|

市场调查报告书

商品编码

1910883

自流平混凝土:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Self Leveling Concrete - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

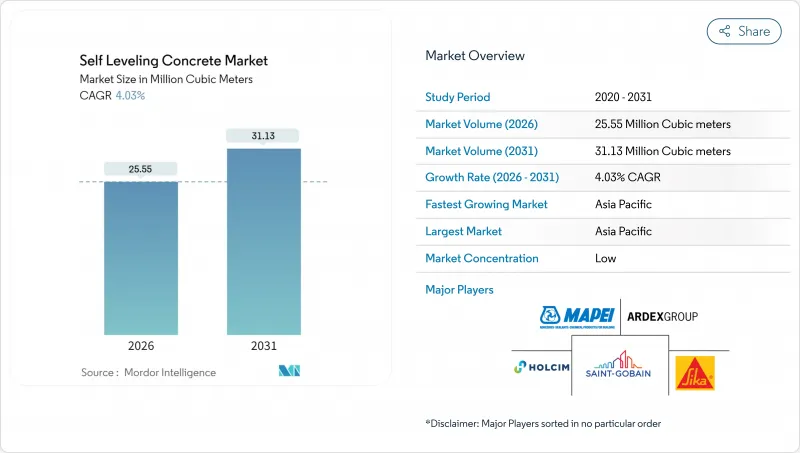

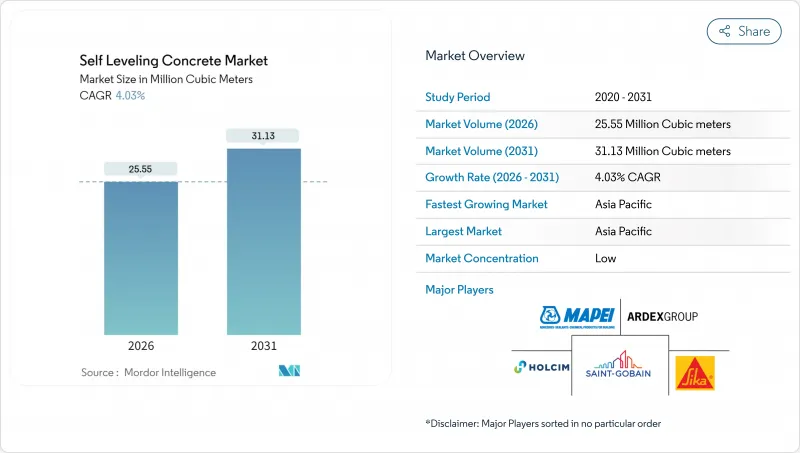

预计到 2026 年,自流平混凝土市场规模将达到 2,555 万立方米,高于 2025 年的 2,456 万立方米。预测到 2031 年,市场规模将达到 3,113 万立方米,2026 年至 2031 年的复合年增长率为 4.03%。

这一稳步增长的趋势反映了持续的维修活动、低碳接合材料的广泛应用以及对快速施工地板材料解决方案日益增长的需求。电商履约中心的强劲需求、公共建筑的持续维修以及政府鼓励使用无挥发性有机化合物(VOC)产品的奖励,都持续推动着用户成长。安装人员也在寻求采用泵车运输系统来减少人工成本,并确保大规模浇筑的一致性,从而进一步推动销售成长。然而,特种水泥价格的波动、安装人员日益短缺以及与潮湿相关的投诉限制了近期的成长,凸显了培训和成本控制措施的重要性。

全球自流平混凝土市场趋势及展望

疫情后商业维修计划迅速復苏

从2024年起,受资料中心、医疗保健和教育产业资产重新定位策略的推动,商业建筑业主将优先考虑内部维修而非新建设。美国建设业承包商协会 (AGC) 的一项调查显示,42% 的公司预计 2025 年资料中心相关工作量将有所成长,其次是医疗保健和教育产业。这些计划通常存在地面高度不平整的问题,因此自流平地面成为加快施工进度、满足紧迫的重新入住期限的首选产品。老旧办公大楼的改造也进一步推动了市场需求,因为不平整的地面会阻碍模组化地毯和弹性地板材料的铺设。美国联邦政府的基础建设资金正在加速公共建筑的维修,而自流平材料正帮助政府机构在满足紧迫的施工进度的同时,保护现有建筑结构。

整合式自干型低碳CSA黏合剂

与一般波特兰水泥相比,硫铝酸钙黏合剂可将产品的固有碳排放降低高达 40%,并可实现当日地板材料。这些特性满足了追求 LEED v4.1 认证积分和净零排放目标的业主的需求。承包商则受惠于更快的施工速度、更低的除湿成本和更低的湿度测试风险。BASF和西卡已开始将硫铝酸钙技术与先进的聚合物固化剂相结合,以提高抗弯强度和耐磨性,展现了兼顾性能和永续性的合作模式。加州的「清洁采购」计画已将基于硫铝酸钙的自流平材料指定为公共工程项目的首选规范,不列颠哥伦比亚省和欧盟也正在考虑类似的采购规则。

特种水泥和外加剂价格波动;

碳定价导致欧洲水泥熟料成本在2024年每吨上涨18美元,进而推动特种水泥价格较去年同期上涨约11%。天气原因导致的矿场关闭也造成了聚合物流动改质剂和碳酸锂的严重供不应求,使承包商在固定价格合约下面临竞标风险。儘管跨国公司正越来越多地将外加剂生产在地化以缩短前置作业时间,但规模较小的混凝土混合料生产商仍然依赖进口原材料,不可避免地将成本转嫁给客户。客户开始在混凝土合约中加入钢铁业的价格上涨条款,但并非所有公共机构都接受这些条款,这可能导致资金筹措缺口和计划启动延误。

细分市场分析

到2025年,底涂剂将占据自流平混凝土市场64.58%的份额,这主要归功于其作为几乎所有建筑类型中用于找平不平整基材的标准解决方案。大型生产商透过设计优化流动性、养护时间和成本平衡的混合料,使这类产品更加通用。然而,持续存在的培训短缺问题依然严峻,因为工人常常低估底涂剂附着力和水分管理的重要性,导致需要重复涂刷,从而降低承包商的盈利。

儘管绝对销量仍然较小,但饰面材料正迅速普及,预计从2026年到2031年将以4.34%的复合年增长率增长。抛光饰面材料正被零售连锁店、精品酒店和企业配套设施空间所采用,以在无需传统播种方法的高昂成本和復杂施工的情况下,营造出类似水磨石的美感。诸如数位印刷表面、半透明彩色覆盖层和混合聚氨酯水泥耐磨层等创新技术,正在提升设计的柔软性。随着业主在预算有限的情况下寻求独特的饰面效果,能够大规模提供创意十足、高性能饰面材料的製造商拥有明显的优势。

自流平混凝土报告按产品类型(面层和基层)、最终用途领域(商业、工业及公共、基础设施、住宅)和地区(亚太地区、北美、欧洲、南美、中东和非洲)进行细分。市场预测以体积(立方米)为单位。

区域分析

到2025年,亚太地区将占据全球38.34%的市场份额,这主要得益于中国的「一带一路」计划、印度的「智慧城市」计画以及东南亚工厂扩张的蓬勃发展。随着各国政府加大对公共运输、机场和资料中心的投入,预计到2031年,亚太市场将以4.14%的复合年增长率成长。仅中国预计到2025年将在省级基础设施建设方面投入超过3940亿美元,并指定使用自流平产品进行候机大厅铺设和航站楼扩建。 Holcim的SMARTFlow模拟程序已在新加坡和韩国获得认可,并受到重视高层建筑泵适用性预测模型的建筑商的支持。

儘管成长放缓,北美仍是关键市场。 《基础设施投资和就业创造法案》提供的联邦资金正在提振政府大楼、桥樑和公共交通枢纽的需求,但由于办公大楼市场的不确定性,私人商业计划的开工受到抑制。预计2025年底的降息可能会重启一些被推迟的计划,尤其是在生命科学研究设施和园区以及先进製造业领域。

欧洲不同地区的发展趋势各不相同。西欧市场正积极引领永续性,德国和法国已将碳减排的CSA产品纳入公共采购清单;西班牙和义大利则正在维修老旧酒店,以实现其2030年的旅游业目标。东欧则持续依赖欧盟凝聚津贴补贴公路和铁路的改善工程,包括自流平桥面铺设。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 疫情后商业维修计划迅速復苏

- 自干低碳CSA黏合剂的集成

- 加速电子商务履约中心的地板铺设流程

- 大型计划中采用泵车式大容量污水处理系统

- 政府对不含挥发性有机化合物的室内产品提供诱因

- 市场限制

- 特种水泥和外加剂价格波动;

- 由于缺乏施工技能,导致性能不佳

- 快速施工楼板中与潮湿相关的索赔

- 价值链分析

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 副产品

- 食材

- 基材

- 按最终用途面积

- 商业的

- 工业和公共设施

- 基础设施

- 住宅

- 按地区

- 亚太地区

- 中国

- 印度

- 韩国

- 日本

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率/排名分析

- 公司简介

- ARDEX Group

- Arkema

- BASF

- Cemex SAB DE CV

- Duraamen Engineered

产品有限公司

- 流化混凝土

- H.B.富勒

- 荷希姆

- 拉蒂克雷特国际有限公司

- 马贝株式会社

- 麦克森有限公司

- 纯环氧树脂

- 圣哥班

- 西卡公司

- Target Products Co., Ltd.

- TCC材料

第七章 市场机会与未来展望

Self Leveling Concrete market size in 2026 is estimated at 25.55 Million Cubic meters, growing from 2025 value of 24.56 Million Cubic meters with 2031 projections showing 31.13 Million Cubic meters, growing at 4.03% CAGR over 2026-2031.

This steady trajectory reflects sustained renovation activity, the adoption of low-carbon binders, and rising demand for rapid-install flooring solutions. Strong uptake in e-commerce fulfillment centers, ongoing public-building refurbishment, and government incentives that reward VOC-free products continue to widen the user base. Contractors also view pump-truck delivery systems as a route to reduce labor requirements and maintain consistency on large pours, further propelling volume growth. At the same time, price volatility in specialty cement, a widening installation skill gap, and moisture-related callbacks temper near-term gains, underscoring the importance of training and cost-management initiatives.

Global Self Leveling Concrete Market Trends and Insights

Rapid Rebound of Commercial Renovation Projects Post-Pandemic

Commercial building owners have prioritized interior upgrades over ground-up construction since 2024, bolstered by asset-repositioning strategies in data centers, healthcare, and education. The Associated General Contractors survey shows 42% of firms anticipate more data-center work in 2025, with healthcare and education following close behind. These projects typically involve highly variable existing substrates, making self-leveling underlayments the product of choice to speed installation and meet tight re-occupancy deadlines. Adaptive-reuse conversions of legacy office towers further expand demand because substrate irregularities hinder the installation of modular carpet tiles and resilient floor coverings. U.S. federal infrastructure funding accelerates public-building refurbishment, and self-leveling compounds help agencies meet aggressive construction timetables while preserving existing structures.

Integration of Self-Drying, Low-Carbon CSA Binders

Calcium sulfoaluminate binders cut embodied-carbon emissions by up to 40% versus ordinary Portland cement and unlock same-day flooring readiness, attributes that resonate with owners pursuing LEED v4.1 points and net-zero goals. Contractors benefit from shorter project schedules, fewer dehumidification costs, and reduced moisture-testing risk. BASF and Sika have begun pairing CSA technology with advanced polymer hardeners to improve flexural strength and abrasion resistance, illustrating a collaborative approach to performance and sustainability. California's Buy Clean program has already positioned CSA-based self-levelers as a preferred specification in public work, and similar procurement rules are under review in British Columbia and the European Union.

Volatility in Specialty Cement and Admixture Prices

Carbon-pricing schemes added USD 18/tons to European clinker costs in 2024, pushing specialty cement prices up by nearly 11% year-on-year. Polymer-based flow modifiers and lithium carbonate also experienced abrupt shortages following weather-related mine closures, exposing contractors to bid risk on fixed-price jobs. Multinationals have responded by regionalizing admixture production to shorten lead times, but smaller formulators remain reliant on imported ingredients, making cost pass-through unavoidable. Owners have begun to implement steel-like escalation clauses in concrete contracts, yet not all public entities accept such provisions, creating a funding mismatch that can delay project starts.

Other drivers and restraints analyzed in the detailed report include:

- Fast-Track Flooring Schedules in E-Commerce Fulfillment Centers

- Adoption of Pump-Truck High-Volume SLU Systems on Megaprojects

- Installation Skill-Gap Causing Performance Failures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Underlayments held 64.58% self-leveling concrete market share in 2025, thanks to their role as the default solution for leveling out-of-tolerance substrates across virtually every building type. Bulk producers have optimized mix designs to balance flow, set time, and cost, drawing the category closer to commodity status. However, recurring training deficits frequently show up here, since crews may underestimate the importance of bonding primers and controlled water addition, leading to callbacks that dent contractor profitability.

Toppings, though smaller in absolute volume, are moving quickly toward mass adoption, projected to expand at a 4.34% CAGR over 2026-2031. Polished toppings now appear in retail chains, boutique hotels, and corporate amenity spaces, offering terrazzo-like aesthetics without the cost and installation complexity of traditional seeded systems. Innovations such as digital print-ready surfaces, translucent pigmented overlays, and hybrid PU-cement wear layers foster design flexibility. With owners hunting for unique finishes that still respect lean budgets, suppliers that can deliver creative, high-performance toppings at scale gain a clear advantage.

The Self Leveling Concrete Report is Segmented by Product (Topping and Underlayment), End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Cubic Meters).

Geography Analysis

Asia-Pacific accounted for 38.34% of 2025 volume, supported by China's Belt and Road projects, India's Smart Cities Mission, and Southeast Asia's factory-expansion wave. Regional volume is projected to increase at a 4.14% CAGR through 2031 as governments channel spending into mass transit, airport, and data center programs. China alone is pouring more than USD 394 billion into provincial infrastructure in 2025, with self-leveling products specified for concourse overlays and terminal expansions. Holcim's SMARTFlow simulation program has found receptive audiences in Singapore and South Korea, where contractors value predictive pumpability models for high-rise construction.

North America remains a heavyweight, albeit with slower growth. Federal funding from the Infrastructure Investment and Jobs Act elevates demand in government buildings, bridges, and public-transit hubs, but private commercial starts are dampened by office-sector uncertainty. Interest-rate cuts expected in late 2025 should unlock some deferred projects, particularly in life-science research and campuses and advanced manufacturing.

Europe shows divergent trends. Western markets pursue sustainability leadership; Germany and France employ carbon-reduced CSA products on public procurement lists, while Spain and Italy refurbish aging hotels ahead of 2030 tourism goals. Eastern Europe continues to rely on EU cohesion funds, channeling grants into roadway and rail upgrades that include self-leveling bridge-deck overlays.

- ARDEX Group

- Arkema

- BASF

- Cemex S.A.B DE C.V.

- Duraamen Engineered Products, Inc.

- Flowcrete

- H.B. Fuller Company

- HOLCIM

- LATICRETE International, Inc.

- MAPEI S.p.A.

- Maxxon, Inc.

- PurEpoxy

- Saint-Gobain

- Sika AG

- Target Products Ltd

- TCC Materials

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid rebound of commercial renovation projects post-pandemic

- 4.2.2 Integration of self-drying, low-carbon CSA binders

- 4.2.3 Fast-track flooring schedules in e-commerce fulfillment centers

- 4.2.4 Adoption of pump-truck high-volume SLU systems on megaprojects

- 4.2.5 Government incentives for VOC-free indoor products

- 4.3 Market Restraints

- 4.3.1 Volatility in specialty cement and admixture prices

- 4.3.2 Installation skill-gap causing performance failures

- 4.3.3 Moisture-related callbacks in fast-track slabs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product

- 5.1.1 Topping

- 5.1.2 Underlayment

- 5.2 By End Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 South Korea

- 5.3.1.4 Japan

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 Spain

- 5.3.3.6 United Kingdom

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 ARDEX Group

- 6.4.2 Arkema

- 6.4.3 BASF

- 6.4.4 Cemex S.A.B DE C.V.

- 6.4.5 Duraamen Engineered

Products, Inc.

- 6.4.6 Flowcrete

- 6.4.7 H.B. Fuller Company

- 6.4.8 HOLCIM

- 6.4.9 LATICRETE International, Inc.

- 6.4.10 MAPEI S.p.A.

- 6.4.11 Maxxon, Inc.

- 6.4.12 PurEpoxy

- 6.4.13 Saint-Gobain

- 6.4.14 Sika AG

- 6.4.15 Target Products Ltd

- 6.4.16 TCC Materials

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment