|

市场调查报告书

商品编码

1910480

物理沉淀(PVD)涂层:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Physical Vapor Deposition Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

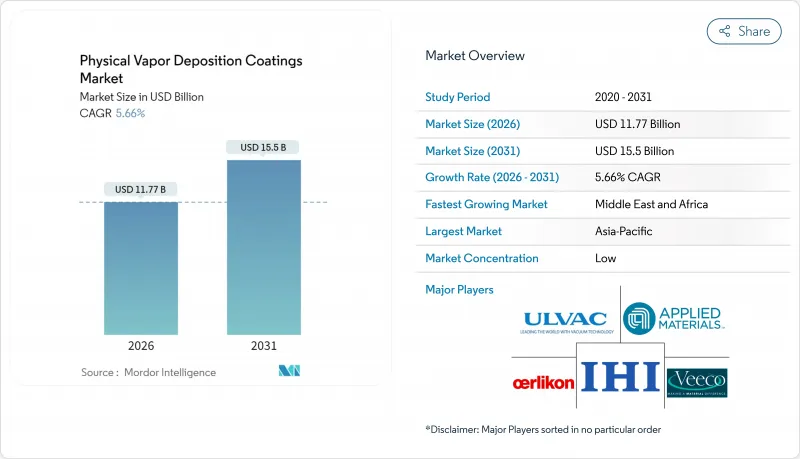

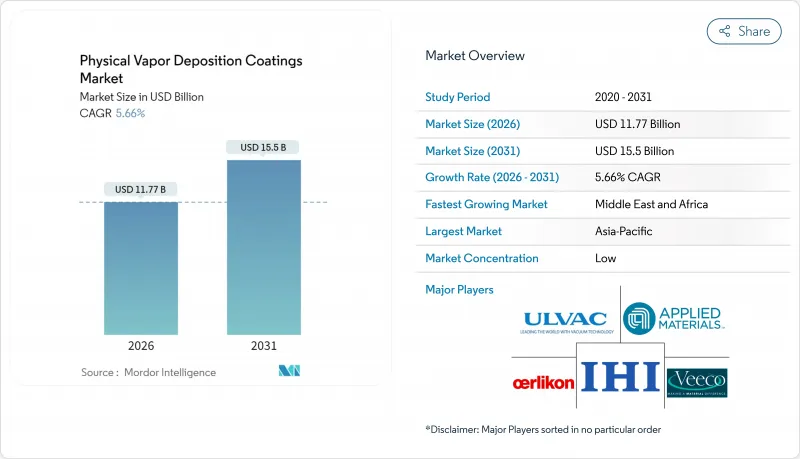

预计到 2026 年,实体沉淀(PVD) 涂层市场规模将达到 117.7 亿美元,高于 2025 年的 111.4 亿美元。

预计到 2031 年将达到 155 亿美元,2026 年至 2031 年的复合年增长率为 5.66%。

这种加速成长反映了7奈米及以下半导体节点需求的激增,以及依赖生物相容性薄膜的微创医疗设备的日益普及。六价铬电镀的监管放鬆,加上3D列印零件表面处理的需求,使得物理沉淀(PVD)既成为合规工具,也成为製程赋能技术。该实行技术能够在金属、塑胶、玻璃和新兴基板上沉积緻密、无缺陷的薄膜,这推动了对新型涂层中心的强劲投资。随着钛靶材价格的上涨,以及更多设备製造商竞相将高电离溅射源商业化,市场竞争日益激烈。

全球物理沉淀(PVD)涂层市场趋势及洞察

加速向7奈米以下半导体节点的过渡

向7奈米及以下逻辑和储存装置的加速过渡,推动了对亚奈米级精度沉积的隔离层层和种子层的需求激增。应用材料公司提供的设备平台正显着增加钼基互连堆迭的采用,以限制极端长宽比的铜扩散。台湾和韩国的大批量部署正在建立超高真空溅射腔、先进钛和钽靶材以及原位测量设备的区域供应链。随着製程尺寸的不断缩小,对公差的要求也越来越高,这促使设备製造商整合高电离溅镀(HiPIMS)源,从而获得更高电离度和更緻密的薄膜。包括晶片组和穿透硅通孔的先进封装技术,进一步推动了对用于3D整合的保形物理沉淀(PVD)製程的投资。

微创医疗设备生产快速成长

随着对导管植入和整形外科固定装置的需求加速成长,涂层需求也从简单的生物相容性发展到抗菌和骨整合能力。磁控溅镀法製备的550奈米厚钽薄膜在BMC生物技术测试中实现了39.184牛顿的临界结合载荷,优于未涂层的钛结构。美国食品药物管理局(FDA)的监管核准在製程验证后带来了可持续的收入,促使美国、德国和爱尔兰的合约涂层公司增设配备无尘室隔离设施的专用医疗生产线。中国和马来西亚注重成本的医疗设备原始设备製造商(OEM)越来越多地将实体沉淀(PVD)製程外包,以满足全球供应链品质审核的要求。

超高真空系统需要高额资本投入

一台12吋丛集式设备的价格可高达500万美元,这还不包括无尘室建设和设施公用费用。这些资金障碍阻碍了巴西、印尼和撒哈拉以南非洲地区的新进业者,订单集中在拥有资产折旧免税额优势的现有企业手中。 5-7年的投资回收期以及随着节点尺寸缩小而导致的製程过时风险,都使资金筹措变得复杂。印度和越南的政府奖励计画可以部分抵销资本支出,但银行协议仍要求主要客户提供订单量担保。

细分市场分析

高功率脉衝磁控溅镀(HiPIMS)技术电离率超过70%,能够为切削刀具製备高附着力、高密度的涂层,预计年复合成长率(CAGR)将达到6.92%,成为成长最快的技术。溅镀技术仍是基础技术,预计到2025年将维持42.35%的市场份额,扩充性涵盖从微电子到建筑玻璃等多个领域。热沉淀和电子束沉淀在光学涂层领域占据一定的市场份额,而电弧沉淀儘管存在大颗粒沉积的问题,但仍继续用于耐磨装饰涂层。随着汽车原始设备製造商(OEM)将氮化物配方标准化以延长冲压製作流程中的刀具寿命,HiPIMS物理沉淀(PVD)涂层市场规模预计将稳定成长。

设备製造商正在采用多阴极配置,实现靶材的即时更换,将配方切换时间缩短30%。离子布植和离子镀在医疗植入领域日益受到认可,该领域融合了表面改质和涂层沉积技术。製程类型的多样化与应用主导蓝图相契合,例如半导体製造厂寻求超洁净环境,工具製造商寻求高能量离子轰击,家具製造商寻求低温装饰性镀铬。

塑胶基板虽然目前市占率较小,但正以6.05%的复合年增长率成长,这主要得益于低温循环製程和等离子体预处理技术的应用,这些技术可以避免聚合物变形。金属仍占据PVD(物理沉淀)涂层市场的主导地位,市占率高达60.78%,这反映了金属在模具和引擎零件领域根深蒂固的需求。溅镀氮化锆正在取代电解铬,用于豪华车的聚碳酸酯和ABS装饰件,从而在美观性和可回收性之间取得平衡。

用于建筑低辐射(Low-E)面板的玻璃金属化过程保持稳定。康宁Eagle XG等特种玻璃在光电应用领域的需求日益增长。受国防费用的推动,直升机和无人机的复合材料基板正成为一个新兴的市场区隔。基板多样化的需求促使涂层必须检验其在不同热膨胀係数下的附着力,从而推动了对原位等离子体活化和底涂层策略的投资。

区域分析

亚太地区预计到2025年将维持47.40%的市场份额,这主要得益于台湾、韩国和中国当地的半导体投资。当地的设备补贴和晶圆製造奖励正在推动资金流入下一代高功率脉衝磁控溅镀(HiPIMS)和离子化物理气相沉积(PVD)生产线。日本和泰国的汽车製造中心正在实施装饰性镀铬替代技术,以满足REACH法规的出口要求。在印度,Ionbond位于孟买的新生产线已运作,有助于缩短国内切削刀具製造商的前置作业时间。

北美地区维持稳定成长,主要得益于航太和医疗设备产业的丛集。美国涡轮发动机原始设备製造商(OEM)正在采用多层耐热阻隔涂层,这种涂层能够承受超过1500摄氏度的燃烧温度。同时,加州的铬禁令加速了低温装饰涂层在管道配件领域的应用。加拿大和墨西哥也为汽车零件(包括汽车工具和需要耐腐蚀性的油砂开采设备)的成长做出了贡献。

欧洲正因禁止使用有害电镀液的法规而取得进展。德国是精密工具领域的主导,瑞士专注于手錶零件的涂层,北欧国家则拥有燃料电池堆层技术的先驱地位。 Iondbond位于瑞典的大型中心将于2024年11月开业,届时将使斯堪地那维亚地区的产能翻番,并有助于降低出口到北美的原始设备製造商(OEM)的物流成本。以沙乌地阿拉伯、阿联酋和南非为首的新兴地区正以5.82%的复合年增长率(CAGR)保持最快增长,这主要得益于不断扩大的基础设施对涂层钻头、阀门和装饰性金属外观五金件的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 半导体节点向7nm以下过渡的趋势日益明显。

- 微创医疗设备生产快速成长

- 六价铬电镀监管过渡

- 需要进行保形PVD表面处理的3D列印零件

- 塑胶和复合材料的低温装饰性PVD

- 市场限制

- 超高真空系统需要高额资本投入

- 与 CVD/ALD 在高长宽比结构中的竞争

- 熟练的真空製程工程师短缺

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 透过流程

- 溅镀沉积

- 热沉淀/电子束沉淀

- 电弧沉淀法

- 离子布植和离子电镀

- HiPIMS

- 按平台

- 金属

- 塑胶

- 玻璃

- 依材料类型

- 金属

- 陶瓷和氧化物

- 其他材料类型

- 最终用户

- 工具

- 成分

- 航太/国防

- 车

- 电子和半导体(包括光学产品)

- 发电

- 其他组件(太阳能产品、医疗设备等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率/排名分析

- 公司简介

- Advanced Energy

- AJA International, Inc.

- Angstrom Engineering Inc.

- Applied Materials, Inc.

- Buhler Leybold Optics,

- Crystallume PVD

- Denton Vacuum

- HEF

- IHI Corporation

- Impact Coatings AB

- KDF Electronic & Vacuum Services Inc.

- KOLZER SRL

- Mitsubishi Materials Corporation

- Mustang Vacuum Systems

- OC Oerlikon Management AG

- PLATIT AG

- Richter Precision Inc.

- Satisloh AG

- Silfex Inc.

- Singulus Technologies AG

- ULVAC

- Veeco Instruments Inc.

- voestalpine eifeler Group

第七章 市场机会与未来展望

Physical Vapor Deposition Coatings market size in 2026 is estimated at USD 11.77 billion, growing from 2025 value of USD 11.14 billion with 2031 projections showing USD 15.5 billion, growing at 5.66% CAGR over 2026-2031.

This acceleration reflects demand spikes from sub-7 nm semiconductor nodes and the wider use of minimally invasive medical devices that rely on biocompatible thin films. Regulatory momentum away from hexavalent chromium electroplating, combined with the need to finish 3D-printed parts, positions physical vapor deposition as both a compliance route and a process enabler. The technology's ability to deliver dense, defect-free layers on metals, plastics, glass, and emerging substrates underpins robust capital spending on new coating centers. Competitive intensity rises as titanium target prices increase and equipment manufacturers rush to commercialize high-ionization sputter sources.

Global Physical Vapor Deposition Coatings Market Trends and Insights

Rising Semiconductor Node Transition Below 7 nm

The current ramp toward sub-7 nm logic and memory devices multiplies demand for barrier and seed layers deposited with sub-nanometer precision. Equipment platforms supplied by Applied Materials reported strong uptake for molybdenum-based interconnect stacks that mitigate copper diffusion at extreme aspect ratios. Volume adoption in Taiwan and South Korea anchors regional supply chains for ultra-high-vacuum sputter chambers, advanced titanium and tantalum targets, and in-situ metrology. Each shrink node tightens tolerance bands, pushing tool makers to integrate HiPIMS sources that deliver higher ionization and denser films. Advanced packaging formats, including chiplets and through-silicon vias, further lift spending on conformal physical vapor deposition steps for 3D integration.

Booming Minimally-Invasive Medical Device Production

The accelerating demand for catheter-based implants and orthopedic fixation hardware elevates coating requirements from simple biocompatibility to antimicrobial and osteointegrative functions. Magnetron-sputtered tantalum films of 550 nm thickness achieved critical adhesion loads of 39.184 N, outperforming uncoated titanium constructs in BMC Biotechnology trials. Regulatory approvals under the US FDA (Food and Drug Administration) create durable revenue once process validation is complete, stimulating contract coaters in the United States, Germany, and Ireland to add dedicated medical lines with clean-room isolation. Cost-sensitive device OEMs (original equipment manufacturers) in China and Malaysia are increasingly outsourcing PVD (physical vapor deposition) steps to meet global supply-chain quality audits.

High Cap-ex of Ultra-High-Vacuum Systems

A single 12-inch cluster tool can cost USD 5 million, excluding clean-room build-out and facility utilities. Such capital thresholds deter new entrants in Brazil, Indonesia, and sub-Saharan Africa, consolidating orders among established players that possess depreciation-advantaged assets. Financing is complicated by five- to seven-year payback horizons and the risk of process obsolescence as node geometry evolves. Government incentive programs in India and Vietnam partially offset cap-ex, yet bank covenants still require volume guarantees from blue-chip customers.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Shift Away from Hex-Chrome Electroplating

- 3D-Printing Parts Requiring Conformal PVD Finishes

- Competition from CVD / ALD for High-Aspect Features

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

HiPIMS recorded the highest 6.92% forecast CAGR, driven by ionization levels exceeding 70%, which yield dense coatings with superior adhesion for cutting tools. Sputter Deposition remains the bedrock, with a 42.35% market share in 2025, favored for its scalability from microelectronics to architectural glass. Thermal and e-beam evaporation occupy niche markets in optical coating, while Arc Vapor Deposition continues to be used in wear-resistant decorative trims, despite challenges from macro-particles. The physical vapor deposition coatings market size for HiPIMS is projected to climb steadily as automotive OEMs standardize on nitride recipes that extend tool life in press shops.

Equipment builders incorporate multi-cathode configurations that allow for on-the-fly target changes, reducing recipe switch-over by 30%. Ion Implantation and Ion Plating gain visibility in medical implants where surface modification and coating deposition converge. Process-type diversification aligns with an application-driven roadmap: semiconductor fabs demand ultra-clean environments, tool manufacturers prize high-energy ion bombardment, and furniture producers seek low-temperature decorative chrome.

Plastic substrates, though smaller today, are advancing at a 6.05% CAGR as low-temperature cycles and plasma pre-treatments avoid polymer deformation. The physical vapor deposition coatings market share for Metals stays dominant at 60.78%, reflecting entrenched tooling and engine component volumes. Polycarbonate and ABS trim pieces in premium cars utilize sputtered zirconium nitride to replace electroplated chrome, striking a balance between aesthetics and recyclability.

Metallization of glass for architectural low-E panels sustains steady volumes; specialty glass, such as Corning Eagle XG, sees an uptick in photonics applications. Composite substrates in helicopters and drones represent an emergent niche propelled by defense spending. Substrate diversification pressures coerce coatings to validate adhesion under disparate coefficients of thermal expansion, prompting investments in in-situ plasma activation and base-coat strategies.

The Physical Vapor Deposition Coatings Market Report is Segmented by Process Type (Sputter Deposition, E-Beam Evaporation, Hipims, and More), Substrate (Metals, Glass, and More), Material Type (Metals/Alloys, Ceramics and Oxides, and More), End User (Tools and Components), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region retained a 47.40% share in 2025, driven by semiconductor investments in Taiwan, South Korea, and mainland China. Local equipment subsidies and wafer-fab incentive packages channel capital into next-generation HiPIMS and ionized PVD lines. Automotive hubs in Japan and Thailand add decorative chrome alternatives to meet REACH-style export requirements. India benefits from Ionbond's new Mumbai line, which shortens lead times for domestic cutting-tool manufacturers.

North America records stable growth, driven by clusters in the aerospace and medical device sectors. US turbine-engine OEMs adopt multilayer thermal-barrier coatings that lift firing temperatures past 1,500 °C, while California's chrome ban accelerates the adoption of low-temperature decorative films on plumbing hardware. Canada and Mexico contribute to the automotive industry through components such as automotive tooling and oil-sand extraction, which demand erosion resistance.

Europe advances through regulatory tailwinds that outlaw toxic plating baths. Germany leads in precision tools, Switzerland specializes in watch component coatings, and the Nordics pioneer fuel cell stack layers. Ionbond's Swedish mega-center, opened November 2024, doubles Scandinavian capacity and reduces logistics costs for OEMs exporting to North America. Emerging regions led by Saudi Arabia, the United Arab Emirates and South Africa record the swiftest 5.82% CAGR, reflecting infrastructure expansions that rely on coated drill bits, valves and decorative metal-effect fittings.

- Advanced Energy

- AJA International, Inc.

- Angstrom Engineering Inc.

- Applied Materials, Inc.

- Buhler Leybold Optics,

- Crystallume PVD

- Denton Vacuum

- HEF

- IHI Corporation

- Impact Coatings AB

- KDF Electronic & Vacuum Services Inc.

- KOLZER SRL

- Mitsubishi Materials Corporation

- Mustang Vacuum Systems

- OC Oerlikon Management AG

- PLATIT AG

- Richter Precision Inc.

- Satisloh AG

- Silfex Inc.

- Singulus Technologies AG

- ULVAC

- Veeco Instruments Inc.

- voestalpine eifeler Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising semiconductor node transition below 7 nm

- 4.2.2 Booming minimally-invasive medical device production

- 4.2.3 Regulatory shift away from hex-chrome electroplating

- 4.2.4 3D-printing parts requiring conformal PVD finishes

- 4.2.5 Low-temperature decorative PVD on plastics and composites

- 4.3 Market Restraints

- 4.3.1 High cap-ex of ultra-high-vacuum systems

- 4.3.2 Competition from CVD / ALD for high-aspect features

- 4.3.3 Shortage of skilled vacuum-process engineers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Process Type

- 5.1.1 Sputter Deposition

- 5.1.2 Thermal / e-Beam Evaporation

- 5.1.3 Arc Vapor Deposition

- 5.1.4 Ion Implantation and Ion Plating

- 5.1.5 HiPIMS

- 5.2 By Substrate

- 5.2.1 Metals

- 5.2.2 Plastics

- 5.2.3 Glass

- 5.3 By Material Type

- 5.3.1 Metals(Includes Alloys)

- 5.3.2 Ceramics and Oxides

- 5.3.3 Other Material Types

- 5.4 By End User

- 5.4.1 Tools

- 5.4.2 Components

- 5.4.2.1 Aerospace and Defense

- 5.4.2.2 Automotive

- 5.4.2.3 Electronics and Semiconductors (incl. Optics)

- 5.4.2.4 Power Generation

- 5.4.2.5 Other Components (Solar Products, Medical Equipment, and Others)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Nordic Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Advanced Energy

- 6.4.2 AJA International, Inc.

- 6.4.3 Angstrom Engineering Inc.

- 6.4.4 Applied Materials, Inc.

- 6.4.5 Buhler Leybold Optics,

- 6.4.6 Crystallume PVD

- 6.4.7 Denton Vacuum

- 6.4.8 HEF

- 6.4.9 IHI Corporation

- 6.4.10 Impact Coatings AB

- 6.4.11 KDF Electronic & Vacuum Services Inc.

- 6.4.12 KOLZER SRL

- 6.4.13 Mitsubishi Materials Corporation

- 6.4.14 Mustang Vacuum Systems

- 6.4.15 OC Oerlikon Management AG

- 6.4.16 PLATIT AG

- 6.4.17 Richter Precision Inc.

- 6.4.18 Satisloh AG

- 6.4.19 Silfex Inc.

- 6.4.20 Singulus Technologies AG

- 6.4.21 ULVAC

- 6.4.22 Veeco Instruments Inc.

- 6.4.23 voestalpine eifeler Group

7 Market Opportunities & Future Outlook

- 7.1 White-space and unmet-need assessment