|

市场调查报告书

商品编码

1910591

锂离子电池隔离膜:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Lithium-ion Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

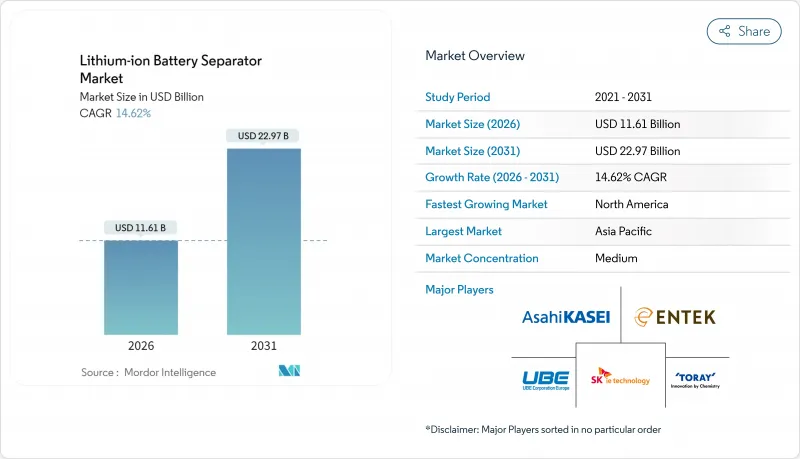

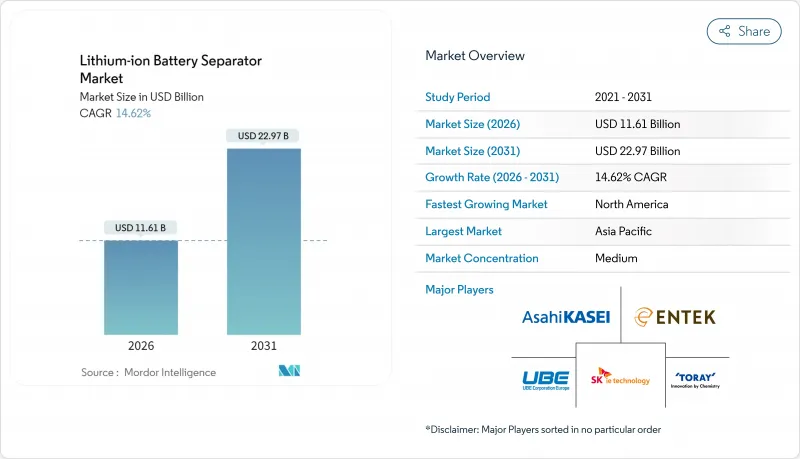

预计锂离子电池隔膜市场将从 2025 年的 101.3 亿美元成长到 2026 年的 116.1 亿美元,预计在 2031 年达到 229.7 亿美元,2026 年至 2031 年的复合年增长率为 14.62%。

电动车和大型储能係统推动了新的需求,这些系统越来越需要高镍化学系统和超薄陶瓷涂层来承受严苛的快速充电环境。虽然湿式加工的聚烯隔膜仍然是主流,但随着汽车製造商加强热保护措施,涂层产品正经历快速成长。资本正流入那些强制要求在地化生产的地区。旭化成在安大略省投资15.6亿加元建设的综合设施就是一个典型的例子,它利用先发优势重塑了供应链结构。同时,北美的税额扣抵、欧洲的电池法规以及中国超级工厂的建设正在扰乱全球贸易流量,并使那些掌握成本效益高的树脂整合技术并能保证本地化生产的供应商受益。

全球锂离子电池隔离膜市场趋势及洞察

锂离子电池价格下降

到2024年,受碳酸锂成本下降和中国电池产能过剩的推动,电池组价格将跌破100美元/kWh。新兴市场对价格弹性的更高需求正在推动电动车的普及,进而带动隔膜平方公尺需求的相应成长。电池製造商越来越多地将涂层製程外包以提高生产线效率,从而提升了涂层薄膜的市场份额,并有助于实现新建工厂20%的利润率目标。成本下降也缩短了技术更新周期,使得薄膜厚度得以降低,同时又不影响其耐用性。

加速全球电动车普及

预计到2024年,全球电动车销量将超过1,700万辆,届时将消耗约21亿平方公尺的隔膜材料。高镍正极材料会产生更高的热量,因此需要使用在200°C以上温度下稳定的陶瓷涂层或芳香聚酰胺增强隔膜。汽车製造商的电气化倡议,例如本田的2040年后发展蓝图,正在促成多年隔膜合约的签订,从而缓解市场波动。

聚烯树脂供需失衡

自2022年以来,超高分子量聚乙烯的产能比需求低8个百分点,导致树脂价格上涨,给非一体化生产商带来压力。旭化成的内部树脂供应网络有效缓解了价格波动,并使其生产线速度比现货树脂竞争对手提高了一倍。北美供不应求迫使新参与企业进口树脂或采用替代聚合物,例如Sepion公司的芳香聚酰胺共混树脂。

细分市场分析

截至2025年,湿式法聚烯将占锂离子电池隔离膜市场60.05%的份额。这一地位主要归功于其均匀的孔隙率和亚微米级孔径控制技术。然而,陶瓷涂层产品正以22.05%的复合年增长率快速增长,并赢得了汽车应用领域的订单,这些应用需要175°C或更高的停机温度。在线连续涂覆技术整合了成型和浆料涂覆,将产量比率损失降低到2%以下,并将利润率提高5至7个百分点。

对于成本敏感型设备而言,未涂覆的聚烯仍然是首选材料,但随着智慧型手机也开始采用更薄的涂覆隔膜,其受欢迎程度正在下降。功能性聚合物覆层,例如PVDF-HFP共混物,可提供低于5°的电解接触角和快40%的涂覆速度,这标誌着第三项技术前沿的到来。

聚丙烯48.02%的市占率反映了其成熟的挤出生产线和较低的树脂成本。聚乙烯由于其130°C的熔点限制,在湿式混炼领域仍占据主导地位,但多层PP/PE/PP复合材料目前已占汽车产业出货量的三分之一。不织布芳香聚酰胺奈米纤维膜在300°C下仍能维持尺寸稳定性,拉伸强度超过200 MPa,但价格为15-25美元/公斤。

低温缩聚製程带来的成本降低预计将在三年内使芳香聚酰胺的价格减半,从而促进其在高端电动车和航太领域的应用。然而,回收仍面临挑战:聚烯薄膜可以降级回收,但芳香聚酰胺目前尚无回收途径,这给2027年欧洲法规结构带来了挑战。

锂离子电池隔膜市场报告按隔膜类型(湿式工艺、干法工艺、陶瓷涂层)、材料(聚丙烯、不织布等)、厚度(小于 15 毫米、16-20 毫米、大于 15 毫米)、形状(软包、圆柱形、棱柱形)、涂层(未涂层聚烯、在线连续陶瓷等)、应用汽车(汽车、电动车等地区)进行细分、汽车等地区。

区域分析

截至2025年,亚太地区将占锂离子电池隔板市场49.75%的份额,其中中国将占据主导地位,其产能占全球的75%。由于树脂一体化和劳动力优势,中国企业已将隔膜成本比日本竞争对手降低了30%至40%。随着东丽和住友化学退出通用型隔板市场,转而专注于固态电池这一细分市场,日本的市占率将从2018年的35%下降到2021年的20%。韩国SK IE Technology在欧洲拥有47.5吉瓦时的电池产能,但累计2024年将亏损2,910亿韩元,这意味着其利润率将面临压力。

北美是成长最快的地区,复合年增长率高达21.43%,这主要得益于通膨控制方面的税收优惠政策以及已宣布的超过50亿美元的分离器投资。旭化成位于安大略省的工厂计划到2027年实现年产能7亿平方公尺,并占据30%的区域市场份额;与此同时,Microporous和Sepion分别在维吉尼亚和加利福尼亚州扩建产能。政策稳定性仍然至关重要,取消税额扣抵可能会导致资产閒置。

由于碳足迹和再生材料含量法规的限制,欧洲市场更倾向于本地生产。 SK IE Technology位于波兰的工厂将新增3.4亿平方公尺的产能,但该公司面临的财务压力使其长期供应前景不明朗。欧洲电池製造商Northvolt、ACC和Vercor正在开发自己的隔膜,这进一步加剧了现有製造商的压力。儘管南美洲和中东/非洲市场规模仍然小规模,但巴西计划在2024年推出15万辆电动车,沙乌地阿拉伯的产业政策也可能从2027年起促成小规模本地产能的建立。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 锂离子电池价格正在下降

- 电动车在全球的加速普及

- 固定式储能计划快速成长

- 政府对国内电池供应链的激励措施

- 推广高镍正极材料超薄隔膜的OEM生产

- 促进区域分离器超级工厂发展的在地化义务

- 市场限制

- 聚烯树脂供需失衡

- 严格的安全和品质认证时间表

- 湿式製程生产线中溶剂回收成本问题

- 对废旧分离器回收途径的限制

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 分隔符

- 湿式聚烯

- 干法製程聚烯

- 陶瓷涂层

- 材料

- 聚丙烯(PP)

- 聚乙烯(PE)

- 多层PP/PE/PP

- 不织布及其他

- 按厚度

- 15微米或更小

- 16~20µm

- 21~25µm

- 25微米或以上

- 按电池形状

- 袋式电池

- 圆柱形电池

- 棱镜电池

- 透过涂层技术

- 在线连续陶瓷涂层

- 离线陶瓷涂层

- 功能性聚合物涂层

- 未涂层聚烯

- 透过使用

- 电动车

- 家用电子电器

- 固定式储能

- 工业和电动工具

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 北欧国家

- 俄罗斯

- 其他欧洲

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 澳洲和纽西兰

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、联盟、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- Asahi Kasei Corporation

- Toray Industries Inc.

- SK IE Technology Co. Ltd

- Entek International LLC

- Ube Corporation

- Sumitomo Chemical Co. Ltd

- Celgard LLC(Polypore)

- W-Scope Corporation

- Shenzhen Senior Technology

- Cangzhou Mingzhu Plastic

- Suzhou GreenPower

- Sinoma Science & Tech

- Dreamweaver International

- Gellec Co. Ltd

- Zhongke Science & Tech

- Mitsubishi Paper Mills

- Foshan Jinhui Hi-Tech

- Freudenberg Performance Materials

- Xiangyang Xingyuan

- Teijin Ltd

- Others(validated niche players)

第七章 市场机会与未来展望

The Lithium-ion Battery Separator Market is expected to grow from USD 10.13 billion in 2025 to USD 11.61 billion in 2026 and is forecast to reach USD 22.97 billion by 2031 at 14.62% CAGR over 2026-2031.

New demand stems from electric vehicles and utility-scale storage, which increasingly specify ultra-thin, ceramic-coated membranes that tolerate high-nickel chemistries and aggressive fast-charge profiles. Wet-process polyolefin separators still dominate, yet coated variants are growing rapidly as automakers elevate thermal-propagation safeguards. Capital is flowing to regions with domestic-content mandates; Asahi Kasei's CAD 1.56 billion Ontario complex exemplifies the first-mover incentives now reshaping the supply map. Meanwhile, North American tax credits, Europe's Battery Regulation, and China's gigafactory build-out are fragmenting global trade flows and rewarding suppliers that certify regional provenance while mastering cost-effective resin integration.

Global Lithium-ion Battery Separator Market Trends and Insights

Declining Lithium-Ion Battery Prices

Pack prices dipped below USD 100 kWh in 2024, aided by lower lithium carbonate costs and Chinese cell overcapacity. Price elasticity widens EV adoption in emerging markets, elevating separator square-meter demand in lockstep. Coated films gain share because cell makers outsource that step for in-line efficiency, supporting 20% margin targets at new integrated plants. Cost deflation also shortens technology refresh cycles, encouraging thinner membranes without sacrificing durability.

Accelerating Global EV Adoption

Global EV sales topped 17 million in 2024, consuming about 2.1 billion m2 of separator material. Nickel-rich cathodes intensify heat generation, forcing the adoption of ceramic-coated or aramid-reinforced separators stable above 200 °C. Automaker electrification pledges, such as Honda's post-2040 roadmap, lock multi-year separator contracts and mitigate market volatility.

Polyolefin Resin Supply-Demand Imbalance

Ultra-high-molecular-weight polyethylene capacity lags demand by eight points since 2022, inflating resin prices and squeezing non-integrated producers. Asahi Kasei's internal resin streams cushion volatility and double line speed relative to spot-resin competitors. North American shortages force startups to import resin or adopt alternative polymers such as Sepion's aramid blends.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Growth in Stationary Energy-Storage Projects

- Government Incentives for Domestic Battery Supply Chains

- Stringent Safety & Quality Certification Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wet-process polyolefin held 60.05% lithium ion battery separator market share in 2025, a position built on uniform porosity and sub-1 µm pore control. Ceramic-coated variants, however, are pacing at 22.05% CAGR, capturing automotive contracts that demand shutdown temperatures above 175 °C. Inline coating integrates formation and slurry application, cutting yield loss to below 2% and boosting margins by 5-7 points.

Uncoated polyolefin still serves cost-sensitive devices, yet its grip is loosening as even smartphones migrate to thinner, coated separators. Functional polymer overlays, such as PVDF-HFP blends, deliver electrolyte contact angles under 5°, trimming formation time by 40% and hinting at a third technology frontier.

Polypropylene's 48.02% share reflects mature extrusion lines and low resin cost. Polyethylene continues to dominate wet-process formulations thanks to its 130 °C melt-point shutdown feature, but multilayer PP/PE/PP stacks now constitute one-third of automotive shipments. Non-woven aramid nanofiber membranes maintain dimensional stability at 300 °C and tensile strengths above 200 MPa, albeit at USD 15-25 kg pricing.

Cost breakthroughs via low-temperature polycondensation could halve aramid pricing within three years, widening adoption in premium EVs and aerospace. Recycling challenges persist: polyolefin films can downcycle, whereas aramid lacks pathways, a liability in Europe's 2027 mandate window.

The Lithium-Ion Battery Separator Market Report is Segmented by Separator Type (Wet-Process, Dry-Process, and Ceramic-Coated), Material (Polypropylene, Non-Woven and Others, and More), Thickness (Up To 15 Mm, 16 To 20 Mm, and More), Form Factor (Pouch, Cylindrical, and Prismatic), Coating (Uncoated Polyolefin, In-Line Ceramic, and More), Application (Automotive EV, and More), and Geography (North America, Asia-Pacific, and More).

Geography Analysis

Asia-Pacific controlled 49.75% of the lithium-ion battery separator market in 2025, led by China's 75% global capacity. Chinese firms lowered separator costs 30-40% below Japanese peers through resin integration and labor advantages. Japan's share slid from 35% in 2018 to 20% in 2021 as Toray and Sumitomo exited commodity grades for solid-state niches. Korea's SK IE Technology holds 47.5 GWh of European battery capacity but logged a 291 billion won loss in 2024, signaling margin pressure.

North America is the fastest-growing region at 21.43% CAGR, buoyed by Inflation Reduction Act incentives and more than USD 5 billion in announced separator investments. Asahi Kasei's Ontario site aims for 700 million m2 annual output and a 30% regional share by 2027, while Microporous and Sepion add capacity in Virginia and California, respectively. Policy stability remains critical; a repeal of credits could strand assets.

Europe's market is shaped by carbon-footprint and recycled-content rules that favor local production. SK IE Technology's Polish plants add 340 million m2 capacity, yet the firm's financial strain clouds longer-term supply. European cell makers Northvolt, ACC, and Verkor pursue in-house separators, further pressuring incumbents. South America and MEA remain minor, but Brazil's 150,000 EVs in 2024 and Saudi industrial policies may spur modest local capacity post-2027.

- Asahi Kasei Corporation

- Toray Industries Inc.

- SK IE Technology Co. Ltd

- Entek International LLC

- Ube Corporation

- Sumitomo Chemical Co. Ltd

- Celgard LLC (Polypore)

- W-Scope Corporation

- Shenzhen Senior Technology

- Cangzhou Mingzhu Plastic

- Suzhou GreenPower

- Sinoma Science & Tech

- Dreamweaver International

- Gellec Co. Ltd

- Zhongke Science & Tech

- Mitsubishi Paper Mills

- Foshan Jinhui Hi-Tech

- Freudenberg Performance Materials

- Xiangyang Xingyuan

- Teijin Ltd

- Others (validated niche players)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining lithium-ion battery prices

- 4.2.2 Accelerating global EV adoption

- 4.2.3 Rapid growth in stationary energy-storage projects

- 4.2.4 Government incentives for domestic battery supply chains

- 4.2.5 OEM push for ultra-thin separators for high-Ni cathodes

- 4.2.6 Localization mandates driving regional separator gigafactories

- 4.3 Market Restraints

- 4.3.1 Polyolefin resin supply-demand imbalance

- 4.3.2 Stringent safety & quality certification timelines

- 4.3.3 Solvent-recovery cost challenges in wet-process lines

- 4.3.4 Limited recyclability pathways for spent separators

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Separator Type

- 5.1.1 Wet-Process Polyolefin

- 5.1.2 Dry-Process Polyolefin

- 5.1.3 Ceramic-Coated

- 5.2 By Material

- 5.2.1 Polypropylene (PP)

- 5.2.2 Polyethylene (PE)

- 5.2.3 Multilayer PP/PE/PP

- 5.2.4 Non-woven and Others

- 5.3 By Thickness

- 5.3.1 Up to 15 µm

- 5.3.2 16 to 20 µm

- 5.3.3 21 to 25 µm

- 5.3.4 Above 25 µm

- 5.4 By Battery Form Factor

- 5.4.1 Pouch Cells

- 5.4.2 Cylindrical Cells

- 5.4.3 Prismatic Cells

- 5.5 By Coating Technology

- 5.5.1 In-line Ceramic Coating

- 5.5.2 Offline Ceramic Coating

- 5.5.3 Functional Polymer Coatings

- 5.5.4 Uncoated Polyolefin

- 5.6 By Application

- 5.6.1 Automotive EV

- 5.6.2 Consumer Electronics

- 5.6.3 Stationary Energy Storage

- 5.6.4 Industrial and Power Tools

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Netherlands

- 5.7.2.7 NORDIC Countries

- 5.7.2.8 Russia

- 5.7.2.9 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 ASEAN Countries

- 5.7.3.6 Australia and New Zealand

- 5.7.3.7 Rest of Asia Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 South Africa

- 5.7.5.3 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 Toray Industries Inc.

- 6.4.3 SK IE Technology Co. Ltd

- 6.4.4 Entek International LLC

- 6.4.5 Ube Corporation

- 6.4.6 Sumitomo Chemical Co. Ltd

- 6.4.7 Celgard LLC (Polypore)

- 6.4.8 W-Scope Corporation

- 6.4.9 Shenzhen Senior Technology

- 6.4.10 Cangzhou Mingzhu Plastic

- 6.4.11 Suzhou GreenPower

- 6.4.12 Sinoma Science & Tech

- 6.4.13 Dreamweaver International

- 6.4.14 Gellec Co. Ltd

- 6.4.15 Zhongke Science & Tech

- 6.4.16 Mitsubishi Paper Mills

- 6.4.17 Foshan Jinhui Hi-Tech

- 6.4.18 Freudenberg Performance Materials

- 6.4.19 Xiangyang Xingyuan

- 6.4.20 Teijin Ltd

- 6.4.21 Others (validated niche players)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment