|

市场调查报告书

商品编码

1910618

饭店物业管理软体(PMS)-市场占有率分析、产业趋势与统计、成长预测(2026-2031)Hospitality Property Management Software (PMS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

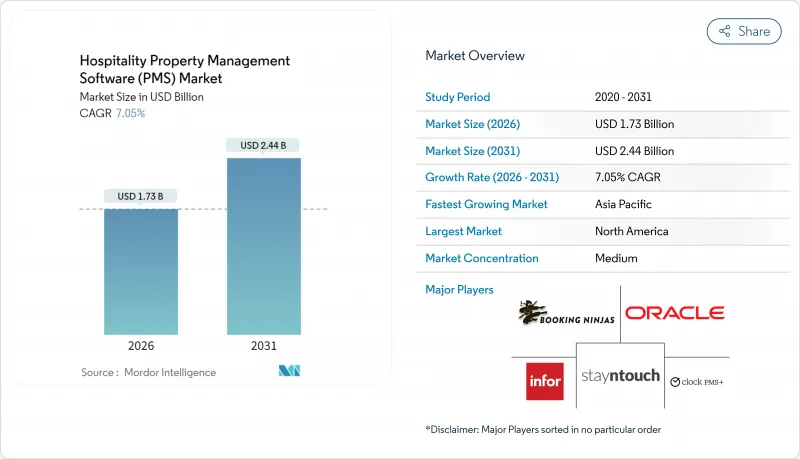

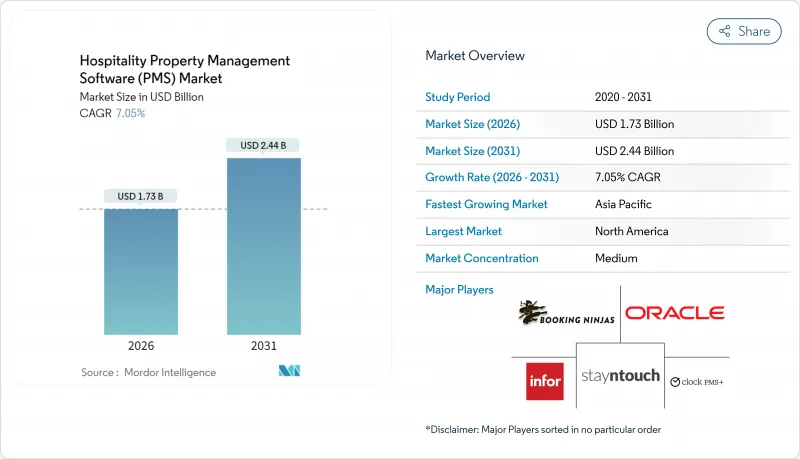

预计到 2026 年,饭店物业管理软体市场价值将达到 17.3 亿美元,从 2025 年的 16.2 亿美元成长到 2031 年的 24.4 亿美元。

预计从 2026 年到 2031 年,其复合年增长率将达到 7.05%。

对旧有系统升级的需求不断增长、云端迁移加速以及人工智慧驱动的收益工具的引入,共同支撑着这一稳步增长的价值。云端采用淘汰本地硬体持续重塑成本结构,而API优先架构则缩短了整合时间,并开启了新的收益共享伙伴关係。独立饭店和民宿业者正在采用曾经只有全球连锁饭店才能使用的先进模组,这扩大了潜在市场规模,也加剧了竞争。同时,亚太地区正在推出区域性数位化项目,新兴市场预计将为未来的授权成长做出重大贡献。北美地区则越来越重视采用高阶功能。

全球酒店物业管理软体(PMS)市场趋势与洞察

扩大中小型工厂的采用率

订阅式定价和简化的实施流程也促使小规模企业将现代饭店管理系统 (PMS) 解决方案视为策略必需品,而非可选项。独立饭店在实施整合通路管理和宾客体验功能的云端 PMS 解决方案后,收入实现了两位数的成长。较低的前期成本使中小企业能够将资金重新投入行销、服务创新和品牌推广。供应商也积极回应,提供自助式实施嚮导,将实施时间从数月缩短至数週。由此形成良性循环,成千上万的中小型酒店加速采用各项功能,从而推动了酒店 PMS 市场的扩张。

从本地部署快速迁移到基于云端的SaaS模式

云端原生套件无需硬体更新,并透过自动版本更新确保物业安全和合规性。大规模迁移可在数週内完成,citizenM 的 7,500 间客房部署便证明了这一点。即时分析支援地理位置分散的团队进行精细化决策。多租户架构集中管理灾害復原通讯协定,并降低审核负担和保险费用。从不定期资本支出 (CAPEX) 到定期订阅费用的转变,为财务长 (CFO) 提供了可预测性,进一步推动了饭店物业管理软体市场的发展。

与旧有系统和第三方系统整合的复杂性

许多老牌饭店仍在使用20年前开发的客製化预订引擎和POS模组,阻碍了资料的顺畅交换。客製化连接器往往会导致预算超支和工期延长,使得一些饭店即使看到明显的投资报酬率,也选择延后升级。新旧系统并行运作增加了训练需求和操作失误的风险。供应商正在透过扩展低程式码整合工具包来应对这一问题,但由于专有资料模式缺乏文件记录,仍存在一些缺口。在淘汰旧有系统的速度加快之前,这种摩擦可能会限製饭店物业管理软体市场某些细分领域的短期成长。

细分市场分析

到2025年,云端平台将占据64.92%的市场份额,随着饭店物业优先考虑扩充性和降低维修成本,预计其主导地位将进一步扩大。预计到2031年,云端部署的饭店物业管理软体市场规模将达到20.2亿美元,与前述12.38%的复合年增长率相符。饭店物业受益于全球内容传递网路,即使在偏远地区也能保持快速回应。供应商将持续的功能更新整合到订阅层级中,并自动套用安全性修补程式。将工作负载迁移异地也有助于多物业整合,使区域集团能够共用支援统一客户檔案的资料仓储。

在资料主权法律严格的地区,本地部署仍然普遍存在,但随着硬体老化,成本差距正在扩大。云弹性在季节性波动期间特别重要,度假村可以根据需要,在高峰期增加实例数量,在淡季减少实例数量,从而节省资金。围绕主流云端PMS套件所建构的增强型API生态系统,可轻鬆整合聊天机器人和物联网客房控制系统,实现新的服务组合。最后,云端的低成本优势正在推动酒店物业管理软体市场中成长最快的管道。

预计到2025年,中小企业将占酒店管理系统(PMS)收入的57.05%,到2031年,其在PMS市场规模中的份额预计将超过16.8亿美元。简易的设定精灵和免费试用降低了缺乏内部技术负责人的业者采用PMS的门槛。培训模组通常包含多语言微学习内容,以满足小规模饭店员工多样化的需求。中小企业也重视与设备无关的介面,这使得员工可以使用个人智慧型手机进行操作,从而避免了PC短缺的问题。

大型企业正稳步地从专有平台升级到全球标准平台,儘管复杂的品牌标准可能会延长采购週期和整合测试时间。随着中小企业在各个触点累积数据,他们开始采用以前只有连锁企业才能使用的会员插件和定向电子邮件宣传活动,这进一步印证了普及化理论。这种转变正在推动酒店物业管理软体市场销量显着增长,儘管单价有所下降。

区域分析

到2025年,北美将占据全球34.20%的市场份额,这主要得益于其与供应商建立的长期合作关係、较高的云端渗透率以及成熟的分销网络。目前,酒店业正致力于利用基于属性的销售和能耗仪表板等先进功能来提高利润率的稳定性。该地区的监管环境稳定也有助于加快第三方认证的审批速度,并缩短新兴模组的上市时间。

亚太地区预计将成为成长最快的地区,复合年增长率将达到12.18%,这主要得益于东南亚地区不断增长的中檔酒店项目以及政府主导的数位化项目。光是菲律宾的独立饭店预计到2025年将新增超过1万名云端平台有效用户,显示云端平台的普及率呈指数级增长。当地产业正逐渐放弃本地部署解决方案,转而采用行动住宿管理系统(PMS),这些系统能够与该地区盛行的QR码支付生态系统无缝整合。

欧洲市场规模庞大且多元化,ESG报告和资料隐私法规对采购决策产生影响。跨境滑雪度假村和岛屿市场网路连线不稳定,因此对多币种支援和强大的离线存取能力尤为重视。儘管传统介面仍存在挑战,但欧盟永续性指令正在推动升级,为饭店管理系统(PMS)市场创造新的机会,因为饭店需要将详细的公用事业追踪资讯整合到PMS工作流程中。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 市场驱动因素

- 扩大中小型工厂的采用率

- 从本地部署快速迁移到基于云端的SaaS模式

- 透过加强OTA/元搜寻整合来促进统一库存管理。

- 以 API 为先导、可设定的 PMS 架构助力生态系创新

- 借助人工智慧驱动的收入管理附加元件提高投资收益(ROI)

- ESG报告要求强制要求在PMS中收集使用资料。

- 市场限制

- 与旧有系统和第三方系统整合的复杂性

- 资料安全和隐私合规成本不断增加

- OTA API收费系统不断上涨,推高了整体拥有成本。

- 独立酒店缺乏熟练的IT人才

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业生态系分析

- 主要用例和案例研究

- 宏观经济趋势评估

- 投资分析

第五章 市场规模与成长预测

- 透过部署

- 本地部署

- 云

- 按物业面积

- 小规模和中型物业

- 大面积房产

- 按属性类型

- 饭店和度假村

- 汽车旅馆和旅馆

- 民宿住宿设施

- 服务式公寓

- 其他物业类型

- 依所有权类型

- 独立财产

- 连锁附属设施

- 按功能模组

- 前台营运

- 预订和安排

- 收益管理

- 通路管理

- 管理工作

- 其他模组

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 荷兰

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 新加坡

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Oracle Corporation

- Infor, Inc.

- Agilysys, Inc.

- Mews Systems BV

- Planet Payment Group Holdings Limited

- StayNTouch, Inc.

- Cloudbeds, LLC

- Maestro PMS(Northwind Canada Inc.)

- Springer-Miller Systems, LLC

- Guestline Limited

- innRoad, Inc.

- AppFolio, Inc.

- RMS Cloud(RMS(Aust)Pty Ltd)

- Hotelogix(HMS InfoTech Pvt. Ltd.)

- Protel Hotelsoftware GmbH

- RoomKeyPMS(NSightUSA)

- SkyTouch Technology, Inc.

- Sabre Hospitality Solutions, LLC

- Frontdesk Anywhere, Inc.

- Clock Software Ltd.

第七章 市场机会与未来展望

Hospitality Property Management Software market size in 2026 is estimated at USD 1.73 billion, growing from 2025 value of USD 1.62 billion with 2031 projections showing USD 2.44 billion, growing at 7.05% CAGR over 2026-2031.

Growing replacement of legacy systems, accelerated cloud migration, and the embedding of artificial-intelligence revenue tools underpin this steady value expansion. Cloud deployment continues to reshape cost structures by removing on-premise hardware, while API-first architectures cut integration time and open new revenue-sharing partnerships. Independent hotels and homestay operators now adopt sophisticated modules once limited to global chains, widening the total addressable pool and boosting competitive intensity. Meanwhile, region-specific digitalization programs in Asia-Pacific position emerging markets as outsized contributors to future license growth, even as North America focuses on advanced feature uptake.

Global Hospitality Property Management Software (PMS) Market Trends and Insights

Growing adoption among small- and medium-scale properties

Small operators now view modern PMS solutions as strategic necessities rather than discretionary upgrades, a shift enabled by subscription pricing and simplified onboarding. Independent hotels report double-digit revenue lifts after implementing cloud PMS that bundle channel management and guest-experience functions. Lower upfront cost structures let SMEs redirect capital toward marketing and service innovation, strengthening brand visibility. Vendors reciprocate by releasing self-service implementation wizards that cut deployment time from months to weeks. The result is a virtuous cycle in which feature uptake accelerates across thousands of lower-tier properties, broadening the Hospitality Property Management Software market footprint.

Rapid shift from on-premise to cloud-based SaaS models

Cloud-native suites eliminate hardware refresh cycles and provide automatic version updates that keep properties secure and compliant. Large migrations such as citizenM's 7,500-room rollout demonstrate that even enterprise portfolios can convert in weeks. Real-time access to analytics supports granular decision-making across geographically dispersed teams. Multitenant architectures also centralize disaster-recovery protocols, easing audit burdens and insurance premiums. With recurring subscription fees replacing lumpy capex, CFOs gain predictability, further propelling Hospitality Property Management Software market adoption.

Integration complexity with legacy and third-party systems

Many heritage properties still operate bespoke booking engines and point-of-sale modules built two decades ago, hampering smooth data exchange. Custom connectors frequently exceed budget and extend timelines, prompting some hotels to delay upgrades despite clear ROI. Dual-running old and new stacks inflates training needs and risks operational errors. Vendors respond by expanding low-code integration toolkits, yet gaps persist where proprietary data schemas remain undocumented. Until legacy attrition accelerates, this friction will temper near-term growth in segments of the Hospitality Property Management Software market.

Other drivers and restraints analyzed in the detailed report include:

- AI-driven revenue-management add-ons boosting ROI

- API-first, composable PMS architectures unlocking ecosystem innovation

- Escalating OTA API-fee structure inflating total cost of ownership

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud platforms represented 64.92% of 2025 value and are forecast to widen their lead as properties prioritize scalability and lower upkeep. The Hospitality Property Management Software market size for cloud deployments is on track to reach USD 2.02 billion by 2031, reflecting the 12.38% CAGR cited earlier. Properties benefit from global content-delivery networks that sustain rapid response times, even in remote locations. Vendors bundle continuous feature updates into subscription tiers, pushing security patches without human intervention. Moving workloads off-site also facilitates multi-property consolidation, allowing regional groups to share data warehouses that power uniform guest profiles.

On-premise installations continue in jurisdictions with strict data-sovereignty laws, yet the cost differential widens as hardware ages. Cloud elasticity proves invaluable during seasonal swings, letting resorts scale instances in peak months and downgrade afterward to conserve cash. Enhanced API ecosystems around leading cloud PMS suites enable straightforward integrations with chatbots and IoT room controls, unlocking new service combinations. Ultimately, capital-light cloud economics underpin the fastest expanding channel of the Hospitality Property Management Software market.

SMEs held 57.05% revenue in 2025, and their share of the Hospitality Property Management Software market size is expected to surpass USD 1.68 billion by 2031. Easier set-up wizards and freemium trials lower adoption hurdles for operators lacking in-house technologists. Training modules often include micro-learning content in multiple languages, aligning with the diverse talent pool typical of small hotels. SMEs also value device-agnostic interfaces that staff can run from personal smartphones, circumventing PC shortages.

Large enterprises display slower yet steady upgrades as they phase out proprietary platforms in favor of global standards. However, complex brand standards can prolong procurement cycles and integration testing. As SMEs accumulate data across customer touchpoints, they leverage loyalty plug-ins and targeted email campaigns previously reserved for chains, reinforcing the democratization thesis. This shift contributes substantial volume to the Hospitality Property Management Software market, even if absolute ticket sizes are smaller.

Hospitality PMS Market Report is Segmented by Deployment (On-Premise, and Cloud), Property Size (SMEs and Large Enterprises), Property Type (Hotels and Resorts, and More), Ownership Model (Independent Properties and Chain-Affiliated Properties), Functionality Module (Front Desk and Operations, Booking and Reservations, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 34.20% of 2025 value because of long-standing vendor relationships, high cloud penetration, and mature distribution networks. Hotels now focus on advanced feature utilization, such as attribute-based selling and energy-consumption dashboards, to enhance margin resilience . The region's regulatory stability also speeds third-party certification, shortening time-to-market for emerging modules.

Asia-Pacific is the fastest growing at 12.18% CAGR, propelled by expanding mid-scale hotel pipelines in Southeast Asia and government-funded digital programs. Philippines-based independents alone added more than 10,000 active users to cloud platforms in 2025, validating leapfrog adoption dynamics. Local operators often bypass on-premise entirely, installing mobile-first PMS versions that synchronize seamlessly with QR-code payment ecosystems popular in the region.

Europe remains sizable but heterogeneous, with ESG reporting and data-privacy regulations shaping purchase decisions. Multi-currency support and strong offline access matter in cross-border ski or island markets that experience patchy connectivity. While legacy interface challenges persist, EU sustainability directives are catalyzing upgrades as properties need granular utility tracking embedded in PMS workflows, driving incremental opportunity within the Hospitality Property Management Software market.

- Oracle Corporation

- Infor, Inc.

- Agilysys, Inc.

- Mews Systems B.V.

- Planet Payment Group Holdings Limited

- StayNTouch, Inc.

- Cloudbeds, LLC

- Maestro PMS (Northwind Canada Inc.)

- Springer-Miller Systems, LLC

- Guestline Limited

- innRoad, Inc.

- AppFolio, Inc.

- RMS Cloud (RMS (Aust) Pty Ltd)

- Hotelogix (HMS InfoTech Pvt. Ltd.)

- Protel Hotelsoftware GmbH

- RoomKeyPMS (NSightUSA)

- SkyTouch Technology, Inc.

- Sabre Hospitality Solutions, LLC

- Frontdesk Anywhere, Inc.

- Clock Software Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption among small- and medium-scale properties

- 4.2.2 Rapid shift from on-premise to cloud-based SaaS models

- 4.2.3 Expansion of OTA/meta-search integrations driving unified inventory

- 4.2.4 API-first, composable PMS architectures unlocking ecosystem innovation

- 4.2.5 AI-driven revenue-management add-ons boosting ROI

- 4.2.6 ESG-reporting mandates requiring usage-data capture in PMS

- 4.3 Market Restraints

- 4.3.1 Integration complexity with legacy and third-party systems

- 4.3.2 Heightened data-security / privacy compliance costs

- 4.3.3 Escalating OTA API-fee structure inflating total cost of ownership

- 4.3.4 Shortage of skilled IT talent across independent hotels

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Property Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By Property Type

- 5.3.1 Hotels and Resorts

- 5.3.2 Motels and Lodges

- 5.3.3 Homestay Accommodations

- 5.3.4 Serviced Apartments

- 5.3.5 Other Property Types

- 5.4 By Ownership Model

- 5.4.1 Independent Properties

- 5.4.2 Chain-affiliated Properties

- 5.5 By Functionality Module

- 5.5.1 Front Desk and Operations

- 5.5.2 Booking and Reservations

- 5.5.3 Revenue Management

- 5.5.4 Channel Management

- 5.5.5 Housekeeping

- 5.5.6 Other Modules

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Colombia

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Netherlands

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 Singapore

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Oracle Corporation

- 6.4.2 Infor, Inc.

- 6.4.3 Agilysys, Inc.

- 6.4.4 Mews Systems B.V.

- 6.4.5 Planet Payment Group Holdings Limited

- 6.4.6 StayNTouch, Inc.

- 6.4.7 Cloudbeds, LLC

- 6.4.8 Maestro PMS (Northwind Canada Inc.)

- 6.4.9 Springer-Miller Systems, LLC

- 6.4.10 Guestline Limited

- 6.4.11 innRoad, Inc.

- 6.4.12 AppFolio, Inc.

- 6.4.13 RMS Cloud (RMS (Aust) Pty Ltd)

- 6.4.14 Hotelogix (HMS InfoTech Pvt. Ltd.)

- 6.4.15 Protel Hotelsoftware GmbH

- 6.4.16 RoomKeyPMS (NSightUSA)

- 6.4.17 SkyTouch Technology, Inc.

- 6.4.18 Sabre Hospitality Solutions, LLC

- 6.4.19 Frontdesk Anywhere, Inc.

- 6.4.20 Clock Software Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment