|

市场调查报告书

商品编码

1910721

大理石:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Marble - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

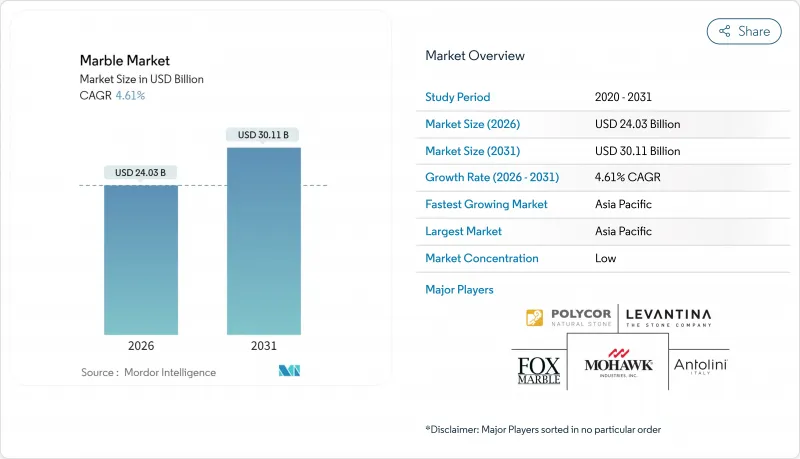

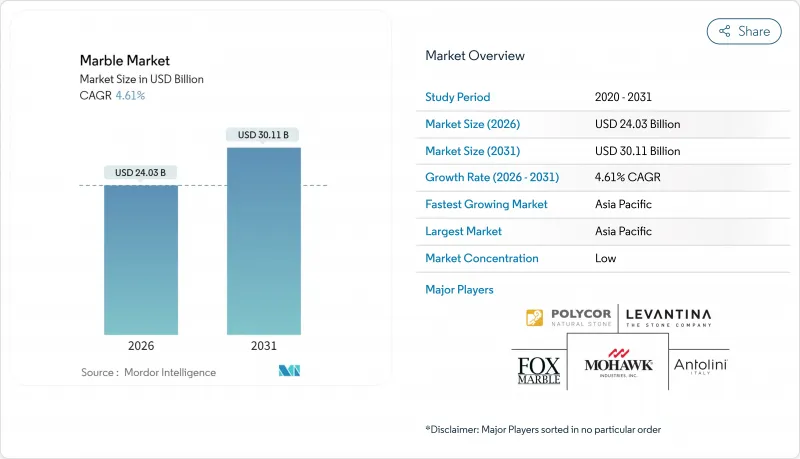

2025年大理石市场价值为229.7亿美元,预计到2031年将达到301.1亿美元,而2026年为240.3亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 4.61%。

受快速的城市扩张和基础设施投资的推动,亚太地区大理石市场预计将以6.16%的复合年增长率成长,超过其他所有地区。现有采石场和加工商之间的整合正在加速,同时,一些灵活的新兴企业正利用数位化采矿、水循环利用和预测性维护技术进入市场,以降低成本和减少废弃物。同时,日益严格的二氧化硅粉尘法规,尤其是在北美和欧洲,促使企业调整营运模式和资本预算。

全球大理石市场趋势与洞察

建设产业的快速成长

随着越来越多的开发商在豪华住宅和综合用途大楼的地面、墙面和檯面选用高檔石材,建筑支出不断增长,对大理石的需求也随之增加。亚太地区各国政府持续为交通枢纽和公共建筑投入资金,这些建筑通常采用大面积石材覆层,从而推动了结构和装饰用途的大理石需求。工厂预製的大理石板材经过精确切割,缩短了施工时间,减少了现场破损,有助于承包商按时完工。厚度仅3-5毫米的薄型板材减轻了高层建筑外墙的重量,而大理石-混凝土复合材料在重量和碳含量方面的优势,正被众多寻求绿色建筑认证的计划所采用,进一步促进了大理石市场的增长。

豪华房地产和基础设施计划的成长

豪华饭店集团和高级办公大楼开发商正纷纷采用特色石材,打造引人注目的入口、康体中心和餐饮空间。杜拜、新加坡和纽约的五星级饭店设计师们指定使用纹理鲜明、引人注目的石板,因为其天然特性能够为宾客营造专属的尊贵感。精品酒店品牌也将类似的概念延伸至小规模的物业,推动对稀有颜色石材的需求,使其区别于人造石材,这也反映了大理石市场的成长。

大理石粉尘相关的健康危害

切割和抛光过程中产生的可吸入性结晶质二氧化硅粉尘正受到越来越多的关注。截至2024年4月,加州已确诊127例硅肺病病例,其中13例死亡,促使该州推出新的暴露限值并强制执行湿式切割。虽然天然大理石的二氧化硅含量低于10%,但监管机构正对所有石材製作流程类似的法规。合规成本,包括封闭式工作站、高吸尘器设备和个人监测系统,给缺乏资金升级设备的小规模大理石加工商带来了沉重负担。

细分市场分析

到2025年,人造大理石将占据80.65%的市场份额,因为工业树脂系统能够复製卡拉拉和卡拉卡塔等优质大理石的纹理,同时兼具硬度和抗污性。在快速发展的家装分销网络和加工技术的推动下,预计该细分市场将保持领先地位,年复合成长率达4.72%。天然大理石在那些更注重真实性和持久耐用性的计划中仍然占有一席之地,而非维护保养。旗舰酒店和定制住宅的设计师们仍然会指定使用大块大理石用于接待台、楼梯和雕塑。在巴西等国家,透过线锯切割和无人机测绘提高了采石场的生产效率,使得新的白色大理石品种得以进入全球展示室。

预计到2025年,白色大理石的需求量将占总需求量的36.02%,并在2031年之前以5.60%的复合年增长率增长,显着高于大理石整体市场的增长速度。设计师偏好白色大理石的主要原因是其色调中性、反光性好,以及与古典建筑风格的契合,尤其是在水疗中心和简约风格的企业大厅。白色大理石在中国和沿岸地区的市场正在扩张,这些地区的炎热气候更适合明亮的室内装潢。

以尼禄·马奎纳(Nero Marquina)为代表的黑色大理石,因其对比鲜明的效果,在零售旗舰店和顶层公寓厨房中得到越来越广泛的应用。黄色、红色和绿色品种在中东和亚洲部分地区需求旺盛,这与当地的偏好和文化象征意义密切相关。多色石材和布雷西亚石材则吸引了追求引人注目墙面效果的前卫建筑师的目光。色彩选择越来越多地透过数位双胞胎库进行筛选,从而在设计阶段即可预览整块石材,减少不确定性和废弃物。

区域分析

预计到2025年,亚太地区将占全球大理石市场份额的33.62%,年复合成长率最高,达6.10%。印度智慧城市的扩张和印尼新首都的建设,催生了对地板材料和外墙石材的新需求。越南和巴基斯坦的生产商正在扩大矿山产能,以满足区域规格要求。

欧洲市场由义大利和土耳其主导。卡拉拉大理石以其标誌性的白色而闻名,但其废弃物却十分棘手,高达70%的产量最终以污泥的形式被丢弃。法规和社会压力正推动着对废弃物能源化技术的投资,例如水循环利用、干式成型和以大理石为原料的3D列印耗材。德国和西班牙的加工商正在向寻求环境认证的建筑师出售经认证的低排放石材。

在北美,高端价位和特色品种的供应仍然紧张,需求集中在豪华住宅大楼、精品酒店和奢侈品零售店。

南美洲正在崛起为供应基地,巴西的白色石英岩和大理石在美国和欧洲的计划中备受青睐。中东和非洲地区的需求也十分强劲,这与沙乌地阿拉伯、阿联酋和南非的大型企划密切相关。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 建设产业的快速成长

- 豪华房地产和基础设施计划的成长

- 扩大大理石粉作为低碳混凝土辅助胶凝材料的应用

- 人们对大理石作为天然永续材料的兴趣日益浓厚。

- 采矿和加工技术的进步推动了大理石产业的成长

- 市场限制

- 大理石粉尘相关的健康危害

- 来自合成替代品的竞争

- 废弃物产生与回收问题

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 贸易分析

第五章 市场规模与成长预测

- 依产品类型

- 天然大理石

- 人造大理石/人造大理石

- 按颜色

- 白色的

- 黑色的

- 黄色的

- 红色的

- 其他颜色

- 透过使用

- 建筑/施工

- 雕像和纪念碑

- 家具

- 其他用途(装饰基础设施)

- 按最终用户行业划分

- 住宅建筑

- 商业和住宿设施

- 工业和公共设施

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 土耳其

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、联盟、采石场整合)

- 市占率(%)/排名分析

- 公司简介

- Antolini Luigi & CSpa

- BC Marble Products Ltd

- Best Cheer Stone Group

- China Kingstone Mining Holdings Limited

- Dimpomar

- Eco Buildings Group Plc

- FHL

- Fox Marble

- HELLENIC GRANITE Co

- Hilltop Stones Pvt. Ltd.

- Kangli stone group

- Levantina y Asociados de Minerales, SA

- Mohawk Industries, Inc.

- Mumal Marbles Pvt. Ltd.

- NQ Acrylic and Stone

- Polycor Inc.

- Santucci Group Srl

- TEKMAR MERKEZ OF?S

- Temmer Marble

- Topalidis SA

- UMGG

- XISHI GROUP LTD.

第七章 市场机会与未来展望

The Marble Market was valued at USD 22.97 billion in 2025 and estimated to grow from USD 24.03 billion in 2026 to reach USD 30.11 billion by 2031, at a CAGR of 4.61% during the forecast period (2026-2031).

Growth in Asia-Pacific, where the marble market is driven by rapid urban expansion and infrastructure spending, is predicted to outpace all other regions at a 6.16% CAGR. Intensifying consolidation among established quarriers and processors is intersecting with agile technology-led entrants that apply digital extraction, water recycling, and predictive maintenance to cut costs and waste. At the same time, stricter silica-dust regulations are reshaping operating practices and capital budgets, particularly in North America and Europe.

Global Marble Market Trends and Insights

Rapid Growth in the Construction Industry

Construction spending is cascading into higher marble demand as developers specify premium stone for floors, walls, and countertops in luxury homes and mixed-use towers. Governments across Asia-Pacific continue to funnel budget into transport hubs and civic buildings that feature large-format stone cladding, lifting structural as well as decorative usage. Prefabricated marble panels, factory-cut to tight tolerances, are saving installation time and reducing on-site breakage, helping contractors meet schedule guarantees. Thin 3-5 mm veneers are opening high-rise facades to lighter loads, and marble-concrete composites are appearing in projects seeking green-building certifications due to weight and embodied-carbon advantages, supporting the growth in the marble market.

Increase in Luxury Real Estate and Infrastructure Projects

Luxury hospitality groups and premium office developers are turning to distinctive stone to craft memorable entrances, wellness areas, and dining venues. Designers working on five-star hotels in Dubai, Singapore, and New York specify statement slabs with dramatic veining because natural variance signals exclusivity to guests. Boutique brands extend the same ethos to small properties, boosting demand for rare colors that differentiate from engineered look-alikes, reflecting growth in the marble market.

Health Hazard Related to Marble Dust

Respirable crystalline silica generated during cutting and polishing is under heightened scrutiny after California recorded 127 silicosis cases and 13 fatalities by April 2024, prompting new exposure limits and mandated wet-cutting protocols. Although natural marble contains less than 10% silica, regulators are applying similar controls across all stone operations. Compliance costs include enclosed workstations, high-vacuum extraction, and personal monitoring systems, pressuring small fabricators that lack the capital to upgrade in the marble market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of Marble Powder as Supplementary Cementitious Material

- Technological Advancements in Extraction and Processing

- Competition from Synthetic Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic grades dominated 80.65% of the marble market in 2025 as industrial resin systems reproduced the look of premium Carrara and Calacatta while providing hardness and stain resistance. The segment is projected to extend leadership at a 4.72% CAGR, supported by home-center channels and accelerated fabrication. Natural marble stays relevant in projects where authenticity and long-term patina outweigh maintenance concerns. Designers of flagship hotels and bespoke residences still specify large blocks for reception desks, staircases, and sculpture. Countries such as Brazil have improved quarry yield through wire saws and drone mapping, bringing new white marble varieties to global showrooms.

White stones captured 36.02% of demand in 2025 and are on track for a 5.60% CAGR through 2031, significantly above the marble market. Designers cite neutrality, light reflectance and association with classical architecture as key reasons for preference, particularly in wellness spas and minimalist corporate lobbies. The marble market size for white varieties is expanding in China and the Gulf, where bright interiors counter hot climates.

Black marbles, led by Nero Marquina, secure orders for contrast features in retail flagships and penthouse kitchens. Yellow, red, and green types cater to regional tastes in the Middle East and parts of Asia, often tied to local cultural symbolism. Multicolored and brecciated stones attract avant-garde architects seeking statement walls. Color choice is increasingly curated through digital twin libraries that allow clients to preview entire slabs at the design stage, reducing uncertainty and waste.

The Marble Market Report Segments the Industry by Product Type (Natural Marble and Synthetic/Artificial Marble), Color (White, Black, Yellow, Red, and Other Colors), Application (Building and Decoration, Statues and Monuments, and More), End-User Sector (Residential Buildings, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 33.62% of the marble market in 2025 and is forecast to post the highest 6.10% CAGR. India's smart-city roll-out and Indonesia's new capital development add fresh demand for flooring and facade stone. Producers in Vietnam and Pakistan are expanding quarry output to meet regional specifications.

Europe is anchored by Italy and Turkey. Carrara delivers iconic whites, yet waste remains a pain point, with up to 70% of extracted mass discarded as sludge. Regulation and social pressure are catalyzing investment in water recycling, dry shaping, and waste-to-product initiatives such as marble-based 3D printing filament. German and Spanish processors market verified low-emission stone to architects pursuing green certifications.

North America maintains premium pricing and a tight supply of distinctive varieties. Demand centers on luxury residential towers, boutique hotels, and upmarket retail.

South America is emerging as a supply hub, with Brazil's white quartzites and marble winning specifications in US and European projects. The Middle East and Africa show robust demand linked to mega-projects in Saudi Arabia, the United Arab Emirates and South Africa.

- Antolini Luigi & C. S.p.a.

- BC Marble Products Ltd

- Best Cheer Stone Group

- China Kingstone Mining Holdings Limited

- Dimpomar

- Eco Buildings Group Plc

- F.H.L.

- Fox Marble

- HELLENIC GRANITE Co

- Hilltop Stones Pvt. Ltd.

- Kangli stone group

- Levantina y Asociados de Minerales, S.A.

- Mohawk Industries, Inc.

- Mumal Marbles Pvt. Ltd.

- NQ Acrylic and Stone

- Polycor Inc.

- Santucci Group Srl

- TEKMAR MERKEZ OF?S

- Temmer Marble

- Topalidis S.A.

- UMGG

- XISHI GROUP LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Growth in the Construction Industry

- 4.2.2 Increase in Luxury Real Estate and Infrastructure Projects

- 4.2.3 Rising Adoption of Marble powder as Supplementary Cementitious Material for Low-carbon Concrete

- 4.2.4 Growing Inclination on Marble as a Natural and Sustainable Material

- 4.2.5 Technological Advancements in Extraction and Processing Driving Growth in the Marble Industry

- 4.3 Market Restraints

- 4.3.1 Health Hazard Related to Marble Dust

- 4.3.2 Competition from Synthetic Alternatives

- 4.3.3 Waste Generation and Recycling Challenges

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Trade Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Natural Marble

- 5.1.2 Synthetic/Artificial Marble

- 5.2 By Color

- 5.2.1 White

- 5.2.2 Black

- 5.2.3 Yellow

- 5.2.4 Red

- 5.2.5 Other Colors

- 5.3 By Application

- 5.3.1 Building and Construction

- 5.3.2 Statues and Monuments

- 5.3.3 Furniture

- 5.3.4 Other Applications (Decorative Infrastructure)

- 5.4 By End-user Sector

- 5.4.1 Residential Buildings

- 5.4.2 Commercial and Hospitality

- 5.4.3 Industrial and Institutional

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Turkey

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, Partnerships, Quarry Integration)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Antolini Luigi & C. S.p.a.

- 6.4.2 BC Marble Products Ltd

- 6.4.3 Best Cheer Stone Group

- 6.4.4 China Kingstone Mining Holdings Limited

- 6.4.5 Dimpomar

- 6.4.6 Eco Buildings Group Plc

- 6.4.7 F.H.L.

- 6.4.8 Fox Marble

- 6.4.9 HELLENIC GRANITE Co

- 6.4.10 Hilltop Stones Pvt. Ltd.

- 6.4.11 Kangli stone group

- 6.4.12 Levantina y Asociados de Minerales, S.A.

- 6.4.13 Mohawk Industries, Inc.

- 6.4.14 Mumal Marbles Pvt. Ltd.

- 6.4.15 NQ Acrylic and Stone

- 6.4.16 Polycor Inc.

- 6.4.17 Santucci Group Srl

- 6.4.18 TEKMAR MERKEZ OF?S

- 6.4.19 Temmer Marble

- 6.4.20 Topalidis S.A.

- 6.4.21 UMGG

- 6.4.22 XISHI GROUP LTD.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Use of Marble Slabs and Powder