|

市场调查报告书

商品编码

1910909

印度自动化物料输送(AMH)市场:市场占有率分析、产业趋势、统计数据和成长预测(2026-2031)India Automated Material Handling (AMH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

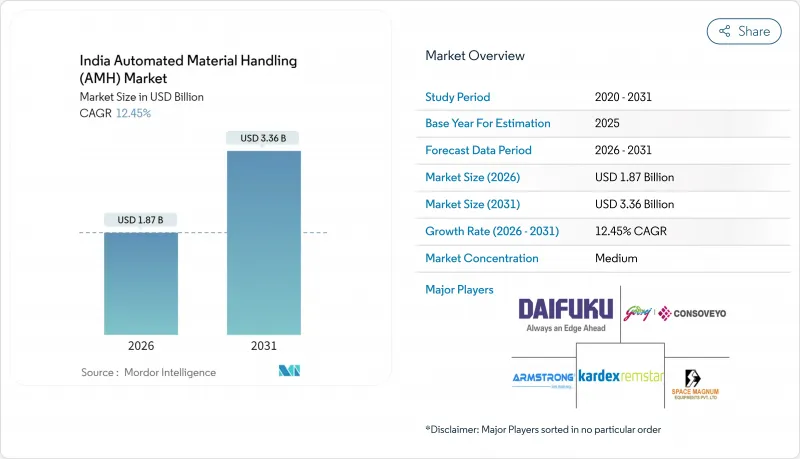

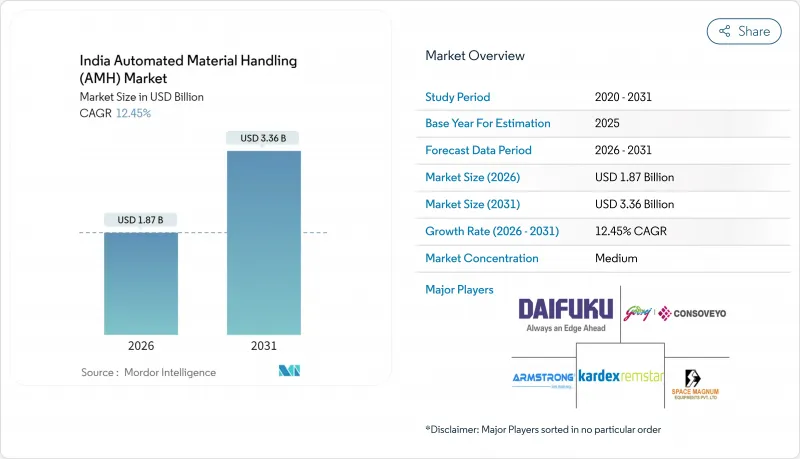

印度自动化物料输送(AMH)市场规模预计到 2026 年将达到 18.7 亿美元,高于 2025 年的 16.6 亿美元。

预计到 2031 年将达到 33.6 亿美元,2026 年至 2031 年的复合年增长率为 12.45%。

电子商务履约中心正在推动需求成长,零售商纷纷扩大仓储面积以兑现当日送达的承诺。政府的生产连结奖励计画计画正引导工厂资本转向整合自动化,以提升出口竞争力;同时,5G专用网路的部署实现了AGV和AMR平台之间的即时车辆协调。随着越来越多的企业寻求能够应对季节性需求波动的可扩充性解决方案,单元货载标准化正变得越来越普遍。劳动成本的上涨,尤其是在大都会圈,正在缩短自动化投资的回收期,并推动向灵活的模组化架构转变,以适应新建和现有场所的需求。

印度自动化物料输送(AMH)市场趋势与洞察

电子商务履约的成长正在加速仓库自动化进程。

随着线上零售商为履行快速配送承诺而不断扩大仓储能力,到2024年,仓储面积将达到5.331亿平方英尺。向二、三线城市的扩张推动了对模组化系统的需求,这些系统无需大规模建设即可部署在小规模的设施中。快速电商业者正在采用高速分类机和机器人拣选来处理传统传送带无法处理的混合SKU订单。随着营运商将速度置于密度之上,以储存为中心的设计正在被以容量为先的布局所取代。这些变化促使人们需要能够实现自动化储存/零售系统(AS/RS)、自主移动机器人(AMR)和机器人拣选站之间即时协调的编配。

政府与生产连结奖励计画鼓励对工厂自动化进行投资

参与生产者责任投资计画 (PLI) 的製造商必须达到产量标准,这使得自动化成为一项实际要求,而非可选项。在电子和汽车产业丛集中,目前正在实施自动化立体仓库 (AS/RS) 和堆迭机器人的组合,以确保品质和产量。工业园区内的共用基础设施降低了单一站点的资本支出,从而鼓励中小企业参与。该计划以出口为导向,要求流程可追溯且正常运行时间达到世界一流运转率,这促使参与企业过渡到嵌入其仓库管理系统 (WMS) 和仓库控制系统 (WCS) 层的预测性维护模组。能够提供设备、软体和全生命週期服务的供应商将最有利于把握这项政策机会。

中小企业面临初始资本投入高、投资回收期长的问题。

一套完整的仓库自动化系统成本在 50 万美元到 200 万美元之间,给许多中小企业的财务状况带来了压力。传统金融机构难以评估机器人技术带来的信用风险,导致贷款核准延迟和抵押品要求增加。机器人即服务 (RaaS) 合约和订阅模式正在逐步填补这一空白,但普及率仍然很低。 Unbox Robotics 已筹集 1,410 万美元,用于开发一个可分阶段部署的模组化平台,从而确保中小企业能够负担得起初始价格。银行和金融科技公司提供的更多能够保证基于绩效的还款的专业金融产品,将是提高普及率的关键。

细分市场分析

在印度自动化物料输送市场,自动化仓储系统(AS/RS)市场规模预计到2025年将达到5.61亿美元,占市场份额的33.78%。这主要得益于大规模物料输送和生产关联投资(PLI)支持的工厂对高密度储存的需求,以期节省占地面积。此外,医药低温运输业者对可追溯库存管理的需求也不断增长。儘管基数较小,但由于感测器成本的下降和车队管理软体的日趋成熟,自动导引车(AGV)和自主移动机器人(AMR)平台仍以14.10%的复合年增长率持续成长。

第二代AGV/AMR设计无需固定导轨即可完成货架重新定位、单元货载牵引以及夹层作业。其与现有设施的兼容性是一大优势,因为安装几乎无需结构改造,使其成为中小企业的首选部署方式。系统整合商正在将AGV车队与基于云端的WMS仪錶板捆绑销售,这些仪錶板可提供机器人运转率和电池状态的即时热力图。随着5G在工业走廊的部署不断推进,零延迟连接将进一步缩短週期时间,从而扩大移动机器人的潜在市场。

据估计,到2025年,印度仓储市场规模将达到6.24亿美元,占印度自动化物料输送市场总额的37.62%。从汽车到电子等各行各业都依赖高密度货架系统结合穿梭车来显着减少拣货错误。可滑入现有托盘货架之间的改装自动化立体仓库(AS/RS)模组,正受到希望逐步实现营运自动化的中型经销商的订单,订单量激增。

拣货和分类业务累计了约4.05亿美元的收入,展现出最高的成长潜力,预计到2031年复合年增长率将达到14.52%。快消业者正在部署人工智慧驱动的机械臂,这些机械手臂在处理完塑胶袋包装的服装后,即可立即处理精緻的化妆品。先进的机器视觉技术使每个机械手臂无需重新训练即可识别数千个SKU,从而缩短了闪购期间的换货时间。位于边缘的推理引擎确保延迟低于100毫秒,使机器人能够在保持与人类拣货速度相当的同时,提高拣货精度。

印度自动化物料输送市场报告按解决方案类型(自动化输送机、自动化立体仓库、自动导引车/自主移动机器人、码垛分拣系统、仓库管理系统/仓库控制系统、机器人拣选系统)、功能(存储、运输等)、终端用户行业(机场、製造业、零售和电子商务等)、负载类型(单元负载、散装负载)和地区进行细分。市场预测以美元以金额为准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务履约的成长加速了仓库自动化进程。

- 政府的生产连结奖励计画计划(PLI)促进了对工厂自动化的投资

- 主要都市区物流中心工资上涨和劳动力短缺

- 药品低温运输配送需要温控自动化仓库

- 永续性的迫切需求推动了节能型自主移动房屋系统的普及。

- 部署5G专用网路可实现对AGV车队的即时控制。

- 市场限制

- 中小企业面临初始资本投入高、投资回收期长的问题。

- 现有设施布局限制了维修的可行性

- 互联AMH资产面临的网路安全风险增加

- 由于电网可靠性缺口导致的系统停机

- 产业价值链分析

- 宏观经济因素的影响

- 技术展望

- 监管环境

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按解决方案类型

- 自动化输送机

- 自动化仓库系统(AS/RS)

- 自动导引车和自主移动机器人(AGV/AMR)

- 堆垛机和分类系统

- 仓库管理系统和仓库控制软体(WMS/WCS)

- 机器人拣选系统

- 按功能

- 贮存

- 运输

- 拣货和分类

- 移动

- 包装和托盘堆垛

- 按最终用户行业划分

- 飞机场

- 製造业

- 零售、电子商务仓库与物流中心

- 食品/饮料

- 製药和医疗保健

- 其他终端用户产业

- 按道路类型

- 单元货载

- 散装货物

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Daifuku India Private Limited

- Godrej Consoveyo Logistics Automation Limited

- Kardex India Storage Solutions Private Limited

- GreyOrange Pte. Ltd.

- Addverb Technologies Limited

- Armstrong Dematic Private Limited

- Bastian Solutions India Private Limited

- Falcon Autotech Private Limited

- Space Magnum Equipment Private Limited

- The Hi-Tech Robotic Systemz Limited

- Hinditron Group of Companies

- Murata Machinery India Private Limited

- Schaefer Systems International Private Limited

- Honeywell Intelligrated India Private Limited

- SSI Schaefer Automation India Private Limited

- Interroll Automation India Private Limited

- Knapp India Automation Private Limited

- Vanderlande Industries India Private Limited

- Beumer Group India Private Limited

- Cleveron India Private Limited

第七章 市场机会与未来展望

The India automated material handling market size in 2026 is estimated at USD 1.87 billion, growing from 2025 value of USD 1.66 billion with 2031 projections showing USD 3.36 billion, growing at 12.45% CAGR over 2026-2031.

E-commerce fulfilment centers are setting the demand pace, with retailers enlarging warehousing footprints to keep up with same-day delivery promises. Government Production Linked Incentive programs are steering factory capital toward integrated automation to boost export competitiveness, while the deployment of 5G private networks is unlocking real-time fleet coordination for AGV and AMR platforms. Unit-load standardization is gaining ground as companies seek scalable solutions that can flex with seasonal demand swings. Rising urban wage costs, especially in Tier-1 cities, are compressing payback periods for automation investments and nudging firms toward flexible, modular architectures that fit both greenfield and brownfield sites.

India Automated Material Handling (AMH) Market Trends and Insights

E-commerce Fulfilment Expansion Accelerating Warehouse Automation

Warehouse footprints reached 533.1 million ft2 in 2024 as online retailers scaled capacity to meet rapid delivery promises. The move into Tier-2 and Tier-3 cities is pushing demand for modular systems that can drop into smaller facilities without lengthy buildouts. Quick-commerce players are adopting high-speed sorters and robotic picking to handle mixed-SKU orders that conventional conveyors cannot manage. Throughput-first layouts are displacing storage-heavy designs as operators favour velocity over density. These shifts reinforce the need for orchestration software that can harmonize AS/RS, AMRs, and robotic pick stations in real time.

Government Production Linked Incentive Scheme Catalysing Factory Automation Investments

PLI-backed manufacturers must meet output thresholds that make automation a practical necessity rather than a discretionary upgrade. Electronics and automotive clusters are layering AS/RS with palletizing robots to secure quality and throughput. Shared infrastructure inside industrial parks lowers per-site capex, encouraging smaller firms to participate. The program's export-orientation demands traceable processes and world-class uptime, nudging adopters toward predictive-maintenance modules baked into WMS and WCS layers. Vendors able to bundle equipment, software, and lifecycle services are best placed to ride this policy tailwind.

High Upfront Capex and Long ROI Cycles for SMEs

Comprehensive warehouse automation can cost USD 500,000-2 million, levels that stretch most SME balance sheets. Traditional lenders still struggle to evaluate robotics credit risk, delaying loan approvals and upping collateral requirements. Robotics-as-a-Service contracts and subscription models are beginning to bridge this gap, but adoption remains low. Unbox Robotics has raised USD 14.1 million to develop modular platforms that deploy in phases, trimming first-phase pricing to levels SMEs can digest. Wider uptake hinges on more tailored financing products from banks and fintech capable of underwriting performance-based payback.

Other drivers and restraints analyzed in the detailed report include:

- Rising Urban Wage Costs and Labor Scarcity in Tier-1 Logistics Hubs

- Cold-Chain Pharma Distribution Demanding Temperature-Controlled Automated Storage

- Legacy Brown-Field Layouts Limiting Retrofit Feasibility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The India automated material handling market size for AS/RS reached USD 561 million in 2025, translating to a 33.78% India automated material handling market share, as large multinationals and PLI-funded factories bank on high-density storage to reclaim floor space. Demand also stems from pharmaceutical cold-chain operators who need validated environments with traceable inventory retrieval. AGV and AMR platforms, while holding a smaller base, are advancing at a 14.10% CAGR, thanks to decreasing sensor costs and maturing fleet-management software.

Second-generation AGV/AMR designs can reposition shelving, tow unit loads, and serve mezzanine levels without fixed guidance infrastructure. Brownfield friendliness is the key appeal; installations rarely require structural changes, making them a preferred entry point for SMEs. System integrators are bundling AGV fleets with cloud-hosted WMS dashboards that deliver real-time heat maps of robot utilization and battery health. As 5G rollouts progress across industrial corridors, latency-free coordination will further reduce cycle times and widen the addressable market for mobile robots.

Storage accounted for USD 624 million in 2025, representing a 37.62% the India automated material handling market share. Verticals ranging from automotive to electronics depend on dense racking systems paired with shuttles that slash retrieval errors. Retrofit AS/RS modules that slide between existing pallet racks are seeing brisk orders among mid-sized distributors seeking gradual automation.

The picking and sorting function posted revenue of roughly USD 405 million yet shows the strongest runway, forecast at a 14.52% CAGR to 2031. Quick-commerce players are deploying AI-driven robotic arms that handle polybagged apparel one minute and fragile cosmetics the next. Machine-vision upgrades allow each arm to recognize thousands of SKUs without re-teaching, cutting changeover time during flash sales. Edge-deployed inference engines ensure latency stays below 100 milliseconds, enabling robots to match human pick rates while improving accuracy.

The India Automated Material Handling Report is Segmented by Solution Type (Automated Conveyor, AS/RS, AGV/AMR, Palletiser and Sortation Systems, WMS/WCS, and Robotic Picking Systems), Function (Storage, Transportation, and More), End-User Industry (Airports, Manufacturing, Retail and E-Commerce, and More), Load Type (Unit Load, and Bulk Load), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Daifuku India Private Limited

- Godrej Consoveyo Logistics Automation Limited

- Kardex India Storage Solutions Private Limited

- GreyOrange Pte. Ltd.

- Addverb Technologies Limited

- Armstrong Dematic Private Limited

- Bastian Solutions India Private Limited

- Falcon Autotech Private Limited

- Space Magnum Equipment Private Limited

- The Hi-Tech Robotic Systemz Limited

- Hinditron Group of Companies

- Murata Machinery India Private Limited

- Schaefer Systems International Private Limited

- Honeywell Intelligrated India Private Limited

- SSI Schaefer Automation India Private Limited

- Interroll Automation India Private Limited

- Knapp India Automation Private Limited

- Vanderlande Industries India Private Limited

- Beumer Group India Private Limited

- Cleveron India Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce fulfilment expansion accelerating warehouse automation

- 4.2.2 Government Production Linked Incentive (PLI) scheme catalysing factory automation investments

- 4.2.3 Rising urban wage costs and labour scarcity in Tier-1 logistics hubs

- 4.2.4 Cold-chain pharma distribution demanding temperature-controlled automated storage

- 4.2.5 Sustainability mandates driving adoption of energy-efficient AMH systems

- 4.2.6 Roll-out of 5G private networks enabling real-time control of AGV fleets

- 4.3 Market Restraints

- 4.3.1 High upfront capex and long ROI cycles for SMEs

- 4.3.2 Legacy brown-field layouts limiting retrofit feasibility

- 4.3.3 Escalating cybersecurity risks across connected AMH assets

- 4.3.4 Grid reliability gaps causing unplanned system downtime

- 4.4 Industry Value-Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Technological Outlook

- 4.7 Regulatory Landscape

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Automated Conveyor

- 5.1.2 Automated Storage and Retrieval System (AS/RS)

- 5.1.3 Automated Guided Vehicles and Autonomous Mobile Robots (AGV/AMR)

- 5.1.4 Palletiser and Sortation Systems

- 5.1.5 Warehouse Management System and Warehouse Control Software (WMS/WCS)

- 5.1.6 Robotic Picking Systems

- 5.2 By Function

- 5.2.1 Storage

- 5.2.2 Transportation

- 5.2.3 Picking and Sorting

- 5.2.4 Retrieval

- 5.2.5 Packaging and Palletising

- 5.3 By End-User Industry

- 5.3.1 Airports

- 5.3.2 Manufacturing

- 5.3.3 Retail, E-commerce Warehouses and Logistics Centres

- 5.3.4 Food and Beverage

- 5.3.5 Pharmaceuticals and Healthcare

- 5.3.6 Other End-User Industries

- 5.4 By Load Type

- 5.4.1 Unit Load

- 5.4.2 Bulk Load

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Daifuku India Private Limited

- 6.4.2 Godrej Consoveyo Logistics Automation Limited

- 6.4.3 Kardex India Storage Solutions Private Limited

- 6.4.4 GreyOrange Pte. Ltd.

- 6.4.5 Addverb Technologies Limited

- 6.4.6 Armstrong Dematic Private Limited

- 6.4.7 Bastian Solutions India Private Limited

- 6.4.8 Falcon Autotech Private Limited

- 6.4.9 Space Magnum Equipment Private Limited

- 6.4.10 The Hi-Tech Robotic Systemz Limited

- 6.4.11 Hinditron Group of Companies

- 6.4.12 Murata Machinery India Private Limited

- 6.4.13 Schaefer Systems International Private Limited

- 6.4.14 Honeywell Intelligrated India Private Limited

- 6.4.15 SSI Schaefer Automation India Private Limited

- 6.4.16 Interroll Automation India Private Limited

- 6.4.17 Knapp India Automation Private Limited

- 6.4.18 Vanderlande Industries India Private Limited

- 6.4.19 Beumer Group India Private Limited

- 6.4.20 Cleveron India Private Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment