|

市场调查报告书

商品编码

1910922

照护现场资料管理软体:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Point-of-Care Data Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

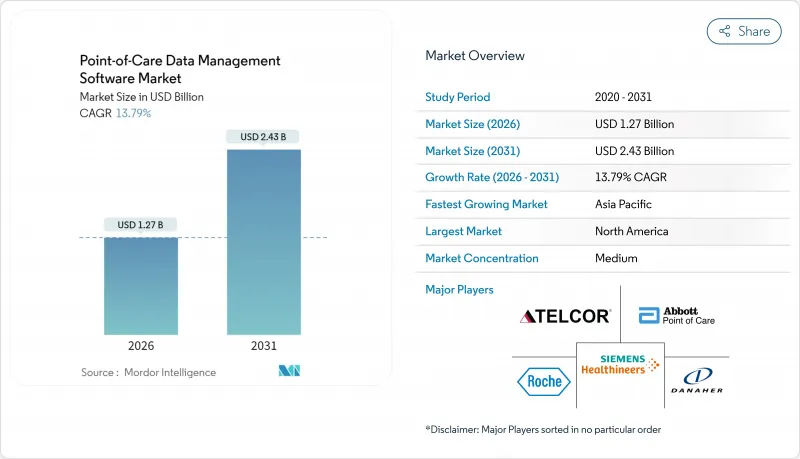

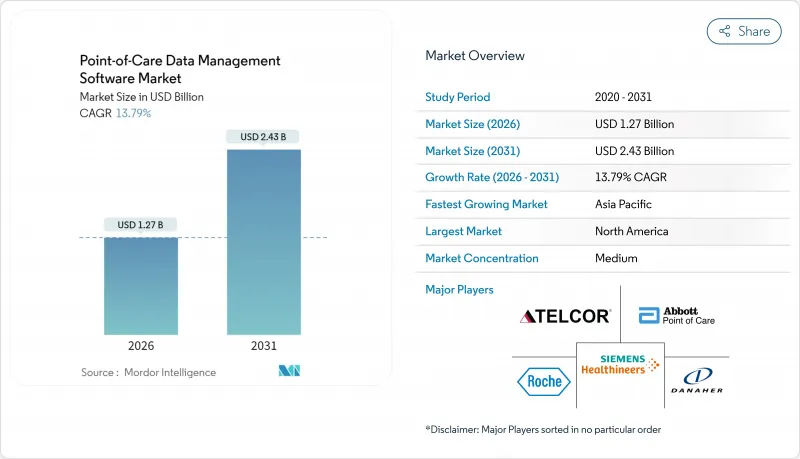

预计到 2025 年,照护现场资料管理软体市场规模将达到 11.2 亿美元,到 2026 年将达到 12.7 亿美元,到 2031 年将达到 24.3 亿美元,2026 年至 2031 年的复合年增长率为 13.79%。

这一快速成长是由医疗保健系统向即时诊断的转型、政府对灵活连接投入的增加以及对按绩效付费系统的日益青睐所驱动的。云端迁移、人工智慧驱动的分析以及连接数百种设备的中间件如今已成为关键的采购标准。随着医院资料工作流程的标准化和居家照护项目的扩展,能够整合软体、服务和网路安全措施的供应商有望获得市场份额。大型现有企业与利基创新者之间的整合并存,形成了一个集中度适中的市场环境,预计将支持稳定的交易活动。

全球照护现场资料管理软体市场趋势与洞察

灵活连接和介面解决方案的创新

在CMS互通性和病患存取规则的推动下,医疗系统需要能够透过标准化的FHIR R4 API连接200多种不同类型的照护现场设备(POCT)的互通中间件。供应商正将连接性定位为核心基础设施,而非附加功能,以避免数据孤岛并加快临床决策。 5G和边缘运算节点的出现缩短了云端原生部署的延迟,并使多站点营运商能够协调不同分散式站点的工作流程。 FDA的数位健康软体预认证计画透过将连接性纳入监管审查并奖励持续的性能监控,进一步推进了连接性的发展。因此,采购方在授予合约时优先考虑中间件的深度和麵向未来的介面蓝图。

扩大医疗基础设施预算

预计各国政府将在2024年投入2,000亿美元用于医疗基础设施计划,其中相当一部分资金将用于数位平台,包括床边资料管理软体。印度的国家数位健康使命和中国的「健康中国2030」等项目正在投资IT现代化,这为符合各国数据本地化法规的供应商打开了市场大门。公私合营( PPP)专案越来越多地将软体条款纳入建设竞标,将可选技术转变为必备设备。新建医院和诊断中心正在指定使用分析套件,为基于价值的医疗保健仪錶板提供数据,从而使软体采购与设施建设进度保持一致。这波支出激增扩大了中等收入国家的潜在基本客群,并透过长期维护合约提高了供应商的收入可见度。

高昂的实施和整合成本

全面实施该系统,每个医疗机构的成本在 50 万至 200 万美元之间,这对于小规模农村医院而言构成了一大障碍,因为这些医院 40% 的 IT 职位空缺。异质的旧有系统增加了介面编码和工作流程重新设计的负担,通常会使实施週期超出预算。年度维护成本、员工培训成本和升级合约费用进一步增加了总拥有成本。收费量较低的医疗机构,由于投资报酬率仍然较低,往往倾向于选择津贴资金筹措或分级付费的 SaaS 方案。提供价格合理的模组化云端託管服务的供应商可以刺激潜在需求,并克服这种复合年增长率的限制。

细分市场分析

到2025年,本地部署仍将占总收入的51.62%,这反映了以往直接在内部伺服器上管理资料的趋势。然而,云端解决方案正以15.88%的复合年增长率快速成长,这主要得益于其强大的灾害復原能力、自动修补程式和可扩充储存等优势。混合部署方案为迁移提供了桥樑。许多系统将对延迟敏感的模组保留在本地,同时将分析处理迁移到符合HIPAA标准的云端。多地点连锁企业优先考虑以云端为中心的仪表板,这些仪表板可以跨园区同步效能指标,从而减少冗余基础设施。美国食品药物管理局(FDA)近期发布的指南将经过检验的云端配置与本地安装等同起来,这进一步缓解了资讯长(CIO)的担忧,并鼓励企业采用SaaS模式。因硬体更新延迟而节省的资金通常用于加强网路安全,从而加快迁移进程。

云端供应商正大力宣传 FedRAMP 和 HITRUST 认证,以赢得联邦政府和学术机构的合同,这削弱了传统本地部署服务商的领先优势。勒索软体威胁的日益加剧也促使人们需要异地备份,而这如今已成为许多云端服务合约的标配。同时,处理基因组数据的研究机构仍依赖本地丛集来最大化计算吞吐量。然而,即便如此,容器化工作负载也能在高峰需求期间为云端提供突发容量,这预示着未来混合架构将模糊本地与本地的界限。随着时间的推移,基于服务的定价结构将使服务商的关注点从永久许可转向以客户维繫为中心的蓝图,并建立丰富的 AI 模组和 API 市场,从而促进生态系统参与的盈利。

到2025年,医院和重症监护室仍将维持46.15%的市场份额,这主要由急诊室吞吐量目标和快速提供检测结果的要求所驱动。然而,居家医疗计画将实现14.71%的复合年增长率,这主要得益于联邦医疗保险(Medicare)扩大家庭医院服务范围以及人口老化的趋势。携带式分析仪和远端医疗设备的广泛应用,推动了对轻量级、基于浏览器的控制面板的需求,以便看护者可以从患者家中存取这些控制面板。诊断中心正在整合自动化检验规则以应对检体处理量的激增,而诊所则正在利用照护现场数据,在固定费用支付系统下缩短咨询週期。

居家照护供应商面临宽频品质不稳定的问题,这促使他们对「储存后转送」架构产生兴趣,该架构可在网路连线恢復时进行同步。医院持续投资于企业级中间件,用于检测品管偏差并整合试剂库存数据,以提高供应链效率。门诊诊所正在采用共用服务模式,在维持对本地设备池自主管理的同时,授权使用集中式分析工具。 「其他」类别扩展至包括长期照护机构和职业健康机构,推动了针对院外工作流程量身定制的模组化使用者介面皮肤的需求和商机。

区域分析

北美地区预计到2025年将保持38.21%的市场份额,这得益于美国国立卫生研究院(NIH)的津贴、生物医学高级研究与发展局(BARDA)的DRIVe计画以及成熟的电子健康记录(EHR)应用。美国医院正在采用分析工具来达到联邦医疗保险优势计划(Medicare Advantage)的品质指标,而加拿大各省的医疗系统则透过中介互通性来投资改善农村地区的医疗服务。创业投资的涌入和可预测的FDA核准流程使该地区成为人工智慧密集型模组的试验场,为供应商提供了早期回馈机制。

亚太地区预计将以16.52%的复合年增长率成为全球成长最快的地区。中国150亿美元的医疗数位化预算正投入到渴望拥有云端仪錶板的县级医院。印度的「阿尤斯曼·巴拉特数位使命」(Ayushman Bharat Digital Mission)强制要求互通性,引导采购方选择符合标准的软体。日本正利用「社会5.0」理念支持一项老年护理试点项目,该项目将家庭监测设备与集中式分析相结合。新加坡作为区域扩张中心,向东南亚输出专业知识。不同的法规环境正在推动具备灵活资料主权切换能力和多语言介面的平台的价值。

欧洲正经历着稳步推进的、由监管主导的数位转型。德国的《数位健康法案》正在资助医院IT系统的现代化改造,而英国的NHS数位转型宣传活动则致力于推动所有急诊医院采用通用的互通性标准。法国和西班牙正利用欧盟復苏基金对远端医疗和检查室IT系统进行现代化改造。严格的GDPR法规要求嵌入式同意管理和加密功能,虽然延长了引进週期,但也提高了可靠性。拥有预先检验的合规模板的供应商在竞标中更具优势。南美洲和中东/非洲的市占率虽然落后于欧洲,但由于公私合营)和基础建设从一开始就定义了数位化工具包,这些地区的成长率也达到了15%左右。

其他福利

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 灵活连接和介面解决方案的创新

- 扩大医疗基础设施预算

- 政府资助即时检测

- 支付方转向以绩效为基础的薪酬体系

- 人工智慧驱动的抗生素合理使用分析模组

- 日益严格的网路安全合规要求

- 市场限制

- 高昂的实施和整合成本

- 资料隐私和网路安全威胁

- 碎片化的旧设备韧体环境

- 本地设施缺乏熟练的IT人员

- 宏观经济因素的影响

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过部署模式

- 基于云端的

- 本地部署

- 杂交种

- 最终用户

- 医院/加护病房

- 诊断中心

- 诊所/门诊

- 居家医疗

- 其他的

- 透过使用

- 感染疾病预防设备

- 血糖监测

- 凝血监测

- 尿液检查

- 心血管代谢监测

- 癌症标记

- 血液学

- 其他概念验证用途

- 按组件

- 软体平台

- 中介软体

- 服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚洲地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Siemens Healthineers AG(Conworx)

- Abbott Point of Care Inc.(Alere Inc.)

- Danaher Corporation(HemoCue AB and Radiometer Medical ApS)

- F. Hoffmann-La Roche Ltd

- TELCOR Inc.

- Orchard Software Corporation

- Randox Laboratories Ltd

- Thermo Fisher Scientific Inc.

- EKF Diagnostics Holdings plc

- HORIBA Ltd

- Nova Biomedical Corporation

- Sysmex Corporation

- Werfen SA

- Alcor Scientific Inc.

- PTS Diagnostics LLC

- Masimo Corporation

- Becton, Dickinson and Company

- Beckman Coulter Inc.

- Medtronic plc

第七章 市场机会与未来展望

The point-of-care data management software market is expected to grow from USD 1.12 billion in 2025 to USD 1.27 billion in 2026 and is forecast to reach USD 2.43 billion by 2031 at 13.79% CAGR over 2026-2031.

This brisk expansion springs from health systems' pivot toward real-time diagnostics, wider government funding for flexible connectivity, and a rising preference for outcome-based reimbursement. Cloud migration, AI-driven analytics, and middleware that links hundreds of device types are now central buying criteria. Vendors able to bundle software, services, and cybersecurity safeguards stand to capture share as hospitals standardize data workflows and home-care programs scale. Consolidation among large incumbents coexists with niche innovators, creating a moderate-concentration landscape poised for steady deal activity.

Global Point-of-Care Data Management Software Market Trends and Insights

Innovation in Flexible Connectivity and Interface Solutions

Health systems are demanding interoperable middleware that links more than 200 distinct point-of-care devices through standardized FHIR R4 APIs, a capability spurred by CMS's Interoperability and Patient Access Rule. Vendors now treat connectivity as core infrastructure, not add-on code, to avoid data silos and accelerate clinical decision-making. The arrival of 5G and edge-computing nodes cuts latency for cloud-native deployments, letting multi-site operators harmonize workflows across dispersed facilities. FDA's Digital Health Software Precertification Program further elevates connectivity by embedding it in regulatory review, creating an incentive for continuous performance monitoring. As a result, buyers prioritize middleware depth and future-proof interface roadmaps when awarding contracts.

Expansion of Healthcare Infrastructure Budgets

Governments spent USD 200 billion on health-infrastructure projects in 2024, earmarking sizable funds for digital platforms that include point-of-care data management software. Programs like India's National Digital Health Mission and China's Healthy China 2030 channel budget toward IT modernization, opening doors for vendors able to meet country-specific data-localization rules. Private-public partnerships often bundle software clauses into construction tenders, effectively converting optional tech into mandatory kit. As new hospitals and diagnostic centers go live, they specify analytics suites that feed value-based care dashboards, ensuring software procurement aligns with bricks-and-mortar schedules. This spends surge enlarges the addressable base in mid-income economies and smooths revenue visibility for suppliers through long-term maintenance deals.

High Deployment and Integration Costs

Comprehensive rollouts cost USD 500,000-USD 2 million per facility, a hurdle that stalls adoption in smaller or rural hospitals where 40% of IT posts sit vacant. Legacy-system heterogeneity inflates interface coding and workflow redesign, often stretching timelines past budget cycles. Total cost of ownership widens when annual maintenance, staff training, and upgrade subscriptions enter the calculus. For facilities with thin patient volumes, payback models remain weak, nudging them toward grant funding or SaaS options with phased billing. Vendors able to package modular, cloud-hosted offerings at lower entry prices can unlock pent-up demand and counter this drag on CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Government Funding Initiatives for POC Testing

- Data Privacy and Cybersecurity Threats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premises deployments still commanded 51.62% revenue in 2025, showing the historical sway of in-house servers for direct data custody. Yet cloud solutions are sprinting at a 15.88% CAGR, fuelled by robust disaster-recovery, auto-patching, and elastic storage benefits. A hybrid approach acts as a transition bridge: many systems keep latency-sensitive modules on-site while pushing analytics to HIPAA-compliant clouds. Multi-site chains prize cloud-centric dashboards that synchronize performance metrics across campuses, trimming duplicated infrastructure. FDA's recent guidance equating validated cloud configurations with local installations further eases CIO concerns, nudging purchase orders toward SaaS models. Savings from hardware refresh deferral often finance cybersecurity upgrades, accelerating the migration curve.

Cloud vendors tout FedRAMP and HITRUST credentials to win federal and academic accounts, denting the head-start enjoyed by legacy on-premises incumbents. Rising ransomware threats also make off-site backups imperative, a default feature in many cloud contracts. Conversely, research institutes handling genomic data still lean on local clusters to maximize compute throughput. Even here, containerized workloads permit burst capacity in the cloud during peak demand, showcasing a future where line-blurring hybrid architectures dominate. Over time, service-based pricing shifts vendor focus from perpetual licenses to retention-driven roadmaps rich in AI modules and API marketplaces that monetize ecosystem participation.

Hospitals and critical-care units retained the lion's 46.15% share in 2025, supported by emergency-department throughput targets and lab turnaround mandates. Nevertheless, home-health programs are clocking a 14.71% CAGR, buoyed by Medicare's Hospital-at-Home expansion and aging-population dynamics. Portable analyzers and telehealth kits feed a need for lightweight, browser-based dashboards that caregiver's access from patient residences. Diagnostic centers integrate auto-verification rules to handle ballooning specimen loads while clinics lean on point-of-care data to shorten visit cycles under capitated payment plans.

Home-care operators grapple with variable broadband quality, propelling interest in store-and-forward architecture that syncs when connectivity resumes. Hospitals continue to invest in enterprise-wide middleware that flags quality-control drifts and consolidates reagent inventory data, improving supply chain efficiency. Outpatient clinics adopt shared-service models, licensing centralized analytics but maintaining autonomy over local device pools. The growing "other" category spanning long-term care and occupational-health sites creates opportunities for modular UI skins tailored to non-hospital workflows, widening addressable revenue.

The Point-Of-Care Data Management Software Market Report is Segmented by Deployment Mode (Cloud-Based, On-Premise, and Hybrid), End User (Hospitals/Critical Care Units, Diagnostic Centers, Clinics/Outpatient, Home Healthcare, and More), Application (Infectious Disease Devices, Glucose Monitoring, and More), Component (Software Platform, and Services), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained a 38.21% share in 2025, anchored by NIH grants, BARDA's DRIVe program, and mature EHR penetration. U.S. hospitals deploy analytics to satisfy Medicare Advantage quality metrics, whereas Canada's provincial systems fund rural-access upgrades that hinge on middleware interoperability. Venture capital flows and predictable FDA pathways make the region a test bed for AI-rich modules, giving suppliers early feedback loops.

Asia Pacific is set to compound at 16.52% CAGR, the fastest worldwide. China's USD 15 billion health-digitization budget funnels into county-level hospitals eager for cloud-hosted dashboards. India's Ayushman Bharat Digital Mission enforces interoperability, nudging buyers toward standards-compliant software. Japan leverages Society 5.0 to back aging-care pilots that marry home-monitoring kits with centralized analytics. Singapore acts as the regional deployment hub, exporting expertise across Southeast Asia. The mosaic of regulations rewards platforms sporting flexible data-sovereignty toggles and multilingual interfaces.

Europe exhibits steady, regulation-driven uptake. Germany's Digital Healthcare Act finances hospital IT overhauls, while the United Kingdom's NHS Digital campaign pushes all acute trusts onto a shared interoperability standard. France and Spain tap EU Recovery funds for telemedicine and lab IT modernization. Strict GDPR rules require baked-in consent management and encryption, extending deployment cycles but enhancing trust. Suppliers that pre-validate compliance templates gain bidding advantages. South America, the Middle East, and Africa trail in share but post mid-teens growth as public-private buildouts stipulates digital kits from the outset.

- Siemens Healthineers AG (Conworx)

- Abbott Point of Care Inc. (Alere Inc.)

- Danaher Corporation (HemoCue AB and Radiometer Medical ApS)

- F. Hoffmann-La Roche Ltd

- TELCOR Inc.

- Orchard Software Corporation

- Randox Laboratories Ltd

- Thermo Fisher Scientific Inc.

- EKF Diagnostics Holdings plc

- HORIBA Ltd

- Nova Biomedical Corporation

- Sysmex Corporation

- Werfen S.A.

- Alcor Scientific Inc.

- PTS Diagnostics LLC

- Masimo Corporation

- Becton, Dickinson and Company

- Beckman Coulter Inc.

- Medtronic plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Innovation in Flexible Connectivity and Interface Solutions

- 4.2.2 Expansion of Healthcare Infrastructure Budgets

- 4.2.3 Government Funding Initiatives for POC Testing

- 4.2.4 Payor Shift Toward Outcome-Based Reimbursement

- 4.2.5 AI-Driven Analytics Modules for Antimicrobial Stewardship

- 4.2.6 Growing Cybersecurity Compliance Requirements

- 4.3 Market Restraints

- 4.3.1 High Deployment and Integration Costs

- 4.3.2 Data Privacy and Cybersecurity Threats

- 4.3.3 Fragmented Legacy Device Firmware Ecosystem

- 4.3.4 Shortage of Skilled IT Staff in Rural Facilities

- 4.4 Impact of Macroeconomic Factors

- 4.5 Industry Value-Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Mode

- 5.1.1 Cloud-Based

- 5.1.2 On-Premise

- 5.1.3 Hybrid

- 5.2 By End User

- 5.2.1 Hospitals / Critical Care Units

- 5.2.2 Diagnostic Centers

- 5.2.3 Clinics / Outpatient

- 5.2.4 Home Healthcare

- 5.2.5 Other End Users

- 5.3 By Application

- 5.3.1 Infectious Disease Devices

- 5.3.2 Glucose Monitoring

- 5.3.3 Coagulation Monitoring

- 5.3.4 Urinalysis

- 5.3.5 Cardiometabolic Monitoring

- 5.3.6 Cancer Markers

- 5.3.7 Hematology

- 5.3.8 Other POC Applications

- 5.4 By Component

- 5.4.1 Software Platform

- 5.4.2 Middleware

- 5.4.3 Services

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank / Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Siemens Healthineers AG (Conworx)

- 6.4.2 Abbott Point of Care Inc. (Alere Inc.)

- 6.4.3 Danaher Corporation (HemoCue AB and Radiometer Medical ApS)

- 6.4.4 F. Hoffmann-La Roche Ltd

- 6.4.5 TELCOR Inc.

- 6.4.6 Orchard Software Corporation

- 6.4.7 Randox Laboratories Ltd

- 6.4.8 Thermo Fisher Scientific Inc.

- 6.4.9 EKF Diagnostics Holdings plc

- 6.4.10 HORIBA Ltd

- 6.4.11 Nova Biomedical Corporation

- 6.4.12 Sysmex Corporation

- 6.4.13 Werfen S.A.

- 6.4.14 Alcor Scientific Inc.

- 6.4.15 PTS Diagnostics LLC

- 6.4.16 Masimo Corporation

- 6.4.17 Becton, Dickinson and Company

- 6.4.18 Beckman Coulter Inc.

- 6.4.19 Medtronic plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment