|

市场调查报告书

商品编码

1910889

欧洲汽车涂料市场:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)Europe Automotive Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

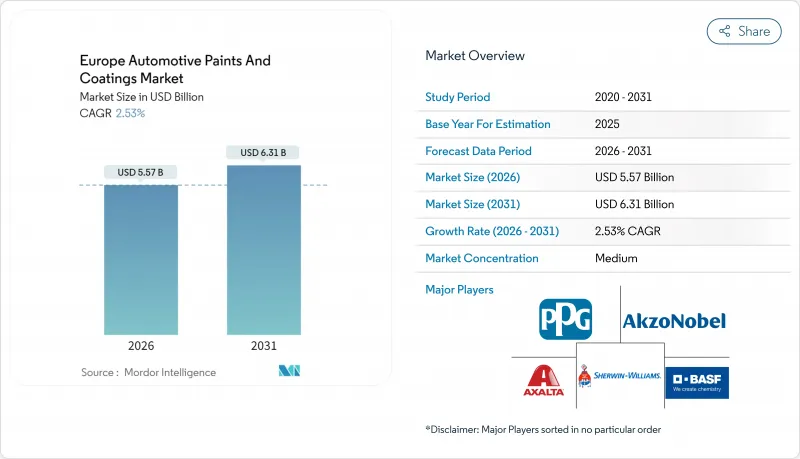

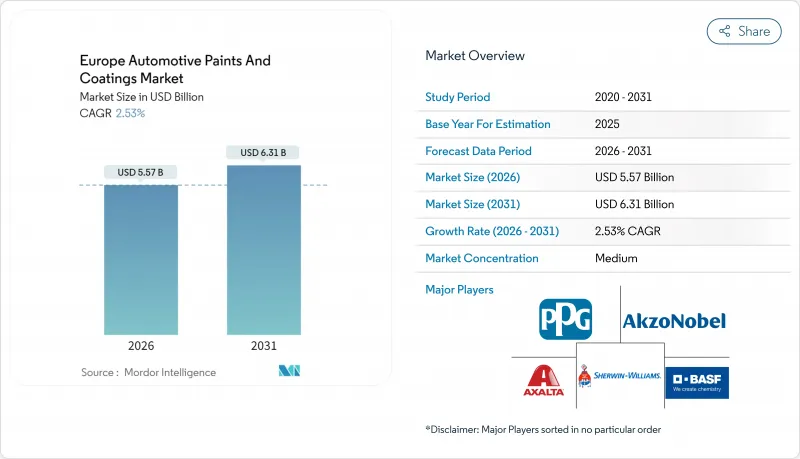

欧洲汽车油漆和涂料市场预计将从 2025 年的 54.3 亿美元成长到 2026 年的 55.7 亿美元,预计到 2031 年将达到 63.1 亿美元,2026 年至 2031 年的复合年增长率为 2.53%。

需求成长主要受组装电气化、限制挥发性有机化合物 (VOC)排放的监管要求以及对预测性配色软体投资增加的推动。电动车 (EV) 产量的扩张正在加速原始设备製造商 (OEM) 对喷漆车间的维修,进一步推动了涂料系统从溶剂型转变为水性型的转变。欧盟委员会拟议的全氟烷基物质 (PFAS) 法规(将于 2025 年生效)将要求对添加剂进行全面重新配方,而碳边境调节机制 (CBAM) 将推高原材料成本,使拥有本地颜料和树脂生产能力的供应商更具优势。人工智慧 (AI) 平台与喷涂机器人的整合可减少过喷并缩短週期时间,使汽车製造商能够在天然气价格波动的情况下降低能源消耗。

欧洲汽车涂料市场趋势与洞察

电动车主导的喷漆车间升级

电动车平台依赖大量使用铝材的车身和电池机壳,这些材料无法承受传统的高温循环。因此,汽车製造商正转向低温烘烤聚氨酯和改性丙烯酸树脂等可在 80-100°C 下固化的材料。 BMW在其慕尼黑组装厂实施人工智慧优化图案控制后,喷漆室的能耗降低了 25%,充分展现了数位化优先喷漆生产线的资本效率优势。随着汽车製造商计划对整个喷漆车间维修以配合电动车平台的推出,那些整合了化学、机器人和分析技术的供应商凭藉先发优势赢得了合约。

向低VOC水基系统过渡

新的工业排放指令将挥发性有机化合物(VOC)的排放阈值设定为35克/平方米,这迫使汽车製造商转向水性底涂层。宾士计画在2024年实现德国所有工厂VOC排放量降至20克/平方米,溶剂用量减少85%,同时实现零色差匹配。全氟烷基和多氟烷基物质(PFAS)法规正在逐步淘汰含氟界面活性剂,迫使配方师转向使用新一代无硅润湿剂。能够稳定无PFAS配方中的成膜性、流动性和耐候性的公司正在获得先发优势,并根据原始设备製造商(OEM)的「绿色化学」评估标准获得长期供应合约。

原物料价格波动

2024年,受能源价格上涨和中国供应增加的影响,二氧化钛价格上涨了18%,丙烯酸单体价格较上季波动达25%。缺乏期货避险工具的独立本地製造商面临利润率下降的困境,导致併购活动加剧,大型公司纷纷收购专业细分领域的企业以扩大采购规模。

细分市场分析

到2025年,丙烯酸类涂料将占欧洲汽车涂料市场的41.82%。其多功能性使其可用于底漆、底涂层和透明涂层层。虽然聚氨酯化学品目前市场份额较小,但随着电动车车身结构对柔软性、耐刮擦且可在低温烘烤下固化的涂料的需求日益增长,预计其将以2.74%的复合年增长率在树脂基体系中实现最快增长。环氧树脂凭藉其优异的防腐蚀腐蚀性能,将继续作为电涂装涂料和底漆发挥重要作用。醇酸树脂和聚酯树脂则应用于巴士和卡车等细分市场,在这些市场中,成本往往比外观更为重要。BASF计画于2024年推出生物基聚氨酯分散体,体现了其在重组树脂产品组合时,将永续性和性能结合的概念。

丙烯酸树脂的优势在于其成本效益高、供应量大,并且与多级水性涂料生产线相容。然而,12年防腐蚀保固的压力迫使原始设备製造商(OEM)在电池托盘相邻面板上指定使用聚氨酯面漆。 CBAM树脂生产的回流进一步强化了欧盟对聚氨酯原料采购的承诺。因此,聚氨酯技术的进步正在逐步蚕食丙烯酸树脂的市场份额,配方师正在将两种树脂混合使用,以在整个涂层中实现成本和性能的平衡。如果电动车的预期销售量得以实现,光是聚氨酯涂料在2031年的欧洲汽车涂料市场规模就可能超过12.6亿美元。

溶剂型涂料系统仍占据欧洲汽车涂料市场47.62%的份额,这主要得益于数十年来喷涂室设备的传承以及高速生产线上可预测的流变性能。然而,水性底涂层正以2.99%的强劲复合年增长率成长,这主要受欧盟VOC排放上限和消费者对永续性品牌的关注所驱动。混合平台将溶剂型闪涂底漆与水性底漆相结合,在实现最佳光泽度的同时,平衡了VOC总排放量。粉末涂料技术曾一度主要应用于卡车车架和小零件生产线,如今随着低温聚酯化学技术的成熟,其应用前景再次受到关注。

原始设备製造商 (OEM) 的资本投资正转向封闭回路型水回收系统、精确的湿度控制以及能够加速水分蒸发的先进雾化器,从而缩小与溶剂型涂料的週期时间差距。阿克苏诺贝尔 2024 年的德国扩张计画将使欧洲大陆水性涂料的产能提高 35%,凸显了这项化学技术的强劲发展势头。虽然溶剂型涂料仍可用于一些特定的金属效果,但供应商的蓝图表明,由于监管确定性和碳审核透明度会影响采购决策,水性涂料要到 2030 年代初才能接近与溶剂型涂料持平。

其他福利

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动车主导的喷漆车间升级

- 向低VOC水基系统过渡

- 欧洲汽车产量正在復苏。

- 碳边境调节机制(CBAM)影响供应合约

- 在OEM生产线中应用AI引导的按需混色

- 市场限制

- 原物料价格波动

- 加强 REACH 和 PFAS 法规

- 能源价格上涨导致淬火炉运作成本飙升。

- 价值链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依树脂类型

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 其他的

- 透过技术

- 溶剂型

- 水溶液

- 粉末涂装

- 分层

- 电涂装涂层

- 底漆

- 底涂层

- 透明涂层

- 透过使用

- 汽车OEM厂商

- 汽车修补漆

- 按地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率/排名分析

- 公司简介

- Akzo Nobel NV

- Axalta Coating Systems

- BASF SE(Carlyle Group)

- Beckers Group

- Brila Coatings

- Jotun

- Kansai Paints Co., Ltd.

- Nippon Paint Holdings

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

第七章 市场机会与未来展望

The Europe automotive paints and coatings market is expected to grow from USD 5.43 billion in 2025 to USD 5.57 billion in 2026 and is forecast to reach USD 6.31 billion by 2031 at 2.53% CAGR over 2026-2031.

Demand stems from the electrification of assembly lines, regulatory mandates that limit VOC emissions, and rising investment in predictive color-matching software. Electric vehicle (EV) production is accelerating OEM retrofits of paint shops, intensifying the shift from solvent-borne to water-borne chemistry. The European Commission's per- and polyfluoroalkyl substances (PFAS) proposal, effective 2025, compels wholesale reformulation of additives, while the Carbon Border Adjustment Mechanism (CBAM) raises raw-material costs, favoring suppliers with regional pigment and resin capacity. The integration of artificial-intelligence (AI) platforms with spray robots reduces overspray and shortens cycle times, enabling automakers to reduce energy consumption even amid volatile natural-gas prices.

Europe Automotive Paints And Coatings Market Trends and Insights

EV-Led Paint-Shop Upgrades

Electric platforms rely on aluminum-intensive bodies and battery enclosures that cannot tolerate legacy high-temperature cycles. Carmakers therefore adopt low-bake polyurethane and modified acrylic chemistries that cure at 80-100 °C. BMW reduced spray-booth energy consumption by 25% after commissioning AI-optimized pattern controls at its Munich assembly facility, confirming the capital efficiency benefits of digital-first coating lines. Suppliers that bundle chemistry, robotics, and analytics are capturing early-mover contracts as OEMs schedule whole-shop refurbishments to coincide with the launch of their EV platforms.

Shift to Low-VOC Waterborne Systems

New Industrial Emissions Directive thresholds of 35 g/m2 VOC pressure automakers to adopt water-borne basecoats. Mercedes-Benz achieved 20 g/m2 in 2024 across its German plants, representing an 85% reduction in solvent use, without any color-match deviations. PFAS curbs now eliminate fluorinated surfactants, prompting formulators to adopt next-generation silicon-free wetting aids. Companies able to stabilize film build, flow, and weathering with PFAS-free packages enjoy first-mover credentials while securing long-term supply agreements under OEM "green-chemistry" scorecards.

Feedstock Price Volatility

Titanium dioxide rose 18% in 2024 on energy-inflated Chinese output, while acrylic monomers swung 25% quarter-to-quarter. Regional independents lacking futures-hedging instruments face margin erosion, prompting merger activity as major companies acquire niche specialists to scale their procurement.

Other drivers and restraints analyzed in the detailed report include:

- Recovery of European Vehicle Output

- Carbon Border Adjustment Mechanism Shaping Supply Contracts

- Tightening REACH and PFAS Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic systems held 41.82 of % European automotive paints and coatings market share in 2025, their versatility enabling deployment in primer, basecoat, and clearcoat film builds. Polyurethane chemistries, though smaller today, are on track for a 2.74% CAGR, the fastest among resins, as EV body structures mandate flexible, chip-resistant coatings that cure at lower bake temperatures. Epoxies retain critical e-coat and primer roles by anchoring corrosion-protection performance. Alkyd and polyester variants serve the bus and truck niches, where cost considerations often trump appearance. Bio-based polyurethane dispersions launched by BASF in 2024 reflect how sustainability converges with performance to rewrite resin portfolios.

Acrylic's entrenched position rests on cost-efficient bulk supply and compatibility with multistage water-borne lines. Yet warranty pressure for 12-year anti-perforation coverage compels OEMs to specify polyurethane topcoats on panels adjacent to battery trays. Reshoring resin manufacturing to meet CBAM constraints reinforces poly-purchase commitments inside the EU trading bloc. Consequently, polyurethane's advance erodes acrylic share gradually, with formulators blending both chemistries to achieve balanced cost-to-performance ratios across the coating stack. The European automotive paints and coatings market size for polyurethane grades alone could surpass USD 1.26 billion by 2031 if projected EV volumes materialize.

Solvent-borne systems still command 47.62% of the European automotive paints and coatings market size, a legacy of decades-old booth infrastructure and predictable rheology in high-line-speed operations. Water-borne basecoats, however, achieve a superior 2.99% CAGR, underpinned by EU VOC ceilings and consumer branding that emphasizes sustainability. Hybrid platforms combine solvent-borne flash primers with water-borne base layers to balance VOC totals and achieve optimal gloss depth. Powder technology, limited chiefly to truck frames and small-part lines, earns renewed interest as low-temperature polyester chemistries mature.

OEM capital spending shifts toward closed-loop water reclaim, fine-tuned humidity control, and advanced atomizers that accelerate water evaporation, narrowing the cycle-time gap with solvent finishes. Akzo Nobel's 2024 German expansion increases continental water-borne capacity by 35%, validating the momentum behind this chemistry. Although solvent systems remain for niche metallic effects, supplier roadmaps indicate that water-borne coatings' climb to near-parity will occur by the early 2030s, with regulatory certainty and carbon-audit transparency influencing procurement preferences.

The Europe Automotive Paints and Coatings Market Report is Segmented by Resin Type (Polyurethane, Epoxy, Acrylic, Other Resin Type), Technology (Solvent-Borne, Water-Borne, Powder), Layer (E-Coat, Primer, Basecoat, Clearcoat), Application (Automotive OEM, Automotive Refinish), and Geography (Germany, United Kingdom, France, Italy, Spain, NORDIC Countries, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Axalta Coating Systems

- BASF SE (Carlyle Group)

- Beckers Group

- Brila Coatings

- Jotun

- Kansai Paints Co., Ltd.

- Nippon Paint Holdings

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-led paint-shop upgrades

- 4.2.2 Shift to low-VOC waterborne systems

- 4.2.3 Recovery of European vehicle output

- 4.2.4 Carbon Border Adjustment Mechanism (CBAM) shaping supply contracts

- 4.2.5 AI-guided colour-on-demand mixing at OEM lines

- 4.3 Market Restraints

- 4.3.1 Feed-stock price volatility

- 4.3.2 Tightening REACH and PFAS restrictions

- 4.3.3 Energy-price driven curing-oven OPEX spikes

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Other Resin Type

- 5.2 By Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.2.3 Powder

- 5.3 By Layer

- 5.3.1 E-coat

- 5.3.2 Primer

- 5.3.3 Basecoat

- 5.3.4 Clearcoat

- 5.4 By Application

- 5.4.1 Automotive OEM

- 5.4.2 Automotive Refinish

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 NORDIC Countries

- 5.5.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems

- 6.4.3 BASF SE (Carlyle Group)

- 6.4.4 Beckers Group

- 6.4.5 Brila Coatings

- 6.4.6 Jotun

- 6.4.7 Kansai Paints Co., Ltd.

- 6.4.8 Nippon Paint Holdings

- 6.4.9 PPG Industries Inc.

- 6.4.10 RPM International Inc.

- 6.4.11 Sika AG

- 6.4.12 Teknos Group

- 6.4.13 The Sherwin-Williams Company

- 6.4.14 TIGER Coatings GmbH & Co. KG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment