|

市场调查报告书

商品编码

1910711

工业用桶:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Industrial Drums - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

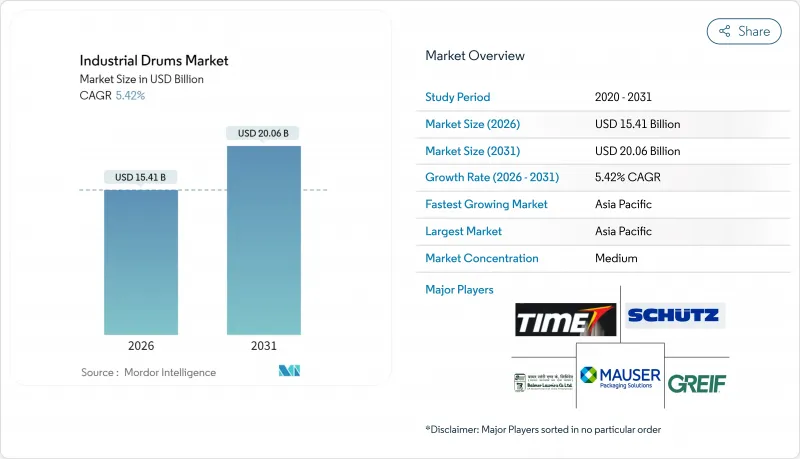

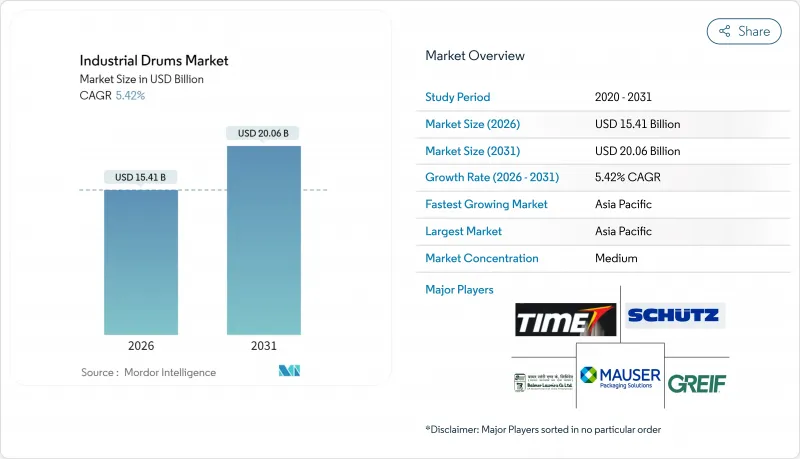

预计工业用桶市场将从 2025 年的 146.2 亿美元成长到 2026 年的 154.1 亿美元,并预计到 2031 年将达到 200.6 亿美元,2026 年至 2031 年的复合年增长率为 5.42%。

稳定的化学产品生产、不断增长的石化投资以及食品级产品出口量的扩大是需求的根本驱动力。可重复使用包装的监管力道不断加大,例如康明斯的RFID可回收包装项目,正在推动消费者逐步淘汰一次性散装袋。随着注重重量的托运人寻求耐腐蚀的包装方案,复合桶的市场份额正在不断扩大;同时,RFID技术在危险品运输车辆中的应用也日益普及,以提高可追溯性。亚太地区是推动销售成长的主要动力,这主要得益于中国裂解装置的扩建以及印度设定的到2030年化工产品年增长率达到12%的目标。同时,北美和欧洲则优先考虑合规性主导的高端包装形式。诸如贝瑞世界(Berry World)与安姆科(Amcor)在2025年的合併等整合,正在创造规模经济效益,并挤压小规模竞争对手的生存空间。

全球工业桶市场趋势与洞察

化工和石油化工产品产量增加

中国特种化学品市场的强劲扩张、中东裂解装置的扩建以及日本大型企业间的併购,都在推动对桶装物料的需求。美国化学理事会(ACC)指出,儘管面临物流瓶颈,美国化学品生产仍展现韧性。同时,印度的目标是实现12%的复合成长率,这将确保桶装物料的需求持续成长。大规模一体化工厂更大的批量生产,推动了运输商对容量100加仑及以上、且内衬复合涂层、能够耐受腐蚀性中间体的桶装物料的需求。 SysKem Chemie公司便是这项成长需求的典型例证,该公司专门使用符合联合国测试标准的涂层桶运输辛酸(8类化学品)。

扩大食品级出口物流

原料来源多角化正在延长甜味剂、植物性蛋白质和浓缩液果汁的供应链。 CDF公司于2025年2月推出了符合美国标准的内衬,显示供应商已准备好应对更严格的污染容忍度。根据国际食品转码器 Alimentarius)制定的统一文件规范,可以实现多区域认证,并支持大规模生产食品级桶的製造商实现规模经济。优质有机产品出口商现在愿意为具有防篡改密封和QR码追溯数据的桶支付差价,从而增强其在目标市场的原产地声明。

原物料价格波动

由于钢铁和塑胶价格波动挤压利润空间,製桶製造商难以使合约与客户价格表保持一致。瑞尔森公司2025年的预测指出,亚洲热轧捲板可能面临反倾销税,进一步加剧了不确定性。为了抵销不断上涨的捲板成本,巴尔默卡车公司已开始试用0.5毫米厚的製桶,每个标准箱可装载80捲捲板,比之前的标准多4卷。该公司2024年的销售额预计为233.9亿印度卢比(约2.808亿美元),因此这项成本节约意义重大。

细分市场分析

钢桶占最大份额,达46.68%,这主要得益于炼油厂和农化生产商对其机械强度和易于回收的重视。同时,复合材料桶的市占率也呈现7.21%的成长态势,买家正在权衡运输成本的节省与前期投入成本。近期对印度港口的审核显示,轻型钢桶占危险化学品出口量的37%,凸显了薄壁带来的成本优势。工业桶市场正受益于全球废钢回收激励政策,这些政策使得低合金钢成为可回收资产,而原生高密度聚乙烯(HDPE)树脂的价格则日益与丙烯价格挂钩。

塑胶和纤维材质的容器种类繁多,分别针对不同的溶质相容性和重量限制。虽然纤维容器尚未获得联合国液体容器认证,但目前已采用防潮内衬来延长干粉食品的保质期。复合材料容器则将聚合物阻隔层与钢肋结合,专门针对对水分敏感的黏合剂成分的配方设计。这些新出现的产品表明,工业用桶市场的发展趋势是材料混合而非简单的二元转换。

容量为 60-100 加仑的桶装产品,由于其符合堆高机作业要求,仍占据市场主导地位,市场份额达 35.21%。然而,全自动化工丛集更倾向于使用 110 加仑的桶装产品,因为这种桶装产品可以减少每吨物料的装卸次数。预计到 2031 年,100 加仑以上的桶装产品将保持最快的成长速度,年增长率达 6.08%。 Camco Chemical 公司价值 300 万美元的生产线配备了双灌装头,可同时满足 30 加仑和 110 加仑两种规格的桶装产品需求,这反映了买家对多容量柔软性的需求。受无托盘机器人搬运单元日益普及的推动,预计到 2031 年,容量超过 100 加仑的工业桶装产品市场规模将达到 45.5 亿美元。

小型桶用于盛装特殊香精、活性药物原料药和实验室试剂,在这些情况下,批次分离比散装经济性更为重要。然而,随着直接从储罐填充的微型混合设备的引入,减少了现场中间库存,小型桶的市场份额正在下降。总体而言,容量的选择反映了操作安全、货物利用率以及空运对每件包装单位允许品质的监管限制之间的权衡。

区域分析

2025年,亚太地区贡献了39.55%的收入,主要得益于中国的裂解装置计划和印度的化学发展蓝图。 Balmer Lawrie利用其八家工厂,并与国内农业化学品出口商签订了合同,实现了233.9亿印度卢比(约2.808亿美元)的销售额。地方政府为炼油厂走廊附近的包装产业丛集提供土地折扣,这有助于加快交货速度并减少运输过程中的凹痕损坏。

北美受益于页岩原料,并受到美国交通部 (DOT) 的严格监管,推动了对高规格钢桶的需求。康明斯的可回收系统展示了美国原始设备製造商 (OEM) 如何将包装内部化以提高循环利用率。欧洲正致力于遵守《包装和包装废弃物法规》规定的循环经济,并计划从 2023 年起将其试点租赁规模扩大三倍,主要用于食品和个人护理原料。南美、中东和非洲虽然规模较小,但成长迅速。巴西生物柴油出口商正在转向复合材料桶以减少大豆油氧化,而墨西哥湾沿岸的石化中心则在采购能够承受极端环境温度的更厚钢桶。区域间的货物套利也促进了钢桶回收网路的发展,并加强了工业钢桶市场的全球合作。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 增加化学和石油化学产品的产量

- 扩大食品级出口物流

- 加强供应链韧性的必要性

- 逐步淘汰一次性散装袋

- 循环经济中的租赁与再製造模式

- 采用RFID技术的油桶追踪系统,符合危险物品法规

- 市场限制

- 原物料价格波动

- 遵守与废弃物处理相关的环境法规的成本

- 利用IBC和柔性罐进行自我改造

- 现场微混合减少了对搅拌桶的需求

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 材料

- 钢鼓

- 塑胶桶

- 纸板桶

- 复合/混合鼓

- 按产能

- 少于30加仑

- 30至60加仑

- 60至100加仑

- 超过100加仑

- 按封闭类型

- 紧头/封闭式头

- 开头

- 按最终用户行业划分

- 化学品和肥料

- 石油和润滑油

- 食品/饮料

- 製药

- 油漆、涂料、黏合剂

- 建筑/施工

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Greif, Inc.

- Mauser Packaging Solutions Holding Company

- SCHUTZ GmbH & Co. KGaA

- Time Technoplast Ltd.

- Balmer Lawrie & Co. Ltd.

- Sicagen India Ltd.

- TPL Plastech Ltd.

- Peninsula Drums(Pty)Ltd.

- Eagle Manufacturing Company(Justrite Safety Group)

- US Coexcell Inc.

- Industrial Container Services, Inc.

- Hoover Ferguson Group, Inc.

- Berry Global Group, Inc.

- Brambles Ltd.

- Myers Industries, Inc.

- Orlando Drum & Container Corp.

- Rahway Steel Drum Co., Inc.

- Re-Gen Drums Ltd.

- Palm Containers(Pty)Ltd.

- Schutz DSL(Asia)Pte Ltd.

第七章 市场机会与未来展望

The industrial drums market is expected to grow from USD 14.62 billion in 2025 to USD 15.41 billion in 2026 and is forecast to reach USD 20.06 billion by 2031 at 5.42% CAGR over 2026-2031.

Steady chemical output, rising petrochemical investments, and widening food-grade export flows anchor demand. Regulatory momentum toward reusable packaging, demonstrated by Cummins' RFID-enabled returnable program, reinforces the shift away from single-use bulk bags. Composite drums win share as weight-sensitive shippers pursue corrosion-resistant options, while RFID adoption spreads across hazardous-materials fleets to improve traceability. Asia-Pacific drives volume on the back of China's cracker additions and India's 12% annual chemical growth target through 2030, whereas North America and Europe prioritize premium, compliance-led formats. Consolidation such as Berry Global's 2025 merger with Amcor adds scale advantages that squeeze smaller rivals.

Global Industrial Drums Market Trends and Insights

Growth in Chemical and Petrochemical Output

Robust specialty-chemical builds in China, cracker expansions in the Middle East, and mergers among Japanese majors collectively increase drum throughput requirements. The American Chemistry Council notes sustained resilience in U.S. chemical production despite logistics bottlenecks, while India is targeting 12% compound growth, which keeps drum demand firmly on an upward path. Larger integrated complexes process greater batch sizes, pushing shippers toward 100-plus gallon formats and composite linings that withstand aggressive intermediates. SysKem Chemie ships Class 8 caprylic acid exclusively in coated drums that meet United Nations test codes, illustrating the higher specification trend.

Expansion of Food-Grade Export Logistics

Diversification of ingredient sourcing has lengthened supply chains for sweeteners, plant proteins, and fruit concentrates. CDF Corporation launched USDA-compliant liners in February 2025, showing suppliers' response to stricter contamination thresholds. Harmonized documentation under the Codex Alimentarius enables multi-regional certification, supporting scale economies for manufacturers producing food-grade drums in bulk. Premium organic exporters have begun to pay price differentials for drums embedded with tamper-evident seals and QR-code lineage data, enhancing provenance claims in destination markets.

Raw-Material Price Volatility

Steel and resin swings squeeze margins as drum makers struggle to synchronize contracts with customer price lists. Ryerson's 2025 forecast flags potential anti-dumping duties on Asian hot-rolled coil, adding another layer of unpredictability. Balmer Lawrie is piloting 0.5 mm-wall drums that allow 80 units per TEU, four more than traditional gauges, to offset rising coil costs; at INR 23.39 billion (USD 280.8 million) 2024 sales, the savings are material.

Other drivers and restraints analyzed in the detailed report include:

- Strengthening Supply-Chain Resiliency Needs

- Regulatory Phase-Out of Single-Use Bulk Bags

- Cannibalization by IBCs and Flexitanks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Steel captured the lion's share at 46.68% because refinery and agrochemical players favor its mechanical strength and straightforward reconditioning loops. At the same time, composite drums are on a 7.21% trajectory as buyers weigh freight savings against initial premiums. Recent audits at Indian ports show that lightweight steel accounted for 37% of outbound haz-chem shipments, underscoring cost reductions from thinner gauges. The industrial drums market benefits from global scrap incentives that make low-alloy steel a closed-loop asset, whereas virgin HDPE resin tracks propylene prices more closely.

Plastic and fiber variants address niche solute compatibility or weight constraints. Although fiber units lack UN credentials for liquids, they now incorporate moisture-resistant liners that extend shelf life for dry food powders. Composite models combine polymer barriers with steel ribs, targeting formulators of moisture-sensitive adhesive ingredients. Their rise illustrates how the industrial drums market evolves through hybridization rather than a binary material switch.

Sixty-to-one-hundred-gallon drums align with forklift clearance and remain the workhorse at 35.21% share. However, fully automated chemical clusters prefer 110-gallon drums that support fewer lifts per ton processed. Through 2031, above-100-gallon formats hold the fastest 6.08% expansion rate. Camco Chemical's USD 3 million line allows dual fill heads for 30 and 110 gallon SKUs, underlining buyers' preference for multi-volume flexibility. The industrial drums market size for capacities beyond 100 gallons is projected to touch USD 4.55 billion by 2031, reflecting wider adoption of palletless robotic handling cells.

Smaller drums serve specialty flavors, pharma actives, and lab reagents where lot segregation trumps bulk economics. Yet their share erodes as tank-to-fill micro-blending units shrink on-site intermediate inventories. Overall, capacity choice mirrors a trade-off between ergonomic safety, freight utilization, and regulatory caps on allowable mass per package in airborne routes.

The Global Industrial Drums Market Report is Segmented by Material (Steel Drum, Plastic Drum, and More), Capacity (Up To 30 Gallons, 30-60 Gallons, and More), Closure Type (Tight-Head/Closed-Head, and Open-Head), End-User Industry (Chemicals and Fertilizers, Petroleum and Lubricants, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 39.55% revenue in 2025, propelled by Chinese cracker projects and India's chemicals roadmap. Balmer Lawrie leveraged eight plants to secure national contracts for agrochemical exporters and logged INR 23.39 billion (USD 280.8 million) turnover. Regional governments offer land rebates for packaging clusters adjacent to refinery corridors, shortening delivery lead times and reducing dent damage.

North America benefits from shale-based feedstock and maintains stringent DOT oversight that drives demand for high-specification steel drums. Cummins' returnable system illustrates how U.S. OEMs internalize packaging for circularity gains. Europe emphasizes circular economy compliance under the Packaging and Packaging Waste Regulation and has seen pilot leasing pools triple since 2023, mostly for food and personal-care ingredients. South America and the Middle East and Africa remain smaller but high-growth nodes. Brazilian biodiesel exporters pivot to composite drums to mitigate soy-oil oxidation, whereas Gulf petrochemical hubs procure thick-gauge steel variants to withstand extreme ambient temperatures. Cross-regional freight arbitrage also stimulates backhaul drum reconditioning networks, reinforcing global linkages within the industrial drums market.

- Greif, Inc.

- Mauser Packaging Solutions Holding Company

- SCHUTZ GmbH & Co. KGaA

- Time Technoplast Ltd.

- Balmer Lawrie & Co. Ltd.

- Sicagen India Ltd.

- TPL Plastech Ltd.

- Peninsula Drums (Pty) Ltd.

- Eagle Manufacturing Company (Justrite Safety Group)

- U.S. Coexcell Inc.

- Industrial Container Services, Inc.

- Hoover Ferguson Group, Inc.

- Berry Global Group, Inc.

- Brambles Ltd.

- Myers Industries, Inc.

- Orlando Drum & Container Corp.

- Rahway Steel Drum Co., Inc.

- Re-Gen Drums Ltd.

- Palm Containers (Pty) Ltd.

- Schutz DSL (Asia) Pte Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in chemical and petrochemical output

- 4.2.2 Expansion of food-grade export logistics

- 4.2.3 Strengthening supply-chain resiliency needs

- 4.2.4 Regulatory phase-out of single-use bulk bags

- 4.2.5 Circular-economy leasing and re-conditioning models

- 4.2.6 RFID-enabled drum tracking for haz-mat compliance

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility

- 4.3.2 Environmental compliance cost for disposal

- 4.3.3 Cannibalization by IBCs and flexitanks

- 4.3.4 On-site micro-blending cutting drum demand

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 The Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Steel Drum

- 5.1.2 Plastic Drum

- 5.1.3 Fiber Drum

- 5.1.4 Composite/Hybrid Drum

- 5.2 By Capacity

- 5.2.1 Up to 30 Gallons

- 5.2.2 30 - 60 Gallons

- 5.2.3 60 - 100 Gallons

- 5.2.4 Above 100 Gallons

- 5.3 By Closure Type

- 5.3.1 Tight-Head / Closed-Head

- 5.3.2 Open-Head

- 5.4 By End-user Industry

- 5.4.1 Chemicals and Fertilizers

- 5.4.2 Petroleum and Lubricants

- 5.4.3 Food and Beverage

- 5.4.4 Pharmaceuticals

- 5.4.5 Paints, Coatings and Adhesives

- 5.4.6 Building and Construction

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Greif, Inc.

- 6.4.2 Mauser Packaging Solutions Holding Company

- 6.4.3 SCHUTZ GmbH & Co. KGaA

- 6.4.4 Time Technoplast Ltd.

- 6.4.5 Balmer Lawrie & Co. Ltd.

- 6.4.6 Sicagen India Ltd.

- 6.4.7 TPL Plastech Ltd.

- 6.4.8 Peninsula Drums (Pty) Ltd.

- 6.4.9 Eagle Manufacturing Company (Justrite Safety Group)

- 6.4.10 U.S. Coexcell Inc.

- 6.4.11 Industrial Container Services, Inc.

- 6.4.12 Hoover Ferguson Group, Inc.

- 6.4.13 Berry Global Group, Inc.

- 6.4.14 Brambles Ltd.

- 6.4.15 Myers Industries, Inc.

- 6.4.16 Orlando Drum & Container Corp.

- 6.4.17 Rahway Steel Drum Co., Inc.

- 6.4.18 Re-Gen Drums Ltd.

- 6.4.19 Palm Containers (Pty) Ltd.

- 6.4.20 Schutz DSL (Asia) Pte Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment