNow. Vendors like Arculus and Sugi shape the discussion by enclosing secure elements in sleek cards that slip into normal wallets, and by enabling tap-to-sign workflows that appeal to shoppers scanning QR codes at point-of-sale. The hardware wallet market size attributable to NFC is therefore expected to surge as super-apps in Southeast Asia enroll merchants that now accept stablecoin micropayments.

Institutional desks still prefer physical cables to reduce radio-frequency leakage and to preserve deterministic paths during SOC-2 audits. Even so, next-generation air-gap solutions adapt NFC in a stateless manner that permits external secure-element attestation without exposing private keys. Regulatory oversight may tilt further once standards bodies like ISO/TC 68 publish final guidelines on NFC-enabled custody. For now, vendors hedge bets by offering tri-modal SKUs, USB, NFC, and Bluetooth, to cover every operational context, thereby preventing channel cannibalization and growing their total addressable share of the hardware wallet market.

Hot wallets dominated early user behavior, grabbing 62.78% hardware wallet market share in 2025 thanks to plug-and-play swaps and decentralized-exchange farming incentives. Yet the asset-wipe headlines of 2024 have pushed fiduciaries toward cold environments that record a 29.85% CAGR through 2031 as boards assign quantitative risk scores to each custody model. That trend lifts the hardware wallet market size devoted to air-gapped vaults, including bunker-installed HSM racks equipped with secure-element blades designed to withstand physical intrusion.

Hybrid designs blur boundaries by allowing "warm" states that temporarily expose signing rights under M-of-N quorum approval, then revert to cold once sweeps finish. This controlled activation fits treasury playbooks that disburse payroll in USDC yet store reserves offline. In emerging capital-market mandates, MiCA interprets cold storage as the reference architecture for reserve verification, further amplifying unit demand. Vendors monetizing the shift receive elevated gross margins because every cold-wallet SKU ships with additional Faraday-cage sleeves, epoxy-sealed PCBs, and high-pixel-density screens required to display full-length smart-contract call data, sustaining profitability inside the hardware wallet market.

The Hardware Wallet Market Report is Segmented by Connectivity (USB, NFC, Bluetooth, and More), Wallet Type (Hot Wallet and Cold Wallet), End User (Individual/Retail and Institutional/Enterprise), Distribution Channel (Online and Offline), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 39.15% of 2025 value as OCC clarification prompted U.S. banks to integrate hardware-secured settlement services. High property-rights enforcement, deep insurance capacity, and significant venture capital pools create an ecosystem where start-ups iterate quickly on secure-element designs while institutional buyers validate those products through rigorous penetration tests. The hardware wallet market benefits when asset-managers replace omnibus custody accounts with on-premises cold-wallet cages that anchor SOC-2 controls.

Asia Pacific is on track for a 29.66% CAGR through 2031, accelerated by Singapore's MAS guidelines that label seed-phrase mis-management a critical operational risk and by Japan's FSA mandate for segregated custody. Domestic component manufacturers shorten lead times and lower costs, letting brands such as OneKey ship open-source units competitive with Western peers at lower ASPs. Consumers' dependence on super-apps cultivates NFC and Bluetooth deployment, so the region often previews mobile-first features that later migrate to Europe and North America, magnifying APAC's influence on the hardware wallet market roadmap.

Europe's MiCA framework translates privacy-first culture into systematic hardware adoption, driving consistent though comparatively moderate growth through 2031. France hosts Ledger's secure-element assembly lines, illustrating supply-chain reshoring designed to hedge tariff and geopolitical exposure. Simultaneously, Nordic pension funds lobby regulators to allow limited crypto allocations-conditional upon cold-wallet proof of reserves, which further embeds secure hardware in traditional finance workflows. Accordingly, regional dynamics enhance innovation density and push collective security standards higher across the hardware wallet market.

- Ledger SAS

- SatoshiLabs s.r.o.

- ShapeShift AG

- Coinkite Inc.

- CoolBitX Technology Ltd.

- Shift Crypto AG

- Penta Security Systems Inc.

- SecuX Technology Inc.

- ARCHOS S.A.

- ELLIPAL Ltd.

- BitLox Limited

- SafePal Technology Ltd.

- Keystone (Cobo Technology Ltd.)

- OPOLO SARL

- zSofitto NV (Sugi)

- KeepKey LLC

- IoTrust Co., Ltd. (D'CENT)

- Prokey Technologies Co., Ltd.

- CryoBit LLC

- BC VAULT d.o.o.

- Tangem AG

- OneKey Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Intensifying institutional adoption of self-custody solutions

- 4.2.2 Surge in cyber-breach publicity pushing demand for offline keys

- 4.2.3 Regulatory push for segregated crypto custody (MiCA, OCC)

- 4.2.4 Expanding DeFi and NFT ecosystems requiring multi-chain support

- 4.2.5 Emergence of Bluetooth/NFC form-factors enabling mobile payments

- 4.2.6 New import tariffs on Chinese crypto hardware boosting on-shore production

- 4.3 Market Restraints

- 4.3.1 Evolving AML/KYC mandates raising compliance costs

- 4.3.2 Persistent consumer UX complexity

- 4.3.3 Hardware supply-chain shortages for secure elements

- 4.3.4 Fragmented standards hindering interoperability

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Hardware Wallet Product Comparison

- 4.8 Assessment of Macroeconomic Factors

- 4.9 Case Study Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Connectivity

- 5.1.1 USB

- 5.1.2 NFC

- 5.1.3 Bluetooth

- 5.1.4 Others

- 5.2 By Wallet Type

- 5.2.1 Hot Wallet

- 5.2.2 Cold Wallet

- 5.3 By End User

- 5.3.1 Individual / Retail

- 5.3.2 Institutional / Enterprise

- 5.4 By Distribution Channel

- 5.4.1 Online

- 5.4.2 Offline

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Rest of Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Ledger SAS

- 6.4.2 SatoshiLabs s.r.o.

- 6.4.3 ShapeShift AG

- 6.4.4 Coinkite Inc.

- 6.4.5 CoolBitX Technology Ltd.

- 6.4.6 Shift Crypto AG

- 6.4.7 Penta Security Systems Inc.

- 6.4.8 SecuX Technology Inc.

- 6.4.9 ARCHOS S.A.

- 6.4.10 ELLIPAL Ltd.

- 6.4.11 BitLox Limited

- 6.4.12 SafePal Technology Ltd.

- 6.4.13 Keystone (Cobo Technology Ltd.)

- 6.4.14 OPOLO SARL

- 6.4.15 zSofitto NV (Sugi)

- 6.4.16 KeepKey LLC

- 6.4.17 IoTrust Co., Ltd. (D'CENT)

- 6.4.18 Prokey Technologies Co., Ltd.

- 6.4.19 CryoBit LLC

- 6.4.20 BC VAULT d.o.o.

- 6.4.21 Tangem AG

- 6.4.22 OneKey Technology Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment