|

市场调查报告书

商品编码

1910723

碘:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Iodine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

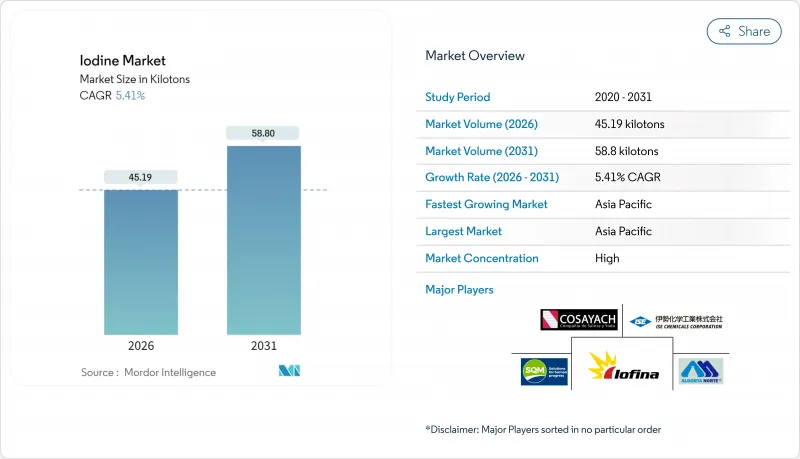

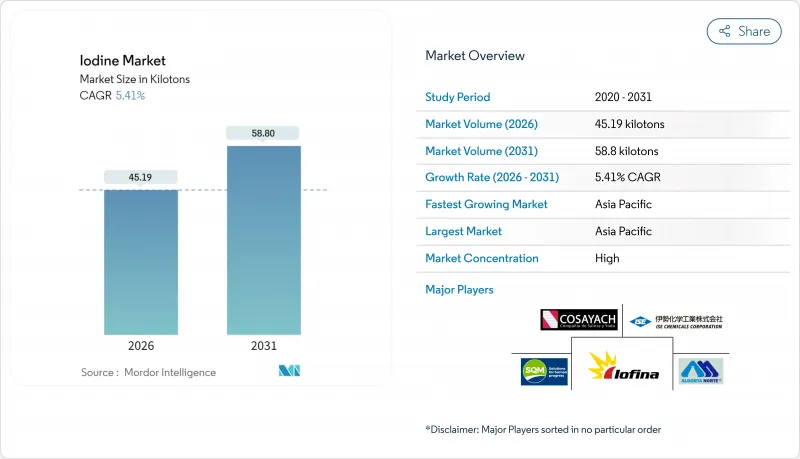

预计到 2026 年,碘市场规模将达到 45.19 千吨,高于 2025 年的 42.87 千吨。预计到 2031 年将达到 58.8 千吨,2026 年至 2031 年的复合年增长率为 5.41%。

碘的需求成长反映了其在X射线/CT成像、液晶显示器和有机发光二极体(LCD/ 有机发光二极体)偏光片、动物保健产品以及特种化学品等领域的不可替代作用,这些领域目前都缺乏经济有效的替代品。儘管医疗影像仍是碘需求的主要来源,但诸如WET IOsorb等地下卤水提取技术不断降低生产成本,削弱了智利钙质土资源的优势。亚太地区凭藉着中国电子製造业和印度不断扩大的诊断能力,推动了碘的消费,但该地区对进口的高度依赖加剧了其对供应中断的脆弱性。 2022-2023年供不应求后,全球库存紧张,促使下游用户签订长期合约、稳定现货价格并推广回收利用,从而形成了一个更可预测但仍然脆弱的供需平衡。

全球碘市场趋势及展望

对X光/CT造影剂的需求不断增长

全球诊断工作量持续成长,光是2023年就进行了超过1,000万例Medicare造影CT扫描,凸显了供应衝击带来的成本。合约造影生产商正透过扩大在爱尔兰的产能以及签署多年原材料供应协议来应对这一挑战,即使价格较高也能确保碘的供应。强调单剂量和多剂量管瓶的永续性倡议,正将成长模式从「按检查次数」转向「按量」模式,从而稳定长期需求。同时,医院也正在实现供应来源多元化,以应对现货市场价格飙升带来的衝击——2011年,碘的价格一度超过每公斤100美元。随着印度和东南亚各地放射科的现代化,碘市场正获得更多结构性利多因素,从而抵消成熟经济体的市场饱和。

碘缺乏症日益严重

近期一项调查显示,儘管印度食盐加碘普及率已达92.4%,但孕妇和哺乳期妇女仍存在轻度碘缺乏,仅靠食盐加碘不足以确保充足的碘摄取。中国2025年修订的膳食参考摄取量进一步证实了因地制宜的营养策略的有效性,这些策略更依赖缓释肥料和生物强化作物来弥补剩余的营养缺口。同时,从美国食品药物管理局(FDA)到香港食物安全中心等监管机构,都在加强标籤法规,以防止因食用单份碘含量超过400微克的海苔零食而导致意外过量摄入碘。这些平行趋势推动了食品加工用药用级碘酸盐需求的稳定成长,同时也促进了缓释肥料包衣技术的发展,从而创造了非医疗需求。

毒性问题和治疗费用

美国职业安全与健康管理局 (OSHA) 将职场碘蒸气浓度限制在 0.1 ppm,而美国政府工业卫生学家协会 (ACGIH) 建议采用更严格的限制,即 0.01 ppm,这要求加工商投资购买洗涤器、隔离室和持续监测设备。同时,美国环保署 (EPA) 对碘基抗菌剂的重新註册决定也在不断变化,要求配方商改用更环保的溶剂并提交额外的毒理学文件。儘管医用同位素用量不大,但仍需要额外的辐射安全通讯协定,这增加了综合生产商的营运成本。这些监管要求共同提高了新进入者的成本门槛,并可能在监管基础设施薄弱的地区延误计划批准。

细分市场分析

截至2025年,钙质矿占全球碘供应量的50.72%,在碘市场占据主导地位,但由于盐水计划的激增,其相对份额正在下降。钙质矿每2,500公斤矿石仅产出1公斤碘,加上智利加强了用水量监测,削弱了其与地下盐水开采的竞争力。地下盐水开采的氧化和萃取过程更为简单。地下盐水开采正以5.55%的复合年增长率快速扩张,利用现有的油气基础设施最大限度地降低资本成本和单位消费量,巩固了其作为增长最快供应途径的地位。回收用于电子元件的偏光片在技术上是可行的,儘管目前仍处于起步阶段。随着回收成本的下降,回收碘有望满足小众的高纯度需求,并缓解首次使用碘的激增。目前,海藻萃取物服务于一个专门的细分市场,为注重「生物来源」认证的保健食品和营养补充剂生产商提供原料,但与主要工业来源相比,其产量仍然小规模。

碘市场报告按来源(地下卤水、钾矿、海藻、回收碘)、形态(元素和同位素、无机盐和错合、有机化合物)、终端用户行业(饲料、医疗、消毒剂、光学偏光片等)以及地区(北美、南美、欧洲、亚太、中东和非洲)进行分析。市场预测以千吨为单位。

区域分析

到2025年,亚太地区将占全球碘市场的34.27%,年复合成长率达6.82%,主要得益于中国电子产业生态系统的发展、对造影造影的强劲需求以及公共卫生强化计画。中国最新的五年规划旨在扩大诊断能力,即使国内矿石和卤水计划达到瓶颈,原物料需求预计仍将保持稳定。印度的需求则得益于CT扫描的快速成长和标准化的碘盐计划,使其成为新兴的医药级碘酸盐主要消费国。

北美市场成熟且稳健,以奥克拉荷马州和犹他州的美国盐湖开采业务为核心。该地区强大的垂直整合策略有效降低了进口风险。近期对模组化开采设备的投资反映了旨在促进关键矿产供应链本地化的政策,预计随着2024年IO#10项目的运作,这一趋势将进一步加强。

欧洲维持严格的食品安全标准和职业接触限制,这推动了婴幼儿营养和药物领域对高纯度碘酸盐的需求。德国、法国和英国支持区域消费,而乳製品行业的残留基准值则自然地抑制了其成长。随着对氯己定替代品的评估,为应对抗菌素抗药性而加强的监管措施可能会进一步增加医院消毒剂中碘的使用量。

南美洲依赖智利的出口,其供应量远超过消费量。儘管巴西和阿根廷的国内消费成长受到医疗保健支出和农药需求增加的推动,但该地区的净出口仍保持强劲成长。中东和非洲地区的绝对吨位虽然最小,但海湾地区的医院手术量已实现两位数增长,并且正在进行碘肥的早期试验,以解决该地区的营养缺乏问题。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对X光和CT造影剂的需求不断增长

- 碘缺乏症日益严重

- 扩大液晶显示器和有机发光二极体偏光片的生产

- 增加牲畜消毒剂的使用

- 直接提取盐水的成本优势

- 市场限制

- 毒性问题和处理成本

- 方解石衍生碘的价格波动

- 乳製品中碘残留的监管限制

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按来源

- 地下盐水

- 钙质矿

- 海藻

- 回收利用

- 按形式

- 元素和同位素

- 无机盐和错合

- 有机化合物

- 按最终用途行业划分

- 动物饲料

- 医疗用品(X光造影剂、药品、带碘化合物和优碘)

- 消毒剂

- 光学偏光片

- 氟化学品

- 尼龙

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Algorta Norte

- Calibre Chemicals Pvt. Ltd.

- Cosayach

- Deep Water Chemicals

- Eskay Iodine

- Glide Chem Private Limited

- Godo Shigen Co. Ltd

- Infinium Pharmachem Limited

- Iochem Corporation

- Iofina plc

- ISE CHEMICALS CORPORATION

- K&O Energy Group Inc.

- Nippoh Chemicals Co. Ltd

- Parad Corporation Pvt Ltd

- Proto Chemical Industries

- Salvi Chemical Industries Ltd

- Samrat Pharmachem Limited

- SQM

- TOHO EARTHTECH,INC

- Woodward Iodine LLC

第七章 市场机会与未来展望

Iodine market size in 2026 is estimated at 45.19 kilotons, growing from 2025 value of 42.87 kilotons with 2031 projections showing 58.8 kilotons, growing at 5.41% CAGR over 2026-2031.

Volume growth reflects the element's irreplaceable role in X-ray/CT imaging, LCD and OLED polarizers, livestock hygiene products, and specialty chemicals, all of which lack cost-effective substitutes. Medical imaging remains the pivotal demand anchor, while underground brine extraction technologies such as WET IOsorb continue lowering production costs and diluting the dominance of Chilean caliche ore resources. Asia-Pacific leads consumption on the back of Chinese electronics manufacturing and India's expanding diagnostic capacity, even as the region's import dependency magnifies exposure to supply disruptions. Tight global inventories following 2022-2023 shortages have prompted downstream users to sign longer contracts, stabilize spot prices, and encourage recycling initiatives, creating a more predictable yet still fragile supply-demand balance.

Global Iodine Market Trends and Insights

Rising Demand for X-Ray/CT Contrast Media

Global diagnostic workloads keep climbing, and more than 10 million Medicare contrast CT scans in 2023 alone illustrated the cost of any supply shocks. Contract-media producers have responded by expanding Irish-based capacity and by committing to multi-year feedstock contracts that lock in iodine supply even at premium prices. Sustainability initiatives that emphasize individualized dosing and multi-dose vials are shifting growth toward a procedure-volume model rather than per-procedure intensity, which steadies long-run demand. Hospitals are concurrently diversifying suppliers to shield themselves from the spot-market spikes that pushed prices above USD 100 per kg in 2011. As radiology departments modernize across India and Southeast Asia, the iodine market gains an additional structural tailwind that offsets mature-economy saturation.

Growing Iodine-Deficiency Disorders

Universal Salt Iodization lifted India's household coverage to 92.4% in the latest survey, yet mild deficiency persists among pregnant and lactating women, proving that fortification alone cannot guarantee adequate intake. China's 2025 dietary-reference update further validated region-specific nutrition strategies that increasingly rely on controlled-release fertilizers and biofortified crops to close residual gaps. Regulatory agencies from the U.S. FDA to Hong Kong's Centre for Food Safety are concurrently tightening label rules to prevent accidental overconsumption from seaweed snacks whose single-serve iodine content can exceed 400 µg. These parallel trends support measured volume growth for pharmaceutical-grade iodates used in food processing while spurring innovation in slow-release fertilizer coatings that add non-medical demand.

Toxicity Concerns and Handling Costs

OSHA caps workplace iodine vapor at 0.1 ppm, while ACGIH recommends an even tighter 0.01 ppm, obliging processors to invest in scrubbers, isolation booths, and continuous monitoring. At the same time, the EPA's reregistration decision for iodine-based antimicrobials continues to evolve, pushing formulators toward greener solvents and demanding extra toxicological dossiers. Medical isotopes raise additional radiation-safety protocols despite low volume, compounding overhead for integrated producers. Collectively these compliance layers raise the cost floor for new entrants and can slow project sanctioning in regions with limited regulatory infrastructure.

Other drivers and restraints analyzed in the detailed report include:

- Expanding LCD and OLED Polarizer Production

- Increasing Livestock Disinfectant Use

- Regulatory Curbs on Residual Iodine in Dairy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Caliche ore contributed 50.72% of global supply in 2025, equal to more than half of the iodine market, but its relative share continues slipping as brine projects gain acceptance. The segment's 2,500 kg ore-per-kilogram output ratio, coupled with water-use scrutiny in Chile, is eroding competitiveness versus subterranean brines that offer simpler oxidation-extraction sequences. Underground brine extraction, expanding at a 5.55% CAGR, leverages existing oil-and-gas infrastructure to minimize infrastructure cost while lowering unit energy consumption, reinforcing its position as the fastest-growing supply route. Recycling of electronics-grade polarizer film is still embryonic in tonnage but is technically viable; as recovery costs fall, reclaimed iodine may cover niche, high-purity demand, tempering first-use consumption spikes. Seaweed-based extraction, now a specialized niche, services health-food and nutraceutical producers who prize "biogenic" credentials, yet output volumes remain small relative to the main industrial streams.

The Iodine Report is Segmented by Source (Underground Brine, Caliche Ore, Seaweed, and Recycling), Form (Elementals and Isotopes, Inorganic Salts and Complexes, and Organic Compounds), End-User Industry (Animal Feed, Medical, Biocides, Optical Polarizing Films, and More), and Geography (North America, South America, Europe, Asia-Pacific, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Kilotons).

Geography Analysis

Asia-Pacific held 34.27% of the iodine market in 2025 and is growing at 6.82% CAGR, fueled by China's electronics ecosystem, robust contrast-media demand, and public-health fortification programs. China's latest Five-Year Plan targets expanded diagnostic capacity, implying persistent feedstock pulls even as domestic ore and brine projects plateau. India sustains demand through high CT procedure growth and regulated iodized-salt programs, positioning the country as a major incremental consumer of pharmaceutical-grade iodates.

North America shows mature yet resilient performance underpinned by U.S. brine operations in Oklahoma and Utah, where stable vertical-integration strategies mitigate import risk. Recent investments in modular extraction units underscore a policy push to localize critical-mineral supply chains, a trend reinforced by the IO#10 facility ramp-up in 2024.

Europe maintains stringent food-safety and occupational-exposure rules, driving demand for highly purified iodates in infant nutrition and pharmaceuticals. Germany, France, and the United Kingdom anchor regional consumption, while dairy-sector residue ceilings impose a natural brake on growth. Regulatory momentum toward antimicrobial-resistance mitigation may further elevate iodine use in hospital disinfectants as chlorhexidine alternatives undergo scrutiny.

South America hinges on Chilean exports that dominate supply rather than consumption. Domestic uptake in Brazil and Argentina is climbing alongside healthcare spending and agrochemical demand, yet regional net exports remain firmly positive. The Middle East and Africa, though the smallest territory in absolute tonnage, registers double-digit procedure growth in Gulf hospitals and showcases early iodine-fertilizer trials aimed at correcting local dietary deficiencies.

- Algorta Norte

- Calibre Chemicals Pvt. Ltd.

- Cosayach

- Deep Water Chemicals

- Eskay Iodine

- Glide Chem Private Limited

- Godo Shigen Co. Ltd

- Infinium Pharmachem Limited

- Iochem Corporation

- Iofina plc

- ISE CHEMICALS CORPORATION

- K&O Energy Group Inc.

- Nippoh Chemicals Co. Ltd

- Parad Corporation Pvt Ltd

- Proto Chemical Industries

- Salvi Chemical Industries Ltd

- Samrat Pharmachem Limited

- SQM

- TOHO EARTHTECH,INC

- Woodward Iodine LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for X-Ray/CT Contrast Media

- 4.2.2 Growing Iodine?Deficiency Disorders

- 4.2.3 Expanding LCD and OLED Polarizer Production

- 4.2.4 Increasing Livestock Disinfectant Use

- 4.2.5 Direct Brine Extraction Cost Advantage

- 4.3 Market Restraints

- 4.3.1 Toxicity Concerns and Handling Costs

- 4.3.2 Price Volatility of Caliche-Derived Iodine

- 4.3.3 Regulatory Curbs on Residual Iodine In Dairy

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Source

- 5.1.1 Underground Brine

- 5.1.2 Caliche Ore

- 5.1.3 Seaweed

- 5.1.4 Recycling

- 5.2 By Form

- 5.2.1 Elementals and Isotopes

- 5.2.2 Inorganic Salts and Complexes

- 5.2.3 Organic Compounds

- 5.3 By End-use Industry

- 5.3.1 Animal Feed

- 5.3.2 Medical (X-ray contrast media, pharmaceuticals, iodophors and povidone-iodine)

- 5.3.3 Biocides

- 5.3.4 Optical Polarizing Films

- 5.3.5 Fluorochemicals

- 5.3.6 Nylon

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Algorta Norte

- 6.4.2 Calibre Chemicals Pvt. Ltd.

- 6.4.3 Cosayach

- 6.4.4 Deep Water Chemicals

- 6.4.5 Eskay Iodine

- 6.4.6 Glide Chem Private Limited

- 6.4.7 Godo Shigen Co. Ltd

- 6.4.8 Infinium Pharmachem Limited

- 6.4.9 Iochem Corporation

- 6.4.10 Iofina plc

- 6.4.11 ISE CHEMICALS CORPORATION

- 6.4.12 K&O Energy Group Inc.

- 6.4.13 Nippoh Chemicals Co. Ltd

- 6.4.14 Parad Corporation Pvt Ltd

- 6.4.15 Proto Chemical Industries

- 6.4.16 Salvi Chemical Industries Ltd

- 6.4.17 Samrat Pharmachem Limited

- 6.4.18 SQM

- 6.4.19 TOHO EARTHTECH,INC

- 6.4.20 Woodward Iodine LLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment