|

市场调查报告书

商品编码

1910904

北美货柜型资料中心市场:市场占有率分析、产业趋势与统计及成长预测(2026-2031 年)North America Containerized Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

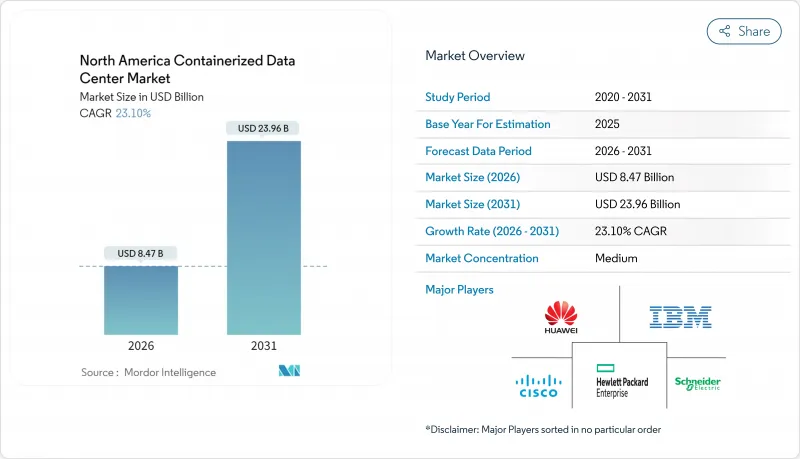

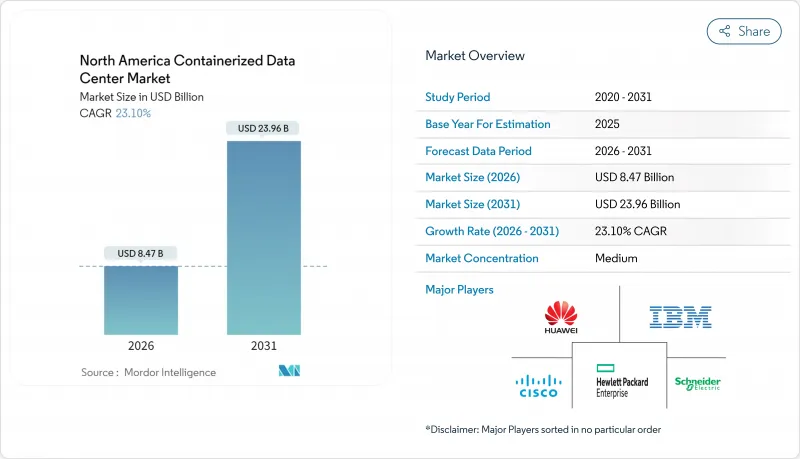

预计到 2025 年,北美货柜型资料中心市场价值将达到 68.8 亿美元,到 2026 年将成长至 84.7 亿美元,到 2031 年将成长至 239.6 亿美元,在预测期(2026-2031 年)内复合年增长率为 23.10%。

5G 的推出和人工智慧工作负载的激增正在加速企业采用 5G 技术,因为企业需要将运算资源部署得更靠近使用者。

面对电网限制,超大规模资料中心业者正在对其设施进行改造,采用模组化单元,这些单元可在 12-14 週内运作,而传统建设方式则需要 18-24 个月。相关的宏观因素包括:试验计画将小型模组化反应器与预製舱结合,以提高离网运作的可靠性;以及国防领域对战场人工智慧能力日益增长的需求。随着机架密度超过 40kW,掌握液冷技术和预製电源模组的供应商有望抓住下一波成长。

北美货柜型资料中心市场趋势与洞察

快速部署和扩充性的需求

随着数位转型週期的缩短,企业优先考虑可在 12 至 14 週内部署的解决方案,远比新建资料中心所需的时间短得多。 IBM 的可携式模组化资料中心展示了承包机柜如何满足偏远内陆地区(施工人员和审批流程往往是瓶颈)的扩展需求。电信业者在网路边缘也采用了类似的策略,使用标准化模组建构区域 5G 枢纽,从而避免因长期租赁而占用大量资金。伊顿等供应商正在销售具有整合电源和行内冷却的预製机架,从而缩短中端市场买家的安装週期。这种速度优势对于需要满足人工智慧推理需求不可预测激增的云端服务供应商同样至关重要。总而言之,快速部署的趋势正在放大先发优势,并取代速度较慢、更为传统的建设方案。

节能型资料中心的需求日益增长

到2024年,冷却将占美国资料中心电力消耗量的约40%,这将导致营运成本上升,并引发对永续性的更多关注。货柜式架构透过整合紧密耦合的气流路径和工厂预装的直接作用于晶片表面的液冷系统,减轻了这一负担。微软在模组化机柜中试点应用了直接作用于晶片的冷却迴路,与传统设施相比,实现了更高的机架密度和更低的PUE指标。分散式部署使营运商能够将资料中心单元部署在再生能源来源附近,从而降低碳排放强度。 GE Vernova的RESTORE直流模组电池系统符合相同的ISO标准,可实现混合储能,以缓解可再生能源的波动性。不断上涨的电费和日益严格的ESG(环境、社会和治理)要求正在推动对设计中就具备高效性的模组化平台的需求。

机架密度及GPU工作负载有限

生成式人工智慧训练丛集通常每个机架需要 40-60kW 的功率,但许多容器化设计却被限制在 30kW 左右。戴尔科技已获得 2025 年第一季价值 121 亿美元的人工智慧伺服器订单,凸显了远超过当前模组化规格的高运算需求。需要连续 GPU 架构的客户仍然倾向于选择配备冷却风道和母线槽的专用设施来处理高密度负载。 NVIDIA 的 Blackwell 平台基于液冷技术,其散热能力超出了现有 ISO 标准外壳的承载能力,且无需重新设计,这进一步加剧了这一限制。因此,预计企业将在未来两年内平衡模组化部署的整体速度,将资源分配到用于边缘推理的快速部署模组和用于模型训练的集中式设施之间。

细分市场分析

由于其卓越的运算密度和与国际运输物流的兼容性,40英尺ISO标准货柜预计在2025年将保持51.45%的市场份额。其主导地位反映了超超大规模资料中心业者资料中心和大型企业核心资料中心转型升级的趋势。同时,随着通讯业者在基地台园区和都市区屋顶等空间受限的场所部署微型边缘节点,预计到2031年,20英尺ISO标准的替代方案将以19.12%的复合年增长率增长。随着通讯业者竞相提高5G覆盖密度,20英尺货柜型资料中心市场预计将快速扩张。较小的面积降低了场地准备成本,简化了审批流程,使通讯业者能够快速实现服务差异化。此外,40英尺以上的客製化机壳主要面向政府和能源计划,这些项目需要高功率电源和射频屏蔽,但运输限制阻碍了其普及。

需求两极化的趋势日益明显:大型 ISO 标准满足云端服务供应商不断增长的核心到边缘运算需求,而超紧凑型机箱则支援零售、製造和智慧城市部署中的即时数据管道。日立系统于 2025 年 5 月对其产品线进行了更新,推出了三个标准 SKU,分别涵盖人工智慧推理、伺服器机房替代和通讯边缘应用场景。这表明供应商已经意识到「一刀切」的时代已经结束。Delta在 CEATEC 展会上展出的 20 英尺机壳整合了 800G 乙太网路和 1.5MW 液冷技术,证明在更紧凑的空间内也能实现高性能。因此,性价比将取决于供应商如何在符合 ISO 标准的前提下,有效地封装高密度计算资源。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速部署和扩充性的需求

- 节能型资料中心的需求日益增长

- 边缘运算和5G流量爆炸

- 超大规模资料中心业者在电力限制下增加容量

- 将小型模组化反应器整合到容器中

- 用于战场和灾难救援的移动式人工智慧舱

- 市场限制

- 机架密度有限与GPU工作负载挑战

- 紧凑外形规格中的温度控管挑战

- 城市规划法规/消防安全标准对层压模组的阻碍

- 预製电力模组供应链瓶颈

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按容器尺寸

- 20英尺 ISO

- 40英尺 ISO

- 超过 40 英尺的定制

- 透过配置模组

- IT模组

- 电源

- 冷却模组

- 监控和管理模组

- 按最终用户行业划分

- 资讯科技/通讯

- BFSI

- 政府/国防

- 医学与生命科学

- 能源与公共产业

- 其他最终用户

- 按地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争情势

- 市占率分析

- 公司简介

- Hewlett Packard Enterprise

- IBM Corporation

- Dell Technologies

- Cisco Systems

- Huawei Technologies

- Schneider Electric(SE+AST Modular)

- Vertiv Group

- Rittal GmbH & Co. KG

- Eaton Corporation

- Delta Electronics

- CommScope

- BMarko Structures

- PCX Corporation

- Compass Quantum

- Vapor IO

- EdgeMicro

- Cannon Technologies

- BladeRoom Group

- ZTE Corporation

- Colt Data Centre Services

- Kstar

- Eltek

- Zella DC

- Stack Infrastructure

第七章 市场机会与未来展望

The North America containerized data center market was valued at USD 6.88 billion in 2025 and estimated to grow from USD 8.47 billion in 2026 to reach USD 23.96 billion by 2031, at a CAGR of 23.10% during the forecast period (2026-2031).

Accelerated uptake comes from enterprises that must position computing resources closer to users as 5G rollouts and artificial intelligence workloads surge.

Hyperscalers facing power-grid constraints are supplementing their brick-and-mortar footprints with modular units that can be commissioned in 12-14 weeks instead of the 18-24 months typical of conventional builds. Allied macro factors include pilot programs that pair small modular reactors with prefabricated pods to achieve off-grid resilience, as well as rising defense demand for battlefield AI capability. Vendors that master liquid cooling and prefabricated power modules are positioned to capture the next wave of growth as rack densities push past 40 kW.

North America Containerized Data Center Market Trends and Insights

Need for rapid deployment and scalability

Enterprises confronted by compressed digital-transformation timelines are prioritizing solutions that can be deployed in 12-14 weeks, well inside the window required for green-field facilities. IBM's Portable Modular Data Center illustrates how turnkey enclosures satisfy remote or land-locked expansion scenarios where construction crews and permits create bottlenecks Telecommunications carriers employ similar logic at the network edge, using standardized pods to seed regional 5G hubs without tying up capital in long-term leases. Suppliers such as Eaton now sell off-the-shelf racks with integrated power and in-row cooling, shortening installation cycles for mid-market buyers. The speed advantage is equally important to cloud providers that need to address unpredictable spikes in AI inference demand. Taken together, the rapid-deployment driver amplifies first-mover advantages and displaces slower, stick-built alternatives.

Rising demand for energy-efficient data centers

Cooling consumed close to 40% of U.S. data center electricity in 2024, resulting in elevated operating expenses and sustainability scrutiny. Containerized architectures mitigate the load by integrating tightly coupled airflow channels and factory-installed liquid cooling that reaches chip surfaces directly. Microsoft has piloted direct-to-chip coolant loops inside modular enclosures, achieving higher rack densities at lower PUE metrics than legacy halls . Distributed footprints also allow operators to drop pods alongside renewable sources, improving carbon-intensity scores. GE Vernova's RESTORE DC Block battery system is delivered in the same ISO form factor, enabling hybrid energy storage that smooths renewable intermittency. Rising electricity tariffs and ESG mandates therefore push buyers toward modular platforms that embed efficiency by design.

Limited rack density vs GPU workloads

Generative AI training clusters often demand 40-60 kW per rack, yet many containerized designs cap out at roughly 30 kW. Dell Technologies booked USD 12.1 billion in AI-server orders in Q1 2025, highlighting compute appetites that overshoot current modular envelopes Customers that need contiguous GPU fabrics still gravitate toward purpose-built halls where cooling plenums and busways handle dense loads. Nvidia's Blackwell platform compounds the constraint by specifying liquid-cooling baselines that exceed what most ISO shells can accommodate without redesign. Enterprises therefore split estates between quick-turn pods for edge inference and centralized facilities for model training, moderating overall modular uptake during the next two years.

Other drivers and restraints analyzed in the detailed report include:

- Edge computing and 5G traffic explosion

- Hyperscale capacity additions amid power constraints

- Thermal management challenges in compact form factor

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 40-foot ISO format retained 51.45% of 2025 revenue owing to superior compute density and compatibility with global shipping logistics. Its dominance reflects the core data center conversion trend among hyperscalers and large enterprises. The 20-foot ISO alternative, however, is forecast to register a 19.12% CAGR through 2031 as operators push micro-edge nodes into space-constrained sites such as cell-tower grounds and urban rooftops. The containerized data center market size for 20-foot units is projected to climb sharply as telecoms race to densify 5G coverage. Smaller footprints lower site-prep costs and simplify permitting, giving carriers a fast path to service differentiation. Conversely, custom enclosures exceeding 40 feet cater to government and energy projects where oversized power gear or RF shielding is mandatory, though transport limitations hinder mainstream adoption.

Demand bifurcation is becoming clearer: large ISO formats satisfy core-to-edge spillover for cloud providers, while ultra-compact pods serve real-time data pipelines in retail, manufacturing and smart-city rollouts. Hitachi Systems refreshed its range in May 2025 with three standard SKUs, each covering AI inference, server-room replacement and telco edge use cases, signaling vendor acknowledgment that one size no longer fits all. Delta's 20-foot design shown at CEATEC integrates 800 G Ethernet and 1.5 MW of liquid cooling, proving high performance is achievable even in tighter volumes. Price-performance ratios therefore hinge on how deftly suppliers package dense compute while adhering to ISO standards.

The North America Containerized Data Center Market Report is Segmented by Container Size (20-Foot ISO, 40-Foot ISO, Greater Than 40-Foot Custom), Component Module (IT Module, Power Module, Cooling Module, Monitoring and Management Module), End-User Industry (IT and Telecommunications, BFSI, Government and Defense, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Hewlett Packard Enterprise

- IBM Corporation

- Dell Technologies

- Cisco Systems

- Huawei Technologies

- Schneider Electric (SE + AST Modular)

- Vertiv Group

- Rittal GmbH & Co. KG

- Eaton Corporation

- Delta Electronics

- CommScope

- BMarko Structures

- PCX Corporation

- Compass Quantum

- Vapor IO

- EdgeMicro

- Cannon Technologies

- BladeRoom Group

- ZTE Corporation

- Colt Data Centre Services

- Kstar

- Eltek

- Zella DC

- Stack Infrastructure

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need for rapid deployment and scalability

- 4.2.2 Rising demand for energy-efficient data centers

- 4.2.3 Edge computing and 5G traffic explosion

- 4.2.4 Hyperscaler capacity additions amid power constraints

- 4.2.5 Integration of small modular reactors with containers

- 4.2.6 Battlefield and disaster-relief mobile AI pods

- 4.3 Market Restraints

- 4.3.1 Limited rack density vs GPU workloads

- 4.3.2 Thermal management challenges in compact form factor

- 4.3.3 Urban zoning / fire-code hurdles for stacked modules

- 4.3.4 Prefab power-module supply-chain bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE and GROWTH FORECASTS

- 5.1 By Container Size

- 5.1.1 20-foot ISO

- 5.1.2 40-foot ISO

- 5.1.3 greater than 40-foot Custom

- 5.2 By Component Module

- 5.2.1 IT Module

- 5.2.2 Power Module

- 5.2.3 Cooling Module

- 5.2.4 Monitoring and Management Module

- 5.3 By End-user Industry

- 5.3.1 IT and Telecommunications

- 5.3.2 BFSI

- 5.3.3 Government and Defense

- 5.3.4 Healthcare and Life Sciences

- 5.3.5 Energy and Utilities

- 5.3.6 Other End Users

- 5.4 By Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.2.1 Hewlett Packard Enterprise

- 6.2.2 IBM Corporation

- 6.2.3 Dell Technologies

- 6.2.4 Cisco Systems

- 6.2.5 Huawei Technologies

- 6.2.6 Schneider Electric (SE + AST Modular)

- 6.2.7 Vertiv Group

- 6.2.8 Rittal GmbH & Co. KG

- 6.2.9 Eaton Corporation

- 6.2.10 Delta Electronics

- 6.2.11 CommScope

- 6.2.12 BMarko Structures

- 6.2.13 PCX Corporation

- 6.2.14 Compass Quantum

- 6.2.15 Vapor IO

- 6.2.16 EdgeMicro

- 6.2.17 Cannon Technologies

- 6.2.18 BladeRoom Group

- 6.2.19 ZTE Corporation

- 6.2.20 Colt Data Centre Services

- 6.2.21 Kstar

- 6.2.22 Eltek

- 6.2.23 Zella DC

- 6.2.24 Stack Infrastructure

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment