|

市场调查报告书

商品编码

1910827

驾驶模拟器:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Driving Simulator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

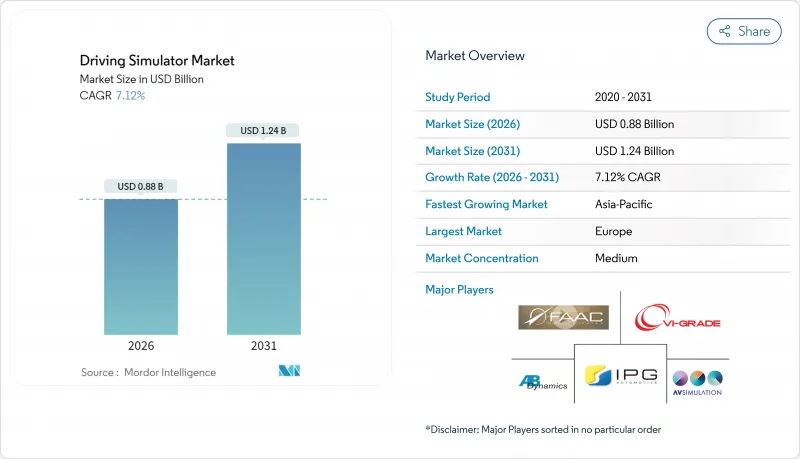

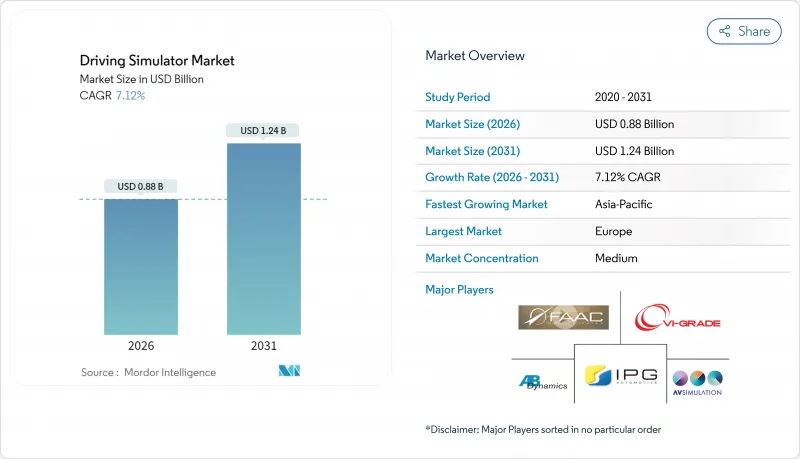

预计到 2025 年,驾驶模拟器市值将达到 8.2 亿美元,从 2026 年的 8.8 亿美元成长到 2031 年的 12.4 亿美元,在预测期(2026-2031 年)内,复合年增长率将达到 7.12%。

这种稳定成长源自于监管机构对更安全驾驶员认证的压力、降低原型测试成本的需求,以及自动驾驶汽车蓝图与虚拟检验要求的契合。商业车队正在采用先进的模拟器来缩短采用週期,汽车製造商则将研发预算转向软体在环测试设备,以补充实际道路测试。订阅式云端平台正在扩大成本敏感地区的存取范围,并培育新的用户群。欧洲凭藉其成熟的汽车生态系统保持主导地位,而亚太地区则凭藉中国和印度物流网络的扩张,推动了最大的收入成长。如今,竞争优势正向那些能够结合数位双胞胎地图、空中软体检验和独立于硬体的运动提示技术的供应商转移。然而,高昂的初始投资、晕动症风险以及日益增长的网路安全警报正在阻碍小规模采用者。

全球驾驶模拟器市场趋势与洞察

ADAS/AV检验需求快速成长

更严格的认证规则要求在自动驾驶功能正式上路前,必须进行数十亿英里的虚拟测试。将于2024年发布的Euro NCAP和NHTSA通讯协定,将真实道路测试与仿真相结合,并将高保真测试设备视为符合性认证的关键。 IEEE预测,到2030年,自动驾驶模拟市场规模将达到10亿美元,凸显了汽车製造商对数位双胞胎技术的依赖,他们利用数位孪生技术来探索那些无法在公共道路上检验的极端情况。将真实感测器日誌与可扩展场景引擎整合的平台,能够帮助工程师缩短迭代周期,并减少原型车队的数量。随着软体更新逐渐普及,虚拟回归测试变得必不可少,这也支撑了驾驶模拟器市场的稳定需求。目前,能够将场景库、实体引擎和资料融合介面整合到单一技术堆迭中的供应商,正收到更多来自一级供应商的询价请求(RFQ)。

电子商务的快速成长正在驾驶人。

线上零售的扩张导致小包裹量激增,货运能力面临压力。 UPS和Fremont Contract Carriers等运输公司正在教室部署基于动作的模拟器,并报告称事故减少,新司机入职速度加快。内布拉斯加州卡车运输协会提供的行动培训单位透过向偏远地区的大学提供培训,缓解了农村地区的人才短缺问题。可重现的危险场景使运输公司能够满足保险审核,并在几週内完成新司机认证,推动了模拟器的普及。这种商业需求抵消了消费者驾驶员教育计画成长缓慢的影响,使驾驶模拟器市场在短期内保持两位数左右的成长。

全动系统需要高资本投入

八轴运动平台、全景圆顶和专用礼堂对许多职业训练中心来说价格过高。欧洲斯图加特的驾驶模拟器清楚地展现了此类设施所需的场地和维护成本。资金筹措障碍会延长投资回收期,尤其是在学费受到管制的地区。新兴市场的买家往往会推迟购买或选择静态驾驶座,这限制了驾驶模拟器市场中高价硬体的销售成长。

细分市场分析

乘用车模拟器在新手驾驶训练和OEM研发领域仍将保持主导地位,预计2025年将占据驾驶模拟器市场59.88%的份额。然而,由于消费者驾照考试机构对模拟器替代驾驶设备的限制,预计其成长速度将放缓。不同的应用趋势表明,物流数位化正在重塑模拟器的需求模式。儘管商用车在2025年的收入基数小规模,但它们将成为未来驾驶模拟器市场扩张的主要驱动力,复合年增长率将达到7.14%。车队管理人员采用模拟器是为了降低每位驾驶员的培训成本,保持车辆运转率,并满足日益严格的驾驶时间监管审核。远端资讯处理技术的整合进一步将车内驾驶行为与课堂复习培训连结起来。

商用车需求的成长带动了周边服务的发展,例如针对危险品运输路线的客製化场景库、多语言使用者介面以及远端指导站。利用模组化驾驶座和云端渲染技术的供应商正在开拓先前因价格过高而难以企及的中小型车队市场。同时,乘用车专案专注于测试下一代资讯娱乐系统的人机介面,这是一个利润丰厚但市场规模有限的细分市场。开发双用途架构、可互换仪錶板和可适应性强的软体堆迭的供应商,在驾驶模拟器市场的各个细分领域保持着柔软性。

截至2025年,在成熟的培训课程和企业合规要求的推动下,驾驶员培训领域占驾驶模拟器市场规模的50.72%。然而,测试和研究领域7.21%的复合年增长率显示市场结构正在转变。汽车製造商为了缩短产品发布週期,正将预算转向软体主导的检验流程,因为虚拟里程比实际行驶里程更具成本效益。监管机构对实验室在可控、可重复的环境下进行碰撞避免检验的需求也是推动市场成长要素。

培训需求依然强劲,尤其是在道路拥挤和高油价导致在职训练效果下降的地区。透过虚拟实境头盔和自适应人工智慧导师提供的个人化模组有助于提高学员的学习保留率。然而,注重预算的教育机构仍在观望,暂缓全面更换其传统设备。供应商透过提供混合用途许可证来分散风险,让他们在测试自动化脚本和课堂内容之间切换,从而提高驾驶模拟器市场的座位运转率并实现收入多元化。

区域分析

2025年,欧洲在驾驶模拟器市场将维持36.22%的份额,主要得益于密集的测试跑道网路、统一的安全标准以及研发税收优惠政策。德国、法国和瑞典的汽车製造商正在运作整合的模拟流程,以支援监管申报并稳定硬体更新周期。各国运输部正在试行模拟器许可证制度,儘管私人预算波动,公共采购项目仍在继续。

亚太地区新增驾驶座最多,复合年增长率达7.17%。中国正将智慧城市预算投入自动驾驶班车试点项目,而印度则在扩建卡车驾驶人培训学院以缓解长期存在的劳动力短缺问题。云端渲染解决方案正在绕过基础设施瓶颈,使教育机构能够在临时教室部署笔记型电脑控制的驾驶座。日本成熟的汽车产业正致力于开发能够重现复杂城市路口的场景库,从而提振驾驶模拟器市场的上游软体需求。

北美受益于完善的联邦商业驾驶员资格认证指南,以及航空和国防领域早期采用模拟器的文化。重型货运公司正在投资建造连接区域枢纽的连网车队,并利用集中式内容传送。拉丁美洲和中东仍然是小规模的消费区域,但沿岸地区石油和天然气运输车队营运商日益增长的兴趣预示着未来地域扩张的趋势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- ADAS/自动驾驶车辆检验需求快速成长

- 电子商务的快速成长正在推动对卡车驾驶人培训的需求。

- 道路安全法规与驾驶执照改革

- 利用基于云端的「模拟器即服务」减少资本投资

- 针对通过模拟器认证的机队,提供与保险相关的保费折扣

- 用于OTA软体回归的数位双胞胎集成

- 市场限制

- 全动系统需要高资本投入

- 晕动症和保真度限制

- 剧本内容开发人员短缺

- 网路模拟器的网路安全风险

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值(美元))

- 按车辆类型

- 搭乘用车

- 商用车辆

- 透过使用

- 训练

- 测试和调查

- 依模拟器类型

- 紧凑型模拟器

- 全尺寸模拟器

- 高空模拟器

- 最终用户

- 驾训班和训练中心

- 汽车製造商

- 车队营运商及物流

- 学术和研究机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 埃及

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AB Dynamics plc

- VI-grade GmbH

- IPG Automotive GmbH

- Ansible Motion Ltd

- Cruden BV

- AutoSim AS

- AVSimulation

- Virage Simulation Inc.

- Tecknotrove Simulator Systems Pvt Ltd

- XPI Simulation

- FAAC Incorporated

- Moog Inc.

- Mechanical Simulation Corp.

- CAE Inc.

- Thales Group

- Bosch Rexroth AG

- Dassault Systemes SE

- Applied Intuition Inc.

- Exail Technologies SA

第七章 市场机会与未来展望

The Driving Simulator Market was valued at USD 0.82 billion in 2025 and estimated to grow from USD 0.88 billion in 2026 to reach USD 1.24 billion by 2031, at a CAGR of 7.12% during the forecast period (2026-2031).

This steady rise stems from regulatory pressure for safer driver certification, the need to cut prototype testing costs, and the alignment of autonomous-vehicle roadmaps with virtual validation mandates. Commercial fleets turn to advanced simulators to shorten recruitment cycles, while carmakers channel research budgets toward software-in-the-loop test beds that complement physical tracks. Subscription-based, cloud-hosted platforms broaden access in cost-sensitive regions and nurture new user segments. Europe keeps its lead on account of a mature automotive ecosystem, but Asia-Pacific contributes the largest incremental revenue as China and India expand logistics networks. Competitive advantage now flows to providers that fuse digital-twin maps, over-the-air software verification, and hardware-agnostic motion cueing, although high capital outlays, motion-sickness risks, and rising cyber-security alerts hold back smaller adopters.

Global Driving Simulator Market Trends and Insights

ADAS/AV Validation Needs Surge

Tougher homologation rules now insist on billions of virtual test miles before autonomous functions reach public roads. Euro NCAP and NHTSA protocols released in 2024 pair track runs with simulation, turning high-fidelity rigs into compliance gates. The IEEE forecasts over a billion dollar autonomous-driving simulation niche by 2030, underscoring how carmakers rely on digital twins to probe edge cases unreachable on open roads. Platforms integrating real-world sensor logs with scalable scenario engines let engineers shorten iteration loops and trim prototype fleets. As software updates move over the air, virtual regression testing becomes mandatory, anchoring steady demand for the driving simulator market. Vendors that wrap scenario libraries, physics engines, and data-fusion interfaces into one stack now win more RFQs from tier-1 suppliers.

E-Commerce Boom Raising Truck-Driver Training Demand

Online retail pushes parcel volumes upward, straining freight capacity. Carriers such as UPS and Fremont Contract Carriers equip classrooms with motion-based simulators and report accident reductions alongside faster rookie onboarding. The Nebraska Trucking Association's mobile units bring training to remote colleges, easing the rural talent gap. Repeatable hazard scenarios help fleets meet insurance audits and qualify recruits within weeks, boosting uptake. This commercial pull offsets slower growth in consumer driver-ed programs and keeps the driving simulator market momentum above one-tenth in the short term.

High Capex Of Full-Motion Systems

Eight-axis motion bases, panoramic domes, and purpose-built halls push acquisition costs beyond the reach of many vocational centers. Europe's Stuttgart Driving Simulator illustrates the real-estate and maintenance footprint such rigs require. Financing hurdles prolong payback periods, especially where tuition fees are regulated. Emerging-market buyers often defer purchases or settle for static cockpits, tempering volume growth for premium hardware in the driving simulator market.

Other drivers and restraints analyzed in the detailed report include:

- Road-Safety Regulations & Driver-Licensing Reforms

- Digital-Twin Integration For OTA Software Regression

- Motion-Sickness & Fidelity Limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger-car simulators still dominate with 59.88% of the driving simulator market share in 2025, serving both novice driver education and OEM R&D, but growth moderates as consumer licensing boards limit simulator substitution. The divergence in uptake illustrates how logistics digitization reshapes simulator demand patterns. Commercial vehicles accounted for a smaller revenue base in 2025, yet their 7.14% CAGR makes them the primary engine of future expansion for the driving simulator market. Fleet managers deploy simulators to cut per-driver training costs, keep rigs on the road, and satisfy stricter hours-of-service audits. Telematics integration further links in-cab behavior with classroom refreshers.

The commercial-vehicle push stimulates peripheral services scenario library customization for hazmat routes, multi-language UI overlays, and remote instructor stations. Vendors leveraging modular cockpits and cloud rendering penetrate small and mid-sized transport operators previously priced out. Meanwhile, passenger-car programs focus on human-machine interface testing for next-gen infotainment, a niche that commands higher margins but fewer seats. Suppliers that craft dual-purpose architectures, swappable dashboards, and adaptable software stacks retain cross-segment flexibility in the driving simulator market.

Training held 50.72% of the driving simulator market size in 2025 due to entrenched driver-ed curricula and corporate compliance needs. Yet the 7.21% CAGR logged by testing and research signals a structural pivot. Automakers wanting to shorten release cycles channel budgets toward software-dominated validation, where virtual miles are cheaper than track miles. Growth also comes from regulatory labs conducting crash-avoidance verification under controlled, repeatable conditions.

Training demand remains resilient, particularly in regions where road congestion and fuel prices make real-world lessons inefficient. Virtual-reality headsets and adaptive AI tutors personalize modules, boosting learner retention. Still, budget-sensitive schools adopt a wait-and-see stance on replacing entire fleets of conventional cars. Providers hedge by offering mixed-use licenses that toggle between test automation scripts and classroom content, increasing seat utilization and diversifying revenue in the driving simulator market.

The Driving Simulator Market Report is Segmented by Vehicle Type (Passenger Car and Commercial Vehicle), Application (Training and Testing & Research), Simulator Type (Compact Simulator and More), End-User (Driving Schools & Training Centers and More), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East & Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe preserved a 36.22% share of the driving simulator market in 2025 on the strength of its dense testing circuits, harmonized safety rules, and R&D tax incentives. Carmakers in Germany, France, and Sweden run integrated simulation pipelines that feed regulatory dossiers, ensuring a steady hardware refresh cycle. National transport ministries pilot simulator-based licensing updates, keeping public procurement programs alive even as private budgets fluctuate.

Asia-Pacific, advancing at a 7.17% CAGR, adds the most new seats. China funnels smart-city budgets into autonomous shuttle pilots, while India scales truck-driver academies to plug chronic labor gaps. Cloud-rendered solutions bypass infrastructure bottlenecks, letting institutes deploy laptop-controlled cockpits in temporary classrooms. Japan's well-established automotive sector focuses on scenario libraries that represent complex urban intersections, reinforcing upstream software demand in the driving simulator market.

North America benefits from structured federal guidelines covering commercial-driver qualifications and an early culture of simulator adoption in aviation and defense. Large freight haulers invest in networked fleets of rigs across regional hubs, leveraging centralized content pushes. Latin America and the Middle East remain smaller consumers, yet oil-and-gas convoy operators in the Gulf show rising interest, signaling wider geographic penetration ahead.

- AB Dynamics plc

- VI-grade GmbH

- IPG Automotive GmbH

- Ansible Motion Ltd

- Cruden BV

- AutoSim AS

- AVSimulation

- Virage Simulation Inc.

- Tecknotrove Simulator Systems Pvt Ltd

- XPI Simulation

- FAAC Incorporated

- Moog Inc.

- Mechanical Simulation Corp.

- CAE Inc.

- Thales Group

- Bosch Rexroth AG

- Dassault Systemes SE

- Applied Intuition Inc.

- Exail Technologies SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 ADAS/AV Validation Needs Surge

- 4.2.2 E-Commerce Boom Raising Truck-Driver Training Demand

- 4.2.3 Road-Safety Regulations & Driver-Licensing Reforms

- 4.2.4 Cloud "Simulator-As-A-Service" Lowering Capex

- 4.2.5 Insurance-Linked Premium Discounts For Simulator-Certified Fleets

- 4.2.6 Digital-Twin Integration For OTA Software Regression

- 4.3 Market Restraints

- 4.3.1 High Capex Of Full-Motion Systems

- 4.3.2 Motion-Sickness & Fidelity Limitations

- 4.3.3 Shortage Of Scenario-Content Developers

- 4.3.4 Cyber-Security Risk In Networked Simulators

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Application

- 5.2.1 Training

- 5.2.2 Testing & Research

- 5.3 By Simulator Type

- 5.3.1 Compact Simulator

- 5.3.2 Full-Scale Simulator

- 5.3.3 Advanced Simulator

- 5.4 By End-User

- 5.4.1 Driving Schools & Training Centers

- 5.4.2 Automotive OEMs

- 5.4.3 Fleet Operators & Logistics

- 5.4.4 Academic & Research Institutions

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 AB Dynamics plc

- 6.4.2 VI-grade GmbH

- 6.4.3 IPG Automotive GmbH

- 6.4.4 Ansible Motion Ltd

- 6.4.5 Cruden BV

- 6.4.6 AutoSim AS

- 6.4.7 AVSimulation

- 6.4.8 Virage Simulation Inc.

- 6.4.9 Tecknotrove Simulator Systems Pvt Ltd

- 6.4.10 XPI Simulation

- 6.4.11 FAAC Incorporated

- 6.4.12 Moog Inc.

- 6.4.13 Mechanical Simulation Corp.

- 6.4.14 CAE Inc.

- 6.4.15 Thales Group

- 6.4.16 Bosch Rexroth AG

- 6.4.17 Dassault Systemes SE

- 6.4.18 Applied Intuition Inc.

- 6.4.19 Exail Technologies SA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment