|

市场调查报告书

商品编码

1910926

欧洲大楼自动化系统市场-份额分析、产业趋势、统计数据和成长预测(2026-2031年)Europe Building Automation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

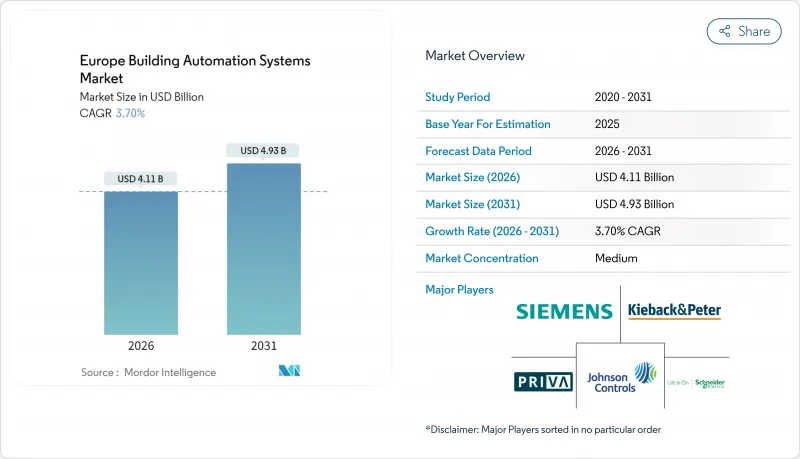

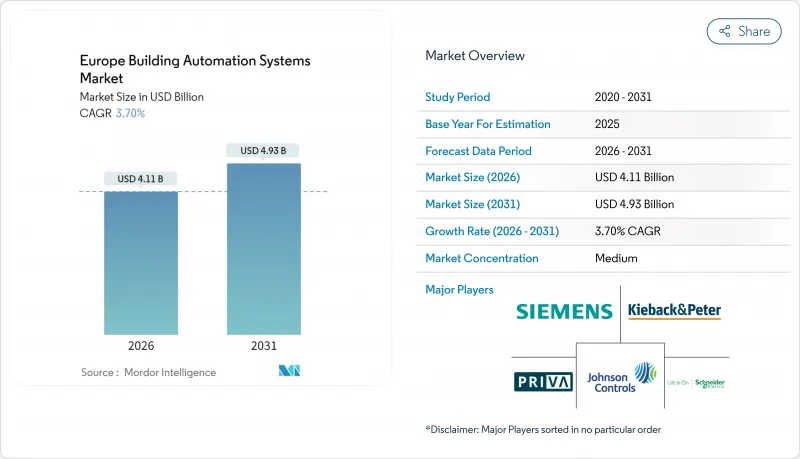

预计到 2025 年,欧洲大楼自动化系统市场规模将达到 39.6 亿美元,到 2026 年将成长至 41.1 亿美元,到 2031 年将成长至 49.3 亿美元,预测期(2026-2031 年)的复合年增长率为 3.70%。

修订后的《建筑能源性能指令》提高了合规要求,电费上涨,以及企业净零排放目标,正在推动大部分投资决策。该地区四分之三的建筑建于1990年以前,因此维修需求占据主导地位,而创新则集中在云端分析、无线感测器和人工智慧驱动的最佳化方面。硬体仍然是收入的基础,但软体即服务 (SaaS) 可以提供持续的收入来源,并加快中型房地产投资组合的投资回收期。竞争程度适中:虽然少数全球製造商提供核心控制器和现场设备,但数百家区域整合商决定交付时间、计划成本和使用者培训效果。持续的劳动力短缺和网路安全风险在短期内会阻碍计划进展,但产品标准化和生态系统伙伴关係正在逐步降低风险认知。

欧洲大楼自动化系统市场趋势与洞察

根据EPBD修正案,BACS是强制性的

修订后的《能源性能指令》(EPBD)将于2025年生效,届时,暖气负载超过290千瓦的非住宅建筑必须采用可互通的自动化和控制系统。德国和法国已采用更严格的标准,这刺激了政府机关、学校和医疗机构的竞标活动。 BACnet和KNX等开放通讯协定解决方案受到补贴计画的青睐,鼓励建筑业主在计画维修更换专有网路。合规期限集中在2027年左右,这将导致工程需求出现显着高峰,并刺激专业培训倡议。虽然各成员国的执行力度有所不同,但总体而言,该指令已为欧洲大楼自动化系统市场的监管时间表预留了成长空间。拥有本地安装合作伙伴和多语言试运行软体的供应商具有明显的竞争优势。

无线感测器价格暴跌

2023年至2025年间,多技术占用、温度和光照感测器的平均售价下降了约30%。这主要归功于东亚地区200毫米晶圆产量的增加以及向系统晶片(SoC)架构的转变。北欧的业主率先采用者,利用电池供电的传感器在漫长的供暖季期间监控高能耗设施。布线和天花板钻孔成本的降低缩短了小规模计划的投资回收期,并将基本客群扩展到甲级办公室以外的领域。新晶片内建的边缘处理功能可降低延迟、筛检误报并现场保存敏感的建筑占用数据,有助于符合GDPR的要求。虽然组件价格的波动性低于2021-2022年供应紧张时期,但专用射频微控制器的间歇性短缺仍导致整合商的前置作业时间週期略有延长。

现有建筑存量零散。

巴黎、罗马和巴塞隆纳等城市的历史悠久的石砌建筑通常限制了岩芯钻探和大规模管道安装,这使得感测器安装和布线变得复杂。不同时期的机械设备,从散热器到可变风量箱,都需要精心设计的接口,从而增加了设计时间和应急预算。业主有时会将先进的自动化系统推迟到租户发生大规模变更时才进行,这使得决策週期超出了传统的财政年度。当地工匠协会对保护标准的严格执行限制了侵入式维修。因此,系统整合商投资于符合历史建筑规范的无线、无电池致动器和可逆安装套件。然而,这些专用组件价格昂贵,并且会缩短投资回报期。

细分市场分析

到2025年,硬体将占总收入的65.58%,可靠的控制器、致动器和多标准闸道将支援欧洲大楼自动化系统市场的所有功能层。控制器通常需要管理数千个I/O点,这迫使供应商在即时处理和增强网路安全方面不断进步。同时,感测器正在向超低功耗无线晶片迁移,扩大了1910年以前建造的、电缆配线架稀少的建筑的维修可能性。

基于云端的分析服务和远端韧体更新推动了SaaS订阅市场6.02%的复合年增长率。楼宇业主优先考虑营运支出而非资本支出,并定期购买基于人工智慧的最佳化功能。可预测的收费结构有助于预算规划,并鼓励持续的功能增强。一旦楼宇的暖通空调系统上线,照明、安防和电动车充电模组也会迅速跟进。供应商正在将边缘人工智慧推理功能整合到房间控制器中,从而减轻超大规模资料中心的运算负载,并确保符合当地的资料主权法律。

到2025年,在强制性能源审核和激烈竞争的推动下,商业建筑将占欧洲大楼自动化系统市场的44.92%。设施管理人员正优先考虑热舒适度和室内空气品质仪錶盘,以吸引混合办公环境中的员工;医院正在升级关键区域以实现负压控制;零售业正在部署基于人工智慧的製冷监控系统以减少食物浪费。

到2031年,受智慧电錶安装补贴和国家电气化推广措施的推动,住宅需求将以5.59%的复合年增长率成长。多用户住宅将采用集中式系统控制系统来精准分配水电费,而语音控制场景和需量反应Widgets将在独栋住宅中普及。虽然每户的安装点数量较少,但家庭整体安装规模与小规模商业设施相当,这促使家电製造商与传统建筑自动化系统(BAS)供应商合作。

欧洲大楼自动化系统报告按组件(硬体:控制器和现场设备、SaaS 软体)、最终用户(住宅、商业、工业)、建筑生命週期(新建、维修)、通讯协定(BACnet、KNX Classic 和 IoT、Modbus/LonWorks)以及地区进行细分。市场预测以美元 (USD) 为以金额为准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 根据修订后的能源性能指令(EPBD),BACS成为强制性要求。

- 无线感测器价格大幅下降

- 企业净零排放目标

- 边缘人工智慧分析对降低营运成本的影响

- 智慧家庭维修的兴起

- 与环境、社会及公司治理(ESG)相关的金融奖励

- 市场限制

- 分散的现有建筑存量

- 网路安全责任问题

- 由于供应商特定通讯协定而导致的锁定

- 技术纯熟劳工短缺

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 硬体

- 控制器

- 现场设备

- 软体即服务 (SaaS)

- 硬体

- 最终用户

- 住宅

- 商业的

- 工业的

- 透过建构生命週期

- 新建工程

- 维修

- 透过通讯协定

- BACnet

- KNX(经典版和物联网版)

- Modbus/LonWorks

- 按地区

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 比利时

- 瑞典

- 芬兰

- 丹麦

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Siemens AG

- Johnson Controls International plc

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd

- Robert Bosch GmbH

- Trane Technologies plc

- Kieback and Peter GmbH and Co. KG

- Priva Holding BV

- Belimo Holding AG

- Fr. Sauter AG

- Lynxspring Inc.

- Delta Controls Inc.

- Legrand SA

- Distech Controls Inc.

- Regin AB

- Danfoss A/S

- Beckhoff Automation GmbH and Co. KG

- Somfy SA

- Crestron Electronics Inc.

第七章 市场机会与未来展望

The Europe Building Automation Systems market was valued at USD 3.96 billion in 2025 and estimated to grow from USD 4.11 billion in 2026 to reach USD 4.93 billion by 2031, at a CAGR of 3.70% during the forecast period (2026-2031).

Growing compliance obligations under the revised Energy Performance of Buildings Directive, rising electricity prices, and corporate net-zero targets guide most investment decisions. Retrofit opportunities dominate because three-quarters of the region's building stock predates 1990, yet innovation centers on cloud-enabled analytics, wireless sensors, and AI-driven optimization. Hardware remains the revenue anchor while Software-as-a-Service introduces recurring income streams and shortens payback periods for mid-sized property portfolios. Competition is moderate: a handful of global manufacturers supply core controllers and field devices, but hundreds of regional integrators shape delivery schedules, project costs, and user training outcomes. Persistent labour bottlenecks and cybersecurity liabilities act as near-term brakes on project velocity, although product standardization and ecosystem partnerships are gradually reducing risk perceptions.

Europe Building Automation Systems Market Trends and Insights

Mandatory BACS in EPBD revision

The 2025 enforcement of the revised Energy Performance of Buildings Directive obliges non-residential facilities above 290 kW heating load to deploy interoperable automation and control systems. Germany and France adopted even stricter thresholds, accelerating tender activity across public offices, schools, and healthcare sites. Open-protocol solutions such as BACnet and KNX receive preferential treatment in grant programs, prompting building owners to replace proprietary networks during planned renovations. Compliance deadlines cluster around 2027, creating pronounced peaks in engineering demand and sparking specialized training initiatives. Enforcement rigor differs by member state, yet the overall mandate locks Europe Building Automation Systems market growth into regulatory timetables. Vendors with local installation partners and multilingual commissioning software gain a visible competitive edge.

Rapid fall in wireless sensor prices

Average selling prices of multi-technology occupancy, temperature, and light sensors dropped by nearly 30% between 2023 and 2025, mainly because of higher 200 mm wafer output in East Asia and a transition to system-on-chip architectures. Nordic property owners were early adopters, using battery-powered sensors to monitor energy-intensive facilities during prolonged heating seasons. Reduced wiring and ceiling core-drilling costs shorten payback periods on small projects, broadening the customer base beyond A-grade office towers. Edge-processing features embedded inside new chips lower latency, screen false positives, and retain sensitive building usage data inside the premises, supporting GDPR compliance. Although component prices are now less volatile than during the 2021-2022 supply crunch, occasional shortages of specialized RF microcontrollers still trigger modest lead-time spikes for integrators.

Fragmented legacy building stock

Historic masonry structures in Paris, Rome, and Barcelona often prohibit core drilling or heavy conduit runs, complicating sensor placement and cabling. Mixed-era mechanical plant - from radiators to variable-air-volume boxes - requires meticulous interface mapping, elevating engineering hours and contingency budgets. Owners sometimes postpone deep automation until major tenancy turnovers, prolonging decision cycles beyond conventional fiscal years. Regional craft guilds enforce preservation norms, curbing invasive retrofits. Consequently, integrators invest in wireless, battery-free actuators and reversible mounting kits that comply with heritage guidelines, yet these specialized components carry price premiums that shrink return-on-investment windows.

Other drivers and restraints analyzed in the detailed report include:

- Corporate net-zero commitments

- Edge-AI analytics boosting OPEX savings

- Cyber-security liability concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware captured 65.58% of 2025 revenue as reliable controllers, actuators, and multi-standard gateways underpin every functional layer of the Europe Building Automation Systems market size. Controllers routinely manage thousands of I/O points, pushing suppliers to refine real-time processing and cyber-hardening. In parallel, sensors migrate to ultra-low-power wireless chips, broadening retrofit feasibility inside pre-1910 buildings where cable trays are scarce.

Cloud-hosted analytics and remote firmware updates explain the 6.02% CAGR in SaaS subscriptions. Building owners favour operating expenses over capital outlays, purchasing AI-based optimization features on rolling contracts. Predictable billing eases budget planning and encourages continuous scope expansion, once a building's HVAC loops are online, lighting, security, and EV-charger modules follow swiftly. Vendors integrate edge-AI inference capabilities into room controllers, shifting computation away from hyperscale data centers and satisfying regional data-sovereignty laws.

Commercial premises held 44.92% of Europe Building Automation Systems market share in 2025, spurred by mandatory energy audits and competitive tenant landscapes. Facility managers prioritize thermal comfort and indoor-air-quality dashboards to attract occupants in hybrid-work environments. Hospitals upgrade critical zones for negative pressure control, whereas the retail sector deploys AI-based refrigeration monitoring to reduce spoilage.

Residential demand grows at a 5.59% CAGR through 2031, catalysed by smart-meter rebates and national electrification incentives. Multi-family dwellings adopt centralized plant control to allocate utility costs precisely, while detached homes lean toward voice-activated scenes and utility-driven demand-response widgets. Despite fewer per-unit points, aggregate household volumes rival small commercial footprints, prompting consumer-electronics brands to forge alliances with traditional BAS suppliers.

The Europe Building Automation Systems Report is Segmented by Component (Hardware - Controllers and Field Devices, Software-As-A-Service), End User (Residential, Commercial, Industrial), Building Life-Cycle (New-Build, Retrofit), Communication Protocol (BACnet, KNX Classic and IoT, Modbus/LonWorks), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Siemens AG

- Johnson Controls International plc

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd

- Robert Bosch GmbH

- Trane Technologies plc

- Kieback and Peter GmbH and Co. KG

- Priva Holding B.V.

- Belimo Holding AG

- Fr. Sauter AG

- Lynxspring Inc.

- Delta Controls Inc.

- Legrand SA

- Distech Controls Inc.

- Regin AB

- Danfoss A/S

- Beckhoff Automation GmbH and Co. KG

- Somfy SA

- Crestron Electronics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory BACS in EPBD revision

- 4.2.2 Rapid fall in wireless sensor prices

- 4.2.3 Corporate net-zero commitments

- 4.2.4 Edge-AI analytics boosting OPEX savings

- 4.2.5 Increasing smart-home retrofits

- 4.2.6 ESG-linked financing incentives

- 4.3 Market Restraints

- 4.3.1 Fragmented legacy building stock

- 4.3.2 Cyber-security liability concerns

- 4.3.3 Vendor-specific protocol lock-in

- 4.3.4 Skilled-labour bottlenecks

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Controllers

- 5.1.1.2 Field Devices

- 5.1.2 Software-as-a-Service

- 5.1.1 Hardware

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 By Building Life-Cycle

- 5.3.1 New-build

- 5.3.2 Retrofit

- 5.4 By Communication Protocol

- 5.4.1 BACnet

- 5.4.2 KNX (Classic and IoT)

- 5.4.3 Modbus / LonWorks

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 Netherlands

- 5.5.7 Belgium

- 5.5.8 Sweden

- 5.5.9 Finland

- 5.5.10 Denmark

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Siemens AG

- 6.4.2 Johnson Controls International plc

- 6.4.3 Schneider Electric SE

- 6.4.4 Honeywell International Inc.

- 6.4.5 ABB Ltd

- 6.4.6 Robert Bosch GmbH

- 6.4.7 Trane Technologies plc

- 6.4.8 Kieback and Peter GmbH and Co. KG

- 6.4.9 Priva Holding B.V.

- 6.4.10 Belimo Holding AG

- 6.4.11 Fr. Sauter AG

- 6.4.12 Lynxspring Inc.

- 6.4.13 Delta Controls Inc.

- 6.4.14 Legrand SA

- 6.4.15 Distech Controls Inc.

- 6.4.16 Regin AB

- 6.4.17 Danfoss A/S

- 6.4.18 Beckhoff Automation GmbH and Co. KG

- 6.4.19 Somfy SA

- 6.4.20 Crestron Electronics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment