|

市场调查报告书

商品编码

1910452

聚四氟乙烯(PTFE):市场占有率分析、产业趋势与统计、成长预测(2026-2031)Polytetrafluoroethylene (PTFE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

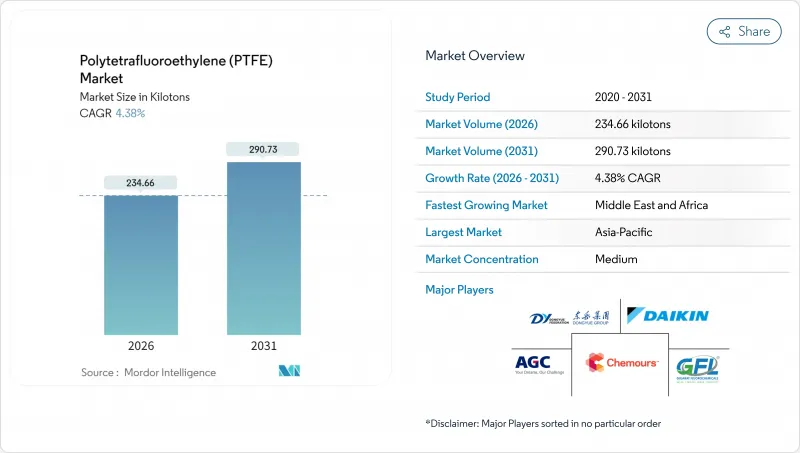

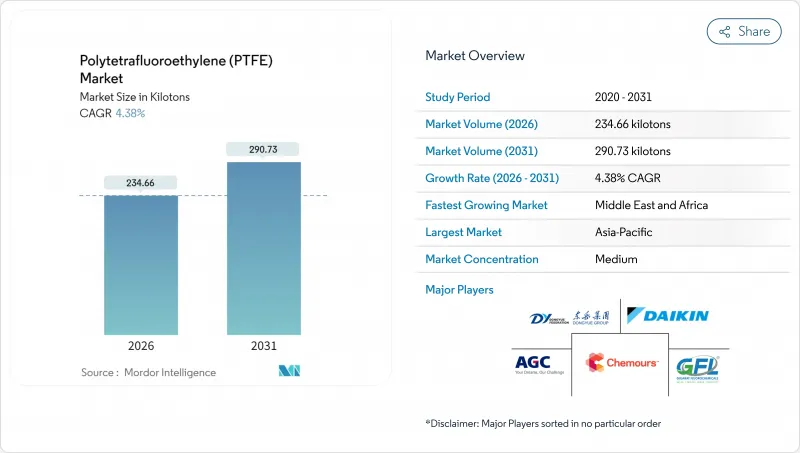

预计聚四氟乙烯(PTFE)市场将从2025年的224.82千吨成长到2026年的234.66千吨,到2031年将达到290.73千吨,2026年至2031年的复合年增长率为4.38%。

这种成长反映了该材料在严苛工业环境中的强势地位,其化学惰性、低摩擦係数和热稳定性难以取代。半导体製造、石油化工加工和电动车基础设施的持续产能扩张支撑着基准消费量,即便潜在的 PFAS 法规收紧了新应用的认证程序。此外,PTFE 市场也受到以下因素的推动:应用设计领域正朝着需要兼具介电强度和耐热性的聚合物方向发展,例如高压轻型线束、固态电池隔膜和增材製造机械部件。竞争策略日益强调萤石供应的垂直整合、开发符合 PFAS 标准的产品线以及靠近电子产业丛集的接近性。

全球聚四氟乙烯(PTFE)市场趋势与洞察

亚洲电子製造业快速扩张

中国当地、台湾、韩国和新加坡正在建造的新型晶圆製造生产线需要超纯聚四氟乙烯(PTFE)阀门、衬垫和晶圆加工组件来应对腐蚀性化学物质。对3奈米和2奈米逻辑节点的大规模投资推动了对耐等离子体氟聚合物组件的需求,而这些组件无法被一般塑胶塑胶经济地取代。晶片晶圆代工厂、代工组装厂和显示器製造商的高度位置如同磁石,将PTFE市场吸引到能够按时交付高精度零件的区域供应商手中。为此,设备供应商正在签订多年期的颗粒状PTFE原料供应合同,以确保无尘室认证的持续性。这些合作正在巩固亚太地区作为全球PTFE市场消费中心的地位。

扩大全球化学加工能力

沙乌地阿拉伯、阿联酋和印度的油气生产商持续批准建造运作条件日益严苛的综合炼油厂和石化联合装置。这些装置内的反应器、热交换器和管道暴露于酸性环境、过热蒸气和高速颗粒物中,进一步巩固了聚四氟乙烯(PTFE)在垫片、阀座和衬里方面的优势。同时,特种化学品产能的提升推动了成型坯料和等静压块需求的成长。由于化学联合装置高度重视长寿命和低停机时间,采购部门通常会在总括采购协议中指定PTFE等级,从而确保了跨经济週期的稳定需求。这些采购量保障是PTFE市场稳定成长的基石。

PFAS 和 PTFE 的环境法规

欧洲化学品管理局 (ECHA) 拟于 2025 年实施的 PFAS 法规草案,除非维持必要的用途豁免,否则将对多种含氟聚合物构成威胁。主要加工商已透过推出符合 PFAS 标准或不含 PFAS 的产品线来应对。 Avient 于 2024 年初推出了用于精密齿轮和衬套的 LubriOne 系列不含 PTFE 的润滑剂。小型製造商由于无法摊销合规性测试成本,被迫退出市场,Micropowders 在 2024 年的新闻稿中宣布,将于 2025 年底前逐步停止其 PTFE 业务,这正反映了这一趋势。消费厨具和服装行业的终端用户正在加速采用硅涂层和溶胶-凝胶基替代品进行双重采购,这减缓了这些领域的需求增长,并减少了对 PTFE 的潜在需求基础。

细分市场分析

截至2025年,颗粒状和模塑状聚四氟乙烯(PTFE)占据了56.74%的市场份额,这得益于垫片、阀门和轴承製造商成熟的压缩成型基础设施。典型的批量可达数吨,确保了规模经济效益,并为具有竞争力的价格奠定了基础。该细分市场为一体化生产商提供了稳定的收入来源,因为其物理性能范围能够满足各种工业设备的规格要求。顶级化学企业通常会将特定的颗粒状PTFE树脂纳入其全厂核准的材料清单,这进一步增强了维护、维修和大修週期中的需求。

由于其基数小,微粉化粉末预计将成为所有粉末形式中成长最快的,到2031年复合年增长率将达到5.82%。粒径小于微米的细颗粒可应用于高性能润滑脂的减摩添加剂、雷射烧结3D列印齿轮以及航太涂料的纹理控製剂等领域。製造商透过投资喷射磨机系统和在线连续分级设备,实现了窄粒径分布,从而能够获得更高的价格。积层製造技术的进步正在加速这一趋势,设计人员越来越多地指定使用聚四氟乙烯(PTFE)微粉来改善复杂形状的脱模性能和尺寸精度。因此,预计微粉化PTFE的市场规模(无论在价值或销售量方面)都将超过整个PTFE市场的成长速度。

聚四氟乙烯 (PTFE) 市场报告按产品形态(颗粒状/模塑 PTFE、细粉/分散 PTFE 等)、终端用户行业(航太、汽车、建筑、电气电子、工业机械等)和地区(亚太、北美、欧洲、南美等)进行细分。市场预测以数量(吨)和价值(美元)为单位。

区域分析

预计到2025年,亚太地区将占据52.28%的聚四氟乙烯(PTFE)市场份额,并凭藉新建晶圆厂和电池材料工厂的运作,在2031年之前保持领先地位。中国已建构起从萤石开采到成品电缆挤出的完整价值链,本土供应商能够提供交货期短、价格具竞争力的产品。政府在「十四五」规划下的奖励措施鼓励了对氟化学品产业的资本流入,从而扩大了国内对树脂的需求。印度正在发展炼油和石化合资企业,这些企业需要耐腐蚀衬里;而韩国和日本则专注于为测量仪器和医疗设备生产高精度氟聚合物零件。

儘管基准较小,但中东和非洲地区预计将超越其他地区,到2031年复合年增长率将达到5.72%。沙乌地阿拉伯的NEOM大型企划和阿联酋ADNOC的下游扩建计画正在其硫酸、氯气和锂加工装置中采用聚四氟乙烯(PTFE)组件。当地电缆製造商正在改用PTFE护套,以符合IEC 62893阻燃标准,用于沙漠气候下的太阳能布线。

儘管北美和欧洲的需求结构已趋于成熟,但监管和技术因素正在重塑消费模式。美国商务部对从古吉拉突邦氟化学有限公司进口的颗粒状聚四氟乙烯征收4.70%至4.89%的反补贴税,正促使国内加工商讨论将生产迁回国内的事宜。

同时,随着欧盟 PFAS 法规蓝图的不断完善,设备原始设备製造商 (OEM) 现在被要求提供必要用途的证明文件,这可能会延缓订单週期,并提高准备不足的供应商的准入门槛。然而,航太主要製造商仍指定使用 PTFE 作为液压密封材料,其工作温度范围为 -55°C 至 +200°C,从而确保了其在高价值细分市场中的稳固地位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲电气和电子设备製造业的快速扩张

- 全球化学加工能力成长

- 电动车需求推动了对轻质电线电缆绝缘材料的需求。

- 聚四氟乙烯(PTFE)在不沾锅市场的应用激增

- 固态电池中的聚四氟乙烯薄膜

- 市场限制

- PFAS 和 PTFE 环境法规的发展趋势

- 萤石供应面临的地缘政治风险

- 用于 5G 硬体的工程塑胶替代品

- 价值链分析

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 进出口趋势

- 形态趋势

- 法律规范

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中国

- EU

- 印度

- 日本

- 马来西亚

- 墨西哥

- 奈及利亚

- 俄罗斯

- 沙乌地阿拉伯

- 南非

- 韩国

- 阿拉伯聯合大公国

- 英国

- 美国

- 终端用户产业趋势

- 航太(航太零件生产收入)

- 汽车(汽车产量)

- 建筑与施工(新建建筑占地面积)

- 电气和电子(电气和电子产品生产收入)

- 包装(塑胶包装量)

第五章 市场规模和成长预测(价值和数量)

- 按产品形式

- 颗粒状/模製聚四氟乙烯

- 细粉/分散型聚四氟乙烯

- 微粉化聚四氟乙烯

- 聚四氟乙烯水性分散体

- 按最终用户行业划分

- 航太

- 车

- 建筑/施工

- 电气和电子

- 工业和机械

- 包装

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 德国

- 义大利

- 俄罗斯

- 英国

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- 3M

- AGC Inc.

- Arkema

- Daikin Industries, Ltd.

- Dongyue Group

- Gujarat Fluorochemicals Limited(GFL)

- HaloPolymer, OJSC

- Saint-Gobain

- Shanghai Huayi 3F New Materials Co., Ltd.

- Sinochem Holdings

- Syensqo

- The Chemours Company

第七章 市场机会与未来展望

第八章:执行长面临的关键策略挑战

The Polytetrafluoroethylene market is expected to grow from 224.82 kilotons in 2025 to 234.66 kilotons in 2026 and is forecast to reach 290.73 kilotons by 2031 at 4.38% CAGR over 2026-2031.

This growth reflects the material's entrenched position in demanding industrial environments, where chemical inertness, low friction, and thermal stability remain hard to substitute. Continuous capacity additions in semiconductor fabrication, petrochemical processing, and electric-vehicle (EV) infrastructure sustain baseline consumption even as potential PFAS restrictions intensify qualification procedures for new applications. The PTFE market also benefits from design shifts toward higher-voltage, lighter-weight wire harnesses, solid-state battery membranes, and additive-manufactured machine parts, all of which require the polymer's unique combination of dielectric strength and temperature resistance. Competitive strategies increasingly revolve around vertical integration of fluorspar supply, development of PFAS-compliant product lines, and geographic proximity to electronics clusters.

Global Polytetrafluoroethylene (PTFE) Market Trends and Insights

Rapid Expansion of Electronics Manufacturing in Asia

Wave after wave of new wafer-fab lines across mainland China, Taiwan, South Korea and Singapore require ultrapure PTFE valves, liners and wafer-processing components to manage aggressive chemistries. Large-scale investments in 3 nm and 2 nm logic nodes elevate demand for plasma-resistant fluoropolymer parts that cannot be economically replaced with commodity plastics. Close clustering of chip foundries, outsourced assembly plants and display makers acts as a demand magnet, pulling the PTFE market toward regional suppliers that can deliver tight-tolerance parts on accelerated build schedules. Equipment suppliers, in turn, lock in multi-year contracts for granular PTFE feedstock to ensure clean-room qualification continuity. These linkages consolidate Asia-Pacific's role as the consumption epicenter of the global PTFE market.

Growth in Global Chemical-Processing Capacity

Hydrocarbon producers in Saudi Arabia, the United Arab Emirates, and India continue to sanction integrated refinery-petrochemical complexes with increasingly severe operating envelopes. Reactors, heat exchangers, and piping in these plants confront acids, superheated steam, and high-velocity particulates, environments that reinforce PTFE's dominance in gaskets, valve seats, and linings. Concurrent debottlenecking in specialty chemicals calls for larger volumes of molded billets and isostatic blocks. Because chemical parks favor long service life and low downtime, procurement departments often specify PTFE grades in blanket purchase agreements, stabilizing offtake across economic cycles. Resultant volume commitments underpin the PTFE market's steady baseline growth trajectory.

Environmental Scrutiny on PFAS and PTFE

The European Chemicals Agency's 2025 draft restriction on PFAS threatens broad classes of fluoropolymers unless exemptions for essential uses are retained. Major processors respond by launching PFAS-compliant or PFAS-free product lines; Avient introduced a PTFE-free LubriOne range for precision gears and bushings in early 2024. Smaller players unable to amortize compliance testing are exiting the category, as reflected in Micro Powders' notice to wind down PTFE operations by late 2025 (company press release, 2024). End-users in consumer cookware and apparel accelerate dual-sourcing with silicon-coated or sol-gel alternatives, blunting incremental demand in these segments and tightening the PTFE market's addressable base.

Other drivers and restraints analyzed in the detailed report include:

- EV-Driven Demand for Lightweight Wire and Cable Insulation

- Surging PTFE Use in Non-Stick Cookware

- Geopolitical Risk to Fluorspar Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Granular and molded grades constituted 56.74% of the PTFE market share in 2025, supported by well-established compression-molding infrastructure across gasket, valve, and bearing manufacturers. Typical batch sizes run into metric tons, ensuring scale economies that anchor competitive pricing. The segment delivers stable baseline revenue for integrated producers because its physical-property envelope fits a wide range of industrial equipment standards. Tier-one chemical processors often codify specific granular PTFE resins into plant-wide approved-materials lists, further reinforcing demand in maintenance, repair, and overhaul cycles.

Micronized powder, while starting from a smaller base, is forecast to post a 5.82% CAGR through 2031, the fastest among all forms. Particles under 10 µm unlock friction-reduction additives for high-performance greases, laser-sintered 3-D-printed gears, and texture-control agents for aerospace coatings. Producers invest in jet-milling systems and in-line classification to deliver narrow particle-size distributions, a capability that commands premium pricing. Growth in additive manufacturing accentuates this trend, as designers specify PTFE micropowders to enhance surface release and dimensional accuracy in complex geometries. The PTFE market size for micronized grades is therefore projected to expand both in value and in volume terms at rates exceeding the overall PTFE market.

The Polytetrafluoroethylene (PTFE) Report is Segmented by Product Form (Granular/Molded PTFE, Fine Powder/Dispersion PTFE, and More), End-User Industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, and More), and Geography (Asia-Pacific, North America, Europe, South America, and More). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

Asia-Pacific dominated with 52.28% of PTFE market share in 2025 and is projected to keep its lead through 2031 as new wafer-fab and battery-material plants come online. China hosts integrated value chains stretching from fluorspar mining to finished cable extrusion, enabling local suppliers to quote shorter lead times and aggressive pricing. Government incentives under China's 14th Five-Year Plan funnel capital into fluorochemicals, catalyzing internal resin demand. India follows with refinery-petrochemical joint ventures that require corrosion-resistant linings, while South Korea and Japan focus on high-precision fluoropolymer components for metrology and medical devices.

The Middle East and Africa, although accounting for a smaller baseline, is forecast to log a 5.72% CAGR to 2031-outpacing all other regions. Mega-projects in Saudi Arabia's NEOM and ADNOC's downstream expansion in the UAE embed PTFE components in sulfuric acid, chlorine, and lithium-processing units. Local cable makers pivot toward PTFE jacketing to meet IEC 62893 fire-retardant standards for photovoltaic wiring in desert climates.

North America and Europe reflect mature demand profiles, yet regulatory and technological factors reshape consumption patterns. The U.S. Department of Commerce's 4.70-4.89% countervailing duties on granular PTFE imports from Gujarat Fluorochemicals Limited encourage reshoring dialogues among domestic converters.

Meanwhile, the European Union's evolving PFAS roadmap compels equipment OEMs to document essential-use justifications, a hurdle that may slow order cycles but also raises barriers to entry for less-prepared suppliers. Aerospace primes, however, continue to specify PTFE for hydraulic seals that function from -55 °C to +200 °C, ensuring a resilient high-value niche.

- 3M

- AGC Inc.

- Arkema

- Daikin Industries, Ltd.

- Dongyue Group

- Gujarat Fluorochemicals Limited (GFL)

- HaloPolymer, OJSC

- Saint-Gobain

- Shanghai Huayi 3F New Materials Co., Ltd.

- Sinochem Holdings

- Syensqo

- The Chemours Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid expansion of electricals and electronics manufacturing in Asia

- 4.2.2 Growth in global chemical processing capacity

- 4.2.3 EV-driven demand for lightweight wire and cable insulation

- 4.2.4 Surging PTFE use in non-stick cookware markets

- 4.2.5 Adoption of PTFE membranes in solid-state batteries

- 4.3 Market Restraints

- 4.3.1 Environmental scrutiny on PFAS and PTFE

- 4.3.2 Geopolitical risk to fluorspar supply

- 4.3.3 Engineering-plastic substitutes for 5G hardware

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Import and Export Trends

- 4.7 Form Trends

- 4.8 Regulatory Framework

- 4.8.1 Argentina

- 4.8.2 Australia

- 4.8.3 Brazil

- 4.8.4 Canada

- 4.8.5 China

- 4.8.6 European Union

- 4.8.7 India

- 4.8.8 Japan

- 4.8.9 Malaysia

- 4.8.10 Mexico

- 4.8.11 Nigeria

- 4.8.12 Russia

- 4.8.13 Saudi Arabia

- 4.8.14 South Africa

- 4.8.15 South Korea

- 4.8.16 United Arab Emirates

- 4.8.17 United Kingdom

- 4.8.18 United States

- 4.9 End-use Sector Trends

- 4.9.1 Aerospace (Aerospace Component Production Revenue)

- 4.9.2 Automotive (Automobile Production)

- 4.9.3 Building and Construction (New Construction Floor Area)

- 4.9.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.9.5 Packaging(Plastic Packaging Volume)

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Product Form

- 5.1.1 Granular/Molded PTFE

- 5.1.2 Fine Powder/Dispersion PTFE

- 5.1.3 Micronized Powder PTFE

- 5.1.4 Aqueous Dispersion PTFE

- 5.2 By End-User Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Industrial and Machinery

- 5.2.6 Packaging

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 United Kingdom

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 Daikin Industries, Ltd.

- 6.4.5 Dongyue Group

- 6.4.6 Gujarat Fluorochemicals Limited (GFL)

- 6.4.7 HaloPolymer, OJSC

- 6.4.8 Saint-Gobain

- 6.4.9 Shanghai Huayi 3F New Materials Co., Ltd.

- 6.4.10 Sinochem Holdings

- 6.4.11 Syensqo

- 6.4.12 The Chemours Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment