|

市场调查报告书

商品编码

1910673

气动设备:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Pneumatic Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

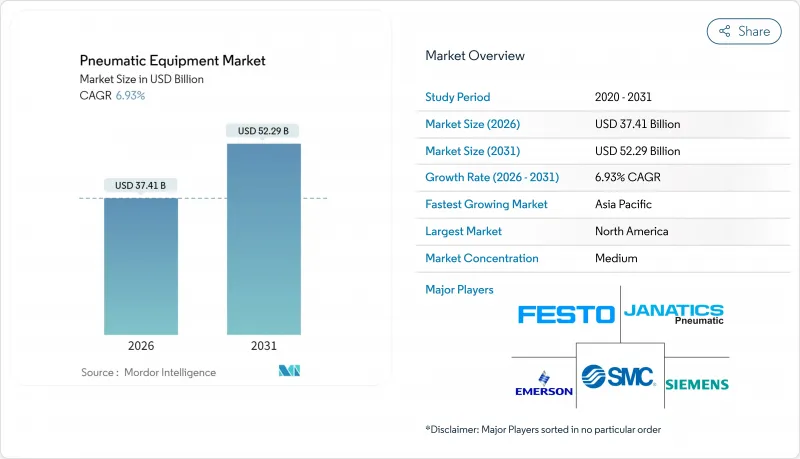

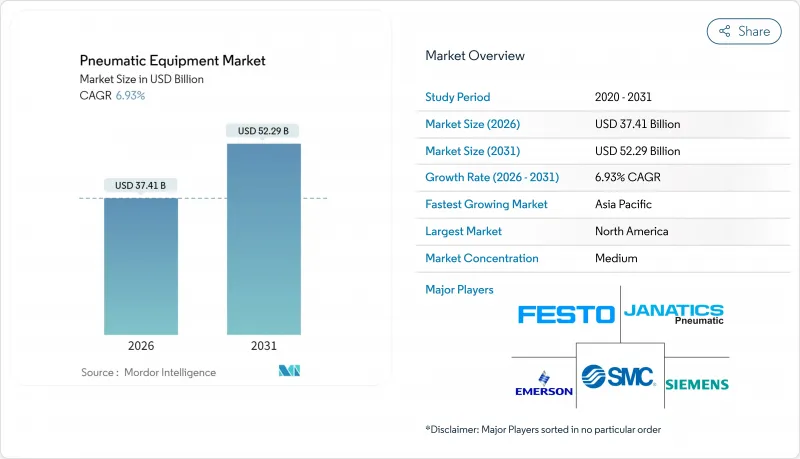

预计到 2026 年,气动设备市场规模将达到 374.1 亿美元,从 2025 年的 349.9 亿美元成长到 2031 年的 522.9 亿美元,2026 年至 2031 年的复合年增长率为 6.93%。

日益精密的工业自动化、节能型压缩空气系统的维修以及气动硬体与工业物联网(IIoT)诊断技术的整合是推动成长要素。半导体洁净室、电动车电池生产线和卫生食品工厂的激增需求凸显了该领域应用范围的不断扩大。随着市场领导将传统气动技术与数位监控相结合以减少停机时间和能源损失,竞争日益激烈。同时,主要经济体日益严格的能源效率法规正在加速向混合动力气动解决方案的转型,为供应商开闢了新的差异化途径。

全球气压设备市场趋势与洞察

跨产业自动化技术的进步

大规模工厂数位化正在重塑气动系统设计,促使供应商整合感测器和无线模组以实现预测分析。 SMC 的 EXW1 无线节点可将阀组尺寸缩小 86%,并支援主流工业乙太网通讯协定,展现了小型化和互联互通在单一包装中的融合。对于工厂管理人员而言,气缸和阀门的即时健康数据有助于减少非计划性停机,并加快根本原因分析。随着新建设「无人值守」生产线的出现,电子、汽车和包装消费品工厂对数位化压缩空气基准的解决方案对于 ISO 11011 合规性审核的重要性日益凸显,使得数位化气动系统成为一项极具吸引力的投资。能够证明其产品可带来可衡量的 OEE 提升的供应商,相比传统竞标更具竞争优势。

对节能型压缩空气系统的需求

压缩空气约占工业电力负载的10%,而美国能源局(DOE) 将于2025年1月生效的新能源效率法规正迫使现有设备进行更换。阿特拉斯·科普柯的混合式压缩机系列,具备定速和变速驱动 (VSD) 模式,可将压力稳定性维持在±0.1 bar以内,同时每年每台设备可减少9吨二氧化碳排放。在欧洲,ASHRAE 90.1-2022 标准将压缩空气纳入考量,提高了建筑师的设计要求。从经济角度来看,洩漏率通常超过30%,导致每个工厂每年损失数万美元的电力,推动了快速投资回报的维修。企业永续发展负责人正将洩漏检测计画定位为一项易于实现的脱碳倡议,这进一步加速了对高效能气动设备的需求。

高昂的生命週期维护和能源成本

总拥有成本审核显示,能源成本占压缩机生命週期成本的77%,远超过资本支出。洩漏预防方案可以降低消费量,但需要测量设备和人员,而这些在小规模工厂往往十分匮乏。澳洲政府的一项研究报告称,平均洩漏率为30%,证实了全球普遍存在的效率低下问题。工业物联网感测器有望实现洩漏自动追踪,但初始硬体和分析服务订阅成本令对价格敏感的营运商望而却步。欧洲部分地区持续两位数的电价上涨,促使人们更加关注气动系统的成本,并鼓励买家在运作週期允许的情况下转向其他驱动系统。

细分市场分析

2025年,上摆式阀门占据气动设备市场33.02%的份额,凸显了其在自动化生产线压力和流量控制中的核心作用。从取放机器人到散装输送机,所有迴路都依赖方向阀和比例阀来协调操作顺序,因此上摆式阀门的市场主导地位将持续下去。市场成长趋势倾向于紧凑型、相容于通讯协定的歧管,这类歧管能够缩短安装时间,并融入智慧工厂架构。

致动器正以7.46%的复合年增长率快速成长,反映出製造商对更高加载精度和更快循环速率的需求。艾默生XV系列产品面积小巧,却能提供350 NL/min的流量,让设计人员能够在不牺牲吞吐量的前提下缩小机柜尺寸。日益严格的洁净空气法规推动了空气处理装置和精密接头的发展,以完善组件配置;同时,预测性维护的普及也促进了感测器附件的兴起。因此,气压设备市场正持续从离散组件转型为完全整合、数据丰富的组件。

到2025年,运动控制将占气动设备市场需求的40.02%,反映出其在直线滑台、旋转工作台和压力机等设备中的广泛应用。该领域充分利用了气动系统优异的功率重量比和毫秒级响应时间,这些特性对于高速组装至关重要。目前,市场重点关注能够将行程数据传输到MES平台以实现可追溯性的反馈式气压缸。

物料输送以7.95%的复合年增长率成为成长最快的领域,这主要得益于电子商务物流推动了自动化分类中心的发展。 SMC的RMH机械手已通过协作机器人认证,是软触式抓取如何拓展SKU处理能力的绝佳范例。流体控制在製程工业仍保持一定的市场份额,而真空发生器则在半导体晶圆处理领域不断拓展应用。融合是当前的重要趋势,先进的歧管将定位、抓取和真空控制整合到单一节点中,从而增强了气压设备市场供应商的客户留存率。

区域分析

到2025年,北美将占西门子全球营收的34.21%,这主要得益于航太、製药和汽车产业的成熟,这些产业对高规格解决方案的需求日益增长。西门子在德克萨斯州和加利福尼亚州新建工厂的100亿美元投资,标誌着该地区製造业持续回流,这将提振运动控制、阀门和压缩机组件的订单。美国能源局即将推出的压缩机法规正在推动一波维修,这将有助于稳定设备更新週期。

预计亚太地区将以7.66%的复合年增长率领跑,到2031年,随着中国、印度和东南亚国协新建晶圆厂和电池工厂,与其他地区的差距将进一步缩小。阿特拉斯·科普柯以4,650万美元收购韩国京源机械,标誌着其为实现在地化供应、满足区域内激增的需求而采取的一项策略性倡议。印度和越南政府为促进半导体自给自足而推出的激励措施,正在推动对超级净气压设备的新需求。

由于严格的能源和永续性指令,欧洲保持着强劲的市场份额。博世力士乐在墨西哥投资1.6亿欧元兴建工厂,凸显了欧洲原始设备製造商(OEM)的双轨战略:一方面将研发重心留在国内,另一方面在更靠近美国基本客群建立成本效益更高的生产能力。南美洲和中东地区规模小规模但成长迅速的市场机会,依赖需要重型高压气动装置的石化多元化计划,正在推动气动设备市场需求的成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 各行业自动化程度提高

- 对节能型压缩空气系统的需求

- 卫生食品和饮料加工生产线快速成长

- 扩大电动车製造设施

- 微流体组装对致动器的需求

- 利用工业物联网进行预测性维护维修

- 市场限制

- 高昂的生命週期维护和能源成本

- 精密工作中替代电动致动器的方案

- 根据ESG标准对压缩空气洩漏处以罚款

- 半导体製造厂超洁净压缩空气短缺

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济影响分析

第五章 市场规模与成长预测

- 按组件

- 致动器

- 阀门

- 空气处理装置(FRL)

- 管件和管材

- 空气压缩机

- 真空发生器

- 配件

- 按功能

- 运动控制

- 流体控制

- 物料输送

- 製造真空

- 发电/空气供应

- 按最终用户行业划分

- 车

- 食品饮料加工包装

- 航太/国防

- 生命科学(製药和医疗设备)

- 电子和半导体

- 化工/石油化工

- 包装器材

- 其他终端用户产业

- 按压力范围

- 低压(低于7巴)

- 中等压力(7 至 15 巴)

- 高压(高于 15 巴)

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- ASEAN-5

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Festo SE and Co. KG

- Emerson Electric Co.

- SMC Corporation

- Parker-Hannifin Corporation

- Siemens AG

- Ingersoll Rand Inc.

- Atlas Copco AB

- Bosch Rexroth AG

- Norgren Ltd.(IMI plc)

- Airtac International Group

- CKD Corporation

- Camozzi Automation SpA

- Danfoss A/S

- Honeywell International Inc.

- Eaton Corporation plc

- ROSS Operating Valve Co.

- Bimba Manufacturing LLC(IMI)

- Janatics India Pvt Ltd

- Chicago Pneumatic Tool Co. LLC

- Koki Holdings Co., Ltd.

- Yamaha Motor Co., Ltd.(Robotics)

第七章 市场机会与未来展望

The pneumatic equipment market size in 2026 is estimated at USD 37.41 billion, growing from 2025 value of USD 34.99 billion with 2031 projections showing USD 52.29 billion, growing at 6.93% CAGR over 2026-2031.

Industrial automation upgrades, energy-efficient compressed-air retrofits, and the fusion of pneumatic hardware with IIoT diagnostics are the primary growth catalysts. Demand spikes from semiconductor clean rooms, electric-vehicle battery lines, and hygienic food plants underscore the sector's expanding application scope. Competitive intensity is rising as market leaders pair traditional pneumatics with digital monitoring to cut downtime and energy loss. At the same time, tightening efficiency rules in major economies are accelerating the shift toward hybrid electro-pneumatic solutions, giving suppliers a new avenue for differentiation.

Global Pneumatic Equipment Market Trends and Insights

Increasing Automation Across Industries

Mass-scale factory digitalization is reshaping pneumatic design, prompting suppliers to embed sensors and wireless modules that allow predictive analytics. SMC's EXW1 wireless node trims valve-manifold size by 86% and supports leading industrial Ethernet protocols, demonstrating how miniaturization and connectivity now converge in a single package. For plant managers, real-time health data on cylinders and valves translates into fewer unplanned stops and faster root-cause analysis. Adoption momentum is especially strong in electronics, automotive, and packaged-goods plants building greenfield "lights-out" lines. Compliance audits under ISO 11011 give added weight to solutions that quantify compressed-air baselines, making digitally enabled pneumatics a compelling investment. Suppliers able to prove measurable OEE gains are winning head-to-head bids against legacy offerings.

Demand for Energy-Efficient Compressed-Air Systems

Compressed air accounts for roughly 10% of industrial electricity load, and new U.S. DOE efficiency rules effective January 2025 are forcing upgrades across the installed base. Atlas Copco's hybrid compressor portfolio, which toggles between fixed-speed and VSD modes, can trim annual CO2 output by 9 tons per unit while keeping pressure stability within +-0.1 bar. In Europe, ASHRAE 90.1-2022 inclusion of compressed air raises the bar for building designers as well. From a financial angle, leak rates often exceed 30% and cost individual factories tens of thousands of dollars in wasted power each year, incentivizing rapid payback retrofits. Enterprise sustainability officers now view leak-detection programs as low-hanging decarbonization wins, further accelerating demand for high-efficiency pneumatics.

High Lifetime Maintenance and Energy Costs

Total cost-of-ownership audits reveal that energy can make up 77% of compressor lifecycle expense, dwarfing capital outlay. Leak-fix programs cut consumption, yet they demand instrumentation and staff hours that smaller plants often lack. Government studies in Australia report average leakage at 30%, confirming a global inefficiency pattern. While IIoT sensors promise automated leak tracking, initial hardware and analytics subscriptions deter price-sensitive operators. The persistence of double-digit electricity inflation in parts of Europe amplifies scrutiny on pneumatic bills and nudges buyers toward alternative actuation modes when duty cycles permit.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of EV Manufacturing Facilities

- IIoT-Enabled Predictive Maintenance Retrofits

- Substitution by Electric Actuators in Precision Tasks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Upswing Valves captured 33.02% of the pneumatic equipment market share in 2025, underscoring their central role in pressure and flow governance inside automated lines. Their dominance persists because every circuit, from pick-and-place robots to bulk conveyors, relies on directional and proportional valves to orchestrate motion sequences. Growth leans toward compact, protocol-agnostic manifolds that shorten installation time and align with smart-factory architectures.

Actuators are accelerating with a 7.46% CAGR, reflecting manufacturers' need for higher payload accuracy and faster cycle rates. Emerson's XV Series pushes 350 NL/min in a slim footprint, allowing designers to shrink cabinets without sacrificing throughput. Air preparation units and precision fittings round out the component mix as clean-air mandates intensify, while sensor accessories flourish thanks to predictive-maintenance adoption. As a result, the pneumatic equipment market continues to migrate from stand-alone parts to fully integrated, data-rich assemblies.

Motion control held 40.02% of 2025 demand across the pneumatic equipment market, reflecting its ubiquity in linear slides, rotary tables, and pressing stations. The segment benefits from pneumatics' favorable power-to-weight ratio and millisecond response, assets prized on high-speed assembly lines. Emphasis is now on feedback-ready cylinders that feed stroke data to MES platforms for traceability.

Material handling posts the swiftest 7.95% CAGR as e-commerce logistics fuels automated sortation centers. SMC's RMH grippers, certified for cobot collaboration, illustrate how soft-touch gripping opens new SKU handling capabilities. Fluid control retains a niche in process industries, while vacuum generation expands in semiconductor wafer transport. Convergence is evident: advanced manifolds are combining positioning, gripping, and vacuum logic in one node, fortifying supplier stickiness in the pneumatic equipment market.

The Pneumatic Equipment Market Report is Segmented by Component (Actuators, Valves, Air Preparation Units, Fittings and Tubing, and More), Function (Motion Control, Fluid Control, Material Handling, and More), End-User Industry (Automotive, Food and Beverage Processing and Packaging, Aerospace and Defense, and More), Pressure Range (Low, Medium, and High), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 34.21% of global 2025 revenue owing to mature aerospace, pharmaceutical, and automotive sectors that demand high-specification solutions. Siemens' USD 10 billion commitment to new Texas and California plants illustrates the region's ongoing reshoring trend, which lifts component orders for motion, valve, and compressor packages. Imminent DOE compressor rules are sparking retrofit waves that stabilize equipment replacement cycles.

Asia Pacific posts the steepest 7.66% CAGR and is set to narrow the gap by 2031 as China, India, and ASEAN states erect new fabs and battery plants. Atlas Copco's USD 46.5 million purchase of Korea-based Kyungwon Machinery signals strategic moves to localize supply and meet skyrocketing regional demand. Government incentives for semiconductor self-reliance in India and Vietnam add fresh pull for ultra-clean pneumatics.

Europe maintains a solid share, buoyed by stringent energy and sustainability directives. Bosch Rexroth's EUR 160 million plant in Mexico underscores European OEMs' split-market strategy: retain R&D at home while building cost-effective capacity near the U.S. customer base. Smaller but rising opportunities in South America and the Middle East hinge on petrochemical diversification projects that require rugged high-pressure pneumatic arrays, adding incremental volume to the pneumatic equipment market.

- Festo SE and Co. KG

- Emerson Electric Co.

- SMC Corporation

- Parker-Hannifin Corporation

- Siemens AG

- Ingersoll Rand Inc.

- Atlas Copco AB

- Bosch Rexroth AG

- Norgren Ltd. (IMI plc)

- Airtac International Group

- CKD Corporation

- Camozzi Automation S.p.A.

- Danfoss A/S

- Honeywell International Inc.

- Eaton Corporation plc

- ROSS Operating Valve Co.

- Bimba Manufacturing LLC (IMI)

- Janatics India Pvt Ltd

- Chicago Pneumatic Tool Co. LLC

- Koki Holdings Co., Ltd.

- Yamaha Motor Co., Ltd. (Robotics)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing automation across industries

- 4.2.2 Demand for energy-efficient compressed-air systems

- 4.2.3 Rapid growth of hygienic FandB processing lines

- 4.2.4 Expansion of EV manufacturing facilities

- 4.2.5 Micro-fluidic assembly demand for micro-actuators

- 4.2.6 IIoT-enabled predictive maintenance retrofits

- 4.3 Market Restraints

- 4.3.1 High lifetime maintenance and energy costs

- 4.3.2 Substitution by electric actuators in precision tasks

- 4.3.3 ESG-driven penalties on compressed-air leakage

- 4.3.4 Shortage of ultra-clean compressed air for semicon fabs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Macroeconomic Impact Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Actuators

- 5.1.2 Valves

- 5.1.3 Air Preparation Units (FRLs)

- 5.1.4 Fittings and Tubing

- 5.1.5 Air Compressors

- 5.1.6 Vacuum Generators

- 5.1.7 Accessories

- 5.2 By Function

- 5.2.1 Motion Control

- 5.2.2 Fluid Control

- 5.2.3 Material Handling

- 5.2.4 Vacuum Creation

- 5.2.5 Power Generation / Air Supply

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Food and Beverage Processing and Packaging

- 5.3.3 Aerospace and Defense

- 5.3.4 Life Sciences (Pharma and Medical Devices)

- 5.3.5 Electronics and Semiconductor

- 5.3.6 Chemical and Petrochemical

- 5.3.7 Packaging Machinery

- 5.3.8 Other End-user Industries

- 5.4 By Pressure Range

- 5.4.1 Low Pressure (less than 7 bar)

- 5.4.2 Medium Pressure (7 - 15 bar)

- 5.4.3 High Pressure (above 15 bar)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN-5

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Festo SE and Co. KG

- 6.4.2 Emerson Electric Co.

- 6.4.3 SMC Corporation

- 6.4.4 Parker-Hannifin Corporation

- 6.4.5 Siemens AG

- 6.4.6 Ingersoll Rand Inc.

- 6.4.7 Atlas Copco AB

- 6.4.8 Bosch Rexroth AG

- 6.4.9 Norgren Ltd. (IMI plc)

- 6.4.10 Airtac International Group

- 6.4.11 CKD Corporation

- 6.4.12 Camozzi Automation S.p.A.

- 6.4.13 Danfoss A/S

- 6.4.14 Honeywell International Inc.

- 6.4.15 Eaton Corporation plc

- 6.4.16 ROSS Operating Valve Co.

- 6.4.17 Bimba Manufacturing LLC (IMI)

- 6.4.18 Janatics India Pvt Ltd

- 6.4.19 Chicago Pneumatic Tool Co. LLC

- 6.4.20 Koki Holdings Co., Ltd.

- 6.4.21 Yamaha Motor Co., Ltd. (Robotics)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment