|

市场调查报告书

商品编码

1910916

欧洲智慧停车市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Europe Smart Parking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

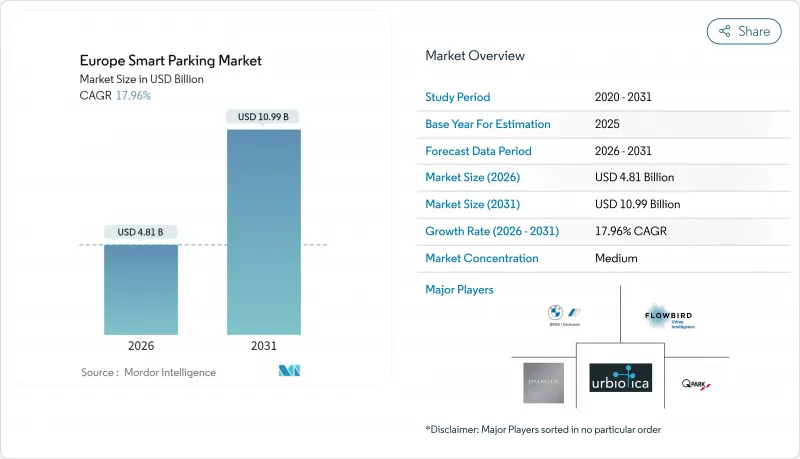

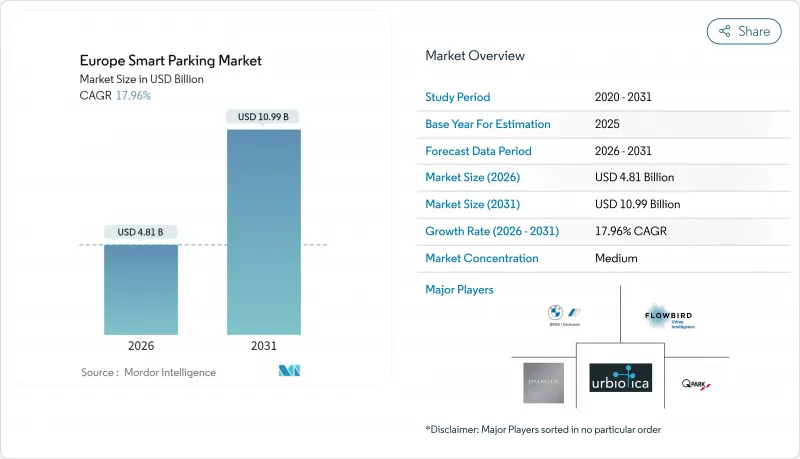

欧洲智慧停车市场预计将从 2025 年的 40.8 亿美元成长到 2026 年的 48.1 亿美元,预计到 2031 年将达到 109.9 亿美元,2026 年至 2031 年的复合年增长率为 17.96%。

即时停车数据强制要求、电动车 (EV) 的快速普及以及企业范围 3 报告要求,正在加速全部区域对智慧停车系统的投资。市政当局的需求集中在能够与现有智慧型运输系统(ITS) 架构整合的扩充性云端平台,而企业则寻求节省空间的解决方案,以完善永续性仪錶板。平台供应商之间的整合和竞争日益加剧,整合化的出行生态系统模糊了停车、充电和票务服务之间的界线。 GDPR 下的隐私纳入设计义务增加了复杂性,但也促使供应商转向更高价值的託管服务和分析解决方案。

欧洲智慧停车市场趋势与洞察

电动车普及导致停车位短缺

电动车强制令正迫使城市对现有停车场进行大规模维修和再利用。 《建筑能源性能指令》要求到2025年每20个停车位配备一个充电桩,到2027年每10个停车位配备一个充电桩,这促使市政当局实施能够在充电和常规使用之间动态切换的系统。像APCOA这样的营运商,透过与丹麦Clever公司的合作,正在将充电硬体整合到现有设施中,并在其站点中添加即时占用率分析功能。动态分配减少了排队现象,定价机制平衡了收入和电动车奖励。随着充电基础设施的扩展,协调电网容量限制和停车尖峰时段需求的演算法面临越来越大的压力。德国和整个斯堪的纳维亚半岛的城市正在将这些以分析为驱动的计划定位为更广泛的智慧交通系统部署的基础用例。

行动支付和停车应用程式的兴起

在荷兰的主要城市,数位支付普及率已超过75%。可互通的行动钱包和车载应用程式降低了执法成本,提高了需求预测的准确性,并为拥塞自适应定价铺平了道路。 BMW的作业系统现已在12个欧洲国家支援停车支付,为用户提供全新的一键式车载支付体验。儘管面临资金筹措不确定性的担忧,英国国家停车平台每月仍记录了覆盖10个城市的超过50万笔交易。该平台的数据被用于机器学习模型,以预测周转率,使营运商能够预先定价并减少收入流失。 GDPR强制执行的隐私保护措施正迫使供应商采用令牌化和边缘处理技术,从而推动了对外包合规专业知识的需求。

感测器和土木工程的初始成本

嵌入式感测器成本高昂,每个感测器在挖掘和铺设路面之前就要花费 250 到 500 美元,这给有限的市政预算带来了沉重负担。捷克共和国帕尔杜比采市安装了 3421 个感测器,使年度停车收入从 2,300 万捷克克朗增加到约 4,000 万捷克克朗,但这笔巨额资本支出也构成了重大障碍。表面安装式设备虽然可以缩短安装时间,但需要更多维护。植入式感测器的使用寿命较长,但计划中会对道路造成损坏 [PARKING.NET]。市政当局通常会将专案分多个财政年度实施,权衡耐用性和预算週期,这减缓了智慧停车在欧洲的推广速度。

细分市场分析

到2025年,传统业者将占据41.02%的收入份额,这主要得益于其基于长期特许经营合约和大规模停车场资产组合的优势。这项基础支撑着欧洲智慧停车市场的规模,但到2031年,P2P平台将以19.79%的复合年增长率蚕食市场成长。 Easypark与Parkbee的合作,使比利时120个停车场无需增加任何实体资产即可实现基于应用程式的租赁服务。作为回应,营运商将其库存资讯白牌连接到该平台,并实施动态收费系统以提高每个停车位的盈利。管理公司作为资产所有者和供应商之间的桥樑,提供维护服务和资料分析的服务等级协定(SLA),而这些服务正越来越多地被市政当局外包。

儘管成长放缓,营运商仍在利用其资产负债表能力为感测器维修和电动车充电桩安装提供资金,以努力维持其在欧洲智慧停车市场的份额。诸如INDIGO收购APCOA比利时公司之类的收购计划,将其本地基地转型为跨国平台,从而能够与汽车製造商直接就SDK整合进行谈判。P2P新兴企业透过预测定价模式释放私人和未充分利用的企业停车位,从而实现差异化竞争,但在人口密集的城市地区,整合路边停车会带来政治风险,并且需要政府核准。

云端平台凭藉其一对多的可扩展性,巩固了软体在欧洲智慧停车市场的地位,预计到2025年将占总收入的44.92%。然而,随着城市将GDPR合规、维护和AI模型调校等工作外包,服务领域的复合年增长率预计将达到20.36%,超过所有其他类别。 JustPark的「洞察-覆盖-优化」套件将报告仪表板与定价演算法相结合,标誌着市场模式正从一次性许可转向持续的託管服务。

由于市政当局采用混合模式,利用监视录影机和众包停车数据,从而推迟全面覆盖感测器,硬体供应商正面临利润压力。 CleverCity 的桅杆式雷达装置可覆盖多达 100 个停车位,降低每个停车位的资本支出,使其更容易被中型城市接受。随着软体向 SaaS 模式发展,预计到本十年末,欧洲智慧停车市场的服务量将与软体收入趋于一致。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动车普及导致停车位短缺

- 行动支付和停车应用程式的兴起

- 欧盟智慧城市资助的旅游即服务(MaaS)试点项目

- 欧盟资料共用义务(修订后的ITS指令)

- 企业范围 3 脱碳目标

- 透过「15分钟城市」计画加速路边改革

- 市场限制

- 初始成本(感测器和土木工程成本)

- 市政采购週期分散

- GDPR 下自动车牌辨识 (ANPR) 分析的局限性

- 减少收费停车位,优先保障电动车在路肩上的行驶。

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业生态系分析

- 案例研究—欧洲重点案例

- 投资分析

第五章 市场规模与成长预测

- 按类型

- 停车场营运商

- 停车场管理公司

- 基础设施提供者(硬体和软体)

- P2P(P2P)停车平台

- 聚合平台/市场

- 透过解决方案

- 硬体

- 软体

- 服务

- 透过技术

- 地下安装/超音波感测器

- 摄影机/电脑视觉和车牌自动辨识(ANPR)

- 物联网连接平台

- 行动应用和数位支付

- 设有电动车充电设施的停车场

- 最终用户

- 地方政府和政府机构

- 商业停车场和购物中心

- 交通枢纽(机场、铁路)

- 企业园区及商务园区

- 住宅和混合用途开发

- 按国家/地区

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 北欧国家

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势与发展

- 市占率分析

- 公司简介

- APCOA Parking Holdings GmbH

- EasyPark Group AB(Arrive Mobility)

- Indigo Group SA

- Q-Park NV

- Flowbird SASU(Parkeon SA)

- Parkopedia Ltd.

- Urbiotica SL

- Cleverciti Systems GmbH

- JustPark Parking Ltd.

- Parclick SL

- ParkBee BV

- RingGo Ltd.

- Telpark(Empark Aparcamientos y Servicios SA)

- Parklio doo

- ParkHub Inc.

- FlashParking, Inc.

- ParkAir Systems AB

- Daimler Mobility

- Parklio doo

- Park+Mobility BV

- Bosch Service Solutions SE(Parking-as-a-Service)

- BMW i Ventures(ParkNow heritage assets)

第七章 市场机会与未来展望

The Europe smart parking market is expected to grow from USD 4.08 billion in 2025 to USD 4.81 billion in 2026 and is forecast to reach USD 10.99 billion by 2031 at 17.96% CAGR over 2026-2031.

Mandates on real-time parking data, rapid EV adoption, and corporate Scope 3 reporting requirements combine to accelerate investment in intelligent parking systems across the region. Municipal demand concentrates on scalable cloud platforms that dovetail with existing ITS architecture, while corporates look for space-saving solutions that feed sustainability dashboards. Consolidation among platform vendors is tightening competitive intensity, and integrated mobility ecosystems are starting to blur the lines between parking, charging, and ticketing services. Privacy-by-design obligations under GDPR add complexity, but they also push suppliers toward higher-value managed services and analytics.

Europe Smart Parking Market Trends and Insights

EV-Driven Parking Space Stress

Electric vehicle mandates force cities to retrofit or repurpose large sections of parking stock. The Energy Performance of Buildings Directive requires one charger per 20 spaces by 2025 and one per 10 by 2027, pushing municipalities to adopt systems that dynamically switch bays between charging and conventional use. Operators such as APCOA, through its partnership with Clever in Denmark, are embedding charging hardware into existing facilities and layering the sites with real-time occupancy analytics. Dynamic allocation eases queuing, while tariff engines balance revenue with EV incentives. As charging infrastructure spreads, pressure grows on algorithms to reconcile grid capacity limits with peak-hour parking demand. German and Nordic cities treat these analytics-centric projects as cornerstone use cases for broader ITS deployments.

Rise of Mobile Payments and Parking Apps

Digital payment penetration has crossed 75% in major Dutch municipalities. Interoperable mobile wallets and in-vehicle apps slash enforcement costs, sharpen demand forecasts, and open the door to congestion-responsive pricing. BMW's operating system now settles parking fees in 12 European countries, resetting user expectations for one-click, car-native transactions. The United Kingdom's National Parking Platform records more than 500,000 monthly transactions across 10 councils even as funding uncertainties loom. Platform data feeds machine-learning models that predict turnover, letting operators pre-price inventory and reduce revenue leakage. Privacy safeguards mandated by GDPR have pushed vendors to implement tokenization and edge processing, increasing demand for outsourced compliance expertise.

Up-Front Sensor and Civil-Works Costs

Embedded sensors range from USD 250 to USD 500 per unit before trenching and resurfacing, placing a heavy load on tight municipal budgets. Pardubice in the Czech Republic laid 3,421 sensors, boosting annual parking revenue from CZK 23 million to almost CZK 40 million yet demonstrating the steep capex hurdle. Surface-mounted devices cut installation time but demand more maintenance; flush-mounted options last longer but disrupt streets during deployment [PARKING.NET]. Cities weigh durability against budget cycles, often phasing projects over several fiscal years, slowing the Europe smart parking market rollout.

Other drivers and restraints analyzed in the detailed report include:

- EU Smart-City Funding for MaaS Pilots

- Corporate Scope-3 Decarbonization Targets

- Fragmented Municipal Procurement Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Traditional operators controlled 41.02% of 2025 revenue, a lead built on long-term concessions and large garage portfolios. This base underpinned the Europe smart parking market size for the segment, though peer-to-peer platforms are eating into growth with a 19.79% CAGR through 2031. EasyPark's link-up with ParkBee opened 120 Belgian garages to app-based rentals without adding physical assets. Operators counter by white-labeling their inventory to platforms and layering dynamic tariffs that raise yield per bay. Management companies sit between asset owners and tech vendors, bundling maintenance and data-analytics SLAs that municipalities increasingly outsource.

Despite slower growth, operators leverage balance-sheet capacity to fund sensor retrofits and EV charger installations, sustaining their hold over the Europe smart parking market share. Acquisition pipelines, exemplified by INDIGO's purchase of APCOA Belgium, convert regional strongholds into multicountry platforms able to negotiate SDK integrations directly with automotive OEMs. Peer-to-peer challengers differentiate through predictive pricing models that unlock driveways and underused corporate lots, but they rely on municipal approval for curbside blending, which can be politically fraught in dense city cores.

Cloud platforms accounted for 44.92% revenue in 2025 thanks to one-to-many scalability, cementing software's rank within the Europe smart parking market. However, services are forecast to outpace all other categories at a 20.36% CAGR as cities outsource GDPR compliance, maintenance, and AI model tuning. JustPark's Insights-Reach-Optimize suite blends reporting dashboards with tariff algorithms, demonstrating the pivot from one-off licenses toward recurring managed services.

Hardware providers confront margin pressure because municipalities can defer full-sensor coverage by adopting hybrid schemes that mix overhead cameras and crowd-sourced occupancy data. Cleverciti's mast-mounted radar units cover up to 100 spaces and cut per-space capex, easing sales into mid-tier cities. As software shifts to SaaS, the Europe smart parking market size for services is expected to converge with software revenue by the decade's end.

The Europe Smart Parking Market Report is Segmented by Type (Parking Operators, Parking Management Companies, Infrastructure Providers, and More), Solution (Hardware, Software, and Services), Technology (In-Ground Sensors, Camera/ANPR, Iot Platforms, Mobile Apps, and EV-Charging Integration), End-User (Municipalities, Commercial Car-Parks, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- APCOA Parking Holdings GmbH

- EasyPark Group AB (Arrive Mobility)

- Indigo Group S.A.

- Q-Park NV

- Flowbird SASU (Parkeon SA)

- Parkopedia Ltd.

- Urbiotica SL

- Cleverciti Systems GmbH

- JustPark Parking Ltd.

- Parclick S.L.

- ParkBee B.V.

- RingGo Ltd.

- Telpark (Empark Aparcamientos y Servicios S.A.)

- Parklio d.o.o.

- ParkHub Inc.

- FlashParking, Inc.

- ParkAir Systems AB

- Daimler Mobility

- Parklio d.o.o.

- Park+ Mobility B.V.

- Bosch Service Solutions SE (Parking-as-a-Service)

- BMW i Ventures (ParkNow heritage assets)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-driven parking space stress

- 4.2.2 Rise of mobile payments and parking apps

- 4.2.3 EU Smart-City funding for MaaS pilots

- 4.2.4 EU data-sharing mandates (ITS-Directive rev.)

- 4.2.5 Corporate scope-3 decarbonisation targets

- 4.2.6 15-Minute-City zoning accelerating curb reforms

- 4.3 Market Restraints

- 4.3.1 Up-front sensor and civil-works costs

- 4.3.2 Fragmented municipal procurement cycles

- 4.3.3 GDPR-driven restrictions on ANPR analytics

- 4.3.4 EV-first kerb allocation shrinking paid bays

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Ecosystem Analysis

- 4.8 Case Studies - Flagship European Deployments

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Parking Operators

- 5.1.2 Parking Management Companies

- 5.1.3 Infrastructure Providers (HW and SW)

- 5.1.4 Peer-to-Peer (P2P) Parking Platforms

- 5.1.5 Aggregators / Marketplaces

- 5.2 By Solution

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Technology

- 5.3.1 In-ground / Ultrasonic Sensors

- 5.3.2 Camera / Computer-Vision and ANPR

- 5.3.3 IoT Connectivity Platforms

- 5.3.4 Mobile Apps and Digital Payments

- 5.3.5 EV-Charging Integrated Parking

- 5.4 By End-User

- 5.4.1 Municipalities and Government

- 5.4.2 Commercial Car-Parks and Malls

- 5.4.3 Transport Hubs (Airports, Rail)

- 5.4.4 Corporate Campuses and Business Parks

- 5.4.5 Residential and Mixed-Use Developments

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 Netherlands

- 5.5.7 Nordics

- 5.5.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 APCOA Parking Holdings GmbH

- 6.4.2 EasyPark Group AB (Arrive Mobility)

- 6.4.3 Indigo Group S.A.

- 6.4.4 Q-Park NV

- 6.4.5 Flowbird SASU (Parkeon SA)

- 6.4.6 Parkopedia Ltd.

- 6.4.7 Urbiotica SL

- 6.4.8 Cleverciti Systems GmbH

- 6.4.9 JustPark Parking Ltd.

- 6.4.10 Parclick S.L.

- 6.4.11 ParkBee B.V.

- 6.4.12 RingGo Ltd.

- 6.4.13 Telpark (Empark Aparcamientos y Servicios S.A.)

- 6.4.14 Parklio d.o.o.

- 6.4.15 ParkHub Inc.

- 6.4.16 FlashParking, Inc.

- 6.4.17 ParkAir Systems AB

- 6.4.18 Daimler Mobility

- 6.4.19 Parklio d.o.o.

- 6.4.20 Park+ Mobility B.V.

- 6.4.21 Bosch Service Solutions SE (Parking-as-a-Service)

- 6.4.22 BMW i Ventures (ParkNow heritage assets)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Opportunity Hotspots (2025-2030)

- 7.3 Strategic Roadmap for Stakeholders