|

市场调查报告书

商品编码

1910911

光纤布拉格光栅(FBG)感测器:市场份额分析、产业趋势与统计、成长预测(2026-2031)Fiber Bragg Grating Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

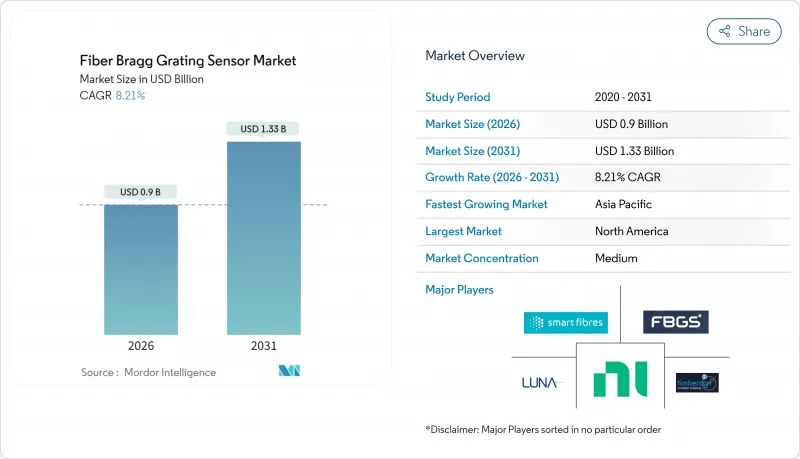

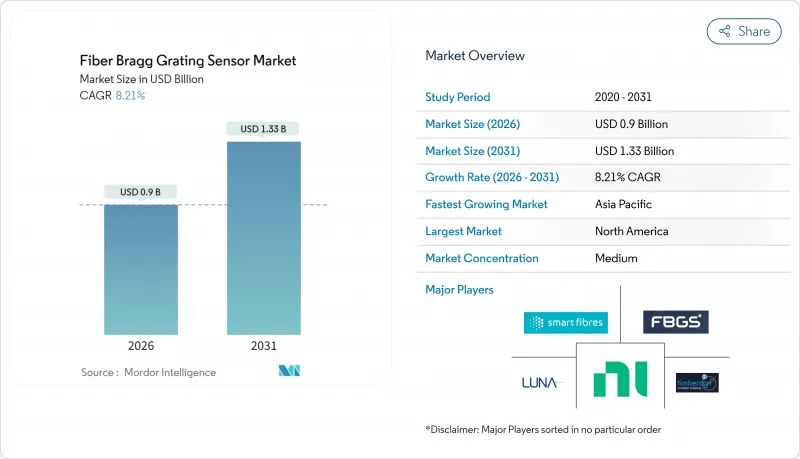

预计光纤布拉格光栅(FBG)感测器市场将从2025年的8.3亿美元成长到2026年的9亿美元,到2031年将达到13.3亿美元,2026年至2031年的复合年增长率为8.21%。

结构健康监测、氢气管道、智慧采矿和5G回程传输基础设施的快速普及支撑着这一稳定成长的趋势。竞争优势主要体现在波长密集型感测器网路、多参数测量能力以及基于人工智慧(AI)的讯号处理。不断增长的基础设施投资、以安全为中心的法规以及传统电传感器的运行局限性,共同推动了光学感测技术的发展。然而,温度和应变之间的交叉敏感性以及较高的初始安装成本,仍然限制了其在价格敏感型部署环境中的短期应用。

全球光纤布拉格光栅(FBG)感测器市场趋势及洞察

对即时结构健康监测的需求日益增长

如今,老旧桥樑、隧道和高层建筑都透过高密度光纤布拉格光栅(FBG)进行持续监测,在结构失效前发现疲劳裂缝和荷载重分布模式。 2024年弗朗西斯·斯科特·基大桥的崩坏加速了美国联邦政府强制要求在繁忙路段进行持续监测的进程。沿着整根梁体进行分散式感测可以产生完整的应变曲线,取代了分散的电感测器,后者往往无法捕捉到早期异常。欧洲类似的法规将公共资金支援的基础设施升级与光学感测技术的部署挂钩,这使得光纤布拉格光栅(FBG)感测器市场在土木工程领域拥有长期稳定的需求。

引入氢气管道网络

欧洲氢能骨干网路计画要求洩漏侦测系统必须不受氢脆影响,并将光纤布拉格光栅(FBG)列为安全标准。双模声学和应变检测技术使操作人员能够同时检测微小洩漏和机械变形,这是电气系统在腐蚀性氢环境中无法实现的。德国H2-Netz为新建输电线路制定的规范已成为可复製的模板,北美和亚太地区的计划也开始效仿,从而扩大了光纤布拉格光栅(FBG)感测器在能源运输基础设施领域的市场份额。

温度和应变之间的相互敏感性

将机械应变与热效应分离仍然需要高成本的双光栅结构和计算补偿,导致航太和能源应用中的测量不确定度达到5-10%。寻求±1%精度的客户被迫采用冗余感测器配置,不仅推高了计划预算,也限制了其在高温度波动环境中的应用。预计在先进的补偿设计具备价格竞争力之前,这项技术挑战将暂时抑制光纤布拉格光栅(FBG)感测器市场的成长。

细分市场分析

到2025年,应变感测器将为光纤布拉格光栅(FBG)感测器市场贡献3.1亿美元(占总收入的37.78%),证实了其在桥樑、飞机机翼和水泥建筑物等众多应用领域的广泛应用。声波感测器虽然绝对值较小,但随着分散式声学感测技术在周界安防和洩漏检测领域的日益普及,其复合年增长率将达到9.12%。应变感测器仍将是大型基础设施计划的基础,而声学系统将作为一种互补技术实现高速成长。

多参数混合技术将应变光栅和温度光栅整合在单一光纤上,从而减少了补偿误差和通道数量。油田服务供应商正越来越多地采用多感测器技术来降低完井的复杂性,这使得光纤布拉格光栅(FBG)感测器的市场拓展到电子压力计无法胜任的井下环境中。

在电信级元件供应和成熟测量硬体的支援下,关键的C波段市场预计到2025年将达到约3.7亿美元的市场规模。网路规模计划正在耗尽可用的C波段频道,推动着向L波段的迁移。 LL波段预计将以9.32%的复合年增长率实现最快增长,随着大型企划需要在单根光纤上实现数百个感测点, L波段光纤布拉格光栅(FBG)感测器市场规模预计将显着扩大。

先进的询问器现在可以同时扫描C波段和L波段,从而实现兼顾组件成本和通道密度的混合架构。研究联盟正在测试用于特定生物医学和水下应用的宽频O波段阵列,但与主流波长相比,其商业化程度仍然有限。

区域分析

北美地区的主导主要来自重大桥樑事故后强制执行的结构监测要求。联邦拨款支持老旧钢拱桥的安装,美国的潜艇船体完整性计划则推动了军方的需求。加拿大极端的气温波动使得光感测器成为易受冰冻负荷影响的偏远输电线路的理想选择。墨西哥汽车工厂部署的光纤阵列减少了计划外停机时间,为当地市场开闢了一个新的工业领域。

亚太地区的蓬勃发展在中国高速铁路的建设中体现得淋漓尽致。中国在多个省份铺设高速铁路,每座高架桥上都安装了数千个格栅,用于侦测旋转滑移和接头位移。日本严格的抗震标准推动了新干线车站的即时监测,而韩国则将感测器整合到5G主干线路中,以精确定位数公尺范围内的光纤断点。印度的智慧城市计画正在资助一个试点项目,该项目利用路肩上的分散式声波感测技术来建构交通监控网络,从而扩大了潜在需求。

在欧洲,人们正在製定标准化法规,以协调氢能、风能和铁路计划,例如在IEC 61757等框架下进行。德国的氢气管道标准现已将声学洩漏检测作为预设选项,而英国皇家地产局则强制要求对固定式和浮体式风电资产进行光学监测。南欧正将重建资金投入到地震带的高速铁路建设中,并强制要求在隧道衬砌上使用光学阵列进行应变测量,这为该地区的光纤布拉格光栅(FBG)感测器市场带来了利好。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对即时结构健康监测的需求日益增长

- 氢气管网部署现状

- 加大智慧采矿作业的投资

- 扩展 5G 光纤回程传输基础设施

- 在高压直流(HVDC)电缆中的应用日益广泛

- 国防部门重视基于状态的飞机维修。

- 市场限制

- 对温度和应变的交叉敏感性

- 与电子仪表相比,初始安装成本较高

- 超快事件中的动态范围限制

- 熟练光纤技术人员短缺

- 产业价值链分析

- 监管环境

- 技术展望

- 宏观经济因素的影响

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 温度感测器

- 应变感测器

- 压力感测器

- 声波感测器

- 其他类型

- 光栅波长范围

- C波段(1530-1565奈米)

- L波段(1565-1625奈米)

- O波段(1260-1360奈米)

- 其他光栅波长范围

- 按最终用户行业划分

- 电讯

- 航太与国防

- 建筑和基础设施

- 能源与电力

- 石油和天然气

- 矿业

- 其他终端用户产业

- 透过使用

- 结构健康监测

- 温度监测

- 振动和声学监测

- 压力监测

- 负载容量和重量监测

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- FBGS International NV

- Smart Fibres Ltd

- Micron Optics Inc-Luna Innovations

- Timbercon Inc

- National Instruments Corporation

- Hottinger Bruel and Kjaer HBM Inc

- Broptics Technology Inc

- ITF Technologies Inc

- Advanced Optics Solutions GmbH

- Technica Optical Components LLC

- Opsens Inc

- TeraXion Inc

- FISO Technologies Inc

- Optromix Inc

- Shenzhen Fibersail Technology Co Ltd

- Neoptix Inc

- Lightwave Logic Inc

- Smart Sensing Solutions GmbH

- Blue Road Research

- Cinogy Technologies GmbH

第七章 市场机会与未来展望

The Fiber Bragg Grating Sensor market is expected to grow from USD 0.83 billion in 2025 to USD 0.9 billion in 2026 and is forecast to reach USD 1.33 billion by 2031 at 8.21% CAGR over 2026-2031.

The surging adoption of structural health monitoring, hydrogen pipelines, smart mining, and 5G backhaul infrastructure underpins this steady trajectory. Competitive differentiation centers on wavelength-dense sensor networks, multi-parameter measurement capabilities, and artificial intelligence-based signal processing. Rising infrastructure investments, safety-centric regulations, and the operational limits of traditional electrical gauges jointly favor optical sensing. Nevertheless, cross-sensitivity between temperature and strain, as well as higher upfront installation costs, continue to moderate near-term adoption in price-sensitive deployments.

Global Fiber Bragg Grating Sensor Market Trends and Insights

Growing Demand for Real-Time Structural Health Monitoring

Aging bridges, tunnels, and high-rise buildings are now monitored continuously with dense arrays of fiber Bragg gratings that reveal fatigue cracks and patterns of load redistribution before structural failure. The 2024 Francis Scott Key Bridge collapse accelerated federal mandates for continuous monitoring on high-traffic corridors in the United States. Distributed sensing along entire girders creates a complete strain profile, replacing scattered electrical gauges that overlook early-stage anomalies. Similar regulations in Europe tie public-funded infrastructure upgrades to the adoption of optical sensing, positioning the Fiber Bragg Grating Sensor market for long-term demand in civil assets.

Adoption in Hydrogen Pipeline Networks

Europe's Hydrogen Backbone initiative requires leak detection systems immune to hydrogen embrittlement, elevating fiber Bragg gratings as a safety standard. Dual-mode acoustic and strain detection enables operators to spot micro-leaks and mechanical deformation simultaneously, a capability that electrical systems cannot deliver in the corrosive hydrogen environment. Germany's H2-Netz specifications for new transmission lines create a replicable template that North American and Asia-Pacific projects are beginning to follow, widening the Fiber Bragg Grating Sensor market footprint in energy transport infrastructure.

Cross-Sensitivity to Temperature and Strain

Separating mechanical strain from thermal effects still necessitates costly dual-grating configurations or computational compensation that introduce 5-10% measurement uncertainty in aerospace and energy applications. Customers seeking +-1% accuracy often resort to redundant sensor schemes, which raises project budgets and hinders adoption in environments with wide thermal swings. This technical hurdle temporarily tempers the expansion of the Fiber Bragg Grating Sensor market until advanced compensation designs become price-competitive.

Other drivers and restraints analyzed in the detailed report include:

- Rising Investments in Smart Mining Operations

- Expansion of 5G Fiber Backhaul Infrastructure

- High Upfront Installation Cost versus Electrical Gauges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Strain sensors contributed USD 0.31 billion to the Fiber Bragg Grating Sensor market in 2025, retaining a 37.78% revenue share, which underscores their ubiquity across bridges, aircraft wings, and concrete structures. Acoustic variants, while smaller in absolute terms, show a 9.12% CAGR as distributed acoustic sensing gains traction in perimeter security and leak detection. Strain devices will continue to anchor flagship infrastructure projects, but acoustic systems provide a high-growth complement.

Multi-parameter hybrids that co-locate strain and temperature gratings on a single fiber are shrinking compensation errors and lowering channel counts. Oilfield service providers are increasingly favoring combined sensors to reduce wellbore completion complexity, thereby broadening the reach of the Fiber Bragg Grating Sensor market across downhole conditions where electronic gauges fail.

The dominant C-Band segment generated nearly USD 0.37 billion in 2025, driven by telecom-grade component availability and proven interrogation hardware. Network-scale projects exhaust available C-Band channels, driving migration to the L-Band, which is posting the fastest 9.32% CAGR. The Fiber Bragg Grating Sensor market size for L-Band devices is forecast to expand significantly as mega-projects demand hundreds of sensing points on a single fiber.

Advanced interrogators now sweep across C- and L-Bands simultaneously, enabling mixed architectures that balance component cost with channel density. Research consortia are testing broader O-Band arrays for niche biomedical and underwater applications, although commercialization remains modest compared to mainstream wavelengths.

The Fiber Bragg Grating Sensor Market Report is Segmented by Type (Temperature Sensor, Strain Sensor, and More), Grating Wavelength Range (C-Band, L-Band, and More), End-User Industry (Telecommunication, Aerospace and Defense, and More), Application (Structural Health Monitoring, Temperature Monitoring, Vibration and Acoustic Monitoring, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

\North American revenue leadership stems from mandated structural monitoring after catastrophic bridge failures. Federal grants subsidize installation on aging steel arches, and the U.S. Navy's submarine hull integrity program extends military demand. Canada's extreme temperature swings make optical sensors a logical choice for remote transmission lines prone to ice loading. Mexico adopts fiber arrays in automotive factories to reduce unplanned downtime, adding a nascent industrial layer to the regional Fiber Bragg Grating Sensor market.

Asia-Pacific's dynamism is evident in China's multi-province high-speed rail rollout, with each viaduct equipped with thousands of gratings to detect rotational slip and joint displacement. Japan's stringent seismic codes drive real-time monitoring on new Shinkansen stations, while Korea integrates sensors into 5G trunk lines to localize fiber cuts within meters. India's smart-city program funds pilot traffic-monitoring grids using distributed acoustic sensing on roadway shoulders, thereby expanding the addressable demand.

Europe benefits from standardized regulations that align hydrogen, wind, and rail projects under frameworks like IEC 61757. Germany's H2-Ready pipeline criteria specify acoustic leak detection by default, and the United Kingdom's Crown Estate requires optical monitoring on fixed and floating wind assets. Southern Europe channels recovery funds into high-speed rail that crosses seismic zones, mandating optical arrays for tunnel liner strain measurement, buttressing the regional Fiber Bragg Grating Sensor market outlook.

- FBGS International NV

- Smart Fibres Ltd

- Micron Optics Inc - Luna Innovations

- Timbercon Inc

- National Instruments Corporation

- Hottinger Bruel and Kjaer HBM Inc

- Broptics Technology Inc

- ITF Technologies Inc

- Advanced Optics Solutions GmbH

- Technica Optical Components LLC

- Opsens Inc

- TeraXion Inc

- FISO Technologies Inc

- Optromix Inc

- Shenzhen Fibersail Technology Co Ltd

- Neoptix Inc

- Lightwave Logic Inc

- Smart Sensing Solutions GmbH

- Blue Road Research

- Cinogy Technologies GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Real-Time Structural Health Monitoring

- 4.2.2 Adoption in Hydrogen Pipeline Networks

- 4.2.3 Rising Investments in Smart Mining Operations

- 4.2.4 Expansion of 5G Fiber Backhaul Infrastructure

- 4.2.5 Increasing Use in High-Voltage Direct Current (HVDC) Cables

- 4.2.6 Defense Focus on Condition-Based Aircraft Maintenance

- 4.3 Market Restraints

- 4.3.1 Cross-Sensitivity to Temperature and Strain

- 4.3.2 High Upfront Installation Cost versus Electrical Gauges

- 4.3.3 Limited Dynamic Range in Ultra-Fast Events

- 4.3.4 Scarcity of Skilled Fiber-Optic Technicians

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Temperature Sensor

- 5.1.2 Strain Sensor

- 5.1.3 Pressure Sensor

- 5.1.4 Acoustic Sensor

- 5.1.5 Other Types

- 5.2 By Grating Wavelength Range

- 5.2.1 C-Band (1530-1565 nm)

- 5.2.2 L-Band (1565-1625 nm)

- 5.2.3 O-Band (1260-1360 nm)

- 5.2.4 Other Grating Wavelength Ranges

- 5.3 By End-User Industry

- 5.3.1 Telecommunication

- 5.3.2 Aerospace and Defense

- 5.3.3 Construction and Infrastructure

- 5.3.4 Energy and Power

- 5.3.5 Oil and Gas

- 5.3.6 Mining

- 5.3.7 Other End-User Industries

- 5.4 By Application

- 5.4.1 Structural Health Monitoring

- 5.4.2 Temperature Monitoring

- 5.4.3 Vibration and Acoustic Monitoring

- 5.4.4 Pressure Monitoring

- 5.4.5 Load and Weight Monitoring

- 5.4.6 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 FBGS International NV

- 6.4.2 Smart Fibres Ltd

- 6.4.3 Micron Optics Inc - Luna Innovations

- 6.4.4 Timbercon Inc

- 6.4.5 National Instruments Corporation

- 6.4.6 Hottinger Bruel and Kjaer HBM Inc

- 6.4.7 Broptics Technology Inc

- 6.4.8 ITF Technologies Inc

- 6.4.9 Advanced Optics Solutions GmbH

- 6.4.10 Technica Optical Components LLC

- 6.4.11 Opsens Inc

- 6.4.12 TeraXion Inc

- 6.4.13 FISO Technologies Inc

- 6.4.14 Optromix Inc

- 6.4.15 Shenzhen Fibersail Technology Co Ltd

- 6.4.16 Neoptix Inc

- 6.4.17 Lightwave Logic Inc

- 6.4.18 Smart Sensing Solutions GmbH

- 6.4.19 Blue Road Research

- 6.4.20 Cinogy Technologies GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment