|

市场调查报告书

商品编码

1910438

电源管理积体电路(PMIC):市场占有率分析、产业趋势与统计、成长预测(2026-2031)Power Management Integrated Circuit (PMIC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

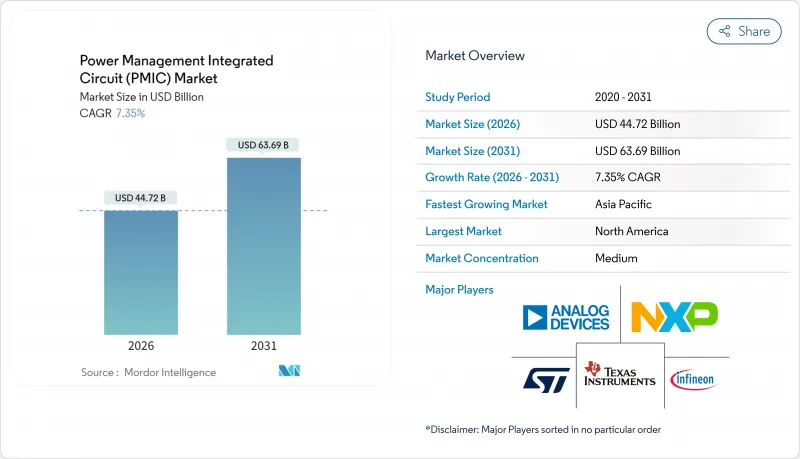

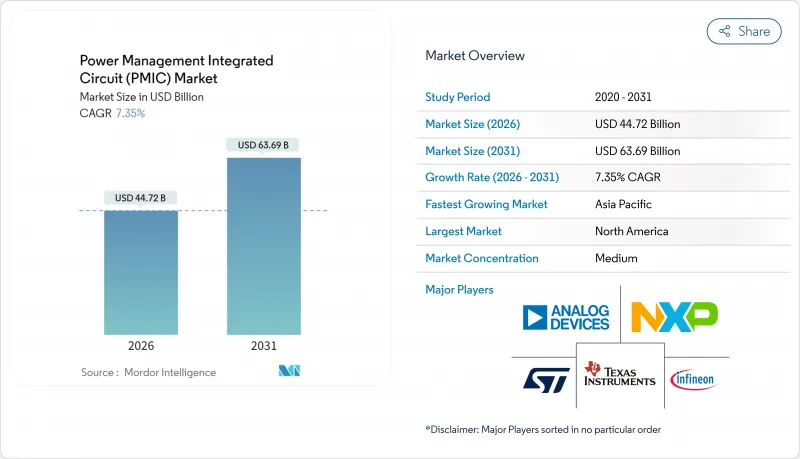

预计到 2026 年,电源管理 IC (PMIC) 市场规模将达到 447.2 亿美元,从 2025 年的 416.6 亿美元成长到 2031 年的 636.9 亿美元。

预计从 2026 年到 2031 年,其复合年增长率将达到 7.35%。

电动车、旗舰智慧型手机和超低功耗物联网设备的普及推动了对高效转换拓扑结构、严格电压容差和先进製程节点的需求。电池管理积体电路仍然是电源管理积体电路 (PMIC) 市场的基础,而无线充电 PMIC、宽能带隙功率级和 20 奈米以下製程设计正成为推动市场成长的关键因素。竞争格局由两类厂商主导:一类是利用专有智慧财产权 (IP) 捍卫市场占有率的老字型大小企业,另一类是为垂直整合开发专有解决方案的处理器供应商。代工厂产能、超薄元件的散热限制以及假冒伪劣产品的涌入,持续对整体市场发展构成风险。

全球电源管理积体电路(PMIC)市场趋势与洞察

电动车和混合动力车的快速普及推动了对高电流、高效率电源管理积体电路(PMIC)的需求。

电动车架构正在重塑电源管理积体电路 (PMIC) 的市场规范。特斯拉的 4680 电池单元需要 PMIC 能够处理高达 500A 的连续电流,同时将结温维持在 125 度C以下,以驱动碳化硅 (SiC) 功率级和先进的散热封装。比亚迪的分散式电池管理设计实现了 10C 快充能力,凸显了对电池级 PMIC 控制的需求。英飞凌的 CoolSiC 模组在 800V 车载充电器中实现了 98.5% 的效率,而车队营运商则优先考虑 PMIC 的诊断功能以实现预测性维护。这些需求正在推动感测器介面和无线链路的集成,使 PMIC 从独立的稳压器转变为智慧子系统。

利用较小的工程节点提高片上功率密度

向 20nm 及以下製程的过渡使得在单一晶粒上实现多个电源轨和控制逻辑成为可能,从而减少基板面积并降低寄生效应。台积电的 16nm FinFET 平台实现了超过 1W/mm² 的功率密度,而 65nm 製程的功率密度仅为 0.3W/mm²,同时保持了设计基板的散热性能。联发科的天玑 9400 整合了 12 个独立的电源域,由片上电源管理积体电路 (PMIC) 管理,可针对 AI 工作负载执行亚微秒电压调节。然而,由于量子效应导致漏电流波动性增加,迫使人们采用补偿演算法,有人建议在 2nm 製程节点中引入环栅结构,旨在与目前的 3nm 製程相比降低 30% 的功耗。

类比和混合讯号节点代工产能的供应链週期性

类比元件产能扩张落后于数位装置,预计到2024年底,台积电专用生产线的运转率将达到95%,而电源管理积体电路(PMIC)的前置作业时间也从8週延长至16週。全球晶圆代工厂向成熟製程节点的策略转型减少了合格汽车零件供应商的数量,加剧了地缘政治风险。随着汽车项目签订五年合约,消费性电子公司竞相争夺日益减少的订单份额,进一步加剧了分配风险。

细分市场分析

至2025年,电池管理IC将占电源管理IC(PMIC)市场规模的33.15%,凸显其在电动车电池组和固定式储能係统中的不可或缺性。然而,随着Qi2磁对准技术将15W无线充电的传输效率提升至85%,以及MagSafe等类似生态系的扩展,预计2031年,无线充电PMIC的复合年增长率将达到8.32%。

电源管理积体电路市场的需求主要集中在电池管理IC的安全诊断、电池均衡精度和热控制方面,而异物检测和自适应谐振控制则是无线充电PMIC的差异化优势。 DC-DC转换器PMIC在资料中心和笔记型电脑的电源轨领域依然保持着强劲的需求,而线性稳压器则凭藉其低于10µV的噪音基底,在细分市场中占据一席之地。工厂自动化的发展带动了马达驱动PMIC的需求。电压基准和监控IC由于汽车功能安全标准的要求,仍然是稳定的收入来源。

到2025年,家用电子电器将占据电源管理积体电路(PMIC)市场份额的42.25%,这主要得益于智慧型手机、笔记型电脑和平板电脑等设备整合了超过15个稳压电源轨。受800V驱动系统和ADAS计算丛集的推动,汽车和电动出行领域预计将以8.55%的复合年增长率成长,超过其他所有领域。

工业和机器人应用需要具有精确扭矩的马达驱动器,而 5G 基础设施则需要高压电源管理积体电路 (PMIC) 来处理 48V 的直接电源。医疗设备,尤其是植入,优先考虑亚微安培的待机电流,而物联网终端则采用支援能源采集的 PMIC,其起始电压可低至 380mV。由于各行业会根据可靠性、电压调节和精确遥测等因素调整 PMIC 的蓝图,因此电源管理积体电路 (PMIC) 市场的供应商路线图各不相同。

区域分析

到2025年,北美将占全球营收的36.85%,这主要得益于特斯拉电池管理系统订单的成长以及苹果对客製化电源管理积体电路(PMIC)晶片的重视。该地区正受惠于日益完善的设计服务生态系统和强劲的电动车基础设施建设。

亚太地区是主要的晶圆代工和消费性电子产品组装基地,预计到 2031 年将以 10.21% 的复合年增长率成长。中国电动车的扩张和韩国的记忆体生产线正在推动电源管理积体电路 (PMIC) 的产量成长,而接近性晶圆厂则缩短了开发週期。

在欧洲,德国汽车製造商采用800V系统,加上严格的环保设计法规,推动了电气化进程,从而带来了稳定的需求。在北欧的可再生能源领域,用于併网逆变器的电源管理积体电路(PMIC)正在推广,这些积体电路能够优化最大功率点追踪(MPPT)。在中东和非洲,太阳能微电网正在推动成长;而在南美洲,巴西的电动车激励政策和阿根廷利用其锂资源建立的本地电池供应网路也是促进成长的因素。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动车 (EV) 和混合动力汽车(xEV) 的快速普及推动了对高电流、高效率 PMIC 的需求。

- 透过小型化製程节点(小于20nm)实现高密度片上电源集成

- 旗舰智慧型手机采用先进电池健康管理PMIC

- 政府针对消费和工业电子设备的节能法规

- 边缘人工智慧/物联网的普及需要超低待机电流的电源管理积体电路(PMIC)。

- 快速充电器中的宽能带隙(GaN/SiC)功率级

- 市场限制

- 类比和混合讯号节点代工厂产能的供应链週转率

- 设计复杂性的增加使得中小规模原始设备製造商难以承受非经常性工程成本。

- 超薄消费性电子设备的温度控管局限性

- 假冒PMIC的日益增加影响了人们对可靠性的认知。

- 产业供应链分析

- 监管环境

- 技术展望

- 宏观经济因素的影响

- 波特五力分析

- 新进入者的威胁

- 买方和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依积体电路类型

- 线性稳压器 PMIC

- DC-DC转换器PMIC

- 电池管理积体电路

- 电压基准和监控积体电路

- 用于马达控制和驱动器的电源管理积体电路

- 无线充电 PMIC

- 透过使用

- 家用电子电器

- 汽车和电动旅行

- 工业机器人

- 电讯和网路

- 医疗和医疗设备

- 物联网和边缘设备

- 按晶圆节点

- 65奈米或以上

- 40~65 nm

- 20~40 nm

- 小于20奈米

- 按功率范围

- 低功耗电源管理积体电路 (PMIC)

- 中功率 PMIC

- 高功率电源管理积体电路 (PMIC)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Texas Instruments Inc.

- Analog Devices, Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- STMicroelectronics NV

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Qualcomm Incorporated

- Broadcom Inc.

- Skyworks Solutions, Inc.

- Dialog Semiconductor(Renesas)

- Rohm Co., Ltd.

- Maxim Integrated(ADI)

- Toshiba Electronic Devices and Storage Corp.

- MediaTek Inc.

- Power Integrations, Inc.

- Silicon Laboratories Inc.

- Monolithic Power Systems, Inc.

- Vishay Intertechnology, Inc.

- Littelfuse, Inc.

第七章 市场机会与未来展望

The power management integrated circuit market size in 2026 is estimated at USD 44.72 billion, growing from 2025 value of USD 41.66 billion with 2031 projections showing USD 63.69 billion, growing at 7.35% CAGR over 2026-2031.

An expanding pool of electric vehicles, flagship smartphones, and ultra-low-power IoT devices is boosting demand for highly efficient conversion topologies, tighter voltage tolerances, and advanced process nodes. Battery management ICs remain the cornerstone of the power management integrated circuit market, while wireless-charging PMICs, wide-bandgap power stages, and sub-20 nm designs are emerging as pivotal growth catalysts. The competitive landscape is shaped by analog stalwarts defending share through proprietary IP and by processor vendors developing captive solutions for vertical integration. Foundry capacity, thermal constraints in ultra-thin devices, and counterfeit-component infiltration continue to pose tangible risks to overall market momentum.

Global Power Management Integrated Circuit (PMIC) Market Trends and Insights

Rapid EV and xEV Penetration Elevating Demand for High-Current, High-Efficiency PMICs

Electric-vehicle architecture is reshaping specifications for the power management integrated circuit market. Tesla's 4680 battery cell demands PMICs that handle up to 500 A continuous current while remaining below 125°C junction temperature, prompting silicon-carbide power stages and advanced thermal packaging. BYD's distributed battery-management design delivers 10C fast-charge capability, illustrating the need for granular cell-level PMIC control. Infineon's CoolSiC modules reach 98.5% efficiency in 800 V on-board chargers, and fleet operators now prioritize PMIC diagnostics to enable predictive maintenance. These requirements spur integration of sensor interfaces and wireless links, transforming PMICs into smart subsystems rather than isolated regulators.

Shrinking Process Nodes Enabling Higher On-Chip Power Density

Sub-20 nm migration allows multiple power rails and control logics on a single die, shrinking board footprints and limiting parasitics. TSMC's 16 nm FinFET platform achieves power densities above 1 W/mm2 versus 0.3 W/mm2 at 65 nm while safeguarding thermal profiles through engineered substrates. MediaTek's Dimensity 9400 integrates 12 independent power domains managed by an on-die PMIC that performs sub-microsecond voltage scaling for AI workloads. Yet quantum effects boost leakage variance, forcing adoption of compensation algorithms and heralding gate-all-around structures in 2 nm nodes targeting 30% power drop relative to current 3 nm.

Supply-Chain Cyclicality of Foundry Capacity for Analog and Mixed-Signal Nodes

Analog production lags digital capacity expansion, reaching 95% utilization at TSMC's specialty lines in late 2024 and elongating PMIC lead times to 16 weeks from a historical 8 weeks. GlobalFoundries' strategy shift toward mature nodes leaves fewer suppliers for automotive-qualified lots, raising exposure to geopolitical events. With automotive programs locking five-year commitments, consumer electronics vie for shrinking slots, intensifying allocation risk.

Other drivers and restraints analyzed in the detailed report include:

- Flagship Smartphone Adoption of Advanced Battery-Health PMICs

- Government Energy-Efficiency Mandates for Consumer and Industrial Electronics

- Rising Design Complexity Driving NRE Costs Beyond Reach of Smaller OEMs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery management ICs accounted for 33.15% of the power management integrated circuit market size in 2025, underscoring their indispensability in electric-vehicle packs and stationary storage. Wireless-charging PMICs, however, are expected to log an 8.32% CAGR through 2031 as Qi2 magnetic alignment boosts 15 W transmit efficiency to 85% and as MagSafe-like ecosystems proliferate.

Demand within the power management integrated circuit market pivots around safety diagnostics, cell-balancing accuracy, and thermal orchestration for battery management ICs, whereas foreign-object detection and adaptive resonance control differentiate wireless-charging PMICs. DC-DC converter PMICs still serve data-center and notebook rails, linear regulators reserve niches that need <10 µV noise floors, and motor-driver PMICs ride factory-automation growth. Voltage-reference and supervisor ICs remain a stable revenue bedrock, mandated by automotive functional-safety norms.

Consumer electronics generated 42.25% of 2025 revenue for the power management integrated circuit market share, reflecting smartphones, notebooks, and tablets that integrate upwards of 15 regulated rails per device. Automotive and e-mobility, supported by 800 V drivetrains and ADAS compute clusters, is forecast to post an 8.55% CAGR, outpacing all other verticals.

Industrial and robotics use cases require torque-accurate motor drives, whereas 5 G infrastructure calls for high-voltage PMICs handling 48 V direct feeds. Healthcare devices, especially implants, prioritize <1 µA standby current, and IoT endpoints adopt energy-harvesting PMICs capable of starting at 380 mV. Each vertical calibrates its PMIC specs around reliability, regulation voltage, and telemetry sophistication, fragmenting supplier roadmaps across the power management integrated circuit market.

The Power Management Integrated Circuit (PMIC) Market Report is Segmented by Type (Linear Regulator PMIC, DC-DC Converter PMIC, and More), Application (Consumer Electronics, Automotive and E-Mobility, and More), Wafer Node (Greater Than or Equal To 65 Nm, 40-65 Nm, and More), Power Range (Low Power PMICs, Medium Power PMICs, High Power PMICs), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 36.85% of global revenue in 2025, propelled by Tesla battery-management orders and Apple's emphasis on custom PMIC silicon. The region benefits from deep design-service ecosystems and a robust EV infrastructure build-out.

Asia-Pacific, home to leading foundries and consumer-electronics assembly, is projected to post a 10.21% CAGR through 2031. China's EV scale-up and South Korea's memory lines fuel PMIC volume, while proximity to fabs shortens iteration cycles.

Europe combines automotive electrification, where German OEMs adopt 800 V systems, with strict eco-design rules, sustaining steady demand. Nordic renewables deploy grid-tie inverter PMICs optimizing maximum-power-point tracking. Growth pockets in the Middle East and Africa arise from solar mini-grids, whereas South America leverages Brazilian EV incentives and Argentine lithium resources for localized battery supply chains.

- Texas Instruments Inc.

- Analog Devices, Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Qualcomm Incorporated

- Broadcom Inc.

- Skyworks Solutions, Inc.

- Dialog Semiconductor (Renesas)

- Rohm Co., Ltd.

- Maxim Integrated (ADI)

- Toshiba Electronic Devices and Storage Corp.

- MediaTek Inc.

- Power Integrations, Inc.

- Silicon Laboratories Inc.

- Monolithic Power Systems, Inc.

- Vishay Intertechnology, Inc.

- Littelfuse, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid EV and xEV penetration elevating demand for high-current, high-efficiency PMICs

- 4.2.2 Shrinking process nodes (Less than 20 nm) enabling higher on-chip power density

- 4.2.3 Flagship smartphone adoption of advanced battery-health PMICs

- 4.2.4 Government energy-efficiency mandates for consumer and industrial electronics

- 4.2.5 Edge-AI/IoT proliferation requiring ultra-low-quiescent-current PMICs

- 4.2.6 Adoption of wide-bandgap (GaN/SiC) power stages in fast chargers

- 4.3 Market Restraints

- 4.3.1 Supply-chain cyclicality of foundry capacity for analog and mixed-signal nodes

- 4.3.2 Rising design complexity driving NRE costs beyond reach of smaller OEMs

- 4.3.3 Thermal-management limits in ultra-thin consumer devices

- 4.3.4 Increasing counterfeit PMIC influx affecting reliability perceptions

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (USD BILLION)

- 5.1 By IC Type

- 5.1.1 Linear Regulator PMIC

- 5.1.2 DC-DC Converter PMIC

- 5.1.3 Battery Management IC

- 5.1.4 Voltage Reference and Supervisor IC

- 5.1.5 Motor-Control and Driver PMIC

- 5.1.6 Wireless-Charging PMIC

- 5.2 By Application

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive and e-Mobility

- 5.2.3 Industrial and Robotics

- 5.2.4 Telecommunications and Networking

- 5.2.5 Healthcare and Medical Devices

- 5.2.6 IoT and Edge Devices

- 5.3 By Wafer Node

- 5.3.1 Greater than and Equal to 65 nm

- 5.3.2 40 - 65 nm

- 5.3.3 20 - 40 nm

- 5.3.4 Less than 20 nm

- 5.4 By Power Range

- 5.4.1 Low Power PMICs

- 5.4.2 Medium Power PMICs

- 5.4.3 High Power PMICs

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Texas Instruments Inc.

- 6.4.2 Analog Devices, Inc.

- 6.4.3 Infineon Technologies AG

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 STMicroelectronics N.V.

- 6.4.6 ON Semiconductor Corporation

- 6.4.7 Renesas Electronics Corporation

- 6.4.8 Qualcomm Incorporated

- 6.4.9 Broadcom Inc.

- 6.4.10 Skyworks Solutions, Inc.

- 6.4.11 Dialog Semiconductor (Renesas)

- 6.4.12 Rohm Co., Ltd.

- 6.4.13 Maxim Integrated (ADI)

- 6.4.14 Toshiba Electronic Devices and Storage Corp.

- 6.4.15 MediaTek Inc.

- 6.4.16 Power Integrations, Inc.

- 6.4.17 Silicon Laboratories Inc.

- 6.4.18 Monolithic Power Systems, Inc.

- 6.4.19 Vishay Intertechnology, Inc.

- 6.4.20 Littelfuse, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment