|

市场调查报告书

商品编码

1910805

镁金属:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Metal Magnesium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

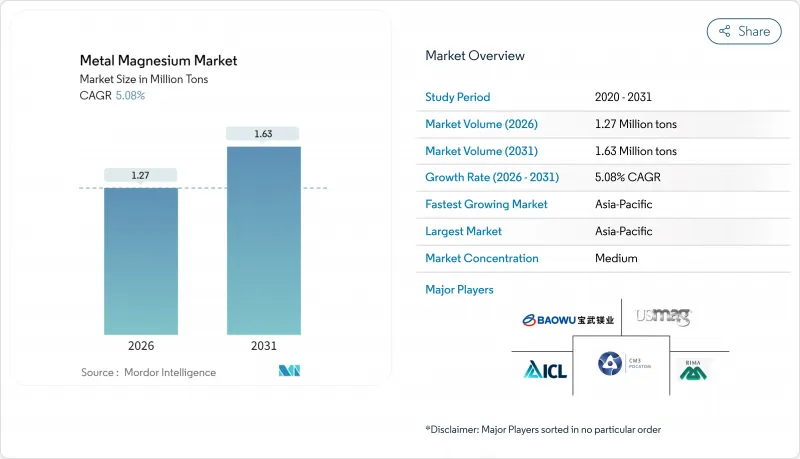

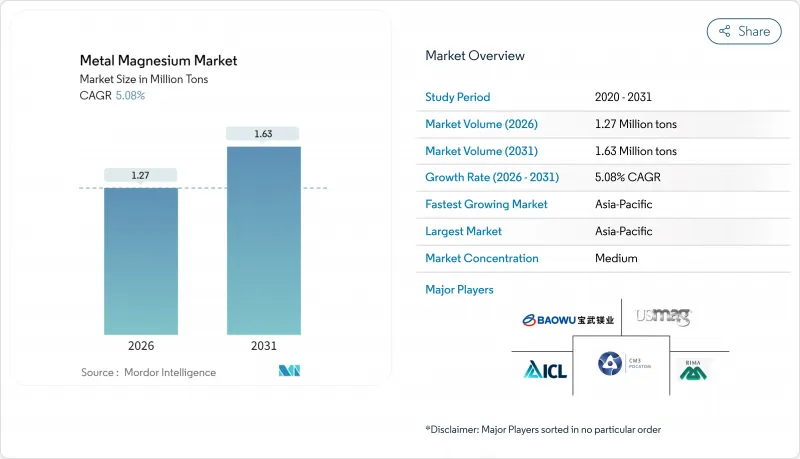

预计到 2026 年,镁金属市场规模将达到 127 万吨,并有望从 2025 年的 121 万吨成长。

预计到 2031 年将达到 163 万吨,2026 年至 2031 年的复合年增长率为 5.08%。

汽车轻量化政策、电动车製造中巨型铸造技术的快速应用以及碳中和萃取技术的规模化发展正加速。对铝合金的持续需求、医疗领域向可生物降解植入的转变以及全球供应链为摆脱对单一国家的依赖而进行的重组,都支撑着市场的中期成长轨迹。能够显着降低能源消耗和二氧化碳排放强度的新型生产路线正开始吸引投资者的关注,这标誌着製程创新和地理多元化发展的转折点。

全球镁金属市场趋势及展望

汽车和航太领域轻量化进展

随着汽车製造商加大材料替代力度以符合排放气体法规,镁成为素车车身零件、横樑和电池外壳的理想选择。其密度为1.74-1.85克/立方厘米,与铝相比可减轻22-30%的重量。一台3500吨压铸机的投入使用,使得以往需要多个零件组装才能完成的大型结构件的生产成为可能。对于电动车平台而言,减重具有倍增效应,能够提高每公斤重量的续航里程。同时,航太製造商正在展示镁在非关键座舱结构中的应用,以降低油耗。目前正在製定将未来金属供应与生命週期碳排放指标挂钩的综合供应协议,优先考虑二氧化碳排放较低的生产商。儘管轻型车整体产量趋于稳定,但这些因素共同推动了近期单车镁消费量的成长。

铝合金需求不断成长

镁作为高强度铝合金中的硬化剂和腐蚀抑制剂,对电动车电池机壳、车身面板和挤压型材等相关领域的成长至关重要。添加0.5至1.5wt.%的镁可以提高屈服强度、焊接性和疲劳寿命。中国铝冶炼厂预计到2024年产量将超过4,000万吨,是全球需求的基础。中国的合金成分正迅速转向镁含量较高的6xxx和5xxx系列钢种。从帷幕墙到桥面等建筑应用构成了另一个基础消费支柱,使供应商免受汽车週期波动的影响。配备在线连续合金化系统的连铸生产线能够更精确地计量镁,将元素损失降低到3%以下,有助于实现严格的成本目标。

鸽子製程的二氧化碳排放量高

监管机构正透过排放权交易机制和拟议的碳边境调节机制施加财政压力。欧盟审核估计,Pigeon製程的二氧化碳排放为每吨11-15公吨,远高于欧盟2030年产业平均目标值1.6公吨。汽车製造商揭露其从摇篮到大门的碳足迹后,正根据经检验的生命週期数据加强对供应商的审查,迫使高碳排放企业在改造废热回收和太阳能煅烧之间做出选择,否则将面临被除名的风险。二次熔炼废料所需的能源仅为一次熔炼製程的5%,可部分减少范围1的排放,但废料的供应仍受到收集物流的限制。这项政策推动正在加速电解和海水製程的相对竞争力。

细分市场分析

海水电解是成长最快的镁金属萃取方法,预计到2031年将以5.62%的复合年增长率成长,而热鸽法目前仍占总产量的62.74%。海水提取镁金属的市场规模估计为16万吨,如果先导工厂成功商业化,到2031年市场规模有望翻倍。成本竞争力取决于低于每千瓦时0.04美元的可再生能源电价,目前中东和北非沿海地区已开始出现这样的电价。先前,电解製程仅限于生产航太纯镁,但随着惰性阳极技术的进步,氯气排放显着降低,电解製程的应用范围也随之扩大,有助于提高环境、社会和治理(ESG)评分。

传统鸽子养殖户凭藉折旧免税额资产和丰富的营运经验维持优势,但日益严峻的碳排放监管成本正在削弱这一优势。陕西和宁夏一家综合矿业公司宣布了一项3.2亿美元的维修预算,用于生产低碳硅铁和实现矿石自动处理,以提高效率。二次回收利用的金属回收率高达95%,随着汽车製造商制定再生材料含量标准,二次回收利用正受到越来越多的关注,但废料分销却落后于需求。国际电池金属公司(International Battery Metals)的模组化直接铅电解(DLE)工厂与其盐水处理厂毗邻,展示如何透过整合多种金属来分散计划风险,同时又能为同一台还原炉供料。

镁金属市场报告按生产流程(热提取、电解、二次/回收、海水电解)、终端用户产业(铝合金、压铸、钢铁、金属还原、其他终端用户产业)和地区(亚太、北美、欧洲、南美、中东和非洲)进行细分。市场预测以吨为单位。

区域分析

到2025年,亚太地区将占全球出货量的47.85%,年复合成长率达5.96%。各国政府正努力将镁列为“军民两用战略金属”,这有望引导低利率贷款流向更环保的生产能力。日本和韩国正在优化家用电器机壳和电动车电池盖的合金技术,进口镁锭的同时出口高附加价值零件。

随着美国镁业公司于 2024 年底关闭位于犹他州的工厂,北美失去了唯一的大型原生镁来源。这种供不应求迫使汽车製造商和国防主要企业依赖亚洲库存和加拿大小规模合约熔炼池,引发了人们对运输成本上升和供应稳定性的担忧。

欧洲正致力于减少蕴藏量排放。德国的回收企业正在扩大闭合迴路项目,以回收浇口和流道,从而将再生镁供应量提升至区域供应量的30%以上。挪威正寻求利用水力发电,并正在研究建造一个年产3万吨的电解园区,该园区预计将碳排放强度降低至全球平均水平的一半。鸽子航线沿线的监管阻力正促使汽车製造商将业务多元化转向土耳其和沙乌地阿拉伯的海水计划,预计2026年动工。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 汽车和航太领域的轻量化蓬勃发展

- 铝合金需求不断成长

- 千兆广播技术在电动车领域的应用

- 碳中和海水电解镁技术

- 可生物降解的镁植入正变得越来越受欢迎。

- 市场限制

- 价格波动和能源成本

- 鸽子工艺的高碳排放

- 腐蚀和火灾隐患

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 透过製造工艺

- 热感鸽

- 电解

- 再生/回收

- 海水电萃取

- 按最终用户行业划分

- 铝合金

- 压铸

- 钢

- 金属还原

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- American Magnesium

- ICL Group

- Fu Gu Yi De Magnesium Alloy Co., Ltd

- Baowu Magnesium Technology Co., Ltd.

- Regal Metal

- Rima Industrial

- Shanxi Bada Magnesium Co., Ltd.

- Solikamsk Magnesium Works

- Southern Magnesium & Chemicals Limited(SMCL)

- Taiyuan Tongxiang Metal Magnesium Co. Ltd

- US Magnesium LLC

- Wenxi YinGuang Magnesium Industry(Group)Co. Ltd

- Western Magnesium Corporation

第七章 市场机会与未来展望

Metal Magnesium Market size in 2026 is estimated at 1.27 million tons, growing from 2025 value of 1.21 million tons with 2031 projections showing 1.63 million tons, growing at 5.08% CAGR over 2026-2031.

Momentum builds around automotive lightweighting policies, rapid gigacasting adoption in electric-vehicle manufacturing, and the scale-up of carbon-neutral extraction technologies. Sustained demand from aluminum alloying, the medical sector's pivot toward biodegradable implants, and a re-ordering of global supply chains away from single-country reliance underpin the market's medium-term trajectory. New production routes that slash energy use and CO2 intensity are beginning to capture investor attention, signaling an inflection point for process innovation and geographic diversification.

Global Metal Magnesium Market Trends and Insights

Automotive and Aerospace Lightweighting Boom

Automakers intensify material substitution programs to meet fleet emission rules, making magnesium attractive for body-in-white parts, cross-members, and battery housings. Its density of 1.74-1.85 g/cm3 delivers 22-30% component weight savings versus aluminum, and emerging die-casting presses rated to 3,500 tons unlock large structural components that previously required multi-piece assemblies. Electric-vehicle platforms amplify the advantage because every kilogram removed can add driving range, while aerospace OEMs validate magnesium for non-critical cabin structures to cut fuel burn. Integrated supply contracts are now linking future metal deliveries to lifecycle carbon metrics, rewarding low-CO2 producers. Taken together, these factors lift near-term unit consumption per vehicle even as overall light-vehicle volumes stabilize

Rising Aluminum-Alloying Demand

Magnesium's role as a hardener and corrosion inhibitor in high-strength aluminum alloys positions it as a growth lever tied to EV battery enclosures, body panels, and extruded profiles. Typical additions of 0.5-1.5 wt% raise yield strength, weldability, and fatigue life. China's aluminum smelters, which exceeded 40 million tons of output in 2024, anchor global demand; their alloy mix is shifting quickly toward 6xxx and 5xxx series grades with higher Mg content. Construction applications-from curtain walls to bridge decking-add a second pillar of baseline consumption, insulating suppliers from auto-cycle swings. Continuous-casting lines fitted with in-line alloying systems now meter magnesium more precisely, cutting element losses below 3% and supporting tight cost targets.

High CO2 Footprint of Pidgeon Process

Regulators add monetary pressure through emissions-trading schemes and proposed carbon-border adjustments. EU auditors peg the Pidgeon route at 11-15 tons CO2 per ton Mg, well above the bloc's 2030 industrial-average target of 1.6 tons. Automakers that publish cradle-to-gate footprints increasingly screen suppliers on verified life-cycle data, pushing high-carbon operators to either retrofit waste-heat recovery and solar calcination or risk delisting. Secondary melted scrap partly mitigates scope-1 emissions, requiring only 5% of the primary process energy, but scrap availability remains limited by collection logistics. The policy drive accelerates the relative competitiveness of electrolytic and seawater routes.

Other drivers and restraints analyzed in the detailed report include:

- Electric-Vehicle Gigacasting Uptake

- Carbon-Neutral Seawater Electro-Magnesium Technology

- Corrosion/Fire-Safety Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Seawater electro-extraction is the fastest-growing route at a 5.62% CAGR through 2031, while the thermal Pidgeon method still holds 62.74% of current output. The metal magnesium market size for seawater extraction is estimated at 0.16 million tons and could double before 2031 if pilot plants are commercialized successfully. Cost competitiveness hinges on renewable-power tariffs below USD 0.04 per kWh, which coastal jurisdictions in the Middle East and North Africa begin to offer. Electrolytic processes, historically confined to aerospace-grade purity batches, benefit from advances in inert anodes that slash chlorine emissions, improving ESG scores.

Legacy Pidgeon producers capitalize on depreciated assets and deep operator know-how, but looming carbon-compliance fees erode the edge. Integrated miners in Shaanxi and Ningxia provinces announced USD 320 million in retrofit budgets for low-carbon ferrosilicon and autonomous ore haulage to raise efficiency. Secondary recycling, leveraging 95% metal recovery, gains traction as automakers set recycled-content thresholds, though scrap flows lag demand. International Battery Metals' modular DLE plant co-sited with brine operations demonstrates how multi-metal integration can dilute project risk while feeding the same reducer furnaces.

The Metal Magnesium Market Report is Segmented by Production Process (Thermal Pidgeon, Electrolytic, Secondary/Recycled, and Seawater Electro-Extraction), End-User Industry (Aluminum Alloys, Die-Casting, Iron and Steel, Metal Reduction, and Other End User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific anchored 47.85% of global shipments in 2025 and is growing at a 5.96% CAGR. Government initiatives that bundle magnesium with "dual-use strategic metals" could channel low-interest loans toward greener capacity. Japan and South Korea optimize alloy technology for consumer electronics casings and BEV battery covers, importing ingots but exporting value-added parts.

North America lost its only large-scale primary source when US Magnesium shuttered Utah operations in late 2024. The shortfall forces automakers and defense primes to draw from Asian inventories or the smaller Canadian toll melting pool, raising freight costs and supply-security concerns.

Europe focuses on cutting embedded carbon. German recyclers scale closed-loop programs that capture sprues and runners, pushing secondary magnesium beyond 30% of regional supply. Norway, aiming to leverage hydropower, studies a 30 kt-per-year electrolytic cell park that would halve carbon intensity relative to the global average. Regulatory headwinds around the Pidgeon route encourage OEMs to diversify to Turkish and Saudi Arabian seawater projects scheduled for groundbreaking in 2026.

- American Magnesium

- ICL Group

- Fu Gu Yi De Magnesium Alloy Co., Ltd

- Baowu Magnesium Technology Co., Ltd.

- Regal Metal

- Rima Industrial

- Shanxi Bada Magnesium Co., Ltd.

- Solikamsk Magnesium Works

- Southern Magnesium & Chemicals Limited (SMCL)

- Taiyuan Tongxiang Metal Magnesium Co. Ltd

- US Magnesium LLC

- Wenxi YinGuang Magnesium Industry (Group) Co. Ltd

- Western Magnesium Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive and aerospace lightweighting boom

- 4.2.2 Rising aluminium-alloying demand

- 4.2.3 Electric-vehicle gigacasting uptake

- 4.2.4 Carbon-neutral seawater electro-magnesium tech

- 4.2.5 Biodegradable Mg implants gaining traction

- 4.3 Market Restraints

- 4.3.1 Price and energy cost volatility

- 4.3.2 High CO2 footprint of Pidgeon process

- 4.3.3 Corrosion / fire-safety concerns

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Production Process

- 5.1.1 Thermal Pidgeon

- 5.1.2 Electrolytic

- 5.1.3 Secondary/Recycled

- 5.1.4 Seawater Electro-extraction

- 5.2 By End-user Industry

- 5.2.1 Aluminum Alloys

- 5.2.2 Die-Casting

- 5.2.3 Iron and Steel

- 5.2.4 Metal Reduction

- 5.2.5 Other End User Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 American Magnesium

- 6.4.2 ICL Group

- 6.4.3 Fu Gu Yi De Magnesium Alloy Co., Ltd

- 6.4.4 Baowu Magnesium Technology Co., Ltd.

- 6.4.5 Regal Metal

- 6.4.6 Rima Industrial

- 6.4.7 Shanxi Bada Magnesium Co., Ltd.

- 6.4.8 Solikamsk Magnesium Works

- 6.4.9 Southern Magnesium & Chemicals Limited (SMCL)

- 6.4.10 Taiyuan Tongxiang Metal Magnesium Co. Ltd

- 6.4.11 US Magnesium LLC

- 6.4.12 Wenxi YinGuang Magnesium Industry (Group) Co. Ltd

- 6.4.13 Western Magnesium Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment