|

市场调查报告书

商品编码

1910616

印尼自动化与控制系统:市场占有率分析、产业趋势、统计及成长预测(2026-2031)Indonesia Automation And Control System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

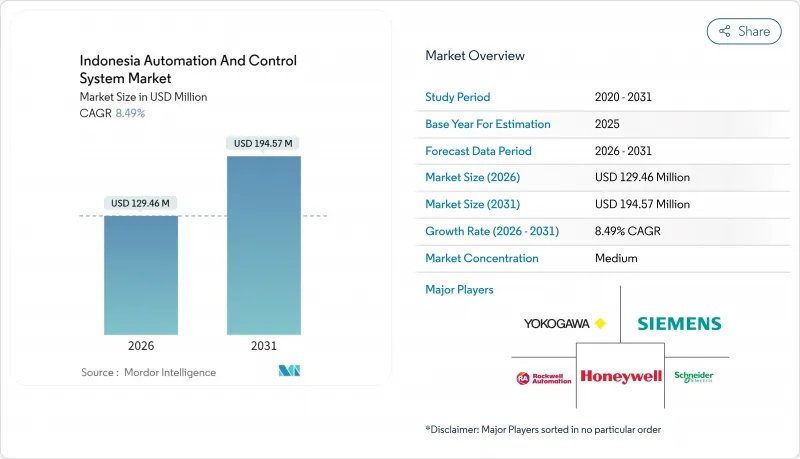

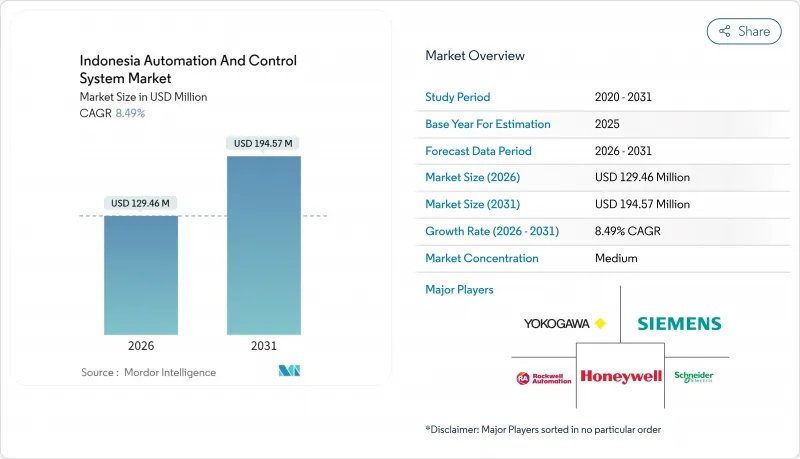

2025年印尼自动化和控制系统市值为1,193.4亿美元,预计到2031年将达到1,945.7亿美元,而2026年为1,294.6亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 8.49%。

这项扩张反映了雅加达致力于将自身打造为东南亚製造地的努力、数位基础设施与工业产能扩张的融合,以及支持节能生产的监管利多。政府的「印尼製造4.0」等项目、对电力产业的大规模资本投资、电动车投资的激增以及放宽的在地采购要求,都助力本土整合商扩大规模,同时也为全球供应商开闢了采购管道。跨国供应商正透过预测性维护软体、网路安全架构和云端对应平臺等优势脱颖而出,而本土服务公司则凭藉具有成本竞争力的整合和全生命週期支援服务获得市场认可。这些发展使印尼的自动化和控制系统市场成为更广泛的工业现代化议程的核心,该议程旨在提升能源安全和出口竞争力。

印尼自动化与控制系统市场趋势及洞察

电力产业产能扩张进展

总投资达51兆印尼币(约32亿美元)的大规模发电和输电计划正在推动对监控与数据采集(SCADA)和分散式控制系统(DCS)的需求,以整合可再生和火力发电设施。随着可再生能源渗透率的提高,国有电力公司PLN正在对其水力发电厂和燃煤发电厂的励磁系统进行升级改造,并部署SCADA系统以稳定频率。 2024年7月,印尼将在在地采购要求放宽至30%以下,这扩大了供应商群体,促使跨国公司与印尼製造商合作以完成其采购配额。例如,横河电机在峇里岛的水处理SCADA系统项目以及PLN在南加里曼丹的多套励磁系统维修项目,都显示印尼自动化和控制系统市场正稳步发展。

无线感测器网路和通讯协定演进

5G部署与低成本感测器的结合,使得工厂无需改动现有线路即可连接输送机、压缩机和空调系统。阿斯特拉大发汽车公司将PLC控制的马达连接到无线边缘设备,使风扇能耗降低了20%,每年节省122.66千瓦时电力,减少10.67吨二氧化碳排放。目前,该製造商正逐步在边缘端部署分析功能,用于即时预警并将模式发现任务排放至云端控制面板。这种配置方案非常适合印尼这个岛国的地理特征。

现有设施维修的初始资本投资负担

老旧的水泥厂、钢铁厂和石化厂在采用先进的分散式控制系统(DCS)之前,需要对控制迴路进行重新布线并培训操作人员。 PT Rainbow Tubulars Manufacture公司正在投资3000亿印尼币(约1890万美元)对其无缝管道进行现代化改造,这凸显了高昂的资本投入,也正是这些投入阻碍了中型企业进行类似的升级改造。模拟I/O与现代以乙太网路为基础系统之间的整合难题,往往会导致预算超支和停机时间延长。

细分市场分析

到2025年,PLC将占总收入的26.66%,证实了其在包装、物料输送和批量处理生产线中的普及程度。这一主导地位巩固了印尼工厂车间自动化和控制系统市场的规模。然而,受新型汽车喷漆车间和电子表面黏着技术生产线对微米级重复精度需求的推动,预计到2031年,工业机器人将以9.74%的复合年增长率成长。 SCADA平台正稳步赢得电力公司的青睐,这些订单致力于实现分散式资产可视性;而DCS正在渗透到化学、食品和饮料工厂,在这些工厂中,配方完整性至关重要。人机介面(HMI)设计正转向电容式触控和移动镜像,在印尼这个地域分散的群岛国家,主管人员能够从远端站点查看关键绩效指标(KPI)至关重要。

随着保险公司和监管机构要求配备SIL-3级紧急停机迴路,对安全系统的需求日益增长,推动了对三模组冗余PLC和火焰探测阵列的需求。对效率的追求促使马达从IE1级向IE3级迁移,后者与变频驱动器配合使用,可降低能源成本并利用数据建立性能仪錶板。这些趋势表明硬体现代化和软体整合正在融合,从而增强了印尼自动化和控制系统市场的规模和深度。

到2025年,硬体将占总收入的61.12%,其中包括控制器、感测器、致动器和安全交换机,这些构成了任何自动化架构的基础。印尼自动化和控制系统市场的大部分资本支出最初都用于这一基础层,这些支出来自汽车、电动车和日常消费品(FMCG)行业的生产线建设者,他们正在建造新的生产设施。软体需求正从基本的人机介面(HMI)发展到高级分析、历史数据整合和异常检测,但就总收入而言,软体仍然落后于硬体。

预计到2031年,服务领域将以9.48%的复合年增长率成长,这主要得益于製造商将系统整合、网路重构和预测性维护专案外包给专业公司(例如,PT Dycom Engineering,该公司2025年营收达580万美元)。涵盖备件、韧体、网路安全修补程式和操作员培训的生命週期合约对那些没有先进内部工程部门的公司尤其具有吸引力。随着已安装系统的老化,服务公司预计将提高其在印尼自动化和控制系统市场的份额,并实现收入来源多元化,获得更多经常性收入。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电力产业装置容量成长取得显着进展

- 无线感测器网路和通讯协定的演进

- 国内「印尼製造4.0」奖励

- 业界强制性能效标准

- 电动车和电池製造领域的投资激增

- 利用人工智慧进行预测性维护的需求日益增长

- 市场限制

- 现有设施维修需要较高的初始资本投资成本。

- 进阶自动化工程技能差距

- 商品价格波动影响石油、天然气和采矿业;

- OT网路中的网路安全问题

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 副产品

- 可程式逻辑控制器(PLC)

- 监控与数据采集(SCADA)

- 分散式控制系统(DCS)

- 人机介面(HMI)

- 安全系统

- 工业机器人

- 电动马达(交流、直流、EC、伺服、步进)

- 驱动器(交流、直流、伺服)

- 按组件

- 硬体

- 软体

- 服务

- 透过部署模式

- 本地部署

- 云/工业物联网边缘

- 按最终用户行业划分

- 石油和天然气

- 发电

- 化工/石油化工

- 食品/饮料

- 金属和采矿

- 水和污水处理

- 其他终端用户产业

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Yokogawa Electric Corporation

- Siemens AG

- Honeywell International Inc.

- Rockwell Automation Inc.

- Schneider Electric SE

- ABB Ltd.

- Emerson Electric Co.

- PT FANUC Indonesia

- Mitsubishi Electric Corporation

- Omron Corporation

- Delta Electronics Inc.

- Beckhoff Automation GmbH and Co. KG

- Advantech Co. Ltd.

- Bosch Rexroth AG

- Schneider Toshiba Inverter(STI)

- Fuji Electric Co. Ltd.

- Panasonic Industry Co. Ltd.

- Lenze SE

- Hitachi Industrial Equipment Systems Co. Ltd.

- Yokogawa Indonesia PT

- PT Omron Manufacturing of Indonesia

第七章 市场机会与未来展望

The Indonesia automation and control system market was valued at USD 119.34 billion in 2025 and estimated to grow from USD 129.46 billion in 2026 to reach USD 194.57 billion by 2031, at a CAGR of 8.49% during the forecast period (2026-2031).

The expansion reflects Jakarta's drive to position the country as Southeast Asia's manufacturing hub, the convergence of digital infrastructure with industrial capacity additions, and regulatory tailwinds that favour energy-efficient production. Government programs such as Making Indonesia 4.0, sizable power-sector capital expenditures, surging electric-vehicle investments, and relaxed local-content thresholds are opening procurement channels for global vendors even as domestic integrators scale up. Multinational suppliers are differentiating on predictive-maintenance software, cyber-secure architectures, and cloud-enabled platforms, while local service firms gain traction through cost-competitive integration and lifecycle support. These dynamics place the Indonesia automation and control system market at the center of a broader industrial modernization agenda that also improves energy security and export competitiveness.

Indonesia Automation And Control System Market Trends and Insights

Flourishing Power-Sector Capacity Additions

Massive generation and grid projects valued at IDR 51 trillion (USD 3.2 billion) are scaling demand for supervisory control and distributed control systems that coordinate renewable and thermal assets. State utility PLN is retrofitting excitation systems and deploying SCADA across hydro and coal plants to stabilize frequency as renewable penetration rises. The July 2024 decision to lower local-content rules below 30% widened the supplier pool and prompted multinationals to partner with Indonesian fabricators to meet sourcing quotas. Yokogawa's water-treatment SCADA in Bali and multiple PLN excitation retrofits in South Kalimantan illustrate the steady pipeline that supports the Indonesia automation and control system market.

Evolution of Wireless Sensor Networks and Protocols

5G rollout combined with lower-cost sensors is allowing factories to link conveyors, compressors, and HVAC systems without rewiring. PT Astra Daihatsu Motor cut fan energy use by 20% after connecting PLC-controlled motors to a wireless edge device, saving 122.66 kWh annually and avoiding 10.67 tCO2 emissions. Manufacturers now stage analytics at the edge for real-time alarms while offloading pattern discovery to cloud dashboards, a configuration well suited to Indonesia's archipelagic geography.

High Upfront CAPEX for Brown-Field Retrofits

Older cement, steel, and petrochemical complexes must rewire control loops and train operators before installing advanced DCS. PT Rainbow Tubulars Manufacture is investing IDR 300 billion (USD 18.9 million) to modernize seamless pipelines, revealing the cash requirements that deter midsize firms from similar upgrades. Integration surprises between analog I/O and modern Ethernet-based systems often inflate budgets and extend shutdown windows.

Other drivers and restraints analyzed in the detailed report include:

- Domestic Making Indonesia 4.0 Incentives

- Mandatory Energy-Efficiency Standards

- Skills Gap in Advanced Automation Engineering

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, PLCs generated 26.66% of revenue, confirming their ubiquity in packaging, material-handling, and batch-process lines. That domination secures a resilient base for the Indonesia automation and control system market size at the plant-floor level. However, Industrial Robotics is set to grow at a 9.74% CAGR through 2031, amplified by new automotive paint shops and electronics surface-mount lines that need micron-level repeatability. SCADA platforms gain steady orders from power utilities interested in distributed asset visualization, while DCS penetrates chemical and F&B plants where recipe integrity is mission-critical. HMI design is shifting toward capacitive touch and mobile mirroring, allowing supervisors to view KPIs from remote stations, an essential feature across Indonesia's dispersed archipelago.

The safety-system niche is widening as insurers and regulators insist on SIL-3 emergency-shutdown loops, boosting demand for triple-modular-redundant PLCs and flame-scanner arrays. Efficiency mandates are pushing a shift from IE1 to IE3 motors, and the pairing of these units with variable-speed drives slashes energy bills and unlocks data for performance dashboards. Together, these trends underscore how hardware modernization and software orchestration are converging, reinforcing both the scale and the depth of the Indonesia automation and control system market.

Hardware produced 61.12% of 2025 sales, encompassing controllers, sensors, actuators, and secure switches that underpin every automation architecture. Much of the capital spending in the Indonesia automation and control system market flows first into this stack as line builders outfit new capacities across automotive, EV, and FMCG verticals. Software demand is maturing from basic HMI to advanced analytics, historian integration, and anomaly detection, though it still trails hardware in total receipts.

Services will expand at a 9.48% CAGR through 2031 because manufacturers are outsourcing system integration, network re-engineering, and predictive-maintenance programs to specialists like PT Dycom Engineering, which reported USD 5.8 million revenue in 2025. Lifecycle contracts that bundle spares, firmware, cybersecurity patching, and operator training are particularly attractive to firms lacking deep in-house engineering benches. As installed bases age, the Indonesia automation and control system market share for service firms is poised to rise, diversifying revenue toward more recurring streams.

The Indonesia Automation and Control System Market Report is Segmented by Product (PLC, SCADA, DCS, HMI, Safety Systems, Industrial Robotics, Electric Motors, and Drives), Component (Hardware, Software, and Services), Deployment Mode (On-Premise, and Cloud/IIoT-Edge), End-User Industry (Oil and Gas, Power Generation, Chemical and Petrochemical, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Yokogawa Electric Corporation

- Siemens AG

- Honeywell International Inc.

- Rockwell Automation Inc.

- Schneider Electric SE

- ABB Ltd.

- Emerson Electric Co.

- PT FANUC Indonesia

- Mitsubishi Electric Corporation

- Omron Corporation

- Delta Electronics Inc.

- Beckhoff Automation GmbH and Co. KG

- Advantech Co. Ltd.

- Bosch Rexroth AG

- Schneider Toshiba Inverter (STI)

- Fuji Electric Co. Ltd.

- Panasonic Industry Co. Ltd.

- Lenze SE

- Hitachi Industrial Equipment Systems Co. Ltd.

- Yokogawa Indonesia PT

- PT Omron Manufacturing of Indonesia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Flourishing power-sector capacity additions

- 4.2.2 Evolution of wireless sensor networks and protocols

- 4.2.3 Domestic "Making Indonesia 4.0" incentives

- 4.2.4 Mandatory energy-efficiency standards for industry

- 4.2.5 Surge in EV and battery manufacturing investments

- 4.2.6 AI-enabled predictive-maintenance demand

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX for brown-field retrofits

- 4.3.2 Skills gap in advanced automation engineering

- 4.3.3 Volatile commodity pricing impacting OandG, mining

- 4.3.4 Cyber-security concerns in OT networks

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Programmable Logic Controller (PLC)

- 5.1.2 Supervisory Control and Data Acquisition (SCADA)

- 5.1.3 Distributed Control System (DCS)

- 5.1.4 Human-Machine Interface (HMI)

- 5.1.5 Safety Systems

- 5.1.6 Industrial Robotics

- 5.1.7 Electric Motors (AC, DC, EC, Servo, Stepper)

- 5.1.8 Drives (AC, DC, Servo)

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud / IIoT-Edge

- 5.4 By End-User Industry

- 5.4.1 Oil and Gas

- 5.4.2 Power Generation

- 5.4.3 Chemical and Petrochemical

- 5.4.4 Food and Beverage

- 5.4.5 Metals and Mining

- 5.4.6 Water and Wastewater

- 5.4.7 Other End-User Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Yokogawa Electric Corporation

- 6.4.2 Siemens AG

- 6.4.3 Honeywell International Inc.

- 6.4.4 Rockwell Automation Inc.

- 6.4.5 Schneider Electric SE

- 6.4.6 ABB Ltd.

- 6.4.7 Emerson Electric Co.

- 6.4.8 PT FANUC Indonesia

- 6.4.9 Mitsubishi Electric Corporation

- 6.4.10 Omron Corporation

- 6.4.11 Delta Electronics Inc.

- 6.4.12 Beckhoff Automation GmbH and Co. KG

- 6.4.13 Advantech Co. Ltd.

- 6.4.14 Bosch Rexroth AG

- 6.4.15 Schneider Toshiba Inverter (STI)

- 6.4.16 Fuji Electric Co. Ltd.

- 6.4.17 Panasonic Industry Co. Ltd.

- 6.4.18 Lenze SE

- 6.4.19 Hitachi Industrial Equipment Systems Co. Ltd.

- 6.4.20 Yokogawa Indonesia PT

- 6.4.21 PT Omron Manufacturing of Indonesia

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment