|

市场调查报告书

商品编码

1910540

消防车:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Fire Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

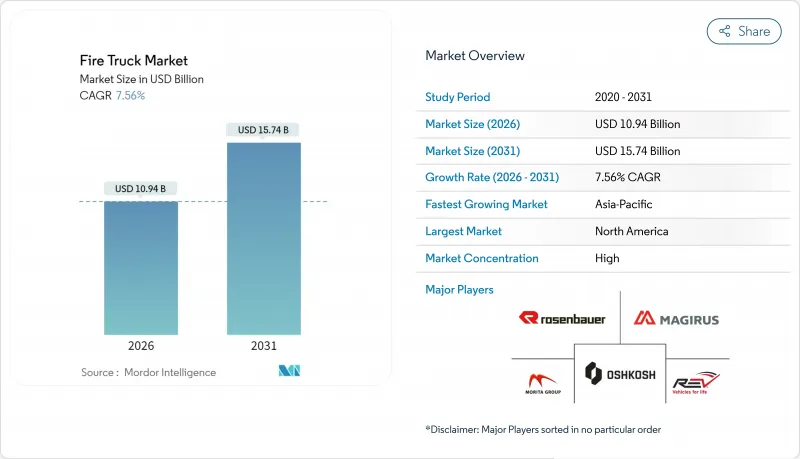

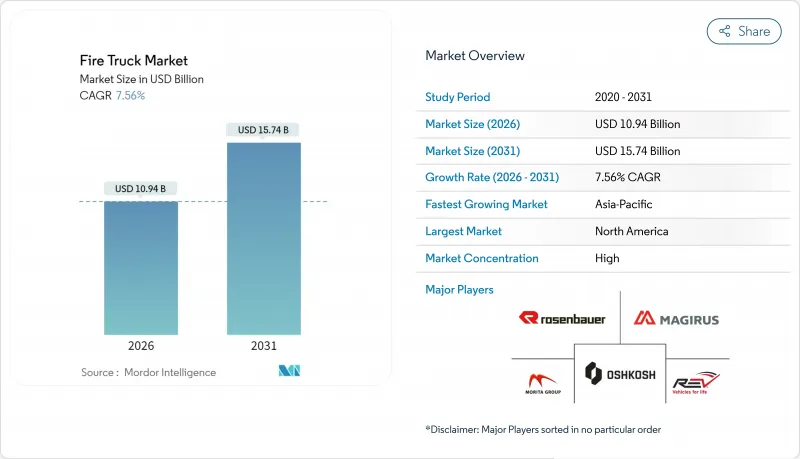

预计消防车市场将从 2025 年的 101.7 亿美元成长到 2026 年的 109.4 亿美元,到 2031 年将达到 157.4 亿美元,2026 年至 2031 年的复合年增长率为 7.56%。

车辆更换週期延长、电气化程度提高以及气候变迁导致野火风险加剧,都促使采购预算不断增加,即便供应链瓶颈依然存在。长达18至33个月的交付週期迫使消防部门在等待新车交付期间对其维护计划进行现代化改造。同时,安全性和性能的提升变得至关重要,消防车市场也持续消化更高的单价。在北美和欧洲,在清洁能源车辆法规以及燃料和维护成本降低的推动下,纯电动消防车正从原型车阶段走向量产阶段。同时,大规模野火的增加推动了对专业野火救援车辆的需求,而随着美国主要製造商之间的整合,这些车辆正面临日益严格的监管审查。

全球消防车市场趋势与洞察

更严格的全球和区域消防安全法规

新的NFPA 1900标准整合了现有的消防车法规,并强制要求配备后监视录影机、LED照明和电动车相容性。监管机构透过从规范性的检查清单转向性能标准,提高了安全标准,同时也为原始设备製造商(OEM)提供了更大的创新空间。统一的要求也有利于消防车的跨境部署,使拥有全球物流网路的製造商受益。然而,不断上涨的合规成本正在推动小型製造商之间的整合,进一步加剧了消防车市场的高度集中。

野火发生频率和严重性增加

预计2024年美国面积将达到770万英亩,超过过去十年的平均水平,儘管火灾总数有所下降。规模更大、强度更高的火灾促使订单激增,消防车可以在行进过程中启动辅助水泵。联邦和州政府为野火防范提供的津贴正在资助专用设备的购置,并使需求与市政预算週期脱钩。如今,火灾季节几乎全年无休,迫使消防局保持全年战备状态,并提高了消防车的可用性标准。

下一代平台的前期成本很高

像RTX这样的电动消防车造价近100万美元,几乎是同类柴油消防车的两倍。虽然营运成本的降低改善了整体拥有成本,但初始资金门槛阻碍了志愿消防队和乡村消防队的普及。津贴计画在一定程度上抵消了成本(博尔德市为其第二辆电动消防车获得了大量外部资金),但在资金充足的大都会圈以外,资金筹措缺口依然存在。儘管电池成本正在下降,但与柴油消防车的价格差距不太可能在2027年后产量大幅提升之前消除。这种两极化将减缓发展中地区的转型,并在短期内限制全球消防车市场的成长。

细分市场分析

预计到2025年,水泵车将占消防车市场的36.28%,到2031年将以7.62%的复合年增长率成长。水泵车的演变包括增加压缩空气泡沫系统和模组化车身,为消防部门提供多功能能力。早期电气化也促进了该细分市场的收入成长,Rosenbauer的RTX平台实现了与柴油车型相媲美的泵送性能。在缺乏消防栓网路的地区,罐式消防车仍然至关重要,而云梯消防车则满足了日益增多的高层建筑的需求。 Bronto Skylift的230英尺(约70公尺)臂展足以覆盖20层楼高的建筑。

现代救援车辆配备了液压救援工具和电池驱动的切割装置,缩短了现场准备时间。集消防车、水罐车和救援车功能于一体的综合车辆需求也在不断增长,这有助于节省采购预算和消防站用地面积。森林消防响应车辆还配备了可在行驶过程中供水的辅助水泵,这在火势迅速蔓延的现场至关重要。由于美国联邦航空管理局 (FAA) 第 139 部分标准对加速和泡沫供应提出了严格的要求,机场消防车 (ARFF) 的价格仍然居高不下。预计在预测期内,技术创新将推动消防车市占率成长至三分之一以上。

到2025年,住宅和商业消防设备将占消防车市场销售额的56.90%,成为消防车市场中最大的单一应用领域。人口密集城区强制推行的消防服务订单。

同时,随着气候变迁导致火灾季节更加严重且持续时间更长,野火消防领域正以7.86%的复合年增长率快速成长。车辆设计正不断改进,包括提高离地间隙、加固底盘以及配备泵送滚动功能,使消防人员能够不间断地扑灭逼近的火势。与野火缓解计画相关的联邦拨款,即使在地方政府收入下降的情况下,也有助于维持采购预算。工业应用领域对耐化学腐蚀密封件和B类危险品运输的需求日益增长,而机场则继续根据美国联邦航空管理局(FAA)的无氟泡沫过渡倡议对机场消防救援车辆(ARFF)提出需求。这些变化表明,多样化的风险状况正在影响消防车市场的演变。

区域分析

北美地区将占2025年总收入的33.95%,并受惠于成熟的紧急服务资金和先进技术测试。该地区将占据早期电动消防车应用的大部分份额,从而巩固其作为未来全球应用模式标竿的地位。持续的联邦基础设施项目为更换车龄超过20年的车辆提供补贴,从而维持了可持续的订单来源。

亚太地区以7.72%的复合年增长率快速发展,中国、印度和东南亚等地的市政消防服务正迅速扩张,以满足都市化。中国各地城市正拨出专款,投资购置专为高密度高层建筑区域设计的消防车和高空作业平台,并扩大消防局网路。印度定期进行竞标,优先考虑本地组装,鼓励全球整车製造商与本土底盘供应商成立合资企业。市场对电池驱动商用车的需求日益增长,呈现出强劲的复合年增长率,这表明一旦充电基础设施成熟,零排放消防车市场潜力巨大。

儘管欧洲市场规模依然庞大,但其成长速度正在放缓,这主要受环保法规和车辆更新换代需求的驱动,而非车辆本身的扩张。更严格的排放气体法规和NFPA合规标准正在影响采购标准,推动欧6引擎和混合动力系统的普及。中东和非洲地区的订单稳定,这与城市扩张和大型企划密切相关;而南美地区的需求则受到宏观经济波动的抑制。这些区域趋势凸显了支撑消防车市场的地理多样性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 严格的全球和地方消防安全法规

- 野火发生频率和严重性增加

- 扩大电动消防车的使用范围

- 欧洲快速更换老旧市政车队

- 都市区高层建筑的增加推动了对高空作业车辆的需求。

- 物联网远端资讯处理整合辅助车队优化

- 市场限制

- 下一代(电动车/混合动力车)平台的初始成本很高

- 半导体和底盘供应链中断

- 熟练的紧急车辆驾驶员短缺

- 新兴国家地方政府面临严峻的预算情势

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 泵浦车

- 油船

- 救援车辆

- 高空作业平台/平台车

- 多功能模组化卡车

- 森林消防车

- 机场紧急应变车辆(ARFF)

- 透过使用

- 住宅和商业

- 工业和製造业

- 飞机场

- 军队

- 森林火灾/森林火灾

- 透过推进力

- 内燃机(ICE)

- 杂交种

- 电池电动车

- 燃料电池电动车

- 最终用户

- 市政消防部门

- 工业设施消防队

- 机场管理局

- 国防/军事

- 合约和私人消防服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Rosenbauer International AG

- Oshkosh Corporation(Pierce)

- REV Group

- Morita Holdings Corporation

- Magirus GmbH

- WS Darley & Co.

- KME(Kovatch Mobile Equipment)

- Sutphen Corporation

- Gimaex GmbH

- Albert Ziegler GmbH

- Bronto Skylift Oy

- NAFFCO

- Emergency One UK Ltd

- Weihai Guangtai

- Iturri Group

- Zhongtian Heavy Industry

- Sides SA

- BAI Brescia Antincendi International

- Fouts Bros Fire Equipment

- Alexis Fire Equipment

第七章 市场机会与未来展望

The Fire Truck Market is expected to grow from USD 10.17 billion in 2025 to USD 10.94 billion in 2026 and is forecast to reach USD 15.74 billion by 2031 at 7.56% CAGR over 2026-2031.

Fleet replacement cycles, electrification momentum, and climate-driven wildfire risk are combining to lift procurement budgets despite lingering supply-chain bottlenecks. Extended order lead times of 18-33 months are prompting departments to modernize maintenance programs while they wait for new deliveries. Yet, the fire truck market continues to absorb higher unit prices as safety and performance features become non-negotiable. Battery-electric models are moving from pilot to production status in North America and Europe, supported by clean-fleet mandates and measurable savings in fuel and maintenance outlays. Meanwhile, an increase in large-scale wildfire incidents stimulates demand for specialized wildland configurations, and consolidated OEM power is drawing heightened regulatory scrutiny in the United States.

Global Fire Truck Market Trends and Insights

Stringent global & regional fire-safety regulations

The new NFPA 1900 standard unifies previous apparatus rules and introduces mandatory rear-view cameras, LED lighting and electric-vehicle guidance. By shifting from prescriptive checklists toward performance-based criteria, regulators give OEMs room to innovate while still elevating baseline safety. Harmonized requirements also support cross-border apparatus deployment, a benefit for manufacturers with global logistics footprints. Compliance costs, however, are accelerating consolidation among smaller builders, reinforcing the high-concentration profile of the fire truck market.

Rising frequency & severity of wildfires

U.S. wildfire acreage hit 7.7 million acres in 2024, outpacing the 10-year average despite fewer total incidents. Larger, more intense events drive orders for Type 1 Wildland-Urban Interface engines with auxiliary pumps that operate while the vehicle is moving. Federal and state grants aimed at wildfire readiness funnel capital into specialized equipment, keeping demand insulated from municipal budget cycles. The extended season now covers nearly the full calendar year, requiring departments to maintain year-round readiness and boosting the baseline for apparatus utilization.

High upfront cost of next-gen platforms

An electric pumper such as the RTX lists close to a million dollar, roughly double a comparable diesel engine. While operational savings improve total cost of ownership, the initial capital hurdle delays adoption for volunteer and rural departments. Grant programs partially offset costs-Boulder secured a decent amount in external funding for its second electric unit-but financing gaps persist outside well-funded metros. Battery costs are falling yet are unlikely to reach parity with diesel until production runs scale meaningfully after 2027. This two-tier dynamic slows the transition in developing regions, restraining global fire truck market growth in the near term.

Other drivers and restraints analyzed in the detailed report include:

- Growing adoption of electric fire trucks

- Rapid replacement of ageing municipal fleets in Europe

- Semiconductor & chassis supply-chain disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The pumper segment held 36.28% of the fire truck market in 2025 and is set to advance at a 7.62% CAGR to 2031. Pumper evolution adds compressed-air foam systems and modular bodywork, giving departments multi-purpose capability. Segment revenue also benefits from early electrification, with Rosenbauer's RTX platform offering identical pump-rating performance to diesel models. Tankers remain indispensable where hydrant networks are sparse, and ladder platforms satisfy growing urban skylines, including Bronto Skylift's 230-foot reach that covers 20-story buildings.

Modern rescue units embed hydraulic extrication tools and battery-powered cutting devices, reducing scene set-up time. Demand is also rising for combination apparatus that blend pumper, tanker and rescue functions to save procurement budgets and station footprints. Wildland trucks add auxiliary pumps that deliver water while the vehicle is moving, a feature vital during fast-moving fires. ARFF vehicles command premium pricing due to FAA Part 139 standards that mandate stringent acceleration and foam-delivery benchmarks. With incremental innovation, the pumper's share of the fire truck market is likely to remain above one-third through the forecast horizon.

Residential & commercial protection accounted for 56.90% of 2025 revenues, making it the largest single application inside the fire truck market. Fire service mandates for dense urban cores keep order flow steady, and new building codes continue to shift equipment needs toward higher pump capacity and integrated decontamination systems.

Wildland & forestry, however, is expanding at 7.86% CAGR as climate patterns intensify severity and length of fire seasons. Vehicle designs incorporate greater ground clearance, reinforced underbodies and pump-and-roll capacity so crews can attack advancing flames without stopping. Federal grants tied to wildfire mitigation programs sustain procurement budgets even during municipal revenue downturns. Industrial applications demand chemical-proof seals and fire suppression agents compatible with class B hazards, while airports continue ordering ARFF units compliant with fluorine-free foam requirements set by the FAA's ongoing F3 transition initiative. Taken together, these shifts demonstrate how diverse risk profiles shape the evolving fire truck market.

The Fire Truck Market Report is Segmented by Type (Pumpers, Tankers, Rescue Trucks, and More), Application (Residential and Commercial, Airports, Military, and More), Propulsion (Internal Combustion Engine (ICE), Hybrid, and More), End-User (Municipal Fire Departments and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 33.95% of 2025 revenue, benefiting from mature emergency-services funding and advanced technology trials. The region hosts the bulk of early electric deployments, reinforcing its role as a bellwether for future global adoption patterns. Ongoing federal infrastructure programs provide supplemental funding to replace apparatus older than 20 years, keeping the order pipeline resilient.

Asia-Pacific, recording a 7.72% CAGR, is rapidly scaling municipal fire services to match urbanization in China, India and Southeast Asia. China's tier-2 and tier-3 cities allocate capital to expand station networks and invest in pumpers and aerials designed for dense, high-rise districts. India issues regular tenders that prioritize local assembly, encouraging joint ventures between global OEMs and domestic chassis suppliers. Emerging interest in battery-electric commercial vehicles at a robust CAGR hints at a budding market for zero-emission apparatus once charging infrastructure matures.

Europe remains a large yet slower-growing arena focused on green compliance and replacement rather than fleet expansion. Tightening emissions rules and NFPA-aligned standards influence procurement criteria, stimulating uptake of Euro-VI engines and hybrid drives. The Middle East & Africa register steady orders linked to expanding urban footprints and industrial megaprojects, while South America's demand is tempered by macroeconomic volatility. Collectively, these regional trajectories underscore the geographic diversity underpinning the fire truck market.

- Rosenbauer International AG

- Oshkosh Corporation (Pierce)

- REV Group

- Morita Holdings Corporation

- Magirus GmbH

- W.S. Darley & Co.

- KME (Kovatch Mobile Equipment)

- Sutphen Corporation

- Gimaex GmbH

- Albert Ziegler GmbH

- Bronto Skylift Oy

- NAFFCO

- Emergency One UK Ltd

- Weihai Guangtai

- Iturri Group

- Zhongtian Heavy Industry

- Sides S.A.

- BAI Brescia Antincendi International

- Fouts Bros Fire Equipment

- Alexis Fire Equipment

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent global & regional fire-safety regulations

- 4.2.2 Rising frequency & severity of wildfires

- 4.2.3 Growing adoption of electric fire trucks

- 4.2.4 Rapid replacement of ageing municipal fleets in Europe

- 4.2.5 Urban high-rise construction boosting aerial truck demand

- 4.2.6 Integration of IoT-telematics for fleet optimisation

- 4.3 Market Restraints

- 4.3.1 High upfront cost of next-gen (EV / hybrid) platforms

- 4.3.2 Semiconductor & chassis supply-chain disruptions

- 4.3.3 Shortage of skilled emergency-vehicle operators

- 4.3.4 Tight municipal budgets in developing economies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Pumpers

- 5.1.2 Tankers

- 5.1.3 Rescue Trucks

- 5.1.4 Aerial / Platform Trucks

- 5.1.5 Multi-tasking Modular Trucks

- 5.1.6 Wildland Fire Trucks

- 5.1.7 Airport Crash Tender (ARFF)

- 5.2 By Application

- 5.2.1 Residential & Commercial

- 5.2.2 Industrial & Manufacturing

- 5.2.3 Airports

- 5.2.4 Military

- 5.2.5 Wildland & Forestry

- 5.3 By Propulsion

- 5.3.1 Internal Combustion Engine (ICE)

- 5.3.2 Hybrid

- 5.3.3 Battery Electric

- 5.3.4 Fuel-Cell Electric

- 5.4 By End-User

- 5.4.1 Municipal Fire Departments

- 5.4.2 Industrial Facility Brigades

- 5.4.3 Airport Authorities

- 5.4.4 Defense & Military

- 5.4.5 Contract & Private Fire Services

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Rosenbauer International AG

- 6.4.2 Oshkosh Corporation (Pierce)

- 6.4.3 REV Group

- 6.4.4 Morita Holdings Corporation

- 6.4.5 Magirus GmbH

- 6.4.6 W.S. Darley & Co.

- 6.4.7 KME (Kovatch Mobile Equipment)

- 6.4.8 Sutphen Corporation

- 6.4.9 Gimaex GmbH

- 6.4.10 Albert Ziegler GmbH

- 6.4.11 Bronto Skylift Oy

- 6.4.12 NAFFCO

- 6.4.13 Emergency One UK Ltd

- 6.4.14 Weihai Guangtai

- 6.4.15 Iturri Group

- 6.4.16 Zhongtian Heavy Industry

- 6.4.17 Sides S.A.

- 6.4.18 BAI Brescia Antincendi International

- 6.4.19 Fouts Bros Fire Equipment

- 6.4.20 Alexis Fire Equipment

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment