|

市场调查报告书

商品编码

1910482

中密度纤维板(MDF):市场占有率分析、产业趋势与统计、成长预测(2026-2031)Medium Density Fiberboard (MDF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

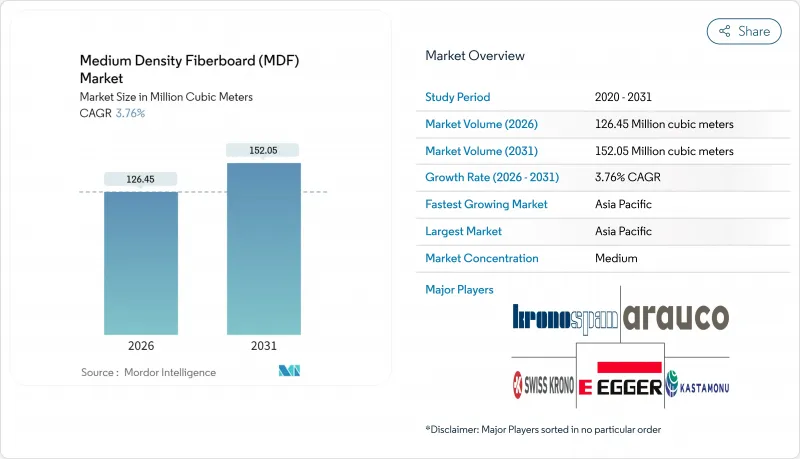

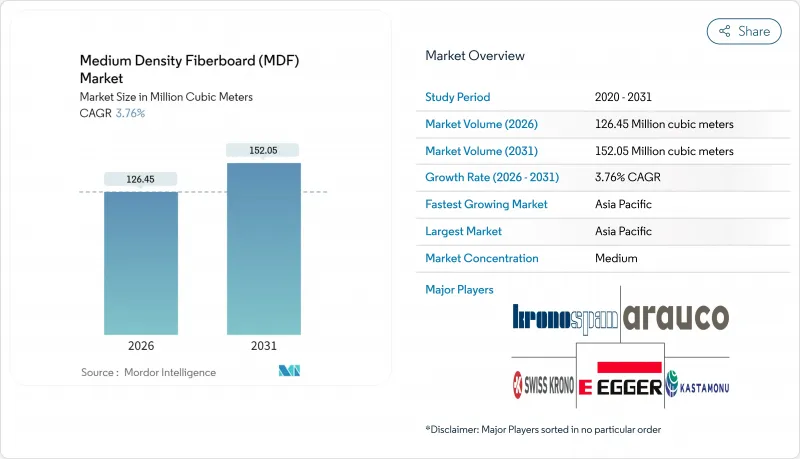

预计中密度纤维板(MDF)市场将从2025年的1.2187亿立方米成长到2026年的1.2645亿立方米,到2031年将达到1.5205亿立方米,2026年至2031年的复合年增长率为3.76%。

儘管全球板材产能成长放缓,但中密度纤维板(MDF)的扩张仍在持续。生产商日益注重透过製程改进、生物基树脂和循环製造技术来提升产品品质,而非单纯追求产量成长。 MDF优异的加工性能、均匀的核心材料和光滑的表面使其成为组装橱柜、门和层架的理想基材,使家具製造商能够实现一致的涂漆和贴面效果。到2024年,亚太地区将占全球产量的60.72%,其中越南和印度等成本优势显着的地区正在增设生产线,以支持国内住宅项目和海外家具订单。同时,北美和欧洲正致力于生产优质、低VOC等级的MDF,以满足日益严格的排放法规。儘管木纤维和脲醛树脂的价格波动仍是短期挑战,但製造商正透过节能精炼、后向整合林业以及采用可减少甲醛排放的聚合物MDI黏合剂来抵消成本上涨的影响。

全球中密度纤维板(MDF)市场趋势及展望

亚太家具製造地产能快速扩张

2024年7月,西门子(Siempelkamp)在越南运作一条日产能600立方公尺的生产线,这标誌着出口商正向后向整合组装,将生产环节延伸至板材生产,以确保原料供应安全和物流可靠性。印尼和菲律宾的类似计划正在提升区域板材自给率,降低运输成本,并使家具OEM厂商能够根据客户的加工系统调整基材规格。在越南扩张的承包商正在柬埔寨和寮国建立卫星装配线,以分散劳动力和港口风险,这种模式正在推动中密度纤维板(MDF)的需求向东道国以外的地区转移。面对不断上涨的电费,中国製造商正将部分生产转移到湄公河流域成本较低的地区,以维持利润率并接近性进口客户。随着生产线总合的消除和新工厂的运作,预计2024年至2026年间,东南亚中密度纤维板(MDF)市场将受益于每年超过600万立方公尺的新增产能。

疫情后全球住宅维修支出復苏

根据Houzz发布的2025年住宅调查,厨房和浴室的翻新意愿已恢復到疫情前的水平,推动了北美地区对橱柜用中密度纤维板(MDF)的需求。在美国,抵押房屋抵押贷款再融资的增加释放了资金,而节能补贴也促进了门窗更换,这些更换通常会指定使用MDF框架材料和包覆层。在欧洲,由于高昂的能源价格推迟了大型计划,MDF的需求成长较为稳定,但对于更换衣柜门板等小规模工程,MDF的需求依然强劲,因为人们更倾向于选择更薄、更易于涂漆的板材。防水和防火等级的MDF供应商获得了溢价,抵消了树脂成本上涨的影响。因此,即使在成熟经济体的新房住宅有所放缓,更广泛的维修需求的復苏也支撑了基准成长。

木材和脲醛树脂价格的波动会对利润率造成压力。

德国和日本生质发电厂对纸浆材的需求激增,导致原木供应紧张,交付格上涨了9%。同时,与天然气价格挂钩的甲醇合约价格飙升,推动脲醛树脂价格达到15个月以来的最高点。 2024年4月,德国中密度纤维板(MDF)价格上涨了1.26%,但由于RTA家具买家提前六个月锁定价格,製造商无法将价格上涨完全转嫁给消费者。工厂正透过转向自建树脂厂来降低价格波动,这些树脂厂将尿素与低成本的豆粉填料混合。一些东南亚製造商正在采用长木片原料以降低精炼能耗,但这种方法存在降低表面光滑度的风险,凸显了成本与品质之间的权衡。

细分市场分析

2025年,家具业占中密度纤维板(MDF)总产量的51.10%,支撑着MDF市场规模达到约6,228万立方公尺。 2026年至2031年,由于消费者倾向于用涂漆的Shaker风格橱柜翻新老旧厨房,而这种风格需要无缺陷的MDF芯材,预计橱柜门、抽屉面板和搁板的复合年增长率将保持4.04%。欧洲建筑商偏好用于浴室盥洗台的防潮绿色芯材板材,而北美则正在向用于无框橱柜的18毫米厚板材过渡。地板材料应用(主要是复合地板基材)正趋于稳定,高端价格分布瓷砖不断取代木纹复合地板,但MDF在价格比尺寸稳定性更重要的低端地板材料中仍然发挥关键作用。

高端家具系列正采用抗菌层压板和超哑光漆,这两种材料都需要超精细抛光的表面。塑合板难以提供具竞争力的价格。巴西和土耳其的製造商透过在线连续共覆纸箔来增加产品价值,并提供减少客户製作流程的组件坯料。源自杨木的轻质中密度纤维板(MDF)透过减轻门扇重量20%和铰链负荷,正在打入高阶室内门市场。这些创新正在巩固中密度纤维板(MDF)作为首选基材的市场基础,因为在这些市场中,表面完美和可加工性是产品差异化的关键。

中密度纤维板 (MDF) 报告按应用领域(家具、橱柜、地板、装饰线条/门/木製品、包装系统及其他应用)、终端用户行业(住宅、商业和公共)以及地区(亚太地区、北美、欧洲、南美以及中东和非洲)进行细分。市场预测以体积(立方米)为单位。

区域分析

亚太地区巩固了其主导地位,预计到2025年将占全球产量的60.30%。印度和越南的政策主导住宅计划进一步强化了这一地位,推动了可预测的中密度纤维板(MDF)需求。儘管中国仍然是最大的生产国,但不断上涨的电费和更严格的环境审核正在促使外国投资流向低成本的东南亚国协。因此,即使产能的增加分散在多个国家,该地区的中密度纤维板市场份额也在不断提升。由于Biesse数控工具机的在地化生产(国产化率已达80%),印度生产商现在能够满足橱柜製造商的精密加工需求,并缩短出口订单的前置作业时间。

北美20.15%的市占率主要由维修带动的板材需求推动,尤其是实木厨房橱柜的需求。中密度纤维板(MDF)易于涂漆,因此其价格高于胶合板。美国乔治亚和北卡罗来纳州的工厂利用当地丰富的速生松木资源和完善的铁路网络,维持了中西部地区具有竞争力的交付价格。加拿大供应商则以北方森林产品认证(Boreal Forest Products Certification)赢得LEED计划,同时也将剩余产品出口到美国东北部。

向循环经济转型是欧洲的重点。德国和波兰计画在2027年将纤维回收率提高到原料投入的11%,具体措施包括引进砂磨粉尘压块锅炉和光学分选线,从生产废弃物中回收纤维。欧盟2026年甲醛排放上限将要求升级吹塑生产线的树脂计量设备和排列型封设备,但许多小规模工厂将无力承担这些成本,导致产业整合。南欧正从上次经济衰退中復苏,西班牙橱柜出口的激增已推动伊比利亚半岛的中密度纤维板(MDF)运转率超过90%。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太家具製造地产能快速扩张

- 疫情后全球住宅维修支出復苏

- 从胶合板/塑合板过渡到光滑的中密度纤维板(用于组装式家具)

- 印度和东南亚政府支持的低收入住宅计划

- 采用PMDI/生物基树脂开启了高端低VOC市场。

- 市场限制

- 木材和脲醛树脂价格的波动会对利润率造成压力。

- 与替代装饰板材(三聚氰胺板、塑胶板、木塑复合材料)的竞争

- 中国不断上涨的电费推高了纺织精炼业的营运成本。

- 价值链分析

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过使用

- 家具

- 内阁

- 地板材料

- 装饰线条、门、木工製品

- 包装系统

- 其他用途

- 按最终用途行业划分

- 住宅

- 商业的

- 公共设施

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- ARAUCO

- EGGER

- Fantoni SpA

- Finsa

- Georgia-Pacific Wood Products LLC

- GREENPANEL INDUSTRIES LIMITED

- Kastamonu Entegre

- Kronoplus Limited

- Masisa

- MDF Mekong

- Pfleiderer Deutschland GmbH

- Roseburg Forest Products

- Sonae Arauco

- Swiss Krono Group

- Unilin Panels

- VRG Dongwha MDF

- West Fraser

- Weyerhaeuser Company

- Yildiz Entegre

第七章 市场机会与未来展望

The Medium Density Fiberboard market is expected to grow from 121.87 million cubic meters in 2025 to 126.45 million cubic meters in 2026 and is forecast to reach 152.05 million cubic meters by 2031 at 3.76% CAGR over 2026-2031.

This expansion continues even as global panel capacity grows more slowly, because producers increasingly rely on process upgrades, bio-based resins and circular manufacturing to lift output quality rather than pure tonnage. MDF's superior machinability, uniform core and smooth face make it the preferred substrate for ready-to-assemble (RTA) cabinets, doors and shelving, allowing furniture makers to achieve consistent painted and laminated finishes. Asia-Pacific commands 60.72% of 2024 production as Vietnam, India and other cost-competitive hubs add lines to serve both domestic housing programs and offshore furniture contracts, while North America and Europe concentrate on premium low-VOC grades to satisfy tightening emission rules. Price volatility for wood fiber and urea-formaldehyde resin remains a short-term challenge, yet manufacturers are offsetting cost spikes through energy-efficient refining, backward integration in timberlands, and adoption of polymeric MDI binders that cut formaldehyde out-gassing.

Global Medium Density Fiberboard (MDF) Market Trends and Insights

Rapid Capacity Additions in Asia-Pacific Furniture Manufacturing Hubs

Vietnam's July 2024 start-up of a 600 m3 day line supplied by Siempelkamp underscores how exporters are back-integrating into panel production to secure feedstock and logistics certainty. Similar projects in Indonesia and the Philippines lift regional panel self-sufficiency, reduce freight exposure, and allow furniture OEMs to align substrate specs with customer finishing systems. Contractors expanding in Vietnam also establish satellite assembly lines in Cambodia and Laos to diversify labor and port risk, a pattern that multiplies MDF demand beyond the host country. Chinese producers, facing higher electricity tariffs, relocate incremental capacity to lower-cost Mekong provinces to protect margins while maintaining proximity to import customers. The medium density fiberboard market benefits as line debottlenecking and new-plant commissioning collectively add more than 6 million m3 of annual nameplate capacity in Southeast Asia between 2024 and 2026.

Recovery in Global Residential Renovation Spending Post-Pandemic

Houzz's 2025 homeowner sentiment survey shows kitchen and bath remodel intentions back at pre-pandemic highs, translating to heightened demand for cabinet-grade MDF panels in North America. Increased mortgage refinancing in the United States frees up discretionary funds, while energy-efficiency rebates spur window and door replacements that often specify MDF jambs and casings. In Europe, the pace is steadier because elevated energy prices delay bigger projects, yet MDF volumes hold as smaller tasks such as closet re-fronting favor thinner, paint-ready boards. Suppliers of water-repellent and fire-rated grades enjoy price premiums, offsetting resin cost inflation. The broader renovation upturn therefore underwrites baseline growth even if new housing starts soften in mature economies.

Volatile Wood and Urea-Formaldehyde Prices Pressuring Margins

Surging pulpwood demand from biomass energy plants in Germany and Japan tightens log supply, lifting delivered fiber costs by 9% between Q4 2024 and Q2 2025. Concurrently, natural-gas-linked methanol contracts spike, pushing urea-formaldehyde resin prices to a 15-month high. German MDF panel prices rose 1.26% in April 2024, yet producers failed to fully pass through hikes because RTA furniture buyers lock prices six months in advance. Mills mitigate volatility by shifting to in-house resin plants that blend urea with lower-cost soy flour extenders. Some Southeast Asian producers adopt longer-chip furnish to cut refining energy, but this approach risks lower face smoothness, underscoring the trade-off between cost and quality.

Other drivers and restraints analyzed in the detailed report include:

- Shift From Plywood/Particleboard to Smoother MDF for RTA Furniture

- Government-Backed Affordable Housing Programs in India and SE Asia

- Competition From Substitute Decorative Panels (Melamine PB, WPC)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The furniture segment captured 51.10% of 2025 volume, anchoring the medium density fiberboard market size near 62.28 million m3. Over 2026-2031, cabinet doors, drawer fronts and shelving sustain a 4.04% CAGR as consumers replace dated kitchens with painted shaker styles that rely on defect-free MDF cores. European builders favor moisture-resistant green-core panels for bath vanities, while North America shifts to thicker 18 mm boards for frameless cabinetry. Flooring uses, mainly laminate substrate, stabilize as luxury vinyl tile keeps displacing wood-look laminate, yet MDF remains pivotal in budget flooring where dimensional stability matters less than price.

Upgraded furniture lines integrate antibacterial laminates and super-matte lacquers, both demanding ultra-fine-sanded surfaces that particleboard struggles to provide at competitive cost. Producers in Brazil and Turkey advance value retention by co-laminating paper foil in-line, thereby shipping component blanks that reduce customer processing steps. Lightweight MDF variants leveraging poplar furnish penetrate premium interior doors by cutting leaf weight 20%, easing hinge load. These innovations reinforce the medium density fiberboard market as the substrate of choice whenever surface perfection and machinability underpin product differentiation.

The Medium Density Fiberboard Report is Segmented by Application (Furniture, Cabinet, Flooring, Molding/Door/Millwork, Packaging System, and Other Applications), End-Use Industry (Residential, Commercial, and Institutional), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Cubic Meters).

Geography Analysis

Asia-Pacific solidified its lead with 60.30% of 2025 production, a position strengthened by policy-driven housing schemes in India and Vietnam that funnel predictable MDF offtake. China remains the single-largest producer, but rising electricity tariffs and stricter environmental audits encourage outbound investment to lower-cost ASEAN states. The region's medium density fiberboard market share therefore rises in qualitative value even as incremental capacity growth disperses across multiple countries. Indian producers, aided by Biesse CNC localization hitting 80% domestic content, now meet cabinetmakers' precision-routing needs and reduce lead times for export orders.

North America's 20.15% share rests on renovation-heavy panel demand, especially for frameless kitchen cabinetry where MDF's paintability justifies a price premium over plywood. U.S. mills in Georgia and North Carolina exploit abundant fast-growing pine and well-developed rail networks, sustaining competitive delivered pricing into the Midwest. Canadian suppliers capitalize on boreal fiber certification to win LEED projects while exporting surplus to the northeastern United States.

Europe emphasizes circular economy compliance. Germany and Poland install sander-dust briquette boilers and optical-sorting lines to reclaim fiber from production waste, thereby raising fiber recovery yield to 11% of intake by 2027. The EU's 2026 formaldehyde cap compels upgrades to blow-line resin dosing and in-line press sealing, costs that many small mills cannot absorb, likely spurring consolidation. Southern Europe rebounds from earlier recessions, and Spain's kitchen cabinet export surge lifts Iberian MDF utilization above 90%.

- ARAUCO

- EGGER

- Fantoni SpA

- Finsa

- Georgia-Pacific Wood Products LLC

- GREENPANEL INDUSTRIES LIMITED

- Kastamonu Entegre

- Kronoplus Limited

- Masisa

- MDF Mekong

- Pfleiderer Deutschland GmbH

- Roseburg Forest Products

- Sonae Arauco

- Swiss Krono Group

- Unilin Panels

- VRG Dongwha MDF

- West Fraser

- Weyerhaeuser Company

- Yildiz Entegre

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Capacity Additions in Asia-Pacific Furniture Manufacturing Hubs

- 4.2.2 Recovery in Global Residential Renovation Spending Post-Pandemic

- 4.2.3 Shift From Plywood/Particleboard to Smoother MDF for RTA Furniture

- 4.2.4 Government-Backed Affordable Housing Programs in India and SE Asia

- 4.2.5 Adoption of Pmdi/Bio-Based Resins Unlocking Premium Low-VOC Segments

- 4.3 Market Restraints

- 4.3.1 Volatile Wood and Urea-Formaldehyde Prices Pressuring Margins

- 4.3.2 Competition from Substitute Decorative Panels (Melamine PB, WPC)

- 4.3.3 Rising Chinese Electricity Tariffs Inflating Fibre-Refining OPEX

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Furniture

- 5.1.2 Cabinet

- 5.1.3 Flooring

- 5.1.4 Molding, Door, and Millwork

- 5.1.5 Packaging System

- 5.1.6 Other Applications

- 5.2 By End-Use Industry

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Institutional

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ARAUCO

- 6.4.2 EGGER

- 6.4.3 Fantoni SpA

- 6.4.4 Finsa

- 6.4.5 Georgia-Pacific Wood Products LLC

- 6.4.6 GREENPANEL INDUSTRIES LIMITED

- 6.4.7 Kastamonu Entegre

- 6.4.8 Kronoplus Limited

- 6.4.9 Masisa

- 6.4.10 MDF Mekong

- 6.4.11 Pfleiderer Deutschland GmbH

- 6.4.12 Roseburg Forest Products

- 6.4.13 Sonae Arauco

- 6.4.14 Swiss Krono Group

- 6.4.15 Unilin Panels

- 6.4.16 VRG Dongwha MDF

- 6.4.17 West Fraser

- 6.4.18 Weyerhaeuser Company

- 6.4.19 Yildiz Entegre

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment