|

市场调查报告书

商品编码

1910643

喷墨列印:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Inkjet Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

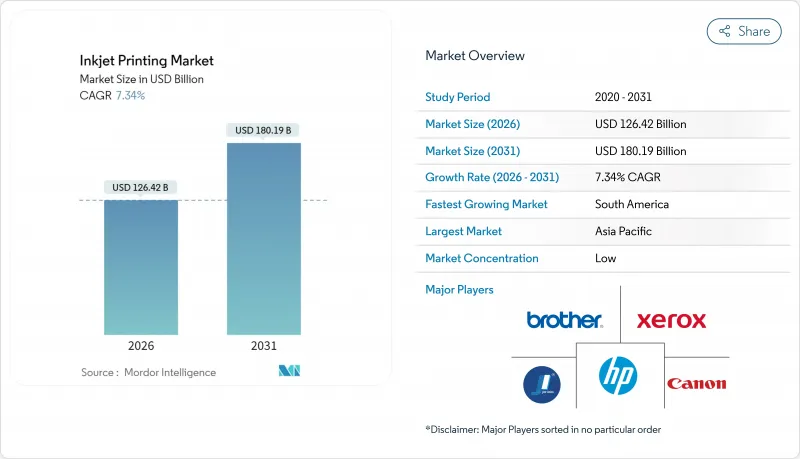

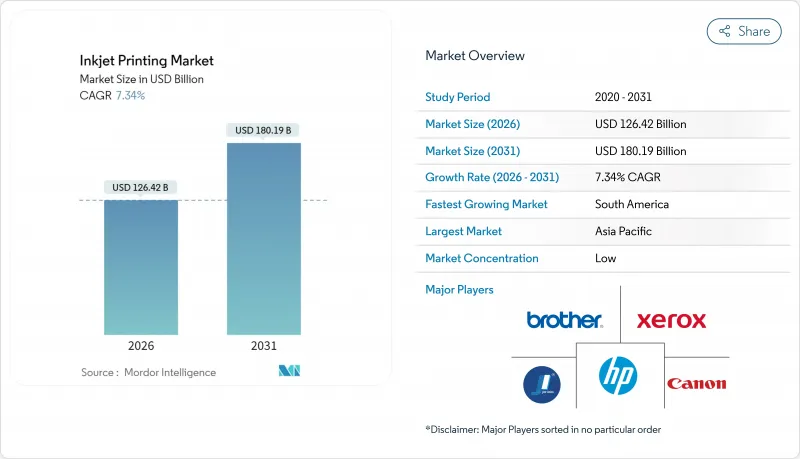

预计到 2025 年,喷墨列印市场规模将达到 1,177.7 亿美元,到 2026 年将达到 1,264.2 亿美元,到 2031 年将达到 1,801.9 亿美元,预测期(2026-2031 年)的复合年增长率为 7.34%。

当前成长动能主要由三大支柱驱动:对数据密集型包装的需求不断增长、时尚产业向按需纺织品生产转型,以及有利于水性化学品的监管压力。供应商正从以硬体为中心的提案转向更互联、服务更丰富的生态系统,以降低整体拥有成本并支援大规模客製化。印表机头技术创新者的整合,以及区域在地化製造倡议,正在重塑竞争格局,同时也为直接成型、功能性电子产品和装饰应用等尚未开发的领域开闢了机会。喷墨列印市场正透过将这些结构性因素转化为可扩展的数位化工作流程而持续成长,这些工作流程正在包装、出版、纺织和工业领域取代类比系统。

全球喷墨列印市场趋势与洞察

快速消费品和食品产业的数据日常消费品包装需求

严格的可追溯性法规和防伪措施迫使品牌所有者应对即时可变数据,而只有喷墨列印市场才能有效率地扩展这种能力。 Graphic Packaging International 的压印技术能够在保持生产线速度的同时实现批次级序列化,证明高解析度热感喷墨技术可以在高吞吐量环境中并存。 MapleJet 的模组化编码系统进一步展示了在线连续整合如何最大限度地减少停机时间并确保可再生薄膜符合法规要求。与 SUDPACK-LEIBINGER 等公司的合作正在将这种方法扩展到单一材料包装,展示了合规油墨和可再生基材的结合如何确保在即将到来的欧盟目标下实现未来的营运目标。在各个市场,嵌入QR码和动态设计元素的能力正在将包装从被动的容器转变为互动式的品牌资产,从而巩固了对创新喷墨平台的持续需求。

短期按需出版的扩张

随着出版商调整库存以应对波动的消费者需求,首印量持续下降。尼尔森图书扫描数据显示,首印订单量出现两位数下滑,这促使出版商采用单张纸和捲筒纸喷墨设备,以期在1000张以下的印量下实现与胶印相媲美的经济效益。Canon新款B2幅面印表机每小时可列印8700张,降低了盈亏平衡点,并支援「缺口」印刷策略,以在社群媒体主导的销售高峰期补充供应。惠普的数位生产平台透过自动化作业排序和表面处理工程、降低人事费用以及整合云端分析,进一步加速了这一转变。随着出版商转向小批量补货和个人化版本,喷墨列印市场脱颖而出,成为唯一能够在不增加仓储成本的情况下实现这些新工作流程获利的技术。

广告支出加速向数位管道转移

随着行销预算日益转向程序化平台,商业印刷产能受到限制。传统上依赖大量传单和产品目录的印刷服务供应商面临挑战,因为广告公司优先考虑点击率指标和即时归因。为了应对这项挑战,企业正在转向利用数据驱动的个人化技术,製作高影响力的广告信和促销印刷品。印刷商透过将独特的QR码与忠诚度计画相结合,保持竞争力并获得更高的利润。然而,整体印刷量的下降仍然对喷墨印刷市场的传统商业领域构成压力。

细分市场分析

到2025年,按需喷墨(DoD)平台将占总收入的45.88%,这表明其能够适应各种承印物,并满足客户对高影像品质的需求。儘管DoD平台占据主导地位,但其成长速度正在放缓,而连续喷墨9.10%的复合年增长率(CAGR)正吸引着寻求不间断高速喷码的包装生产线。由连续喷墨驱动的喷墨列印市场预计到2031年将超过336亿美元,这表明对于许多加工商而言,速度正变得与品质同等重要。 DoD供应商正在透过整合循环喷头和人工智慧辅助的墨滴控制技术来应对这项挑战,以在不牺牲1200 dpi解析度的前提下,实现超过80公尺/分钟的列印速度。

投资决策越来越围绕着产品种类(SKU)的复杂性和停机接受度。每天管理数百个批次代码的食品饮料生产线正在转向连续列印技术,而装饰和照片列印领域由于灰度调製优势,仍然以按需喷墨列印为主导。将按需喷墨预涂与连续清漆油层结合的混合架构,代表了喷墨列印市场未来的融合方向。

水性墨水因其低VOC含量和广泛的纸张相容性而备受青睐,预计到2025年将占据34.22%的市场份额。虽然更严格的法规正在加速水性墨水的普及,但乳胶墨水(将水性载体与聚合物颗粒相结合)也因其优异的户外耐久性而日益受到关注。乳胶墨水的复合年增长率(CAGR)为10.78%,预计到2031年,其在喷墨列印市场的份额将达到约四分之一。凭藉大容量储墨罐和无异味的特性,乳胶墨水正越来越多地应用于先前由溶剂型墨水主导的店内标誌和装饰领域。

儘管溶剂型油墨在需要极高附着力和耐化学性的领域仍被应用,但就连汽车配件产业也在尝试使用UV-LED和乳胶油墨作为替代方案。 Mimaki的固定装置CMR UV油墨和HP的Latex R系列油墨展现了研发週期的加速,其重点在于在不牺牲耐用性的前提下实现永续性。随着监管机构标准的日益严格,喷墨列印产业正在转向将合规性融入价值提案而非事后考虑的化学技术。

本喷墨列印市场报告按列印技术(例如,按需喷墨、连续喷墨)、墨水类型(例如,水性墨水、溶剂型墨水、UV固化墨水)、组件(例如,印表机、墨盒、散装墨水)、应用领域(例如,书籍出版、广告)、承印物(例如,纸张和纸板、塑胶薄膜和箔材)以及地区(例如,北美)进行分析。市场预测以美元为以金额为准。

区域分析

亚太地区的领先地位反映了以大规模生产为导向的中国加工商与高精度日本喷头製造商之间无与伦比的协同效应。从广东到泰米尔纳德邦的纺织中心正透过加大对自动化和人工智慧印刷机的投资,巩固其区域主导地位。韩国正利用其电子产业生态系统,试点用于OLED和PCB製造的功能性喷墨生产线,从而扩展支持喷墨印刷市场的技术基础。

南美洲的加速成长依赖政策主导的本地化,这不仅能保护加工商免受进口关税的影响,也能刺激就业成长。财政激励措施将支持中小型工厂升级到数位化生产线,尤其是在食品包装领域,该领域对可追溯性和快速交货的需求与喷墨技术不谋而合。 2024年的供应链中断将凸显国内印刷能力的战略价值,并推动2031年之前的资本投资。

北美和西欧透过研发丛集和严格的环境标准,持续引领技术发展方向。德国的印刷油墨法规和REACH法规的扩展,促进了向低VOC化学品的快速过渡,并确立了事实上的全球标准。在中东和非洲,电子商务的蓬勃发展推动了对标籤和软包装的需求,但基础设施的匮乏限制了规模化生产。然而,海湾地区的先导计画展示了一条用于饮料编码的高速单一途径生产线,预示着喷墨列印市场的未来成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速消费品和食品产业的数据日常消费品包装需求

- 小批量按需出版的普及

- 工业装饰印刷和直接成型印刷的成长

- 单一途径高速喷墨印刷机的出现

- 利用基于物联网的预测性维护降低整体拥有成本 (TCO)

- 使用水性油墨以符合更严格的VOC法规

- 市场限制

- 广告支出正越来越多地转向数位管道

- 与传统的柔版印刷机和网版印刷机相比,资本投资成本持续偏高。

- 印字头设计专利正变得越来越复杂。

- 特种颜料原料价格波动

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 透过印刷技术

- 按需喷墨

- 连续喷墨

- 其他印刷技术

- 按墨水类型

- 水溶液

- 溶剂型

- 紫外线固化型

- 乳胶

- 热昇华列印

- 其他墨水类型

- 按组件

- 印表机

- 墨盒和散装墨水

- 列印头

- 软体和服务

- 透过使用

- 图书与出版

- 商业印刷

- 广告

- 交易型

- 标籤

- 包装

- 纺织印花

- 电子元件和基板印刷

- 其他用途

- 按基础材料

- 纸和纸板

- 塑胶薄膜和铝箔

- 纤维

- 金属

- 玻璃和陶瓷

- 其他基质

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 新加坡

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- HP Inc.

- Canon Inc.

- Seiko Epson Corp.

- Brother Industries Ltd.

- Ricoh Company Ltd.

- Xerox Holdings Corp.

- Fujifilm Holdings Corp.

- Konica Minolta Inc.

- Kyocera Corp.

- Lexmark International

- Durst Group AG

- Mimaki Engineering Co. Ltd.

- Roland DG Corp.

- Hitachi Industrial Equipment Systems

- Videojet Technologies Inc.

- Domino Printing Sciences

- Inkjet Inc.

- Jet Inks Pvt Ltd.

- King Printing Co. Ltd.

- Electronics For Imaging(EFI)

- Nazdar Ink Technologies

第七章 市场机会与未来展望

The inkjet printing market was valued at USD 117.77 billion in 2025 and estimated to grow from USD 126.42 billion in 2026 to reach USD 180.19 billion by 2031, at a CAGR of 7.34% during the forecast period (2026-2031).

Current momentum rests on three pillars: rising demand for data-rich packaging, the fashion sector's pivot to on-demand textile output, and regulatory pressure that favors water-based chemistries. Vendors are shifting from hardware-centric propositions toward connected, service-rich ecosystems that lower the total cost of ownership and support mass customization. Consolidation among printhead innovators, coupled with region-specific incentives for localized production, is reshaping competitive dynamics while opening white-space opportunities in direct-to-shape, functional electronics, and decor applications. The inkjet printing market continues to thrive by translating these structural forces into scalable, digitally enabled workflows that replace analog systems across packaging, publishing, textile, and industrial verticals.

Global Inkjet Printing Market Trends and Insights

Data-driven Packaging Demand from FMCG and Food Sectors

Stringent traceability mandates and anti-counterfeiting initiatives are pushing brand owners toward real-time, variable data capabilities that only the inkjet printing market can scale efficiently. Graphic Packaging International's deployment of imprinting technology embeds batch-level serialization while maintaining line speeds, proving that high-resolution thermal inkjet can coexist with high-throughput environments. MapleJet's modular coding systems further illustrate how inline integration minimizes downtime and ensures regulatory compliance on recyclable films. Collaborations such as SUDPACK-LEIBINGER extend this approach to mono-material packaging, demonstrating how compliant inks combined with recyclable substrates future-proof operations under forthcoming EU targets. Across markets, the ability to embed QR codes and dynamic design elements is transforming packaging from a passive container to an interactive brand asset, locking in sustained demand for innovative inkjet platforms.

Proliferation of Short-run, On-demand Publishing

Average first-print runs continue to contract as publishers align inventory with volatile consumer demand. Nielsen BookScan data show double-digit drops in initial orders, prompting adoption of sheetfed and web inkjet devices that deliver offset-like economics at runs below 1,000 copies. Canon's new B2 device prints 8,700 sheets per hour, reducing breakeven points and enabling "gap" printing strategies that bridge supply during social-media-driven sales spikes. HP's digital production platforms reinforce this shift by automating job sequencing and finishing, trimming labor costs, and integrating cloud-based analytics. As publishers pivot to micro-batch replenishment and personalized editions, the inkjet printing market stands out as the only technology able to monetize these emerging workflows without inflating warehousing costs.

Accelerating Shift of Ad-spend into Digital Channels

The ongoing transition of marketing budgets to programmatic platforms limits addressable volumes for commercial print. Agencies favor click-through metrics and real-time attribution, challenging print service providers that were once reliant on high-volume flyers and catalogs. In response, firms reposition toward high-impact direct mail and transpromo pieces that leverage data-driven personalization. By coupling unique QR codes with loyalty programs, printers preserve relevance and capture premium margins, yet overall volume shrinkage remains a drag on the inkjet printing market's legacy commercial segment.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Industrial Decor and Direct-to-shape Printing

- Advent of Single-pass, High-speed Inkjet Presses

- Persistent Cap-ex Premium over Legacy Flexo/Screen Lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Drop-on-Demand (DoD) platforms delivered 45.88% of 2025 revenue, underscoring their versatility across substrates and the high image fidelity clients require. Despite leadership, DoD growth decelerates as Continuous Inkjet's 9.10% CAGR appeals to packaging lines seeking uninterrupted, high-velocity coding. The inkjet printing market size attributable to Continuous Inkjet is projected to surpass USD 33.6 billion by 2031, indicating that speed now carries equal weight with quality for many converters. DoD vendors respond by integrating recirculation heads and AI-assisted droplet control to push speeds past 80 m/min without sacrificing 1,200 dpi resolution.

Investment decisions increasingly revolve around SKU complexity and downtime tolerance. Food and beverage lines that manage hundreds of batch codes daily gravitate toward Continuous technology, while decor and photographic segments remain DoD strongholds due to grayscale modulation advantages. Hybrid architectures that blend DoD pre-coats with Continuous varnish layers illustrate the convergence path ahead for the inkjet printing market.

Aqueous formulations held 34.22% share in 2025, benefiting from low VOC profiles and broad paper compatibility. Regulatory headwinds expedite adoption, yet they also elevate Latex chemistries that combine water-based carriers with polymer particles to deliver exterior durability. Latex's 10.78% CAGR could lift its slice of the inkjet printing market to nearly one-quarter by 2031. High-capacity bulk tanks and odor-free operation position Latex for in-store signage and decor, segments historically served by solvent inks.

Solvent-based lines persist where extreme adhesion or chemical resistance prevails, but even automotive fixtures now pilot UV-LED and Latex alternatives. Mimaki's CMR-free UV inks and HP's Latex R-series underscore an accelerating R&D cycle focused on sustainability without durability trade-offs. As regulators harden thresholds, the inkjet printing industry is pivoting toward chemistries that embed compliance into their value proposition rather than treating it as a retrofit.

The Inkjet Printing Market Report is Segmented by Printing Technology (Drop-On-Demand, Continuous Inkjet, and More), Ink Type (Aqueous, Solvent, UV-Curable, and More), Component (Printers, Ink Cartridges and Bulk Inks, and More), Application (Books and Publishing, Advertising, and More), Substrate (Paper and Paperboard, Plastic Films and Foils, and More), and Geography (North America, and More). Market Forecasts in Value (USD).

Geography Analysis

Asia-Pacific's dominance reflects unparalleled synergy between volume-oriented Chinese converters and high-precision Japanese head manufacturers. Investments in automation and AI-enabled presses proliferate across textile hubs from Guangdong to Tamil Nadu, reinforcing regional leadership. South Korea leverages its electronics ecosystem to pilot functional inkjet lines for OLED and PCB fabrication, widening the technology pool that feeds the inkjet printing market.

South America's acceleration hinges on policy-driven localization that shields converters from import tariffs while fostering job creation. Fiscal incentives help smaller plants upgrade to digital lines, especially in food packaging, where demand for traceability and shorter lead times aligns with inkjet capabilities. Supply chain disruptions in 2024 illustrated the strategic value of domestic print capacity, spurring cap-ex through 2031.

North America and Western Europe continue to shape technological trajectories via R&D clusters and stringent environmental norms. The German Printing Ink Ordinance and REACH expansions catalyze rapid migration to low-VOC chemistries, setting de facto global benchmarks. In the Middle East and Africa, rising e-commerce elevates label and flexible-packaging demand, yet infrastructure gaps temper scale. Nonetheless, pilot projects in Gulf states demonstrate high-speed single-pass lines for beverage coding, hinting at future momentum in the inkjet printing market.

- HP Inc.

- Canon Inc.

- Seiko Epson Corp.

- Brother Industries Ltd.

- Ricoh Company Ltd.

- Xerox Holdings Corp.

- Fujifilm Holdings Corp.

- Konica Minolta Inc.

- Kyocera Corp.

- Lexmark International

- Durst Group AG

- Mimaki Engineering Co. Ltd.

- Roland DG Corp.

- Hitachi Industrial Equipment Systems

- Videojet Technologies Inc.

- Domino Printing Sciences

- Inkjet Inc.

- Jet Inks Pvt Ltd.

- King Printing Co. Ltd.

- Electronics For Imaging (EFI)

- Nazdar Ink Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Data-driven packaging demand from FMCG and food sectors

- 4.2.2 Proliferation of short-run, on-demand publishing

- 4.2.3 Growth of industrial decor and direct-to-shape printing

- 4.2.4 Advent of single-pass, high-speed inkjet presses

- 4.2.5 IoT-enabled predictive maintenance lowering TCO

- 4.2.6 Adoption of water-based inks to meet stricter VOC caps

- 4.3 Market Restraints

- 4.3.1 Accelerating shift of ad-spend into digital channels

- 4.3.2 Persistent cap-ex premium over legacy flexo/screen lines

- 4.3.3 Widening patent thicket around print-head designs

- 4.3.4 Raw-material price volatility for specialty pigments

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of the Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Printing Technology

- 5.1.1 Drop-on-Demand Inkjet

- 5.1.2 Continuous Inkjet

- 5.1.3 Other Printing Technologies

- 5.2 By Ink Type

- 5.2.1 Aqueous

- 5.2.2 Solvent-based

- 5.2.3 UV-curable

- 5.2.4 Latex

- 5.2.5 Dye-Sublimation

- 5.2.6 Other Ink Type

- 5.3 By Component

- 5.3.1 Printers

- 5.3.2 Ink Cartridges and Bulk Inks

- 5.3.3 Print-heads

- 5.3.4 Software and Services

- 5.4 By Application

- 5.4.1 Books and Publishing

- 5.4.2 Commercial Print

- 5.4.3 Advertising

- 5.4.4 Transactional

- 5.4.5 Labels

- 5.4.6 Packaging

- 5.4.7 Textile Printing

- 5.4.8 Electronics and PCB Printing

- 5.4.9 Other Applications

- 5.5 By Substrate Material

- 5.5.1 Paper and Paperboard

- 5.5.2 Plastic Films and Foils

- 5.5.3 Textile

- 5.5.4 Metal

- 5.5.5 Glass and Ceramics

- 5.5.6 Other Substrate Material

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Singapore

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 HP Inc.

- 6.4.2 Canon Inc.

- 6.4.3 Seiko Epson Corp.

- 6.4.4 Brother Industries Ltd.

- 6.4.5 Ricoh Company Ltd.

- 6.4.6 Xerox Holdings Corp.

- 6.4.7 Fujifilm Holdings Corp.

- 6.4.8 Konica Minolta Inc.

- 6.4.9 Kyocera Corp.

- 6.4.10 Lexmark International

- 6.4.11 Durst Group AG

- 6.4.12 Mimaki Engineering Co. Ltd.

- 6.4.13 Roland DG Corp.

- 6.4.14 Hitachi Industrial Equipment Systems

- 6.4.15 Videojet Technologies Inc.

- 6.4.16 Domino Printing Sciences

- 6.4.17 Inkjet Inc.

- 6.4.18 Jet Inks Pvt Ltd.

- 6.4.19 King Printing Co. Ltd.

- 6.4.20 Electronics For Imaging (EFI)

- 6.4.21 Nazdar Ink Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment