|

市场调查报告书

商品编码

1910608

雷射焊接机:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Laser Welding Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

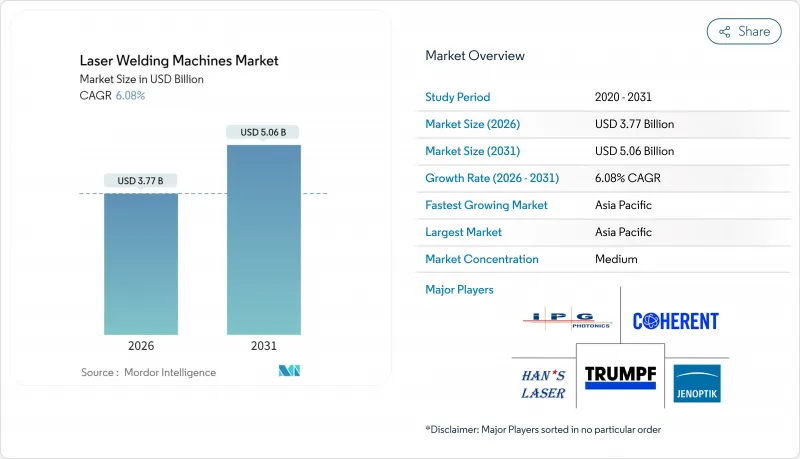

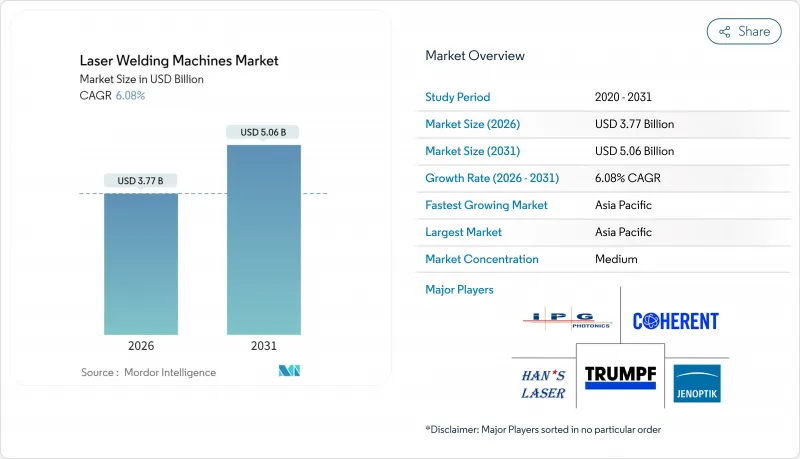

预计雷射焊接机市场将从 2025 年的 35.5 亿美元成长到 2026 年的 37.7 亿美元,到 2031 年将达到 50.6 亿美元,2026 年至 2031 年的复合年增长率为 6.08%。

这一成长趋势主要得益于电池组组装的强劲资本投资、工业4.0机器人单元的日益普及以及手持式四合一光纤系统的日益普及。雷射焊接机市场也受到製造商逐步抛弃传统焊接方式的推动,他们追求更高的精度、更低的热输入和更无缝的自动化。锗和镓供应有限导致材料成本上涨,提高了市场进入门槛,但同时也加速了主要厂商自主生产雷射光源。对能够焊接高反射率铜的绿色波长平台的巨大需求,进一步扩大了高端供应商的潜在机会。

全球雷射焊接机市场趋势与洞察

焊接电动车电池组的需求迅速成长

电动车的日益普及推动了对能够深入铜材并最大限度地减少孔隙的雷射光源的需求。特斯拉的4680个圆柱形电池需要厚度超过2毫米的焊缝,同时也要保持铜基板95%以上的导电率。红外线雷射器在铜中仅吸收5%的入射能量,而绿光雷射器则能将吸收率提高到35-50%,从而减少飞溅和返工。绿光光源价格的上涨有助于供应商扩大利润空间,汽车製造商正在其未来的超级工厂中推广这些系统的标准化应用。预计到2020年代中期,此因素将为整体成长贡献1.2个百分点。

适用于中小型企业的便利式四合一光纤焊接机

像IPG的LightWELD 2000 XR这样的可携式设备,将焊接、切割、清洗和硬焊功能整合在一个2千瓦的功率单元中,售价不到5万美元。这种手持式设计使得车间可以用一台设备取代多个传统工位,同时保持了现场维修的灵活性。东协和拉丁美洲的中小型企业正在采用这些系统,以避免投资50万美元购买机器人设备,并将投资回收期缩短至18个月以内。此外,当地银行提供的低利率租赁方案也刺激了市场需求,使短期利率贡献率提高了1.1个百分点。

高昂的资本成本与电弧焊接替代方案相比

一套完整的雷射焊接单元造价在20万至200万美元之间,远高于MIG或TIG焊接设备1.5万至5万美元的成本。在人事费用低于每小时15美元的低成本地区,如果投资回报期超过三年,製造商会延后采用这项技术。由于镓和倡议的限制,零件价格上涨,光学元件和晶片的成本上涨高达25%,进一步提高了采用这项技术的门槛。虽然存在资金筹措,但信贷取得仍然不均衡,短期内将使复合年增长率下降0.9个百分点。

细分市场分析

光纤平台凭藉其卓越的成本绩效和成熟的整合商生态系统,预计将在2025年保持43.68%的收入份额。光纤系统雷射焊接机的市场规模受益于光纤原料成本的下降,但其光束参数乘积通常在4至8毫米毫弧度之间,限制了超精细加工的应用。固体雷射虽然价格较高,但可提供低于2毫米毫弧度的输出功率,推动了微电子和血管支架组装等领域的应用。这种高精度正推动固体雷射在2031年之前以6.43%的复合年增长率成长,成为所有技术配置中成长最快的。供应商透过将能够在奈秒脉衝和连续波之间切换的光束模组捆绑销售,来规避跨产品竞争的风险。同时,二氧化碳雷射器仍然主要应用于小众的塑胶焊接领域,而精度适中的直接二极体雷射则赢得了汽车座椅靠背框架的订单。

绿色波长单元正在「其他」类别中崭露头角,其铜吸收率超过35%。通快(TRUMPF)的TruDisk Pulse在汇流排焊接领域树立了新的标桿,在500W平均功率下实现了稳定的小孔焊接条件。系统整合商正在对现有的光纤焊接站进行改造,采用倍频模组升级光学元件,而不是报废整个单元。这些维修升级为雷射焊接机市场带来了持续的收入,包括校准服务和备用光学元件的出货,从而提高了供应商的利润率。

到2025年,机器人整合单元将占据41.85%的市场份额,这主要得益于其在汽车和航太产业的广泛应用。这些单元采用六轴运动机构和视觉引导操作,可实现小于50µm的重复焊接定位精度。然而,手持式设备最受关注,其复合年增长率高达8.39%。便捷的即插即用电源模组和一体化耗材盒等易于维护的配件,推动了手持式雷射焊接机市场份额的成长。对于没有保护气体设施的操作人员,他们正在采用内建双气嘴的设备,该设备可在氩气和氮气之间切换。桌上型工作站和混合型设备分别面向研发实验室和晶圆级封装领域,但其普及速度相对较慢。

船舶船体维修和风力塔维修等现场服务领域,对于可携式系统而言仍是一片尚未开发的处女地。 LightWELD 2000 XR 现场不銹钢维修速度比 TIG 焊接快 70%,能够更快恢復船舶的运作。随着保险公司开始强制要求对关键船舶资产进行雷射维修,手持式雷射设备的普及应用正经历着监管方面的推动。服务合约是初始设备销售的补充,包含基于订阅的培训、光学元件更换和软体更新等服务。

区域分析

到2025年,亚太地区将占据雷射焊接机市场49.35%的份额,并将保持最快的成长速度,到2031年复合年增长率将达到7.62%。预计到2024年,中国的雷射焊接机装置容量将超过2.5万台,地方政府正在补贴新工厂的建设,以加强区域供应链。日本系统整合商正在将精密机器人与国产光纤光源结合,以解决技术纯熟劳工的问题。同时,韩国正在补贴需要多层铜板焊接的电池组製造地。印度的生产连结奖励计画促进了本地设备组装,降低了进口关税,并鼓励西方供应商与印度系统整合商合作。

北美地区维持高价策略,充分利用其在航太和III类医疗设备产业的优势。美国中西部地区电动车的普及加速了绿色波长电池的安装,但锗供应风险可能导致光学成本上涨高达75%。加拿大监管机构正在加快稀土元素矿的核准,但提炼瓶颈意味着仍依赖进口。 《通膨控制法案》下的联邦税额扣抵可报销清洁製造设施高达30%的资本支出,进而降低资本投资对价格的敏感度。

在欧洲,由于面临中国新参与企业的成本竞争,德国中型机械製造商的成长较为温和。将于2026年生效的欧盟碳边境调节机制将鼓励采用低热输入工艺,例如雷射焊接,尤其是在钢铁密集型行业。斯堪地那维亚的造船厂正在试点使用手持式系统来改造氨气相容推进系统,而东欧的汽车工厂则在使用与通快公司合作的当地整合商提供的承包单元。 《供应安全法》正在推动一个联盟在欧盟内部发展氮化镓外延片製造能力,旨在削弱中国在上游原料领域的主导地位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 焊接电动车电池组的需求迅速成长

- 引入与工业4.0相容的机器人单元

- 适用于中小型企业的便利式四合一光纤焊接机

- 精密医疗设备组装业务成长

- 绿色波长铜焊接效率

- 中欧清洁技术供应链补贴竞争

- 市场限制

- 高额资本投入与电弧焊接替代方案的比较

- 雷射焊接工程师短缺

- 两用雷射的贸易合规风险

- 光纤传输中易受污染性影响

- 价值/供应链分析

- 监管环境

- 技术展望

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 雷射塑胶焊接亮点

第五章 市场规模与成长预测

- 透过技术

- 纤维

- CO2

- 固态

- 二极体

- 其他(杂交,绿色)

- 依系统类型

- 手持式/可携式

- 固定式檯面

- 机器人整合单元

- 混合多功能(焊接、切割、清洗)

- 透过使用

- 车

- 电子设备

- 航太/国防

- 矿业

- 石油和天然气

- 其他(医疗、珠宝饰品、生物工程科学等)

- 依材料类型

- 钢

- 铝

- 钛

- 铜

- 塑胶和聚合物

- 其他金属(例如:镍、镍合金、贵金属、镁及其合金等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- 北欧国家(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东协(印尼、泰国、菲律宾、马来西亚、越南)

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 科威特

- 土耳其

- 埃及

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- TRUMPF Group

- IPG Photonics Corporation

- Han's Laser Technology Group

- Coherent Corp.

- Jenoptik AG

- Emerson Electric(Branson)

- FANUC Robotics

- Panasonic Smart Factory

- Huagong Laser Engineering

- Wuhan Golden Laser

- LaserStar Technologies

- Amada Miyachi

- Baison Laser

- Lincoln Electric(PythonX)

- Alpha Laser GmbH

- NLight Inc.

- Raycus Fiber Laser

- HGTECH

- II-VI Incorporated

- DILAS Diode Laser

第七章 市场机会与未来展望

The Laser Welding Machines market is expected to grow from USD 3.55 billion in 2025 to USD 3.77 billion in 2026 and is forecast to reach USD 5.06 billion by 2031 at 6.08% CAGR over 2026-2031.

Robust capital spending on battery-pack assembly lines, growing deployment of Industry 4.0 robotic cells, and wider availability of handheld four-in-one fiber systems are the primary engines behind this growth trajectory. The laser welding machines market also benefits from a gradual pivot away from conventional fusion methods as manufacturers seek tighter tolerances, lower heat input, and seamless automation. Material cost inflation linked to germanium and gallium restrictions has raised entry barriers, yet it simultaneously accelerates in-house laser source production among leading players. Pent-up demand for green-wavelength platforms capable of welding highly reflective copper further widens the addressable opportunity for premium vendors.

Global Laser Welding Machines Market Trends and Insights

Surge in EV-battery Pack Welding Demand

Escalating electric-vehicle penetration lifts demand for laser sources that achieve deeper copper penetration with minimal porosity. Tesla's 4680 cylindrical cells rely on welds surpassing 2 mm while maintaining electrical conductivity above 95% of base copper. Infrared lasers absorb only 5% of incident energy on copper, yet green-wavelength devices raise absorption to 35-50%, trimming spatter and rework. Premium pricing on green sources widens vendor margins, and automakers standardize these systems across future Gigafactories. The driver adds 1.2 percentage points to overall growth through mid-decade.

Hand-Held 4-in-1 Fiber Welders for SMEs

Portable units, such as IPG's LightWELD 2000 XR, consolidate welding, cutting, cleaning, and brazing in a 2 kW device priced below USD 50,000. The handheld form factor lets workshops replace multiple conventional stations while preserving mobility for field repairs. SMEs in ASEAN and Latin America acquire these systems to bypass USD 500,000 robotic installations, shrinking payback periods to under 18 months. Demand accelerates further as local banks bundle low-interest leasing packages, lifting the driver's short-term contribution to 1.1 percentage points.

High Capex Versus Arc Alternatives

Complete laser welding cells range from USD 200,000 to USD 2 million, dwarfing the USD 15,000-50,000 outlay for MIG or TIG setups. Manufacturers in lower-cost geographies where labor sits below USD 15 per hour delay adoption when ROI stretches beyond three years. Component price spikes arising from gallium and germanium restrictions inflate optics and chip costs by up to 25%, aggravating the hurdle. Financing initiatives exist, but credit access remains uneven, pulling down CAGR by 0.9 percentage points in the near term.

Other drivers and restraints analyzed in the detailed report include:

- Green-Wavelength Copper Welding Efficiencies

- Adoption of Industry 4.0 Robotic Cells

- Shortage of Laser-Welding Technicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiber platforms retained 43.68% of 2025 revenue on the back of favorable cost-performance ratios and established integrator ecosystems. The laser welding machines market size for fiber systems benefits from raw-fiber cost deflation, but beam parameter products typically hover between 4 and 8 mm-mrad, limiting ultra-fine work. Solid-state configurations, while pricier, deliver sub-2 mm-mrad outputs that drive micro-electronics and vascular stent assembly. This precision underpins a 6.43% CAGR for solid-state through 2031, the fastest inside the technology mix. Vendors hedge against cannibalization by bundling switchable beam modules that toggle between nanosecond pulsing and continuous wave. Meanwhile, CO2 lasers cling to niche plastic welding duties, and direct-diode devices secure automotive seat-back frame contracts where moderate precision suffices.

Green-wavelength units rise within the "Others" bucket because they reach copper absorption rates above 35%. TRUMPF's TruDisk Pulse sets new benchmarks in busbar welding, achieving stable keyhole regimes at 500 W average power. Integrators retrofit legacy fiber stations with frequency-doubled modules, upgrading optics rather than scrapping entire cells. The laser welding machines market captures annuity revenues from these retrofits, including calibration services and spare optics shipments, thereby thickening vendor margin profiles.

Robotic-integrated cells controlled 41.85% of the market value in 2025, owing to entrenched automotive and aerospace pipelines. These cells deliver repeatable sub-50 µm weld positioning through six-axis kinematics and vision-guided motion. However, handheld devices spark the most enthusiasm, expanding at 8.39% CAGR. The laser welding machines market share of handheld units benefits from drop-in power modules and all-in-one consumable cartridges, easing maintenance. Operators without shielding-gas infrastructure now employ built-in dual-gas nozzles that alternate between argon and nitrogen. Bench-top stations and hybrid machines target R&D labs and wafer-level packaging, respectively, but encounter slower uptake.

Field services such as ship-hull repair or wind-tower refurbishment form an untapped vein for portable systems. LightWELD 2000 XR completes on-site stainless repairs 70% faster than TIG, freeing vessels sooner. Insurance firms begin mandating laser repair in critical maritime assets, adding a regulatory tailwind to handheld adoption. Service contracts bundle training, optics swaps, and software updates under subscription, complementing initial equipment sales.

The Laser Welding Machines Market Report is Segmented by Technology (Fiber, CO2, Solid-State, and More), by System Type (Hand-held/Portable, Stationary Bench-Top, and More), by Application (Automotive, Electronics, Mining, Oil & Gas and More), by Material Type (Steel, Aluminum, Titanium, Copper, and More), and by Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated the laser welding machines market with 49.35% value in 2025 and remains the fastest-growing territory at a 7.62% CAGR to 2031. China's capacity surpassed 25,000 laser systems in 2024, with provincial governments subsidizing new plant builds to reinforce local supply chains. Japanese integrators combine precision robots with domestic fiber sources to absorb skilled-labor shortages, while South Korea channels subsidies toward battery-pack fabrication centers that demand multilayer copper welding. India's production-linked incentives nurture localized equipment assembly, reducing import duties and encouraging Western vendors to partner with Indian system houses.

North America leverages its entrenched aerospace and Class-III medical device clusters to maintain premium pricing. EV expansion across the United States Midwest accelerates green-wavelength cell installation, although germanium supply risks lift optics costs by as much as 75%. Canadian regulators fast-track rare-earth mining approvals, yet refining bottlenecks force continued import dependence. Federal tax credits under the Inflation Reduction Act reimburse up to 30% of capital expenditures on clean manufacturing assets, buffering capex sensitivity.

Europe experiences middling growth as German mid-sized machine builders contend with cost competition from Chinese entrants. The European Union's Carbon Border Adjustment Mechanism, effective 2026, incentivizes low-heat-input processes like laser welding, especially in steel-intensive sectors. Scandinavian shipyards trial handheld systems to retrofit ammonia-ready propulsion lines, while Eastern European auto plants adopt turnkey cells supplied by local integrators partnered with TRUMPF. Supply security legislation spurs consortiums to develop gallium-nitride epi-wafer capabilities inside the bloc, aiming to loosen China's stranglehold on upstream raw materials.

- TRUMPF Group

- IPG Photonics Corporation

- Han's Laser Technology Group

- Coherent Corp.

- Jenoptik AG

- Emerson Electric (Branson)

- FANUC Robotics

- Panasonic Smart Factory

- Huagong Laser Engineering

- Wuhan Golden Laser

- LaserStar Technologies

- Amada Miyachi

- Baison Laser

- Lincoln Electric (PythonX)

- Alpha Laser GmbH

- NLight Inc.

- Raycus Fiber Laser

- HGTECH

- II-VI Incorporated

- DILAS Diode Laser

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in EV-battery pack welding demand

- 4.2.2 Adoption of Industry 4.0 robotic cells

- 4.2.3 Hand-held 4-in-1 fiber welders for SMEs

- 4.2.4 Growth of precision medical-device assembly

- 4.2.5 Green-wavelength copper welding efficiencies

- 4.2.6 Subsidy races in China-EU clean-tech supply chains

- 4.3 Market Restraints

- 4.3.1 High capex vs. arc alternatives

- 4.3.2 Shortage of laser-welding technicians

- 4.3.3 Trade-compliance risks on dual-use lasers

- 4.3.4 Fiber-delivery contamination sensitivity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Spotlight on Laser Plastic Welding

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Technology

- 5.1.1 Fiber

- 5.1.2 CO2

- 5.1.3 Solid-State

- 5.1.4 Diode

- 5.1.5 Others (Hybrid, Green)

- 5.2 By System Type

- 5.2.1 Hand-held / Portable

- 5.2.2 Stationary Bench-top

- 5.2.3 Robotic-Integrated Cell

- 5.2.4 Hybrid Multi-Function (Weld-Cut-Clean)

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Electronics

- 5.3.3 Aerospace & Defense

- 5.3.4 Mining

- 5.3.5 Oil & Gas

- 5.3.6 Others (medical, jewelry, BES, etc.)

- 5.4 By Material Type

- 5.4.1 Steel

- 5.4.2 Aluminum

- 5.4.3 Titanium

- 5.4.4 Copper

- 5.4.5 Plastics & Polymers

- 5.4.6 Others (other metals nickel, nickel alloys, precious metals, magnesium & alloys, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Kuwait

- 5.5.5.5 Turkey

- 5.5.5.6 Egypt

- 5.5.5.7 South Africa

- 5.5.5.8 Nigeria

- 5.5.5.9 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 TRUMPF Group

- 6.4.2 IPG Photonics Corporation

- 6.4.3 Han's Laser Technology Group

- 6.4.4 Coherent Corp.

- 6.4.5 Jenoptik AG

- 6.4.6 Emerson Electric (Branson)

- 6.4.7 FANUC Robotics

- 6.4.8 Panasonic Smart Factory

- 6.4.9 Huagong Laser Engineering

- 6.4.10 Wuhan Golden Laser

- 6.4.11 LaserStar Technologies

- 6.4.12 Amada Miyachi

- 6.4.13 Baison Laser

- 6.4.14 Lincoln Electric (PythonX)

- 6.4.15 Alpha Laser GmbH

- 6.4.16 NLight Inc.

- 6.4.17 Raycus Fiber Laser

- 6.4.18 HGTECH

- 6.4.19 II-VI Incorporated

- 6.4.20 DILAS Diode Laser

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment