|

市场调查报告书

商品编码

1910919

中东油气管线:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Middle-East Oil And Gas Line Pipe - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

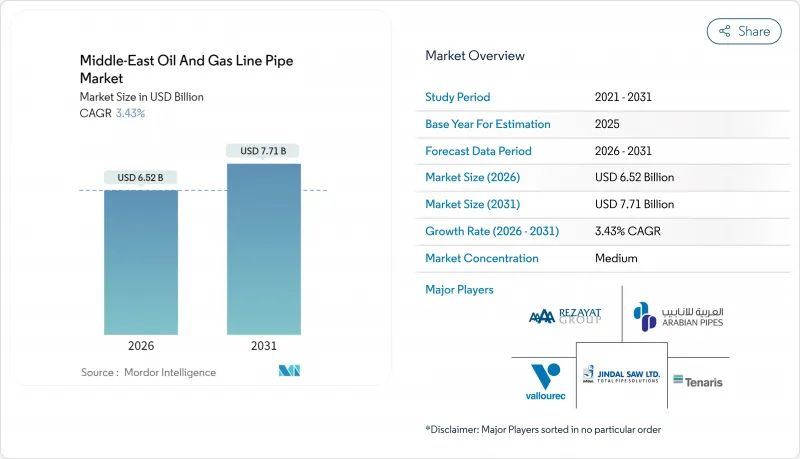

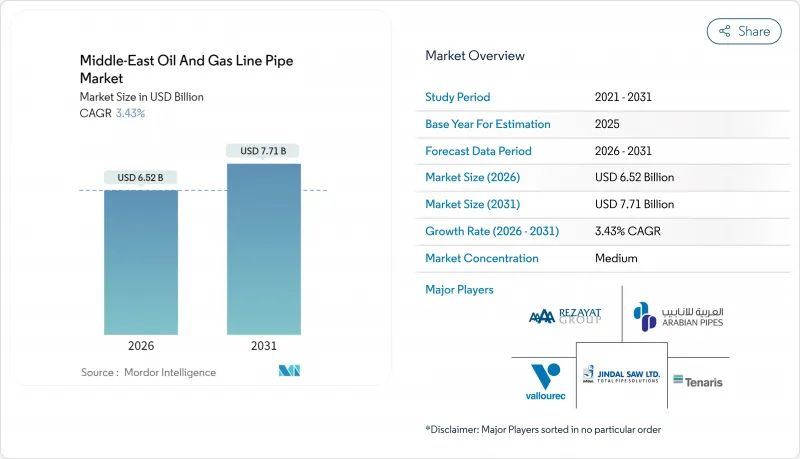

2025年中东油气管线市场价值为63亿美元,预计到2031年将达到77.1亿美元,高于2026年的65.2亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.43%。

强劲的上游天然气业务、跨境干线管道和氢能试点计画是关键的成长引擎,而在地采购要求正推动采购趋势向国内製造商倾斜。对大直径螺旋焊管的需求不断增长,双相不銹钢在酸性气体和氢气环境中的应用日益广泛,以及政府的支出支持,都在增强区域製造商的竞争力。同时,欧盟碳边境调节机制(CBAM)带来的成本压力和突发的油价衝击限制了出口商的近期扩张。伊朗的计划延期和伊拉克部分资金筹措的延迟表明,地缘政治风险仍在持续影响支出趋势。

中东油气管线市场趋势及分析

阿拉伯湾海上天然气田上游投资增加

阿布达比国家石油公司 (ADNOC) 耗资 170 亿美元的哈伊勒和加萨计画需要一条耐腐蚀衬里 (CRA) 管道,能够日输送 15 亿立方英尺高酸性天然气,所有竞标均包含高耐腐蚀性要求。卡达的北田西部计画(预算约 170-180 亿美元)显着增加了对海底管道的需求,因为 EPCI 承包商正在整合高压额定直径 24 英吋及以上的管段。沙乌地阿拉伯的红海海上评估计划旨在到 2030 年将天然气产量提高 60%,该计画倾向于在浅水区使用柔性输油管线,这为复合复合材料替代方案创造了独特的市场机会。海湾地区水深的增加需要直径 24 英吋及以上的管道,推动了焊接 SAW 管道供应量的成长。认证要求也变得更加严格,ISO 14001 现在对在阿联酋和沙乌地阿拉伯油田作业的离岸承包商是强制性的,这实际上提高了资格门槛。

扩建跨国原油出口干管线管

巴士拉-亚喀巴输油管(全长1,200公里,耗资50亿营运成本)于2024年3月获得伊拉克内阁核准,目标日出口量为225万桶。然而,银行製裁使资金筹措复杂化,并可能延长专案实施时间。沙乌地阿拉伯和科威特的合作伙伴正在为多拉气田设计一条联合管道,这表明海上单元化如何促进管道项目的扩展。印度-中东-欧洲经济走廊(IMEC)设想的氢能走廊正在透过引入断裂韧性指标,将材料规格从API 5L X70提升至耐氢钢材。政治敏感的长距离管道线路需要更厚的壁厚和更完善的阴极防蚀,从而增加吨位和价值。

原油价格波动导致EPC合约授予延迟

历史上,中东地区油价下跌与EPC合约授予之间存在12个月的滞后;例如,2014年至2015年间,合约数量在18个月内下降了60%。目前管道EPC合约中的对冲条款规定,如果布兰特原油价格连续90天低于每桶50美元,则成本将增加15%至20%。在伊拉克,由于财政收入短缺,石油部下属的多个管道计划被安排在2026年预算週期内。虽然沙乌地阿拉伯和阿联酋的主权财富基金在一定程度上具有反週期性,但海湾合作委员会(GCC)小规模的国家缺乏类似的缓衝机制,这加剧了计划工期风险。

细分市场分析

2025年,焊接管材在中东油气管线市场占有62.25%的份额,为重视埋弧焊(SAW)成本优势的长距离原油和天然气计划提供了支援。 G5PS公司从沙乌地阿美公司订购的价值1.86亿沙特里亚尔(约5000万美元)的螺旋订单进一步巩固了埋弧焊在关键运输管道中的应用。虽然无缝管材的供应对于高压氢气先导工厂仍然至关重要(在这些装置中,材料完整性比成本更为重要),但其在大宗运输领域的份额正在逐步下降。本地化生产正在提升焊接管材工厂的竞争力,因为运输成本的节省和在地采购的收益超过了进口无缝管材的优势。随着干线管道的不断扩张,预计到2031年,中东油气管线市场中焊接管材的规模将以3.44%的复合年增长率成长。

自动化超音波检测和机器人焊接技术的日益普及提高了品质标准,降低了现场废品率和生命週期成本。为了满足即将开展的大型天然气计划需求,泰纳瑞斯沙特钢管公司于2024年7月将其朱拜勒工厂的LSAW(长埋弧焊钢管)产能翻了一番。将涂层和螺纹加工生产线整合到工厂内部的製造商能够提高产品附加价值,并更好地满足日益加快的交货週期。

由于碳钢在传统油气运输领域具有成本绩效优势,预计到2025年,碳钢将占64.40%的市场份额。然而,由于氢气、蓝氨和超酸性气体的运输需要更优异的耐腐蚀性和抗脆性,双相不銹钢和超级双相不銹钢市场预计将以6.00%的复合年增长率成长。沙乌地基础工业公司(SABIC)年产120万吨蓝氨计划的前期工程设计(FEED)需要一条低温双相不銹钢管道,这使得其采购目标从碳钢转向双相不銹钢。此外,沙乌地阿拉伯的主天然气系统也在向高压气体应用领域转向API 5L X80钢材,这显示市场正朝着更高强度钢材发展。

阿联酋钢铁公司(Emirates Steel Alcan)对超级双相钢熔炼製程的投资表明,区域性钢铁厂正在追求特种钢的利润率。儘管特种合金在中东油气管线市场的份额仍然不大,但它们对利润的贡献却十分显着,能够使钢铁厂免受大宗商品价格波动的影响。

中东油气管线市场报告按类型(无缝管和焊接管)、材质类型(碳钢、合金钢、不銹钢/耐腐蚀合金钢、双相/超级双相钢)、直径类型(小于 12 英寸、12-24 英寸和大于 24 英寸)、应用(运输、地下套管和油管、油气集输、302 英寸和大于 24 英寸)、应用(运输、地下套管和油管、油气集输、安全

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 阿拉伯湾海上天然气田上游投资增加

- 扩建跨国原油出口干管线管

- 对老旧管道网路更换的需求

- 阿布达比国家石油公司和沙乌地阿美氢气就绪管线试点计画

- IKTVA 和 ICV 计划下的在地采购义务

- GTL和蓝氨计划需要低温合金

- 市场限制

- 原油价格波动导致EPC合约延期

- 浅水区过渡到复合柔性管道。

- 制裁引发的伊朗和伊拉克资金筹措限制

- 欧盟碳边境调节机制(CBAM)推高了海湾合作委员会地区钢管出口成本

- 供应链分析

- 监管环境

- 技术展望

- 已安装管道容量分析

- 即将进行的主要计划

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争强度

第五章 市场规模与成长预测

- 按类型

- 无缝的

- 焊接(ERW 和 SAW)

- 材料

- 碳钢

- 合金钢

- 不銹钢/耐腐蚀合金钢

- 双相/超级双相不銹钢

- 依直径

- 小于12英寸

- 12 至 24 英寸

- 24吋或以上

- 透过使用

- 运输(陆上和海上)

- 井下套管和油管

- 石油和天然气聚合

- 水/气注入

- 按地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 科威特

- 阿曼

- 巴林

- 伊拉克

- 伊朗

- 其他中东地区

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、联盟、购电协议)

- 市场占有率分析(主要企业的市场排名/份额)

- 公司简介

- Arabian Pipes Company

- Rezayat Group

- EEW Group

- Sumitomo Corp.

- Vallourec SA

- Abu Dhabi Metal Pipes & Profiles

- Jindal SAW Ltd

- ArcelorMittal SA

- Tenaris SA

- National Pipe Company(NPC)

- TMK Group

- Tata Steel

- ChelPipe Group

- Nippon Steel Corp.

- Welspun Corp.

- Salzgitter AG

- Borusan Mannesmann

- JSW Steel

- SeAH Steel

- Al Jazeera Steel

第七章 市场机会与未来展望

The Middle-East Oil And Gas Line Pipe Market was valued at USD 6.30 billion in 2025 and estimated to grow from USD 6.52 billion in 2026 to reach USD 7.71 billion by 2031, at a CAGR of 3.43% during the forecast period (2026-2031).

Robust upstream gas programs, cross-border trunk lines, and hydrogen-ready pilots are the principal growth engines, while localization mandates tilt procurement in favor of domestic mills. Rising demand for large-diameter spiral-welded pipes, widening use of duplex alloys in sour-gas and hydrogen service, and supportive sovereign spending buffers are strengthening the competitive positions of regional manufacturers. At the same time, cost pressures from the EU Carbon Border Adjustment Mechanism (CBAM) and episodic oil-price shocks temper near-term expansion for exporters. Project deferrals in Iran and selective funding delays in Iraq demonstrate how geopolitical risk continues to impact spending trajectories.

Middle-East Oil And Gas Line Pipe Market Trends and Insights

Rising Upstream Investment in Arabian Gulf Offshore Gas Fields

ADNOC's USD 17 billion Hail & Ghasha program requires CRA-lined lines that can carry 1.5 billion cubic feet per day of ultra-sour gas, inserting premium corrosion-resistant requirements into every bid. Qatar's North Field West, budgeted at about USD 17-18 billion, adds substantial subsea pipe demand as EPCI contractors integrate 24-in-plus spools with elevated pressure ratings. Saudi Arabia's offshore Red Sea appraisals, linked to meeting a 60% gas production growth target by 2030, favor flexible flowlines in shallow waters-a niche opportunity for composite alternatives. Deeper water profiles across the Gulf now mandate diameters of>= 24 inches, shifting volumes toward welded SAW supply. Certification requirements are tightening, with ISO 14001 compliance compulsory for offshore contractors operating in the UAE and Saudi blocks, effectively lifting qualification thresholds.

Expansion of Cross-Border Crude Export Trunk Lines

The 1,200 km, USD 5 billion Basra-Aqaba pipeline, which won Iraqi cabinet clearance in March 2024, targets a 2.25 million bpd export capacity. However, banking sanctions complicate financing, lengthening the execution window. Saudi and Kuwaiti partners are designing shared pipelines for the Dorra gas field, underscoring how maritime unitization is enlarging pipe packages. Hydrogen corridors outlined in the India-Middle East-Europe Economic Corridor (IMEC) enhance material specifications toward hydrogen-compatible steels that exceed API 5L X70 by incorporating fracture-toughness metrics. Longer, politically sensitive routes are also specifying thicker walls and expanded cathodic protection, magnifying tonnage and value.

Oil-Price Volatility Postponing EPC Awards

Historical data indicate a 12-month lag between crude-price dips and Middle East EPC awards, with the 2014-2015 episode resulting in a 60% reduction in contracts over 18 months. Current hedging clauses in pipeline EPCTs include cost-escalation bandwidths of 15-20% once Brent oil prices fall below USD 50 per barrel for 90 consecutive days. In Iraq, several pipeline projects linked to the Ministry of Oil have been included in the 2026 budget cycle amid revenue shortfalls. Saudi and UAE sovereign funds are partially counter-cyclical; however, smaller GCC states lack similar buffers, thereby amplifying project timing risk.

Other drivers and restraints analyzed in the detailed report include:

- Aging Pipeline Network Replacement Demand

- Hydrogen-Ready Line-Pipe Pilots by ADNOC & Aramco

- EU CBAM Raising Cost for GCC Steel Pipe Exports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Welded pipe claimed a 62.25% share of the Middle East oil and gas line pipe market in 2025, underpinning long-distance crude and gas projects that favor SAW cost economics. G5PS secured a SAR 186 million (USD 50 million) Aramco spiral-welded order, reinforcing SAW acceptance in critical transmission. Seamless supply remains indispensable for high-pressure hydrogen pilots where material integrity trumps cost, but its share is inching down within bulk transmission. Localization makes welded plants more competitive because shipping savings and local-content credits outweigh the benefits of seamless imports. The Middle East oil and gas line pipe market size attributable to welded categories is projected to post a 3.44% CAGR through 2031 as trunk-line kilometers expand.

The growing adoption of automated ultrasonic inspection and robotic welding is enhancing quality levels, reducing field rejects, and lowering lifecycle cost profiles. Tenaris Saudi Steel Pipes doubled LSAW capacity in Jubail in July 2024 to address upcoming master-gas packages. Mills that integrate coating and threading lines in-house are capturing additional value and better meeting accelerated delivery timetables.

Carbon steel captured a 64.40% share in 2025 thanks to its cost-performance fit in conventional oil and gas flows. However, the duplex and super-duplex segment is growing at a 6.00% CAGR because hydrogen, blue ammonia, and ultra-sour gas service require superior corrosion and embrittlement resistance. SABIC's FEED for a 1.2 million tpa blue ammonia project calls for cryogenic-capable duplex lines, moving procurement beyond carbon grades. Alloy selections are also migrating toward API 5L X80 for high-pressure gas in Saudi Arabia's Master Gas System, cementing a trend toward higher strength.

Investment by Emirates Steel Arkan into super-duplex melt routes indicates regional mills are chasing specialty margins. The Middle East oil and gas line pipe market share for specialty alloys remains modest, but its contribution to profits is outsized, shielding mills from commodity price swings.

The Middle-East Oil and Gas Line Pipe Market Report is Segmented by Type (Seamless and Welded), Material (Carbon Steel, Alloy Steel, Stainless/CRA, and Duplex/Super-Duplex), Diameter (Below 12 Inch, 12 To 24 Inch, and Above 24 Inch), Application (Transmission, Down-Hole Casing and Tubing, Oil and Gas Gathering, and Water/Gas Injection), and Geography (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, Iraq, and More).

List of Companies Covered in this Report:

- Arabian Pipes Company

- Rezayat Group

- EEW Group

- Sumitomo Corp.

- Vallourec SA

- Abu Dhabi Metal Pipes & Profiles

- Jindal SAW Ltd

- ArcelorMittal SA

- Tenaris SA

- National Pipe Company (NPC)

- TMK Group

- Tata Steel

- ChelPipe Group

- Nippon Steel Corp.

- Welspun Corp.

- Salzgitter AG

- Borusan Mannesmann

- JSW Steel

- SeAH Steel

- Al Jazeera Steel

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising upstream investment in Arabian Gulf offshore gas fields

- 4.2.2 Expansion of cross-border crude export trunk lines

- 4.2.3 Aging pipeline network replacement demand

- 4.2.4 Hydrogen-ready line-pipe pilots by ADNOC & Aramco

- 4.2.5 Localization mandates under IKTVA & ICV programs

- 4.2.6 GTL & blue-ammonia projects needing low-temperature alloys

- 4.3 Market Restraints

- 4.3.1 Oil-price volatility postponing EPC awards

- 4.3.2 Shift toward composite flexible pipe in shallow offshore

- 4.3.3 Sanctions-driven funding limits in Iran & Iraq

- 4.3.4 EU CBAM raising cost for GCC steel pipe exports

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Installed Pipeline Capacity Analysis

- 4.8 Key Upcoming Projects

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Seamless

- 5.1.2 Welded (ERW and SAW)

- 5.2 By Material

- 5.2.1 Carbon Steel

- 5.2.2 Alloy Steel

- 5.2.3 Stainless/CRA

- 5.2.4 Duplex/Super-Duplex

- 5.3 By Diameter

- 5.3.1 Below 12 inch

- 5.3.2 12 to 24 inch

- 5.3.3 Above 24 inch

- 5.4 By Application

- 5.4.1 Transmission (Onshore and Offshore)

- 5.4.2 Down-hole Casing and Tubing

- 5.4.3 Oil and Gas Gathering

- 5.4.4 Water/Gas Injection

- 5.5 By Geography

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Oman

- 5.5.6 Bahrain

- 5.5.7 Iraq

- 5.5.8 Iran

- 5.5.9 Rest of Middle East

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Arabian Pipes Company

- 6.4.2 Rezayat Group

- 6.4.3 EEW Group

- 6.4.4 Sumitomo Corp.

- 6.4.5 Vallourec SA

- 6.4.6 Abu Dhabi Metal Pipes & Profiles

- 6.4.7 Jindal SAW Ltd

- 6.4.8 ArcelorMittal SA

- 6.4.9 Tenaris SA

- 6.4.10 National Pipe Company (NPC)

- 6.4.11 TMK Group

- 6.4.12 Tata Steel

- 6.4.13 ChelPipe Group

- 6.4.14 Nippon Steel Corp.

- 6.4.15 Welspun Corp.

- 6.4.16 Salzgitter AG

- 6.4.17 Borusan Mannesmann

- 6.4.18 JSW Steel

- 6.4.19 SeAH Steel

- 6.4.20 Al Jazeera Steel

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment