|

市场调查报告书

商品编码

1910686

线上彩票:市场份额分析、行业趋势和统计数据、成长预测(2026-2031)Online Lottery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

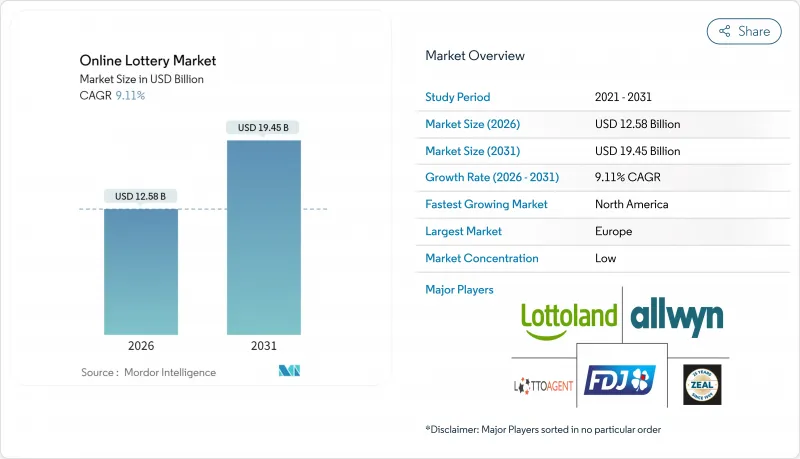

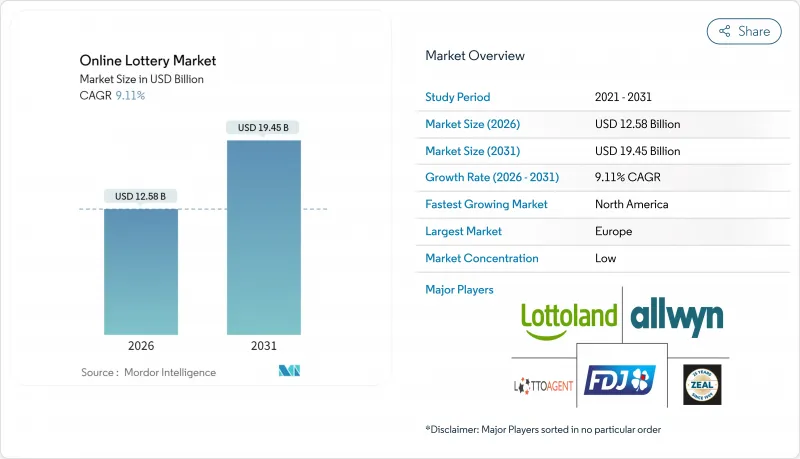

预计到 2025 年,线上彩券市场价值将达到 115.3 亿美元,到 2026 年将成长至 125.8 亿美元,到 2031 年将成长至 194.5 亿美元,在预测期(2026-2031 年)内复合年增长率为 9.11%。

这一增长得益于行动装置的普及、便捷的数位支付流程以及不断完善的监管。行动通路目前占彩券总销售额的一半以上,行动商务的普及也简化了转换流程。区块链技术等创新技术提高了透明度,行动应用程式、安全付款闸道和人工智慧驱动的用户帐户等也提升了玩家的安全性和参与度。社群媒体、导向电子邮件宣传活动和线上广告等策略在吸引和留住彩票爱好者方面都卓有成效。订阅服务和游戏化体验等功能不仅提高了玩家留存率,也有助于吸引更年轻的族群。欧洲主导其清晰的许可框架和跨国彩券体系,在市场价值方面处于领先地位,而美国在近期合法化后也不断扩大其市场规模。年轻族群更倾向于数位化即开型游戏,而传统彩券形式由于媒体对奖金池式彩券的关注而依然流行。网路安全和合规自动化投入的增加正在巩固现有平台提供者的地位。

全球线上彩票市场趋势与洞察

数位钱包和行动支付整合度不断提高

数位钱包和行动支付方式使彩票购买变得便捷安全,用户可以随时随地购买彩票。这些进步消除了传统支付方式的局限性,扩大了基本客群,并促进了彩票销售。根据中国互联网资讯中心预测,2024年,中国92.8%的行动网路用户将使用行动支付。这一成长使得彩券购买更加轻鬆便捷,突破了现金交易和实体店销售的限制。欧洲中央银行的数位欧元计画旨在完善现有支付系统,同时减少对非欧洲平台的依赖,简化跨境彩券交易。行动支付的整合对于刮刮乐彩券尤其有利,因为刮刮乐彩券既满足了用户对即时结果的需求,又兼具数位钱包的便利性。在销售点基础设施有限的亚洲新兴市场,QR码支付系统已成为基于NFC解决方案的有力竞争者,为彩票市场成长创造了新的机会。此外,采用储存支付凭证可以增强安全性,并支援定期订阅彩票服务,从而有助于实现稳定的产生收入。

合法化和放鬆管制

合法化将透过建立明确的监管规定、许可要求和消费者保护措施,增强人们对线上彩券的信心。这将确保游戏的公平性和中奖保障,从而提升玩家的信心。 2024年7月,麻萨诸塞州州长莫拉·希利核准了2025年预算,使线上彩券的销售合法化。麻州彩券公司计划在16个月内推出数位平台,要求参与者年满21岁。芬兰的博彩市场改革提案对体育博彩和线上游戏营运商实行开放的许可製度,同时维持Veikkaus对彩票的垄断地位。新加坡博彩管理局根据2022年《博彩监管法》向新加坡博彩公司颁发了有效期至2025年10月的许可证,为亚太地区提供了一种结构化的监管方法。犹他州众议员凯拉·伯克兰计划在2025年重新提出一项宪法修正案,以使州彩票合法化,从而将犹他州居民原本会花在其他州购买的彩票上的2亿美元彩票收入引入该州。这些监管倡议将扩大市场机会,并建立合规框架,使线上彩票业务合法化。巴西第14790/2023号法律强制要求负责任博彩行为,并要求业者实施系统来监控投注者的活动并识别高风险玩家,从而为新兴市场树立监管标准。

监管和法律挑战

全球监管标准的零碎化导致许可、课税和消费者保护方面出现混乱。这些不一致之处不仅存在于国界之间,也存在于各州内部,使得彩券业者的市场准入和营运更加复杂。 2025年4月,德克萨斯州彩券委员会一致投票透过禁止宅配,理由是先前与这些服务相关的争议性中奖事件引发了人们对合法性和诚信的担忧。德克萨斯州参议院通过了第28号参议院法案,将透过宅配销售线上彩券的行为定为犯罪,凸显了法规环境的不稳定性。在香港,《博彩条例》实施了严格的监管,并赋予香港赛马会博彩活动和六彩运营的垄断权,限制了国际运营商的市场准入。同样,西澳大利亚州2024年的《博彩法修正案》透过提高违规处罚力度和要求彩票牌照提供银行担保,加强了对互动博彩服务的监管。这种监管碎片化增加了合规的复杂性和营运成本,有利于拥有更强监管专业知识的成熟企业,而对小规模的企业造成不成比例的影响。

细分市场分析

行动平台将在2025年占据55.72%的市场份额,并展现出最快的成长势头,到2031年复合年增长率将达到11.08%。这一成长主要得益于智慧型手机的普及和行动支付系统的整合。桌面平台对于需要精细介面的复杂彩票游戏仍然至关重要,但随着行动装置优化程度的提高,用户参与度一直在下降。行动优先策略支援定位服务、彩票结果推播通知以及无缝的社交共用,从而突破传统桌面平台的局限,提升玩家参与度。

Pollard Banknote与爱尔兰Premier Lotteries于2024年12月合作推出行动应用程式和电子即开型彩票游戏组合,体现了业界对行动装置体验的重视。该平台包含玩家註册、游戏购买和彩票扫描等功能。行动平台受益于应用程式商店的分发管道,但同时也必须应对监管方面的挑战,例如地理位置限制和年龄验证。将行动游戏的美学元素与传统彩票机制结合,打造出既能吸引年轻用户群又能符合监管标准的混合体验。此外,跨平台同步功能可让玩家在行动装置上发起交易,并在桌面平台上完成交易,从而提升整个使用者体验流程的转换率。

到2025年,抽奖式彩券游戏将占据32.10%的市场份额,凸显了消费者对定期开奖、奖金丰厚的传统彩券游戏的强烈偏好。这类游戏,例如欧洲百万彩票,利用跨境奖池,创造出任何单一司法管辖区都无法企及的巨额奖金。即时彩票游戏预计将快速成长,到2031年复合年增长率将达到10.12%,这主要得益于即时满足感和行动游戏功能对数位原住民的吸引力。此外,体育博彩和其他新兴游戏类型融合了传统彩票机制和现代娱乐形式,但不同地区的法规结构差异显着。

即时游戏利用科技创新,提供媲美行动游戏的先进图形、动画和互动体验,同时符合彩票合规标准。此外,区块链技术在彩票营运中的应用,透过为彩票游戏和即时游戏提供透明、防篡改的记录,正在改变整个行业。这项创新有助于防止欺诈,并促进智慧合约的自动化。游戏类型的多样化体现了营运商为满足不同玩家的偏好所做的努力,从追求改变人生巨额奖金的玩家到喜欢快速赢取小额奖金的休閒玩家,都能找到适合自己的游戏。

区域分析

2025年,欧洲维持了45.20%的市场份额,这主要得益于成熟的跨境彩票营运模式,例如欧洲百万彩票(EuroMillions)。欧洲百万彩券在九个国家运营,采用标准化的奖金结构和收益分成机制。英国经历了重大转型,Allwin Entertainment成为其第四家获得许可的营运商。此次转型涉及3.5亿英镑的投资、30多个新系统的实施以及复杂的资料迁移,旨在使公共产业的收益翻倍。德国继续根据《州际博彩公约》调整法规结构,该公约确立了线上博彩法规,并解决了近期社群媒体调查中提出的污名化问题。北欧国家取得了显着进展,芬兰计划进行全面的博彩市场改革,将于2027年1月前为商业运营商引入开放式许可製度。此外,欧洲中央银行的数位欧元计画正在创建一个统一的支付基础设施,这有望简化跨境彩票交易,并减少对非欧洲支付提供者的依赖。

预计北美将经历最快的成长,到2031年将以10.44%的复合年增长率成长。这一成长主要得益于各州层级的合法化努力和对技术基础设施的投资,从而扩大了潜在市场。 2024年7月,马萨诸塞州核准了线上彩票销售,并将收入分配给幼儿教育计画。维吉尼亚将其与NeoPollard Interactive的线上彩票合约延长至2028年,延续了伙伴关係创下的收入纪录。在加拿大,亚伯达推出了线上彩票,这是北美首个整合式彩票游戏。这展现了各州在数位彩券产品方面的创新。然而,监管的碎片化,例如德克萨斯州禁止第三方宅配服务,构成了一项挑战。与此同时,其他一些州正在推动数位彩票的扩张。儘管先进的行动支付系统和智慧型手机的高普及率正在推动地方彩票的数位化,但联邦博彩法规给跨州彩票营运带来了合规方面的挑战。

亚太地区及其他全球市场蕴藏着多元化的成长机会,但这些机会受到监管方式和文化对博彩态度差异的限制。新加坡博彩管理局已根据《2022年博彩管制法》向新加坡博彩公司(Singapore Pools)颁发许可证,使其成为包括公共彩票在内的在线非赌场博彩服务的独家运营商,这体现了发达亚洲市场结构化的法规结构。澳洲的监管环境也在不断发展,推出了国家消费者保护框架和BetStop自我排除登记系统,并对与外国兼容的彩票和线上基诺服务进行了审查。在南美洲,巴西的第14790/2023号法律强调负责任博彩措施并强制要求建立营运商监控系统,为该地区的新兴市场树立了监管先例。随着新兴经济体数位基础设施的持续发展,高所得收入国家和低收入国家之间的网路普及率差距蕴藏着巨大的成长潜力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 数位钱包普及率不断提高,行动支付整合度不断提升

- 合法化和放鬆管制

- 全球网路普及率不断提高

- 跨境累积奖金池增加奖金金额

- 数位科技的进步

- 利用微型网红联盟行销降低客户获取成本

- 市场限制

- 监管和法律挑战

- 加强对应用程式商店中真钱赌博的监管

- 网路安全威胁与诈欺风险

- 负面的社会看法和污名

- 消费行为分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依平台类型

- 桌面

- 移动的

- 按游戏类型

- 抽籤

- 即时彩券

- 现场彩券

- 其他的

- 按年龄组

- 25岁以下

- 25至40岁

- 40至55岁

- 55岁或以上

- 最终用户

- 男性

- 女士

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 瑞典

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 大洋洲国家

- 亚太其他地区

- 其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Allwyn Entertainment

- PlayHugeLottos

- Francaise des Jeux

- ZEAL Network SE

- Lotto Direct Ltd

- Lottoland

- Lotto Agent

- LottoKings

- WinTrillions

- Lotto247

- Annexio Ltd.

- China Welfare Lottery

- Intralot

- Sisal

- The Lottery Corporation

- International Game Technology(IGT)

- Flutter Entertainment(The Lotteries Pilot)

- NeoGames

- Pollard Banknote

- Jumbo Interactive

第七章 市场机会与未来展望

The online lottery market was valued at USD 11.53 billion in 2025 and estimated to grow from USD 12.58 billion in 2026 to reach USD 19.45 billion by 2031, at a CAGR of 9.11% during the forecast period (2026-2031).

This growth is bolstered by a surge in mobile adoption, seamless digital payment processes, and forward-thinking regulations. Currently, mobile channels account for over half of all ticket sales, and the familiarity with m-commerce streamlines the conversion process. Innovations like blockchain for enhanced transparency, mobile applications, secure payment gateways, and AI-driven user accounts are elevating player security and engagement. Strategies such as leveraging social media, targeted email campaigns, and online advertising are proving effective in both attracting and retaining lottery enthusiasts. Features like subscription services and gamified experiences are not only boosting player retention but also drawing in a younger demographic. Europe leads in market value, thanks to its clear licensing frameworks and multi-country draws. Meanwhile, recent legalizations are expanding the market base in the U.S. While younger adults are leaning towards digital-first instant games, traditional draw formats still hold their ground, largely due to the media's focus on pooled jackpots. Increased spending on cybersecurity and automation in compliance are fortifying the position of established platform providers.

Global Online Lottery Market Trends and Insights

Rising penetration of digital wallets and mobile payments integration

Lottery ticket purchases have become seamless and secure with the use of digital wallets and mobile payment options, allowing users to buy tickets anytime and anywhere. This advancement removes the challenges of traditional payment methods, increasing the customer base and driving ticket sales. In 2024, 92.8% of mobile internet users in China utilized mobile payments, according to the China Internet Network Information Center. This growth facilitates hassle-free lottery ticket purchases, bypassing the limitations of cash transactions and physical retail outlets. The European Central Bank's digital euro initiative, currently under preparation, seeks to complement existing payment systems while reducing reliance on non-European platforms, potentially streamlining cross-border lottery transactions. Mobile payment integration is particularly advantageous for instant lottery games, where the demand for immediate results aligns with the convenience of digital wallets. In developing Asian markets with limited point-of-sale infrastructure, QR code-based payment systems are emerging as strong competitors to NFC-based solutions, creating new opportunities for lottery market growth. Additionally, the adoption of stored payment credentials enhances security and supports subscription-based lottery services, fostering consistent revenue generation.

Legalization and regulatory liberalization

Legalization establishes clear regulations, licensing requirements, and consumer protections, enhancing trust in online lotteries. This increases player confidence by ensuring fair games and secure winnings. In July 2024, Massachusetts Governor Maura Healey approved the FY 2025 budget, legalizing online lottery sales. The Massachusetts Lottery plans to launch its digital platform within 16 months, requiring participants to be at least 21 years old. Finland's gaming market reform suggests an open licensing system for commercial operators in sports betting and online gaming while preserving Veikkaus's monopoly over lotteries. Singapore's Gambling Regulatory Authority issued a license to Singapore Pools under the 2022 Gambling Control Act, valid until October 2025, showcasing structured regulatory measures in Asia-Pacific. Utah State Representative Kera Birkeland intends to reintroduce a constitutional amendment in 2025 to legalize the state lottery, aiming to capture the USD 200 million spent by Utah residents on lottery tickets in neighboring states. These regulatory developments expand market opportunities and establish compliance frameworks that legitimize online lottery operations. Brazil's Law 14,790/2023 enforces responsible gambling practices, requiring operators to monitor bettor activity and implement systems to identify at-risk players, setting a regulatory standard for emerging markets.

Regulatory and legal challenges

Fragmented global regulatory standards cause confusion regarding licensing, taxation, and consumer protection. This inconsistency, present across countries and even within states, complicates market entry and operations for lottery operators. In April 2025, the Texas Lottery Commission unanimously decided to ban third-party courier services from purchasing lottery tickets, citing concerns over legality and integrity after controversial jackpot wins linked to these services. Highlighting the volatility of the regulatory environment, the Texas Senate passed Senate Bill 28, criminalizing online lottery ticket sales through couriers. In Hong Kong, the Gambling Ordinance enforces strict regulations, granting the Hong Kong Jockey Club exclusive rights to betting activities and Mark Six Lottery operations, thereby restricting market access for international operators. Similarly, Western Australia's Gambling Legislation Amendment Act 2024 strengthens regulations for interactive gambling services by increasing penalties for noncompliance and requiring operators to provide bank guarantees for lottery permits. This regulatory fragmentation increases compliance complexities and operational costs, disproportionately affecting smaller operators while favoring established players with greater regulatory expertise.

Other drivers and restraints analyzed in the detailed report include:

- Increasing global internet penetration

- Cross-border jackpot pooling boosting prize sizes

- App-store policy tightening on real-money gambling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mobile platforms captured 55.72% market share in 2025 and exhibit the fastest growth trajectory at 11.08% CAGR through 2031. This growth is primarily driven by the widespread use of smartphones and the integration of mobile payment systems. Desktop platforms remain relevant, particularly for complex lottery games requiring detailed interfaces, but they are experiencing a decline in user engagement as mobile optimization continues to improve. The mobile-first approach supports location-based services, push notifications for draw results, and seamless social sharing, enhancing player engagement beyond the limitations of traditional desktop platforms.

Pollard Banknote's partnership with Premier Lotteries Ireland in December 2024, which introduced a mobile app and an eInstant games portfolio, highlights the industry's focus on mobile-centric experiences. This platform includes features such as player registration, game purchases, and ticket scanning. While mobile platforms benefit from app store distribution channels, they must address regulatory challenges, including geo-gating and age verification. The fusion of mobile gaming aesthetics with traditional lottery mechanics creates hybrid experiences that attract younger demographics while adhering to regulatory standards. Additionally, cross-platform synchronization allows players to initiate transactions on mobile devices and complete them on desktop platforms, improving conversion rates across the user journey.

Draw-based lottery games commanded 32.10% market share in 2025, highlighting consumers' strong preference for traditional lotteries with scheduled draws and attractive jackpots. These games, such as EuroMillions, utilize cross-border jackpot pooling to generate prize sizes that individual jurisdictions cannot achieve alone. Instant lottery games are experiencing rapid growth, with a 10.12% CAGR projected through 2031, driven by the appeal of immediate gratification and mobile gaming features that attract digital-native audiences. Additionally, sports lotteries and other emerging game types combine traditional lottery mechanics with modern entertainment formats, though regulatory frameworks differ significantly across regions.

Instant games are leveraging technological advancements to deliver enhanced graphics, animations, and interactive features that mimic mobile gaming experiences while adhering to lottery compliance standards. Furthermore, the adoption of blockchain technology in lottery operations is transforming the industry by providing transparent and immutable records for both draw-based and instant games. This innovation helps reduce fraud and facilitates smart contract automation. The diversification of game types reflects operators' efforts to meet the varied preferences of players, ranging from those seeking life-changing jackpots to casual participants favoring quick, smaller-value wins.

The Online Lottery Market Report is Segmented by Platform Type (Desktop, Mobile), Game Type (Draw-Based Lottery, Instant Lottery, Sports Lottery, Others), Age Group (Below 25 Years, 25-40 Years, 40-55 Years, 55+ Years), End User (Male, Female), and Geography (North America, Europe, Asia-Pacific, Rest of the World). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintained a 45.20% market share in 2025, supported by well-established cross-border lottery operations such as EuroMillions. EuroMillions operates across nine countries with standardized prize structures and revenue distribution mechanisms. The UK experienced a major shift as Allwyn Entertainment became the Fourth Licence operator. This transition involved a GBP 350 million investment, introducing over 30 new systems and complex data migrations, with the goal of doubling returns to Good Causes. Germany continues to adapt its regulatory framework under the State Treaty on Gambling, which structured online gambling regulations and addressed stigmatization concerns highlighted in recent social media studies. Nordic countries are making significant progress, with Finland planning a comprehensive gaming market reform to introduce open licensing systems for commercial operators by January 2027. Additionally, the European Central Bank's digital euro initiative is creating a unified payment infrastructure that could streamline cross-border lottery transactions and reduce reliance on non-European payment providers.

North America is experiencing the fastest regional growth, with a 10.44% CAGR projected through 2031. This growth is driven by state-level legalization efforts and investments in technological infrastructure, which are expanding the addressable market. In July 2024, Massachusetts approved online lottery sales, allocating funds to early childhood education programs. Virginia extended its iLottery contract with NeoPollard Interactive through 2028, continuing a partnership that has achieved record gross sales. In Canada, Alberta launched online draw-based lottery games, marking the first integration of draw games in North America and showcasing provincial innovation in digital lottery delivery. However, regulatory fragmentation poses challenges, as seen in Texas's ban on third-party courier services, while other states embrace digital lottery expansion. Advanced mobile payment systems and high smartphone penetration rates are driving lottery digitization in the region, though federal gambling regulations create compliance challenges for interstate lottery operations.

Asia-Pacific and other global markets offer diverse growth opportunities, though these are constrained by varying regulatory approaches and cultural attitudes toward gambling. Singapore's Gambling Regulatory Authority, under the 2022 Gambling Control Act, has authorized Singapore Pools as the exclusive operator for online non-casino gambling services, including public lotteries, reflecting structured regulatory frameworks in developed Asian markets. Australia's regulatory landscape is evolving with the implementation of the National Consumer Protection Framework and the BetStop self-exclusion register, alongside reviews of foreign-matched lotteries and online keno services. In South America, Brazil's Law 14,790/2023 emphasizes responsible gambling measures and mandates operator monitoring systems, setting a regulatory precedent for emerging markets in the region. As digital infrastructure continues to develop in emerging economies, disparities in internet penetration between high-income and low-income countries highlight significant growth potential.

- Allwyn Entertainment

- PlayHugeLottos

- Francaise des Jeux

- ZEAL Network SE

- Lotto Direct Ltd

- Lottoland

- Lotto Agent

- LottoKings

- WinTrillions

- Lotto247

- Annexio Ltd.

- China Welfare Lottery

- Intralot

- Sisal

- The Lottery Corporation

- International Game Technology (IGT)

- Flutter Entertainment (The Lotteries Pilot)

- NeoGames

- Pollard Banknote

- Jumbo Interactive

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising penetration of digital wallets and mobile payments integration

- 4.2.2 Legalization and regulatory liberalization

- 4.2.3 Increasing global internet penetration

- 4.2.4 Cross-border jackpot pooling boosting prize sizes

- 4.2.5 Advancement of digital technologies

- 4.2.6 Micro-influencer affiliate marketing lowering acquisition costs

- 4.3 Market Restraints

- 4.3.1 Regulatory and legal challenges

- 4.3.2 App-store policy tightening on real-money gambling

- 4.3.3 Cybersecurity threats and fraud risks

- 4.3.4 Negative public perception and stigma

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Platform Type

- 5.1.1 Desktop

- 5.1.2 Mobile

- 5.2 By Game Type

- 5.2.1 Draw-based Lottery

- 5.2.2 Instant Lottery

- 5.2.3 Spots Lottery

- 5.2.4 Others

- 5.3 By Age Group

- 5.3.1 Below 25 Years

- 5.3.2 25-40 Years

- 5.3.3 40-55 Years

- 5.3.4 55+ Years

- 5.4 By End User

- 5.4.1 Male

- 5.4.2 Female

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 Sweden

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Italy

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 Oceanic Countries

- 5.5.3.2 Rest of Asia-Pacific

- 5.5.4 Rest of the Wolrd

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Allwyn Entertainment

- 6.4.2 PlayHugeLottos

- 6.4.3 Francaise des Jeux

- 6.4.4 ZEAL Network SE

- 6.4.5 Lotto Direct Ltd

- 6.4.6 Lottoland

- 6.4.7 Lotto Agent

- 6.4.8 LottoKings

- 6.4.9 WinTrillions

- 6.4.10 Lotto247

- 6.4.11 Annexio Ltd.

- 6.4.12 China Welfare Lottery

- 6.4.13 Intralot

- 6.4.14 Sisal

- 6.4.15 The Lottery Corporation

- 6.4.16 International Game Technology (IGT)

- 6.4.17 Flutter Entertainment (The Lotteries Pilot)

- 6.4.18 NeoGames

- 6.4.19 Pollard Banknote

- 6.4.20 Jumbo Interactive