|

市场调查报告书

商品编码

1910710

夜视设备:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Night Vision Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

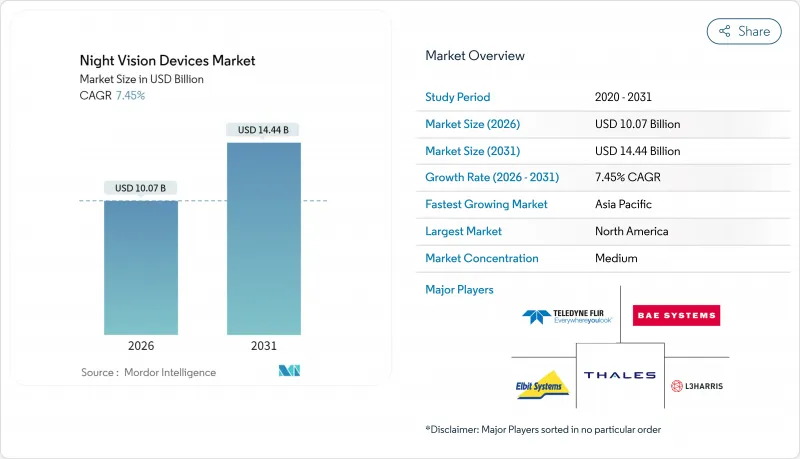

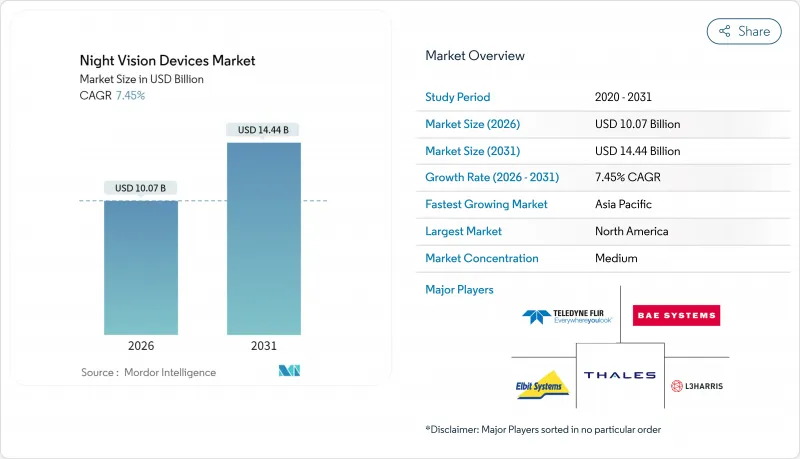

预计到 2025 年,夜视设备市场价值将达到 93.7 亿美元,并预计从 2026 年的 100.7 亿美元增长到 2031 年的 144.4 亿美元,在预测期(2026-2031 年)内,复合年增长率将达到 7.45%。

由于国防部致力于将低光照条件下的作战能力製度化,汽车监管机构强制要求商用车辆配备热感摄像头,以及小型化技术的进步降低了重量和功耗,夜视设备市场正蓬勃发展。投资趋势也反映出民用需求的成长,例如野生动物保护机构部署热成像感测器用于反盗猎措施,公共安全部门则将融合感测器护目镜整合到战术行动中。在供应方面,美国承包商之间的整合正在加剧,尤其是泰莱公司(Teledyne)于2024年以7.1亿美元收购Excelitas公司。此外,鼓励盟国国内采购的出口管制政策也具有显着特征。

全球夜视设备市场趋势与洞察

增加国防现代化预算

北约及其盟国的国防预算优先考虑步兵基本装备中的夜视能力,而非专用附加设备。到2024年,美国将部署超过18,000套ENVG-B夜视仪,该设备可将夜视镜与武器瞄准镜无线连接,使每位士兵都成为联网感测器。德国和法国的「下一代士兵」计画也遵循类似的战略转变,批量采购确保了订单的持续性。这种采购需求的转变稳定了夜视设备市场供应商的收入状况。同时,执法机关在反恐任务中也越来越多地采用军用级光学设备。这种不断增长的机构需求为夜视设备市场带来了可预测的多年合约。

FMVSS-127 强制要求使用汽车热感摄影机

美国联邦机动车辆安全标准127 (FMVSS-127) 规定了夜间或暴雨天气下标准倒车摄影机无法满足的后方视野要求。热成像技术弥补了这一不足,Teledyne 和 FLIR 等公司已为车队卡车提供环境加固型感测器。这项强制性要求将即时催生大规模需求,并降低夜视设备市场整个产业链的单位成本。汽车原始设备製造商 (OEM) 的采用将促进通用组件平台的开发,国防项目也将受益于成本的降低。一级供应商与半导体代工厂合作,提升产品汽车级可靠性,从而增强规模经济效益,使民用和军用合约均受益。车队营运商将透过共用製造和更稳定的备件供应降低生命週期成本。

高昂的生命週期成本和校准成本

拥有成本远高于购买价格。根据美国国防安全保障部的一项研究,每台设备的维修成本在 500 美元到 2000 美元之间,更换成本最高可达 5,000 美元。定期校准对于在关键任务应用中保持感测器精度至关重要。多感测器夜视镜需要专业技术人员和专用软体,这使得维护合约的复杂程度堪比武器系统。民用买家,例如保全公司或小规模警察部门,面临预算限制,这可能会延缓设备的更新换代。虽然夜视设备设备的一大障碍。

细分市场分析

到2025年,摄影机将占据夜视设备市场33.56%的份额,主要得益于军用车辆、商用车队、安全警戒系统和无人机等领域对这类设备的日益普及。北美地区多年采购计画的基础是FMVSS-127法规,该法规也为此细分市场带来了正面影响。随着感测器核心尺寸的缩小,整合商正将摄影机封装成紧凑型模组,以便轻鬆整合到车辆格栅、飞机云台和固定装置中。强劲的营收得益于多元化的客户群,有助于抵御国防费用的波动。同时,护目镜的复合年增长率(CAGR)为8.02%,它能够提供士兵现代化计划中必不可少的免手持情境察觉。执法机关也正在效仿军方的做法,采购融合感测器护目镜,用于在白天、黄昏和完全黑暗的城市环境中开展行动。单筒望远镜和双筒望远镜则服务于诸如海上导航和狩猎等细分市场,在这些领域,远程目标定位能力至关重要。步枪瞄准镜仍然是一个小众市场,由于精准射击者需要影像稳定和弹道运算等功能,其价格一直居高不下。其他类型的瞄准镜,例如头盔显示器,正在兴起,扩增实境迭加技术可以提升任务表现。

此细分市场的成长模式反映了用户不断变化的需求。士兵和战术警察部队优先考虑轻便易用的产品,推动了夜视镜每隔几年就需要更新换代。相机用户则优先考虑产品的稳定性和网路连接性,促使製造商整合乙太网路和基于人工智慧的边缘侦测演算法。双筒望远镜由于电池续航力的逐步提升而保持着稳定的需求。能够根据这些不同需求调整产品蓝图的製造商正在赢得持续的合同,这印证了产品类型多样性在夜视设备市场中的战略重要性。

区域分析

到2025年,北美将以31.08%的市场份额主导夜视设备市场,这主要得益于国防现代化预算、严格的车辆安全法规以及成熟的供应商体系。美国耗资数十亿美元的ENVG-B项目正在稳定工厂的运作,而FMVSS-127法规则强制要求民用卡车安装热成像感测器。出口限制推动了国内采购,确保高端製造在国内进行,并支撑着强大的售后服务网络。

到2031年,亚太地区将以8.78%的复合年增长率领先,原因是区域安全问题促使日本、韩国和印度加速采购军用光学设备。在国家补贴和低人事费用的推动下,中国製造商正积极扩大规模,其产品价格比西方同类产品低50%至60%。这种价格优势迫使全球现有企业透过感测器融合、软体和安全通讯协定来实现差异化。同时,澳洲的民用无人机(UAV)法规刺激了对用于丛林火灾监测的热成像无人机的需求,尤其是在能见度低、烟雾瀰漫的环境中。

在欧洲,北约的标准化推动了可互通夜视设备的共同采购,从而维持了稳定的需求。诸如德国的「未来士兵系统」等计画将一定比例的步兵预算用于光学设备升级,从而创造了可预测的支出流。中东和非洲地区正在采用热成像技术进行边境监视和管道安全防护,但资本支出週期仍依赖资源收入。南美洲的成长较为集中,主要由在地形崎岖的丛林地区进行的禁毒行动所驱动。总体而言,地理趋势反映了已开发市场监管主导的需求与新兴地区安全主导的迫切性之间的平衡,这支撑了夜视设备市场长期稳健的前景。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 增加国防现代化预算

- 执法机关引进融合感测器夜视系统

- FMVSS-127 强制要求使用汽车热感摄影机

- 数位化士兵视觉计划(ENVG-B,DNVT)

- 将夜视设备整合到商用无人机(UAV)中

- 小型化、尺寸、重量、功耗低、成本低的影像增强管

- 市场限制

- 高昂的生命週期成本和校准成本

- 出口管制(ITAR/Wassenaar)法规

- 日光晕染和感测器饱和度

- 供不应求

- 产业价值链分析

- 影响市场的宏观经济因素

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依设备类型

- 相机

- 风镜

- 单筒望远镜与双筒望远镜

- 步枪瞄准镜

- 其他设备类型

- 透过技术

- 热感成像

- 影像增强器

- 红外线照明

- 其他技术

- 透过使用

- 军事/国防

- 野生动物观察与保护

- 监控与安防

- 航海和海洋

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Teledyne FLIR LLC

- L3Harris Technologies Inc.

- Elbit Systems Ltd.

- BAE Systems plc

- Thales Group

- Raytheon Technologies Corp.

- Bushnell Holdings Inc.

- Exosens SAS

- Panasonic Holdings Corp.

- Excelitas Technologies Corp.

- EOTECH LLC

- Opgal Optronic Industries Ltd.

- QinetiQ Group plc

- Photonis France SAS

- Theon Sensors SA

- Rheinmetall AG

- Hensoldt AG

- SATIR Europe(Ireland)Co. Ltd.

- American Technologies Network Corp.

- AGM Global Vision LLC

- Yukon Advanced Optics Worldwide

- FLIR Systems AB(Sweden)

- Nivisys LLC

- Opticoelectron Group JSCo.

- Tactical Night Vision Company LLC

- Tak Technologies Pvt. Ltd.

第七章 市场机会与未来展望

The night vision devices market was valued at USD 9.37 billion in 2025 and estimated to grow from USD 10.07 billion in 2026 to reach USD 14.44 billion by 2031, at a CAGR of 7.45% during the forecast period (2026-2031).

The night vision devices market is gaining momentum as defense ministries institutionalize low-light capability, automotive regulators mandate thermal cameras for commercial fleets, and miniaturization breakthroughs lower weight and power needs. Investment flows also reflect rising civilian demand, with wildlife conservation agencies deploying thermal sensors to combat poaching and public-safety departments integrating fused-sensor goggles for tactical operations. Supply-side dynamics feature consolidation among U.S. contractors, highlighted by Teledyne's USD 710 million purchase of Excelitas in 2024, alongside export-control policies that encourage domestic sourcing in allied nations.

Global Night Vision Devices Market Trends and Insights

Rising Defense Modernisation Budgets

Defense budgets across NATO and allied regions are prioritizing night-vision capabilities in baseline infantry kits, rather than specialized add-ons. The U.S. Army delivered more than 18,000 ENVG-B units by 2024 and now links goggles wirelessly to weapon-mounted sights, turning every soldier into a networked sensor. German and French future-soldier programs follow similar doctrine shifts, ensuring that volume procurement keeps recurring orders flowing. Procurement shifts from discretionary to essential status, smooths the revenue profile for suppliers active in the night vision devices market. Parallel growth is emerging in law enforcement agencies that are adopting military-grade optics for counter-terror missions. This expanding institutional demand underpins predictable, multiyear contract pipelines for the night vision devices market.

Automotive Thermal Cameras Mandated by FMVSS-127

Federal Motor Vehicle Safety Standard 127 sets rear-visibility rules that standard backup cameras cannot meet during night or heavy rain. Thermal imaging fills that gap, and Teledyne FLIR already markets sensors ruggedized for fleet trucks. The mandate creates immediate volume demand, reducing per-unit costs across the night vision devices market chain. The adoption of automotive OEMs drives the development of common component platforms, allowing defense programs to benefit from the falling cost curves. Tier-1 suppliers partner with semiconductor foundries to add automotive-grade reliability, reinforcing scale economies that benefit both civilian and military contracts. Fleet operators achieve lower lifecycle costs as shared production stabilizes spare part availability.

High Lifecycle and Calibration Cost

Ownership costs stretch well beyond the sticker price. A U.S. Homeland Security study lists repair bills of USD 500-2,000 per unit and replacement expenses reaching USD 5,000. Periodic calibration remains mandatory to sustain sensor accuracy for mission-critical tasks. Multi-sensor goggles require specialist technicians and dedicated software, raising maintenance contracts to near weapon-system levels. Commercial buyers, such as security firms or small police departments, face budget hurdles, which can delay refresh cycles. Vendors in the night vision devices market respond with modular designs and extended service agreements; however, the total cost of ownership continues to slow adoption outside defense circles.

Other drivers and restraints analyzed in the detailed report include:

- Digitised Soldier-Vision Programmes (ENVG-B, DNVT)

- Commercial UAV Night-Vision Integration

- Export-Control (ITAR/Wassenaar) Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cameras accounted for 33.56% of the night vision devices market share in 2025, capitalizing on the adoption of these devices across military vehicles, commercial fleets, security perimeters, and drones. The segment benefits from FMVSS-127 mandates that anchor multi-year purchasing schedules in North America. As sensor cores shrink, integrators package cameras into compact modules that slot easily into vehicle grilles, aerial gimbals, and fixed installations. Revenue resilience stems from a diversified customer portfolio that hedges against fluctuations in defense spending. In parallel, goggles post an 8.02% CAGR by offering hands-free situational awareness essential to soldier modernisation programs. Law-enforcement teams echo military practice, procuring fused-sensor goggles for urban operations that span daylight, dusk, and complete darkness. Monoculars and binoculars serve marine navigation and hunting niches, where long-range spot-and-identify functions matter most. Rifle scopes stay niche yet command premium pricing as precision shooters demand image stability and ballistic calculators. Other types, including helmet-mounted displays, emerge where augmented reality overlays drive mission performance.

Segment growth patterns mirror the evolving needs of users. Soldiers and tactical police units prioritize weight savings and intuitive interfaces, fueling demand for goggle refresh cycles every few years. Camera users emphasize ruggedness and network connectivity, pushing manufacturers to integrate Ethernet and AI-based detection algorithms on the edge. Binoculars hold steady with incremental improvements in battery life. Manufacturers that align product roadmaps to these divergent needs secure sustained contracts, underscoring the strategic significance of product-type diversity within the night vision devices market.

The Night Vision Devices Market Report is Segmented by Device Type (Cameras, Goggles, Monoculars and Binoculars, and More), Technology (Thermal Imaging, Image Intensifier, and More), Application (Military and Defence, Wildlife Spotting and Conservation, Surveillance and Security, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated the night vision devices market, accounting for 31.08% of the revenue share in 2025, thanks to defense modernization budgets, stringent automotive safety regulations, and a mature supplier base. The U.S. Army's multibillion-dollar ENVG-B program stabilizes factory workloads, while FMVSS-127 ensures civilian truck lines also integrate thermal sensors. Export controls favor domestic sourcing, keeping high-end manufacturing onshore and supporting a robust aftermarket service network.

The Asia-Pacific region records the highest 8.78% CAGR through 2031, as regional security concerns prompt Japan, South Korea, and India to accelerate the procurement of soldier-borne optics. Chinese manufacturers scale up aggressively, courtesy of state subsidies and lower labor costs, offering products 50-60% cheaper than their Western equivalents. This price edge forces global incumbents to differentiate themselves on sensor fusion, software, and secure communications protocols. Meanwhile, Australia's civil UAV rules are stimulating demand for thermal drones, particularly for bushfire monitoring in low-visibility smoke conditions.

Europe maintains steady uptake as NATO standardization drives collective procurement of interoperable night-vision kits. Programs like Germany's Future Soldier System allocate fixed percentages of infantry budgets to optical upgrades, keeping the spending stream predictable. The Middle East and Africa adopt thermal imaging for border monitoring and pipeline security, although capex cycles remain tied to resource revenues. South America exhibits selective growth, primarily centered on anti-narcotics operations in challenging jungle terrain. Overall, geographic dynamics reflect a balance between regulation-led pull in developed markets and security-driven urgency in emerging regions, underpinning a resilient long-term outlook for the night vision devices market.

- Teledyne FLIR LLC

- L3Harris Technologies Inc.

- Elbit Systems Ltd.

- BAE Systems plc

- Thales Group

- Raytheon Technologies Corp.

- Bushnell Holdings Inc.

- Exosens SAS

- Panasonic Holdings Corp.

- Excelitas Technologies Corp.

- EOTECH LLC

- Opgal Optronic Industries Ltd.

- QinetiQ Group plc

- Photonis France SAS

- Theon Sensors SA

- Rheinmetall AG

- Hensoldt AG

- SATIR Europe (Ireland) Co. Ltd.

- American Technologies Network Corp.

- AGM Global Vision LLC

- Yukon Advanced Optics Worldwide

- FLIR Systems AB (Sweden)

- Nivisys LLC

- Opticoelectron Group JSCo.

- Tactical Night Vision Company LLC

- Tak Technologies Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising defence modernisation budgets

- 4.2.2 Adoption of fused-sensor night-vision for law-enforcement

- 4.2.3 Automotive thermal cameras mandated by FMVSS-127

- 4.2.4 Digitised soldier-vision programmes (ENVG-B, DNVT)

- 4.2.5 Commercial UAV night-vision integration

- 4.2.6 Miniaturised SWaP-C image-intensifier tubes

- 4.3 Market Restraints

- 4.3.1 High lifecycle and calibration cost

- 4.3.2 Export-control (ITAR/Wassenaar) restrictions

- 4.3.3 Day-bright blooming and sensor saturation

- 4.3.4 Supply-chain scarcity of indium antimonide

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors on the Market

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Type

- 5.1.1 Cameras

- 5.1.2 Goggles

- 5.1.3 Monoculars and Binoculars

- 5.1.4 Rifle Scopes

- 5.1.5 Other Device Types

- 5.2 By Technology

- 5.2.1 Thermal Imaging

- 5.2.2 Image Intensifier

- 5.2.3 Infra-Red Illumination

- 5.2.4 Other Technologies

- 5.3 By Application

- 5.3.1 Military and Defense

- 5.3.2 Wildlife Spotting and Conservation

- 5.3.3 Surveillance and Security

- 5.3.4 Navigation and Marine

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core Segments, Financials, Strategic Info, Market Share, Products and Services, Recent Developments)

- 6.4.1 Teledyne FLIR LLC

- 6.4.2 L3Harris Technologies Inc.

- 6.4.3 Elbit Systems Ltd.

- 6.4.4 BAE Systems plc

- 6.4.5 Thales Group

- 6.4.6 Raytheon Technologies Corp.

- 6.4.7 Bushnell Holdings Inc.

- 6.4.8 Exosens SAS

- 6.4.9 Panasonic Holdings Corp.

- 6.4.10 Excelitas Technologies Corp.

- 6.4.11 EOTECH LLC

- 6.4.12 Opgal Optronic Industries Ltd.

- 6.4.13 QinetiQ Group plc

- 6.4.14 Photonis France SAS

- 6.4.15 Theon Sensors SA

- 6.4.16 Rheinmetall AG

- 6.4.17 Hensoldt AG

- 6.4.18 SATIR Europe (Ireland) Co. Ltd.

- 6.4.19 American Technologies Network Corp.

- 6.4.20 AGM Global Vision LLC

- 6.4.21 Yukon Advanced Optics Worldwide

- 6.4.22 FLIR Systems AB (Sweden)

- 6.4.23 Nivisys LLC

- 6.4.24 Opticoelectron Group JSCo.

- 6.4.25 Tactical Night Vision Company LLC

- 6.4.26 Tak Technologies Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment